Professional Documents

Culture Documents

COST AND MANAGEMENT ACCOUNTING ASSIGNMENT

Uploaded by

Aasim ShakeelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

COST AND MANAGEMENT ACCOUNTING ASSIGNMENT

Uploaded by

Aasim ShakeelCopyright:

Available Formats

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

Problems of Job order Costing System

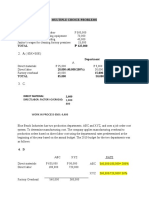

Q.1: Margoob Company uses job order cost accounting system. The following information appears in the goods in process controlling account for the month of June 1993, and company uses FIFO method. Debits to Account Credit to account Balance June 1, 1993 8,000 Transferred to finished Direct materials 20,000 Goods Inventory account ? Direct Labour 12,000 Balance June 30, 1993 8,500 Manufacturing overhead incurred on account 14,000 Total debits 54,000 Total Credit 54,000 Over applied Factory overhead Rs. 400 and used Factory overhead rate based on Direct Labour Cost. 90% completed units sold on account for Rs. 50,000.

Solution

Factory overhead Rate =factory overhead X 100 Direct Labor Factory OverHead Rate= 14000+400 x 100 12000 Factory OverHead Rate = 120 %

GOOD IN PROCESS ENDING INVENTORY COST

Direct Material ( 8,500 4, 620 ) Direct Labour Factory Overhead ( 2, 100 x 120 / 100 ) 3,880 2,100 2, 520 ______ 8,500

Total Good In Process At End

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

Margoob And Company Gernal journal For the mounth of june 31-1993 No 1 PARTICULERS

Good in Process Raw material Accrued payroll Factory overhead applied

P.R DEBIT

46,400

CREDIT

20,000 12,000 14,400

( To record the manufacturing cost ) Finished goods Goods in process ( To record the completed )

45,900 45,900 41,310 41,310

Cost Of Good Sold ( 45,900 x 90 / 100 ) Finished good (To record the cost of good sold )

Account Receivable Sale ( To record sate on account )

50,000 50,000

Factory Overhead Account Payable ( To record the actual overhead )

14,000 14,000

Over applied Factory Overhead Cost Of Good Sold (to close the over applied factory overhead )

400 400

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

Goods In Process ______________________________________________________________________ / / Balance 8,000// / Transferred to finished 45,900 Direct material 20,000 / Direct Labour 12,000 / Overhead Applied 14,400 / balance june 30-1993 8,500 / ______ / _______ 54, 4000/ / 54, 4000 Total _______ / ______ / Q.2 : Sheikh Sons uses a job order cost accounting system.

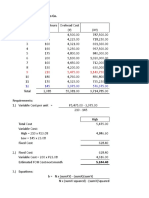

Factory overhead is charged to individual jobs through the use of a predetermined overhead rate based on direct labour cost.The following information appears in the companys Goods-in-Process Inventory cost for the month of June. Debit to account Balance, June 1 Rs. 8,300 Raw Materials 12,000 Direct labour 9,000 Factory overhead (applied to jobs as percentage of direct cost) 11,700 Rs. 41,000 Credit to account Transferred to Finished goods inventory account 32,000 Balance, June 30 Rs. 9,000 REQUIRED: a) Compute the predetermined overhead application rate used by the Company. b) Assuming that the direct labour charged to the jobs still in process at June 30, amounts to Rs. 2,400, compute the amount of factory overhead and the amount of raw materials which have been charged to these jobs as of June 30. c) Prepare general journal entries to summarize: 1. The manufacturing costs (materials, labour and overhead) charged to production during June. 2. The transfer of production completed during June to the Finished Goods inventory account. 3. The Cash sales of 90% of the merchandise completed during June, at a total sales price of Rs. 46,500. Show the related cost of goods sold in a separate journal entry

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

SOLUTION A) computation of Predetermine Overhead Rate

Factory Overhead Rate = Factory Overhead Rate Direct Labour Cost Factory Overhead Rate = 11,700 9,000 LABOUR

