Professional Documents

Culture Documents

Mortgage Litigation

Uploaded by

CarrieonicOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mortgage Litigation

Uploaded by

CarrieonicCopyright:

Available Formats

White Paper - January 15, 2011

Mortgage Litigation Affiliate Practice

Loan Modifications Do Not Work!

As the last two years have demonstrated, banks across the United States are dragging their feet in the hope that homeowners get frustrated with the negotiation process and give up. This is unfortunate, because the United States Government advanced more than $1 trillion in TARP money so that the banks would not drag their feet. Instead, banks took the TARP money and began grabbing land. The land grab has not yet reached epidemic proportions because of the presence of trial lawyers throughout America. While all this has been happening, banks are denying 94% of all modification requests. If the bank does give the homeowner a modification, it will most likely save them only a couple of dollars a month, will not reduce the principal balance, and the bank always reserves the right to welch on the modification and go back on it. Knowing that the banks are the ones guilty of wrongdoing, the banks then turn the borrowers attention to the loan modification lawyer or other professional by using multi-million-dollar lobbying firms to pass legislation or otherwise politically blame those who are merely doing what the President of the United States, Congress and the banks said to do: Modify their mortgages. If the homeowner paid a third party to perform a modification, their lender will call and tell the homeowner lies like, No one is working on a modification for you. They are a scam! or You should demand your money back. We can do this for you for free. It makes this process all the more frustrating for the homeowner because the banks want the homeowner to give up. Banks do not have a financial incentive to modify mortgages any longer. Banks would much rather foreclose on the property today and get to liquidate it at a time of their choosing. Their alternative is to most likely foreclose on the property a year from now at a substantially reduced market value (it is projected that property values will decrease an additional 20% in 2011). Furthermore, once banks modify a mortgage (if that event ever happens), they must reduce the value of the mortgage asset on their balance sheet, which may trigger audits from regulators like the FDIC and ultimately may result in the bank becoming bankrupt or insolvent.

In this history of America, litigation has often been the only source of relief.

Going back to the beginning and heritage of America, trial lawyers were the only ones standing in the background as a safety net for the American citizenry.

Page | 1

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

Throughout our history, many of the most important and far-reaching advancements of American society have been achieved through the work of trial lawyers fighting for the rights of citizens and consumers. Without the tireless work of these conscientious trial attorneys, much of the positive progress of our society and the numerous consumer protections we take for granted would likely not exist. From social policy to the safety and quality of consumer products, many of the most celebrated and important achievements of American social progress have been the result of the litigation by dedicated lawyers working within the system to help citizens realize their rights and protections. Examples of changes that fell into the trial lawyers safety net, we consider a few from the many: From Brown vs Board of Education of Topeka, the landmark decision that declared separate public schools for black and white students unconstitutional and paved the way for integration and the civil rights movement, to Roe Vs Wade, the Supreme Court decision that established that a right to privacy extends to a woman's decision to have an abortion, to the Tobacco Master Settlement Agreement of 1998 that settled Medicaid lawsuits in 46 states, curtailed tobacco marketing practices, established annual payments to states to compensate them for medical costs of caring for persons with smoking-related illnesses and funding a national anti-smoking advocacy group, litigation has made it possible for us to progress as a nation and become a more equal, just and fair country under the Law. With this backdrop, trial lawyers are where the American public is turning today. Many experienced legislators and experts believe litigation may be the only alternative. Hartford Dunn, LLP has evaluated the problem and believes that mortgage litigation represents the only viable alternative at this time in American history to protect homeowners: The backbone of our society.

