Professional Documents

Culture Documents

FLS011 Application For PenCon Special STL

Uploaded by

willienorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FLS011 Application For PenCon Special STL

Uploaded by

willienorCopyright:

Available Formats

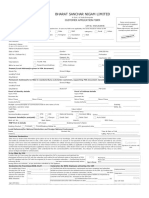

APPLICATION FOR PENALTY CONDONATION/ FOR HDMF USE ONLY SPECIAL SHORT-TERM LOAN (STL)

(TO BE FILLED OUT BY APPLICANT)

PLEASE READ GUIDELINES AND INTRUCTIONS AT THE BACK. TYPE OR PRINT ALL INFORMATION IN CAPITAL LETTERS.

FLS011

PURPOSE SPECIAL STL PENCON & SPECIAL STL TAV OFFSETTING WITH PENCON

LAST NAME

FIRST NAME

NAME EXTENSION

(e.g., JR, II)

MIDDLE NAME

NO MIDDLE NAME REGISTRATION TRACKING No. APPLICATION No.

(if applicable only)

MOTHER'S MAIDEN NAME

GENDER

MALE FEMALE

CIVIL STATUS

SINGLE MARRIED WIDOW/ER ANNULLED LEGALLY SEPARATED

DATE OF BIRTH

mm dd yyyy

PLACE OF BIRTH

SSS/GSIS ID No.

TIN

PERMANENT HOME ADDRESS (Pls. indicate complete address)

HOME TEL. No.

CELLPHONE No.

LAST EMPLOYER/BUSINESS NAME

EMPLOYER/BUSINESS ADDRESS

DATE OF DISPLACEMENT

SIGNATURE OF APPLICANT IN THE EVENT OF THE APPROVAL OF MY APPLICATION FOR SPECIAL SHORTTERM LOAN, I HEREBY AUTHORIZE HDMF TO CREDIT MY LOAN PROCEEDS THROUGH MY LANDBANK ACCOUNT THAT I HAVE INDICATED ON THE RIGHT PORTION.

.

MEMBER'S LANDBANK ACCOUNT NO.

BRANCH (Where member maintains LandBank account)

LANDBANK ADDRESS

APPLICATION AGREEMENT

I certify that the information given and any or all statements made herein are true and correct to the best of my knowledge and belief. I hereby certify under pain of perjury that my signature appearing herein is genuine and authentic. Should there be no loan proceeds after TAV offsetting, if any, this application shall serve as application for penalty condonation. In case of falsification, misrepresentation or any similar acts committed by me, HDMF shall automatically suspend my loan privileges indefinitely. I shall abide with all the applicable rules and regulations governing this lending program that HDMF may promulgate from time to time. In case of membership termination prior to full payment of the loan, I understand that no claim for provident benefit shall be paid to me or my beneficiaries until after the full satisfaction of any amount arising from this agreement which remains unpaid as of the date of such termination

_____________________________________ Signature of Applicant over Printed Name

PROMISSORY NOTE

For value received, I promise to pay on due date without need of demand to the order of Home Development Mutual Fund (HDMF) with principal office at the Atrium of Makati, Makati Ave., City of Makati the sum of Pesos: (P_______________) Philippine Currency, with interest at the rate of 10.75% p. a., compounded monthly. Interest shall be charged during the grace period. I hereby waive notice of demand for payment and agree that any legal action, which may arise in relation to this note, may be instituted in the proper court of Makati City, or in any locality where HDMF conducts its business, through its Branches. Finally, this note shall likewise be subject to the following terms and conditions: 1. The borrower shall pay the amount of Pesos: _______________________________ (P_______________) directly to any HDMF office or to any of its authorized collecting agents. Should the borrower become employed at any time within the term of the loan, he may opt to pay thru his new employer. 2. Payments are due on or before the fifteenth (15th) of the month starting on the thirteenth (13th) month from date of approval of loan application. 3. The borrower who fails to pay the full monthly amortization when due shall pay 1/2% of the amount due for every month of delay. A fraction of a month shall be considered as one month. 4. The monthly payment shall be applied according to the following order of priorities: Penalties, Interest and Principal. 5. The borrower shall be considered in default in any of the following cases: a. Any willful misrepresentation made by the borrower in any of the documents executed in relation hereto. b. Failure to pay any three (3) consecutive monthly amortizations and other obligations on the loan during the term of the loan. c. Violation by the borrower of any of the policies, rules, regulations and guidelines of the Fund. 6. In the event of default, the outstanding loan balance, all accumulated interests and penalties shall become due and demandable. The said amount shall be applied against the borrowers TAV on the fifth (5th) month of non-payment.

