Professional Documents

Culture Documents

Currency Analysis EURUSD

Uploaded by

Ciocoiu Vlad AndreiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Currency Analysis EURUSD

Uploaded by

Ciocoiu Vlad AndreiCopyright:

Available Formats

Erste Group Research Currency Analysis | EURUSD 04.

January 2012

Currency Analysis EURUSD

Dollar - safe haven for Eurozone crisis? Fed vs. ECB: Ever more complex, but slightly euro-negative Fundamental fair value at EURUSD 1.25 Technical outlook: Sell euro rallies

Analysts: Fundamental view Mildred Hager mildred.hager@erstegroup.com Technical view Ronald Stferle Ronald.stferle@erstegroup.com

The long-lasting discussion about the dollars status as a safe haven, which is regularly contested, entered a new stage by mid-2011. By then, the Eurozone debt crisis also started to impact the EURUSD exchange rate (which prior to that was not the case). Due to persistently better growth perspectives in the US and a lack of alternatives, we expect the dollar to retain this safe haven status throughout 2012 as well. However, it is also worth mentioning that the quantitative extent remains limited. As a consequence of the debt crisis and corresponding downside risks to the Eurozone economy and inflation, we also expect the ECB to expand their monetary policy stance more than the US Fed in 2012, which is euro-negative. Despite the Feds ongoing Operation Twist and possible forthcoming MBS purchases, the ECBs very generous liquidity provision, expected rate cuts and possible further easing is likely to be of greater importance. This should also impact the interest rate differential, which should support the dollar on a relative basis. Finally, long-term fundamentals (in particular, purchasing power parity, but also a still narrower trade balance deficit of the US and especially the dollars status as the worlds first reserve currency) also point to a stronger dollar, so that we expect appreciation to EURUSD 1.25 (perhaps even beyond) throughout the year. Technical outlook: The current rebound may continue for some time and a further rise to EURUSD 1.31 seems likely. Following this technical bounce, we believe that the euro-bears are most likely to strike again, as the overall technical bias remains clearly bearish. A sell the rallies approach is advisable. We believe that trend acceleration may lead to a 1y low at 1.188 (low June 2010). This should be the final leg of the downtrend and a very solid support level. Afterwards, we envisage 1.26 as a major target on the upside.

Erste Group Research Currency Analysis EURUSD

Page 1

Erste Group Research Currency Analysis | EURUSD 04. January 2012

Analyst

Fundamental Outlook The dollars traditional status as a safe haven is as often confirmed as it is contested. Indeed, the property does not seem to be stable over time, and in the dollars case appears to be threshold-triggered (so that the dollar appreciates only in case of extreme financial market stress). Indeed, there is no visible correlation of the EURUSD exchange rate with any measure of financial market stress, such as volatility (e.g., the VIX as in the following chart inverted on the right-hand side) or other financial stress indicators. However, in the event of extreme stress (as marked in blue in the following chart), the dollar almost systematically appreciates. Hence, in the event of renewed financial market turmoil, the dollar should appreciate further.

1.7 1.6 1.5 1.4 1.3 1.2 1.1 180 1

03.01.2005 23.05.2005 10.10.2005 27.02.2006 17.07.2006 04.12.2006 23.04.2007 10.09.2007 28.01.2008 16.06.2008 03.11.2008 23.03.2009 10.08.2009 28.12.2009 17.05.2010 04.10.2010 21.02.2011 11.07.2011 28.11.2011

Mildred Hager

mildred.hager@erstegroup.com

-70 -20 30 80 130

EURUSD

VIX, inverted rhs

Source: Bloomberg, Erste Group Research

Beyond that, the stress related to the Eurozone debt crisis increasingly impacts the EURUSD exchange rate. In 2010, several factors counteracted the safe haven status of the dollar. For example, other safe havens seemed more appealing on a fundamental basis (e.g., CHF), but have now been eliminated by central bank intervention. Furthermore, QE2 had contributed to a weaker dollar in 2010 (see next section). Since mid-2011, the dollar has increasingly become a safe haven. This is visible in the following chart, showing the onset of a co-movement of the exchange rate with peripheral yield spread increases. We expect this to persist, but do not see it as any manifestation of a euro crisis, as the extent of exchange rate sensitivity still remains relatively mild (in contrast to the EURCHFs past reaction, for example).