Benefits of Mortgage Litigation

Actual Lawsuit Is Filed Can Provide Real Results Powerful Litigation Attorney Representation Affordable Solution for Homeowners Takes the Power Away From Banks Protect Your Home

Hartford Dunn, LLP has evaluated lawyers state-by-state and, in working with lawyers, has put together a turn-key system that allows you to start offering mortgage litigation as a readily accessible solution in a matter of hours. In conjunction with lawyers across the Country, Hartford Dunn, LLP provides all the required backend services to support the litigation process. Our focus is on providing the very best customer service and attorney services for companion law firms nationwide. I am very confident that we will be able to help you and I think you will quickly

Page | 2

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

see why our customers find our attorneys to be the experts when it comes to helping them get their financial issues resolved. Hereafter, we invite your attention to the best and the brightest lawyers in this field from our experience and research:

If you have any questions, call us and we will discuss a particular attorney with you. Nothing in this list infers that Hartford Dunn, LLP is affiliated with any attorney. Asterisks (*) Denote Particular, Unique and Heightened Experience or Skills.

* In our view, these are the top lawyers -- nationally -- in the area of bank litigation brought by members of the general public. STATE NAME AKA FIRM

CA

*Mitchell Stein

The Doberman Mitchell Stein & Associates

George Baugh Paul N. Taylor Louis R. Skip Miller Luan Phan NY John Golden Brian Murray Paul Rheingold Mitchell Pollack FL *Willie Gary Andrew Needle Mark Kaire James A. Ferraro TX Cynthia Chapman Louis Haki *Richard Haynes

The Gladiator

Law Offices of George L. Baugh Taylor Law Group Miller Barondess Phan Law Center Albert Buzetti & Associates Ginsberg & Katsorhis Murray, Frank & Sailer Llp Rheingold, Valet, Rheingold, Shkolnik & McCartney Mitchell Pollack & Associates Needle & Ellenberg Law Offices of Mark A. Kaire The Ferraro Law Firm Caddell & Chapman Miller Curtis & Weisbrod Richard Haynes & Associates

Racehorse

Page | 3

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

JC Bailey III Frank L. Broyles Jim Walker Leonard Gabbay IL Eric Brunick *Daniel Edelman Warren S. George MA J. Michael Conley George Keches *Keith Halpern Jeffrey Denner NV Kyle Kring M. Lani Esteban-Trinidad --------------------------------Daniel Allred Barry Levinson MD PA Jeffrey M. Bloom Robert Huber William Ballaine Patrick McDonnell *Timothy Conboy Marc Scaringi Robert Pierce

Bailey & Galyen Goins, Underkofler, Crawford & Langdon Walker & Crawford Leonard B Gabbay PC Freed & Weiss Edelman Combs Latturner & Goodwin Keis George LLP Kenney & Conley Keches Law Group Keith Halpern Law Denner Pellegrino, L.L.P., Kring & Chung Esteban-Trinidad Law, P.C Parsons Behle & Latimer Law Offices of Barry Levinson The Law Offices of Jeffrey M. Bloom Huber & Palsir Landman Corsi Ballaine & Ford P.C The Law Offices of McDonnell & Associates Caroselli Beachler McTiernan & Conboy, L.L.C Scaringi & Scaringi, P.C. Robert Peirce & Associates, P.C

Page | 4

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

Mortgage Litigation against Your Lender

With mortgage litigation, the homeowner will have attorneys on their side fighting for their rights in the US court system. Banks will no longer have the power to make the decision as to what the homeowner will get. The attorneys are using the leverage of the lawsuit to get results. Naturally, the attorneys follow the clients instructions surrounding settlement of the litigation. In the event the client so chooses, they will attempt to settle the suit for a principal reduction and rate reduction. If the bank will not settle, they will present this in front of a jury and attempt to get the mortgage free and clear. Remember, banks are vilified in todays society. If bank litigationmatters go to a jury trial, banks will be held accountable for the bad mortgages that were written and the unresponsiveness they had in providing financial relief to the homeowners who were victimized. Hartford Dunn, LLP has relationship with Law Firms that are taking the fight with us against the banks. We can assess your case and see how many potential litigation cases you fit into based on your circumstances and profile. We will continue to serve you on all cases you qualify for as a Plaintiff and this gives you more strength in numbers.