_____________________________________ Signature of Applicant over Printed Name

Signed in the presence of:

____________________________

Witness (Signature over Printed Name)

___________________________

Witness (Signature over Printed Name)

THIS PORTION IS FOR HDMF USE ONLY

LOAN EVALUATION

DOCUMENTS SUBMITTED

NOTICE OF SEPARATION/TERMINATION CERTIFICATE OF RETRENCHMENT/LAY-OFF PROOF OF BILLING ADDRESS VALID ID CARD REFLECTING COMPLETE ADDRESS PASSPORT (FOR OFW ONLY) DFA ISSUED TRAVEL DOCUMENTS (FOR OFW ONLY) OTHERS ____________________

REMARKS

VALIDATED BY

DATE

CLAIM/STL VERIFICATION

PARTICULARS CLAIMS MPL/CALAMITY LOAN NONE WITH DV/CHECK NO. / APPLICATION NO. DATE FILED / DV NO. VERIFIED BY DATE

LOAN APPROVAL

DATE GRANTED APPROVED LOAN VALUE MONTHLY AMORTIZATION REPAYMENT PERIOD

REVIEWED BY

DATE

ACTION TAKEN

APPROVED DISAPPROVED

REMARKS

APPROVING AUTHORITY

DATE

THIS FORM CAN BE REPRODUCED. NOT FOR SALE

Revised 05/2009

GUIDELINES AND INSTRUCTIONS

A. WHO MAY FILE Any HDMF member who satisfies the following requirements: 1. Has been displaced from work beginning October 2008 due to the following reasons: 1.1 Closure of the company/employer 1.2 Retrenchment/lay-off 1.3 In the case of Pag-IBIG Overseas Program (POP), those who were repatriated to the Philippines due to pre-termination of employment contract resulting from retrenchment, closure of the company, or armed conflict. 2. Has made at least twenty-four (24) monthly contributions. B. HOW TO FILE The applicant shall: 1. Secure Application for Penalty Condonation/Special STL from any HDMF NCR/Regional branch. NOTE: At point of loan application, the member shall be required to update his membership records via the on-line Membership Registration System or by submitting a completely filled out Members Data Form (MDF). 2. Accomplish 1 copy of the application form. 3. Under PACSVAL releasing, attach photocopy of passbook or Automated Teller Machine (ATM) card reflecting the account name and bank account number. 4. Attach photocopy of the following documents, the original copies of which must be presented for authentication: a. Notice of Separation/Termination or Certification of Retrenchment/Lay-off b. Proof of billing address or valid ID card reflecting complete address* *Any proof of billing address (e.g., parents, spouse, etc.) may be used provided that the member-applicant is residing in the said address. c. For displaced OFWs - Passport or DFA issued travel documents - Employment Contract reflecting date of contract 5. Submit complete application to HDMF NCR/Regional branch maintaining your record. Processing of loans shall commence only upon submission of complete documents. C. LOAN FEATURES 1. PENALTY CONDONATION An eligible borrower whose outstanding MPL/Calamity Loan is delinquent and who files an application for Special STL shall be granted penalty condonation. Prior to TAV offsetting, all penalties incurred up to date of approval of application for Special STL shall be condoned. If during evaluation the borrower has no loan proceeds or if the borrower decides not to claim the same, the application for Special STL shall serve as his application for penalty condonation. It shall be reckoned up to date of approval of application. 2. TAV OFFSETTING Pursuant to Section 11 of HDMF Circular No. 56-H, a borrowers existing Multi-Purpose Loan (MPL) or Calamity Loan may be subjected to immediate TAV offsetting due to unemployment. Hence, the outstanding balance and all unpaid interests as of date of approval of application for Special STL and/or penalty condonation shall be applied against his TAV. 3. LOAN AMOUNT The loanable amount shall be equivalent to fifty percent (50%) of members Total Accumulated Value (TAV). In case the borrowers outstanding MPL/Calamity Loan underwent offsetting, his loan amount shall be equivalent to fifty percent (50%) of his remaining TAV. 4. LOAN TERM The loan shall have a term of three (3) years, inclusive of a one-year grace period on principal payments. 5. INTEREST RATE The loan shall bear an interest at the rate of 10.75% per annum, compounded monthly. Interest shall be charged during the grace period. 6. LOAN RELEASE The loan proceeds shall be released through any of the following modes: a. Credited to the borrowers bank account through the LANDBANKs Payroll Credit Systems Validation (PACSVAL) / and other similar modes of payment b. Through check, payable to the borrower 7. LOAN PAYMENT The special STL shall be paid in equal monthly amortizations in such amounts as may fully cover the principal and interest over the loan period. The first monthly amortization of the Special STL shall begin on the thirteenth (13th) month from date of approval of loan application. The monthly payments shall be paid every fifteenth (15th) of the month. Should the due date fall on a non-working day, the monthly payments shall be paid on the first working day after due date. Payments shall be made directly to any HDMF office or to its authorized collecting agents/banks. Should the borrower become employed at any time within the term of the loan, he may opt to pay thru his new employer. The borrower who fails to pay the full monthly amortization when due shall pay one-half percent (1/2%) of the amount due for every month of delay. A fraction of a month shall be considered as one month. The monthly payment shall be applied according to the following order of priorities: a.) Penalties b.) Interest c.) Principal Any amount paid in excess of the required monthly amortization shall be applied to future amortizations. The borrower has the option to pay his total obligation in full at any time within the term of the loan. Thereafter, he shall be allowed to avail of a new loan under the regular MPL program.

