Professional Documents

Culture Documents

Woodgate Clark Executive Summary

Uploaded by

Michael YapOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Woodgate Clark Executive Summary

Uploaded by

Michael YapCopyright:

Available Formats

4

Executive Summary

Executive Summary

THE Autumn of 2010 saw the publication of Insurance 360s rst ever Loss Adjusters Insight Report, based on frank, informed input from those at the front-line of claims handling. This, our second annual report, uses a more sophisticated methodology (see pages 8-9); crucially, it makes a clear distinction between performance on commodity claims (those of less than 100,000) and performance on major losses (100,000-plus). This year, we therefore have two parallel league tables, 11 performance proles and a much sharper focus on the true nature of rms strengths and weaknesses. So how, overall, have Britains leading adjusters been performing during the past year? Certos management team and adjusters showed real commitment to their clients and their business. Care taken at the FNOL stage, well-rounded professionalism and robust, modern information management fed through into economic settlements, even on Woodgate & Clark ranked rst for commodity-type risks and third for for major loss with a 91% score. Client comment on Certo was uniformly positive. Certo gave superlative performance across the board. Its adjusters were seasoned, technically skilled professionals who dealt with every stage of a large loss situation efciently and with a sensible outcome in mind. Likeable, capable, good communicators, they inspired condence in policyholders and insurer claims staff alike. Although a small rm, Certo had made a serious investment in up-to-date information technology and its management information was among the best in the business. Second in both tables was McLarens Young International (MYI). Client comment was a striking 51:0 positive. Whether handling commodity work or major losses, MYIs service on FNOL was quick and competent. Staff were welltrained, knowledgeable and committed. Armed with skilled adjusters and sound processes, MYI soaked up surge events without drama. Management information was succinct and t for purpose and claims leakage was kept rmly in check. Where service is concerned, MYI seems to have a winning formula: good resourcing, keen and able adjusters, active communication, rst rate systems and robust procedures. A well-ordered business that clients can rely on. complex and potentially thorny claims. A class act.

Top of the Class

Certo didnt feature in our commodity rankings, but it took the gold medal

Woodgate & Clark came out top for commodity-type claims

% 100 90 80 70 60 50 40 30 20 10 0 Average Score

Woodgate & Clark

McLarens Young

VRS Vericlaim

Questgates

GAB Robins

Agrical

Cunningham Lindsey

Davies

Crawford & Co

Merlin

82%

81%

80%

74%

71%

70%

69%

65%

59%

52%

LOSS ADJUSTERS INSIGHT REPORT 2011

Executive Summary

major losses. Respondents reported a reliable, professional performance right across the board. Comment totalled 32:2 positive. The rm was quick on its feet with FNOL and showed a sure grip, even during surge situations. Woodgates staff were skilled, seasoned practitioners who inspired condence and while not the most advanced in the industry, its management information was ideal for most insurers purposes. Proactive management by experienced people meant minimal leakage. One claims manager cited a recent 100,000 BI claim. Other rms had struggled to nd a reason to reduce settlement, he said yet Woodgates adjuster had got settlement agreed at 7,000. For its insurer clients, Woodgate & Clark was a well-organised, properly-resourced rm with a clear professional service focus. No fuss, no contractor network, no delay. It is all about the loss adjusting, said a claims manager, which they deliver so well.

Vericlaim has made a creditable start in the UK market, but some insurers see the rm as too much focused on the policyholder. Questgates came in fourth on commodity work and sixth for major losses. Comment totalled 22:5 positive. On commodity claims, Questgates gave a rst class service on FNOL and surge and elded one of the best teams in the market savvy, energetic folk who got to work quickly and kept insurers upto-speed on progress. On major losses, however, respondents were more critical of Questgates. It had delivered an admirable FNOL service for some clients, but others reported rushed work. Despite some glowing feedback on Questgates major loss adjusters, they had been noticeably overstretched at times and hadnt impressed everyone. Management information left a bit to be desired, on commodity claims and major losses alike, while on leakage, Questgates performance was broadly average. All in all, Questgates emerged as one of the better rms for commodity work, with a strong, well-organised and well-motivated team of professionals. On major losses, it couldnt quite hit the high notes, though sixth place was no disgrace. Questgates has some rst rate adjusters on the major loss side. It could use a few more of them. Cunningham Lindsey? Seventh for commodity-type claims, fourth for major loss. Despite some patchiness on FNOL and surge management on the commodity side, this was a capable, well-organised rm that showed

