Professional Documents

Culture Documents

How To Compute The 13th Month Pay in The Philippines

Uploaded by

Jesa MarieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

How To Compute The 13th Month Pay in The Philippines

Uploaded by

Jesa MarieCopyright:

Available Formats

How to Compute the 13th Month Pay in the Philippines "The term '13th Month Pay' denotes the

one twelfth (1/12) of the employee's basic salary within a calendar year."

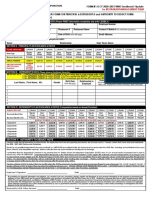

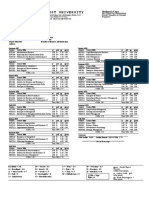

Under the Presidential Decree No. 851, the 13th Month Pay is required by law and will be entitled to every employee working in the Philippines, with the computation of the 13th Month Pay equivalent to the number of months the employee has worked. This is regardless of the amount of the basic salary (See: Memorandum Order No. 28, regarding the removal of the salary ceiling, 13 August 1986), regardless of the employee's designation and employment status, and regardless of the method by which the employee collects his/her compensation. The Presidential Decree No. 851 otherwise known as the 13th Month Pay is fundamentally a Government implementation of monetary assistance equivalent to the monthly basic salary received by an employee. The 13th Month Pay computation is pro rata, it is based on how many months within the calendar year that the employee has worked for the employer(s). To compute the 13th Month Pay: (Basic Monthly Pay) 12 * (Number of Months worked within the Calendar Year) The term '13th Month Pay' denotes the one twelfth (1/12) of the employee's basic salary within a calendar year. The 13th Month Pay computation is derived from the 12 months of one calendar year. For an employee to be entitled for the 13th Month Pay, he/she must have worked for the employer at least one month during the calendar year, provided that the employer is covered and is not stated in Section 3 of the decree. The term 'Basic Salary' denotes the wage or salary the employee receives from the employer(s) for services rendered with the payouts set according to the predetermined schedule agreed by both employer and employee. The term 'calendar year' refers to the Gregorian calendar that starts from January 1 and ends on December 31. A payment which is deemed not part of the Basic Salary and thus will not be included in the 13th Month Pay computation (but may be included in other payments, e.g. Christmas Bonus) includes the following: Benefits received for regular holidays and night differentials will not be included in the 13th month pay computation. Premium benefits received for work rendered during rest days and special holidays will not be included in the 13th month pay computation. Sick leave, Vacation leave and Maternity leave aren't included in the 13th Month Pay computation.

The 13th Month Pay is to be distinguished from the Christmas Bonus, which both categorizes as year-end bonuses.

While the 13th Month Pay is mandated by law, the Christmas Bonus isn't. The Christmas bonus is not a required and demandable responsibility, provided that this bonus, as per agreement made by the employer and employee, it is not made part of the compensation or wage benefit of the employee. In such instances when a Christmas bonus (or any kind of bonus for that matter) becomes a longstanding policy, withdrawing the benefit is tantamount to a reduction of employee benefits prohibited under the Philippine Labor Code.

You might also like

- Exit Interview FormDocument2 pagesExit Interview FormG. Shri MuruganNo ratings yet

- Chapter 4 Analyzing Work and Designing JobsDocument41 pagesChapter 4 Analyzing Work and Designing Jobsjanna marithe100% (1)

- Agreement For PlacementDocument3 pagesAgreement For Placementnishucheeku100% (1)

- Flexible Work Arrangments: Implemintation ApproachDocument7 pagesFlexible Work Arrangments: Implemintation ApproachDr-Raghda A. YounisNo ratings yet

- 5 Important Reasons Why Teamwork Matters - PotentialDocument2 pages5 Important Reasons Why Teamwork Matters - PotentialViyura EngNo ratings yet

- Philhealth Payroll System Includes The FollowingDocument5 pagesPhilhealth Payroll System Includes The FollowingMary Ann MarinoNo ratings yet

- C0009 Contractual Employment ContractDocument1 pageC0009 Contractual Employment ContractAndrea R. LageraNo ratings yet

- Compensation Policy - Chapter 02 Compensation Administration Process Principles of Administration of CompensationDocument6 pagesCompensation Policy - Chapter 02 Compensation Administration Process Principles of Administration of CompensationSanam PathanNo ratings yet

