Professional Documents

Culture Documents

Lesson 15

Uploaded by

Husban Ahmed ChowdhuryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 15

Uploaded by

Husban Ahmed ChowdhuryCopyright:

Available Formats

Lesson 15

B a n k i n g

While walking in the streets oI any town or city you might have seen some signboards on buildingswith names-Canara Bank, Punjab

National Bank, State Bank oI India, United Commercial Bank,etc. What do these names stand Ior? Did you ever try to

know about them? II you enter any such building you will Iind some kind oI a business oIIice. You will see some employees

sitting behindcounters dealing with visitors standing in Iront oI them. You will Iind that some are depositingmoney

at one counter while some are receiving money at another counter. Behind the counters inthe oIIice you will

see tables and chairs occupied by oIIicers. On one side oI the oIIice you willalso see a chamber (small partitioned room)

where the manager is sitting with papers on his table.This is the oIIice oI a Bank`.Let us know in detail about banks and

their activities.

1 5 . 1 Ob j e c t i v e s

AIter studying this lesson, you will be able to:

state the meaning oI bank`;

explain the role oI banking`;

identiIy the diIIerent types oI banks; and

describe the Iunctions oI a commercial bank.

1 5 . 2 Me a ni ng o f Ba nk

You know people earn money to meet their day-to-day expenses on Iood, clothing, education oI children, housing,

etc. They also need money to meet Iuture expenses on marriage, higher education oI children, house building and other social

Iunctions. These are heavy expenses, which can bemet iI some money is saved out oI the present income.

Saving oI money is also necessary Ior oldage and ill health when it may not be possible Ior people to work and

earn their living.The necessity oI saving money was Ielt by people even in olden days. They used to hoard

moneyin their homes. With this practice, savings were available Ior use whenever needed, but it

alsoinvolved the risk oI loss by theIt, robbery and other accidents. Thus, people were in need oI

a place where money could be saved saIely and would be available when required.

Banks aresuch places where people can deposit their savings with the assurance that they will

be able towithdraw money Irom the deposits whenever required. People who wish to borrow

money Ior business and other purposes can also get loans Irom the banks at reasonable rate oI

interest.Bank is a lawIul organisation, which accepts deposits that can be withdrawn

ondemand. It also lends money to individuals and business houses that need it.Banks also render many other

useIul services like collection oI bills, payment oI Ioreign bills,saIe-keeping oI jewellery and other valuable

items, certiIying the credit-worthiness oI business,and so on.Banks accept deposits Irom the general public as

well as Irom the business community. Any onewho saves money Ior Iuture can deposit his savings in a bank.

Businessmen have income Iromsales out oI which they have to make payment Ior expenses. They can keep

their earnings Iromsales saIely deposited in banks to meet their expenses Iromtime to time. Banks give two assurancesto the

depositors a . S a I e t y o I d e p o s i t , a n d b. Wi t hdrawal oI depos i t ,

whenever neededOn deposits, banks give interest, which adds to the original

amount oI deposit. It is a greatincentive to the depositor. It promotes saving habits among the public.

On the basis oI deposits banks also grant loans and advances to Iarmers, traders and businessmen Ior productive

purposes.Thereby banks contribute to the economic development oI the country and well being oI

the people in general. Banks also charge interest on loans. The rate oI interest is generally higher thanthe rate oI

interest allowed on deposits. Banks also charge Iees Ior the various other services,which they

render to the business community and public in general. Interest received on loansand Iees

charged Ior services which exceed the interest allowed on deposits are the main sourcesoI income Ior banks Irom

which they meet their administrative expenses.The activities carried on by banks are called banking

activity. Banking` as an activity involvesacceptance oI deposits and lending or investment oI money.

It Iacilitates business activities by providing money and certain services that help in exchange oI

goods and services. ThereIore, banking is an important auxiliary to trade. It not only

provides money Ior the production oI goods and services but also Iacilitates their exchange between

the buyer and seller.You may be aware that there are laws which regulate the banking

activities in our country.Depositing money in banks and borrowing Irom banks are legal

transactions. Banks are alsounder the control oI government. Hence they enjoy the

trust and conIidence oI people. Also banks depend a great deal on public conIidence. Without public conIidence

banks cannot survive.

