Professional Documents

Culture Documents

Chief Financial Officer or Controller or Director or VP

Uploaded by

api-121411114Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chief Financial Officer or Controller or Director or VP

Uploaded by

api-121411114Copyright:

Available Formats

PAUL A.

McCLINTOCK, CPA ________________________________________ 18115 Apache Springs Drive San Antonio, Texas 78259 net ________________________________________ Chief Financial Officer - Controller - Director

Phone: 210-386-9564 Email: pm12e9c54@westpost.

Senior financial professional with successes managing complex financial operatio ns to facilitate profitable business in diverse industries. Goal-focused visiona ry and change agent. Extensive experience in financial reporting, analysis, fore casting, inventory, cash management, auditing and controls in multi-location ret ail and wholesale organizations. Strong leader with valuable interpersonal skill s utilized to build, strengthen and maintain people relationships and cross-func tional team interactions. Solid personal commitment to high standard of professi onal integrity. CORE COMPETENCES * * * * * * * * * * Strategic and Business Planning Banking and Insurance Management Financial Statement and Management Reporting Turnarounds, Acquisitions and Mergers Internal Financial Controls Inventory Management Cash Flow Projections and Management Operational and Capital Budget Preparation Information Systems Management Human Resource Management

SELECTED ACHIEVEMENTS * Was contracted to convert an installment sale auto finance business into a lea sing operation. Working with a team developed a model, implementation plans, do cumentation and financial reporting process to optimize cash flow and profitabil ity of business. RESULTS: Plan was developed that will improve cash flow by $5. 6 million and improve profitability by $2.3 million due to reduced sales taxes e xpense, better return on financing and shorten conversion of bankruptcies while maintain customer pricing and lowering sales prices. * Led the total financial operations of a car rental company with 100 operating locations in nine states. Supervised directors of Finance, Accounting, Human Res ources, Operations, and Fleet and a staff of 50. Reorganized $500 million of inv entory debt to avert a financial crisis. Negotiated refinancing programs with ni ne existing lenders and built relationships with new lenders. Rolled negative ca sh flows on existing inventory to new inventory that was purchased and financed. RESULTS: Allowed the company to survive by rolling $40 million of debt on to fu ture acquisitions and spreading the negative cash flow over the future 10 to 24 months. Saved $5.2 million in late charges. Lowered borrowing costs by 50 basis points. * Revitalized an eroding revenue basis in a highly competitive business. Analyze d causes of revenue decline. Developed a business plan to increase rates with e xisting customers by utilizing a strong sales and customer service approach to i ncremental sales. Created a comprehensive incremental sales team and directed de velopment of new hiring practices, bonus programs, sales training process, and c ustomer evaluation processes. RESULTS: Improved incremental sales by 100% over t wo years, generating an additional $20 million in gross revenue and 25% ($5 mill ion) in net profit while improving customer service.

* Drove financial and operations activities for a commercial real estate managem ent company with four separate operating companies and $500 million in assets. S upervised six managers and a staff of 20. Resolved critical problems caused by t he use of multiple accounting software systems. Acquired and implemented a singl e accounting system to strengthen the financial process. RESULTS: Use of unifie d accounting system cut the collection process in half, improved cash flow, allo wed 40% reduction in accounting payroll, and generated accurate financials for m anagement review in only five days after month end. * Turned around three struggling subsidiaries of a major real estate management company, two with lossses and a third with chronically low profit. Prepared stra tegic plans for each. Hired and trained qualified staff to run each company. Di rected and executed focused plans to success. RESULTS: Grew revenue by 25% in a tough economy and turned all three companies to a profit of 10% of sales. * Managed the operations of the finance and leasing division of a $4 billion dis tributor. Led seven managers and a staff of 45. Developed a comprehensive busine ss plan to grow revenue while improving chronically low profitability. Hired and trained new management team. Expanded customer base through competitive pricing and service. RESULTS: Built business from 4,000 to 29,000 leases in 3.5 years , increasing net profit by 400%. PROFESSIONAL EXPERIENCE PAM Financial Group LLC, Texas and Indiana 2009 - 2011 Acting Chief Financial Officer and Treasurer - Oak Motors and Indiana Finance Co mpany DOMINION ADVISORY GROUP INC., commercial real estate developer, San Antonio, Tex as 2007 - 2009 Chief Financial Officer and Controller ADVANTAGE RENT A CAR, San Antonio, Texas 2000 - 2007 Chief Financial Officer and Treasurer PASS INTERNATIONAL INC., commercial construction company, Deerfield Beach, Flori da 1997 - 1999 Chief Financial Officer and Controller ADVANTAGE RENT A CAR, San Antonio, Texas 1991 - 1996 Director, Finance WORLD OMNI LEASING INC., Commercial Division, Deerfield Beach, Florida 1987 - 19 91 General Manager 1988 - 1991 Operations Manager 1987 ALAMO RENT A CAR, INC., Fort Lauderdale, Florida 1981 - 1987 Senior Director, Field Sales 1985 - 1987 Director, Acquisitions and Fleet Planning 1981 - 1985 PEAT, MARWICK, MITCHELL AND CO., Fort Lauderdale, Florida 1978 - 1981 Senior Audit Specialist 1979 - 1981 Audit Specialist 1978 - 1979 EDUCATION and LICENSING M.B.A. studies, Florida Atlantic University, Boca Raton, Florida B. S., cum laude, Accounting and Finance, Florida State University, Tallahassee, Florida C.P.A., State of Florida TECHNICAL EXPERTISE

