Professional Documents

Culture Documents

Acc 491

Uploaded by

Maitham_Ali_3219Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 491

Uploaded by

Maitham_Ali_3219Copyright:

Available Formats

An organization that is using the cost leadership approach would: a. incur costs for innovative R&D b.

provide products at a higher cost than competitors c. focus on productivity through efficiency improvements d. bring products to market rapidly The purpose of the balanced scorecard is BEST described as helping an organization: a. b. c. d. develop customer relations mobilize employee skills for continuous improvements in processing capabilities, quality, and response times introduce innovative products and services desired by target customers translate an organizations mission and strategy into a set of performance measures that help to implement the strategy

Identify the BEST description of the balanced scorecards internal business processes perspective. To achieve our firms vision and strategy, a. b. c. d. how do we lower costs? how do we motivate employees? how can we obtain greater profits? what processes will increase value to customers?

Which component of strategy measures the change in operating income attributable solely to changes in a companys profit margins between Year 1 and Year 2? a. The growth component b. The price-recovery component c. The productivity component d. The cost leadership component

74. Successful implementation of a product differentiation strategy will result in a. a large favorable growth and price-recovery components. b. a large favorable price-recovery and productivity components. c. a large favorable productivity and growth components. d. only a large favorable growth component.

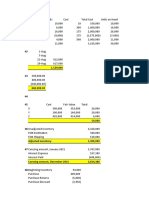

THE FOLLOWING INFORMATION APPLIES TO QUESTIONS 89 THROUGH 98: Following a strategy of product differentiation, Lucas Company makes a high-end Appliance, AP15. Lucas Company presents the following data for the years 20X3 and 20X4:

20X3 Units of AP15 produced and sold 20,000 Selling price $200 Direct materials (square feet) 60,000 Direct materials costs per square foot $20 Manufacturing capacity in units of AP15 25,000 Total conversion costs $1,000,000 Conversion costs per unit of capacity $40 Selling and customer-service capacity (customers) 60 Total selling and customer-service costs $360,000 Selling and customer-service capacity cost per customer $6,000

20X4 21,000 $220 61,500 $22 25,000 $1,110,000 $44 58 $362,500 $6,250

Lucas Company produces no defective units but it wants to reduce direct materials usage per unit of AP15 in 20X4. Manufacturing conversion costs in each year depend on production capacity defined in terms of AP15 units that can be produced. Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support. Lucas Company has 46 customers in 20X3 and 50 customers in 20X4. The industry market size for high-end appliances increased 5% from 20X3 to 20X4. 89. What is operating income for 20X3? a. $364,500 b. $1,804,500 c. $1,440,000 d. $200,000 Answer: c Difficulty: 2 Objective: Terms to Learn: operating income ($200 x 20,000) [($20 x 60,000) + ($40 x 25,000) + ($6,000 x 60)] = $1,440,000 90. What is operating income in 20X4? a. $1,440,000 b. $1,804,500 c. $364,500 d. $200,000 Answer: b Difficulty: 2 Objective: Terms to Learn: operating income ($220 x 21,000) [($22 x 61,500) + ($44 x 25,000) + ($6,250 x 58)] = $1,804,500 4 4

91. What is the change in operating income from 20X3 to 20X4? a. $1,440,000 F b. $1,804,500 F c. $364,500 F d. $200,000 F Answer: c Difficulty: 2 Terms to Learn: operating income $1,440,000 $1,804,500 = $364,500 F (see calculations for answers to questions 89 and 90) Objective: 4

92. What is the revenue effect of the growth component? a. $220,000 F b. $420,000 F c. $400,000 F d. $200,000 F Answer: d Difficulty: Terms to Learn: growth component (21,000 20,000) x $200 = $200,000 F 2 Objective: 4

93. What is the cost effect of the growth component? a. $60,000 U b. $140,000 F c. $60,000 F d. $200,000 F Answer: a Difficulty: 3 Objective: 4 Terms to Learn: growth component [(63,000 - 60,000) x $20] + [(25,000 25,000) x $40] + [(60 60) x $6,000] = $60,000 U 94. What is the net effect on operating income as a result of the growth component? a. $60,000 U b. $140,000 F c. $60,000 F d. $200,000 F Answer: b Difficulty: 3 Terms to Learn: growth component $200,000 F + $60,000 U = $140,000 F (see calculations for answers to questions 92 and 93) 95. What is the revenue effect of the price-recovery component? a. $220,000 F b. $420,000 F c. $400,000 F d. $200,000 F Answer: b Difficulty: 2 Terms to Learn: price-recovery component ($220 $200) x 21,000 = $420,000 F Objective: 4 Objective: 4

