Professional Documents

Culture Documents

2012 - 0202 - Bridge Bancorp Reports Fourth Quarter and Year-End 2011 Results

Uploaded by

RiverheadLOCALOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2012 - 0202 - Bridge Bancorp Reports Fourth Quarter and Year-End 2011 Results

Uploaded by

RiverheadLOCALCopyright:

Available Formats

Press Release FOR IMMEDIATE RELEASE Contact: Howard H.

Nolan Senior Executive Vice President Chief Financial Officer(631) 537-1001, ext. 7255 BRIDGE BANCORP, INC. REPORTS FOURTH QUARTER AND YEAR END 2011 RESULTS Growth in Loans, Core Deposits and Net Income (Bridgehampton, NY January 23, 2012) Bridge Bancorp, Inc. (NASDAQ:BDGE), the pa rent company of The Bridgehampton National Bank, today announced fourth quarter and year end results for 2011. Highlights of the Companys financial results for the quarter and year end include: Record net income of $3.0 million and $.42 per share for the quarter, a 23% increase in net income over 2010. Core net income of $10.9 million and $1.62 per share for the year, 19% h igher than the $9.2 million recorded in 2010. Returns on average assets and equity utilizing core net income for 2011 were .92% and 15.13%, respectively. Net interest income increased $5.7 million for 2011, with a net interest margin of 3.97%. . Loan growth of 21%, with loans exceeding $612 million at year end. Total assets of $1.34 billion at year end, 30% higher than year end 2010

Deposits of $1.19 billion at year end, an increase of 30% over 2010, con tinuing strong growth trends. . ring. nd 2010. Tier 1 Capital increased by $38.4 million, nearly 50% higher than year e Declared quarterly dividend of $.23 per share. Successful and efficient completion of a $24.7 million common stock offe Solid asset quality metrics with continued increases in reserve coverage

2011 was a historic year for achievements at Bridgehampton National Bank. We grew our business by successfully completing our first acquisition, and expanding re lationships with new and existing customers. We strengthened our organization by substantially increasing equity capital, and enhancing our staff and systems in frastructure. We delivered exceptional financial results with record levels of r evenues and net income, growth in deposits, loans and reserves, while reducing p roblem assets. Our execution of these strategic initiatives was accomplished des pite the challenging economic and regulatory environment. We believe a strong, w ell-capitalized balance sheet, funded by core branch deposits is the key to succ essfully fulfilling our mission to be the community bank for the communities we serve, commented Kevin M. OConnor, President and CEO of Bridge Bancorp, Inc.

