Professional Documents

Culture Documents

Needs For VAT Act 2011 Not Modern Excise Act

Uploaded by

Mohammad Shahjahan SiddiquiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Needs For VAT Act 2011 Not Modern Excise Act

Uploaded by

Mohammad Shahjahan SiddiquiCopyright:

Available Formats

Needs for VAT Act 2011 not modern Excise Act

M S Siddiqui Part Time Teacher, Leading University Pursuing PhD in Open University, Malaysia e-mail: shah@banglachemical.com Bangladesh introduced the VAT about two decades ago in 1991, replacing the excise duty system in a bid to collect more revenue, but the latest tax system has so far failed to make any major impact in revenue generation. Bangladesh's tax-GDP ratio has averaged a low eight-nine per cent for the last two decades, despite the introduction of VAT and a number of reforms at the NBR. The 'poor' ratio is has seriously affected the country's growth as the government could only allocate a fraction of the amount it needed to invest in infrastructure, health and education. The basic idea of VAT is to impose tax on value addition and tax payable at sales stage. The system has been ignored in original law of 1991 and rule made by National Board Revenue (NBR) with imposition of VAT from retail level and import stage at port as fixed advance VAT and trade VAT without giving rebate and ignoring the cascading effect causing resentment in the business community. Value-added tax is a primary source of tax revenue in many European and other developed countries with the exception of the United States, all countries of the Organization for Economic Cooperation and Development (OECD) use a VAT or similar tax on consumer expenditures. Bangladesh should make 'massive changes' in the country's existing Value Added Tax (VAT) laws and rules to boost growth of revenue, which remains one of the lowest in the region. The reform proposal of World Bank to bring massive changes in the VAT laws and rules to make VAT as workhorse of future revenue generation against the backdrop of the country's policy of continuous trade liberalization. On the other hand the VAT rules and regulation should be business-friendly and technology based such as the electronic cash registers to collect VAT and on line tax return system so that the tax official and tax payers does not require face to face interaction. It has to be designed properly so that the businessmen and others have easy access to the system. The process of assessing value-added tax occurs roughly are follows chronologically such as: Manufacture adds value to a product; the amount of value added can be described as the difference between the cost of the materials used to make the product and the price charged to the customer (often a wholesaler). The manufacturer pays value-added tax (a percentage of the value added), which is then included in the purchase price charged to the customer (wholesaler). The manufacturer gets a rebate from the government for VAT paid on the materials. The customer (wholesaler) pays a VAT on the value they add, which can be described as the difference between what they paid to the manufacturer and the price they at which they sell it to their customer (retailer). This VAT amount is included in the price charged to the retailer. The wholesaler gets a rebate for VAT from the government for the VAT paid to the manufacturer. The retailer pays valueadded tax on the value they add, which can be described as the price charged to customers less the wholesale cost, and includes the VAT in the final sales price of the product. The retail store collects value-added tax from the person buying the product (retail price thus includes all VATs collected at each stage of this process) and gets a rebate for the VAT paid to the wholesaler. There are three types of value-added tax used around the world. The methods are calculated in the ways that taxes on expenditures are handled with a few exceptions of basic and social needs like

food, food and agricultural products, animal products, poultry sector, agriculture imputes medicine, shelter and education. The most common is the consumption method, which allows businesses to immediately deduct the full value of taxes paid on purchases. The second is the net income method, which allows gradual deduction of VAT paid on purchases over a number of years, much like depreciation. The third type, gross national product method of value-added tax, provides no allowance for taxes paid on purchases. The name of this type of tax is derived from the fact that the tax base is approximately equal to private GNP. The consumption method is most favored among general populations because it most equally taxes income from labor and capital and promotes capital formation. The existing VAT system is on consumption in principal but the rule and application of act does not match the adapted theory. The existing VAT system is an excise tax system in reality since the cascading effect i. e. VAT on VAT, lack of rebate and proper credit system, fix tax like fixed trade VAT at import stage etc. Bangladesh even imposed VAT on basic needs like education in Private institutions and medical services. A few years back the honorable high court verdict against VAT of medical services. No citizen yet file writ against VAT on education, the other basic need of human. The law should have massive reform in VAT administration, tax return, tax calculation, valuation of end products, payment of tax, rebates, carry forward of advance or excess tax paid and settlement of dispute on tax related issues. But the proposed new act could not address all the short comings of the existing law. The proposed act imposed tax on taxable imports (sec 18- 1-b) making the VAT on purchase of raw materials stage ignoring the method of tax at sales stage. More over the law exempted tax on import for personal consumption (sec 27) and assets for private purpose (sec 70). The VAT is a consumption tax but the import for consumption under baggage rule and other personal consumption has been set to exempted from VAT which really conflicting to philosophy of VAT. The argument made in the note/ clarification of draft that import for private consumption is not in course of economic activities. The mind set of policy makers (in fact the bureaucrats) is to impose tax on businessperson not on consumers. Again in the section 44 mentioned that the Act applies the destination principle, under which the objective is to impose VAT only on consumption in Bangladesh. The section 27 and 44 is directly conflicting within the draft Act. The section 61 proposed for withholding of VAT by recipient of goods and services. This section make obligation of government entity, NGO, Bank, limited liability company etc to collect VAT from the service providers. This means the tax imposed on service provider not the service recipients or consumers. This again is deviation of imposing tax on service provider wherein the methods should be to collect VAT from consumers by service providers. It seems that the system is other way around making the law complex and contradictory. The framers of law are kind enough to allow the service providers to adjust the withheld tax with other business within limited time frame (sec 62). But the section 62 -2 has given a discretionary power to Tax Commissioner to disallow if not satisfied. The satisfaction of Tax Commissioner is unexplained and too flexible. The law proposed for single rate of VAT @15% but the section 83 allowed imposition of supplementary duty on import and supply of goods etc. This is again conflicting with single rate of VAT.