1.7 1.6 1.5 1.4 1.3 1.2 1.1 1 03.01.2005 03.07.2005 03.01.2006 03.07.2006 03.01.2007 03.07.2007 03.01.2008 03.07.2008 03.01.2009 03.07.2009 03.01.2010 03.07.2010 03.01.2011 03.07.2011 17.5 12.5 2.5 7.5 -2.5

EURUSD

10Y Spread gips-DE, rhs inverted

Source: Bloomberg, Erste Group Research Erste Group Research Currency Analysis EURUSD Page 2

Erste Group Research Currency Analysis | EURUSD 04. January 2012

Besides perceived or real risk factors, the expected return of an asset is of course one of the main driving forces of its price. Higher interest rates (or smaller monetary aggregates) support a currencys relative attractiveness, so that the monetary policy stance is of great importance for the exchange rate. As long as interest rates are strictly positive, nominal and real interest rate/yield differentials of different maturities are the main reflection of the current and expected monetary policy stance. Short-term interest rates/yields are directly linked to the setting of the main refinancing rate. We expect the ECB to lower the main refinancing rate to 0.5%, which is already priced in in 2Y yields. This points to the EURUSD decreasing towards 1.25 quite rapidly.

1.7 1.6 1.5 1.4 1.3 1.2 1.1 1 Jn.05 Jn.06 Jn.07 Jn.08 Jn.09 Jn.10 Jn.11 Jul.05 Jul.06 Jul.07 Jul.08 Jul.09 Jul.10 Jul.11

2000 1800 1600 1400 1200 1000 800 600 400 200 0 Jul.05 Jul.06 Jul.07 Jul.08 Jul.09 Jul.10 Jn.05 Jn.06 Jn.07 Jn.08 Jn.09 Jn.10 Jn.11 Jul.11

3 2 1 0 -1 -2 -3

EURUSD 2Y Yield differential (rhs) Source: Bloomberg, Erste Group Research

Once the short-term rate is at zero, the central bank can relax monetary conditions further through balance sheet measures. In the case of the EURUSD, this will be one of the most complex issues in 2012. An expansion of the balance sheet (such as QE or expanded liquidity provision) can affect the exchange rate through the relative provision of currency, or expectations in this respect. Indeed, the expansion of liquidity provision in terms of maturity and collateral by the ECB has already led to a relative increase in the ECBs balance sheet as compared to the Feds (see the following chart), thus exerting a weakening pressure on the euro. We expect the ECB to remain more generous than the Fed (even if the latter were to consider MBS purchases), thus weakening the euro.

1.7 1.6 1.5 1.4 1.3 1.2 1.1 1

EURUSD

M0 US / M0 EU

Source: Bloomberg, Erste Group Research Erste Group Research Currency Analysis EURUSD Page 3

Erste Group Research Currency Analysis | EURUSD 04. January 2012

The composition of the CBs balance sheet (as opposed to its size) can affect the exchange rate indirectly because of its potential impact on longer term interest rates (for example, Operation Twist lowers long-term yields, while short-term yields are pegged down by interest rate expectations). We expect the ECB to lower rates to 0.5% and for them to remain there until 2014 thus longer than the Fed. If necessary, the bank could also aim to lower long-term rates further (asset purchases similar to the Fed), so that we expect slightly more yield increases in the US than for the Eurozone benchmark. This exerts a weakening effect on the euro.

