Professional Documents

Culture Documents

HB 1776, The Property Tax Independence Act: Frequently Asked Questions (Faqs)

Uploaded by

Octorara_ReportOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HB 1776, The Property Tax Independence Act: Frequently Asked Questions (Faqs)

Uploaded by

Octorara_ReportCopyright:

Available Formats

HB 1776, The Property Tax Independence Act

Frequently Asked Questions (FAQs)

First, lets look at the basic philosophy of House Bill 1776, the Property Tax Independence Act. A simple substitution of the property tax with a Sales and Use Tax (SUT) as some lawmakers have suggested will not be effective at solving the education finance problem in Pennsylvania. Former governors' recommendations (and everyone else who recommends a similar idea) of raising the sales tax rate just to reduce property taxes a bit is a valueless recommendation. Like the failed Act 1, this proposal and others like it are all the same. They just throw different money at the problem. They incorporate nothing that fixes any of the causes of the current public school financing meltdown, do nothing to discipline out-of-control spending, and do nothing to improve economic conditions, restore homeownership, or address any of the existing severe financial problems facing our schools and the Commonwealth. The authors of House Bill 1776, the Property Tax Independence Act, are sensitive to the philosophical underpinnings of this plan, as evidenced by the history of the development of this legislation over many years. The primary reason for using an expanded sales tax base to solve the property tax problem is first and foremost a financial reason. This is built on the premise that to ELIMINATE the school property tax in order to restore homeownership, we must have the following: A predictable revenue stream that will grow with economic activity so that, when designed properly (as it is in the Property Tax Independence Act), it will never again require an increase in the tax rate. A revenue stream that is the most broad-based possible so that: o The financial burden is the lowest possible for all our citizens. o The most people possible contribute to the tax because it is for the purpose of public education, which is a constitutional obligation for the benefit of all.

o It provides the most flexibility possible so that people have a choice in how they contribute (for example, when they buy and what they buy). A revenue stream that has the economic capacity to replace the current taxes used for paying for education costs. This criteria is ONLY met with the sales tax, and when one considers the fact that the sales tax was implemented by the Legislature in 1953 for the stated reason that it was to be the mechanism to provide the state's share of public education costs AND that the name of the sales tax in law today remains, The PA Education Sales Tax, it makes good sense to use that tax as the primary funding source. It is, however, important to note that the Property Tax Independence Act is the ONLY comprehensive financial reform plan ever put forward, and to date is the ONLY plan that has been vetted in the public through its predecessor versions, is simple to understand, and fully addresses ALL the problems we have with the current funding system. While there are those who would argue that The Property Tax Independence Act seems socialistic in nature, the real fact is that the philosophical underpinnings of the plan are painstakingly free market in every element. In fact, it can be argued that the current system of government education is socialistic in that it provides no real parental choice, takes taxes at will, and through the power of government, can and increasingly does take peoples property (their homes and farms) when they cannot afford to pay their rent. That is truly the pattern of socialism. Much has been written about the plan through its years of development and it has been directly presented to more than 50,000 people all across Pennsylvania with the same response in every location nearly unanimous support. Below are some of the most frequently asked questions (FAQs) about House Bill 1776, the Property Tax Independence Act.

Q. How much money is required to fund K-12 public education in Pennsylvania? Who or what entity determines this amount? A. The current total cost of providing K-12 public education in Pennsylvania is now approximately $24 billion per year. This figure is the result of Pennsylvania Department of Education and local school districts financial statements. Q. The addition of the sales tax on some items currently not taxed has produced opposition to the bill since some people believe it will hamper the ability of specific businesses to compete and be profitable. Is this a valid objection?

