Professional Documents

Culture Documents

Fashion Shoe

Uploaded by

Manal ElkhoshkhanyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fashion Shoe

Uploaded by

Manal ElkhoshkhanyCopyright:

Available Formats

Solutions Guide: Please reword the answers to essay type parts so as to guarantee that your answer is an original.

Do not submit as is Problem 4-21) and submit to your instructor. The Fashion Shoe Company operates a chain of womens shoe shops around the country. The shops carry many styles of shoes that are all sold at the same price. Sales personnel in the shops are paid a substantial commission on each pair of shoes sold (in addition to a small basic salary) in order to encourage them to be aggressive in their sales efforts. The following worksheet contains cost and revenue data for Shop 48 and is typical of the companys many outlets: Per Pair of Shoes Selling price $ 30.00 Variable expenses: Invoice cost $ 13.50 Sales commission 4.50 Total variable expenses $ 18.00 Annual Fixed expenses: Advertising $ 30,000 Rent 20,000 Salaries 100,000 Total fixed expenses $ 150,000 Calculate the annual breakeven point in dollar sales and in unit sales for Shop 48. Prepare a CVP graph showing cost and revenue data for Shop 48 from zero shoes up to 17,000 pairs of shoes sold each year. Clearly indicate the break-even point on the graph. If 12,000 pairs of shoes are sold in a year, what would be Shop 48's net operating income or loss? The company is considering paying the store manager of Shop 48 an incentive commission of Shop 48 an incentive commission of 75 cents per pair of shoes (in addition to the salesperson's commission). If this change is made, what will be the new break-even point in dollar sales and in unit sales? Refer to the original data. As an alternative to (4) above, the company is considering paying the store manager 50 cents commission on each pair of shoes sold in excess of the break-even point. If this change is made, what will be the shop's net operating income or loss if 15,000 pairs of shoes are sold? Refer to the original data. The company is considering eliminating sales commissions entirely in its shops and increasing fixed salaries by $31,500 annually. If this change is made, what will be the new break-even point in dollar sales and in unit sales for Shop 48? Would you recommend that the change be made? Explain. 1. Profit = Unit CM Q Fixed expenses $0 = ($30 $18) Q $150,000 $0 = ($12) Q $150,000 $12Q = $150,000 Q = $150,000 $12 Q = 12,500 pairs 12,500 pairs $30 per pair = $375,000 in sales Alternative solution:

Fixed expenses Unit sales to = break even Unit contribution margin = $150,000 = 12,500 pairs $12.00

Dollar sales to = Fixed expenses break even CM ratio = $150,000 = $375,000 in sales 0.40

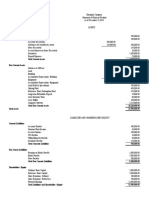

2. See the graph on the following page. 3. The simplest approach is: Break-even sales......................................... Actual sales................................................. Sales short of break-even........................... 12,500 pairs 12,000 pairs 500 pairs

500 pairs $12 contribution margin per pair = $6,000 loss Alternative solution: Sales (12,000 pairs $30.00 per pair).......................... Variable expenses $500 (12,000 pairs $18.00 per pair)............................... Break-even point: $450 Contribution margin..................................................... 12,500 pairs of shoes or Fixed expenses............................................................. $375,000 total sales $400 operating loss......................................................... Net $360,000 Total 216,000 Sales 144,000 Total 150,000 Expense s ($ 6,000)

Total Sales (000s)

$350 $300 $250 $200 $150 $100 $50 $0 0 2,500 5,000 7,500 10,000 12,500 15,000 17,500 20,000

Total Fixed Expense s

Number of Pairs of Shoes Sold

4. The variable expenses will now be $18.75 ($18.00 + $0.75) per pair, and the contribution margin will be $11.25 ($30.00 $18.75) per pair. Profit = Unit CM Q Fixed expenses $0 = ($30.00 $18.75) Q $150,000 $0 = ($11.25) Q $150,000 $11.25Q = $150,000 Q = $150,000 $11.25 Q = 13,333 pairs (rounded) 13,333 pairs $30.00 per pair = $400,000 in sales Alternative solution:

Unit sales to = Fixed expenses break even CM per unit = $150,000 = 13,333 pairs $11.25

