Professional Documents

Culture Documents

Teaser PLTMH Dominanga

Uploaded by

Yayan CahyanaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Teaser PLTMH Dominanga

Uploaded by

Yayan CahyanaCopyright:

Available Formats

Mini Hydro Power Plant Dominanga

INVESTMENT SNAPSHOT Investment Required Installed Power Annual Energy Output Offer Exit Strategy Investment term NPV IRR : IDR 59.3 Billion : 3.8 MW : 22,982 mWh : Equity (seat capital) or / Loan Financing : Shares buy back at year 5 and or full repayment : 5 years : IDR 2.2 Billion (17%) : 19 % INVESTMENT THESIS Strong case in green energy output in harmony with local nature and value Establish in most deficit supply of electricity region under a off take agreement of Power Purchase Agreement by PLN, Indonesian power producer company Significant return with 19% IRR, and yield positive NPV Minimum investment risks with shares buyback option at year 5 for a fixed price of share Positive social impact on local community is expected to occur FINANCIAL HIGHLIGHTS

(all in IDR Billion)

Mini Hydro Power Plant with a run of river method will be over Dominanga river in Bolaang Mongondo, North Sulawesi. Head Water debit Water way Distance to grid Est. PPA Province Population Local Population Current Capacity Renewable Energy Power INDUSTRY ANALYSIS : 90 m : 3.60 m3 per min : 2.9 km : 2 km : IDR 787/kwh : 2,012,098 : 24,044 : 224 MW : 37 MW / 16.5 %

Investment Revenue COGS NIAT Net Margin(%)

Year 1 59.3 20.6 0.6 14.8 72

Year 5 20.6 0.9 14.5 70

The growth of domestic electricity supply is not proportional to the population and economy growth. Electricity supply has been critically underdeveloped despite roles of private sector through Independent Power Producer (IPP). The demand remains high to support 7% economy growth in the coming years. Hydropower has the highest potential energy resources but has not been effectively harnessed. Hydropower potential in Indonesia is estimated at 76,174 MW, but current total installed capacity is only 4,286 MW, or around 5,6% of its total Indonesia potential capacity. Similar to other Renewable Energy (RE) resources, much of the hydropower resource suffers from the economics of investment by distance to its load centre. The technology is well developed and broadly available and therefore can be expected to play a significant role in meeting the rapidly growing rural electricity demand. In the province of North Sulawesi itself the electricity deficits reach up to 30 MW. PLN (Indonesian Power Company) with the issuance of Ministerial Decree No 31 Th 2009 is obliged to buy the electricity generated from RE by the private sector with a fixed rate at non negotiable price, this strategy is to encourage strong participation of private sector. The PLN has outlook that RE would take around 17% of the total power supplied by year 2025. ICE oversees that this opportunity is not just commercially feasible but also it would produce significant social impact on the development of local economy and GDP per capita. Yet it is also to prove to the vision on green energy. PT. Indonesia Clean Energy Mega Plaza, 12th Floor Tel : +62 21 521 29 66 Jl. HR Rasuna Said Kav C-3 Fax: +62 21 527 3319 Jakarta 12920 Indonesia www.ice.co.id Yayan Cahyana Norman Nugroho yayan@ice.co.id Norman@ice.co.id

Further Info

You might also like

- Good and Bad of Mini Hydro Power Vol.2Document78 pagesGood and Bad of Mini Hydro Power Vol.2Rehmani Mehboob100% (1)

- Vacuum Contactor Switching Phenomena PDFDocument9 pagesVacuum Contactor Switching Phenomena PDFjulianvillajosNo ratings yet

- Executive Summary PLTM Muara Sahung EngDocument6 pagesExecutive Summary PLTM Muara Sahung EngElwansyahRisman100% (1)

- BUKAKA LEAD RUBBER BEARING MilestonesDocument32 pagesBUKAKA LEAD RUBBER BEARING MilestonesKrisna JAPEKELEVATEDNo ratings yet