= 130 % Direct Labour Cost

B ) Calculation For FOH Applied Cost in Ending Inventory Of Good in Process

Total Value of ending Good In Process Less : Direct Labour Cost FOH Applied ( 2,400 x 130 % ) 2,400 3,120

9,000

(5,520)

Cost of raw material ( balancing figure )

3,480

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

M/S Sheikh & Son General & journal For the month of June- 30 1996

Dat e 1

PARTICULERS

Work in process Material Payroll FOH applied ( To recored the Direct Material Direct Labour N Applied FOH to Production )

P. R

DEBIT

32,700

CREDIT

12,000 9,000 11,700

Finished Good Work In process ( To record transfer of W.I.P in to Finished Good )

32,000 32,000

Cost Of Good Sold Finished Goods (To record The Cost of Good Sold )

28,800 28,800

Accounts Receivable Sale ( To record Sale on Account )

46,500 46,500

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

Q.3: Sunshine Co. uses a job order cost accounting system. The following information was provided for the month of March. a) Purchases of direct materials during the month amounted to Rs. 59,700/= on account. b) Materials requisitions issued by the production department during the month total to Rs. 56,200/= c) Time cards of direct workers show 2000 hours worked on various jobs during the month, for total direct labour cost of Rs. 30,000/= d) Direct workers were paid Rs. 26,300/= in March. e) Actual overhead costs for the month amounted to 34,900/= f) Overhead is applied to jobs at a rate of Rs. 18/= per direct labour hour. g) Jobs with total accumulated cost of Rs. 1,16,000/= were completed during the month. h) On March 31, finished goods inventory was valued at Rs. 22,000/= i) During March finished goods were sold for Rs. 1,28,000/= on account. REQUIRED: Prepare general journal entries for each of the above transactions (including cost of goods sold and closing of factory overhead account.

Sunshine Company General Journal For the Month of March Date a) PARTICULERS Material Account Payable (To record Purchase Of raw Material on Account ) P. R DEBIT 59,700 59,700 CREDIT

b)

W.I.P Material To record direct material )

56,200 56,200

c)

W.I.P Payroll (To record Direct Labour )

30,000 30,000

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A) 26,300 26,300

d)

Accrued Payroll Bank To record the payment of direct labour)

e)

F.O.H Account Payable To record Incurred cost of FOH

34,900 34,900

f)

W.I.P FOH Applied To record The Applied FOH )

36,000 36,000

Finished Good W.I P Transfer Of WIP into Finished good)

116,000 116,000

Cost Of good Sold Finished Good ( 116,000-22,000) To record cost of good sold )

94,000 94,000

i)

Account Receivable Sale To record sale on account )

128,000 128,000

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

Problems of Manufacturing Accounting

Q.1: Maroof Manufacturing Company showed beginning and ending inventories balances for 1992:

Inventory accounts 1992 Dec. 31 1992 Jan. 1 Material Rs. 30,000 Rs. 26,000 Goods in process 9,000 12,000 Finished goods 35,000 39,000 The amount debited and credited during the year to the accounts used in recording manufacturing costs are summarized below: Account Debit Entries Credit Entries Merchandise Inventory 200,000 19,8000 Direct Labour 60,000 68,000 Manufacturing overhead 85,000 85,000 Goods in process inventory ? ? Finished goods inventory ? ? Required: a) Compute the amounts for 1992: 1) Direct Material purchased, 2) Direct Materials used, 3) Direct Labour Payroll paid during the year 4) Direct Labour costs total to units manufactured, 5) The year end liability for Direct Wages Payable, 6) The overhead application rate, assuming that overhead costs are applied to units manufactured in proportion to Direct Labour cost, 7) Total Manufacturing cost debited to goods in process inventory, 9) Cost of goods sold. b) Prepare Statement of Cost of Goods sold for 1992