- BSP Foreign Exchange Regulations March 2018Document25 pagesBSP Foreign Exchange Regulations March 2018Alyssa TanNo ratings yet

- Leicester Medical Support: Paternity Policy Paternity - Policy - v1Document3 pagesLeicester Medical Support: Paternity Policy Paternity - Policy - v1stephanieNo ratings yet

- Sangalang & Gaerlan, Business Lawyers Employee Clearance FormDocument2 pagesSangalang & Gaerlan, Business Lawyers Employee Clearance FormGerard Nelson ManaloNo ratings yet

- Jeff Lavarez Final - Employment Contract 9622Document4 pagesJeff Lavarez Final - Employment Contract 9622jeff lavarezNo ratings yet

- Candidate Screening TrackerDocument15 pagesCandidate Screening TrackerFeisalNo ratings yet

- Show Cause Letter for Gross MisconductDocument2 pagesShow Cause Letter for Gross Misconductpaul machariaNo ratings yet

- DOLE Form IP-5 Report of Safety OrgDocument1 pageDOLE Form IP-5 Report of Safety Orggilbert bacliaan50% (2)

- Wage Order No. ROVII-18Document12 pagesWage Order No. ROVII-18nia0323No ratings yet

- 01 Consolidated Financial StatementsDocument4 pages01 Consolidated Financial Statementseduson2013No ratings yet

- Philhealth Orientation-Part1 PDFDocument33 pagesPhilhealth Orientation-Part1 PDFjohnel doceNo ratings yet

- Employee RightsDocument19 pagesEmployee RightsAlmira NamocaNo ratings yet

- Employee Written Warning for Policy ViolationDocument1 pageEmployee Written Warning for Policy ViolationRobFNo ratings yet

- Vacation, Sick and Bereavement LeaveDocument4 pagesVacation, Sick and Bereavement LeaveCherry AldayNo ratings yet

- Retirement Policy ResearchesDocument4 pagesRetirement Policy ResearchesGrace NudaloNo ratings yet

- Mid-Year Manager EvaluationDocument3 pagesMid-Year Manager Evaluationprojectrik roomNo ratings yet

- ANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFDocument1 pageANNEX A - Compensation & Benefits (FT Agents) 12012019 PDFRovic OrdonioNo ratings yet

- Government Employee Benefits GuideDocument10 pagesGovernment Employee Benefits GuideMyriz AlvarezNo ratings yet

- Revised Establishment Report Form v3 1Document5 pagesRevised Establishment Report Form v3 1Sai GuyoNo ratings yet

- HMO Enrollment FormDocument1 pageHMO Enrollment FormJoshuaBatisla-onSorianoNo ratings yet

- Sample No Due Certificate FormatDocument2 pagesSample No Due Certificate Formatdayadss86% (7)

- Whitman College Salary Advance Request FormDocument2 pagesWhitman College Salary Advance Request FormJessica TerryNo ratings yet

- How To Write An Employee Handbook D12848Document14 pagesHow To Write An Employee Handbook D12848roxiNo ratings yet

- Job Description - Recruitment OfficerDocument2 pagesJob Description - Recruitment Officersara mohammedNo ratings yet

- 50 Fixed Assets RegisterDocument30 pages50 Fixed Assets RegisterKiran NanduNo ratings yet

- Status Change FormDocument1 pageStatus Change FormComsale HRNo ratings yet

- Sample Employee Policies Manual 2011Document0 pagesSample Employee Policies Manual 2011pielzapaNo ratings yet

- Nestle Personal Information Sheet 2017Document5 pagesNestle Personal Information Sheet 2017Ryan CabusasNo ratings yet

- Microsoft Candidate Travel PolicyDocument3 pagesMicrosoft Candidate Travel PolicymegkhNo ratings yet

- Non-Disclosure Agreement SummaryDocument5 pagesNon-Disclosure Agreement SummaryLuigi Marvic FelicianoNo ratings yet

- Mobile Working Policy Agreement FormDocument3 pagesMobile Working Policy Agreement FormJillian SmithNo ratings yet

- Human Resources PresentationDocument8 pagesHuman Resources Presentationapi-299534152No ratings yet

- Second Tranche Salary Increase 2017 LBC-No113Document20 pagesSecond Tranche Salary Increase 2017 LBC-No113joancutever100% (4)