heavyweight expertise and a real commitment to professional service. Comment totalled 84:19 positive, plus 15 mixed. On commodity work, Cunningham Lindsey delivered broadly average performance on FNOL sound, on the whole, but often slow. Staff calibre varied, but was generally decent. Cunninghams winter surge performance had been a little disappointing, however, service evidently having taken some time to regain normal levels. The rms MI was impressive and its supply chain management gave no cause for concern, though some Cunninghams clients did have issues with leakage. On major losses, Cunningham Lindsey seldom failed to give a quick, vigorous, professional and communicative response at FNOL and barring the occasional duffer, its adjusters were seasoned experts with strong technical knowledge and all-round savoir faire. MI on major losses was detailed, accessible and insurer-friendly and despite the odd stumble, the rm did a reasonable job on avoidance of leakage too. Cunningham Lindsey had a lot going for it: nationwide coverage; robust, modern-minded MI; a culture of active relationship management; numerous well-trained and highly-motivated staff; a broad and widening range of specialist expertise; a commitment to professional standards. The rm was not immune from the problems of a volume business, as client comment made clear, particularly on surge management and leakage. But for a big business, overall service was not bad at all.

LOSS ADJUSTERS INSIGHT REPORT 2011

A Passable Performance

Third on commodity-type claims and fth for major losses was VRS Vericlaim. Comment totalled 24:4 positive, plus one mixed. VRS Vericlaim gave a generally procient service. It was fast out of the blocks fast at FNOL and its adjusters were expert and reliable. Surge management was efcient, MI was sound enough and leakage seemed minimal. Yet broker and insurer claims staff had somewhat divergent views of the rm. Broker people a small minority among our overall respondent group gave glowing feedback. Insurer folk were sometimes less convinced, though their criticisms focused less on VRS competence than its priorities. VRS

Executive Summary

GAB Robins ranked fth for commodity-type claims. For major losses it ranked seventh. Comment totalled 81:14 positive, plus ten mixed. For the most part, GAB Robins gave a capable service. Despite the odd fumble, service on FNOL was generally quick and efcient. GAB Robins adjusters tended to be well-rounded professionals, who kept all parties up-to-speed, maintained a rm grip on costs and took real pride in their work though less experienced ones did occasionally let the side down. Surge management had been tolerably good, while management information was clear, user-friendly, easy to access and bang up-to-date. Judging by insurer feedback, GAB Robins kept contractors well under control and bore down hard on leakage, though handling of Property Owners and subsidence claims did prompt some criticism. GAB Robins was by no means perfect.

Respondents cited specic points for improvement in almost every area. Service was moving in the right direction, however, driven by a real and ongoing effort to listen to clients, improve processes, add value, build partnerships and deliver the goods. Sixth for commodity work and eighth for major loss was Agrical. The rm gave a competent service on FNOL and its people were of good professional quality. Insurers claims staff liked working with them. Performance on surges and avoidance of leakage had been ne. Agricals only real shortcoming was on management information, which sometimes seemed lacking in depth, particularly where large claims were concerned. In its niche specialisms rural and high net worth claims Agrical has won a loyal clientele. Now that it is looking to broaden its commercial offering,

increased investment in MI may be in order.

Could Do Better

Davies ranked eighth for commoditytype claims and tenth for major losses. Comment totalled 16:25 negative, plus seven mixed. Davies gave a spluttering service on FNOL. Too often, its staff seemed dozy, inefcient and indifferent to the insured. Lack of communication was a routine problem. Save for West Country agricultural claims, reported service in surge situations had not been impressive. Davies supply chain had caused complaints from policyholders and overall performance on leakage was nowhere near good enough. One claims director blamed, in effect, the pressures of private equity. Davies have tried to move a high-performing traditional adjuster into a new model, he said, and have damaged their proposition in the process.