The law is a civil in nature in all purpose as mentioned in section 124 explaining the recovery of unpaid tax to follow have the same powers which a Civil Court has possess but the section 118 10 has provision of delegation of power of Magistrate to VAT Officer as specified in the schedule III to the Code of Criminal Procedure, 1898 (Act V of 1898) to exercise the power under section 36 of the CrPc. The Tax officials are fortunate to be empowered with civil and criminal Acts. This is against the separation of Judiciary from administration and against judgment of Mazder Hossain case. There are some words in the law as tax evasion and fraud etc in the sec 119. The dispute of tax is a calculation of tax between tax payer and tax official or a dispute civil nature but the wordings are from CrPc. The section 133 make every representative of tax payer personally liable for the payment of amounts due and this in more particularly mentioned in the section 135 to make liable the Directors of the companies. The liability is jointly and severally for amount, interest and penalty thereof. As per companies Act, the Director or shareholders are liable to the face value of their share in the company not more that the amount of face value of share. The Appeal, Revision and References has made difficult for the tax pay payers by imposing restriction Burdon of prof will rest on the taxpayer to rebut the content of the depositions of tax authority (sec 181). There will be no appeal unless the getting decision or order theron from Commissioner (Appeal) or the Appellate Tribunal (Sec 180). No appeal to high court will be allowed with out payment of 10% of the imposed tax. This is against basic human rights enshrined in the constitution. None is guilty until declared by court. The Alternate dispute resolution (ADR) also not fair to the tax payers. The section 176 and sub sec-2 empower the NBR to appoint a committee consisting of VAT Officer and two person appointed by NBR to examine application for ADR. The decision shall be taken to the appropriate forum for decision (sub sec 5). The board may, on the recommendations of the committee, pass order, as it deems appropriate (sub sec 6). The appointment of facilitators (committee) and also the decision of the committee is acceptable to the NBR (deems appropriate) shall make the ADR meaningless for the tax payer. This is also against the hundreds years old traditional SALISH system of our society. The facilitators or Salisdars shall be independent and selected by both NBR and Tax payer and the verdict of ADR shall mandatory on both NBR and Tax payer. The law has been drafted to increase tax collection mostly focusing on trading with a mind set of trading character of business in Bangladesh but there is no policy support for industrialization. The law more to increase the collection of tax means there is no efforts to make fair calculation of tax. There fair collection of tax will make fair competition among business houses and shall increase economic activities in level paying field. The level playing field is precondition for increased economic activities. Finally, the rule making authority proposed to give to NBR under section 188. The policy and rule making as well as implementation of rule simultaneously shall give undesirable authority to NBR. The rule and policy making authority shall be either with Parliamentary Standing Committee on Finance or to Ministry of Finance. There should be a check and balance of power and authority. Bangladesh needs a modern VAT act not a modern Excide Act.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Lacerte - e - File - Returns (Wazhua - Com)Document58 pagesLacerte - e - File - Returns (Wazhua - Com)haiderabbaskhattakNo ratings yet

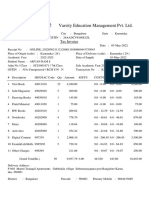

- 1 PaySlipDocument1 page1 PaySlipUpal RajNo ratings yet

- Evaluation of Import Policy Order 2021-2024Document6 pagesEvaluation of Import Policy Order 2021-2024Mohammad Shahjahan SiddiquiNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- IMF and Reforms in BangladeshDocument4 pagesIMF and Reforms in BangladeshMohammad Shahjahan SiddiquiNo ratings yet

- Evaluation of Bangladesh's Data Protection BillDocument4 pagesEvaluation of Bangladesh's Data Protection BillMohammad Shahjahan SiddiquiNo ratings yet

- How Insiders Are Manipulating Dollar RatesDocument4 pagesHow Insiders Are Manipulating Dollar RatesMohammad Shahjahan SiddiquiNo ratings yet

- About Doing Business' ReportDocument4 pagesAbout Doing Business' ReportMohammad Shahjahan SiddiquiNo ratings yet

- Post Clearance Customs AuditDocument3 pagesPost Clearance Customs AuditMohammad Shahjahan SiddiquiNo ratings yet