96. What is the cost effect of the price-recovery component? a. $179,000 F b. $179,000 U c. $241,000 U d. $420,000 F Answer: c Difficulty: 3 Objective: 4 Terms to Learn: price-recovery component [($22 $20) x 63,000] + [($44 $40) x 25,000] + [($6,250 $6,000) x 60] = $241,000 U 97. What is the net effect on operating income as a result of the price-recovery component? a. $179,000 F b. $179,000 U c. $241,000 U d. $420,000 F Answer: a Difficulty: 3 Terms to Learn: price-recovery component $420,000 F + $241,000 U = $179,000 F (see calculations for answers to questions 95 and 96) Objective: 4

98. What is the net effect on operating income as a result of the productivity component? a. $179,000 F b. $45,500 F c. $241,000 U d. $420,000 F Answer: b Difficulty: 3 Objective: 4 Terms to Learn: productivity component [(61,500 63,000) x $22] + [(25,000 25,000) x $40] + [(58 60) x $6,250] = $45,500 F

141. Define engineered and discretionary costs and give two examples of each. Answer: An engineered cost results from a cause-and-effect relationship between the cost driver output and the resources used to produce that output. An example of an engineered cost would be direct materials in the production of products. Other examples of engineered costs might include shipping costs or electrical costs. A discretionary cost has two features. The first feature is that the cost arises from a periodic decision regarding the amount of cost to be incurred. The second feature is that no measurable cause-and-effect relationship exists between the output and the resources used. An example of a discretionary cost would be the cost of advertising for a product, the amount spent on researching new products, or employee training expenses.

7. Market vesting conditions vesting conditions A undertaking granted share options that become exercisable when the market price increases by at least 10% in each year over the next three years. At the end of year three, this target has not been met. 1. The undertaking should revise the grant date fair value and should reverse the staff benefits expense already recognised. 2. The undertaking should not revise the grant date fair value and should not reverse the staff benefits expense already recognised. 3. The undertaking should transfer the staff benefits expense to equity.

8. Non-market vesting conditions Example Non-market vesting condition

Management introduced a new equity-settled compensation plan with a non-market performance condition. During the following year, after a downturn in the undertakings fortunes, it considers that there is no chance that it will meet the target.

1. The cumulative expense at the end of the second year will be adjusted to nil, and the charge is reversed in the current year. 2. The undertaking should not revise the grant date fair value and should not reverse the staff benefits expense already recognised. 3. The undertaking should transfer the staff benefits expense to equity.

10. For cash-settled share-based payment transactions, IFRS 2 requires an undertaking to measure the goods or services acquired and:

1. Establish a liability which remains unchanged; 2. Establish a liability. Until the liability is settled, the undertaking is required to remeasure the fair value of the liability at each reporting date and at the date of settlement, with any changes in value recognised in the income statement for the period; 3. Hold the cost in equity; 4. The undertaking should use the reload option 11. IFRS 2 prescribes various disclosure requirements to enable users to understand: i. the nature and extent of share-based payment arrangements that existed during the period; ii. how the fair value of the goods or services received, or the fair value of the equity instruments granted, during the period was determined; iii. the effect of share-based payment transactions on the undertakings profit or loss for the period and on its financial position; iv. the impact on clients of these transactions. 1. i 2 i-ii 3. i-iii 1. i-iv

You might also like

- CIA Part 1 Mock Exam 1Document59 pagesCIA Part 1 Mock Exam 1aymen marzouki100% (1)

- Acc 213 3e Q2Document6 pagesAcc 213 3e Q2Rogel Dolino67% (3)

- CFA Performance Evaluation Amp AttributionDocument38 pagesCFA Performance Evaluation Amp AttributionverashelleyNo ratings yet

- Final Review Questions SolutionsDocument5 pagesFinal Review Questions SolutionsNuray Aliyeva100% (1)

- FinalexamDocument12 pagesFinalexamJoshua GibsonNo ratings yet

- Instructions: Cpa Review School of The PhilippinesDocument17 pagesInstructions: Cpa Review School of The PhilippinesCyn ThiaNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- The Key to Higher Profits: Pricing PowerFrom EverandThe Key to Higher Profits: Pricing PowerRating: 5 out of 5 stars5/5 (1)

- Cost Questions For Review 2020Document16 pagesCost Questions For Review 2020omarNo ratings yet

- Cat/fia (Ma2)Document12 pagesCat/fia (Ma2)theizzatirosli50% (2)

- Ma2 Specimen j14Document16 pagesMa2 Specimen j14talha100% (3)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Finals SolutionsDocument9 pagesFinals Solutionsi_dreambig100% (3)

- Ma1 Mock Test 1Document5 pagesMa1 Mock Test 1Vinh Ngo Nhu83% (12)