Certo topped the table for overall service on major losses

% 100 90 80 70 60 50 40 30 20 10 0 Average Score

Certo

MYI

Woodgate & Clark

Cunningham Lindsey

VRS Vericlaim

Questgates

GAB Robins

Agrical

Crawford & Co

Davies

91%

89%

82%

78%

77%

76%

75%

75%

69%

65%

LOSS ADJUSTERS INSIGHT REPORT 2011

Executive Summary

Davies MI wasnt too bad and the firm did have some real professionals, particularly on the agricultural and HNW side. But in the round, it delivered a sub-standard service and showed little inclination to do much about it unless and until clients held its feet to the fire, as two mid-sized insurers recently had done. With the latest finance deal now done, Davies managers need to start focusing on the fundamentals of service. Ninth on commodity-type claims and on major loss was Crawford & Co. Comment totalled 50:64 negative, plus four mixed. On commodity work, some clients reported efficient service on FNOL, but just as many complained of a stumbling performance from overstretched staff. Policyholders did not always get the communication and consideration they deserved. Crawfords specialist ARIEL team showed impressive professionalism, but its other adjusters often came across as raw, overworked and disorganised. Failings in Crawfords processes didnt help. For most insurers, Crawfords surge performance had been inadequate, causing knock-on effects well into 2011. MI was alright, on the whole, but Crawfords control and management of the supply chain showed considerable scope for improvement. There were some issues with leakage too. When it came to major losses, reports of fast, professional service on FNOL were again balanced by tales of slow responses and undermanning and many clients found Crawfords adjusters unresponsive and hard to locate. With too high a workload, they seemed reluctant to communicate

or to treat any loss as particularly urgent. Often enough, this resulted in unnecessary leakage later in the claim. MI on major losses needed improvements in both quality and quantity. Feedback wasnt all bad, however. Several claims managers said service had improved, reporting a real effort by Crawfords to work in partnership, apply fresh thinking and meet their needs in inventive ways. For some insurers, it seemed, the firm was willing to ring-fence key resources. For many others, however, Crawfords is still synonymous with blurred processes, clumsy management, overstretch and delay. Crawfords new UK & Ireland CEO Greg Gladwell has plenty to work on. Some key priorities? Sharpen up operational management, take a hard look at resourcing and try to build a culture of communication. Merlin Professional Claims Services didnt feature in our major loss table, but ranked tenth and last commoditytype claims. Service, on FNOL and more generally, seemed plagued by communication problems. Perceptions of Merlins surge management ability varied, some clients reporting stretched resources others, capable teams that had taken the strain without drama. MI was fine when it arrived, but it often arrived late. Clients had little faith in Merlins supply chain management. They feared the companys preference for its own supply chain increased overall claim costs and doubted it was in policyholders best interests. The firm could be distinctly over-zealous in declining claims, it seemed, and was doing little to minimise leakage.

Corporate nance difculties during 2008 and 2009 no doubt impacted heavily on Merlins resources, stafng and management time. In the 18 months since its renance and stabilisation, however, Merlin had made some useful hires and taken steps to improve its business model, diversify and innovate. Comment on Merlins performance had improved a little since last year, even if its scores hadnt. Indeed, a few clients had been pleasantly surprised by Merlins winter surge performance. Modest signs of progress, then. Still, management have a lot of work to do to get service up to scratch. As one claims director put it: Merlin just make too many basic mistakes. We hope you nd this years Loss Adjusters Insight Report interesting and useful. If you have any queries about the content, or critical feedback, please feel free to contact me directly. Peter Joy Principal, Insurance 360 December 2011 E: peter.joy@incisivemedia.com W: 020 7316 9814 M: 07711 897930

LOSS ADJUSTERS INSIGHT REPORT 2011

You might also like

- A Short Guide To Procurement Risk: Richard RussillDocument19 pagesA Short Guide To Procurement Risk: Richard RussillRoberto Yoshio InoueNo ratings yet

- Short Guide To Procurement Risk Ch1Document19 pagesShort Guide To Procurement Risk Ch1carwadevilisbackNo ratings yet

- Key Insights On M&A Advisory Fees in The Middle Market.: Partnered WithDocument27 pagesKey Insights On M&A Advisory Fees in The Middle Market.: Partnered Withnotcor nowNo ratings yet

- Factory Mutual 2012 Annual ReportDocument68 pagesFactory Mutual 2012 Annual ReportNguyen03No ratings yet