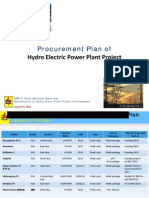

- Procurement Plan of Hydro Electric Power Plant Project 2012Document16 pagesProcurement Plan of Hydro Electric Power Plant Project 2012Rizal Irnandi HidayatNo ratings yet

- Katalog Peralatan PDFDocument438 pagesKatalog Peralatan PDFHelmi AzharfarouqiNo ratings yet

- Distance Protection PerformanceDocument5 pagesDistance Protection PerformanceabohamamNo ratings yet

- Mfg. Of: LT Panel, APFC, AMF, PCC, MCC, Street Light Panel, High Mast Panel, Automation PanelDocument5 pagesMfg. Of: LT Panel, APFC, AMF, PCC, MCC, Street Light Panel, High Mast Panel, Automation PanelRajesh PatelNo ratings yet

- Technical Aspects - BakunDocument24 pagesTechnical Aspects - BakunYana Jaapari100% (1)

- Cost Estimating of SWRO Desalination Plants: Estimating Indirect and Total Capital CostsDocument33 pagesCost Estimating of SWRO Desalination Plants: Estimating Indirect and Total Capital CostsYhuaman2No ratings yet

- 69kV Three-Phase Transmission Line AnalysisDocument16 pages69kV Three-Phase Transmission Line Analysisمحمد عبد الوهابNo ratings yet

- Indonesia Small Hydropower MappingDocument279 pagesIndonesia Small Hydropower MappingBaskara Prabawa100% (1)

- Instalasi Turbin Air IIDocument10 pagesInstalasi Turbin Air IIIfnu SetyadiNo ratings yet

- Bill of Quantity Proyek Pembangunan Gardu Induk 150 KV Bati - Bati + Incomer Sutt 150 KV (Cempaka - Pelaihari) RekapitulasiDocument7 pagesBill of Quantity Proyek Pembangunan Gardu Induk 150 KV Bati - Bati + Incomer Sutt 150 KV (Cempaka - Pelaihari) RekapitulasiYanuar Putra100% (1)

- Development of A Wind Energy Project - Case Study Indonesia PDFDocument39 pagesDevelopment of A Wind Energy Project - Case Study Indonesia PDFIrving Paul GirsangNo ratings yet

- Materi 1 - Pengelolaan Aset Distribusi-1,1Document106 pagesMateri 1 - Pengelolaan Aset Distribusi-1,1Andreas FerdianNo ratings yet

- Boq Gabung Gi Teluk Naga Ii - Full Digital.r3-SentDocument237 pagesBoq Gabung Gi Teluk Naga Ii - Full Digital.r3-SentTika LorenzaNo ratings yet

- Planning & Design Minihydro Power PlantDocument16 pagesPlanning & Design Minihydro Power PlantIfnu SetyadiNo ratings yet

- Indonesia East Kalimantan Kayan River Basin Hydropower and Aluminum Smelting ProjectDocument32 pagesIndonesia East Kalimantan Kayan River Basin Hydropower and Aluminum Smelting ProjectAkhid SidqiNo ratings yet

- Feasibility Study Poring (Jica) PDFDocument278 pagesFeasibility Study Poring (Jica) PDFtnlesmanaNo ratings yet

- Investment Plan and Startegy To Increase Transaparancy and Governance On PLN's ProjectsDocument10 pagesInvestment Plan and Startegy To Increase Transaparancy and Governance On PLN's ProjectsFREE FOR FREEDOMNo ratings yet

- DESIGN GUIDELINES FOR HYDROPOWER HEADWORKSDocument444 pagesDESIGN GUIDELINES FOR HYDROPOWER HEADWORKSBalkrishna Pangeni100% (1)