Law Firms With Active Cases of the Kind We Provide Backend Support

(Click on Defendant Company to view case detail) Mitchell J. Stein & Associates Los Angeles, CA Defendant Company Bank of America Jon D. Pels, Esq., Lawrence J. Anderson, Esq., Justin M. Reiner, Esq. and Jennifer Schiffer, Esq. Bethesda, Maryland Defendant Company HSBC Mortgage Corp. Mitchell J. Stein & Associates Los Angeles, CA Defendant Company GMAC Mortage Mitchell J. Stein & Associates Los Angeles, CA Defendant Company JP Morgan Chase Bank Cuneo, Gilbert & LaDuca, LLP Washington DC Defendant Company CitiGroup, Inc. & CitiMortgage Guldenschuh & Associates Georgia Defendant Company

Page | 5

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

E. Craig Smay, Esq. & John Christian Barlow Salt Lake City, Utah Defendant Company ReconTrust, MERS, BOA, BAC Home Loan Servicing, HSBC, Wells Fargo Bank, US Bank, Bank of New York Melon, Keybank , Does 1-10

Frydman, LLC New York, New York Defendant Company Goldman Sachs, Hudson Mezzanine Funding 2006-1 other Hudson Funding entities, Peter Ostrem, Darryl Herrick

Cohen & Malad, LLP Class Action Attorneys Indianapolis, Indiana Defendant Company Bank of America

Kenneth Eric Trent Oakland Park, Florida Defendant Company Law offices of David Stern, MERS Figuerora vs Mers

Susan Chana Lask New York, New York Defendant Company Stephen J Baum, Esq, Stephen J. Baum, PC, MERS, HSBC others (see complaint)

Law Offices of Christie Arkovich Tampa, Florida Defendant Company GMAC Mortgage

Law Offices of Heather Boone McKeever Lexington, Kentucky Defendant Company Mers, GMAC, Deutsche, Nationstar, Aurora, BAC, Citi, US

Ebanks & Sattler, llp. New York, New York Defendant Company Chase Home Finance

Page | 6

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

Lanza & Smith, PLC Irvine,, California Defendant Company

Forizs & Dogali, P.A. Tampa, Florida Defendant Company Bank of America

Friscia & Associates Newark, New Jersey Defendant Company Bank of America

The Ferraro Firm Miami, Florida Defendant Company BAC home loans servicing, Deutsche Bank National Trust, US Bank National Association Lieff Cabraser Heimann & Bernstein New York, New York Defendant Company Ocwen Federal Bank, Ocwen Financial

Lauren Paulson Aloha, Oregon Defendant Company Fairway Commercial Mortgage Company, Fairway America, FHLF,LLC, Skylands Investment Corporation Hagens Berman Sobol Shapiro LLP Washington, DC, Washington DC Defendant Company Aurora Loan Services Bank of America

Page | 7

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

Beneficial Program for Clients

Fee is a fraction of the cost of traditional litigation Real results compared to modifications Actual lawsuit filed against lender Major law firm experience, skill and resources without sacrificing client-centric focus Responsive, effective and accessible 24-7 customer service Skilled legal counsel in national and international real estate law and litigation Support from Hartford Dunn, LLP, specialists in litigation against banks Opportunity to participate in mass joinder litigation gives individuals greater legal leverage over banks and lenders Staff and litigators trained in cost-containment and attention to detail Experienced, aggressive litigation specialists dedicated to positive results for your case

The Mortgage Litigation Process

Evaluation Phase

Discovery Phase

Litigation Phase

Settlement / Trial Phase

Page | 8

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

Claims Against Lenders Include:

Malfeasance 3rd-Party Beneficiary Claims Unfair Business Practices MERS Violations Statutory Violations Phantom Investors and Beneficiaries Fraudulent Foreclosure Practices Identity Theft

Thousands of Americans have reclaimed their lives through mortgage litigation. Our network of attorneys provides clients with all the information they need to make well informed decisions about their mortgage situation. We are an industry leader in matching clients with qualified legal representation they need and deserve. The banks have attorneys working hard on their sides, IT IS ABOUT TIME YOUR CLIENTS DO THE SAME.