- Willis Supply ChainDocument2 pagesWillis Supply ChainDon HeymannNo ratings yet

- Shipping InsightsDocument34 pagesShipping InsightsSachin SikkaNo ratings yet

- Accounting Analysis FinalDocument10 pagesAccounting Analysis FinalSarwar IqbalNo ratings yet

- The Hidden Opportunity in Container ShippingDocument8 pagesThe Hidden Opportunity in Container ShippingAkshay LodayaNo ratings yet

- EY Risk Management For Asset Management Survey 2013Document48 pagesEY Risk Management For Asset Management Survey 2013bharatNo ratings yet

- RCS Corporation: Background: Product Lines Responding To Declining Growth RateDocument7 pagesRCS Corporation: Background: Product Lines Responding To Declining Growth RateNikki LabialNo ratings yet

- Digilog BrochureDocument8 pagesDigilog BrochureMark AldissNo ratings yet

- ZA Digital-Age 160916Document28 pagesZA Digital-Age 160916GarimaNo ratings yet

- At Capital OneDocument36 pagesAt Capital OnesumeetpatnaikNo ratings yet

- Winning From The Inside Out: Internal Service QualityDocument5 pagesWinning From The Inside Out: Internal Service Qualityrey_rempakoNo ratings yet

- Counting On It: Sustainability Reporting in Financial ServicesDocument21 pagesCounting On It: Sustainability Reporting in Financial ServicesComunicarSe-ArchivoNo ratings yet

- True/False (10 Marks) : Submitted By: Anjo Princy N01356152Document3 pagesTrue/False (10 Marks) : Submitted By: Anjo Princy N01356152AnjoNo ratings yet

- Quality and The Financial Service Sector: ElaborateDocument4 pagesQuality and The Financial Service Sector: ElaboraterimzhaNo ratings yet

- Paw PPT-1Document21 pagesPaw PPT-1Mudassir MehboobNo ratings yet

- Telecommunications 2012-01-01Document28 pagesTelecommunications 2012-01-01STEVENo ratings yet

- Total Quality Management in Property - Casualty Insurance - An Acturial Perspective - by Philip HeckmanDocument28 pagesTotal Quality Management in Property - Casualty Insurance - An Acturial Perspective - by Philip HeckmanazizNo ratings yet

- Service Marketing Case Study 1Document5 pagesService Marketing Case Study 1Rishabh VishwakarmaNo ratings yet

- Om MetlifeDocument3 pagesOm MetlifeRITIKANo ratings yet

- Spot Risk SupplierDocument8 pagesSpot Risk SuppliermuputismNo ratings yet

- CIA 4001 Case CUP CorporationDocument8 pagesCIA 4001 Case CUP CorporationKwek yuxuanNo ratings yet

- VIP Compliance GRCDocument8 pagesVIP Compliance GRCdr_mahmoud71No ratings yet

- ROI On CRM Customer Journey Approach.Document20 pagesROI On CRM Customer Journey Approach.Amartuvshin Tseden-IshNo ratings yet

- WIF Inadequately Pricing InsuranceDocument38 pagesWIF Inadequately Pricing InsuranceAsad UllahNo ratings yet

- Bci Supply Chain Resilience REPORT 2018Document40 pagesBci Supply Chain Resilience REPORT 2018Shahnewaj SharanNo ratings yet

- Compliance Risk SalaryDocument31 pagesCompliance Risk SalaryHer HuwNo ratings yet

- Solution Manual For Operations and Supply Chain Management The Core 5th Edition F Robert Jacobs Richard ChaseDocument38 pagesSolution Manual For Operations and Supply Chain Management The Core 5th Edition F Robert Jacobs Richard Chaseadmixtionaglittern9qxf100% (9)

- IAIAWP24-Blog-Why Is Claims-V1Document2 pagesIAIAWP24-Blog-Why Is Claims-V1metineeklaNo ratings yet

- Credit Risk and Bad Debt in TelecommunicationsDocument3 pagesCredit Risk and Bad Debt in TelecommunicationsAssuringBusiness100% (3)

- Risk Management Selby Jennings USA 2022Document22 pagesRisk Management Selby Jennings USA 2022Kobe BryantNo ratings yet

- Manzana Fruitvale Insurance: Submitted To: Prof. Haritha SarangaDocument6 pagesManzana Fruitvale Insurance: Submitted To: Prof. Haritha SarangaHarshita PathakNo ratings yet

