Professional Documents

Culture Documents

Online STMT

Uploaded by

djk765Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Online STMT

Uploaded by

djk765Copyright:

Available Formats

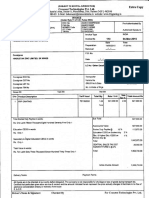

THE O N EQUITY SALES COMPANY

ONE FINANCIAL WAY

CINCINNATI OH 45242

TEL:(513)794-6794

FAX:(513)794-4514

Account Number: 3CG-120620

Recipient's Identification

Number: 392-80-4313

Recipient's Name and Address:

Your Account Executive:

Payer Information:

DAVID J KUMMER &

CARRIE J KUMMER MARITAL SURVIVOR

214 RIDGE VIEW TRAIL

VERONA WI 53593-8350

DONITA A ST MARIE

2923 MARKETPLACE DR. STE 210

MADISON

WI 53719-5321

(608) 274-9110

ID: 323

PERSHING, LLC

2006 1099-DIV

Summary of Gross Proceeds and Regulated Futures Contracts

Gross Proceeds (Less Commissions and Fees) .............................................................

Federal Income Tax Withheld - Gross Proceeds ......................................

Regulated Futures Contracts:

Profit or (Loss) Realized in 2006 .......................................................................................

Unrealized Profit or (Loss) on Open Contracts - 12/31/2005 ...................................

Unrealized Profit or (Loss) on Open Contracts - 12/31/2006 ...................................

Aggregate Profit or (Loss) ...................................................................................................

Federal Income Tax Withheld - Reg. Futures Contracts ..........................

Amount

4,394.86 *

0.00

0.00

0.00

0.00

0.00

0.00

* Details of each Gross Proceeds transaction are reported to the IRS.

Refer to the 1099-B section of this statement for these details.

2006 1099-INT

Box

1

2

3

4

5

6

7

8

9

2006

YOUR TAX INFORMATION STATEMENT

Interest Income

OMB No. 1545-0112

Interest Income ........................................................................................................

Early Withdrawal Penalty .......................................................................................

Interest on U.S. Savings Bonds & Treasury Obligations ................................

Federal Income Tax Withheld .......................................................

Investment expenses ..............................................................................................

Foreign Tax Paid .......................................................................................................

Foreign Country or U.S. Possession ....................................................................

Tax-Exempt Interest .................................................................................................

Specified Private Activity Bond Interest ..............................................................

Amount

117.52

0.00

0.00

0.00

0.00

0.00

n/a

0.00

0.00

Federal Identification

Number:

13-2741729

Dividends and Distributions

Box

1a Total Ordinary Dividends ........................................................................................

1b Qualified Dividends ..................................................................................................

2a Total Capital Gain Distributions .............................................................................

2b Unrecaptured Section 1250 Gain .........................................................................

2c Section 1202 Gain ....................................................................................................

2d Collectibles (28%) Gain .........................................................................................

3 Nondividend Distributions .....................................................................................

4 Federal Income Tax Withheld ........................................................

5 Investment expenses ...............................................................................................

6 Foreign Tax Paid .......................................................................................................

7 Foreign Country or U.S. Possession .....................................................................

8 Cash Liquidation Distributions ..............................................................................

9 NonCash Liquidation Distributions ......................................................................

OMB No. 1545-0110

Amount

1,743.78

1,314.11

235.59

0.00

0.00

0.00

0.00

0.00

0.00

31.27

Various

0.00

0.00

Summary of Original Issue Discount

Original Issue Discount (Non-U.S. Treasury Obligations) ......................................

Other Periodic Interest ....................................................................................................

Federal Income Tax Withheld ..............................................................

Original Issue Discount on U.S. Treasury Obligations .............................................

Investment expenses .......................................................................................................

Amount

0.00

0.00

0.00

0.00

0.00

This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction

may be imposed on you if this income is taxable and the IRS determines that it has not been reported.

(3CG 133394)

Page 1 of 7

Recipient's Name and Address:

Account Number: 3CG-120620

DAVID J KUMMER &

CARRIE J KUMMER MARITAL SURVIVOR

Recipient's Identification

Number: 392-80-4313

2006

YOUR TAX INFORMATION STATEMENT

Summary Of Transactions We Do Not Report To The IRS (See instructions for additional information)

Amount

Securities Purchased

Net Cost of Securities Purchased ..................................................................................................................................................................................................................

2006 Form 1099-B PROCEEDS FROM BROKER AND BARTER EXCHANGE TRANSACTIONS

4,582.50

OMB No. 1545-0715

(For individuals, report details on Form 1040; Schedule D; Line 1 or 8.)