Great Plains, Platinum, MRI, Yardi, and other ERP software systems

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Ledger & Trial BalanceDocument4 pagesThe Ledger & Trial BalanceJohn Marvin Delacruz Renacido80% (5)

- NYSF Leveraged Buyout Model Solution Part ThreeDocument23 pagesNYSF Leveraged Buyout Model Solution Part ThreeBenNo ratings yet

- BP - AkuntansiDocument73 pagesBP - AkuntansiUlin HsbNo ratings yet

- WSP Cash Conversion Cycle - VFDocument8 pagesWSP Cash Conversion Cycle - VFMichael OdiemboNo ratings yet

- Journal List For AccountingDocument5 pagesJournal List For AccountingNikhil Chandra ShilNo ratings yet

- Accounting Information System and Organi PDFDocument98 pagesAccounting Information System and Organi PDFSaleamlak MuluNo ratings yet

- R41819 IRR ABD The Accounting Quiz BeesDocument14 pagesR41819 IRR ABD The Accounting Quiz BeesGeraldo MejillanoNo ratings yet

- Management Information (ICAI)Document43 pagesManagement Information (ICAI)Rajib HossainNo ratings yet

- Report On Performance Management by Gelase Mutahaba 2 November 2010Document73 pagesReport On Performance Management by Gelase Mutahaba 2 November 2010pcman92No ratings yet

- Test Bank For Core Concepts of Accounting Information Systems 14th by SimkinDocument36 pagesTest Bank For Core Concepts of Accounting Information Systems 14th by Simkinpufffalcated25x9ld100% (48)

- SBR INT SD21 AsDocument9 pagesSBR INT SD21 AsCheng Chin HwaNo ratings yet

- Audit in Nursing Management and AdministrationDocument31 pagesAudit in Nursing Management and Administrationbemina jaNo ratings yet

- Engagement Letter (ISA 210) 2020Document2 pagesEngagement Letter (ISA 210) 2020Noman AnserNo ratings yet

- WIP Configuration SettingsDocument6 pagesWIP Configuration SettingsSantosh Vaishya75% (4)

- Accounting quiz with 11 multiple choice questionsDocument3 pagesAccounting quiz with 11 multiple choice questionsMelu100% (2)

- Closing EntriesDocument23 pagesClosing EntriesLeonabelle Yago DawitNo ratings yet

- Budget Management 176Document9 pagesBudget Management 176Pratik WaghelaNo ratings yet

- Advanced Accounting UpdatesDocument113 pagesAdvanced Accounting UpdatesYash KediaNo ratings yet

- McMurray Métis 2015 - Financial Statements - Year Ended March 31, 2015Document13 pagesMcMurray Métis 2015 - Financial Statements - Year Ended March 31, 2015McMurray Métis (MNA Local 1935)No ratings yet

- Langara College Employees and Salaries 2014Document41 pagesLangara College Employees and Salaries 2014mar leeNo ratings yet

- 2008 ch1 ExsDocument21 pages2008 ch1 ExsamatulmateennoorNo ratings yet

- Quizzer - Revised Conceptual FrameworkDocument6 pagesQuizzer - Revised Conceptual FrameworkJohn Reiven Adaya Mendoza100% (1)

- CH 06Document40 pagesCH 06lalala010899No ratings yet

- Bank Audit-1.Document7 pagesBank Audit-1.Venkatraman ThiyagarajanNo ratings yet

- Aging Report MacroDocument119 pagesAging Report MacroSenthilkumar0606No ratings yet

- F - SAS DAY 26 FINAL COMPREHENSIVE EXAM - PDF - 194557631Document18 pagesF - SAS DAY 26 FINAL COMPREHENSIVE EXAM - PDF - 194557631Christian Jade Siccuan AglibutNo ratings yet

- Sap Fi End User Practice Work: AR AP Asset AccountingDocument19 pagesSap Fi End User Practice Work: AR AP Asset AccountingHany RefaatNo ratings yet

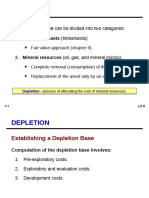

- Deplesi, Revaluasi Aset Tetap, Penjualan Aset TetapDocument25 pagesDeplesi, Revaluasi Aset Tetap, Penjualan Aset TetapM Syukrihady IrsyadNo ratings yet

- SUF PR 14 Quality AuditingDocument8 pagesSUF PR 14 Quality AuditingAvnish YadavNo ratings yet

- Learn warranty liability in 40 charsDocument9 pagesLearn warranty liability in 40 charsNovylyn AldaveNo ratings yet