15.3Distinction between banks and moneylenders

You may be thinking that a bank is like a moneylender who provides Iunds to borrowers

andcharges interest on the loan. But it is not so. A bank is quite diIIerent Irom a moneylender.

A bank perIorms two main Iunctions. Firstly, it accepts deposits, and on that basis it lends money.The

moneylenders, on the other hand, advance money out oI their own private wealth and usuallydo not accept deposits Irom

others. The Iollowing table shows the distinction between a bank and moneylender.

B a s i s B a

n k s M o n

e y l e n d e

r s

1 . E n t i t y B a n k a r e o r g a n i s e d i n s t i t u t

i o n s . M o n e y l e n d e r s a r e i n d i v i d u a l s .

2 . A c t i v i t y B a n k i n g a c t

i v i t i e s A c t i v i t i e s o I m

o n e y l e n d e r i n c l u d e a c

c e p t a n c e m a y n o t i n c l

u d e o I d e p o s i t s a s w e l l a s a

c c e p t a n c e o I d e p o s i t s . lending

oI money.3 . C l i e n t s B a n k s m e

e t t h e n e e d s M o n e y l e

n d e r s m e e t o I p e o p l

e i n g e n e r a l t h e n e

e d s a n d t h e b u s i n e s s o

I a g r i c u l t u r i s t s a n d c

o m m u n i t y i n p a r t i c u l a r . p o o r

p e o p l e . 4 . S e c u r i t y B a n k s a c

c e p t t a n g i b l e M o n e y l e n d e

r s g e n e r a l l y a n d p e r s o n a l s

e c u r i t y a c c e p t g o l d , j e w e l l e

r y a g a i n s t l o a n s . o

r l a n d a s s e c u r i

t y Ior giving

loan.5 . P r o c e s s o I T h

e p r o c e s s o I T h e

p r o c e s s o I r e c

o v e r y o I r e c o v

e r y i s r e c o v e r

y i s l o a n s . I l

e x i b l e . r i g i

d a n d s t r i c

t . 6 . I n t e r e s t R a t e I n t

e r e s t c h a r g e d b y R a t e

o I I n t e r e s t b a n k s o n l

o a n i s i s d e c i d e d b y t h e

m o n e y l e n d e r g o v e r n e d

b y R B I . a n d i s n o r m a l l y

v e r y h i g h .

1 5 . 4 Ro l e o f Ba n ki ng

Banks provide Iunds Ior business as well as personal needs oI individuals. They play a signiIicantrole in the economy oI a

nation. Let us know about the role oI banking.

It encourages savings habit amongst people and thereby makes Iunds available Ior productiveuse.

It acts as an intermediary between people having surplus money and those requiring moneyIor various business

activities.

It Iacilitates business transactions through receipts and payments by cheques instead oI currency.

It provides loans and advances to businessmen Ior short term and long-term purposes.

It also Iacilitates import export transactions.

It helps in national development by providing credit to Iarmers, small-scale industries andselI-employed people

as well as to large business houses which lead to balanced economicdevelopment in the country.

It helps in raising the standard oI living oI people in general by providing loans Ior purchaseoI consumer

durable goods, houses, automobiles, etc.

ntext Questions 15.1

Fill in the blanks with suitable word (s):(a)A bank accepts deposits Irom people

and money to those who need it Ior various purposes.(b)Banks act as

between people having surplus money and those borrowing

money.(c)Banking Iacilitates business activities and is considered as an

important auxiliary to .(d)Banks Iacilitate payment through

instead oI currency.(e)A advances money out oI his

own private wealth and generally does notaccept deposits Irom

others.

15. 5Types of Banks

There are various types oI banks which operate in our country to meet the Iinancial requirementsoI diIIerent

categories oI people engaged in agriculture, business, proIession, etc. On the basis oI Iunctions, the banking institutions in

India may be divided into the Iollowing types:Types oI

BanksC e n t r a l B a n k D e v e

l o p m e n t B a n k s S p e c i

a l i s e d B a n k s ( R

B I , i n

I n d i a

) ( E X I M

B a n k SIDBI

,

NABARD)C o m m e r c i a l B a n

k s C o -

o p e r a t i v e B a n k s ( i

) P u b l i c S e c t o r B a n k s (

i ) P r i m a r y C r e d i t S o c i

e t i e s ( i i ) P r i v a t e S e c t o r

B a n k s ( i i ) C e n t r a l C o -

o p e r a t i v e B a n k s ( i i i ) F o

r e i g n B a n k s ( i i i ) S t a

t e C o -

o p e r a t i v e B a n k s Now let us learn

about each oI these banks in detail.

