Professional Documents

Culture Documents

Rough

Uploaded by

atik750Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rough

Uploaded by

atik750Copyright:

Available Formats

lnlLlally known as LasL aklsLan 8angladesh ls a poor counLry feaLurlng negaLlve Lrade balance slnce lLs

lndependence ln 1971 1he counLry's economy experlenced vasL lmprovemenL ln Lhe 1990s Powever

forelgn Lrade ln SouLh Aslan reglon sLlll ls an area of concern

1he value of lmporLs doubled beLween 1971 and 1991 as compared Lo Lhe value of exporLs 1he Lrade

deflclL has decllned conslderably owlng Lo an lncrease ln exporLs slnce 1991 A closer look aL Lhe Lrade

sLaLlsLlcs of Lhe counLry reveals LhaL ln 198990 lmporLs exceeded exporLs by 120 1hls percenLage

came down Lo 36 ln 1996 and 62 ln 1997 1he economy of 8angladesh was once rldlng on [uLe lLs

ma[or produce unforLunaLely Lhe Lrend of polypropylene producLs across Lhe globe led Lo a seLback for

Lhe [uLe lndusLry of 8angladesh

lmporL and exporL condlLlon ls noL so good ln 8angladesh Many Llmes 8angladesh lmporL many

producLs from oLher counLrles 1hrough lmporL and exporL one counLry can earn more forelgn

currencles LhaL are helped Lo economlc developmenL Some counLrles Lhey LoLally depends on lmporL or

exporL Lrade So lmporL and exporL ls essenLlal ln our counLry ever oLhers counLrles

1he maln channel for selllng goods ln 8angladesh ls Lhrough a local agenL le an agenL wholesaler or

dlsLrlbuLor lf auLhorlzed companles may use Lhelr local agenLs Lo servlce lndusLrlal consumers and

suggesL on governmenL conLracLs 1he organlzaLlons prefer Lo deal wlLh local flrms acLlng as excluslve

agenLs or dlsLrlbuLors of forelgn manufacLurers and suppllers lorelgn flrms should conslder hlrlng an

excluslve agenL/dlsLrlbuLor Lo monlLor Lhese [obs AgenLprlnclple agreemenLs may be elLher excluslve

or

hLLp//wwwepbgovbd/lndexphp?noarameLer1hemedefaulLScrlpLexporLLrend LxporL

promoLlon bureau

|etter of cred|t

ueflnlLlon

L/C A blndlng documenL LhaL a buyer can requesL from hls bank ln order Lo guaranLee LhaL Lhe paymenL

for goods wlll be Lranferred Lo Lhe seller 8aslcally a leLLer of credlL glves Lhe seller reassurance LhaL he

wlll recelve Lhe paymenL for Lhe goods ln order for Lhe paymenL Lo occur Lhe seller has Lo presenL Lhe

bank wlLh Lhe necessary shlpplng documenLs conflrmlng Lhe shlpmenL of goods wlLhln a glven Llme

frame lL ls ofLen used ln lnLernaLlonal Lrade Lo ellmlnaLe rlsks such as unfamlllarlLy wlLh Lhe forelgn

counLry cusLoms or pollLlcal lnsLablllLy

Letter of Credit (L/C)

Letter oI credit is an undertaking by the importers bank (Issuing Bank) that iI the exporter

exports goods and make a complying presentation oI documents that was stipulated in the letter.

The letter oI credit is superior method devised Ior settlement oI debts which could assure the

exporter that iI he exports the goods as per the contract entered into with importer and produces

draIts, shipping documents and such other papers he would receive payment without deIault.

Balance of Payment

Balance oI payment is a record oI all transactions made between one particular country and all

other countries during a speciIied period oI time. Balance oI payment compares the currency oI

the amount oI exports and imports, including all Iinancial exports and imports.

$teps Taken for Remittance Process Improvement

Government as well as private sector has undertaken various strategies to make remittance

transIer easier and hassle Iree. Now, the Nationalized Commercial Banks (NCBs) have some

overseas branches/remittance wings Ior transIerring remittances. The private commercial banks

(PCBs) also become aggressive in transIerring remittances by providing quick and reliable

services. Some oI the PCBs also have established oversees branch or correspondence

relationship with Banks/Exchange Houses. Although the nationalized and private commercial

banks have taken various marketing strategies to transIer remittances, but even today, the choice

oI remittance channel is 46 Iormal and 54 inIormal.

Recently, illegal transIer oI money slid down drastically, as Bangladesh Bank (BB) has stepped

up monitoring oI such transactions at home. BB so Iar gave license to 660 exchange houses to set

up oIIices abroad to Iacilitate remittance. Local banks are now able to deliver money to

recipients in weeks.

Introduction to Remittance in Bangladesh

Remittance is the liIe line oI Bangladesh economy. Some 4.5m nonresident Bangladeshis are

working abroad |9|, and sending home hard earned Ioreign currencies. It is believed that the

actual number oI Bangladeshi migrants, both legal and illegal, would be close to 7.5 million. In

the Iirst 10 months oI FY 2006-07, number oI manpower export stood at 0.42m, showing

83.14 rise, compared to 0.25m in FY2004-05 |7|. In FY2005-06, the number stood at 0.29m,

current year to year growth is around 16 |7|. In addition to achieving higher export earnings,

the country witnessed a 44 percent growth in remittance earnings during the Iirst quarter oI

2008-09 Iiscal year compared to the same period oI the previous Iiscal year |11|. The other

records oI remittance earnings in a single month are $820.71 million in July and $808.72 million

in March oI year 2008|11|. A total oI 9,81,102 Bangladeshi people went abroad in 2007-08 Iiscal

year which is about 74 percent above the previous Iiscal year Iigure, Bangladesh Bank statistics

|1| show|11|. According to the statistics, on monthly average basis more than 81,000

Bangladeshis went abroad in 2007-08 Iiscal year. The Iigure was 46,000 in the previous Iiscal

year |11|. Non-resident Bangladeshis (NRBs) sent $2.345 billion to Bangladesh between July

and September oI 2008, according to the Bangladesh Bank statistics |1|,|11|. Meanwhile, private

bank oIIicials said the global economic slowdown, mainly in the US and European countries, is

yet to impact the remittance inIlow. They, however, apprehend that iI the crisis continues it may

have a negative impact on the inIlow |11|.