A. No. As the broadened sales tax will be uniform, any company, whether a Pennsylvania company or an out-of-state company, that does business in Pennsylvania will be required to collect the sales tax. Also, any Pennsylvania company that provides goods or services to an outof-state company that does not require a sales tax on the particular goods or services will not be subject to the sales tax. Q. Is it true that sales tax rates are lower in border states, prompting many Pennsylvanians to shop out of state? A. No. It is not true that sales tax rates are lower in states that border Pennsylvania. Almost every border state has a sales tax rate already greater than 6 percent. For example, some counties in New York have rates as high as 9.75 percent. In addition, most of the border states also tax a wider range of goods and services, or in the case of Delaware, rely on a gross receipts tax on goods and services. Q. A Sales and Use Tax (SUT) shifts the burden, probably to businesses and those earning money, and inhibits investment in new businesses which create jobs, which produce the goods and provide the services we need, and which generate the revenue to finance necessary government services. Would centralizing the education bureaucracy then be counterproductive? The sales tax would be crushing, something like 23 percent and will fall on the same people the property tax does now. The productive people, especially young people looking for jobs, will leave the state as they are now doing and businesses, jobs, products and services will decline. Is this a reasonable and fair assessment? A. This is in the box thinking and is very wrong. The Property Tax Independence Act has been studied in previous versions by Moodys Economy.com. This was the very first econometric study obtained on any proposed tax plan in the Pennsylvania Legislature. Its findings and the economic underpinnings of the Property Tax Independence Act prove just the opposite of these fears. As an example, the plan, if enacted, would create tremendous economic expansion and produce more than 130,000 NEW jobs in the first three years. The economic stimulus created by the elimination of the largest tax burden afflicting our citizens would put approximately $10 billion a year into the pockets of our people, all of which will either be spent, saved, or given away, all of which is good economically. The increased spending power will produce tremendous broad-based economic growth, which is exactly what cutting taxes always does. Secondly, the greatest immediate economic stimulus will be realized through commercial investment because the value of all commercial property will skyrocket overnight at the signing of the legislation when the second largest business tax (property taxes) is eliminated. The return on investment will immediately go up substantially and for all intents and purposes would make our entire state a Keystone Opportunity Zone. Ask any real estate agent or commercial developer what this would do. There are many who are ready to buy the moment the Property Tax Independence Act makes its way to the governor.

Third, the Property Tax Independence Act broadens the base by including services as well, with key business exemptions remaining for certain services and for manufacturing and agriculture (as it is now). Under the SUT, everyone pays a little. The less you earn, the less you spend, and the less you spend the less you contribute. This fact, as well as the fact that the sales tax is fair and flexible, is why literally everyone who knows about the Property Tax Independence Act so strongly supports it. Q. There are many goods and services in Pennsylvania that are not currently subject to the state sales tax. However, under the Property Tax Independence Act the businesses that provide these goods and services will now be required to become tax collectors for the Department of Revenue. Is this true? A. Yes, it is true that some businesses that previously did not file with the state as sales tax collecting entities will now be required to do so. This again is a leveling of the playing field for businesses. However, many businesses are already required to submit the appropriate paperwork as they sell a combination of taxed and non-taxed items. It should also be noted that all businesses by law are paid 1 percent of all collections to offset the costs that are incurred as tax collecting agents for the Department of Revenue. Q. It would appear that, for every household that pays less in total taxes, there is a household that will pay more in taxes. Is this true? A. No, this is not necessarily true, but this is a frequently asked question about which many people are unclear. Right now in Pennsylvania, the burden of funding public education rests unevenly on those who own property. Anyone who does not own property does not proportionally contribute to public education funding. Therefore, in a general sense, those who rent and therefore do not pay a proportional share of education funding may see a net increase in cost. However, low-income renters will actually benefit from the plan with the swap from a local Earned Income Tax to the state-level Personal Income Tax, since low-income people earning less than $35,000 are forgiven the Personal Income Tax while they pay the local Earned income Tax from the first dollar earned. The Property Tax Independence Act simply changes public education funding to a revenue stream that takes a little from everyone rather than a large amount from some. In a simple analogy, imagine a classroom of 30 students that is being asked by their teacher to pay for a $30 gift for their principal. You have the option of having three students pay $10 (similar to what happens under the current property tax system) or thirty students pay $1 (like what would happen under the Property Tax Independence Act). In the end, the same amount of revenue is raised without having to rely unfairly on a certain segment of the classroom (population).

In addition, those who never own property in Pennsylvania but still buy items in Pennsylvania, like tourists, would be contributing to fund public education.