1.7 1.6 1.5 1.4 1.3 1.2 1.1 1 Jn.05 Jn.06 Jn.07 Jn.08 Jn.09 Jn.10 Jn.11 Jn.12

Jn.11

0.8 0.3 -0.2 -0.7 -1.2 -1.7 Jul.05 Jul.06 Jul.07 Jul.08 Jul.09 Jul.10 Jul.11

Jn.09

EURUSD 10Y Yield differential (rhs) Source: Bloomberg, Erste Group Research

Furthermore, from a fundamental and long-term perspective, there are some other factors supporting the dollar. Most important from a quantitative perspective is the fair value of the exchange rate. This value is determined by the fact that the same good should cost the same in both countries (Purchasing Power Parity). Of course, there are numerous limitations for this approach (transportation costs, tariffs, not all goods are tradable, price and wage setting is sticky, one does not have an absolute measure for prices, only some relative proxies such as Consumer Price Indices or Producer Price Indices with the exception of the famous but not entirely representative Big Mac Index). However, in the long run, exchange rates seem to return to their fair value based on relative price dynamics. For some of the reasons mentioned above, we have based our fair value on Producer Prices, and obtain a current fair value of EURUSD 1.25, which is our strongest argument in the medium term.

1.7 1.6 1.5 1.4 1.3 1.2 1.1 1 0.9 0.8 0.7 Jn.91 Jn.93 Jn.95 Jn.97 Jn.99 Jn.01 Jn.03 Jn.05 Jn.07

EURUSD (DEMUSD prior to 1999) EURUSD Fair Value (PPI US/ PPI EZ indexed on 1999 EURUSD)

Source: Datastream, Erste Group Research

Erste Group Research Currency Analysis EURUSD

Page 4

Erste Group Research Currency Analysis | EURUSD 04. January 2012

Finally, the trade balance, and in particular the balance of payments inflows due to the dollars status as the first reserve currency worldwide, have a long-term but hard to quantify impact on the exchange rate. The narrowing of the US trade deficit (also vs. the EU) subsequently to the crisis is one more factor speaking in favor of the US currency. We expect the US current account to remain narrower than prior to the crisis, which should also support the dollar.

1.7 1.6 1.5 1.4 1.3 1.2 1.1 1 0.9 0.8 0.7 Jn.00 Jn.01 Jn.02 Jn.03 Jn.04 Jn.05 Jn.06 Jn.07 Jn.08 Jn.09 Jn.10 Jn.11 -15000 -13000 -11000 -9000 -7000 -5000 -3000

EURUSD

TB US vs. EU (rhs, inverted)

Source: Bloomberg, Erste Group Research

In principle, a trade balance deficit should exert weakening pressure on the currency per se (there is less demand for domestic goods abroad than vice versa, hence less demand for dollars to pay for them). However, the dollars status as a reserve currency probably more than offsets this. Indeed, dollar holdings for currency reserve purposes have remained quite stable throughout the last decade (at least the ones officially declared as shown in the following chart), and the euro only marginally caught up as the second reserve currency. Indeed, it is estimated that the interest rate required to hold dollars is 60BPs lower due to the dollar being a reserve 1 currency , so that even remarkably low yields (treasuries have been the best performing asset in 2011, according to Bloomberg) might suffice to keep demand for dollars stable.

100.00% 90.00% 80.00% 70.00% 60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% 1995 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011Q2 1996* 1997*

Share of USD in allocated Reserve currencies Share of EUR in allocated reserve currencies

Source: IMF, Erste Group Research

This also reinforces the argument that the dollar should, in principle be even stronger than predicted by the interest rate differential except for fears of Fed easing. However, as we have argued, we expect the ECB to compensate for this in 2012, so that overall we expect the EURUSD exchange rate to range closely to its fair value of 1.25 in 2012.

1

F.C. Warnock, V.C. Warnock, International Capital Flows and U.S. Interest Rates, Federal Reserve System International Finance Discussion Papers Erste Group Research Currency Analysis EURUSD Page 5

Erste Group Research Currency Analysis | EURUSD 04. January 2012

Analyst

Technical outlook The current rebound may continue for some time and a further rise to EURUSD 1.31 seems likely. MACD is posting a positive divergence and might trigger the signal-line soon. Moreover, short-term sentiment turned very bearish recently. Following this technical bounce, we believe that the euro-bears are most likely to strike again, as the overall technical bias remains clearly bearish. The medium- and long-term downtrends are still intact. The recent break of the 200d-Moving Average, a highly negative RSI reading, bearish CoT readings, as well as most sentiment indicators support our bearish view. A sell the rallies approach is advisable. Although the central topic of conversation in 2011 used to be discussions about the stability of the Monetary Union, price action held up surprisingly well. Therefore, we believe that trend acceleration might lead to a 1y low at 1.188 (low June 2010). This should be the final leg of the downtrend and a very solid support level. Afterwards, we envisage 1.26 as a major target on the upside.