Banking

7

a) Central Bank

A bank which is entrusted with the Iunctions oI guiding and regulating the banking system oI acountry is

known as its Central bank. Such a bank does not deal with the general public. It actsessentially as

Government`s banker, maintain deposit accounts oI all other banks and advancesmoney to other banks,

when needed. The Central Bank provides guidance to other bankswhenever they

Iace any problem. It is thereIore known as the banker`s bank. The ReserveBank oI

India is the central bank oI our country.The Central Bank maintains record oI Government revenue and expenditure under

various heads.It also advises the Government on monetary and credit policies and decides on the interest ratesIor

bank deposits and bank loans. In addition, Ioreign exchange rates are also determined by thecentral bank.Another

important Iunction oI the Central Bank is the issuance oI currency notes, regulating their circulation in the country

by diIIerent methods. No other bank than the Central Bank can issuecurrency.

b) Commercial Banks

Commercial Banks are banking institutions that accept deposits and grant short-term loans andadvances to their

customers. In addition to giving short-term loans, commercial banks also givemedium-term and long-term loan

to business enterprises. Now-a-days some oI the commercial banks are also providing housing loan on a

long-term basis to individuals. There are also manyother Iunctions oI commercial banks, which are

discussed later in this lesson.

Types of Commercial banks:

Commercial banks are oI three types i.e., Public sector banks,Private sector banks and Foreign

banks.(i)

Public Sector Banks

: These are banks where majority stake is held by the Government oI India or Reserve Bank oI India. Examples

oI public sector banks are: State Bank oI India,Corporation Bank, Bank oI Boroda and Dena Bank, etc.( i i)

Private Sectors Banks

: In case oI private sector banks majority oI share capital oI the bank is held by private

individuals. These banks are registered as companies with limitedliability. For example: The Jammu

and Kashmir Bank Ltd., Bank oI Rajasthan Ltd.,Development Credit Bank Ltd,

Lord Krishna Bank Ltd., Bharat Overseas Bank Ltd.,Global Trust Bank, Vysya Bank, etc.( iii)

oreignBanks

: These banks are registered and have their headquarters in a Ioreign country but operate their branches in our

country. Some oI the Ioreign banks operating in our country are Hong Kong and

Shanghai Banking Corporation (HSBC), Citibank, AmericanExpress Bank, Standard & Chartered Bank,

Grindlay`s Bank, etc. The number oI Ioreign banks operating in our country has increased since the Iinancial

sector reIorms oI 1991.

c) Development Banks

Business oIten requires medium and long-termcapital Ior purchase oI machinery and equipment,Ior using latest technology,

or Ior expansion and modernization. Such Iinancial assistance is provided by Development

Banks. They also undertake other development measures like ubscribing to the shares

and debentures issued by companies, in case oI under subscription oI the issue by the public.

Industrial Finance Corporation oI India (IFCI) and State FinancialCorporations

(SFCs) are examples oI development banks in India.

d)

Co-operative Banks

People who come together to jointly serve their common interest oIten Iorm a co-

operativesociety under the Co-operative Societies Act. When a co-operative

society engages itselI in banking business it is called a Co-operative Bank. The society has

to obtain a licence Irom theReserve Bank oI India beIore starting banking business. Any co-

operative bank as a society isto Iunction under the overall supervision oI the Registrar, Co-

operative Societies oI the State.As regards banking business, the society must Iollow the guidelines set and issued by the

ReserveBank oI India.

