Professional Documents

Culture Documents

Leonie M Brinkema Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leonie M Brinkema Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

Rev.

1/2011

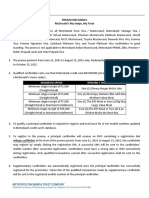

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. 101-111)

1. Person Reporting (last name, first, middle initial) Brinkema, Leonie M.

4. Title (Article II1 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report

United States District Court for the Eastern District of Virginia (Alexandria Division)

5a. Report Type (check appropriate type) [] Nomination, [] Initial Date [] Annual [] Final

May 15, 2011

6. Repo~ng Pe~od

United States District Judge (active) 7. ChambersorOfficeAddress Albert V. Bryan U.S. Courthouse 401 Courthouse Square Alexandria, VA 22314-5799

1/1/lO to 12/31/lO

5b. [] Amended Report 8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in complianci~ with applicable laws and regulations.

Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followel Complete all parts, checking the NONE box for each part where you have no reportable information. Sign on last pag~

I. POSITIONS. (Repora,,g individual only; see pp. 9-13 of filing instructions.)

[-~ NONE (No reportable positibns.)

POSITION

NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. ~Re~,ort~.g individual only; seepp. 14-16 of filing instructions.)

[-~ NONE (No reportable agreements.)

DATE PARTIES AND TERMS

Brinkema, Leonie M.

FINANCIAL DISCLOSURE REPORT Page 2 of 6

Name of Person Reporting

Brinkema, Leonie M.

Date of Report May 15, 2011

III. NON-INVESTMENT INCOME. (Reporting individual and spouse; seepp. 17-24 of filing i,structions.)

A. Filers Non-Investment Income ~-] NONE (No reportable non-investment income.)

DATE SOURCE AND TYPE

INCOME (yours, not spouses)

B. Spouses Non-Investment Income - If you were married during anyportion of the reportingyear, complete this section.

(Dollar amount not required except for honoraria.,)

~-~

NONE (No reportable non-investment income.) DATE SOURCE AND TYPE

2. 3. 4.

IV. REIMBURSEMENTS - t~anspartatiou, lodgi,g, Sood, entertainmen,

(Includes those to spouse and dependent children; see pp. 25-27 o filling instructions.)

NONE (No reportable reimbursements.) LOCATION DATES March 15-16, 2010 Lexinqton, VA PURPOSE Presented Lecture ITEMSPAID OR PROVIDED One night lodging and food

SOURCE Wasington and Lee ].Law School 2. 3. 4. 5.

FINANCIAL DISCLOSURE REPORT Page 3 of 6

Name of Person Reporting

Brinkema, Leonie M.

Date of Report May 15, 2011

V. GIFTS. a.c1,,des a, ose ,o ~,,o,~ 0.~ ~p~.~,,, c,,it~re.; s~ pp. 28-31 of filing instmctio.$.)

NONE (No reportable gifts.) SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. a,,.t.d~; a, os~ o/ ~0o.~ a.d dependent cMldren; see pp. 32-33 of filing instructions.)

NONE (No reportable liabilities.)

CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 6

Name of Person Reporting

Date of Reporl May 15, 2011

Brinkema, Leonie M.

VII. INVESTMENTS and TRUSTS - i.come, val.e, transactions, attcllldes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place"(X)" alder each asset exempt from prior disclosure B. : Income d~ng reportingpefibd: (1) Amount Cod~ 1 (A-H) C. Gross value at end of reporting period (1) (2) (2) Type (e.g., Value , : Value div:~rent, Code 2 Method Code 3 or inE) ........ O-P) (Q-W) D. Transactions during reporting period (1) Type (e.g., buy, sell, (gdemption) (2) Date mm/dd/yy (3) (~) Value ~ Gain Code 2 Code 1 (J-P) (A-H) (5) Identity of buyer/seller (if private transaction)

1. IRA-Keogh Merrill Lynch Blackrock Basic Mutual Fund 2. IRA-American Century Fund Ultra Mutual Fund and Schwab MMF

3. IRA-Sun Trust Bank Orlando Fla. Cert. of Deposit 4. United States Savings Bonds Series EE BB&T Checking Account

div. int.

D A A A

int. int. int. int.

L J j J T T T

I0. II. 12. 13. 14. 15. 16. 17.

I. Income Gaih Codes! : (See Columns BI and D4) Z Value Codes (See Columns C1 and D3) 3. Value Method Codes (See Column C2)

A ~$i 000 6le~g : F =$50,001 - $100,000 J=$15~OOOorless N =$250,001 - $500,000 P3 =$25 ~ 000 , 001 - $50,000,000 Q =Appraisal U =Book Value

B i$i;00i - $2,500 G =$100,001 - $1,000,000 K =$15~001 -$50,000 0 =$500,001 - $1,000~000 R =Cost (Real Estaie Only) V =Other

c =$2,501 - $5,000 HI =$1~000,00! - $5,000,000 L =$50,001 - $i00,000 PI =$1 ~000,001 -$5,000;000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M -$100,001 ~ $250,000 P2 =$5,0001001 - $25,000,000 Y =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 6

Name of Person Reporting Brinkema, Leonie M.