Type of Clients Who Can Benefit:

Have been turned down for a loan mod. Have multiple properties Have too much debt Dont have a hardship Have received previous modifications Are current on their mortgage Facing foreclosure Are in bankruptcy

On behalf of all Plaintiff lawyers in the United States attempting to ameliorate the wrongdoing of banks and financial institutions from 2004 through 2011, I sincerely hope the foregoing information is helpful to you and I invite you to contact us or any of the foregoing law firms in the event you wish to learn more about the Litigation Solution. Sincerely, HARTFORD DUNN, LLP

Michael Riley, Director Bank Compliance

Page | 9

"This communication emanates from the Law Firm of Brookstone Law. All rights reserved. Copyright 2011. Brookstone Law has licensed these materials from Mr. Riley and has a "Of Counsel" working relationship, accordingly only Brookstone Law and Mr. Riley is authorized to disseminate the foregoing information."

You might also like

- World Bank Insider Blows Whistle On Corruption - Federal Reserve May 2013Document8 pagesWorld Bank Insider Blows Whistle On Corruption - Federal Reserve May 2013CarrieonicNo ratings yet

- Outline Foreclosure Defense - Tila & RespaDocument13 pagesOutline Foreclosure Defense - Tila & RespaEdward BrownNo ratings yet

- Fannie Mae Term Sheet For The Citigroup - New Century Mortgage Deal 2006-09-07 Cmlti 2006-NC2Document50 pagesFannie Mae Term Sheet For The Citigroup - New Century Mortgage Deal 2006-09-07 Cmlti 2006-NC283jjmackNo ratings yet

- FCA Citi Mortgage Complaint-In-InterventionDocument36 pagesFCA Citi Mortgage Complaint-In-InterventionjodiebrittNo ratings yet

- Class V III ProspectusDocument209 pagesClass V III ProspectusCarrieonicNo ratings yet

- SEC Vs Citigroup CDOs RMBS and Class V III Funding Comp-Pr2011-214Document21 pagesSEC Vs Citigroup CDOs RMBS and Class V III Funding Comp-Pr2011-214CarrieonicNo ratings yet

- Citigroup Whistle-Blower Says Bank's Brute Force' Hid Bad Loans From U.SDocument5 pagesCitigroup Whistle-Blower Says Bank's Brute Force' Hid Bad Loans From U.SCarrieonicNo ratings yet

- FHFA V Citigroup Inc. (09-02-11)Document95 pagesFHFA V Citigroup Inc. (09-02-11)Master ChiefNo ratings yet

- Bloomberg Markets Magazine - Citifraud July 2012Document10 pagesBloomberg Markets Magazine - Citifraud July 2012CarrieonicNo ratings yet

- r01c 079901Document522 pagesr01c 079901CarrieonicNo ratings yet

- Citi V SMITH WDocument4 pagesCiti V SMITH WCarrieonicNo ratings yet

- In RE CitiGroup Inc Securities Litigation 1Document547 pagesIn RE CitiGroup Inc Securities Litigation 1CarrieonicNo ratings yet

- Citi Subsidiarys 2010 Exhibit 21-01Document4 pagesCiti Subsidiarys 2010 Exhibit 21-01CarrieonicNo ratings yet

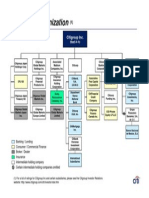

- Corp Struct CitigroupDocument1 pageCorp Struct CitigroupCarrieonicNo ratings yet

- Citi Portfolio CorpDocument2 pagesCiti Portfolio CorpCarrieonicNo ratings yet

- Subsidiarys of Citigroup Inc. 2009 Exhibit21-01Document5 pagesSubsidiarys of Citigroup Inc. 2009 Exhibit21-01CarrieonicNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Louisiana Department of Public Safety and Corrections Office of State Police Louisiana Concealed Handgun Permit Application PacketDocument8 pagesLouisiana Department of Public Safety and Corrections Office of State Police Louisiana Concealed Handgun Permit Application Packetanon_322262811No ratings yet