- Stasiun Pengisian Listrik Umum (Electric Vehicle Charger Station)Document32 pagesStasiun Pengisian Listrik Umum (Electric Vehicle Charger Station)Bayu Arga NugrahaNo ratings yet

- FOX 3F As Water Anti-Slam Air Valve 11.2021Document4 pagesFOX 3F As Water Anti-Slam Air Valve 11.2021bre brilianNo ratings yet

- Indonesia Toll Road Authority Ministry of Public Works and Housing OverviewDocument16 pagesIndonesia Toll Road Authority Ministry of Public Works and Housing Overviewdindin04No ratings yet

- Technical Requirements and Scope of Work for Oil and Gas ProjectDocument82 pagesTechnical Requirements and Scope of Work for Oil and Gas ProjectFreddy HutaurukNo ratings yet

- 01 Bangunan Intake Pengambilan Bendungan Jlantah-Model - PDF 2Document1 page01 Bangunan Intake Pengambilan Bendungan Jlantah-Model - PDF 2Ilham PratamaNo ratings yet

- PLTS ApungDocument50 pagesPLTS ApungRahmat Salim100% (1)

- Operasi PLTM Cikopo-2 (2x3,7MW)Document11 pagesOperasi PLTM Cikopo-2 (2x3,7MW)grahazenNo ratings yet

- Modul Pelatihan Panas Bumi Untuk Organisasi Masyarakat SipilDocument111 pagesModul Pelatihan Panas Bumi Untuk Organisasi Masyarakat Sipiligede.unyNo ratings yet

- Dredging Works for Sea Water Intake and JettyDocument7 pagesDredging Works for Sea Water Intake and Jettyedwardo100% (2)

- Smart Griid and Energy Challenges in Indonesia PLN PUSDIKLAT - ZainalDocument24 pagesSmart Griid and Energy Challenges in Indonesia PLN PUSDIKLAT - Zainalwuri prasetyoNo ratings yet

- Resume Logawa 2, Logawa 3 & Banjaran TranslateDocument71 pagesResume Logawa 2, Logawa 3 & Banjaran TranslateDimas MulyanaNo ratings yet

- Booklet Pindad Elektrik A5 Eng - Compressed PDFDocument18 pagesBooklet Pindad Elektrik A5 Eng - Compressed PDFIjal LubisNo ratings yet

- Coanda Intake Basics: Self-Cleaning Water Intake GuideDocument4 pagesCoanda Intake Basics: Self-Cleaning Water Intake GuideClemente CurnisNo ratings yet

- Coanda Hydro Intake ScreenDocument32 pagesCoanda Hydro Intake ScreenefcarrionNo ratings yet

- Standar Kode Internasional Tek - SipilDocument2 pagesStandar Kode Internasional Tek - SipilAgunXwidodoNo ratings yet

- TOR KSCS Consultant 26-05-2021Document55 pagesTOR KSCS Consultant 26-05-2021Teguh mulia aribawaNo ratings yet

- 2013.08.30 River Management in Indonesia (ENG Vers)Document326 pages2013.08.30 River Management in Indonesia (ENG Vers)Hafidh FarisiNo ratings yet

- Kurva S Pembangunan PLTSDocument1 pageKurva S Pembangunan PLTSEris Osman RifkiNo ratings yet

- General Plan PLTM Tanjung MulyaDocument1 pageGeneral Plan PLTM Tanjung MulyaGneis Setia GrahaNo ratings yet

- Company Profile PT Mega Power TeknindoDocument13 pagesCompany Profile PT Mega Power TeknindoTasya SalsabilaNo ratings yet

- Single Line Sistem Sulselra 2015Document1 pageSingle Line Sistem Sulselra 2015fadelNo ratings yet

- Koordinat PLTM BiakDocument1 pageKoordinat PLTM BiakannisaNo ratings yet

- Pedoman SUTT - SUTET Final Setelah D EdiDocument122 pagesPedoman SUTT - SUTET Final Setelah D EdiDaniel Christian SihombingNo ratings yet