Q. Will this bill eliminate the hold harmless feature of the current school district funding system? If not, how do we overcome the objection that growing school districts are being short-funded? A. Under the Property Tax Independence Act, all school districts would be fully funded. Because of significant variations between districts, and the phase-out of property taxes and into the new Sales and Use Tax, new funding will occur in two different ways. 1. Initially, all school districts will initially receive 100 percent funding sufficient to meet all financial obligations and levels will be established at a per-student expenditure level per district. Initial funding levels will increase annually based on the increase in the Consumer Price Index (CPI), allowing school budgets to remain in step with inflation. 2. Further, all districts will be evaluated in predetermined periods for changes in student population and funding will be adjusted upward or downward to reflect those changes. Q. Much of the increase in cost is as a result of construction. Wouldnt strengthening the Taj Mahal Act help reduce spending that does not seem to lead to learning? A. Most of the crushing property tax burden borne by our taxpayers and the cause of the high cost of public education is attributable to salaries, federal special education mandates and similar programs. However, the tremendous increase in property taxes during the past 10 years or so has increasingly been because of construction. In fact, the current long-term debt held by our 500 school districts is now more than $24 billion. Some legislators have been saying that this debt albatross is like the horse coming around the outside of the track that overtakes the lead horse of teacher salaries as the leader of the property tax burden. If we do not overhaul the entire public education financial system soon and put immediate controls on spending, the system will be nearly impossible to stabilize. The Taj Mahal Act is a good thing, but it does not work when the voters have no say. And, it does not work when the horse is already out of the barn. It is critical to understand that the Property Tax Independence Act is not just trying to prevent a future problem. It is, in fact, trying to correct a very bad current financial problem that is getting geometrically worse by the month. The Property Tax Independence Act deals very specifically with the issue of construction debt and the entire issue of spending by requiring a voter referendum for any new construction debt that requires funding not provided in the basic school district budget. Q. Shouldnt the focus be on spending? Isnt the taxpayer protection or Taxpayer Bill of Rights (TABOR) the more effective and, politically, the more feasible approach?

A. If you favor TABOR and taxpayer protection, then you must embrace the Property Tax Independence Act because it incorporates a common element of control that would constrain spending to at or below economic growth. Under this legislation, the taxpayers keep more of their money. That means less taxes, more consumer spending, a more vibrant economy, and more financially secure citizens. No other suggestion for tax reform has been developed and tested like the Property Tax Independence Act. Q. Property taxes have been approved by voters of your own local community and it would seem that the place to address the issue is through the local school board and in those elections. What is the objection to this strategy? A. The fact is, none of the property taxes in the state have been voted in by the voters. They have been voted in by a small band of school board members essentially unaccountable to the taxpayer. If we would have had genuine voter referendums like many states, this statement might be true. Therefore, the problem is in fact not really local in the sense that the voters have created the current problem. Secondly, there is NO local solution for more than 100 school districts that will be forced to declare financial distress in the next few years and for which the state will be responsible by law to take over. These districts are poor districts that have NO wealth from which to derive revenue. They have no property value to tax and they have no income base to tax either. The entire system is on the verge of financial collapse and, whether we like it or not, the Commonwealth by statute and Constitution has an obligation regarding public education. Therefore, the solution is NOT local. Q. Will this bill eliminate the need for properties to be reassessed? A. No, not immediately. However, the need for assessment will be reduced. The frequency of assessments will decrease as the most common need for reassessment is to meet the demand for school budgets. Ultimately, if all property taxes are eliminated, assessments would be eliminated. Q. The Pennsylvania School Boards Association and Pennsylvania State Education Association are very influential in Harrisburg and would not permit any reduction in spending for their members, whether administrators or teachers, and would capture the bureaucracy as the insurance industry has captured the Department of Insurance. Is this a fair and accurate prediction? A. It is very true that these entities are influential. That is why in most districts and certainly in a statewide view, there has been no genuine spending control in our districts. The locals have been captive and that is why the spending has increased so sharply and why the Taj Mahals have been built even against the wishes of the local taxpayers. Under the Property Tax

Independence Act, spending increases are not suspended, but are realistically reduced. In part, the Property Tax Independence Act in a disciplined but realistic and predictable fashion slows the spending beneath the economic growth rate of the sales tax and forces financial discipline on the school boards by only allowing them a certain amount of revenue in which to operate. At the same time, the act does provide the revenue sufficient to meet their needs. It also introduces the concept of voter approval for new projects and expenditures. Q. Does the bill reduce the size of the state government? How? A. Initially, there is no change in state government size affected by this legislation, although because the Property Tax Independence Act slows the growth of spending, the size of local government will be reduced.