Dollar sales to = Fixed expenses break even CM ratio =

5. The simplest approach is: Actual sales.................................................. Break-even sales.......................................... Excess over break-even sales....................... 15,000 pairs 12,500 pairs 2,500 pairs

$150,000 = $400,000 in sales 0.375

2,500 pairs $11.50 per pair* = $28,750 profit *$12.00 present contribution margin $0.50 commission = $11.50 Alternative solution: Sales (15,000 pairs $30.00 per pair)....................................... Variable expenses (12,500 pairs $18.00 per pair; 2,500 pairs $18.50 per pair)................................................................... Contribution margin................................................................... Fixed expenses........................................................................... Net operating income................................................................. 6. The new variable expenses will be $13.50 per pair. Profit = Unit CM Q Fixed expenses $0 = ($30.00 $13.50) Q $181,500 $0 = ($16.50) Q $181,500 $16.50Q = $181,500 Q = $181,500 $16.50 Q = 11,000 pairs 11,000 pairs $30.00 per pair = $330,000 in sales Although the change will lower the break-even point from 12,500 pairs to 11,000 pairs, the company must consider whether this reduction in the break-even point is more than offset by the possible loss in sales arising from having the sales staff on a salaried basis. Under a salary arrangement, the sales staff has less incentive to sell than under the present commission arrangement, resulting in a potential loss of sales $450,000 271,250 178,750 150,000 $ 28,750

and a reduction of profits. Although it is generally desirable to lower the break-even point, management must consider the other effects of a change in the cost structure. The break-even point could be reduced dramatically by doubling the selling price but it does not necessarily follow that this would improve the companys profit.

You might also like

- Basic AccountingDocument84 pagesBasic AccountingMusthaqMohammedMadathilNo ratings yet

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- Larry Williams Webinar PDFDocument85 pagesLarry Williams Webinar PDFVishal Patil100% (1)

- Marriott-Corporation - HBR CaseDocument4 pagesMarriott-Corporation - HBR CaseAsif RahmanNo ratings yet

- CH 07 DOitDocument4 pagesCH 07 DOitHanna DizonNo ratings yet

- UnitronDocument9 pagesUnitronIvan Naufal PriadyNo ratings yet

- MTT GuideDocument45 pagesMTT GuideSlavko Svagelj100% (4)

- Letter To Postmaster General Rev1Document2 pagesLetter To Postmaster General Rev1ppdfarm1usa100% (1)

- Brkeven Ex2 PDFDocument1 pageBrkeven Ex2 PDFSsemakula Frank0% (1)

- Parent, Inc Actual Financial Statements For 2012 and OlsenDocument23 pagesParent, Inc Actual Financial Statements For 2012 and OlsenManal ElkhoshkhanyNo ratings yet

- 1482299666Document638 pages1482299666Mike SmithNo ratings yet

- Baldwin Bicycle CaseDocument10 pagesBaldwin Bicycle CaseAli Zaigham AghaNo ratings yet

- Ifrs For SmesDocument130 pagesIfrs For SmesDharren Rojan Garvida AgullanaNo ratings yet

- Sol Wellington Chemicals DivisionDocument3 pagesSol Wellington Chemicals DivisionRahul Goyal100% (1)

- Solutions To Iron Pit FoundryDocument3 pagesSolutions To Iron Pit FoundryAbhijit KoundinyaNo ratings yet

- Group - 4 - Kooistra - Autogroep - MB EnnyDocument24 pagesGroup - 4 - Kooistra - Autogroep - MB EnnyDiah BauNo ratings yet

- 50 Multiple Choice, T/F, & Essay QuestionsDocument24 pages50 Multiple Choice, T/F, & Essay QuestionsManal Elkhoshkhany100% (1)

- 0081 150 CH02Document89 pages0081 150 CH02Siyeong SimNo ratings yet

- FinanceDocument3 pagesFinanceyogi9009No ratings yet

- Key Ans Master Budget AssignmentDocument13 pagesKey Ans Master Budget AssignmentNCTNo ratings yet

- Chapter 4 Solutions Manual PDFDocument18 pagesChapter 4 Solutions Manual PDFRemin ScarletNo ratings yet