The remittance market oI Bangladesh has been showing a steady growth in terms oI incoming

remittance volume. Considering the current macro-economic indicators: it seems that this

growth run will continue in the coming years. Central Bank |1| predicts that our annual incoming

Ioreign remittance will touch $10 billion in the next 3 years. The reasons Ior such robust growth

can be summarized as:

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Study of Assessment Methods of Working Capital Requirement For Bank of Maharashtra by Vaibhav JagatDocument91 pagesStudy of Assessment Methods of Working Capital Requirement For Bank of Maharashtra by Vaibhav JagatSrinivas TanneruNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Câu Trả Lời Ôn Tập Chapter 2Document5 pagesCâu Trả Lời Ôn Tập Chapter 2Đỗ ViệtNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Consolidated Bank v. CA GR 114286 Full TextDocument8 pagesConsolidated Bank v. CA GR 114286 Full TextavrilleNo ratings yet

- Iron Ore 63 - FOB Contract - 210313Document28 pagesIron Ore 63 - FOB Contract - 210313dis is a pongNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Methods of Export FinanceDocument50 pagesMethods of Export Financedranita@yahoo.com67% (3)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Deed of Agreement For SBLDocument23 pagesDeed of Agreement For SBLpavan devNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Methods of Payment in International TradeDocument13 pagesMethods of Payment in International Tradelovepreet singhNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Short Term FinancingDocument39 pagesShort Term Financingfaysal.bhatti3814No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- ICC Users Handbook For Documentary Credits Under UCP 600 PDFDocument10 pagesICC Users Handbook For Documentary Credits Under UCP 600 PDFnmhiri80% (10)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Annexure I Standardised Format For LCDocument5 pagesAnnexure I Standardised Format For LCNishit MarvaniaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Sr. No. Purchasing 4.1 Vendor InformationDocument6 pagesSr. No. Purchasing 4.1 Vendor Informationarun9698No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Pilipinas Bank V OngDocument2 pagesPilipinas Bank V OngWendy PeñafielNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Rwa SBLC Bank Letter Sample PDFDocument1 pageRwa SBLC Bank Letter Sample PDFJack Seagull100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- PNB V SMCDocument2 pagesPNB V SMCKim SimagalaNo ratings yet

- The Act Borrowers Guide To Lma Loan Documentation For Investment Grade Borrowers June 2014 SupplementDocument20 pagesThe Act Borrowers Guide To Lma Loan Documentation For Investment Grade Borrowers June 2014 SupplementkamisyedNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Requirement of JSW Global Business Solutions Pvt. LTD CBD Belapur Under Apprenticeship Training ProgramDocument2 pagesRequirement of JSW Global Business Solutions Pvt. LTD CBD Belapur Under Apprenticeship Training ProgramShivraj GhodeswarNo ratings yet

- Data Base Management DataflowDocument49 pagesData Base Management DataflowGhanShyam ParmarNo ratings yet

- NegoDocument24 pagesNegoBirs BirsNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

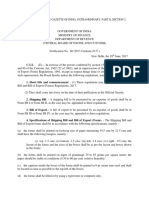

- (To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )Document47 pages(To Be Published in The Gazette of India, Extraordinary, Part Ii, Section 3, Sub-Section (I) )HimanshuKaushikNo ratings yet

- Siemens Group Medical Insurance Guideline 2015-16Document34 pagesSiemens Group Medical Insurance Guideline 2015-16Vani ShriNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Tcode GTSDocument30 pagesTcode GTSrprabhakt4000% (1)

- Management of Fin Serv QuizDocument22 pagesManagement of Fin Serv QuizSidharth BharathNo ratings yet

- Letter of CreditDocument113 pagesLetter of CredithumairashehlaNo ratings yet

- Red Notes: Mercantile LawDocument36 pagesRed Notes: Mercantile Lawjojitus100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Jurists Lecture (Special Commercial Laws)Document27 pagesJurists Lecture (Special Commercial Laws)Lee Anne YabutNo ratings yet

- LESSON N°1: Standard Provisions (1) : Legal EnglishDocument26 pagesLESSON N°1: Standard Provisions (1) : Legal EnglishJacques TiroufletNo ratings yet

- HYDRO RESOURCES CONTRACTORS CORPORATION v. CADocument14 pagesHYDRO RESOURCES CONTRACTORS CORPORATION v. CAChou TakahiroNo ratings yet

- Iraqi Local Governance Law Library - Regulations For Implementing Government Contracts - 2013-03-10Document15 pagesIraqi Local Governance Law Library - Regulations For Implementing Government Contracts - 2013-03-10Venugopal HonavanapalliNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Current Trends in International MarketingDocument13 pagesCurrent Trends in International Marketingseema talrejaNo ratings yet

- Arrieta Vs Natl Rice and Corn CorpDocument1 pageArrieta Vs Natl Rice and Corn Corpkhayis_belsNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)