You might also like

- How America was Tricked on Tax Policy: Secrets and Undisclosed PracticesFrom EverandHow America was Tricked on Tax Policy: Secrets and Undisclosed PracticesNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Tax TheoriesDocument5 pagesTax TheoriesIsmail Budiono IINo ratings yet

- The New Income Tax Scandal: How the Income Tax Cheats Workers out of Million$ Each Year and the Corrupt Reasons Why This HappensFrom EverandThe New Income Tax Scandal: How the Income Tax Cheats Workers out of Million$ Each Year and the Corrupt Reasons Why This HappensNo ratings yet

- Summary: Flat Tax Revolution: Review and Analysis of Steve Forbes's BookFrom EverandSummary: Flat Tax Revolution: Review and Analysis of Steve Forbes's BookNo ratings yet

- NhlanhlaNeneSpeechTax Indaba2018Document7 pagesNhlanhlaNeneSpeechTax Indaba2018Tiso Blackstar GroupNo ratings yet

- Constructing a Better Tomorrow: A Logical Look to Reform AmericaFrom EverandConstructing a Better Tomorrow: A Logical Look to Reform AmericaNo ratings yet

- Taxes Are Obsolete by Beardsley Ruml, Former FED ChairmanDocument5 pagesTaxes Are Obsolete by Beardsley Ruml, Former FED ChairmanPatrick O'SheaNo ratings yet

- American Tyranny: Our Tax-Apocalypse-Cause for the Fairtax and the Abolishment of the Irs?From EverandAmerican Tyranny: Our Tax-Apocalypse-Cause for the Fairtax and the Abolishment of the Irs?No ratings yet

- Westminster MiGa Neg Kentucky Round 4Document39 pagesWestminster MiGa Neg Kentucky Round 4EmronNo ratings yet

- Jobs, Jobs, Jobs: Follow What's Happening OnDocument4 pagesJobs, Jobs, Jobs: Follow What's Happening OnPAHouseGOPNo ratings yet

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- The Benefit and The Burden: Tax Reform-Why We Need It and What It Will TakeFrom EverandThe Benefit and The Burden: Tax Reform-Why We Need It and What It Will TakeRating: 3.5 out of 5 stars3.5/5 (2)

- PPI - Family Friendly Tax Reform (Weinstein 2005)Document13 pagesPPI - Family Friendly Tax Reform (Weinstein 2005)ppiarchiveNo ratings yet

- The Importance of Taxes To The Government and The EconomyDocument3 pagesThe Importance of Taxes To The Government and The EconomyClarice Kee100% (5)

- Harvest PlanDocument2 pagesHarvest PlanTime Warner Cable NewsNo ratings yet

- “Life” Saving Tax Solutions: Leave Your Legacy to Heirs for Generations to Come …Income-Tax-FreeFrom Everand“Life” Saving Tax Solutions: Leave Your Legacy to Heirs for Generations to Come …Income-Tax-FreeNo ratings yet

- Buque - Prelim Exam-Income TaxationDocument3 pagesBuque - Prelim Exam-Income TaxationVillanueva, Jane G.No ratings yet

- Community Bulletin - April 2013Document9 pagesCommunity Bulletin - April 2013State Senator Liz KruegerNo ratings yet

- Welfare Services Are Actions or Procedures That Cover The Basic Well-Being of The Individuals and TheDocument5 pagesWelfare Services Are Actions or Procedures That Cover The Basic Well-Being of The Individuals and ThekarenepacinaNo ratings yet

- A Real Estate Agent's Guide to Pay Less Tax & Build More WealthFrom EverandA Real Estate Agent's Guide to Pay Less Tax & Build More WealthNo ratings yet

- US Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksFrom EverandUS Government Economics - Local, State and Federal | How Taxes and Government Spending Work | 4th Grade Children's Government BooksNo ratings yet

- A Primer On National Tax Reform ProposalsDocument2 pagesA Primer On National Tax Reform ProposalsJoshua StokesNo ratings yet

- Constitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxFrom EverandConstitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxNo ratings yet

- HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaDocument6 pagesHB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaOctorara_ReportNo ratings yet

- Freer Markets Within the Usa: Tax Changes That Make Trade Freer Within the Usa. Phasing-Out Supply-Side Subsidies and Leveling the Playing Field for the Working Person.From EverandFreer Markets Within the Usa: Tax Changes That Make Trade Freer Within the Usa. Phasing-Out Supply-Side Subsidies and Leveling the Playing Field for the Working Person.No ratings yet

- Forming A Policy For Tax Reform: by Thomas H. Spitters, CPADocument5 pagesForming A Policy For Tax Reform: by Thomas H. Spitters, CPAThomas H. SpittersNo ratings yet

- The Problem With Our Tax System and How It Affects UsDocument65 pagesThe Problem With Our Tax System and How It Affects Ussan pedro jailNo ratings yet

- 10 Good ReasonsDocument2 pages10 Good ReasonsApeironNo ratings yet

- Are Taxes EvilDocument5 pagesAre Taxes Evilpokeball0010% (1)

