Professional Documents

Culture Documents

ESI

Uploaded by

Saprativa PalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ESI

Uploaded by

Saprativa PalCopyright:

Available Formats

Coverage under the ESI Act,1948

Applicability Under Section 2(12) The Act is applicable to the factories employing 10 or more persons irrespective of whether power is used in the process of manufacturing or not. Under Section 1(5) of the Act, the Scheme has been extended to shops, hotels, restaurants, cinemas including preview theatre, road motor transport undertakings and newspaper establishment employing 20 or more persons. Further, u/s 1(5) of the Act, the Scheme has been extended to Private Medical and Educational Institutions employing 20 or more persons in certain States . The State Govt. has been requested to issue notification under Section 1(5) on the lines of Section 2(12) keeping the threshold limit for coverage as 10 employees instead of 20. The existing wage-limit for coverage under the Act, is Rs.15,000/- per month (with effect from 01.05.2010). AREAS COVERED The ESI Scheme is being implemented area-wise by stages. The Scheme has already been implemented in different areas in the following States/Union Territories STATES All the States except Nagaland, Manipur, Tripura, Sikkim, Arunachal Pradesh and Mizoram. UNION TERRITORIES Delhi, Chandigarh and Pondicherry

Contribution

E.S.I. Scheme being contributory in nature, all the employees in the factories or establishments to which the Act applies shall be insured in a manner provided by the Act. The contribution payable to the Corporation in respect of an employee shall comprise of employers contribution and employees contribution at a specified rate. The rates are revised from time to time. Currently, the employees contribution rate (w.e.f. 1.1.97) is 1.75% of the wages and that of employers is 4.75% of the wages paid/payable in respect of the employees in every wage period. Employees in receipt of a daily average wage upto Rs.70/- are exempted from payment of contribution. Employers will however contribute their own share in respect of these employees. Collection of Contribution An employer is liable to pay his contribution in respect of every employee and deduct employees

contribution from wages bill and shall pay these contributions at the above specified rates to the Corporation within 21 days of the last day of the Calendar month in which the contributions fall due. The Corporation has authorized designated branches of the State Bank of India and some other banks to receive the payments on its behalf. Contribution Period and Benefit Period There are two contribution periods each of six months duration and two corresponding benefit periods also of six months duration as under. Contribution period Corresponding Cash Benefit period Contribution Period 1st April to 30th Sept. 1st Oct. to 31st March Cash Benefit Period 1st January of the following year to 30th June. 1st July to 31st December of the year following

Benefits

The section 46 of the Act envisages following six social security benefits :(a) Medical Benefit : Full medical facilities for self and family from day one of entering insurable employment. (b) Sickness Benefit(SB) : Payment of contribution for 78 days in corresponding contribution period of six months. 1. Extended Sickness Benefit(ESB) : Same as above 2. Enhanced Sickness Benefit : For 34 specified long term diseases, Continuous insurable employment for two years with 156 days contribution in four consecutive contribution periods. (c) Maternity Benefit(MB) (d) Disablement Benefit 1. Temporary disablement benefit (TDB) : From day one of entering insurable employment & irrespective of having paid any contribution in case of death due to employment injury. 2. Permanent disablement benefit (PDB) : Same as above (e) Dependants Benefit(DB) : From day one of entering insurable employment & irrespective of having paid any contribution in case of death due to employment injury. (f) Other Benefits : - Funeral Expenses : An amount of Rs. 5000/- is payable to the dependents or to the person who performs last rites from day one of entering insurable employment. - Confinement Expenses : An Insured Women or an I.P.in respect of his wife in case confinement

occurs at a place where necessary medical facilities under ESI Scheme are not available. In addition, the scheme also provides some other need based benefits to insured workers. - Vocational Rehabilitation : In case of physical disablement due to employment injury. - Physical Rehabilitation : In case of physical disablement due to employment injury. - Rajiv Gandhi Shramik Kalyan Yojana - This scheme of Unemployment allowance was introduced w.e.f. 01-04-2005. An Insured Person who become unemployed after being insured three or more years, due to closure of factory/establishment, retrenchment or permanent invalidity are entitled to :

Unemployment Allowance equal to 50% of wage for a maximum period of upto one year. Medical care for self and family from ESI Hospitals/Dispensaries during the period IP receives unemployment allowance. Vocational Training provided for upgrading skills - Expenditure on fee/travelling allowance borne by ESIC.