Net Earnings and Returns Net income for the quarter ended December 2011 was $3.0 million or $.42 per shar e, compared to $2.4 million or $.38 per share, for the same period in 2010, refl ecting a 23% increase in net income and an 11% increase in earnings per share. I n 2011, net income was $10.4 million or $1.54 per share, while core net income, was $10.9 million or $1.62 per share, an increase in core net income of 19% from 2010. The core net income and related ratios reflect the quarterly and annual r esults adjusted for acquisition costs, related to the May 2011 Hamptons State Ba nk, HSB transaction. These increases reflect the growth in earning assets as we ex perienced higher levels of net interest income and other income, offsetting incr eases in operating expenses associated with our larger organization. Returns on average assets and equity for 2011 were .88% and 14.37%, respectively, while cor e returns on average assets and equity, adjusted for acquisition related costs, were .92% and 15.13%, respectively. Interest income grew in 2011 as average earning assets increased by 22% or $202. 0 million, offsetting the net interest margin decline from 4.22% to 3.97%. This decline was due to a variety of factors, as the positive impact of higher depos it balances and increased loan demand were offset by increases in the levels of lower yielding liquid assets, and historically low market interest rates. This t rend continued in the fourth quarter of 2011. The provision for loan losses was $.9 million for the quarter, consistent with the 2010 fourth quarter. For 2011, the provision was $3.9 million, an increase of $.4 million over 2010. Total no n-interest income grew $.4 million for the fourth quarter with fee income, servi ce charges and title revenue increasing. During the year, total non-interest in come declined $.5 million resulting from $1.2 million in lower securities gains, partially offset by higher fee income and service charges. Non-interest expense for 2011 increased in both the quarter and year due to expenses associated with new and acquired branches and compliance initiatives. Although non-interest exp ense increased in 2011, the Companys efficiency ratio improved to 57.96% from 60. 92% in the quarter and to 58.64% from 62.32% for the year. The improvement refl ects the return on the investments made in new branches, technology and staff. The revenue growth is directly attributable to the increasing scale of our succes sful community bank. Weve added core deposits and have identified, underwritten a nd funded new loans providing credit for our communities. These revenues offset the higher costs associated with expansion, compliance and credit, generating in creases in our net income and earnings per share. Our substantial growth and the post-crisis regulatory mandate for higher capital levels for all banks, created certain dynamics we have been addressing during 2011. In the current quarter, t he 1.4 million share common equity offering added $23.5 million in net new capit al. Additionally, during 2011 we raised $4.6 million through our previously ann ounced Dividend Reinvestment Plan (the DRP). As a historically well capitalized bank , the new equity capital significantly improved all relevant capital ratios, and is critical to maintaining our positive momentum. In the near term, certain mea sures of profitability will be impacted, by the higher equity and increased shar e count, as we conservatively deploy these proceeds. Long term we believe a str ong, fortified balance sheet will, provide the platform for the continued execut ion of our community banking business strategy, commented Mr. OConnor. Balance Sheet and Asset Quality Total assets of $1.34 billion at December 2011, were $309 million higher than la st year and average assets increased 22%. This reflects strong organic growth in new and existing markets and, to a lesser extent, the May 2011 HSB acquisitio n. Total asset growth, excluding the impact of HSB, was robust at $240 million o r 23% over December 2010, including growth of $115.2 million or 24% in investmen ts, $69 million or 14% in loans and $54.3 million in cash and cash equivalents. Total deposits were $1.19 billion at December 2011 and included $321.5 million of demand deposits. The increase in total deposits at year end 2011, exclusive o

f HSB deposits, reflects organic growth of $214.3 million or 23% compared to Dec ember 2010. Asset quality measures improved as non-performing assets (NPA) at December 2011 de clined 38% to $4.2 million from $6.7 million at December 2010, and currently rep resents only 0.68% of total loans, compared to 1.33% at December 2010. A portio n of the decline reflects the classification of $2.3 million in non-performing l and loans as loans held for sale. These loans were reported at their fair value at December 2011, and were sold in January 2012 with no gain or loss. For 2011 , the allowance for loan losses increased $2.3 million to $10.8 million. The all owance as a percentage of total loans increased to 1.77% compared to 1.69% at De cember 2010. Excluding the impact of the acquired HSB loans, which were initial ly recorded at their fair values this ratio would be 1.87%. Our asset quality metrics remain well above our peers and we continue to originat e new loans following our prudent underwriting standards. Our coverage levels b oth to total loans and to NPAs remain strong, commented Mr. OConnor. Stockholders equity grew to $107 million reflecting the capital raised through th e stock offerings, the HSB transaction and the DRP, as well as continued earning s growth, net of dividends. Overall, Tier 1 capital increased to $118.3 million or 48% higher than the December 2010 level. The Companys capital ratios exceed a ll regulatory minimums and it continues to be classified as well capitalized. Challenges & Opportunities The current banking environment remains challenging in many respects. The absolu te level of interest rates and the potential for them to remain at or near histo ric lows, for an extended period, creates issues for margin management and heigh tened risks to the eventuality of higher rates. The omnipresent regulatory envir onment with its pending new regulations, rules and compliance burdens certainly contributes to uncertainty. Finally, the credit environment appears to be improv ing. We have the potential at any moment for a change depending on the impact of world and national events, or more localized issues with municipal budgets and the related fallout. Any one of these factors could affect economic activity and our customers businesses, creating a domino effect on credit quality. This was another year of milestone achievements and significant change for our C ompany. The acquisition, organic growth and considerably higher capital demonstr ate our ability to identify, leverage and efficiently execute on opportunities. As we look ahead, we see future opportunities to continue this trajectory and po sitive momentum. Our customers and certain markets in which we operate have bee n less affected than others by recent economic turmoil. However, they and more i mportantly, we, are not insulated from the general economic environment and its related impacts. Recognizing this is critical to our continued ability to execu te our strategy. We must continue to foster relationships with businesses and cu stomers that share our principles and philosophies for prudent and reasonable fi scal and operational management, concluded Mr. OConnor. About Bridge Bancorp, Inc. Bridge Bancorp, Inc. is a one bank holding company engaged in commercial banking and financial services through its wholly owned subsidiary, The Bridgehampton N ational Bank. Established in 1910, the Bank, with assets of approximately $1.3 billion, and a primary market area of Suffolk County, Long Island, operates 20 r etail branch locations. Through this branch network and its electronic delivery channels, it provides deposit and loan products and financial services to local businesses, consumers and municipalities. Title insurance services are offered t hrough the Banks wholly owned subsidiary, Bridge Abstract. Bridge Investment Serv ices offers financial planning and investment consultation. The Bridgehampton National Bank continues a rich tradition of involvement in the