Ronald Stferle

Ronald.stferle@erstegroup.com

Erste Group Research Currency Analysis EURUSD

Page 6

Erste Group Research Currency Analysis | EURUSD 04. January 2012

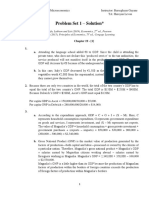

FORECASTS

current 1.30 Mar 12 1.30 Jun.12 1.25 Sep.12 1.25 Dec 12 1.25

EURUSD

Interest rates EZB MRR 3M Euribor Germ any 2Y Germ any 5Y Germ any 10Y

current 1.00 1.33 0.18 0.82 1.92

Mar 12 0.50 0.90 0.30 1.00 2.10

Jun.12 0.50 0.70 0.35 1.10 2.15 Jun.12 0.25 0.40 0.25 1.35 2.20

Sep.12 0.50 0.70 0.40 1.25 2.25 Sep.12 0.25 0.40 0.35 1.50 2.40

Dec 12 0.50 0.70 0.45 1.40 2.40 Dec 12 0.25 0.40 0.50 1.70 2.50

current Mar 12 Fed Funds Target Rate 0.25 0.25 3M Libor 0.58 0.50 Yield 2Y 0.26 0.20 Yield 5Y 0.87 1.20 Yield 10Y 1.94 2.10 Source: Bloomberg, Datastream, Erste Group Research

Erste Group Research Currency Analysis EURUSD

Page 7

Erste Group Research Currency Analysis | EURUSD 04. January 2012

Contacts

Group Research

Head of Group Research Friedrich Mostbck, CEFA Macro/Fixed Income Research Head: Gudrun Egger, CEFA (Euroland) Adrian Beck (AT, SW) Mildred Hager (US, JP, Euroland) Alihan Karadagoglu (Corporates) Peter Kaufmann (Corporates) Carmen Riefler-Kowarsch (Covered Bonds) Elena Statelov, CIIA (Corporates) Macro/Fixed Income Research CEE Co-Head CEE: Juraj Kotian (Macro/FI) Birgit Niessner (Macro/FI) CEE Equity Research Co-Head: Gnther Artner, CFA Co-Head: Henning Ekuchen Gnter Hohberger (Banks) Franz Hrl, CFA (Steel, Construction) Daniel Lion, CIIA (IT) Christoph Schultes, CIIA (Insurance, Utility) Thomas Unger; CFA (Oil&Gas) Vera Sutedja, CFA (Telecom) Vladimira Urbankova, MBA (Pharma) Martina Valenta, MBA (Real Estate) Gerald Walek, CFA (Machinery) International Equities Hans Engel (Market strategist) Stephan Lingnau (Europe) Ronald Stferle (Asia) Editor Research CEE Brett Aarons Research, Croatia/Serbia Head: Mladen Dodig (Equity) Head: Alen Kovac (Fixed income) Anto Augustinovic (Equity) Ivana Rogic (Fixed income) Davor Spoljar, CFA (Equity) Research, Czech Republic Head: David Navratil (Fixed income) Petr Bittner (Fixed income) Petr Bartek (Equity) Vaclav Kminek (Media) Jana Krajcova (Fixed income) Martin Krajhanzl (Equity) Martin Lobotka (Fixed income) Lubos Mokras (Fixed income) Research, Hungary Head: Jzsef Mir (Equity) Bernadett Papp (Equity) Gergely Gabler (Equity) Zoltan Arokszallasi (Fixed income) Research, Poland Tomasz Kasowicz (Equity) Piotr Lopaciuk (Equity) Marek Czachor (Equity) Research, Romania Head: Lucian Claudiu Anghel Head Equity: Mihai Caruntu (Equity) Dorina Cobiscan (Fixed Income) Dumitru Dulgheru (Fixed income) Eugen Sinca (Fixed income) Raluca Ungureanu (Equity) Research Turkey Head: Erkin Sahinoz (Fixed Income) Sevda Sarp (Equity) Evrim Dairecioglu (Equity) Ozlem Derici (Fixed Income) Mehmet Emin Zumrut (Equity) +43 (0)5 0100 - 11902 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 - 11909 - 11957 - 17331 - 19633 - 11183 - 19632 - 19641 Research, Slovakia Head: Juraj Barta, CFA (Fixed income) Sona Muzikarova (Fixed income) Maria Valachyova (Fixed income) Research, Ukraine Head: Maryan Zablotskyy (Fixed income) Ivan Ulitko (Equity) Igor Zholonkivskyi (Equity) +421 2 4862 4166 +421 2 4862 4762 +421 2 4862 4185 +38 044 593 - 9188 +38 044 593 - 0003 +38 044 593 - 1784