- The Role of Color Logo and Brand Name in Business An Special Focus On BanksDocument15 pagesThe Role of Color Logo and Brand Name in Business An Special Focus On BanksNafees RezaNo ratings yet

- Internship Report On KBLDocument33 pagesInternship Report On KBLMurtaza Mari67% (9)

- IBC02 Group C 2.S1 Back Savers Production ProblemDocument11 pagesIBC02 Group C 2.S1 Back Savers Production ProblemPhuong Vy PhamNo ratings yet

- CH 5 - 1Document25 pagesCH 5 - 1api-251535767No ratings yet

- Problem 5-19 Basic CVP Analysis Graphing (LO1, LO2, LO4, LO6)Document16 pagesProblem 5-19 Basic CVP Analysis Graphing (LO1, LO2, LO4, LO6)Chamrith SophearaNo ratings yet

- Class Participation 9 E7-18: Last Name - First Name - IDDocument2 pagesClass Participation 9 E7-18: Last Name - First Name - IDaj singhNo ratings yet

- Single Company QuizDocument3 pagesSingle Company QuizShanthan AkkeraNo ratings yet

- GROUP ASSIGNMENT (Chapter 3, Case 3-62)Document6 pagesGROUP ASSIGNMENT (Chapter 3, Case 3-62)T Yoges Thiru MoorthyNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by AquinoBaesittieeleanor Mamualas100% (1)

- Exchange Rate Determination: Answers To End of Chapter QuestionsDocument14 pagesExchange Rate Determination: Answers To End of Chapter QuestionsMichael Rongo0% (1)

- Cash BudgetDocument2 pagesCash BudgetSenthil Kumar0% (1)

- Problem 18 - 18 18 - 31 and 18 - 32Document5 pagesProblem 18 - 18 18 - 31 and 18 - 32anon_459698449No ratings yet

- CVPDocument3 pagesCVPRajShekarReddyNo ratings yet

- 202E03Document29 pages202E03Ariz Joelee ArthaNo ratings yet

- 3-34. A Group of Medical Professionals Is Considering The Construction of ADocument3 pages3-34. A Group of Medical Professionals Is Considering The Construction of AsafwanNo ratings yet

- Managerial Accounting: Osama KhaderDocument37 pagesManagerial Accounting: Osama Khaderroaa ghanimNo ratings yet

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- This Study Resource Was: InstructionsDocument3 pagesThis Study Resource Was: InstructionsRama fauziNo ratings yet

- Chapter 17 Standard Costing Setting Standards and Analyzing VariancesDocument23 pagesChapter 17 Standard Costing Setting Standards and Analyzing VariancesHashir AliNo ratings yet

- Incremental AnalysisDocument18 pagesIncremental AnalysisMary Joy BalangcadNo ratings yet

- IAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionDocument41 pagesIAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionShameel IrshadNo ratings yet

- CH 11+16th+globalDocument37 pagesCH 11+16th+globalAmina SultangaliyevaNo ratings yet

- FM - Assignment I - Kubra FatimaDocument15 pagesFM - Assignment I - Kubra FatimaFaryal MughalNo ratings yet

- Chapter 11 PDFDocument66 pagesChapter 11 PDFSyed Atiq TurabiNo ratings yet

- A. Loan Processing Operation: 87.50%: UtilizationDocument36 pagesA. Loan Processing Operation: 87.50%: UtilizationQueenie Marie CastilloNo ratings yet

- BeechyChap21 PDFDocument51 pagesBeechyChap21 PDFkeo phommaNo ratings yet

- Garrison 11ce SM ch11 FinalDocument90 pagesGarrison 11ce SM ch11 FinalCoco ZaideNo ratings yet

- Quiz KeysDocument11 pagesQuiz KeyspragadeeshwaranNo ratings yet

- Tuff Wheels Was Getting Ready To Start Its Development ProjectDocument1 pageTuff Wheels Was Getting Ready To Start Its Development ProjectAmit PandeyNo ratings yet

- Time Value of Money General Instructions:: Activity 4 MfcapistranoDocument2 pagesTime Value of Money General Instructions:: Activity 4 MfcapistranoAstrid BuenacosaNo ratings yet