- CRM at BankDocument20 pagesCRM at Bankindranils2009No ratings yet

- CRMDocument8 pagesCRMdownload4artNo ratings yet

- Week 4.1Document3 pagesWeek 4.1chum se LenNo ratings yet

- The Role of Strategic Procurement in Risk ManagementDocument4 pagesThe Role of Strategic Procurement in Risk ManagementMarsha WindiraNo ratings yet

- PWC 12 Reporting TipsDocument28 pagesPWC 12 Reporting Tipssathyasai1972No ratings yet

- Treasury HandbookDocument137 pagesTreasury Handbookcarltawia100% (8)

- F Report Card NOV 2018Document14 pagesF Report Card NOV 2018sigitsutoko8765No ratings yet

- Lecture 5 - Customer Relationship ManagementDocument5 pagesLecture 5 - Customer Relationship Managementmariam1990hatemNo ratings yet

- PB2 BL (Q A SET 2) FinalDocument25 pagesPB2 BL (Q A SET 2) FinalKevin Chaa100% (1)

- Managing Risk in The Global Supply ChainDocument36 pagesManaging Risk in The Global Supply ChainKhoubaieb Dridi100% (1)

- Service Power Your Frontline With Field Service Management PDF FinalDocument21 pagesService Power Your Frontline With Field Service Management PDF Finalajaygupta.af3919No ratings yet

- 2022 Small Business Bravery ReportDocument18 pages2022 Small Business Bravery ReportJane DawsonNo ratings yet

- CINTAS Corporation Case Competition: The ProactivesDocument8 pagesCINTAS Corporation Case Competition: The Proactivesapi-356054955No ratings yet

- PWC Western Canada Oil and Gas Benchmarking Report 2012 12 en PDFDocument24 pagesPWC Western Canada Oil and Gas Benchmarking Report 2012 12 en PDFogu100% (1)

- Customer Relationship Management in Insurance SectorDocument22 pagesCustomer Relationship Management in Insurance SectorNandini Jagan100% (2)

- A Starters Guide To Sustainability ReportingDocument76 pagesA Starters Guide To Sustainability ReportingEnrique Navarrete Morales100% (1)

- Importance of Managing Supply Chain in A Time of Global Recession by RIJAZ M.Document16 pagesImportance of Managing Supply Chain in A Time of Global Recession by RIJAZ M.Rijaz Bin MuhammedNo ratings yet

- CIGNA PAC CaseAnalysisDocument7 pagesCIGNA PAC CaseAnalysismuddanapNo ratings yet

- Climate Change Confronts Financial Services - A Benchmark Study On Climate Risk - 2Document139 pagesClimate Change Confronts Financial Services - A Benchmark Study On Climate Risk - 2CH KamNo ratings yet

- Mergers Acquisitions Sam ChapDocument24 pagesMergers Acquisitions Sam ChapNaveen RaajNo ratings yet

- Agency Pricing Financials Report-HubSpotDocument43 pagesAgency Pricing Financials Report-HubSpotagnihoonNo ratings yet

- 2021-3579-fnd Supply Chain Risk Management-Report HighresfinalDocument16 pages2021-3579-fnd Supply Chain Risk Management-Report HighresfinalAbdel Ghader Oumar M'HayhamNo ratings yet

- Kpi Yschools 3Document4 pagesKpi Yschools 3zeghariaymane26No ratings yet

- Activity 1 Module 3-2Document14 pagesActivity 1 Module 3-2Joseph BaghNo ratings yet

- American Woodworker 163 2012-2013 PDFDocument76 pagesAmerican Woodworker 163 2012-2013 PDFkaskdos100% (1)

- VCEguide 300-360Document25 pagesVCEguide 300-360olam batorNo ratings yet

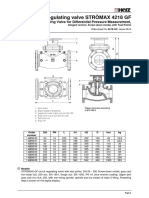

- Circuit Regulating Valve STRÖMAX 4218 GFDocument14 pagesCircuit Regulating Valve STRÖMAX 4218 GFMario Mô Ri ANo ratings yet