community by supporting programs and initiatives that promote local business, t he environment, education, healthcare, social services and the arts. Please see the attached tables for selected financial information.

This report may contain statements relating to the future results of the Company (including certain projections and business trends) that are considered forwardlooking statements as defined in the Private Securities Litigation Reform Act of 1995 (the PSLRA). Such forward-looking statements, in addition to historical info rmation, which involve risk and uncertainties, are based on the beliefs, assumpt ions and expectations of management of the Company. Words such as expects, believ es, should, plans, anticipates, will, potential, could, intend, may, out timated, assumes, likely, and variation of such similar expressions are intended to i dentify such forward-looking statements. Examples of forward-looking statements include, but are not limited to, possible or assumed estimates with respect to the financial condition, expected or anticipated revenue, and results of operati ons and business of the Company, including earnings growth; revenue growth in re tail banking lending and other areas; origination volume in the consumer, comme rcial and other lending businesses; current and future capital management progra ms; non-interest income levels, including fees from the title abstract subsidiar y and banking services as well as product sales; tangible capital generation; ma rket share; expense levels; and other business operations and strategies. For t his presentation, the Company claims the protection of the safe harbor for forwa rd-looking statements contained in the PSLRA. Factors that could cause future results to vary from current management expectat ions include, but are not limited to, changing economic conditions; legislative and regulatory changes, including increases in FDIC insurance rates; monetary a nd fiscal policies of the federal government; changes in tax policies; rates and regulations of federal, state and local tax authorities; changes in interest ra tes; deposit flows; the cost of funds; demands for loan products; demand for fin ancial services; competition; changes in the quality and composition of the Banks loan and investment portfolios; changes in managements business strategies; chan ges in accounting principles, policies or guidelines, changes in real estate val ues; a failure to realize or an unexpected delay in realizing, the growth opport unities and cost savings anticipated from the Hamptons State Bank merger; an une xpected increase in operating costs, customer losses and business disruptions f ollowing the Hamptons State Bank merger; expanded regulatory requirements as a r esult of the Dodd-Frank Act, which could adversely affect operating results; and other factors discussed elsewhere in this report, and in other reports filed by the Company with the Securities and Exchange Commission. The forward-looking statements are made as of the date of this report, and the Company assumes no ob ligation to update the forward-looking statements or to update the reasons why a ctual results could differ from those projected in the forward-looking statement s.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Tops Bankruptcy DocumentsDocument83 pagesTops Bankruptcy DocumentsAnonymous vhwDL2u100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- BarclaysDocument1 pageBarclaysEtherikal CommanderNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Insurance Agency Business PlanDocument43 pagesInsurance Agency Business PlanJoin Riot100% (5)

- The Longest HatredDocument44 pagesThe Longest HatredRene SchergerNo ratings yet

- Direct Deposit Enrollment Form: The Bancorp Bank 123Document1 pageDirect Deposit Enrollment Form: The Bancorp Bank 123rita ggggggNo ratings yet

- Project Manager Construction Real Estate Development in Los Angeles CA Resume Rey AdalinDocument2 pagesProject Manager Construction Real Estate Development in Los Angeles CA Resume Rey AdalinReyAdalinNo ratings yet

- Luneta Motors CaseDocument4 pagesLuneta Motors CaseErikha AranetaNo ratings yet