This is important tax information and is being furnished to the Internal Revenue Service. If you are required to file a return, a negligence penalty or other sanction

may be imposed on you if this income is taxable and the IRS determines that it has not been reported.

Description

(Box 7)

TEXAS INSTRUMENTS INC

CUSIP

(Box 1b)

882508104

Trade/Process

Date

(Box 1a)

11/09/2006

Proceeds

(Less Commissions & Fees)

(Box 2)

4,394.86

Quantity

150

Total

4,394.86

INTEREST INCOME

0.00

(Details of Form 1099-INT)

CUSIP/

Security Type

055185201

U.S. Corp.

Description

BAC CAP TR IV PFD GTD CAP SECS 5.875%

CALLABLE 5/1/08 MTY 5/03/33

Date Paid

02/01/2006

05/01/2006

08/01/2006

11/03/2006

Total

Interest

Income

(Box 1)

29.38

29.38

29.38

29.38

-----------117.52

Interest on U.S. Savings

Bonds and Treasury

Obligations (Box 3)

117.52

DIVIDENDS AND DISTRIBUTIONS

Description

GARMIN LTD COM

ISIN#KYG372601099

Federal Income

Tax Withheld

(Box 4)

Date

Paid

12/15/2006

Total

Ordinary

Dividends

(Box 1a)

25.00

Federal Income

Tax Withheld

(Box 4)

0.00

0.00

Investment

Expenses

(Box 5)

0.00

Foreign

Tax Paid

(Box 6)

0.00

(Details of Form 1099-DIV)

Qualified

Dividends

(Box 1b)

25.00

(3CG 133394)

*Total Capital

Gain

Distributions

(Box 2a)

Nondividend

Distributions

(Box 3)

Federal

Income

Tax Withheld

(Box 4)

Investment

Expenses

(Box 5)

Foreign Tax

Paid

(Box 6)

Page 2 of 7

Recipient's Name and Address:

Account Number: 3CG-120620

DAVID J KUMMER &

CARRIE J KUMMER MARITAL SURVIVOR

Recipient's Identification

Number: 392-80-4313

DIVIDENDS AND DISTRIBUTIONS

Description

FEDERATED CAPITAL

RESERVES

FOR TAX YEAR 2006

Date

Paid

(Details of Form 1099-DIV)

Total

Ordinary

Dividends

(Box 1a)

209.51

Qualified

Dividends

(Box 1b)

OAKMARK EQUITY AND

INCOME FUND

12/18/2006

90.29

39.84

MCDONALDS CORP

12/01/2006

50.00

50.00

NASDAQ 100 TR UNIT

SER 1

CASH INCOME 2006

12/31/2006

6.64

6.63

STANDARD & POORS

DEPOSITARY RECEIPTS

(SPDR'S) UNITS OF

UNDIVIDED BENEFICIAL

INTEREST

04/28/2006

07/31/2006

10/31/2006

33.77

36.11

37.66

-----------107.54

33.77

36.11

37.66

-----------107.54

TEXAS INSTRUMENTS

INC

02/13/2006

05/22/2006

08/21/2006

11/20/2006

4.50

4.50

4.50

6.00

-----------19.50

4.50

4.50

4.50

6.00

-----------19.50

VANGUARD EUROPE

INDEX FUND

12/22/2006

723.97

554.27

VANGUARD INDEX

TRUST TOTAL STOCK

MARKET PORTFOLIO

03/20/2006

06/26/2006

09/25/2006

12/22/2006

117.10

117.10

117.10

160.03

-----------511.33

117.10

117.10

117.10

160.03

-----------511.33

1,549.08

194.70

1,289.11

25.00

Dividends - U.S. Corporations ............

Dividends - Foreign Corporations .......

2006

YOUR TAX INFORMATION STATEMENT

*Total Capital

Gain

Distributions

(Box 2a)

Nondividend

Distributions

(Box 3)

Federal

Income

Tax Withheld

(Box 4)

Investment

Expenses

(Box 5)

Foreign Tax

Paid

(Box 6)

235.59

Total

1,743.78

1,314.11

235.59

* All Capital Gain Distributions paid were classified as Long Term Capital Gain Distributions (see instructions for details).