- Swifty Loudspeaker KitDocument5 pagesSwifty Loudspeaker KitTNNo ratings yet

- Solved MAT 2012 Paper With Solutions PDFDocument81 pagesSolved MAT 2012 Paper With Solutions PDFAnshuman NarangNo ratings yet

- Mohit Soni ReportDocument104 pagesMohit Soni ReportMohitNo ratings yet

- LSZH Apch11 Rwy28 IlsDocument1 pageLSZH Apch11 Rwy28 Ilssamykarim2009No ratings yet

- Nivel Liquido Dodge 62teDocument4 pagesNivel Liquido Dodge 62teMario Do' HirchsNo ratings yet

- FGRU URAN 08.12.2015 Rev.02Document3 pagesFGRU URAN 08.12.2015 Rev.02Hitendra PanchalNo ratings yet

- HARTING Industrial Connectors Han: Short Form CatalogueDocument40 pagesHARTING Industrial Connectors Han: Short Form CatalogueFabrizio AugustoNo ratings yet

- Service Manual MIH Series Condensing Units Heat Pump: 1.5 Tons To 5 TonsDocument30 pagesService Manual MIH Series Condensing Units Heat Pump: 1.5 Tons To 5 TonsHenry Javier RíosNo ratings yet

- Ecen 607 CMFB-2011Document44 pagesEcen 607 CMFB-2011Girish K NathNo ratings yet

- Teco VFD Operating ManualDocument69 pagesTeco VFD Operating ManualStronghold Armory100% (1)

- ' ' Shail Ahmad: Privet of India Acres N Inches List of ClientDocument3 pages' ' Shail Ahmad: Privet of India Acres N Inches List of Clientapi-243316402No ratings yet

- 15 Oil Fired Crucible FurnaceDocument2 pages15 Oil Fired Crucible Furnaceudaya kumarNo ratings yet

- Schaeffler Kolloquium 2010 13 enDocument7 pagesSchaeffler Kolloquium 2010 13 enMehdi AlizadehNo ratings yet

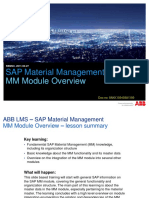

- SAP MM Module OverviewDocument15 pagesSAP MM Module OverviewAmit Kumar100% (1)

- Chapter 3 - Bending MembersDocument41 pagesChapter 3 - Bending MembersSuhailah SuhaimiNo ratings yet

- Indian Standard: Stationary Valve Regulated Lead Acid Batteries - SpecificationDocument12 pagesIndian Standard: Stationary Valve Regulated Lead Acid Batteries - Specificationmukesh_kht1No ratings yet

- BS en 00480-6-2005 PDFDocument8 pagesBS en 00480-6-2005 PDFShan Sandaruwan AbeywardeneNo ratings yet

- Swot Analysis of PTCLDocument5 pagesSwot Analysis of PTCLM Aqeel Akhtar JajjaNo ratings yet

- Guideline On Smacna Through Penetration Fire StoppingDocument48 pagesGuideline On Smacna Through Penetration Fire Stoppingwguindy70No ratings yet

- Maintenance ManualDocument6 pagesMaintenance ManualHuda LestraNo ratings yet

- LRS Trading StrategyDocument24 pagesLRS Trading Strategybharatbaba363No ratings yet

- BE Spec Flash EconomizerDocument4 pagesBE Spec Flash Economizeronkarrathee100% (1)

- O21350 CMMKKDocument2 pagesO21350 CMMKKwade.hynesoutlook.comNo ratings yet

- Course Add Drop Form For Ug Course 1718T2 PDFDocument1 pageCourse Add Drop Form For Ug Course 1718T2 PDFArtyomNo ratings yet

- Active Suspension System of Quarter CarDocument70 pagesActive Suspension System of Quarter CarMarcu SorinNo ratings yet

- Interrupt: ECE473/573 Microprocessor System Design, Dr. Shiue 1Document25 pagesInterrupt: ECE473/573 Microprocessor System Design, Dr. Shiue 1shanty85No ratings yet

- Database Testing: Prepared by Sujaritha MDocument21 pagesDatabase Testing: Prepared by Sujaritha Mavumaa22No ratings yet

- Hero Found: The Greatest POW Escape of the Vietnam WarFrom EverandHero Found: The Greatest POW Escape of the Vietnam WarRating: 4 out of 5 stars4/5 (19)