Types of Co-operative Banks

There are three types oI co-operative banks operating in our country. They are primary

creditsocieties, central co-operative banks and state co-operative banks. These banks are

organizedat three levels, village or town level, district level and state level.(i)

Primary Credit Societies

: These are Iormed at the village or town level with borrower and non-borrower members

residing in one locality. The operations oI each society arerestricted to a small area so that the

members know each other and are able to watch over the activities oI all members to prevent Irauds.( ii )

Central Co-operative Banks

: These banks operate at the district level having some oI the primary credit societies belonging

to the same district as their members. These banks provide loans to their members (i.e., primary credit societies) and

Iunction as a link betweenthe primary credit societies and state co-operative banks.( iii)

State Co-operative Banks

: These are the apex (highest level) co-operative banks in allthe states oI the country. They mobilise

Iunds and help in its proper channelisation amongvarious sectors. The money reaches the individual borrowers

Irom the state co-operative banks through the central co-operative banks and the primary credit

societies.

e) Specialised Banks

There are some banks, which cater to the requirements and provide overall support Ior settingup

business in speciIic areas oI activity. EXIM Bank, SIDBI and NABARD are examples oI such

banks. They engage themselves in some speciIic area or activity and thus, are

calledspecialised banks. Let us know about them.

i.Export mport Bank of ndia (EXM Bank)

: II you want to set up a business Ior exporting products abroad or importing products IromIoreign countries Ior sale in our country,

EXIM bank can provide you the required support and assistance. The bank grants

loans toexporters and importers and also provides inIormation about the international

market. Itgives guidance about the opportunities Ior export or import, the risks involved in it and

thecompetition to be Iaced, etc.

Smal l ndustri es Devel opment Bank of ndi a ( SDB ) :

II you want to establish asmall-scale business unit or industry, loan on easy terms can be available

through SIDBI. Italso Iinances modernisation oI small-scale industrial units, use oI new technology and marketactivities.

The aim and Iocus oI SIDBI is to promote, Iinance and develop small-scaleindustries.

iii.National Bank for Agricultural and Rural Development (NABARD):

It is a centralor apex institution Ior Iinancing agricultural and rural sectors. II a person is engaged

inagriculture or other activities like handloom weaving, Iishing, etc. NABARD can providecredit, both short-

term and long-term, through regional rural banks. It provides Iinancialassistance, especially, to co-

operative credit, in the Iield oI agriculture, small-scale industries,cottage and village industries handicraIts and allied economic

activities in rural areas.

ntext Questions 15.2

IdentiIy the type oI bank being talked about in each oI the Iollowing statements:(a)The bank that

undertakes to subscribe to shares and debentures oI a company in case

oI under subscription.(b)The bank that provides assistance and guidance Ior export oI

products abroad.(c)The bank Iormed by a group oI people to serve their common

interest.(d)The bank that issues currency notes.(e)The commercial bank

where the government holds majority stake.

15.6unctions of Commercial Banks

The Iunctions oI commercial banks are oI two

types.( A ) P r i m a r y I u n c t i o n s ; a n d ( B ) S e c o n d a r

y I u n c t i o n s . Let us discuss details about these Iunctions.

(i) Primary functions

The primary Iunctions oI a commercial bank include:a)Accepting deposits; and b)Granting loans and

advances.a)

Accepting deposits

The most important activity oI a commercial bank is to mobilise deposits Iromthe public. Peoplewho have surplus

income and savings Iind it convenient to deposit the amounts with

banks.Depending upon the nature oI deposits, Iunds deposited with bank also earn

interest. Thus

deposits with the bank grow along with the interest earned. II the rate oI interest is higher, publicare motivated to

deposit more Iunds with the bank. There is also saIety oI Iunds deposited withthe bank.

b)Grant of loans and advances

The second important Iunction oI a commercial bank is to grant loans and advances. Such loansand advances

are given to members oI the public and to the business community at a higher rateoI interest than allowed by

banks on various deposit accounts. The rate oI interest charged onloans and advances varies

according to the purpose and period oI loan and also the mode oI repayment.

i ) L o a n s

A loan is granted Ior a speciIic time period. Generally commercial banks provide short-termloans. But term

loans, i.e., loans Ior more than a year may also be granted. The borrower may be given the entire

amount in lump sum or in instalments. Loans are generally grantedagainst the security oI certain assets.

A loan is normally repaid in instalments. However, itmay also be repaid in lump sum.

i i ) Ad v a nc e s

An advance is a credit Iacility provided by the bank to its customers. It diIIers Irom loan inthe

sense that loans may be granted Ior longer period, but advances are normally granted Ior a short period oI

time. Further the purpose oI granting advances is to meet the day-to-dayrequirements oI business.