SOLUTION

1, Direct material purchase ..Rs 200,000 2, Direct material Used Raw material opening inventory Less: Raw material purchase Raw material available for use Less: Raw material ending inventory Raw material used 3- Direct labour payroll paid Rs 60,000 26,000 200,000 -----------226,000 30,000 -----------196,000 ------------

4- Direct labour used in production

68,000 68,000 60,000 ----------8,000 -----------

5- Direct labour wages Balance at end labour used Less: Payroll paid Labour wages balance at end

COST AND MANAGMENT ACCOUNTING ASSIGMENT 6- Factory Overhead rate = factory overhead ----------------------- X 100 Direct labour = 85,000 ------------ X 100 68, 000

Prepared By,Aasim Shakeel (A)

Factory Overhead rate = 125 %

Manufacturing Cost 7- Direct material Direct labour Factory Overhead Manufacturing cost 196,000 68,000 85,000 ---------349,000 ------------

-----------------------------------------------------------------------------------------------------------------------Q.2: The Accounting Records of Alladen Mfg. Co. include the following information relating to the year ended December 31, 1996. December 31 January 1 Materials inventory 60,000 47,500 Goods in Process Inventory 18,750 20,000 Finished goods inventory Jan. 1 (5,000 units) 108,000 95,000 Raw Materials purchases 142,500 Direct Labour cost 97,500 Factory overhead cost 221,250 The company manufactured a single product during 1996, 22,500 units were manufactured and 20,000 units were sold. Required: a) Prepare a statement of cost of finished goods manufactured for 1996. c) Compute the cost of good Sold during 1996 using FIFO method b) Compute the cost of goods sold during 1996, assuming that the FIFO inventory costing is used. d) Compute the cost of the Inventory of finished goods at December 31, 1996 assuming that the FIFO method of inventory costing is used.

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

A--) SOLUTION

Aladdin Manufacturing Co Cost Of Good Manufacturing For the period ended December 31. 1996 Raw material used Material inventory Add: Raw material purchase Less: Raw material available for use Material inventory Raw material used Direct labour Factory overhead Add: Less: Manufacturing cost Good in Process Jun 1 Total cost of good in process Goods in process dec 31 47,500 142,000 ---------190,000 60,000 -----------130,000 97,000 221,250 ------------448,750 20,000 --------------468,750 18,750 ----------------450,000 ------------------

COST OF GOOD MANUFACTURED

Working for unit Total cost unit manufactured 450,000 Total unit manufactured 22,500 Per unit cost ( 450,000/ 22,500 ) 20 -------------------------------------------------------------------------------------------------B) Finished Good Inventory At end Finshed good January 5,000 unit Add Finished good during the period 22,000 --------Total finished goods 27,500 Less Finished Good Sold 20,000 Finished inventory December 31 7,500 -------Per unit 20 COST OF FINISHED GOOD SOLD DEC 31 ( 7,500 x 20) 150,000

C_ Cost of good sold During 1996 FIFO inventory method costing used Finishes good January 1 95,000 Add: Cost of good Manufactured 450,000 ------------Finished Good Available for sale 545,000 Less: Finishing Good December 31 ( 7,500 x 20 ) 150,000 -----------Cost of good sold 395,000 -------------

10

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

Q.3: The following balance have been taken from the general ledger for Fano Manufacturing Company: Raw Materials Inventory (1-12-91) 37,950 Raw Materials Purchases 1,89,600 Raw Materials Returns 8,800 Carriage Inwards 15,700 Direct Labour 2,54,400 Indirect Labour 59,250 Depreciation (Machinery) 30,850 Heat, Light and Power 25,400 Factory Rent & Taxes 31,450 Factory Repair Expense 19,350 Foremans Salary 24,500 Raw Materials Inventory (31-12-91) 57,500 Word in Process Inventory (1-12-91) 53,400 The foreman estimates that Rs. 31, 800 of Raw Materials and Rs. 24,800 of Direct Labour are to be allocated to the unfinished goods in process on 31-12-91. REQUIRED: 1) Determine the factory overhead rate bases on direct labour cost. 2) Compute the cost of December 31, 1991 inventory of Goods in Process. 3) Prepare a Statement of Cost of Goods Manufactured for December 91.