- CV Uhammad Addifa Yulman - Feb - 2021Document5 pagesCV Uhammad Addifa Yulman - Feb - 2021kantorNo ratings yet

- 03-Denah Desain Plta Sawangan-POWERHOUSEDocument1 page03-Denah Desain Plta Sawangan-POWERHOUSEKomang SuantikaNo ratings yet

- Power plants and renewable energy projects in SulawesiDocument8 pagesPower plants and renewable energy projects in SulawesiHadi SofyanNo ratings yet

- Project Plan Platinum Ceramic Gresik VER05 14 11 2020Document30 pagesProject Plan Platinum Ceramic Gresik VER05 14 11 2020NanangDatadikJatimNo ratings yet

- Konstruksi Peralatan Proteksi Pada Jaringan DistribusiDocument17 pagesKonstruksi Peralatan Proteksi Pada Jaringan DistribusiMuhammad Lutfi HidayatNo ratings yet

- Data Rab PLTMH CileatDocument10 pagesData Rab PLTMH Cileatkesiswaan smkn1legonkulonNo ratings yet

- Standards for Steel Poles for 70kV and 150kV Transmission LinesDocument27 pagesStandards for Steel Poles for 70kV and 150kV Transmission LinesValentinoNo ratings yet

- Bid Drawing LMS-02Document204 pagesBid Drawing LMS-02nuryan oceandaNo ratings yet

- Brochure Submarine Cable Final-EmailDocument4 pagesBrochure Submarine Cable Final-EmailMuhammad Zhafran AlivaNo ratings yet

- SLD Gardu Distribusi BenarDocument18 pagesSLD Gardu Distribusi BenarRivaldy IqbalNo ratings yet

- Standard Konstruksi Distribusi Jateng PDFDocument46 pagesStandard Konstruksi Distribusi Jateng PDFADil ILahiNo ratings yet

- RENCANA ANGARAN BIAYA PLTS HYBRID 3-12 kWhDocument33 pagesRENCANA ANGARAN BIAYA PLTS HYBRID 3-12 kWhilhamNo ratings yet

- Pre Feasibility PDFDocument90 pagesPre Feasibility PDFSulaksha WimalasenaNo ratings yet

- Drawing List SUTT Bangil-New PorongDocument2 pagesDrawing List SUTT Bangil-New Porongfaizal rahadiansyahNo ratings yet

- Lampiran ND. 177 DRPPLN Green Book 2021 Final V2Document179 pagesLampiran ND. 177 DRPPLN Green Book 2021 Final V2tmaulanaNo ratings yet

- RAB PLTS Hybrid 1kWp-ScheneiderDocument4 pagesRAB PLTS Hybrid 1kWp-ScheneiderilhamNo ratings yet

- Indonesia Energy Situation - EnergypediaDocument9 pagesIndonesia Energy Situation - EnergypediaZoebairNo ratings yet

- Harnessing South Sudan's Hydropower PotentialDocument2 pagesHarnessing South Sudan's Hydropower Potentialabdul nasir khanNo ratings yet

- Overpaid and Underutilized How Capacity Payments To Coal Fired Power Plants Could Lock Indonesia Into A High Cost Electricity Future August2017Document33 pagesOverpaid and Underutilized How Capacity Payments To Coal Fired Power Plants Could Lock Indonesia Into A High Cost Electricity Future August2017Fauzan KurniaNo ratings yet

- An Extended Modeling of Synchronous Generators For Internal Fault Evaluation and Protection AssessmentDocument8 pagesAn Extended Modeling of Synchronous Generators For Internal Fault Evaluation and Protection AssessmentR0B0T2013No ratings yet

- ABL8RPM24200Document4 pagesABL8RPM24200Silvio Romero CaladoNo ratings yet

- Summary of EE QuestionsDocument19 pagesSummary of EE QuestionsDan Edison Ramos0% (1)