- Entrepreneurship12q2 Mod8 Computation of Gross Profit v3Document22 pagesEntrepreneurship12q2 Mod8 Computation of Gross Profit v3Marc anthony Sibbaluca80% (10)

- Fma Past Papers 1Document23 pagesFma Past Papers 1Fatuma Coco BuddaflyNo ratings yet

- KPMG Basel IIDocument34 pagesKPMG Basel IIkenpty0% (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Cost Accounting Test Bank CKDocument12 pagesCost Accounting Test Bank CKLeo Tama67% (9)

- MG FNSACC517 Provide Management Accounting InformationDocument11 pagesMG FNSACC517 Provide Management Accounting InformationGurpreet KaurNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- A Study On Customer Satisfaction Towards Asian Paints in Lucknow CityDocument7 pagesA Study On Customer Satisfaction Towards Asian Paints in Lucknow CityChandan Srivastava50% (4)

- Managerial Accounting Quiz 3 - 1Document8 pagesManagerial Accounting Quiz 3 - 1Christian De LeonNo ratings yet

- ABC Company allocates service department costs using direct, step-down, and reciprocal methodsDocument2 pagesABC Company allocates service department costs using direct, step-down, and reciprocal methodsedrianclyde100% (1)

- Managerial Accounting Sample ExamDocument4 pagesManagerial Accounting Sample ExamJerome Delos Reyes100% (1)

- AssignmentDocument20 pagesAssignmentbabarakhssNo ratings yet

- Module 1 Process Costing Nature and OperationsDocument19 pagesModule 1 Process Costing Nature and Operationscha11100% (3)

- Chapter 4 - Completing The ADocument153 pagesChapter 4 - Completing The APatricia Pantin100% (2)

- Chapter 5Document39 pagesChapter 5carlo knowsNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- P2 March2014 AnswersDocument16 pagesP2 March2014 Answersjoelvalentinor100% (3)

- Exam For AccountingDocument16 pagesExam For AccountingLong TranNo ratings yet

- Final ExamDocument12 pagesFinal ExamKang JoonNo ratings yet

- Chartered UniversityCollege FMA Management Accounting EXAMDocument12 pagesChartered UniversityCollege FMA Management Accounting EXAMMohsena MunnaNo ratings yet

- E 3Document7 pagesE 3MianAsrarUlHaqNo ratings yet

- ... Exercises Chapter 14Document5 pages... Exercises Chapter 14ScribdTranslationsNo ratings yet

- C01 Modelquestionpaper AnswersDocument28 pagesC01 Modelquestionpaper AnswersLogs MutaNo ratings yet

- Quiz+ 1+Version+a+B+CKeyDocument5 pagesQuiz+ 1+Version+a+B+CKeySehoon OhNo ratings yet

- Final Exam Review: Chapters 1-14Document12 pagesFinal Exam Review: Chapters 1-14Tomoko KatoNo ratings yet

- MASDocument10 pagesMASMelvin TalaveraNo ratings yet

- Final Exam, s2, 2018-FINALDocument11 pagesFinal Exam, s2, 2018-FINALShivneel Naidu0% (1)

- Profitability Analysis - Product Wise/ Segment Wise/ Customer WiseDocument10 pagesProfitability Analysis - Product Wise/ Segment Wise/ Customer WisecasarokarNo ratings yet

- N1227106 Busi48901 261123Document11 pagesN1227106 Busi48901 261123malisiddhant2602No ratings yet

- Solutions To Week 3 Practice Text ExercisesDocument6 pagesSolutions To Week 3 Practice Text Exercisespinkgold48No ratings yet

- Sample MidTerm MC With AnswersDocument5 pagesSample MidTerm MC With Answersharristamhk100% (1)

- Saage SG Fma RevisionDocument21 pagesSaage SG Fma RevisionNurul Shafina HassanNo ratings yet

- MA Tutorial 7: Balanced Scorecard Question 1aDocument3 pagesMA Tutorial 7: Balanced Scorecard Question 1aYasmin ZainuddinNo ratings yet

- Bill FrenchDocument27 pagesBill FrenchRusidi Omar100% (1)

- Saa Group Cat TT7 Mock 2011 PDFDocument16 pagesSaa Group Cat TT7 Mock 2011 PDFAngie NguyenNo ratings yet

- 2 Points: Clear SelectionDocument8 pages2 Points: Clear SelectionKimmy ShawwyNo ratings yet

- F 2 BLPDFDocument20 pagesF 2 BLPDFEmon D' CostaNo ratings yet

- Advanced Cost and Management Acct MSC LeadstarDocument7 pagesAdvanced Cost and Management Acct MSC LeadstarKalkidan pm100% (1)