An interesting feature of the ESI Scheme is that the contributions are related to the paying capacity as a fixed percentage of the workers wages, whereas, they are provided social security benefits according to individual needs without distinction. Cash Benefits are disbursed by the Corporation through its Branch Offices (BOs) / Pay Offices (POs), subject to certain contributory conditions.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Corporate Restructuring Companies Amendment Act 2021Document9 pagesCorporate Restructuring Companies Amendment Act 2021Najeebullah KardaarNo ratings yet

- Unit 8 - Week 7: Assignment 7Document3 pagesUnit 8 - Week 7: Assignment 7Nitin MoreNo ratings yet

- Cost Volume Profit AnalysisDocument7 pagesCost Volume Profit AnalysisMatinChris KisomboNo ratings yet

- Maths VIII FA4Document3 pagesMaths VIII FA4BGTM 1988No ratings yet

- Power Dense and Robust Traction Power Inverter For The Second Generation Chevrolet Volt Extended Range EDocument8 pagesPower Dense and Robust Traction Power Inverter For The Second Generation Chevrolet Volt Extended Range Ejrz000No ratings yet

- Management and Entrepreneurship Important QuestionsDocument1 pageManagement and Entrepreneurship Important QuestionslambazNo ratings yet

- Lab 1Document8 pagesLab 1Нурболат ТаласбайNo ratings yet

- Burberry Annual Report 2019-20 PDFDocument277 pagesBurberry Annual Report 2019-20 PDFSatya PhaneendraNo ratings yet

- HRM OmantelDocument8 pagesHRM OmantelSonia Braham100% (1)

- CDCS Self-Study Guide 2011Document21 pagesCDCS Self-Study Guide 2011armamut100% (2)

- Adding Print PDF To Custom ModuleDocument3 pagesAdding Print PDF To Custom ModuleNguyễn Vương AnhNo ratings yet

- 15.910 Draft SyllabusDocument10 pages15.910 Draft SyllabusSaharNo ratings yet

- 032017Document107 pages032017Aditya MakwanaNo ratings yet

- MIami Beach City Attorney's DenialDocument7 pagesMIami Beach City Attorney's DenialDavid Arthur WaltersNo ratings yet

- PT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaDocument16 pagesPT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaihsanlaidiNo ratings yet

- Risk-Based IA Planning - Important ConsiderationsDocument14 pagesRisk-Based IA Planning - Important ConsiderationsRajitha LakmalNo ratings yet

- Design of Accurate Steering Gear MechanismDocument12 pagesDesign of Accurate Steering Gear Mechanismtarik RymNo ratings yet

- Learning Activity Sheet Science 10 Second Quarter - Week 8Document4 pagesLearning Activity Sheet Science 10 Second Quarter - Week 8Eller Jansen AnciroNo ratings yet

- Freelance Contract TemplateDocument7 pagesFreelance Contract TemplateAkhil PCNo ratings yet

- Kudla Vs PolandDocument4 pagesKudla Vs PolandTony TopacioNo ratings yet

- PRI SSC TutorialDocument44 pagesPRI SSC TutorialSantosh NarayanNo ratings yet

- A Case Study From The: PhilippinesDocument2 pagesA Case Study From The: PhilippinesNimNo ratings yet

- New York State - NclexDocument5 pagesNew York State - NclexBia KriaNo ratings yet

- Millets: Future of Food & FarmingDocument16 pagesMillets: Future of Food & FarmingKIRAN100% (2)

- Pa 28 151 161 - mmv1995 PDFDocument585 pagesPa 28 151 161 - mmv1995 PDFJonatan JonatanBernalNo ratings yet

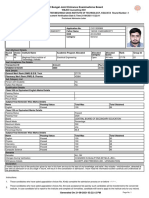

- West Bengal Joint Entrance Examinations Board: Provisional Admission LetterDocument2 pagesWest Bengal Joint Entrance Examinations Board: Provisional Admission Lettertapas chakrabortyNo ratings yet

- Renvoi in Private International LawDocument4 pagesRenvoi in Private International LawAgav VithanNo ratings yet

- Chinaware - Zen PDFDocument111 pagesChinaware - Zen PDFMixo LogiNo ratings yet

- TC 9-237 Welding 1993Document680 pagesTC 9-237 Welding 1993enricoNo ratings yet

- Add New Question (Download - PHP? SC Mecon&id 50911)Document9 pagesAdd New Question (Download - PHP? SC Mecon&id 50911)AnbarasanNo ratings yet