Treasury - Erste Bank Vienna

Saving Banks & Sales Retail Head: Thomas Schaufler Equity Retail Sales Head: Kurt Gerhold Fixed Income & Certificate Sales Head: Uwe Kolar Treasury Domestic Sales Head: Markus Kaller Corporate Sales AT Head: Christian Skopek Institutional Sales International Head: Christoph Kampitsch Institutional Sales Austria Head: Thomas Almen Martina Fux Michael Konczer Marc Pichler Institutional Solutions Head: Zachary Carvell Brigitte Mayr Mikhail Roshal Institutional & High End Sales Head: Patrick Lehnert Antony Brown Abdalla Bachu Lukash Beeharry Ulrich Inhofner Margit Hraschek Institutional Sales Germany Head: Jrgen Niemeier Marc Friebertshuser Sven Kienzle Michael Schmotz Sabine Loris Carsten Demmler Jrg Moritzen Rene Klasen Klaus Vosseler Milosz Chrustek Andreas Goll Mathias Gindele Institutional Sales CEE Head: Jaromir Malak Sales CEE Pawel Kielek Piotr Zagan Ciprian Mitu Institutional Sales Slovakia Head: Peter Kniz Sarlota Sipulova Institutional Sales Czech Republic Head: Ondrej Cech Pavel Zdichynec Milan Bartos Radek Chupik Institutional Sales Croatia Head: Darko Horvatin Natalija Zujic Institutional Sales Hungary Norbert Siklosi Institutional Sales Romania Head: Valentin Popovici Ruxandra Carlan +43 (0)5 0100 - 84225 +43 (0)5 0100 - 84232 +43 (0)5 0100 - 83214 +43 (0)5 0100 - 84239 +43 (0)5 0100 - 84146

+43 (0)5 0100 - 17357 +43 (0)5 0100 - 18781 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 +43 (0)5 0100 - 11523 - 19634 - 17354 - 18506 - 17420 - 16314 - 17344 - 11905 - 17343 - 11913 - 16360

Fixed Income & Credit Institutional Sales

+43 (0)5 0100 - 84979 +43 (0)50100 - 84323 +43 (0)50100 - 84113 +43 (0)50100 - 84121 +43 (0)50100 - 84118 +43 (0)50100 - 83308 +43 (0)50100 87481 +43 (0)50100 87487 +43 (0)5 0100 - 84259 +44 20 7623 - 4159 +44 20 7623 - 4159 +43 (0)50100 - 84125 +43 (0)50100 - 84324 +43 (0)50100 - 84117 +43 (0)50100 - 85503 +43 (0)50100 - 85540 +43 (0)50100 - 85541 +43 (0)50100 - 85542 +43 (0)50100 - 85543 +43 (0)50100 - 85580 +43 (0)50100 - 85581 +43 (0)50100 - 85521 +43 (0)50100 - 85560 +43 (0)50100 - 85522 +43 (0)50100 - 85561 +43 (0)50100 - 85562 +43 (0)50100 - 84254 +48 22 538 62 23 +43 (0)50100 - 84256 +43 (0)50100 - 84253 +421 2 4862-5624 +421 2 4862-5629 +420 2 2499 - 5577 +420 2 2499 - 5590 +420 2 2499 - 5562 +420 2 2499 - 5565 +385 (0)6237 - 1788 +385 (0)6237 - 1638 +36 1 235 - 5842 +40 21 310-4449 - 59 +40 21 310-4449 - 612