- Legal ResearchDocument27 pagesLegal ResearchPaul ValerosNo ratings yet

- Final Result of Udc Under Transport Department 2019Document1 pageFinal Result of Udc Under Transport Department 2019Hmingsanga HauhnarNo ratings yet

- IcjDocument18 pagesIcjakshay kharteNo ratings yet

- In The Matter of The Charges of Plagiarism, Etc., Against Associate Justice Mariano C. Del CastilloDocument2 pagesIn The Matter of The Charges of Plagiarism, Etc., Against Associate Justice Mariano C. Del CastilloRidzanna AbdulgafurNo ratings yet

- Paras Vs ComelecDocument2 pagesParas Vs ComelecAngel VirayNo ratings yet

- G.R. No. L-20687Document7 pagesG.R. No. L-20687MeecaiNo ratings yet

- 01.27.2020 Checklist of Building Permit RequirementsDocument2 pages01.27.2020 Checklist of Building Permit RequirementsRamon AngNo ratings yet

- Barangay Peace and Order and Public Safety PlanDocument3 pagesBarangay Peace and Order and Public Safety PlanPeter Fritz Boholst100% (1)

- Bill of Rights For Agricultural LaborDocument3 pagesBill of Rights For Agricultural LaborElyn ApiadoNo ratings yet

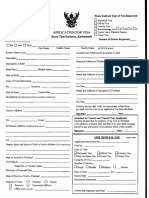

- Thailand VISA Application Form PDFDocument2 pagesThailand VISA Application Form PDFnimesh gautam0% (1)

- 46 Figuracion V LibiDocument1 page46 Figuracion V LibiRachel LeachonNo ratings yet

- Padilla V DizonDocument5 pagesPadilla V DizonJulius ManaloNo ratings yet

- Certified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Local Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsNo ratings yet

- Midterm Transcript 15-16Document76 pagesMidterm Transcript 15-16MikMik UyNo ratings yet

- 217 - de Guzman V TumolvaDocument2 pages217 - de Guzman V TumolvaJanine IsmaelNo ratings yet

- Llda v. CA DigestDocument4 pagesLlda v. CA DigestkathrynmaydevezaNo ratings yet

- CASE OF DUTERTE-WPS OfficeDocument11 pagesCASE OF DUTERTE-WPS OfficepaoNo ratings yet

- Ra 386 Civil Code of The Philippines AnnotatedDocument16 pagesRa 386 Civil Code of The Philippines AnnotatedMarie Mariñas-delos Reyes100% (1)

- Napoleon BonaparteDocument11 pagesNapoleon BonaparteChido MorganNo ratings yet

- Prem Joshi Vs Jurasik Park Inn & Anr. On 17 October, 2017Document7 pagesPrem Joshi Vs Jurasik Park Inn & Anr. On 17 October, 2017Abhishek YadavNo ratings yet

- Why Is Tax Important For The Company of A Country?: T + S + M I + X + GDocument2 pagesWhy Is Tax Important For The Company of A Country?: T + S + M I + X + GAnonymous rcCVWoM8bNo ratings yet

- Scannerindustriallabourchapter1 PDFDocument4 pagesScannerindustriallabourchapter1 PDFVijay VikasNo ratings yet

- West Pakistan Government Servants Benevolent Fund Part-I (Disbursement) RULES, 1965Document6 pagesWest Pakistan Government Servants Benevolent Fund Part-I (Disbursement) RULES, 1965General BranchNo ratings yet

- TASK 3 - Activity 1Document2 pagesTASK 3 - Activity 1Jose LopezNo ratings yet

- Corruption 141020104210 Conversion Gate01Document16 pagesCorruption 141020104210 Conversion Gate01UmangNo ratings yet

- Company Law PresentationDocument27 pagesCompany Law PresentationByron TanNo ratings yet

- Appellees Brief in 12-20164Document31 pagesAppellees Brief in 12-20164rikwmunNo ratings yet

- Sources of Law PDFDocument35 pagesSources of Law PDFsanshlesh kumarNo ratings yet

- Moppets Worker ApplicationDocument3 pagesMoppets Worker Applicationapi-89463374No ratings yet