8. DEFAULT The borrower shall be considered in default in any of the following cases: a. Any willful misrepresentation made by the borrower in any of the documents executed in relation hereto. b. Failure to pay any three (3) consecutive monthly amortizations and other obligations on the loan during the term of the loan. c. Violation by the borrower of any of the policies, rules, regulations and guidelines of the Fund. A Notice of Default shall be issued to the borrower. 9. EFFECTS OF DEFAULT In the event of default, the outstanding loan balance, all accumulated interests and penalties shall become due and demandable. The said amount shall be applied against the borrowers TAV on the fifth (5th) month of non-payment. 10. LOAN RENEWAL A borrower may avail of an MPL under the regular program after paying at least six (6) monthly amortization payments.

You might also like

- Unified Application Form For Building Permit 2020Document2 pagesUnified Application Form For Building Permit 2020Jonathan ManuelNo ratings yet

- RDWork Laser Engraving Cutting Software V1.3Document79 pagesRDWork Laser Engraving Cutting Software V1.3Дудар ВадімNo ratings yet

- RELIANCEDocument5 pagesRELIANCEKrupal MehtaNo ratings yet

- Bill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Document4 pagesBill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Keshaw RajNo ratings yet

- Fsec & Fsic Application Form 2020Document2 pagesFsec & Fsic Application Form 2020Shi Yuan ZhangNo ratings yet

- Tenant Application Form 2018Document2 pagesTenant Application Form 2018Mae Camille VeraNo ratings yet

- Your Reliance Communications Bill: Summary of Current Charges Amount (RS.)Document5 pagesYour Reliance Communications Bill: Summary of Current Charges Amount (RS.)amritabhosleNo ratings yet

- Ogl 258541672382071375Document5 pagesOgl 258541672382071375RaamNo ratings yet

- Bill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Document4 pagesBill Enquiries: 3033 7777 or 377: Name Due Date Total Amount Due (RS.)Ashish NaikNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document4 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377rahuljaiswal20097313No ratings yet

- Proforma Invoice For 3 Ton Tube Ice Machine 2020.12.24 PDFDocument12 pagesProforma Invoice For 3 Ton Tube Ice Machine 2020.12.24 PDFARIS0% (1)

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document6 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Prashant SinghNo ratings yet

- Bottled Drinking Water Ao 18-A S 1993Document15 pagesBottled Drinking Water Ao 18-A S 1993cher28No ratings yet

- Viral Collection Contract v2.5Document3 pagesViral Collection Contract v2.5Desmond Tiongquico100% (1)

- Ogl 046821567831680558Document3 pagesOgl 046821567831680558Deependra SinghNo ratings yet

- Print PDFDocument2 pagesPrint PDFLany GepegaNo ratings yet

- Tax Invoice: SHREE GAS SERVICE (0000123693)Document2 pagesTax Invoice: SHREE GAS SERVICE (0000123693)Satish RajNo ratings yet

- CIMB CashRebate CalculationDocument5 pagesCIMB CashRebate CalculationLindaNo ratings yet

- 0129450730004260Document3 pages0129450730004260Deependra Singh100% (1)

- FWD Life Insurance Corp.: Expresslink Automatic Debit ArrangementDocument1 pageFWD Life Insurance Corp.: Expresslink Automatic Debit ArrangementMatteo Messina DenaroNo ratings yet