(3CG 133394)

(Continued)

31.27

0.00

0.00

0.00

31.27

Page 3 of 7

Recipient's Name and Address:

Account Number: 3CG-120620

DAVID J KUMMER &

CARRIE J KUMMER MARITAL SURVIVOR

Recipient's Identification

Number: 392-80-4313

2006

YOUR TAX INFORMATION STATEMENT

TRANSACTIONS WE DO NOT REPORT TO THE IRS

SECURITIES PURCHASED

Description

GARMIN LTD COM ISIN#KYG372601099

CUSIP

G37260109

Trade/Process

Date

11/09/2006

MCDONALDS CORP

580135101

11/09/2006

Total

Quantity

50

50

Net Cost

2,436.00

2,146.50

4,582.50

(3CG 133394)

Accrued Interest Purchased

Amount

Security Type

0.00

Page 4 of 7

Recipient's Name and Address:

Account Number: 3CG-120620

DAVID J KUMMER &

CARRIE J KUMMER MARITAL SURVIVOR

Recipient's Identification

Number: 392-80-4313

(3CG 133394)

2006

YOUR TAX INFORMATION STATEMENT

Page 5 of 7

Recipient's Name and Address:

Account Number: 3CG-120620

DAVID J KUMMER &

CARRIE J KUMMER MARITAL SURVIVOR

Recipient's Identification

Number: 392-80-4313

(3CG 133394)

2006

YOUR TAX INFORMATION STATEMENT

Page 6 of 7

Recipient's Name and Address:

Account Number: 3CG-120620

DAVID J KUMMER &

CARRIE J KUMMER MARITAL SURVIVOR

Recipient's Identification

Number: 392-80-4313

(3CG 133394)

2006

YOUR TAX INFORMATION STATEMENT

Page 7 of 7

You might also like

- Spending Account StatementDocument2 pagesSpending Account StatementTaylor LynnNo ratings yet

- SunTrust StatDocument1 pageSunTrust StatIrakli IrakliNo ratings yet

- C001194C A073972181A 271109194347C: Giorgina OlivaDocument1 pageC001194C A073972181A 271109194347C: Giorgina OlivaShonda DietzNo ratings yet

- Christopher Collins March Bank StatementDocument2 pagesChristopher Collins March Bank StatementJim BoazNo ratings yet

- Jojoe Agyeman RBC Mar 2022Document2 pagesJojoe Agyeman RBC Mar 2022Ali HassanNo ratings yet

- Edna Unzueta: Direct Deposit Enrollment FormDocument1 pageEdna Unzueta: Direct Deposit Enrollment FormAll Result BD 2019No ratings yet

- Date Transaction Description Amount (In RS.)Document2 pagesDate Transaction Description Amount (In RS.)MITESH KUMAR100% (1)

- December StatementDocument3 pagesDecember StatementNoriely Altagracia Paulino Rivas100% (1)

- MyfileDocument1 pageMyfileanon-302065No ratings yet

- Employee Paystub EditedDocument1 pageEmployee Paystub EditedSandra ChrisNo ratings yet

- Income Statement Template V3Document21 pagesIncome Statement Template V3Third WheelNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- MSB RegistrationDocument1 pageMSB RegistrationWiredEnterpriseNo ratings yet

- Bank Accounts TableDocument1 pageBank Accounts TableAyon MandalNo ratings yet

- Cesar Simon Abreu Suarez 7320 SW 72Nd Avenue Miami FL 33143-4203Document4 pagesCesar Simon Abreu Suarez 7320 SW 72Nd Avenue Miami FL 33143-4203CESAR ABREUNo ratings yet

- 26 Estat PDFDocument4 pages26 Estat PDFRicky CazaresNo ratings yet

- Frequently Asked Questions On Electronic Clearing ServiceDocument7 pagesFrequently Asked Questions On Electronic Clearing Serviceravi150888No ratings yet

- Transaction Summary: Contact UsDocument1 pageTransaction Summary: Contact UsJesseneNo ratings yet

- TD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Document18 pagesTD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Stan J. CaterboneNo ratings yet

- Copart Wire IntructionsDocument1 pageCopart Wire IntructionsGeorge PlishkoNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument8 pagesMonthly Statement: Name Address Account Number Statement PeriodAzeez AyomideNo ratings yet

- Authentic and ORIGINAL Documents of 1987 RESTORED ON DECEMBER 15, 2016Document646 pagesAuthentic and ORIGINAL Documents of 1987 RESTORED ON DECEMBER 15, 2016Stan J. CaterboneNo ratings yet

- City BankDocument3 pagesCity BankChong ShanNo ratings yet

- Credit Card AuthorizationDocument1 pageCredit Card Authorizationschrowa0% (1)