Date of Report May 15, 2011

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

FINANCIAL DISCLOSURE REPORT Page 6 of 6

Name of Person Reporting

Dale of Repor~ May 15,2011

Brinkema, Leonie M.

IX. CERTIFICATION.

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure.

I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature:

s/ Leonie M. Brinkema

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO C1VIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- Opinion - JW V NavyDocument7 pagesOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- Holder Travel Records CombinedDocument854 pagesHolder Travel Records CombinedJudicial Watch, Inc.No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Water Test ReportDocument2 pagesGitmo Water Test ReportJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JW Cross Motion v. NavyDocument10 pagesJW Cross Motion v. NavyJudicial Watch, Inc.No ratings yet

- Visitor Tent DescriptionDocument3 pagesVisitor Tent DescriptionJudicial Watch, Inc.No ratings yet

- Navy Water Safety ProductionDocument114 pagesNavy Water Safety ProductionJudicial Watch, Inc.No ratings yet

- May 2007 BulletinDocument7 pagesMay 2007 BulletinJudicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- 'KS22936'20201214Document1 page'KS22936'20201214Aakash PrajapatiNo ratings yet

- What Is Systematic Investment PlanDocument5 pagesWhat Is Systematic Investment PlanAbhijitNo ratings yet

- 12Document16 pages12JDNo ratings yet

- May 2004Document83 pagesMay 2004DeepakSehrawatNo ratings yet

- BS Moudule 2Document5 pagesBS Moudule 2Ram VeenNo ratings yet

- Boi MF Common Application FormDocument3 pagesBoi MF Common Application FormQUSI E. ABDNo ratings yet

- Paper 4 Studycafe - inDocument28 pagesPaper 4 Studycafe - inApeksha ChilwalNo ratings yet

- Annexa Prime Trading CoursesDocument11 pagesAnnexa Prime Trading CoursesFatima FX100% (1)

- Personal Finance SyllabusDocument5 pagesPersonal Finance SyllabusRaymond DiazNo ratings yet

- Project Report: "A Descriptive Analysis of Depository Participant WithDocument97 pagesProject Report: "A Descriptive Analysis of Depository Participant WithJOMONJOSE91No ratings yet

- Capital Budgeting Case StudyDocument3 pagesCapital Budgeting Case StudySafi Sheikh100% (1)

- 2021 - MSMT (McDonald's) - Promo Mechanics - 0620Document4 pages2021 - MSMT (McDonald's) - Promo Mechanics - 0620kheriane veeNo ratings yet

- Differences Between A Partnership and CorporationDocument4 pagesDifferences Between A Partnership and CorporationIvan BendiolaNo ratings yet

- Goldilocks-All Bout GoldilocksDocument13 pagesGoldilocks-All Bout GoldilocksCharisse Nhet Clemente64% (14)

- BOI-business Guide 2017-20170222 - 44021Document146 pagesBOI-business Guide 2017-20170222 - 44021Kamon Eak AungkhasirikunNo ratings yet

- New Summer Training Project ReportDocument62 pagesNew Summer Training Project ReportSagar Bhardwaj100% (1)

- Management Accounting Module - VDocument11 pagesManagement Accounting Module - Vdivya kalyaniNo ratings yet

- Accountant - MIS Reporting.Document3 pagesAccountant - MIS Reporting.Fazlihaq DurraniNo ratings yet

- D. All of ThemDocument6 pagesD. All of ThemRyan CapistranoNo ratings yet

- 44th Annual Report 2005-2006: National Organic Chemical Industries LimitedDocument73 pages44th Annual Report 2005-2006: National Organic Chemical Industries Limitedsandesh1506No ratings yet

- Inner Circle Trader Ict Forex Ict NotesDocument110 pagesInner Circle Trader Ict Forex Ict NotesjcferreiraNo ratings yet

- Housing ReportDocument6 pagesHousing ReportJasmin QuebidoNo ratings yet

- Report Sales Periode 23, OktDocument5 pagesReport Sales Periode 23, OktgarnafiqihNo ratings yet

- Corporate Liquidation Problem SolvingDocument21 pagesCorporate Liquidation Problem SolvingRujean Salar AltejarNo ratings yet

- Final Report On Attock - IbfDocument25 pagesFinal Report On Attock - IbfSanam Aamir0% (1)

- Double Entry PresentationDocument16 pagesDouble Entry Presentation409005091No ratings yet

- Brokers' Voice Survey Results - January 29th, 2021Document17 pagesBrokers' Voice Survey Results - January 29th, 2021Avishek JaiswalNo ratings yet

- Muntiariani - NTUC Income-Security BondDocument2 pagesMuntiariani - NTUC Income-Security BondSyscom PrintingNo ratings yet

- Apac DataDocument1,990 pagesApac DatamohanNo ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseKim GarridNo ratings yet