- For Billing Enquiry Visit Https://selfcare - Tikona.inDocument2 pagesFor Billing Enquiry Visit Https://selfcare - Tikona.inAdd K0% (1)

- BPI Autodebit Arrangement FormDocument1 pageBPI Autodebit Arrangement FormKane Arvin ChingNo ratings yet

- BSNL CafDocument3 pagesBSNL CafAnoop K JayanNo ratings yet

- Payment ReceiptDocument5 pagesPayment Receiptshilp shahNo ratings yet

- Purchase Order: Forty Five Thousand Five Hundred Pesos OnlyDocument1 pagePurchase Order: Forty Five Thousand Five Hundred Pesos Onlyalbert moldonNo ratings yet

- Customer Declaration FormDocument2 pagesCustomer Declaration FormAbhinanth Mj90% (10)

- Digital Customer Copy: I Confirm ThatDocument2 pagesDigital Customer Copy: I Confirm ThatTarun KumarNo ratings yet

- Transfer of Ownership (Too) - IndividualDocument2 pagesTransfer of Ownership (Too) - IndividualHarold VargasNo ratings yet

- Form Wsd78aDocument1 pageForm Wsd78ajeffreymacaseroNo ratings yet

- Invoice TemplateDocument7 pagesInvoice Templatetawhid anamNo ratings yet

- PCL LT - DS 20 KW - 1A APPLICATION AND AGREEMENT - A A - FORMDocument6 pagesPCL LT - DS 20 KW - 1A APPLICATION AND AGREEMENT - A A - FORMNavjyot Singh100% (1)

- CPRI Testing Charges.Document1 pageCPRI Testing Charges.Rakshit KumarNo ratings yet

- Elefant GfeDocument3 pagesElefant GfeCarolynElefantNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument1 pageTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- Customer Info Sheet PDFDocument3 pagesCustomer Info Sheet PDFMcAsia Foodtrade CorpNo ratings yet

- Bpi Ada FormDocument1 pageBpi Ada FormJohnrod AbrazaldoNo ratings yet

- 9126572009Document5 pages9126572009Ravi Kumar VarmaNo ratings yet

- 03-Mar-2013 Idea BillDocument7 pages03-Mar-2013 Idea BillMohd NafishNo ratings yet

- PGVCL Bill-25401028709Document1 pagePGVCL Bill-25401028709SDH HALVADNo ratings yet

- Stay Connected FormDocument3 pagesStay Connected Formkumarneeraj0% (1)

- How To Apply For SSS Death BenefitDocument4 pagesHow To Apply For SSS Death BenefitShilalah Openiano100% (1)

- Vat Relief Bir Transmittal Form Annex A 1Document1 pageVat Relief Bir Transmittal Form Annex A 1Gil DelenaNo ratings yet

- Home Loan Form NewDocument6 pagesHome Loan Form Newpatruni sureshkumarNo ratings yet

- Application Form Edsp CollegeDocument3 pagesApplication Form Edsp CollegeCherry Ann RoblesNo ratings yet

- Acc No: 917805912 BSNO: 15 D: MR V Siva Kumar - ReddyDocument8 pagesAcc No: 917805912 BSNO: 15 D: MR V Siva Kumar - ReddySivaReddyNo ratings yet

- Tax Invoice: Vijaya Indane Gas AGENCY (0000125369)Document2 pagesTax Invoice: Vijaya Indane Gas AGENCY (0000125369)Venkat DaimondNo ratings yet

- Your Reliance Communications BillDocument2 pagesYour Reliance Communications BillRajesh UpadhyayNo ratings yet

- FSED 001 - Application Form FSECDocument1 pageFSED 001 - Application Form FSECKristine BarrettoNo ratings yet

- Tax Invoice: AARSH INDANE (0000305336)Document2 pagesTax Invoice: AARSH INDANE (0000305336)Ashvin RamanaNo ratings yet

- Challan MTR Form Number-6: Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectDocument1 pageChallan MTR Form Number-6: Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectMANOJNo ratings yet

- BVS Form 2022Document1 pageBVS Form 2022Atibroc Neyadnis MariaginaNo ratings yet

- Delivery Note: (Company Name)Document11 pagesDelivery Note: (Company Name)compass marineNo ratings yet

- Merchant Integration Services: E-Stamp: IN-DL17949517426799QDocument6 pagesMerchant Integration Services: E-Stamp: IN-DL17949517426799QbaraniNo ratings yet