SOLUTION Schedule of Factory Overhead (A)

Indirect Labour Depreciation (Machinery) Heat, Light and Power Factory Rent & Taxes Factory Repair Expense Foremans Salary

Total factory overhead Factory overhead rate = Factory Overhead ------------------------ X 100 Direct Labour = 190,800 ------------ x 100 254, 400 Factory overhead rate = 75 %

59,250 30,850 25,400 31,450 19,350 24,500

----------190,800 -------------

11

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

B)

Good In Process Ending Inventory 31,800 24,800 18,600 ---------75,200 -----------

Raw Material Direct Labour Factory overhead ( 24,800 x 75/ 100 ) Total Goods in Process at end C)

FANO MANUFACTURING CO COST OF GOODS MANUFACTURED FOR THE PERIAD ENDEND DEC---311991 Raw material inventory ( 1-12-91) Add: raw material Purchase Add: Carriage inward Less: Raw material return Net purchase : Raw material available for use Less: Law material inventory Raw material Used Direct labour Factory Overhead Manufacturing Cost Add: Good In Process Inventory ( 01-12- 91 ) Total goods in Process Goods In Prosess ( 31-12-91) COST OF GOOD MANUFACTURED 37,950 189,600 15,700 205,300 8,800 ---------196,500 -----------234,450 57,500 -----------176,950 254,400 190,800 -----------622,150 75,200 -----------675,550 75,200 ----------600,350 -------------

12

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

Problems of Standard Accounting

Q.1: 1996. The Accountant for Syntax Inc. have developed the following information manufactured in June Materials Standard : Actual Direct Labour Standard Actual Factory Overhead Standard : Actual Factory Overhead Standard 80,000 ounces at Rs. 0.30 per ounce. : 88,000 ounces at Rs. 0.29 per ounce. : : 4,000 ounces at Rs. 10.00 per ounce. 3,600 ounces at Rs. 10.40 per ounce.

4,000 ounces at Rs. 10.00 per ounce. : 3,600 ounces at Rs. 10,40 per ounce. :

Rs. 9,000 fixed cost and Rs. 5,000 variable cost for 10,000 units normal monthly volume. Actual : Rs. 9,000 fixed cost and Rs. 4,600 variable cost for 8,000 units actually produced in June The normal volume is 10,000 units per month, but only 8,000 units were manufactured in June. Required: Compute the following cost variances for the month of June. a) Material price variance and material quantity variance. b) Labour rate variance and labour usage variance. c) Controllable factory overhead variance and volume variance

SOLUTION :

A)terial Price Variance = ( Actual Price Standard Price ) X Actual Quantity ( Rs: 0.29 - Rs .30 ) x 88,000 unit = Rs 880 Favorable A.1)rial Quantity variance = (Actual Quantity Standard Quantity) x Standard price per unit = ( 88,000 units 80,000 units ) Rs,0,03 = Rs 2,400 unfavorable B) labour Rate Variance = ( Actual Rate Standard Rate ) x Actual Hour = ( Rs 10,40 Rs 10,00 ) x 3,600 = ( 1,440 unfavorable = ( Actual Hour Standard Hours ) x Standard Rate per hour = ( 3,600 hrs 4, 000 hrs ) x RS 10 = Rs 4,000 favorable = ( total actual FOH ( 9,000 + 4,600) Estimated FOH cost for actual output Controllable Variance ( Unfavorable ) 13,600 ( 13,000) 600

B,1) labour usage variance

C ) FOH Variance

13

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

WORKING FOR ESTIMATED FOH Fixed assest FOH cost 8,000 unit x ( 5,000 / 10,000 Add Variable cost ( actual output x x Variable FOH Rate Eliminated FOH cost WORKING FOR VARIANCE AND VOLUME Etimated FOH cost for actule out put Less Applied FOH for actule ( actule output x total FOH rate = 8,000 unit x RS 1.40 = Volume variance ( unfavorable ) 13,000 ( 11,200) 1,800 9,000 4,000 13,000 ---------