- Final Exam AkmenlanDocument12 pagesFinal Exam AkmenlanThomas DelongeNo ratings yet

- Answers Homework # 13 Cost MGMT 2Document6 pagesAnswers Homework # 13 Cost MGMT 2Raman ANo ratings yet

- Managerial Accounting Exam ReviewDocument9 pagesManagerial Accounting Exam ReviewZyraNo ratings yet

- 2 ACFN 623 Advanced Cost and Management Accounting Assignment 2Document7 pages2 ACFN 623 Advanced Cost and Management Accounting Assignment 2Ali MohammedNo ratings yet

- CUP- ADVISORY ON MANAGEMENT SERVICESDocument7 pagesCUP- ADVISORY ON MANAGEMENT SERVICESJerauld BucolNo ratings yet

- WE FNSACC517 Provide Management Accounting InformationDocument12 pagesWE FNSACC517 Provide Management Accounting InformationGurpreet KaurNo ratings yet

- Fma Past Paper 3 (F2)Document24 pagesFma Past Paper 3 (F2)Shereka EllisNo ratings yet

- ACT 5060 MidtermDocument20 pagesACT 5060 MidtermAarti JNo ratings yet

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocument33 pagesChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- Week 3 Workshop Exercise SolutionsDocument6 pagesWeek 3 Workshop Exercise SolutionsJenDNg100% (1)

- MBA 6030 - Managerial Accounting Final Exam QuestionsDocument10 pagesMBA 6030 - Managerial Accounting Final Exam Questionscoolhep007100% (3)

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesFrom EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- 12 Acc SP 01Document36 pages12 Acc SP 01ganeshNo ratings yet

- BCG MatrixDocument5 pagesBCG MatrixDulakshi SubasingheNo ratings yet

- Food World (A) Market Entry StrategyDocument17 pagesFood World (A) Market Entry Strategyshish5125484No ratings yet

- Session 1Document27 pagesSession 1Faheem AhmadNo ratings yet

- Ap 501Document7 pagesAp 501Christine Jane AbangNo ratings yet

- Plan Audit EffectivelyDocument12 pagesPlan Audit Effectivelysadananda52No ratings yet

- Syllabus For Acctg101 (Fundamentals of Accounting I) : Philippine Advent College - Salug CampusDocument9 pagesSyllabus For Acctg101 (Fundamentals of Accounting I) : Philippine Advent College - Salug CampusJM LomoljoNo ratings yet

- Saurabh Singh Mini Project On Digital MarketingDocument43 pagesSaurabh Singh Mini Project On Digital Marketingvaibhav singhNo ratings yet

- MCQDocument7 pagesMCQLiyan ShahNo ratings yet

- ACCCOB2 Quiz 2 SolutionsDocument2 pagesACCCOB2 Quiz 2 SolutionsRafael CaparasNo ratings yet

- CF-II Govt. Failure at SatyamDocument10 pagesCF-II Govt. Failure at SatyamLaksh SinghalNo ratings yet

- Form - II & III: Operating and Balance Sheet ProjectionsDocument22 pagesForm - II & III: Operating and Balance Sheet Projectionsmadhukar sahayNo ratings yet

- Inventory Management, Just-in-Time, and Simplified Costing MethodsDocument43 pagesInventory Management, Just-in-Time, and Simplified Costing MethodsKarissa Rizka LNo ratings yet

- Dow TheoryDocument10 pagesDow TheorygoodthoughtsNo ratings yet

- NF 902 PDFDocument5 pagesNF 902 PDFG.C chandrahasreddyNo ratings yet

- Encouraging Men's Grooming Through Beard CareDocument19 pagesEncouraging Men's Grooming Through Beard CareFenny ShahNo ratings yet

- MKT 465 ch2 SehDocument45 pagesMKT 465 ch2 SehNurEZahanKantaNo ratings yet

- Chap 3 Accounting Classification & Equation (Basic+Expended) - ClassDocument37 pagesChap 3 Accounting Classification & Equation (Basic+Expended) - Classnabkill100% (1)

- Improve Productivity with Material Requirements Planning (MRPDocument5 pagesImprove Productivity with Material Requirements Planning (MRPNiño Rey LopezNo ratings yet

- Assignment 6 SolutionsDocument4 pagesAssignment 6 SolutionsjoanNo ratings yet

- Facebook Remarketing 3.0 PLR ArticlesDocument29 pagesFacebook Remarketing 3.0 PLR ArticlesLearn It AllNo ratings yet

- Lilliput Kidswear LTD: Presented byDocument13 pagesLilliput Kidswear LTD: Presented bypujil2009No ratings yet