- Summer Internship Project Report in L&T PDFDocument18 pagesSummer Internship Project Report in L&T PDFVishal Biswakarma100% (1)

- N-000063 e C1 9801 We 01Document2 pagesN-000063 e C1 9801 We 01S Rao CheepuriNo ratings yet

- Installation of Condenser for Steam Turbine by Large Block Construction: A Case Study of Hokuriku Electric Power Company’s Shika Nuclear Power Station Unit 2Document6 pagesInstallation of Condenser for Steam Turbine by Large Block Construction: A Case Study of Hokuriku Electric Power Company’s Shika Nuclear Power Station Unit 2selviraNo ratings yet

- Flyer SN Workshop 2013 Neutral Treatment - Arc Suppression Coil & Earth Fault ProtectionDocument3 pagesFlyer SN Workshop 2013 Neutral Treatment - Arc Suppression Coil & Earth Fault ProtectionScott NewtonNo ratings yet

- 3VL57631SG360AE1 Datasheet enDocument5 pages3VL57631SG360AE1 Datasheet engilbertomjcNo ratings yet

- Disjunctor BVAC ScheronDocument4 pagesDisjunctor BVAC ScheronDobrete KatyNo ratings yet

- Vocational Training Report:: S.R.M University Kattankulathur (Electronics &instrumentation) REG. NO. 1171110153Document32 pagesVocational Training Report:: S.R.M University Kattankulathur (Electronics &instrumentation) REG. NO. 1171110153Ani SinghNo ratings yet

- Datasheet S6-GR1P (2.5-6) K GBR V2.1 2022 10Document2 pagesDatasheet S6-GR1P (2.5-6) K GBR V2.1 2022 10Benjie CallantaNo ratings yet

- Liebert GXT4™ UPS, 500VA - 3000VA: Intelligent, Reliable UPS ProtectionDocument4 pagesLiebert GXT4™ UPS, 500VA - 3000VA: Intelligent, Reliable UPS Protection윤석No ratings yet

- 615 Series General Presentation - 756700 - ENgDocument75 pages615 Series General Presentation - 756700 - ENgmarcondesmague1No ratings yet

- Wind Turbine ManualDocument19 pagesWind Turbine Manualwizardgrt1No ratings yet

- TP48200E-D09A1 Outdoor Power System Datasheet For Enterprise 01-20130507Document2 pagesTP48200E-D09A1 Outdoor Power System Datasheet For Enterprise 01-20130507Zaheer Ahmed TanoliNo ratings yet

- MCQ 4Document10 pagesMCQ 4Manish KumawatNo ratings yet

- As 2067Document8 pagesAs 2067Muhammad MohsinNo ratings yet

- Three Phase Fully Controlled and Half Controlled Bridge RectifierDocument10 pagesThree Phase Fully Controlled and Half Controlled Bridge RectifierGökhan KAYANo ratings yet

- 12) Universalmotor2Document7 pages12) Universalmotor2Vinod Kumar KadakalNo ratings yet

- Text With EEA RelevanceDocument14 pagesText With EEA RelevancesetiyawanNo ratings yet

- Catalog IME - 2018 - ENDocument216 pagesCatalog IME - 2018 - ENBogdan IlieNo ratings yet

- FLS MAAG Gear ElectricalLevelSwitch WebDocument2 pagesFLS MAAG Gear ElectricalLevelSwitch WebMuhammadNo ratings yet

- Electrical Design For HRB-Classroom Seminars Part-2-3Document166 pagesElectrical Design For HRB-Classroom Seminars Part-2-3Ryan RamosNo ratings yet

- Single-Phase To Three-Phase Power Converters State of The ArtDocument16 pagesSingle-Phase To Three-Phase Power Converters State of The ArtAnonymous AMjDOJ0lNo ratings yet

- Scope CC 2661Document64 pagesScope CC 2661Pawan MishraNo ratings yet