+43 (0)5 0100 - 19835 +43 (0)5 0100 - 16574 +43 (0)5 0100 - 11723 +420 956 711 014 +381 11 +385 62 +385 62 +385 62 +385 62 22 09 178 37 1383 37 2833 37 2419 37 2825 995 995 995 995 995 995 995 995 439 172 227 289 232 434 192 456

+420 224 +420 224 +420 224 +420 224 +420 224 +420 224 +420 224 +420 224

+361 235-5131 +361 235-5135 +361 253-5133 +361 373-2830 +48 22 330 6251 +48 22 330 6252 +48 22 330 6254 +40 37226 1021 +40 21 311 2754 +40 37226 1028 +40 37226 1029 +40 37226 1026 +40 21311 2754 +90 212 371 2540 +90 212 371 2537 +90 212 371 2535 +90 212 371 2536 +90 212 371 2539

Erste Group Research Currency Analysis EURUSD

Page 8

Erste Group Research Currency Analysis | EURUSD 04. January 2012

Published by Erste Group Bank AG, Neutorgasse 17, 1010 Vienna, Austria. Phone +43 (0)5 0100 - ext. Erste Group Homepage: www.erstegroup.com On Bloomberg please type: EBS AV and then F8 GO

This research report was prepared by Erste Group Bank AG (Erste Group) or its affiliate named herein. The individual(s) involved in the preparation of the report were at the relevant time employed in Erste Group or any of its affiliates. The report was prepared for Erste Group clients. The information herein has been obtained from, and any opinions herein are based upon, sources believed reliable, but we do not represent that it is accurate or complete and it should not be relied upon as such. All opinions, forecasts and estimates herein reflect our judgment on the date of this report and are subject to change without notice. The report is not intended to be an offer, or the solicitation of any offer, to buy or sell the securities referred to herein. From time to time, Erste Group or its affiliates or the principals or employees of Erste Group or its affiliates may have a position in the securities referred to herein or hold options, warrants or rights with respect thereto or other securities of such issuers and may make a market or otherwise act as principal in transactions in any of these securities. Erste Group or its affiliates or the principals or employees of Erste Group or its affiliates may from time to time provide investment banking or consulting services to or serve as a director of a company being reported on herein. Further information on the securities referred to herein may be obtained from Erste Group upon request. Past performance is not necessarily indicative for future results and transactions in securities, options or futures can be considered risky. Not all transactions are suitable for every investor. Investors should consult their advisor, to make sure that the planned investment fits into their needs and preferences and that the involved risks are fully understood. This document may not be reproduced, distributed or published without the prior consent of Erste Group. Erste Group Bank AG confirms that it has approved any investment advertisements contained in this material. Erste Group Bank AG is regulated by the Financial Market Authority (FMA) Otto-Wagner-Platz 5,1090 Vienna, and for the conduct of investment business in the UK by the Financial Services Authority (FSA). Please refer to www.erstegroup.com for the current list of specific disclosures and the breakdown of Erste Groups investment recommendations.

Erste Group Research Currency Analysis EURUSD

Page 9

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- What Is Gross Domestic Product?: Tim CallenDocument2 pagesWhat Is Gross Domestic Product?: Tim CallenDivyadarshi VickyNo ratings yet

- Capital Cost Quinckly Calculated PDFDocument8 pagesCapital Cost Quinckly Calculated PDFLeo Jiménez Montes100% (1)

- The Military Balance 1995Document321 pagesThe Military Balance 1995Рустем Дашкин100% (3)

- Solution Manual For Economic Growth 3rd Edition byDocument4 pagesSolution Manual For Economic Growth 3rd Edition byLuíza Neves20% (10)

- SHRM ToyotaDocument21 pagesSHRM ToyotaSyed Ahmed Tajuddin100% (1)

- ING - FX TalkingDocument18 pagesING - FX TalkingCiocoiu Vlad AndreiNo ratings yet

- PWC Emerging Trends Real Estate Europe 2012Document60 pagesPWC Emerging Trends Real Estate Europe 2012Ciocoiu Vlad AndreiNo ratings yet