- Pandemic Recession and Employment CrisisDocument4 pagesPandemic Recession and Employment CrisisMohammad Shahjahan SiddiquiNo ratings yet

- At Last Asset Management CompanyDocument3 pagesAt Last Asset Management CompanyMohammad Shahjahan SiddiquiNo ratings yet

- The Inflow and Outflow of CapitalDocument4 pagesThe Inflow and Outflow of CapitalMohammad Shahjahan SiddiquiNo ratings yet

- Need For A Payment System ActDocument4 pagesNeed For A Payment System ActMohammad Shahjahan SiddiquiNo ratings yet

- Mutualisation of Public ServicesDocument4 pagesMutualisation of Public ServicesMohammad Shahjahan SiddiquiNo ratings yet

- When Women & Men Will Be EqualDocument3 pagesWhen Women & Men Will Be EqualMohammad Shahjahan SiddiquiNo ratings yet

- Banning Rickshaw Without Alternate Transport!Document4 pagesBanning Rickshaw Without Alternate Transport!Mohammad Shahjahan SiddiquiNo ratings yet

- A. Legal Owner Information: EIN - SSN 578-17-7124Document2 pagesA. Legal Owner Information: EIN - SSN 578-17-7124Trevor AlexanderNo ratings yet

- Annexure To Form 16 Part B (2020)Document3 pagesAnnexure To Form 16 Part B (2020)Dharmendra ParmarNo ratings yet

- P 46Document2 pagesP 46Charlotte JamesNo ratings yet

- EAG 036 Financial Managment Cash Vs Accrual AccountingDocument4 pagesEAG 036 Financial Managment Cash Vs Accrual AccountingMICHAEL USTARENo ratings yet

- Taxation Law - Leonen Case DigestsDocument53 pagesTaxation Law - Leonen Case DigestsInna Franchesca S. VillanuevaNo ratings yet

- IRS Form 4868Document4 pagesIRS Form 4868Anil AletiNo ratings yet

- Sales Tax System in IndiaDocument7 pagesSales Tax System in IndiaKarthi_docNo ratings yet

- Chapter 6. Income From Property v2Document6 pagesChapter 6. Income From Property v2LEARN FROM MENo ratings yet

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,831Document1 pageBilling Summary Customer Details: Total Amount Due (PKR) : 2,831Shazil ShahNo ratings yet

- Fiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order ToDocument2 pagesFiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order TominhaxxNo ratings yet

- Instructions For Form CT-1: Department of The TreasuryDocument4 pagesInstructions For Form CT-1: Department of The TreasuryIRSNo ratings yet

- Solved Phyllis Sued Martin S Estate and Won A 65 000 SettlementDocument1 pageSolved Phyllis Sued Martin S Estate and Won A 65 000 SettlementAnbu jaromiaNo ratings yet

- Barrel Quote - 20211110 - 0001Document1 pageBarrel Quote - 20211110 - 0001RAVEENDRA OFFICENo ratings yet

- INA43913Document1 pageINA43913playht791No ratings yet

- Tax I R K FINAL AS AT 20 2 06Document315 pagesTax I R K FINAL AS AT 20 2 06Adarsh. UdayanNo ratings yet

- FabHotels BTGKV 2324 00287 Invoice ZRPFLQDocument2 pagesFabHotels BTGKV 2324 00287 Invoice ZRPFLQMohanGuptaNo ratings yet

- Period: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraDocument6 pagesPeriod: Salary Statement For Fy-2021-2022 of S.Ragini, (SGT), Id No: 1354755, Mpps KumsaraNagesh AdumullaNo ratings yet

- 227 Tax AnalysisDocument25 pages227 Tax AnalysisBurton PhillipsNo ratings yet

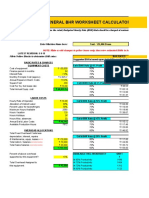

- General BHR Worksheet CalculatorDocument2 pagesGeneral BHR Worksheet CalculatorEmba MadrasNo ratings yet

- Payslip Jan 2023Document1 pagePayslip Jan 2023Palanivelan KamarajNo ratings yet

- BapaDocument12 pagesBapaJeni LagahitNo ratings yet

- Chapter 1: Basic Concepts: Cma Vipul ShahDocument27 pagesChapter 1: Basic Concepts: Cma Vipul ShahsmitaNo ratings yet

- Tax Invoice Trucks and BuyersDocument2 pagesTax Invoice Trucks and BuyersSyam JamiNo ratings yet

- Laxmi Timber 2 BillDocument1 pageLaxmi Timber 2 BillAcma Renu SinghaniaNo ratings yet

- Online 645Document2 pagesOnline 645Aishwarya SenthilNo ratings yet

- Branch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectDocument1 pageBranch Teller: Use SCR 008765 Deposit Fee Collection State Bank CollectShivani MishraNo ratings yet

- Your Invoice No. RE200143606Document1 pageYour Invoice No. RE200143606Erick MetzNo ratings yet