- 1 Unified Application For BLDG Permit (Front) - DPWHDocument1 page1 Unified Application For BLDG Permit (Front) - DPWHPatricia TiamaNo ratings yet

- Muthoot FinanceRBI Licence RegnDocument30 pagesMuthoot FinanceRBI Licence RegnTHE PHILOSOPHER MADDYNo ratings yet

- Ayala Coop Loan ApplicationDocument2 pagesAyala Coop Loan ApplicationRANDOMDUDEOFFICIALNo ratings yet

- Calamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)Document2 pagesCalamity Loan Application Form (CLAF, HQP-SLF-066) (Applicable To Imus Branch Members Only)egabad78% (9)

- Calamity HMDFDocument3 pagesCalamity HMDFchennieNo ratings yet

- Pag-IBIG Fund Multi Purpose Loan Application SLF001 V03Document2 pagesPag-IBIG Fund Multi Purpose Loan Application SLF001 V03Jazz Adaza67% (3)

- Pag-Ibig Multi Purpose Loan Application FormDocument2 pagesPag-Ibig Multi Purpose Loan Application Formhailglee192580% (5)

- Professional Education UnitsDocument1 pageProfessional Education UnitsNelvin Rivera NoolNo ratings yet

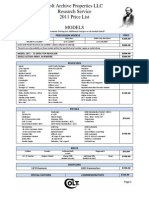

- Colt Archive Specification SheetDocument1 pageColt Archive Specification SheetwillienorNo ratings yet

- 01-General Administrative Service (Gas) - 2006Document5 pages01-General Administrative Service (Gas) - 2006Ron Man0% (1)

- Bersa CatalogDocument16 pagesBersa CatalogJonJon MivNo ratings yet

- BIR Form 1700Document2 pagesBIR Form 1700Al Ison MangampatNo ratings yet

- PNP Lateral Entry Form PDFDocument1 pagePNP Lateral Entry Form PDFgeorge_castaneda2013No ratings yet

- Region Province Name of Institution (Public/Private) Address Tel. No. Sector Course/Registered Program DurationDocument2 pagesRegion Province Name of Institution (Public/Private) Address Tel. No. Sector Course/Registered Program DurationwillienorNo ratings yet

- Ritemed Simvastatin: Therapeutic CategoryDocument2 pagesRitemed Simvastatin: Therapeutic CategorywillienorNo ratings yet

- Personal Data SheetDocument4 pagesPersonal Data SheetLeonil Estaño100% (7)

- Self Study ScheduleDocument1 pageSelf Study SchedulewillienorNo ratings yet

- AtorvastatinDocument3 pagesAtorvastatinwillienorNo ratings yet

- S&W M&P 2012 Catalog Part 1Document28 pagesS&W M&P 2012 Catalog Part 1tyrant88No ratings yet

- 6WG1AB1Document0 pages6WG1AB1willienor100% (1)

- TR - Driving NC IIDocument61 pagesTR - Driving NC IIMichael V. Magallano79% (14)

- Iwi Ace 762x51 ArDocument2 pagesIwi Ace 762x51 ArDizzyDynNo ratings yet

- YtubepwDocument2 pagesYtubepwwillienorNo ratings yet

- YtubepwDocument2 pagesYtubepwwillienorNo ratings yet

- Issp Annex4 111703Document2 pagesIssp Annex4 111703willienorNo ratings yet

- How To Drive A Manual CarDocument10 pagesHow To Drive A Manual CarworkNo ratings yet

- Requirements For License To Exercise Security ProfessionDocument5 pagesRequirements For License To Exercise Security ProfessionSalman Ranaw90% (20)

- Iwi Ace 762x39 ArDocument2 pagesIwi Ace 762x39 ArwillienorNo ratings yet

- General Education Pointers To ReviewDocument6 pagesGeneral Education Pointers To ReviewSandino RomanoNo ratings yet

- 2011 Archive Properties Price ListDocument2 pages2011 Archive Properties Price ListwillienorNo ratings yet

- YtubeDocument1 pageYtubewillienorNo ratings yet

- Iwi Galil Sniper SaDocument2 pagesIwi Galil Sniper Sawillienor0% (1)

- Remote DesktopDocument6 pagesRemote DesktopDhamotharan KalaiNo ratings yet

- 2012 LWRCI CatalogDocument24 pages2012 LWRCI CatalogJoe Behrle100% (2)