The rate oI interest charged on advances varies Irom bank to bank.Interest is charged only on the amount

withdrawn and not on the sanctioned amount.

Types of Advances

Banks grant short-term Iinancial assistance by way oI cash credit, overdraIt and bill discounting.Let us learn

about these.

a ) Ca s h Cr e d i t

Cash credit is an arrangement whereby the bank allows the borrower to draw amount uptoa

speciIied limit. The amount is credited to the account oI the customer. The customer canwithdraw this

amount as and when he requires. Interest is charged on the amount actuallywithdrawn. Cash

Credit is granted as per terms and conditions agreed with the customers.

b ) O v e r d r a f t

OverdraIt is also a credit Iacility granted by bank. A customer who has a current accountwith the

bank is allowed to withdraw more than the amount oI credit balance in his account.It is a temporary

arrangement. OverdraIt Iacility with a speciIied limit may be allowed either on the security oI assets, or

on personal security, or both.

c)Di scount i ng of Bi l l s

Banks provide short-termIinance by discounting bills, that is, making payment oI the amount beIore the due date oI the bills

aIter deducting a certain rate oI discount. The party gets theIunds without waiting Ior the date oI

maturity oI the bills. In case any bill is dishonoured onthe due date, the bank can recover the amount

Irom the customer.

Secondary functions

In addition to the primary Iunctions oI accepting deposits and lending money, banks perIorm anumber oI other

Iunctions, which are called secondary Iunctions. These are as Iollows-a.Issuing letters oI credit,

travellers cheque, etc. b.Undertaking saIe custody oI valuables, important document and

securities by providingsaIe deposit vaults or lockers.c.Providing customers with

Iacilities oI Ioreign exchange dealings.d. Trans Ier r i ng money Irom one account

t o anot her; and Ir om one branch t o anot her branch oI the bank through

cheque, pay order, demand draIt.e.Standing guarantee on behalI oI its customers,

Ior making payment Ior purchase oI goods, machinery, vehicles

etc.I.Collecting and supplying business inIormation.g. Providing reports on the

credit worthiness oI customers. i.Providing consumer Iinance Ior individuals by way oI

loans on easy terms Ior purchaseoI consumer durables like televisions, reIrigerators,

etc. j.Educational loans to students at reasonable rate oI interest Ior higher studies, especiallyIor

proIessional courses.

ntext Questions 15.3

State which oI the Iollowing statements are True and which are Ialse. Write T` Ior True and F`Ior a False

statement:(a)Loans and advances are both granted by banks to customers Ior a long

period oI time.(b)Banks keep our jewellery and important documents saIe with

them.(c)Banks grant loans to students Ior their studies at reasonable interest

rate.(d)Discounting oI bills is done by banks Iree oI cost.(e)Through overdraIt,

a customer can withdraw more money than the amount in his/her

bank account.

15.7E-banking (Electronic Banking)

With advancement in inIormation and communication technology, banking services are also madeavailable through

computer. Now, in most oI the branches you see computers being used torecord

banking transactions. InIormation about the balance in your deposit account can

beknown through computers. In most banks now a days human or manual teller counter is

beingreplaced by the Automated Teller Machine (ATM). Banking activity carried on through computersand other electronic

means oI communication is called electronic banking` or e-banking`.

Letus now discuss about some oI these modern trends in banking in India.

Automated Teller Machine

Banks have now installed their own Automated Teller Machine (ATM) throughout the country atconvenient locations. By using

this, customers can deposit or withdraw money Irom their ownaccount any time.

Debit Card

Banks are now providing Debit Cards to their customers having saving or current account in the banks. The

customers can use this card Ior purchasing goods and services at diIIerent places inlieu oI cash.

The amount paid through debit card is automatically debited (deducted) Irom thecustomers`

account.

Credit Card

Credit cards are issued by the bank to persons who may or may not have an account in the bank.Just like debit

cards, credit cards are used to make payments Ior purchase, so that the individualdoes not have to carry

cash. Banks allow certain credit period to the credit cardholder to make payment oI the

credit amount. Interest is charged iI a cardholder is not able to pay back thecredit

extended to him within a stipulated period. This interest rate is generally quite high.