- Sully: The Untold Story Behind the Miracle on the HudsonFrom EverandSully: The Untold Story Behind the Miracle on the HudsonRating: 4 out of 5 stars4/5 (103)

- Dirt to Soil: One Family’s Journey into Regenerative AgricultureFrom EverandDirt to Soil: One Family’s Journey into Regenerative AgricultureRating: 5 out of 5 stars5/5 (125)

- The Fabric of Civilization: How Textiles Made the WorldFrom EverandThe Fabric of Civilization: How Textiles Made the WorldRating: 4.5 out of 5 stars4.5/5 (58)

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachFrom EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachRating: 3.5 out of 5 stars3.5/5 (6)

- The Future of Geography: How the Competition in Space Will Change Our WorldFrom EverandThe Future of Geography: How the Competition in Space Will Change Our WorldRating: 4 out of 5 stars4/5 (6)

- The Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyFrom EverandThe Intel Trinity: How Robert Noyce, Gordon Moore, and Andy Grove Built the World's Most Important CompanyNo ratings yet

- Four Battlegrounds: Power in the Age of Artificial IntelligenceFrom EverandFour Battlegrounds: Power in the Age of Artificial IntelligenceRating: 5 out of 5 stars5/5 (5)

- The End of Craving: Recovering the Lost Wisdom of Eating WellFrom EverandThe End of Craving: Recovering the Lost Wisdom of Eating WellRating: 4.5 out of 5 stars4.5/5 (82)

- The Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaFrom EverandThe Beekeeper's Lament: How One Man and Half a Billion Honey Bees Help Feed AmericaNo ratings yet

- Permaculture for the Rest of Us: Abundant Living on Less than an AcreFrom EverandPermaculture for the Rest of Us: Abundant Living on Less than an AcreRating: 4.5 out of 5 stars4.5/5 (33)

- The Manager's Path: A Guide for Tech Leaders Navigating Growth and ChangeFrom EverandThe Manager's Path: A Guide for Tech Leaders Navigating Growth and ChangeRating: 4.5 out of 5 stars4.5/5 (99)

- Mini Farming: Self-Sufficiency on 1/4 AcreFrom EverandMini Farming: Self-Sufficiency on 1/4 AcreRating: 4 out of 5 stars4/5 (76)

- The Technology Trap: Capital, Labor, and Power in the Age of AutomationFrom EverandThe Technology Trap: Capital, Labor, and Power in the Age of AutomationRating: 4.5 out of 5 stars4.5/5 (46)

- Pale Blue Dot: A Vision of the Human Future in SpaceFrom EverandPale Blue Dot: A Vision of the Human Future in SpaceRating: 4.5 out of 5 stars4.5/5 (588)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- ChatGPT Money Machine 2024 - The Ultimate Chatbot Cheat Sheet to Go From Clueless Noob to Prompt Prodigy Fast! Complete AI Beginner’s Course to Catch the GPT Gold Rush Before It Leaves You BehindFrom EverandChatGPT Money Machine 2024 - The Ultimate Chatbot Cheat Sheet to Go From Clueless Noob to Prompt Prodigy Fast! Complete AI Beginner’s Course to Catch the GPT Gold Rush Before It Leaves You BehindNo ratings yet

- Reality+: Virtual Worlds and the Problems of PhilosophyFrom EverandReality+: Virtual Worlds and the Problems of PhilosophyRating: 4 out of 5 stars4/5 (24)

- The Knowledge: How to Rebuild Our World from ScratchFrom EverandThe Knowledge: How to Rebuild Our World from ScratchRating: 3.5 out of 5 stars3.5/5 (133)

- How to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerFrom EverandHow to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerRating: 4.5 out of 5 stars4.5/5 (54)

- Process Plant Equipment: Operation, Control, and ReliabilityFrom EverandProcess Plant Equipment: Operation, Control, and ReliabilityRating: 5 out of 5 stars5/5 (1)

- How to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerFrom EverandHow to Build a Car: The Autobiography of the World’s Greatest Formula 1 DesignerRating: 4.5 out of 5 stars4.5/5 (122)

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (242)

- Faster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestFrom EverandFaster: How a Jewish Driver, an American Heiress, and a Legendary Car Beat Hitler's BestRating: 4 out of 5 stars4/5 (28)