- Lenovo G460 Hardware Mainenance ManualDocument97 pagesLenovo G460 Hardware Mainenance ManualPATRICIO POBLETENo ratings yet

- Cisco 877w Adsl Configuration GuideDocument137 pagesCisco 877w Adsl Configuration GuidewillienorNo ratings yet

- BR-6624 MDocument81 pagesBR-6624 MwillienorNo ratings yet

- Personal Finance: Prelim Quiz 1 15/15Document6 pagesPersonal Finance: Prelim Quiz 1 15/15Baduday SicatNo ratings yet

- Recruitment and Selection Process For 1st Level Officer in Bank AlfalahDocument28 pagesRecruitment and Selection Process For 1st Level Officer in Bank AlfalahArslan Nawaz100% (1)

- Annual Report 2022 en Final WebsiteDocument76 pagesAnnual Report 2022 en Final WebsiteSin SeutNo ratings yet

- CHAPTER 3 Banker Customer Relationship Rights of A BankDocument8 pagesCHAPTER 3 Banker Customer Relationship Rights of A BankCarl AbruquahNo ratings yet

- Internship ReportDocument18 pagesInternship ReportSofonias MenberuNo ratings yet

- Income Statement and Statement of Financial Position Prepared byDocument7 pagesIncome Statement and Statement of Financial Position Prepared byFakhrul IslamNo ratings yet

- 2 Major Types of AccountsDocument18 pages2 Major Types of AccountsLUKE ADAM CAYETANONo ratings yet

- Assignment 1Document2 pagesAssignment 1georgeNo ratings yet

- F2 Joint CostDocument3 pagesF2 Joint CostMyo NaingNo ratings yet

- Ketan Parekh ScamDocument2 pagesKetan Parekh Scamrehan husainNo ratings yet

- Construction All RisksDocument6 pagesConstruction All RisksAzman YahayaNo ratings yet

- The Franchisor Feasibility StudyDocument12 pagesThe Franchisor Feasibility StudyLeighgendary CruzNo ratings yet

- Income Tax Lessons July 2019 0 PDFDocument124 pagesIncome Tax Lessons July 2019 0 PDFHannah YnciertoNo ratings yet

- Cast Study - GM MotorsDocument9 pagesCast Study - GM MotorsAbdullahIsmailNo ratings yet

- Cash Flow Statements Study GuideDocument37 pagesCash Flow Statements Study GuideAshekin MahadiNo ratings yet

- Issue of Debentures Redemption of Debentures UnderwrtingDocument47 pagesIssue of Debentures Redemption of Debentures UnderwrtingKeshav PantNo ratings yet

- Balance Sheet of Eicher Motors For MonicaDocument4 pagesBalance Sheet of Eicher Motors For MonicaBBA SFNo ratings yet

- New Summer Training Project ReportDocument62 pagesNew Summer Training Project ReportSagar Bhardwaj100% (1)

- FINECO 01 Consumption N InvestmentDocument33 pagesFINECO 01 Consumption N InvestmentHiếu Nhi TrịnhNo ratings yet

- Account Name BSB Account Number Account Type Date OpenedDocument6 pagesAccount Name BSB Account Number Account Type Date OpenedSandeep TuladharNo ratings yet

- Jeankeat TreatiseDocument96 pagesJeankeat Treatisereadit777100% (9)

- 2020 Beximco and Renata Ratio AnalysisDocument18 pages2020 Beximco and Renata Ratio AnalysisRahi Mun100% (2)

- Notes To The Financial Statements Are Additional Notes and Information Added To The End of TheDocument9 pagesNotes To The Financial Statements Are Additional Notes and Information Added To The End of TheReal AptitudeNo ratings yet

- LK BMHS 30 September 2021Document71 pagesLK BMHS 30 September 2021samudraNo ratings yet

- Workbook Week 7 SolutionsDocument11 pagesWorkbook Week 7 SolutionsThi Van Anh VUNo ratings yet

- ArundelDocument6 pagesArundelArnab Pramanik100% (1)

- How To Create Corporation WorksheetDocument4 pagesHow To Create Corporation WorksheetMaryNo ratings yet

- Rural Bank of Lipa vs. CA (366 SCRA 740)Document2 pagesRural Bank of Lipa vs. CA (366 SCRA 740)Rivera Meriem Grace MendezNo ratings yet

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageBill ChenNo ratings yet

- FundamentalsOfFinancialManagement Chapter8Document17 pagesFundamentalsOfFinancialManagement Chapter8Adoree RamosNo ratings yet