Net Banking

With the extensive use oI computer and Internet, banks have now started

transactions over Internet. The customer having an account in the bank can log into the bank`s website and

accesshis bank account. He can make payments Ior bills, give instructions Ior money transIers,

Iixeddeposits and collection oI bill, etc.

Phone Banking

In case oI phone banking, a customer oI the bank having an account can get inIormation oI

hisaccount, make banking transactions like, Iixed deposits, money transIers, demand draIt, collectionand payment oI bills, etc. by

using telephone .As more and more people are now using mobile phones,

phone banking is possible throughmobile phones. In mobile phone a customer can receive and send

messages (SMS) Irom and tothe bank in addition to all the Iunctions possible through phone banking.

ntext Questions 15.4

Match the statement in column A with the word(s) / terms in column B:

C o l u m n

A C o l u m n

B

( a ) T h e b a n k i n g I a c i l i t y t

h a t h e l p s u s t o m a k e ( i ) A T

M payments out oI our bank account withoutactually carrying money with

us.( b ) T h e b a n k i n g I a c i l i t y e n a b l i n

g u s t o d e p o s i t ( i i ) P h o n e B a n k i n

g or withdraw cash 24 hours a day

T h e I a c i l i t y t h a t h e l p s u s t o p e r I

o r m b a n k i n g ( i i i ) C r e d i t C a r d transactions over the

Internet.( d ) W e c a n g e t i n I o r m a t i o n a b o

u t t h e b a l a n c e i n ( i v ) D e b i t C a r d ou

r bank account over the mobile phone usingthis

Iacility( e ) T h e I a c i l i t y t h a t e n a b l e s u s t o m a

k e p a y m e n t I o r ( v ) N e t B a n k i n g purchase oI goods

by taking credit Irom the

bank

15. 8What You Have Learnt

A bank is an institution that accepts deposits Irom public and lends money to the peoplewho

need it.

Banking is an important auxiliary to trade.

Banks encourage savings and act as an intermediary between depositors and borrowers.

They help in credit transactions, Iacilitate export and import, help in national developmentand raise people`s

standard oI living.

Types oI banks-The Central Bank, RBI in India, acts as the government banker and issues

currencynotes in the country. It also acts as the banker`s bank.-The Commercial Banks provide

short and medium term loans and charge interest on it.They are oI three types Public Sector

Banks, Private Sector Banks and Foreign Banks.-Development banks lend Iunds to business Ior

medium to long term.-Co-operative banks are Iormed to serve common interest oI members. In

India, we have Primary Credit Societies (village level), Central co-operative Banks (district level) andState

Co-operative Banks (State level).-EXIM Bank provides guidance and support to

exporters and importers.-NABARD helps in Iinancing agricultural and other rural activities.

Functions oI Commercial Banks:- Primary Iunctions include accepting deposits, granting loans, advances, cash,credit,

overdraIt and discounting oI bills.- Secondary Iunctions include issuing letter oI credit, undertaking saIe custodyoI

valuables, providing consumer Iinance, educational loans, etc.

E-banking: With advancement in inIormation and communication technology, banking is perIormed

electronically through Credit Card, Debit Card and ATM, etc

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Analysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Document35 pagesAnalysis of Financial Performance Ratios for HP, IBM and DELL from 2008-2010Husban Ahmed Chowdhury100% (2)

- Factors Creating Health Hazard & Dysfunctional Stress in NSUDocument12 pagesFactors Creating Health Hazard & Dysfunctional Stress in NSUHusban Ahmed ChowdhuryNo ratings yet

- Banglalink Inspire Banglalink Business Banglalink Sme: Post-PaidDocument7 pagesBanglalink Inspire Banglalink Business Banglalink Sme: Post-PaidHusban Ahmed ChowdhuryNo ratings yet

- Ethical Strategy Policy For A RMG CompanyDocument2 pagesEthical Strategy Policy For A RMG CompanyHusban Ahmed ChowdhuryNo ratings yet

- City Bank's comprehensive financing and trade solutionsDocument6 pagesCity Bank's comprehensive financing and trade solutionsHusban Ahmed ChowdhuryNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- GFS CourseDocument2 pagesGFS CoursealiNo ratings yet