- Empowering leaders with legal compliance templatesDocument1 pageEmpowering leaders with legal compliance templatesRadical GraceNo ratings yet

- Attendance PunctualityDocument3 pagesAttendance Punctualityapi-387651574No ratings yet

- Agreement For Refund of Training Fees If Employee Does Not Remain in Employment For Specified PeriodDocument5 pagesAgreement For Refund of Training Fees If Employee Does Not Remain in Employment For Specified PeriodIkem IsiekwenaNo ratings yet

- Status of Working in New NormalDocument23 pagesStatus of Working in New NormalMark Kevin SantosNo ratings yet

- Benefits and Challenges of Adopting A Diversity Management ApproachDocument13 pagesBenefits and Challenges of Adopting A Diversity Management ApproachjanesteveNo ratings yet

- Week 13-14 Air Passenger Bill of RightsDocument7 pagesWeek 13-14 Air Passenger Bill of Rightsmark AbiogNo ratings yet

- Tax Process QuestionnaireDocument4 pagesTax Process QuestionnaireRodney LabayNo ratings yet

- HRD Application FormDocument3 pagesHRD Application FormYudis TiraNo ratings yet

- Difference in Recruitment ProcessDocument11 pagesDifference in Recruitment ProcessSiddhartha ModakNo ratings yet

- Probationary Appraisal Forms VerDocument2 pagesProbationary Appraisal Forms VerMShoaibUsmaniNo ratings yet

- Ch4 Termination of EmploymentDocument69 pagesCh4 Termination of EmploymentjesNo ratings yet

- Work From Home Policy SampleDocument3 pagesWork From Home Policy SamplevinnshineNo ratings yet

- Cash Advance Form TitleDocument2 pagesCash Advance Form Titlegreenapple015100% (1)

- Marketing Communication Strategy of GilletteDocument7 pagesMarketing Communication Strategy of GilletteMahmudul_Islam_du0% (2)

- Exit InterviewDocument6 pagesExit InterviewBhagavanRaj ReddyNo ratings yet

- 62a361c98518ea5b613d4a53 - Company Vehicle PolicyDocument4 pages62a361c98518ea5b613d4a53 - Company Vehicle PolicyHermenegildo ChissicoNo ratings yet

- Equalities PolicyDocument4 pagesEqualities Policymanager100% (1)

- Leo Corp Serg AppraisalDocument6 pagesLeo Corp Serg Appraisalar15t0tleNo ratings yet

- HR Scope of WorkDocument2 pagesHR Scope of WorkJenn Torrente50% (2)

- 13th Month Pay Law ExplainedDocument3 pages13th Month Pay Law ExplainedEmmarlone96No ratings yet

- 8 PA116 RA7160 LGU Officials in GeneralDocument69 pages8 PA116 RA7160 LGU Officials in GeneralJewel AnggoyNo ratings yet

- Full Download Managerial Accounting Braun 3rd Edition Test Bank PDF Full ChapterDocument34 pagesFull Download Managerial Accounting Braun 3rd Edition Test Bank PDF Full Chapterdrearingpuncheonrpeal100% (18)

- Executive Men's Saloon Business PlanDocument7 pagesExecutive Men's Saloon Business PlanDemelash Gebre100% (2)

- Chapter 3Document4 pagesChapter 3hnin scarletNo ratings yet

- Quiz MidtermDocument4 pagesQuiz MidtermAndrei ArkovNo ratings yet

- Outsourcing and Moving Up The Value ChainDocument2 pagesOutsourcing and Moving Up The Value ChainShreya AgrawalNo ratings yet

- MBA105 - Almario - Parco - Assignment 3Document10 pagesMBA105 - Almario - Parco - Assignment 3nicolaus copernicusNo ratings yet

- Special Contract Assignment PDFDocument11 pagesSpecial Contract Assignment PDFsankalp bhardwajNo ratings yet

- Abraraw and KindalemDocument42 pagesAbraraw and Kindalem0921666897No ratings yet

- Unit 1 Introduction Journal Ledger and Trial BalanceDocument51 pagesUnit 1 Introduction Journal Ledger and Trial Balancedivimba87100% (1)

- Regular vs Pakyaw EmploymentDocument3 pagesRegular vs Pakyaw EmploymentPaula Marquez MenditaNo ratings yet