- Metropolitan Bank Vs CabilzoDocument10 pagesMetropolitan Bank Vs CabilzoJoey MapaNo ratings yet

- 5-10-2022 Budget Hearing Presentation UpdatedDocument12 pages5-10-2022 Budget Hearing Presentation UpdatedRiverheadLOCALNo ratings yet

- Riverhead Town Proposed Battery Energy Storage CodeDocument10 pagesRiverhead Town Proposed Battery Energy Storage CodeRiverheadLOCALNo ratings yet

- RXR/GGV Qualified & Eligible Documents (Final 09.26.22)Document23 pagesRXR/GGV Qualified & Eligible Documents (Final 09.26.22)RiverheadLOCALNo ratings yet

- Draft Scope Riverhead Logistics CenterDocument20 pagesDraft Scope Riverhead Logistics CenterRiverheadLOCALNo ratings yet

- N.Y. Downtown Revitalization Initiative Round Five GuidebookDocument38 pagesN.Y. Downtown Revitalization Initiative Round Five GuidebookRiverheadLOCALNo ratings yet

- 2022 - 03 - 16 - EPCAL Resolution & Letter AgreementDocument9 pages2022 - 03 - 16 - EPCAL Resolution & Letter AgreementRiverheadLOCALNo ratings yet

- Riverhead Budget Presentation March 22, 2022Document14 pagesRiverhead Budget Presentation March 22, 2022RiverheadLOCALNo ratings yet

- Catherine KentDocument7 pagesCatherine KentRiverheadLOCALNo ratings yet

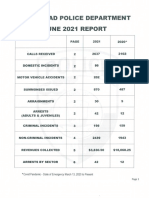

- Riverhead Town Police Monthly Report July 2021Document6 pagesRiverhead Town Police Monthly Report July 2021RiverheadLOCALNo ratings yet

- Riverhead Comprehensive Plan Update Public Outreach Compendium Feb 16, 2022Document7 pagesRiverhead Comprehensive Plan Update Public Outreach Compendium Feb 16, 2022RiverheadLOCALNo ratings yet

- Peconic Bay Region Community Preservation Fund Revenues 1999-2021Document1 pagePeconic Bay Region Community Preservation Fund Revenues 1999-2021RiverheadLOCALNo ratings yet

- Riverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022Document30 pagesRiverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022RiverheadLOCALNo ratings yet

- AKRF Public Outreach Report AttachmentsDocument126 pagesAKRF Public Outreach Report AttachmentsRiverheadLOCALNo ratings yet

- Yvette AguiarDocument10 pagesYvette AguiarRiverheadLOCALNo ratings yet

- Pediatric Covid-19 Hospitalization ReportDocument15 pagesPediatric Covid-19 Hospitalization ReportKevin TamponeNo ratings yet

- Robert E. KernDocument3 pagesRobert E. KernRiverheadLOCALNo ratings yet

- Kenneth RothwellDocument5 pagesKenneth RothwellRiverheadLOCALNo ratings yet

- 2021 General Election - Suffolk County Sample Ballot BookletDocument154 pages2021 General Election - Suffolk County Sample Ballot BookletRiverheadLOCALNo ratings yet

- Juan Micieli-MartinezDocument3 pagesJuan Micieli-MartinezRiverheadLOCALNo ratings yet

- Riverhead Town Police Report, March 2021Document6 pagesRiverhead Town Police Report, March 2021RiverheadLOCALNo ratings yet

- League of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsDocument2 pagesLeague of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsRiverheadLOCAL67% (3)

- Evelyn Hobson-Womack Campaign Finance DisclosureDocument3 pagesEvelyn Hobson-Womack Campaign Finance DisclosureRiverheadLOCALNo ratings yet

- Riverhead Town Police Monthly Report, June 2021Document6 pagesRiverhead Town Police Monthly Report, June 2021RiverheadLOCALNo ratings yet

- NYSED Health and Safety Guide For The 2021 2022 School YearDocument21 pagesNYSED Health and Safety Guide For The 2021 2022 School YearNewsChannel 9100% (2)

- "The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PEDocument10 pages"The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PERiverheadLOCALNo ratings yet

- Riverhead Town Police Report, August 2021Document6 pagesRiverhead Town Police Report, August 2021RiverheadLOCALNo ratings yet