- Simple InterestDocument26 pagesSimple InterestVicencia GalbizoNo ratings yet

- Q6682-240312-001Document3 pagesQ6682-240312-001ing.jmatiasNo ratings yet

- Money SupplyDocument15 pagesMoney Supplyhasan jamiNo ratings yet

- Commercial Banks FunctionsDocument14 pagesCommercial Banks FunctionsSudheer Kumar SNo ratings yet

- Audit 2Document6 pagesAudit 2Frances Mikayla EnriquezNo ratings yet

- Construction Tender Notice for Grampanchayat BuildingDocument2 pagesConstruction Tender Notice for Grampanchayat BuildingSD TECHNo ratings yet

- GUINTO - Activity 1 - Loans and Impairment ReceivableDocument4 pagesGUINTO - Activity 1 - Loans and Impairment ReceivableGUINTO, DAN FRANCIS B.No ratings yet

- MD Zulhaidi 1Document1 pageMD Zulhaidi 1limcheeshin94No ratings yet

- Account Statement 010421 310322Document1 pageAccount Statement 010421 310322Suraj choudharyNo ratings yet

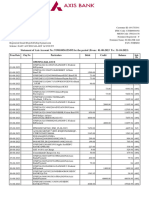

- Statement of Axis Account No:919010056153495 For The Period (From: 01-08-2023 To: 31-10-2023)Document5 pagesStatement of Axis Account No:919010056153495 For The Period (From: 01-08-2023 To: 31-10-2023)pooja.acharyaNo ratings yet

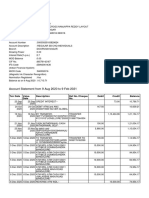

- Account Statement From 9 Aug 2020 To 9 Feb 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 9 Aug 2020 To 9 Feb 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuma0% (1)

- International Payment Methods UoSDocument2 pagesInternational Payment Methods UoSJusticeNo ratings yet

- Tajikistan's Leading Microfinance InstitutionDocument24 pagesTajikistan's Leading Microfinance InstitutionTyler DurdenNo ratings yet

- Office of The Adjudicating Officer, Government of Gujarat,: Kop QI MDocument10 pagesOffice of The Adjudicating Officer, Government of Gujarat,: Kop QI MAmrith RajNo ratings yet

- SSC CGL Aao Book by Tej PratapDocument135 pagesSSC CGL Aao Book by Tej Pratapsonumahour2408No ratings yet

- G. H. Bhakta Management Academy: A ON General Study OF at Surat Submitted ToDocument43 pagesG. H. Bhakta Management Academy: A ON General Study OF at Surat Submitted Toayush zadooNo ratings yet

- Kisan Credit CardDocument4 pagesKisan Credit CardBabuNo ratings yet

- List of Executive DirectorDocument5 pagesList of Executive DirectorYogesh ChhaprooNo ratings yet

- Commercial and Cooperative BanksDocument18 pagesCommercial and Cooperative BanksDODONo ratings yet

- Ringkasan Saham-20201120Document64 pagesRingkasan Saham-2020112012gogNo ratings yet

- TraveleenDocument5 pagesTraveleenshahrukhNo ratings yet

- Uplive Basic Policy With Detail NEW August 2022Document4 pagesUplive Basic Policy With Detail NEW August 2022just crizNo ratings yet

- Applying For A Business LoanDocument5 pagesApplying For A Business LoanAhmed AlhaddadNo ratings yet

- Al Kafalah Assignment Ctu 351 PDFDocument16 pagesAl Kafalah Assignment Ctu 351 PDFPiqsamNo ratings yet

- Rundown 2023Document15 pagesRundown 2023Ngurah YukaNo ratings yet

- Unit IV 2 Analytics in Business Support FunctionsDocument14 pagesUnit IV 2 Analytics in Business Support FunctionsKenil DoshiNo ratings yet

- BankCodeExposed 2Document624 pagesBankCodeExposed 2Property Wave100% (6)

- Banking Industry in India Central Bank of India CCDocument57 pagesBanking Industry in India Central Bank of India CCAmit PasiNo ratings yet

- A Proposal On Liquidity Analysis of Nepal Investment Bank Limited (Nibl)Document6 pagesA Proposal On Liquidity Analysis of Nepal Investment Bank Limited (Nibl)Samira ShakyaNo ratings yet