- ING FX TalkingDocument20 pagesING FX TalkingCiocoiu Vlad AndreiNo ratings yet

- Global Economic Outlook Q2 2012Document48 pagesGlobal Economic Outlook Q2 2012Ciocoiu Vlad AndreiNo ratings yet

- Ipo Q1 2012Document14 pagesIpo Q1 2012Ciocoiu Vlad AndreiNo ratings yet

- BW Female Client Group ReportDocument20 pagesBW Female Client Group ReportCiocoiu Vlad AndreiNo ratings yet

- Basel III and BeyondDocument27 pagesBasel III and BeyondDeepak AgrawalNo ratings yet

- PWC Q4 2011 Ipo SurveryDocument17 pagesPWC Q4 2011 Ipo SurveryCiocoiu Vlad AndreiNo ratings yet

- Raiffeisen Research-CEE Weekly Bond Market OutlookDocument12 pagesRaiffeisen Research-CEE Weekly Bond Market OutlookCiocoiu Vlad AndreiNo ratings yet

- ING Forex TalkingDocument19 pagesING Forex TalkingCiocoiu Vlad AndreiNo ratings yet

- ERSTE Forex NewsDocument6 pagesERSTE Forex NewsCiocoiu Vlad AndreiNo ratings yet

- Produs Structurat Cu Randament de 7% in USDDocument3 pagesProdus Structurat Cu Randament de 7% in USDCiocoiu Vlad AndreiNo ratings yet

- ING - Foreign Exchange OutlookDocument61 pagesING - Foreign Exchange OutlookCiocoiu Vlad AndreiNo ratings yet

- CEE Bond Outlook 2012Document14 pagesCEE Bond Outlook 2012Ciocoiu Vlad AndreiNo ratings yet

- ING Forex UpdateDocument9 pagesING Forex UpdateCiocoiu Vlad AndreiNo ratings yet

- Produs Structurat Cu Randament de 12%Document3 pagesProdus Structurat Cu Randament de 12%Ciocoiu Vlad AndreiNo ratings yet

- Garanti Bank Q4 Earnings PreviewDocument2 pagesGaranti Bank Q4 Earnings PreviewCiocoiu Vlad AndreiNo ratings yet

- Central Banks Gold Reserve HoldingsDocument5 pagesCentral Banks Gold Reserve HoldingsCiocoiu Vlad AndreiNo ratings yet

- CEE Weekly Bond OutlookDocument12 pagesCEE Weekly Bond OutlookCiocoiu Vlad AndreiNo ratings yet

- Dobanzi PF UnicreditDocument1 pageDobanzi PF UnicreditCiocoiu Vlad AndreiNo ratings yet

- World Official Gold Holdings As of January 2012Document3 pagesWorld Official Gold Holdings As of January 2012Ciocoiu Vlad AndreiNo ratings yet

- Produs Structurat JPMOrgan - Goldman - Bank of AmericaDocument3 pagesProdus Structurat JPMOrgan - Goldman - Bank of AmericaCiocoiu Vlad AndreiNo ratings yet

- Erste Group Research - Economic Outlook 2012Document15 pagesErste Group Research - Economic Outlook 2012Ciocoiu Vlad Andrei0% (1)

- Raiffeisen Research - CEE Weekly Bond Market OutlookDocument12 pagesRaiffeisen Research - CEE Weekly Bond Market OutlookCiocoiu Vlad AndreiNo ratings yet

- Change in Rating of AustriaDocument2 pagesChange in Rating of AustriaCiocoiu Vlad AndreiNo ratings yet

- Standard Poor Stakes Various Rating Actions On Euro Zone Sovereign Governments SPMDocument7 pagesStandard Poor Stakes Various Rating Actions On Euro Zone Sovereign Governments SPMBull RunNo ratings yet

- Erste Group Research - Global Strategy OutlookDocument32 pagesErste Group Research - Global Strategy OutlookCiocoiu Vlad AndreiNo ratings yet

- Produs Structurat Denominat in Euro Cu 8.75% DobandaDocument3 pagesProdus Structurat Denominat in Euro Cu 8.75% DobandaCiocoiu Vlad AndreiNo ratings yet