Q.2 Riaz Process Standard and Actual Cost data for the single product they manufacture, for the month of

September, 1992, are as following: Material Labour Overhead Standard 5,000 kgs. 5,000 hours Rs. 2.80 per Actual 900 kgs. @ 5,200 kgs. Rs. 14,900. @ Rs. @ Rs. Labour hour 1.60. 3.60

Material Rs. 1.90 Labour @ Rs. 1.90 Overhead REQUIRED: 1) Computation Mat. Price Variance, Mat. Quantity Variance. Lab. Wage Variance, Lab. Efficiency Variance, and Overhead Variance. 2) General Journal entries for the above. 3) General Journal entries to close the variance accounts.

SOLUTION

1- Material quantity variance = difference in quantity x standard price 100 x 1.60 160 = Difference in quantity x actual quantity = 0.30 4,900 = 1, 470 = Difference in hour x standard price = 200 x 3,60 = 720 = difference in rate x actual hours 0.10 x 5,200 = 520 = Standard cost actual cost 14,000 - 14,900

2-Material price variance

3-labour efficiency Variance

4-labour wages variance

5-)overhead Variance

14

COST AND MANAGMENT ACCOUNTING ASSIGMENT 900

Prepared By,Aasim Shakeel (A)

DATE 1-

PARTICULERS

RIAZ MANUFACTURING COMPANY GENERAL JOURNAL FOR TE MOUNTH OF SEPTEMBER P.R

DEBIT 8,000 1,470

CREDIT

Good in Process Material price Variance Material Quantity Variance Raw material To record the Material used and variance

160 6,310

2-

Goods In Process Labour Efficiency Variance Labour wages Variance Accrued Payroll

18,000 720 520 19,240

To record the Payroll And Variances 3Goods in process Overhead Variance Applied Factory overhead applied To record Overhead and variance 14,000 900 14,900

DATE 1-

RIAZ MANUFACTURING COMPANY CLOSING ENTRIES FOR TE MOUNTH OF SEPTEMBER PARTICULES P,R DEBIT Material quantity variance 160 Cost of good sold 3,450 Material Price Variance Labour efficiency Variance Labour wages Variance Overhead variance To record Close Various variance into cost of good sold

CREDIT 1,470 720 520 900

15

COST AND MANAGMENT ACCOUNTING ASSIGMENT

Prepared By,Aasim Shakeel (A)

16

You might also like

- Chapter 3 - Accumulating Costs For Products and Services (1-20)Document24 pagesChapter 3 - Accumulating Costs For Products and Services (1-20)JAY AUBREY PINEDA100% (1)

- Midterm Quiz 2 - Problem and Answer KeyDocument6 pagesMidterm Quiz 2 - Problem and Answer KeyRynette Flores100% (1)

- Chapter 5 True or False, Multiple Choice, and Journal Entries for Alexis and Golden Shower CompaniesDocument12 pagesChapter 5 True or False, Multiple Choice, and Journal Entries for Alexis and Golden Shower Companies?????0% (1)

- Prelim ExaminationDocument46 pagesPrelim ExaminationJenny Rose M. YocteNo ratings yet

- Problems: 2-58. Cost ConceptsDocument16 pagesProblems: 2-58. Cost ConceptsChristy HabelNo ratings yet

- Cost Accounting 7 8 - Solution Manual Cost Accounting 7 8 - Solution ManualDocument27 pagesCost Accounting 7 8 - Solution Manual Cost Accounting 7 8 - Solution ManualMARIA100% (1)

- Job Order Costing TheoryDocument3 pagesJob Order Costing TheoryMiscaCruzNo ratings yet

- JIT and Backflush Costing - Sample Problems With SolutionsDocument2 pagesJIT and Backflush Costing - Sample Problems With SolutionsMarjorie NepomucenoNo ratings yet