- JIT, Creation of Manufacturing Cells, Behavioral Considerations, Impact On Costing PracticesDocument2 pagesJIT, Creation of Manufacturing Cells, Behavioral Considerations, Impact On Costing PracticesKim FloresNo ratings yet

- Indore Law Project on ConsiderationDocument37 pagesIndore Law Project on ConsiderationShubham SarkarNo ratings yet

- Artikel 3 PDFDocument24 pagesArtikel 3 PDFanrassNo ratings yet

- Inventory ManagementDocument88 pagesInventory ManagementSudhir Kumar100% (2)

- VW Apr 2018 PDFDocument136 pagesVW Apr 2018 PDFSaqib AliNo ratings yet

- Safe Use Lorry Cranes LoaderDocument23 pagesSafe Use Lorry Cranes LoaderBigbearBigbearNo ratings yet

- The Body Shop Place Strategy in VietnamDocument2 pagesThe Body Shop Place Strategy in VietnamQuynh NguyenNo ratings yet

- Over 800 Random Project TopicsDocument33 pagesOver 800 Random Project TopicsMohan Ravi100% (1)

- St. Luke's Roosevelt 2019 Audited Financial StatementsDocument62 pagesSt. Luke's Roosevelt 2019 Audited Financial StatementsJonathan LaMantiaNo ratings yet

- 2012 The Darwinian Workplace.Document4 pages2012 The Darwinian Workplace.kasireddyvarun98No ratings yet

- Princeton Creative Writing ThesisDocument4 pagesPrinceton Creative Writing Thesisfjfyj90y100% (2)

- TranscriptDocument1 pageTranscriptRehman SaïfNo ratings yet

- Questions On PPC 1.Document3 pagesQuestions On PPC 1.Mahimaa HoodaNo ratings yet

- NISM-Series-XXII: Fixed Income Securities Certification ExaminationDocument5 pagesNISM-Series-XXII: Fixed Income Securities Certification ExaminationVinay ChhedaNo ratings yet

- Yes Bank ProjectDocument2 pagesYes Bank ProjectKamlesh Kumar SahuNo ratings yet

- 3 Rs of Waste Management - Reduce, Reuse, RecycleDocument2 pages3 Rs of Waste Management - Reduce, Reuse, RecycleCOSGA CaloocanNo ratings yet

- Day 4.work Immersion Global Caravan 2 Narrative DocuDocument4 pagesDay 4.work Immersion Global Caravan 2 Narrative DocuFrancine VillanuevaNo ratings yet

- 6.type and Basic Characterstics of Companies in Ethiopia Types of Business OrganizationsDocument14 pages6.type and Basic Characterstics of Companies in Ethiopia Types of Business OrganizationsTamene Tekile86% (7)

- Armed Forces Pension Scheme 1975 Your Pension Scheme ExplainedDocument32 pagesArmed Forces Pension Scheme 1975 Your Pension Scheme ExplainedbobNo ratings yet

- Legal Writing in Plain English, Third Edition: A Text with ExercisesFrom EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNo ratings yet

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersFrom EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersRating: 5 out of 5 stars5/5 (2)

- Everybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeFrom EverandEverybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeNo ratings yet

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsFrom EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsRating: 3 out of 5 stars3/5 (2)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyFrom EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyRating: 5 out of 5 stars5/5 (2)

- Torts: QuickStudy Laminated Reference GuideFrom EverandTorts: QuickStudy Laminated Reference GuideRating: 5 out of 5 stars5/5 (1)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionFrom EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionRating: 5 out of 5 stars5/5 (1)

- Nolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsFrom EverandNolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsRating: 4 out of 5 stars4/5 (18)

- Legal Writing in Plain English: A Text with ExercisesFrom EverandLegal Writing in Plain English: A Text with ExercisesRating: 3 out of 5 stars3/5 (2)

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolFrom EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNo ratings yet

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersFrom EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNo ratings yet

- Nolo's Essential Guide to Buying Your First HomeFrom EverandNolo's Essential Guide to Buying Your First HomeRating: 4 out of 5 stars4/5 (43)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersFrom EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersRating: 5 out of 5 stars5/5 (4)

- Comprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedFrom EverandComprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedNo ratings yet

- Form Your Own Limited Liability Company: Create An LLC in Any StateFrom EverandForm Your Own Limited Liability Company: Create An LLC in Any StateNo ratings yet