- MANAGERIAL FINANCE AssignmentDocument2 pagesMANAGERIAL FINANCE Assignmentfahim zamanNo ratings yet

- Question 1Document8 pagesQuestion 1elvitaNo ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida Amri50% (4)

- CVP AnalysisDocument7 pagesCVP AnalysisKat Lontok0% (1)

- Question-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Document6 pagesQuestion-Ias 2 - Ias 16 and Ias 40 - Admin-2019-2020-1Letsah BrightNo ratings yet

- Chapter 3: Working With Financial StatementsDocument10 pagesChapter 3: Working With Financial StatementsNafeun AlamNo ratings yet

- MA Chap 23-3ADocument2 pagesMA Chap 23-3Aminh hiếu trịnhNo ratings yet

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamNo ratings yet

- An Individual Assignment For Acc2 For MGMT2Document123 pagesAn Individual Assignment For Acc2 For MGMT2Amanuel GirmaNo ratings yet

- Cagayan State University - AndrewsDocument4 pagesCagayan State University - AndrewsWynie AreolaNo ratings yet

- 12-2 Cost AccountingDocument3 pages12-2 Cost AccountingRichKing100% (1)

- Chapter 12 SolutionsDocument29 pagesChapter 12 SolutionsAnik Kumar MallickNo ratings yet

- FIN 4610 HW 3Document19 pagesFIN 4610 HW 3Michelle Lam50% (2)

- ACCT-312: Class Exercises (Chapter 2) : AnnualDocument35 pagesACCT-312: Class Exercises (Chapter 2) : AnnualAmir ContrerasNo ratings yet

- Chapter 21Document4 pagesChapter 21Rahila RafiqNo ratings yet

- Corporate Finance - Chapter 16 and 17Document20 pagesCorporate Finance - Chapter 16 and 17Shamaas Hussain100% (5)

- CH 13#6Document13 pagesCH 13#6jjmaducdoc100% (1)

- The Cross-Price Elasticity of Demand For The Two Is CalculatedDocument3 pagesThe Cross-Price Elasticity of Demand For The Two Is CalculatedhaNo ratings yet

- Adam Bataineh Ch5Document10 pagesAdam Bataineh Ch5Omar AssafNo ratings yet

- Assignment On Management AccountingDocument17 pagesAssignment On Management AccountingMarysun Tlengr100% (2)

- Assignment On Management AccountingDocument17 pagesAssignment On Management Accountingbaburangpur100% (2)

- Cost, Volume, Profit Analysis - Ex. SoluDocument19 pagesCost, Volume, Profit Analysis - Ex. SoluHimadri DeyNo ratings yet

- Chapter 3 Solutions ManualDocument18 pagesChapter 3 Solutions ManualLoic GrahamNo ratings yet

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyNo ratings yet

- Auditing SP 2008 CH 5 SolutionsDocument13 pagesAuditing SP 2008 CH 5 SolutionsManal ElkhoshkhanyNo ratings yet

- Auditing SP 2008 CH 6 SolutionsDocument19 pagesAuditing SP 2008 CH 6 SolutionsManal ElkhoshkhanyNo ratings yet

- The Demand For Audit and Other Assurance Services: Review Questions 1-1Document13 pagesThe Demand For Audit and Other Assurance Services: Review Questions 1-1Audric AzfarNo ratings yet

- Egypt Revolution Inc.Document4 pagesEgypt Revolution Inc.Manal ElkhoshkhanyNo ratings yet

- Omaha 1Document7 pagesOmaha 1Manal ElkhoshkhanyNo ratings yet

- Chapters 11 & 12Document4 pagesChapters 11 & 12Manal ElkhoshkhanyNo ratings yet

- Accounting For Managers FinalDocument4 pagesAccounting For Managers FinalManal ElkhoshkhanyNo ratings yet

- Hightower ServiceDocument3 pagesHightower ServiceManal Elkhoshkhany100% (2)

- Accounting For Managers FinalDocument1 pageAccounting For Managers FinalManal ElkhoshkhanyNo ratings yet

- Chapters 11 & 12ADocument14 pagesChapters 11 & 12AManal ElkhoshkhanyNo ratings yet