- Cost Accounting & Control Midterm ExaminationDocument7 pagesCost Accounting & Control Midterm ExaminationFerb CruzadaNo ratings yet

- Final Quiz 3 - Standard Costing and Back Flush CostingDocument10 pagesFinal Quiz 3 - Standard Costing and Back Flush Costingpaolo pallesNo ratings yet

- Acctg201 Exercises2Document18 pagesAcctg201 Exercises2sarahbeeNo ratings yet

- Exercises - Job Order CostingDocument7 pagesExercises - Job Order CostingJericho DupayaNo ratings yet

- Joint Cost Allocation and By-Product Costing for Three Manufacturing CompaniesDocument6 pagesJoint Cost Allocation and By-Product Costing for Three Manufacturing CompaniesMaricon Berja100% (2)

- AnswerDocument31 pagesAnswerJabeth IbarraNo ratings yet

- Job Order Costing SAMPLE PROBLEMSDocument3 pagesJob Order Costing SAMPLE PROBLEMSDiane Cris DuqueNo ratings yet

- Chapter 8 de LeonDocument1 pageChapter 8 de LeonRose Ann De GuzmanNo ratings yet

- Answers To Cost Accounting Chapter 9Document6 pagesAnswers To Cost Accounting Chapter 9Raffy Roncales0% (1)

- 625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2Document2 pages625009eef26fe Cost Accounting and Cost Management 1 Quiz No. 2El Jehn Grace Babor - Ledesma100% (1)

- Accounting For Labor ProblemsDocument2 pagesAccounting For Labor ProblemsRyan Maliwat0% (1)

- 1Document13 pages1Mikasa MikasaNo ratings yet

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNo ratings yet

- Answers To Cost Accounting Chapter 10Document15 pagesAnswers To Cost Accounting Chapter 10Raffy Roncales100% (2)

- Cost Acc. & Control QuizzesDocument18 pagesCost Acc. & Control Quizzesjessamae gundanNo ratings yet

- Cost Accounting Chapter 6Document18 pagesCost Accounting Chapter 6Raffy Roncales70% (10)

- Job Order Costing ProblemsDocument15 pagesJob Order Costing ProblemsClarissa Teodoro100% (2)

- Q3 Part 2 Problem On Job Order CostingDocument9 pagesQ3 Part 2 Problem On Job Order CostingLadybellereyann A TeguihanonNo ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Standard Costing - Answer KeyDocument6 pagesStandard Costing - Answer KeyRoselyn LumbaoNo ratings yet

- Cost Accounting & Control: Unit 1, Topic 2: Job Order Cost SystemDocument13 pagesCost Accounting & Control: Unit 1, Topic 2: Job Order Cost SystemAna Marie AllamNo ratings yet

- Problem 1-20: 1 JGG Manufacturing Company Manufacturing CostDocument9 pagesProblem 1-20: 1 JGG Manufacturing Company Manufacturing CostMackenzie Heart Obien0% (1)

- Rante 2019 SolmanDocument128 pagesRante 2019 SolmanGillian Cristel Samiano100% (1)

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Job Order Costing QuizDocument5 pagesJob Order Costing Quizxenoyew100% (1)

- Cost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsDocument14 pagesCost Accounting Guerrero Chapter 6 Solutions Cost Accounting Guerrero Chapter 6 SolutionsPremium AccountsNo ratings yet

- Barfield Chapter 5Document27 pagesBarfield Chapter 5Trisha SacramentoNo ratings yet

- Job Order Quiz 05 PDFDocument3 pagesJob Order Quiz 05 PDFZamantha Tiangco0% (1)

- POP QUIZ OVERHEAD CALCULATIONSDocument10 pagesPOP QUIZ OVERHEAD CALCULATIONSXyne FernandezNo ratings yet

- Chapter 2 Multiple Choice Computational Cost Acc Guerrero 2018 EdDocument14 pagesChapter 2 Multiple Choice Computational Cost Acc Guerrero 2018 EdJuan FrivaldoNo ratings yet