- Fair Taxation: The Starting Point For Fair EconomicsDocument10 pagesFair Taxation: The Starting Point For Fair EconomicsFairnessCoalitionNo ratings yet

- Summary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookFrom EverandSummary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookNo ratings yet

- Nevada Planning To End Taxation 2014Document5 pagesNevada Planning To End Taxation 2014enerchi1111No ratings yet

- Importance of Tax in EconomyDocument7 pagesImportance of Tax in EconomyAbdul WahabNo ratings yet

- Tax Shifting With BohacDocument6 pagesTax Shifting With BohaclightseekerNo ratings yet

- Behind Tax Policy Controversies: Social, Legal and Economic FoundationsFrom EverandBehind Tax Policy Controversies: Social, Legal and Economic FoundationsNo ratings yet

- The IRS Problem Solver: From Audits to Assessments—How to Solve Your Tax Problems and Keep the IRS Off Your Back ForeverFrom EverandThe IRS Problem Solver: From Audits to Assessments—How to Solve Your Tax Problems and Keep the IRS Off Your Back ForeverRating: 2 out of 5 stars2/5 (1)

- Module 15 Assignment 1Document3 pagesModule 15 Assignment 1Bea De ChavezNo ratings yet

- Dave Hickernell: Dear NeighborDocument4 pagesDave Hickernell: Dear NeighborPAHouseGOPNo ratings yet

- Let's Understand Social Security and Stimulate Investment: Or Separating Economic Voodoo from the TruthFrom EverandLet's Understand Social Security and Stimulate Investment: Or Separating Economic Voodoo from the TruthNo ratings yet

- Tax Inefficiencies and Alternative SolutionsDocument13 pagesTax Inefficiencies and Alternative SolutionsAbdullahNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- Tax Inefficiencies and Alternative SolutionsDocument13 pagesTax Inefficiencies and Alternative SolutionsAbdullahNo ratings yet

- Octorara Administration Office: Thomas L. Newcome II, Ed.DDocument2 pagesOctorara Administration Office: Thomas L. Newcome II, Ed.DOctorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 19Document1 page2013-14 Budget PResentation II Page 19Octorara_ReportNo ratings yet

- Octorara Administration Office: Thomas L. Newcome II, Ed.DDocument5 pagesOctorara Administration Office: Thomas L. Newcome II, Ed.DOctorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 16Document1 page2013-14 Budget PResentation II Page 16Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 20Document1 page2013-14 Budget PResentation II Page 20Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 12Document1 page2013-14 Budget PResentation II Page 12Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 14Document1 page2013-14 Budget PResentation II Page 14Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 7Document1 page2013-14 Budget PResentation II Page 7Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 8Document1 page2013-14 Budget PResentation II Page 8Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 18Document1 page2013-14 Budget PResentation II Page 18Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 13Document1 page2013-14 Budget PResentation II Page 13Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 21Document1 page2013-14 Budget PResentation II Page 21Octorara_ReportNo ratings yet

- Policy 011 11.21.11Document5 pagesPolicy 011 11.21.11Octorara_ReportNo ratings yet

- Ten ReasonsDocument3 pagesTen ReasonsOctorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 5Document1 page2013-14 Budget PResentation II Page 5Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 6Document1 page2013-14 Budget PResentation II Page 6Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 4Document1 page2013-14 Budget PResentation II Page 4Octorara_ReportNo ratings yet

- Newcome Response0001Document10 pagesNewcome Response0001Octorara_ReportNo ratings yet

- 2013-14 Budget PResentation II Page 3Document1 page2013-14 Budget PResentation II Page 3Octorara_ReportNo ratings yet

- HB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaDocument6 pagesHB 1776, The Property Tax Independence Act: A Solution That Makes Sense For PennsylvaniaOctorara_ReportNo ratings yet

- Policy 707-App A 11.21.11Document2 pagesPolicy 707-App A 11.21.11Octorara_ReportNo ratings yet

- Policy 707 11.21.11Document9 pagesPolicy 707 11.21.11Octorara_ReportNo ratings yet

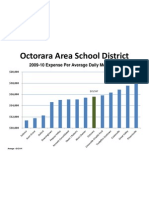

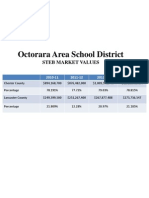

- Octorara Area School DistrictDocument4 pagesOctorara Area School DistrictOctorara_ReportNo ratings yet

- Policy 004 11.21.11Document7 pagesPolicy 004 11.21.11Octorara_ReportNo ratings yet

