Professional Documents

Culture Documents

Funds Ratings

Uploaded by

teotayOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Funds Ratings

Uploaded by

teotayCopyright:

Available Formats

Investment Topic October 2003

Do fund ratings add value?

Introduction One of the main advantages of investment funds is that even a relatively small investment allows investors to buy a broadly diversified instrument and consequently be less exposed to the risk associated with individual securities. The snag is choosing the right product from the huge selection of funds available that is best suited to the individuals investment needs and level of risk tolerance. How should investors tackle this problem? Firstly they can seek the advice of their bank, although there is always the risk of it pushing its own products to the fore. Fund ratings offer a more independent approach. Below we will explain the fund ratings awarded by Standard & Poors and FERI Trust and ask whether they meet investors requirements. STANDARD & POORS AA: Based on the quality of the investment process and consistency of performance, the fund is of a very high quality compared with funds with similar investment objectives within the sector. A: Based on the quality of the investment process and consistency of performance, the fund is of a high quality compared with funds with similar investment objectives within the sector. NR: Funds designated NR (not rated) do not currently satisfy the necessary performance standards or minimum qualitative criteria. UR: A rating is suspended and the fund is placed Under Review when significant changes of management take place, until such time as Standard & Poors has the opportunity to assess the impact on the qualitative appraisal. The rating process Standard & Poors thinks past performance is a good starting point on the way to successful fund selection. However, this is not the only factor that needs considering when looking for the right investment fund, which must also correspond to the investors personal profile. It is vital to understand the management team, philosophy and process behind the funds past and future performance. There are five steps to Standard & Poors rating process: Step 1: Quantitative analysis Firstly, S&P singles out those funds which have delivered a consistent, risk-adjusted, aboveaverage performance over three years versus their asset class. Around 80% of all investment funds fail at the first hurdle. The remaining 20% go on to the next stage of the rating process. They are then analysed in terms of the consistency of their past performance relative to their peers. Their performance is not compared on the basis of cumulative earnings, but with reference to three discrete 12-month periods including a 6 -month moving average. Step 2: Initial background audit Before the analysts carry out interviews, stage

Definition of fund management ratings Standard & Poors fund management ratings are based on an evaluation of quantitative factors (historical performance, volatility) and qualitative factors (management, investment process, etc.), which contribute to long-term performance. Every fund awarded a Standard & Poors fund management rating is among the top 20% of its investment class. S&Ps fund ratings are awarded on a scale of AAA to A, with the categories defined as follows:

AAA: Based on the quality of the investment process and consistency of performance, the fund is of an exceptionally high quality compared with funds with similar investment objectives within the sector.

two of the process involves assessing all the information available on a fund. This includes an up-to-date portfolio valuation, the fund prospectus, the funds audited annual and interim reports for the preceding two years and where appropriate a benchmark index for the fund, the biographies for the fund management team, an up-to-date list of shareholders and last but not least the marketing literature for the fund company and the fund itself. Step 3: Quality-oriented face-to-face interview

What do the ratings mean? Funds are assigned to categories A to E based on total points scored and using fixed category boundaries. The ratings signify the following: A B C D E very good good average below average weak

Minimum requirements Stage three involves two analysts carrying out interviews on site in order to assess the fund company, fund manager, team and fund specifics. Step 4: The ratings committee The findings of the analysis of the fund and fund company are presented to the ratings committee. The committee then evaluates both the qualitative and quantitative assessments and determines the fund rating. Performance data have a 30% bearing on the rating while the interview findings are given a 70% weighting. This highlights the crucial link between the management quality and the consistency of the funds relative performance, providing a more robust conclusion than could be achieved by simply analysing performance data. Step 5: Fund monitoring Standard & Poors has set up a dedicated team that monitors fund performance and detects in good time any changes within the investment industry that may affect the fund and require the rating to be suspended or reviewed. To ensure the quality of the ratings, rated funds are reassessed from scratch each year and monthly performance reviews are carried out. Our view The drawback of the Standard & Poors rating process is that a large proportion of the full spectrum of funds is not actually rated. It is therefore important for investors not to focus on funds rated by Standard & Poors alone, as the selection process excludes many fund products. FERI TRUST Feri Trust sets certain minimum requirements which equity and bond funds must first meet to be assessed at all. One such requirement is that the fund must be up and running for at least five years. This will have given the fund management ample time to demonstrate its management quality during various market phases. In addition, the fund must be authorised for public sale in Germany and belong to a peer group comprising at least 20 funds, all meeting the stipulated criteria. A suitable peer group is required if relative ratings are to be meaningful. Structure of the rating In the case of the FERI Trust fund rating, the aim is to evaluate a funds performance and risk compared with its competitors.