- Cost Accounting - Chapter - 7Document8 pagesCost Accounting - Chapter - 7xxxxxxxxx100% (1)

- Joint Cost Allocation ProblemsDocument3 pagesJoint Cost Allocation ProblemsJune Maylyn MarzoNo ratings yet

- Solutions To ProblemsDocument42 pagesSolutions To ProblemsJane TuazonNo ratings yet

- Cost AccountingDocument9 pagesCost Accountingnicole friasNo ratings yet

- Process CostingDocument19 pagesProcess CostingmilleranNo ratings yet

- Job-Order Costing Explained: Materials, Labor, Overhead AllocationDocument6 pagesJob-Order Costing Explained: Materials, Labor, Overhead Allocationyza0% (3)

- COST ACCTNG - Chapters 7 9 ActivitiesDocument27 pagesCOST ACCTNG - Chapters 7 9 ActivitiesAnjelika ViescaNo ratings yet

- Cost Accounting Questions and AnswersDocument17 pagesCost Accounting Questions and Answerslolli lollipopNo ratings yet

- Cost Accounting & Control Long Quiz No. 2Document6 pagesCost Accounting & Control Long Quiz No. 2JUSTIN KYLE SIMPOROSONo ratings yet

- Cost Accounting Midterm Examination ReviewerDocument7 pagesCost Accounting Midterm Examination ReviewerCj TolentinoNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsNaveed Mughal AcmaNo ratings yet

- (OH Is Overapplied) (Actual Activity) (ABC) : (Have A Difference)Document21 pages(OH Is Overapplied) (Actual Activity) (ABC) : (Have A Difference)Janna Mari FriasNo ratings yet

- Accounting QuestionDocument8 pagesAccounting QuestionMusa D Acid100% (1)

- Brewer Chapter 2 Alt ProbDocument6 pagesBrewer Chapter 2 Alt ProbAtif RehmanNo ratings yet

- Mid Term Exam - Cost Accounting With AnswerDocument5 pagesMid Term Exam - Cost Accounting With AnswerPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Cost Accounting Past Paper 2016 B Com Part 2Document4 pagesCost Accounting Past Paper 2016 B Com Part 2Sana BudhwaniNo ratings yet

- Assignment One and TwoDocument5 pagesAssignment One and Twowalelign yigezawNo ratings yet

- Cost AccountingDocument59 pagesCost AccountingMuhammad UsmanNo ratings yet

- Cost Accounting 7 & 8Document2 pagesCost Accounting 7 & 8Kyrara100% (1)

- Job Order Costing HandoutsDocument8 pagesJob Order Costing HandoutsHannah Jane Arevalo LafuenteNo ratings yet

- 4 5879525209899272176 PDFDocument4 pages4 5879525209899272176 PDFYaredNo ratings yet

- Ma As2Document6 pagesMa As2Omar AbidNo ratings yet

- Stop ServicesDocument1 pageStop ServicesAasim ShakeelNo ratings yet

- AmlkycbasicsDocument27 pagesAmlkycbasicsGopi ChandNo ratings yet

- Freight ForwarderDocument5 pagesFreight ForwarderAasim ShakeelNo ratings yet

- GFR 2005Document279 pagesGFR 2005chunayNo ratings yet

- Consumer Market and Buying BehaviourDocument20 pagesConsumer Market and Buying BehaviourAasim ShakeelNo ratings yet

- Final Thesis DownsizingDocument126 pagesFinal Thesis DownsizingAdnan Rasheed100% (4)

- OH Corporation Income Statement 1992 vs 1991Document1 pageOH Corporation Income Statement 1992 vs 1991Aasim ShakeelNo ratings yet

- Unethical Practices in AdvertisingDocument34 pagesUnethical Practices in AdvertisingAyushi Aggarwal100% (1)

- aasimCVDocument1 pageaasimCVAasim ShakeelNo ratings yet

- Finance - LM 4Document5 pagesFinance - LM 4Kelvin SaplaNo ratings yet

- READING 10 Industry and Company AnalysisDocument26 pagesREADING 10 Industry and Company AnalysisDandyNo ratings yet