- Riverhead Town Police Report, January 2021Document6 pagesRiverhead Town Police Report, January 2021RiverheadLOCALNo ratings yet

- Aguiar-Kent Campaign Finance Report 32-Day Pre GeneralDocument2 pagesAguiar-Kent Campaign Finance Report 32-Day Pre GeneralRiverheadLOCALNo ratings yet

- Old Steeple Church Time CapsuleDocument4 pagesOld Steeple Church Time CapsuleRiverheadLOCALNo ratings yet

- Navy Environmental Concerns Survey For CalvertonDocument3 pagesNavy Environmental Concerns Survey For CalvertonRiverheadLOCALNo ratings yet

- Pnadk 970Document64 pagesPnadk 970Kasolo DerrickNo ratings yet

- Al Dhaid Trading & Contracting Al Dhaid Trading ContractingDocument5 pagesAl Dhaid Trading & Contracting Al Dhaid Trading ContractingAbi JithNo ratings yet

- Life Insurance Needs CalculatorDocument6 pagesLife Insurance Needs CalculatorNakkolopNo ratings yet

- Lucknow Unoiversity Syllabus of BBA-302 & BBA-503Document2 pagesLucknow Unoiversity Syllabus of BBA-302 & BBA-503shailesh tandonNo ratings yet

- ASPIRE Home Finance Corp. LTD - PD ReportDocument6 pagesASPIRE Home Finance Corp. LTD - PD Reportsushant1903No ratings yet

- Abstract:: Financial Institutions and Their Role in The Development and Financing of Small Individual ProjectsDocument14 pagesAbstract:: Financial Institutions and Their Role in The Development and Financing of Small Individual ProjectsRamona Georgiana IonițăNo ratings yet

- Al Arafah Islamic BankDocument8 pagesAl Arafah Islamic Bankmd. Piar Ahamed100% (1)

- Internship Report On MCB Bank Limited: Introduction of Banking Industry What Is Bank?Document55 pagesInternship Report On MCB Bank Limited: Introduction of Banking Industry What Is Bank?Muhammad BurhanNo ratings yet

- PDFDocument4 pagesPDFShreya AgrawalNo ratings yet

- Worksheet 2019Document1,366 pagesWorksheet 2019Lex AmarieNo ratings yet

- UntitledDocument10 pagesUntitledHien HaNo ratings yet

- Background of The CompaniesDocument7 pagesBackground of The CompaniesJerhome LunaNo ratings yet

- Response To Comments On Sh. Ashish Gupta MemorandumDocument5 pagesResponse To Comments On Sh. Ashish Gupta MemorandumShaurya SinghNo ratings yet

- Haj Application - 2012 - (Print in Legal Size Only)Document6 pagesHaj Application - 2012 - (Print in Legal Size Only)Loved HerNo ratings yet

- A PresentationDocument6 pagesA Presentationmosa2486No ratings yet

- OpTransactionHistoryTpr17 09 2019 PDFDocument2 pagesOpTransactionHistoryTpr17 09 2019 PDFSonu DangiNo ratings yet

- Corporate Action Processing: What Are The Risks?: Sponsored By: The Depository Trust & Clearing CorporationDocument45 pagesCorporate Action Processing: What Are The Risks?: Sponsored By: The Depository Trust & Clearing CorporationMalcolm MacCollNo ratings yet

- Assignment of Mortgage Assignment OF MortgageDocument4 pagesAssignment of Mortgage Assignment OF MortgageHelpin HandNo ratings yet

- Acca Paper F3 Financial Accounting Mock Exam Prepared By: MR Yeo Hong AnnDocument23 pagesAcca Paper F3 Financial Accounting Mock Exam Prepared By: MR Yeo Hong AnnOrion0088No ratings yet

- "Customer Attitude Towards COMMERCIAL LOANDocument58 pages"Customer Attitude Towards COMMERCIAL LOANPulkit SachdevaNo ratings yet

- Fast Facts Mastercard New Payments Index 2022Document1 pageFast Facts Mastercard New Payments Index 2022jefcheung19No ratings yet

- Synopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Document4 pagesSynopsis Tittle of The Project: A Study of Rural Banking in A State (Maharashtra)Rohit UbaleNo ratings yet