FERI Trust regards performance as the key assessment criterion and gives it a weighting of 70%. Risk is weighted 30% in the evaluation, which can be attributed to the following considerations: Firstly it fits in with the general observation that investors are risk-averse to a lesser or greater extent and so risk must be a consideration. Secondly, the risk component means due attention is given to the way in which the funds performance has been achieved. And thirdly, a funds risk profile generally provides additional clues as to its quality. Performance indicator The point of the performance indicator is to measure the performance of the fund

management against the benchmark index and rival products. The indicator comprises three subelements: Relative assessment (weighted 35%) To assess a funds relative performance, its annual outperformance against the benchmark index over the past five years is first calculated. This reveals how well the fund has fared against its benchmark. Next, the average position achieved within its peer group over rolling threemonth periods is determined. This makes it possible to work out whether a fund has performed significantly better than its rival products merely by chance or whether it has consistently been one of the top performers. Long-term earnings power (weighted 25%) The concept of elasticity is used to determine long-term earnings power. Positive elasticity shows whether a fund can benefit disproportionately in rising markets. Stability (weighted 40%) The third component of the performance indicator involves assessing a funds stability. An analysis is made of how often a fund outperformed its benchmark index in any three-month interval within a five-year assessment period. The number of intervals during which it outperformed is compared with the number of intervals during which it underperformed. Conclusions can then be drawn as to the likelihood of the fund outperforming. The stability aspect is seen as fundamental, hence its 40% weighting within the performance indicator. Risk indicator The risk indicator, like the performance indicator, is made up of three sub-elements, to take account of the different types of risk. Timing risk (weighted 25%) Timing risk can be described as the possibility of suffering above-average losses or missing opportunities because of mistiming a purchase or sale. It is calculated on the basis of a funds annualised earnings fluctuations. Risk of loss (weighted 60%) Risk of loss is calculated using a variety of key figures. For example, an analysis is made of the biggest loss a fund incurred over a six-month period within the five-year review period. Another key figure is negative elasticity. In contrast with positive elasticity, this indicates by what percentage the fund price falls if the underlying benchmark index slips 1%.

Performance risk (weighted 15%) Lastly, a funds performance risk against its benchmark is examined with the aid of tracking risk. This key figure shows how closely the fund tracks its benchmark index and thus reveals the extent to which the fund managements selection decisions pose a further risk. Categorisation The last stage in the fund rating process involves adding up the points allotted to the six elements comprising the performance and risk indicators, on a weighted basis. The fund is then allocated to category A, B, C, D or E based on the total tally and according to fixed category boundaries. Our view On the plus side, Feri Trust rates all funds which fulfil the set minimum requirements. However, the Feri Trust process only draws on quantitative criteria. Conclusion: Past performance alone cannot be used as a guide to quality nor to the future performance or riskiness of an investment fund. As the two rating systems outlined have shown, it takes a more comprehensive analysis to be able to evaluate funds. Rating agencies have a valuable contribution to make in this respect. However, it is important for investors to give thought to the level of risk they are willing and able to take on, in advance of selecting funds. After all, no fund rating can guide an investor in their decision as to which fund category they should invest in. It is also true that a fund rating does not constitute a recommendation to buy, but is merely an aid to building a portfolio. Finally, it is worth remembering that no investor should rely on the ratings issued by a single agency as they only cover part of the fund spectrum. Dresdner Bank (Switzerland) AG has its own independent fund evaluation process, which covers the entire fund universe. We perform qualitative as well as quantitative analyses. When building portfolios (fund selection and weighting) we take due account of clients investment profiles, drawn up during a personal discussion with their relationship manager. This allows us to focus squarely on our clients needs and choose the right product for them. Mark Jung, October 2003 Sources: - Standard & Poors Fund Services - FERI Trust - Dresdner Bank (Switzerland) AG

You might also like

- JD AdminDocument1 pageJD AdminteotayNo ratings yet

- YA 2013-2015 CIT Rebate 30% Cap $30KDocument1 pageYA 2013-2015 CIT Rebate 30% Cap $30KteotayNo ratings yet

- YA 2013, YA 2014 and 2015: 30% Corporate Income Tax (CIT) RebateDocument1 pageYA 2013, YA 2014 and 2015: 30% Corporate Income Tax (CIT) RebateteotayNo ratings yet