- Basic Practice of Ratio Analysis NumericalDocument9 pagesBasic Practice of Ratio Analysis NumericalhammadmajeedNo ratings yet

- Supply Chain Management A Logistics Perspective 9th Edition Coyle Test BankDocument9 pagesSupply Chain Management A Logistics Perspective 9th Edition Coyle Test Bankotissamfli8q100% (16)

- Material Cost Lecture 1Document10 pagesMaterial Cost Lecture 1YashaswiNo ratings yet

- Master Budgeting ProblemsDocument4 pagesMaster Budgeting ProblemsKRook NitsNo ratings yet

- Senior Manager Supply Chain, Heading Eastern IndiaDocument4 pagesSenior Manager Supply Chain, Heading Eastern IndiaRobin SahaNo ratings yet

- Procurement Kpis - Intro BriefDocument6 pagesProcurement Kpis - Intro BriefSivaprakashNo ratings yet

- DRP Vs Order Point ReplenishmentDocument17 pagesDRP Vs Order Point Replenishmentlibranatul100% (1)

- Module 1 and 2 CFMADocument74 pagesModule 1 and 2 CFMAk 3117No ratings yet

- Homework 2Document4 pagesHomework 2Pandurang ThatkarNo ratings yet

- Guidelines for Hazardous Materials InventoryDocument50 pagesGuidelines for Hazardous Materials InventoryAndre BlueNo ratings yet

- Glossary: JDA Software Group, Inc., October 2010 JDA Education ServicesDocument8 pagesGlossary: JDA Software Group, Inc., October 2010 JDA Education Servicesgren cirNo ratings yet

- Apple IncDocument5 pagesApple Incsyg_sahabt26No ratings yet

- Chapter 1 AnswerDocument4 pagesChapter 1 AnswerJanine NazNo ratings yet

- MRP II - Manufacturing Requirement Planning Application of ComputersDocument17 pagesMRP II - Manufacturing Requirement Planning Application of ComputersVimal KekNo ratings yet

- Too Good Ice Cream Business PlanDocument71 pagesToo Good Ice Cream Business PlanEunice Rangel100% (1)

- Gateway: A Direct Sales Manufacturer: Zara: Apparel Manufacturing and RetailDocument4 pagesGateway: A Direct Sales Manufacturer: Zara: Apparel Manufacturing and RetailTauseef QaziNo ratings yet

- Production/ Operations Management: Estrella Y. Yu, DBMDocument76 pagesProduction/ Operations Management: Estrella Y. Yu, DBMTristan ZambaleNo ratings yet

- Complete ModuleDocument99 pagesComplete ModuleMhel DemabogteNo ratings yet

- © Pearson Education 2014 1Document33 pages© Pearson Education 2014 1ehab kamalNo ratings yet

- MITx SCX Supply Chain DesignDocument64 pagesMITx SCX Supply Chain DesignIrving HernándezNo ratings yet

- 1 POM FrameworkDocument32 pages1 POM FrameworkRyan ParadinaNo ratings yet

- Module 4 Absorption and Variable Costing NotesDocument3 pagesModule 4 Absorption and Variable Costing NotesMadielyn Santarin Miranda100% (3)

- Benefits of MRP II: Manufacturing Resource PlanningDocument2 pagesBenefits of MRP II: Manufacturing Resource PlanningFazli Aleem100% (2)

- CFO Controller Director Finance in Pittsburgh PA Resume Richard HureyDocument2 pagesCFO Controller Director Finance in Pittsburgh PA Resume Richard HureyRichardHureyNo ratings yet

- 09 - Chapter 2 PDFDocument37 pages09 - Chapter 2 PDFsanthosh dNo ratings yet

- BudgetingDocument9 pagesBudgetingshobi_300033% (3)

- Zara-Benneton Case Study PDFDocument136 pagesZara-Benneton Case Study PDFrizka100% (1)