- October, 2023Document3 pagesOctober, 2023Nestor MartinezNo ratings yet

- DD 2870 Health Release Form - Scan PDFDocument1 pageDD 2870 Health Release Form - Scan PDFremolacha147No ratings yet

- CmregionsstatementDocument1 pageCmregionsstatementDae MacNo ratings yet

- Account StatementDocument3 pagesAccount StatementKatie LongNo ratings yet

- Chase Bank Financial StatementDocument3 pagesChase Bank Financial StatementGo DumpNo ratings yet

- 3232 Void Corrected: Form W-2GDocument8 pages3232 Void Corrected: Form W-2GMichael HenryNo ratings yet

- Citi Cash Back Mastercard Citi Cash Back Mastercard: Statement of AccountDocument4 pagesCiti Cash Back Mastercard Citi Cash Back Mastercard: Statement of AccountJeffreyNo ratings yet

- NFC July 2023 UpdatedDocument3 pagesNFC July 2023 UpdatedMuhammad UsmanNo ratings yet

- Schedule of Liabilities (SBA Form 2202)Document1 pageSchedule of Liabilities (SBA Form 2202)Vaé Ribera100% (1)

- Bluebird Statement - Bluebird - 1625594969518Document2 pagesBluebird Statement - Bluebird - 1625594969518daniel floydNo ratings yet

- My Statements ControlDocument6 pagesMy Statements ControlDaniel KentNo ratings yet

- Betty'S Myvanilla: Pending Transactions ($0.00)Document2 pagesBetty'S Myvanilla: Pending Transactions ($0.00)AngelaNo ratings yet

- ReportID 458234878 Report PDFDocument4 pagesReportID 458234878 Report PDFAnonymous XDjz6zLGCFNo ratings yet

- Annu Acc StatementDocument1 pageAnnu Acc StatementAHMAD ANTOINE DELAINENo ratings yet

- Victor M Orozco 8860 SW 123 CT APT K310 Miami FL 33186Document4 pagesVictor M Orozco 8860 SW 123 CT APT K310 Miami FL 33186Wa Riz LaiNo ratings yet

- 2021 3 StatementDocument5 pages2021 3 StatementRobert LiNo ratings yet

- Fabian Bortz Feb 2020 StatementDocument4 pagesFabian Bortz Feb 2020 StatementChamp HillaryNo ratings yet

- Karen Henney 1120 Grove ST Apt 2 Downers Grove, Il 60515Document1 pageKaren Henney 1120 Grove ST Apt 2 Downers Grove, Il 60515Sharon JonesNo ratings yet

- QwertyDocument1 pageQwertyqwew1eNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument2 pagesStatement of Account: Credit Limit Rs Available Credit Limit RsIqbal MohammadNo ratings yet

- Citi Card Disputes FormDocument1 pageCiti Card Disputes FormAlex MingNo ratings yet

- Savings Summary: We'Re Updating Our AtmsDocument2 pagesSavings Summary: We'Re Updating Our AtmsJP Ramos DatinguinooNo ratings yet

- Invoice - 01201017Document1 pageInvoice - 01201017Abhishek SinghNo ratings yet

- USA Citibank BankDocument6 pagesUSA Citibank BankPolo OaracilNo ratings yet

- PNC Savings Acc StatementDocument1 pagePNC Savings Acc StatementHermanNo ratings yet

- Bank Monitoring Dec - 2011Document164 pagesBank Monitoring Dec - 2011chisteaNo ratings yet

- Retail XXX6651 Statement 10 - 19 - 2015Document2 pagesRetail XXX6651 Statement 10 - 19 - 2015alfonso loboNo ratings yet

- ZhI6Jn6596kJrCx96K97699d759798eeb2 67922000Document3 pagesZhI6Jn6596kJrCx96K97699d759798eeb2 67922000Char LaPlante SlovenzNo ratings yet

- Pine Ridge Apartment Welcome LetterDocument2 pagesPine Ridge Apartment Welcome LetterKamil KowalskiNo ratings yet

- Cash FlowDocument1 pageCash Flowpawan_019No ratings yet

- Michael Easley 1040 2017Document2 pagesMichael Easley 1040 2017MichaelNo ratings yet

- SunTrust Truist Bank BAD FAITH ComplaintDocument6 pagesSunTrust Truist Bank BAD FAITH ComplaintBud TuglyNo ratings yet

- Meraj Din H 66fateh Garh LHR: Web Generated BillDocument1 pageMeraj Din H 66fateh Garh LHR: Web Generated BillNadir PervezNo ratings yet