- YA 2013, YA 2014 and 2015: 30% Corporate Income Tax (CIT) RebateDocument1 pageYA 2013, YA 2014 and 2015: 30% Corporate Income Tax (CIT) RebateteotayNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

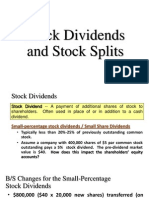

- Stock Dividends and Stock SplitsDocument18 pagesStock Dividends and Stock SplitsPaul Dexter Go100% (1)

- Udaan Training Document PDFDocument12 pagesUdaan Training Document PDFKishore KammelaNo ratings yet

- 1 What Did Arthur Andersen Contribute To The Enron DisasterDocument1 page1 What Did Arthur Andersen Contribute To The Enron DisasterAmit PandeyNo ratings yet

- Chapter 5Document56 pagesChapter 5Sugim Winata Einstein100% (1)

- Alok Kejriwal - CEO Games2win-Speaker and Presenter ProfileDocument3 pagesAlok Kejriwal - CEO Games2win-Speaker and Presenter ProfileAnubhav ShrivastavaNo ratings yet

- Rules andDocument30 pagesRules andBabaji BautistaNo ratings yet

- Final Report - PrintDocument105 pagesFinal Report - PrintabhikhosNo ratings yet

- Customer Information RecordDocument2 pagesCustomer Information Recordiam cjNo ratings yet

- 39 Smith, Stone and Knight LTDDocument6 pages39 Smith, Stone and Knight LTDPiyush Nikam MishraNo ratings yet

- Common Size Financial StatementsDocument3 pagesCommon Size Financial Statementsirfanabid828No ratings yet

- 2010-06-17 040118 TsaddlerDocument3 pages2010-06-17 040118 Tsaddler林秀霞No ratings yet

- Accounting's Role in Business DecisionsDocument52 pagesAccounting's Role in Business DecisionsJakaria UzzalNo ratings yet

- C Law T2Document5 pagesC Law T2hudaNo ratings yet

- Corporate Social ResponsibilitDocument10 pagesCorporate Social ResponsibilitIrma Poldi SchweiniMiroNo ratings yet

- Module 2Document46 pagesModule 2Priyanka SharmaNo ratings yet

- Closing An AP Accounting PeriodDocument4 pagesClosing An AP Accounting PeriodtalupurumNo ratings yet

- Concorde Airlines RoutesDocument10 pagesConcorde Airlines RoutesFauziah FarhahNo ratings yet

- RM Project KFCDocument39 pagesRM Project KFCSangeeta RachkondaNo ratings yet

- CH 13 Working Capital OverviewDocument12 pagesCH 13 Working Capital OverviewIlyas SadvokassovNo ratings yet

- Operations 12122017 12032018Document2 pagesOperations 12122017 12032018Mohamed ElankoudNo ratings yet

- Sharon Barnes Sutton and Judy Brownlee Final P-Cards Doc. - Spending by District 4Document25 pagesSharon Barnes Sutton and Judy Brownlee Final P-Cards Doc. - Spending by District 4Viola DavisNo ratings yet

- Sbi and HDFC Comparative Study of Customer S Satisfaction TowardsDocument67 pagesSbi and HDFC Comparative Study of Customer S Satisfaction TowardsMõørthï Shãrmâ75% (4)

- Tax Chapter 5 Answer KeyDocument63 pagesTax Chapter 5 Answer Keyawby04No ratings yet

- House BanksDocument24 pagesHouse BanksNarsimha Reddy YasaNo ratings yet

- Checklist of Eligibility & Technical Components During Opening of Bids (Infrastructure)Document5 pagesChecklist of Eligibility & Technical Components During Opening of Bids (Infrastructure)bobosNo ratings yet

- Vikash Marketing Plans of SpicejetDocument9 pagesVikash Marketing Plans of SpicejetvikashpgdmNo ratings yet

- Comment On This Topic: Accounting Setup Manager in R12Document7 pagesComment On This Topic: Accounting Setup Manager in R12doitfirst4No ratings yet

- Unilever Annual Report and Accounts 2016 Tcm244 498880 enDocument192 pagesUnilever Annual Report and Accounts 2016 Tcm244 498880 enromNo ratings yet

- Hedge Funds and The Technology BubbleDocument3 pagesHedge Funds and The Technology BubblePhil HoubiersNo ratings yet