- Erste Group Research - CEE Valuation MonitorDocument81 pagesErste Group Research - CEE Valuation MonitorCiocoiu Vlad AndreiNo ratings yet

- ING-Financial Markets ResearchDocument45 pagesING-Financial Markets ResearchCiocoiu Vlad AndreiNo ratings yet

- Ilm Al UmraniyatDocument107 pagesIlm Al UmraniyatIslamiaNo ratings yet

- Coastal Governance Index 2015: An Index and Study by The Economist Intelligence UnitDocument39 pagesCoastal Governance Index 2015: An Index and Study by The Economist Intelligence UnitQuin ShaNo ratings yet

- Final Ibf ProjectDocument11 pagesFinal Ibf Projectchoco_pie_952No ratings yet

- International Corporate FinanceDocument31 pagesInternational Corporate FinancegagafikNo ratings yet

- Study Guide - Chapter 10Document6 pagesStudy Guide - Chapter 10Peko YeungNo ratings yet

- Porter Stansberry The Corruption of AmericaDocument16 pagesPorter Stansberry The Corruption of AmericaBritton Trimmer100% (1)

- Glob Finc - Practice Set For Exam 1 - SolutionsDocument7 pagesGlob Finc - Practice Set For Exam 1 - SolutionsInesNo ratings yet

- MFM 842: Financial Risk ManagementDocument74 pagesMFM 842: Financial Risk Management121923602032 PUTTURU JAGADEESHNo ratings yet

- International MarketingDocument27 pagesInternational MarketingĐinh Minh Anh 1M-20ACNNo ratings yet

- Class 4 - HDI and MPIDocument33 pagesClass 4 - HDI and MPIVarun FrancisNo ratings yet

- Quiz6 MEAcctg1102 - 91 E0Document17 pagesQuiz6 MEAcctg1102 - 91 E0Saeym SegoviaNo ratings yet

- Macroeconomic TrendsDocument5 pagesMacroeconomic Trendsberi tsegeabNo ratings yet

- A) The Following Is The Iphone 7 Price List and The Spot Exchange Rate For Both CountriesDocument10 pagesA) The Following Is The Iphone 7 Price List and The Spot Exchange Rate For Both CountriesDR LuotanNo ratings yet

- South Asian Free Trade Area: Opportunities and ChallengesDocument249 pagesSouth Asian Free Trade Area: Opportunities and ChallengesHrishikesh.100% (1)

- Problem Set 1 - SolutionDocument8 pagesProblem Set 1 - SolutionH ENGNo ratings yet

- Ceylon Tobacco Company Initiation ReportDocument32 pagesCeylon Tobacco Company Initiation ReportMurtaza JafferjeeNo ratings yet

- Individual-Asm3 Pham-Chung ss181258Document3 pagesIndividual-Asm3 Pham-Chung ss181258hoantkss181354No ratings yet

- Maternal Mortality in 2000-2017: OzambiqueDocument7 pagesMaternal Mortality in 2000-2017: OzambiqueFabio Amaro AmaroNo ratings yet

- Autopista Central Case: Group CDocument44 pagesAutopista Central Case: Group CKirti VohraNo ratings yet

- Inflation and Its Impact On Project Cash FlowsDocument45 pagesInflation and Its Impact On Project Cash FlowsukhyeonNo ratings yet

- MKT 397 Exam 2Document14 pagesMKT 397 Exam 2ncNo ratings yet

- Final ProjectDocument6 pagesFinal ProjectEsteban LermaNo ratings yet

- Why Do Diffrent Places Have Different CurrenceysDocument20 pagesWhy Do Diffrent Places Have Different CurrenceysDani JainNo ratings yet

- Unit 4 INTERNATIONAL BUSINESS MANAGEMENTDocument11 pagesUnit 4 INTERNATIONAL BUSINESS MANAGEMENTnoroNo ratings yet

- IP - Chapter1 - Foreign Exchange and Currency Risk Management - StudentDocument22 pagesIP - Chapter1 - Foreign Exchange and Currency Risk Management - Studentđan thi nguyễnNo ratings yet