- Joe's DeliDocument2 pagesJoe's DeliManal ElkhoshkhanyNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingManal Elkhoshkhany100% (1)

- PeacockDocument3 pagesPeacockManal ElkhoshkhanyNo ratings yet

- CarsonDocument1 pageCarsonManal ElkhoshkhanyNo ratings yet

- Managerial AccountingDocument5 pagesManagerial AccountingManal ElkhoshkhanyNo ratings yet

- FlackDocument2 pagesFlackManal ElkhoshkhanyNo ratings yet

- Comprehensive Problem 2Document3 pagesComprehensive Problem 2Manal ElkhoshkhanyNo ratings yet

- Project A Project B Probability Net Cash Flow Probability Net Cash FlowDocument1 pageProject A Project B Probability Net Cash Flow Probability Net Cash FlowManal ElkhoshkhanyNo ratings yet

- CarsonDocument1 pageCarsonManal ElkhoshkhanyNo ratings yet

- Loan Amortization 0206Document3 pagesLoan Amortization 0206Manal ElkhoshkhanyNo ratings yet

- Bad enDocument2 pagesBad enManal ElkhoshkhanyNo ratings yet

- SymphonyDocument1 pageSymphonyManal ElkhoshkhanyNo ratings yet

- Summertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Document2 pagesSummertime Corporation Statement of Owner's Equity For The Year Ending 12/31/2012Manal ElkhoshkhanyNo ratings yet

- Gray HouseDocument2 pagesGray HouseManal ElkhoshkhanyNo ratings yet

- The Real Power of Real OptionsDocument12 pagesThe Real Power of Real OptionsgoogkiteNo ratings yet

- The Economic Consequences of IFRS AdoptionDocument9 pagesThe Economic Consequences of IFRS AdoptionDiana IstrateNo ratings yet

- 2019 Level III Errata PDFDocument4 pages2019 Level III Errata PDFlinhatranNo ratings yet

- Hedge Fund Structures PDFDocument9 pagesHedge Fund Structures PDFStanley MunodawafaNo ratings yet

- Uniform Format of Accounts - SummaryDocument8 pagesUniform Format of Accounts - SummaryGotta Patti House100% (1)

- Civproc Digest RFC Vs AltoDocument1 pageCivproc Digest RFC Vs Altojoselle gaviolaNo ratings yet

- Exim BankDocument18 pagesExim BankvootlamNo ratings yet

- Securities Listing by Laws 2053Document14 pagesSecurities Listing by Laws 2053Krishna GiriNo ratings yet

- ATW108 Chapter 24 TutorialDocument1 pageATW108 Chapter 24 TutorialShuhada ShamsuddinNo ratings yet

- FMCG Report July 2018Document32 pagesFMCG Report July 2018Anshuman UpadhyayNo ratings yet

- Bank and NBFCDocument21 pagesBank and NBFCManika AggarwalNo ratings yet

- Supervising Officer Directing Any Illegal Payment or Disposition of The Funds Shall BeDocument2 pagesSupervising Officer Directing Any Illegal Payment or Disposition of The Funds Shall BeForkensteinNo ratings yet

- Topic 9 - The Standard Capital Asset Pricing Model Answer PDFDocument20 pagesTopic 9 - The Standard Capital Asset Pricing Model Answer PDFSrinivasa Reddy S100% (1)

- 2 Ride Holding Accelerates Its Development With The Financial Support of Eurazeo PME and Acquires Italian Company NolanDocument2 pages2 Ride Holding Accelerates Its Development With The Financial Support of Eurazeo PME and Acquires Italian Company NolanGanda PrajaNo ratings yet

- Exemplar Company - Fortunado PDFFDocument1 pageExemplar Company - Fortunado PDFFmitakumo uwuNo ratings yet

- THFJ Europe 50 2011Document15 pagesTHFJ Europe 50 2011nickmontNo ratings yet

- Portfolio Management: Case StudyDocument8 pagesPortfolio Management: Case StudyharterNo ratings yet

- Tariq Ali 1Document62 pagesTariq Ali 1Hafeezullah ShareefNo ratings yet

- FII in India Sept 09Document35 pagesFII in India Sept 09nettravellers100% (1)