- Policy 008 11.21.11Document1 pagePolicy 008 11.21.11Octorara_ReportNo ratings yet

- Policy 006 11.21.11Document12 pagesPolicy 006 11.21.11Octorara_ReportNo ratings yet

- Policy 007 11.21.11Document3 pagesPolicy 007 11.21.11Octorara_ReportNo ratings yet

- Policy 005 11.21.11Document5 pagesPolicy 005 11.21.11Octorara_ReportNo ratings yet

- Managing Brands GloballyDocument13 pagesManaging Brands GloballySonam SinghNo ratings yet

- ACCT1501 Perdisco 1-3Document20 pagesACCT1501 Perdisco 1-3alwaysyjae86% (7)

- Audit of The Capital Acquisition and Repayment CycleDocument7 pagesAudit of The Capital Acquisition and Repayment Cyclerezkifadila2No ratings yet

- Oz Shy - Industrial Organization: Theory and Applications - Instructor's ManualDocument60 pagesOz Shy - Industrial Organization: Theory and Applications - Instructor's ManualJewggernaut67% (3)

- ECONDocument10 pagesECONChristine Mae MataNo ratings yet

- Illustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesDocument3 pagesIllustration: The Following Data Were Reported For 200A Business Activities of Western UniversitiesCarlo QuiambaoNo ratings yet

- Book On Making Money, The - Steve OliverezDocument177 pagesBook On Making Money, The - Steve Oliverezpipe_boy100% (1)

- Michael Milakovich - Improving Service Quality in The Global Economy - Achieving High Performance in Public and Private Sectors, Second Edition-Auerbach Publications (2005) PDFDocument427 pagesMichael Milakovich - Improving Service Quality in The Global Economy - Achieving High Performance in Public and Private Sectors, Second Edition-Auerbach Publications (2005) PDFCahaya YustikaNo ratings yet

- S AshfaqDocument45 pagesS AshfaqCMA-1013 V.NAVEENNo ratings yet

- Heritage Tourism: Submitted By, Krishna Dev A.JDocument5 pagesHeritage Tourism: Submitted By, Krishna Dev A.JkdboygeniusNo ratings yet

- REFLECTION PAPER (CAPEJANA VILLAGE) FinalDocument3 pagesREFLECTION PAPER (CAPEJANA VILLAGE) FinalRon Jacob AlmaizNo ratings yet

- CSR STPDocument7 pagesCSR STPRavi Shonam KumarNo ratings yet

- Cost Concept and ApplicationDocument11 pagesCost Concept and ApplicationGilbert TiongNo ratings yet

- Morong Executive Summary 2016Document6 pagesMorong Executive Summary 2016Ed Drexel LizardoNo ratings yet

- Procurement WorkDocument8 pagesProcurement WorkbagumaNo ratings yet

- OM Assignment Sec 2grp 3 Assgn2Document24 pagesOM Assignment Sec 2grp 3 Assgn2mokeNo ratings yet

- Recap: Globalization: Pro-Globalist vs. Anti-Globalist DebateDocument5 pagesRecap: Globalization: Pro-Globalist vs. Anti-Globalist DebateRJ MatilaNo ratings yet

- Project On Ibrahim Fibers LTDDocument53 pagesProject On Ibrahim Fibers LTDumarfaro100% (1)

- Sap TutorialDocument72 pagesSap TutorialSurendra NaiduNo ratings yet

- Statement 08 183 197 8Document6 pagesStatement 08 183 197 8Olwethu NgwanyaNo ratings yet

- INTERESTSDocument15 pagesINTERESTSAnastasia EnriquezNo ratings yet

- (Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Document223 pages(Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Felippe RochaNo ratings yet

- Business Plan Template 2023Document8 pagesBusiness Plan Template 2023Anecita OrocioNo ratings yet

- Independent University of Bangladesh: An Assignment OnDocument18 pagesIndependent University of Bangladesh: An Assignment OnArman Hoque SunnyNo ratings yet

- Case 7Document2 pagesCase 7Manas Kotru100% (1)

- Module Session 10 - CompressedDocument8 pagesModule Session 10 - CompressedKOPERASI KARYAWAN URBAN SEJAHTERA ABADINo ratings yet

- Unemployment ProblemDocument12 pagesUnemployment ProblemMasud SanvirNo ratings yet

- Ahmad FA - Chapter4Document1 pageAhmad FA - Chapter4ahmadfaNo ratings yet

- ch1 BPP Slide f1 ACCADocument95 pagesch1 BPP Slide f1 ACCAIskandar Budiono100% (1)