- W 2Document6 pagesW 2prads1259No ratings yet

- Tamyah 12:30 PDFDocument1 pageTamyah 12:30 PDFChris LeeNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Chapter 5 TaxationDocument3 pagesChapter 5 TaxationAngela Nicole NobletaNo ratings yet

- December 2022 Bill: 510 BT Batok ST 52 #07-15 Singapore 650510Document2 pagesDecember 2022 Bill: 510 BT Batok ST 52 #07-15 Singapore 650510Jahid IslamNo ratings yet

- 2019 P T D 2072Document5 pages2019 P T D 2072Ishratfatima wazirNo ratings yet

- T CODES 2Document13 pagesT CODES 2aashima_soodNo ratings yet

- Tyscn 10 AugDocument83 pagesTyscn 10 AugVivek PatilNo ratings yet

- Wise Ltd. 56 Shoreditch High Street London E1 6JJ United KingdomDocument1 pageWise Ltd. 56 Shoreditch High Street London E1 6JJ United KingdomA VNo ratings yet

- Estimate of Expenses 2020-2021: (Fees Subject To Change in Fall 2021)Document2 pagesEstimate of Expenses 2020-2021: (Fees Subject To Change in Fall 2021)Walid TaouhidNo ratings yet

- HZL 4100070676 Inv Pay Slip PDFDocument12 pagesHZL 4100070676 Inv Pay Slip PDFRakshit KeswaniNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSunil KumarNo ratings yet

- Direct Deposit and ACH Payment Enrollment Form 2-2-22Document2 pagesDirect Deposit and ACH Payment Enrollment Form 2-2-22ganesh pathakNo ratings yet

- QVLFUIk MRDWGZR 1 UDocument7 pagesQVLFUIk MRDWGZR 1 UShubham TyagiNo ratings yet

- TRF 01Document2 pagesTRF 01Muhammad Faisal KhanNo ratings yet

- Tolentino vs. Secretary of Finance (G.R. No. 115455, October 30, 1995)Document7 pagesTolentino vs. Secretary of Finance (G.R. No. 115455, October 30, 1995)Jennilyn Gulfan YaseNo ratings yet

- Annotated BibliographyDocument4 pagesAnnotated BibliographyJBizz0No ratings yet

- Sage Payroll CSV TemplatesDocument50 pagesSage Payroll CSV TemplatesJosh Moore33% (3)

- Bill Pay Features FunctionsDocument18 pagesBill Pay Features FunctionsZorex ZisaNo ratings yet

- FL0322696960Document1 pageFL0322696960AshwaniNo ratings yet

- Value of SupplyDocument36 pagesValue of SupplyTreesa Mary RejiNo ratings yet

- Single Payment To Alternate Payee, With Multiple Vendors Across Company CodDocument14 pagesSingle Payment To Alternate Payee, With Multiple Vendors Across Company CodManas Kumar Sahoo0% (1)

- RTGS Merits Demerits To The Retail BankerDocument61 pagesRTGS Merits Demerits To The Retail BankerDayananda Kumar N RNo ratings yet

- 2017 Transpay Service GuideDocument7 pages2017 Transpay Service GuideBuddy KertunNo ratings yet

- XDocument2 pagesXSophiaFrancescaEspinosaNo ratings yet

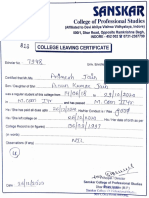

- Mcom Marksheet TCDocument2 pagesMcom Marksheet TCArjav jainNo ratings yet

- DWM1 NN TV G1 Omr W2 QDocument2 pagesDWM1 NN TV G1 Omr W2 QsalmanNo ratings yet

- Course Outline Audit & TaxDocument5 pagesCourse Outline Audit & TaxMuhammad RizwanNo ratings yet

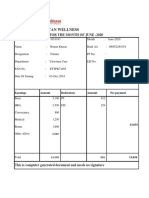

- Hindustan Wellness: Pay Slip For The Month of June - 2020Document3 pagesHindustan Wellness: Pay Slip For The Month of June - 2020ManishNo ratings yet

- Doing Business in The UkDocument20 pagesDoing Business in The UkMalena BerardiNo ratings yet

- VAT LetterDocument2 pagesVAT Letterrhea CabillanNo ratings yet

- PercentagesDocument2 pagesPercentagessamdhathriNo ratings yet

- How To Find If A Wage Type Is Taxable or Not - SAP Q&ADocument4 pagesHow To Find If A Wage Type Is Taxable or Not - SAP Q&AMurali MohanNo ratings yet