Professional Documents

Culture Documents

Dickinson R Debevoise Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dickinson R Debevoise Financial Disclosure Report For 2010

Uploaded by

Judicial Watch, Inc.Copyright:

Available Formats

Rev.

i/20ii

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization District Court - New Jersey

5a. Report Type (check appropriate type) ] Nomination, Date [] Annual [] Final

Report Required by the Ethics in Government Act of 1978 (5 U.S.C. app. b~5q 101-111)

1. Person Reporting (last name, first, middle initial) Debevoise, Dickinson R.

4. Title (Article 111 judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 4/15/201 I 6. Reporting Period 01/01/2010 to 12/31/2010

U.S. District Judge (Senior)

[] Initial

5b. [] Amended Report

7. Chambers or Office Address MLK, Jr. Federal Bldg. & Court 50 Walnut Street Newark, New Jersey 07102-0999

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance with applicable laws and regulations. Reviewing Officer Date

IMPORTANT NOTES: The instructions accompanying this form must be followed. Complete all parts,

checking the NONE box for each part where yoa have no reportable information. Sign on last page.

I. POSITIONS. (Reporting individual only; see pp. 9-13 of filing instructions.)

~ NONE (No reportable positions.) POSITION

1. Trustee 2. 3. 4. 5. Trustee NAME OF ORGANIZATION/ENTITY Fund for NJ (Non-Profit charitable foundation) Revocable Trust (See Note VIII).

II. AGREEMENTS. (Reporting individual only; seepp. 14-16 of filing instruction~)

~] NONE (No reportable agreements.)

DATE PARTIES AND TERMS

Debevoise, Dickinson R.

FINANCIAL DISCLOSURE REPORT Page 2 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report "4/15/2011

III. NON-INVESTMENT INCOME. (Reporting individual andspouse; seepp. 17-24 of filing instructions.)

A. Fliers Non-Investment Income

~] NONE (No reportable non-investment income.)

DATE

SOURCE AND TYPE

INCOME

(yours, not spouses)

2. 3. 4.

B. Spouses Non-Investment Income - lf you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.) DATE

1. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS -transportation, lodging, food, entertainment.

(Inchtdes those to spouse and dependent children; see pp. 25-27 of f!ling instructions.)

NONE (No reportable reimbursements.) SOURCE

1. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

V. GIFTS. ancludes those ,o spouse and dependent children; see pp. 28-31 of filing instructions.)

NONE (No reportable gifts.) SOURCE

1. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. (1,,ctuae~ a, os~ oy~poas~ and a~p,na, nt chlt,~r~n; s,, pp. ~2-~ of filing instructions.)

[~] NONE (No reportable liabilities.) CREDITOR

1. 2. 3. 4. 5.

DESCRIPTION

VALUE CODE

FINANCIAL DISCLOSURE REPORT Page 4 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

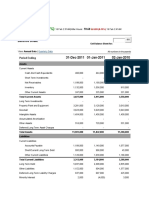

VII. INVESTMENTS and TRUSTS -ineo,,e, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

~-] NONE (No reportable income, assets, or transactions.) Description of Assets (including trust assets) Place "(x)" after each asset exempt from prior disclosure Income during repoaing period (l) (2) Amount Type (e.g., Code I div., rent, (A-H) or int.) Gross value at end of reporting period (t) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W) M J K J J J L J K T T T T T T T T T Redeemed K K T T Sold K K J PI T T T T Buy 07/15/10 07/08/101 J K A 07/15/10 J See VIII A See VIII See VIII See VIII See VIII See VIII See PartVlll See VllI Transactions during reporting period

(1) Type (e.g., buy, sell, redemption) (2) (3) Date Value mm/dd/yy Code 2 (J-P) (4) Gain Code 1 (A-H) (5) Identity of buyer/seller (if private transaction)

1. 2. 3. 4. 5. 6. 7. 8. 9.

UBS Financial Services Cash Fund, Iselin, NJ UBS Financial Services Cash Fund, Iselin, NJ PNC Bank, N.A., Millbum, NJ Wells Fargo, Millbum, NJ Wells Fargo, Newark, NJ Nuveen Bond Fund, Unit 519 (200) Williams College Pooled Income Fund #3 Wells Fargo, Summit, NJ ~ N.J. State Due 8/I/20

C A A

Interest Interest Interest None None

A C

Interest Interest None

B A B B A B B A E

Interest Interest Interest Interest Interest Dividend Interest Interest Dividend

10. ~ N.J. Health Care Auth. 07/01/20 11. [~Monmouth Cty. Imp. Auth. 12/01/16 12. ~ N.J. Health Care Auth. 07/01/12 13. 14. 15. 16. 17. Lopatcong Twp. 7/I 5/22 Allianz, SE PFD. WinslowTwp. Bd. of Ed. 8/01/19 Bank of America Brunswick, ME Trust See VIII

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50.001 o $100,000 J =$15,000 or less N =$250,001 - $500.000 P3 =$25.000.001 - $50,000,000 Q =Appraisal U =Book Value

13 =$1.00| - $2,500 G =$ I00,001 - $1,000,000 K =$15.001 - $50,000 O =$500,001 - $1.000.000 R ~Cos! (Real Estate Only) V =Other

C =$2.501 - $5,000 HI =$1,000,001 - $5,000,000 L =$50,001 - $100,000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000.000 S =Assessment W =Estimated

D :$5,9~ 1 - $15,~30 H2 =More than $5,000,000 M $100,001-$250,000 P2 -$5,000,001 - $25,000,000 T =Cash Market

E =$| 5,001 - $50,~00

FINANCIAL DISCLOSURE REPORT Page 5 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

VII. INVESTMENTS and TRU STS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (l) Amount Code l (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (l) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) (I) Type (e.g., buy, sell, redemption)

Transactions during reporting period

(2) (3) (4) Date Value Gain mm/dd!yy Code2 Code 1 (J-P) (A-H)

Identity of buyer/seller (if private transaction)

18. [~ Trust See Vlll 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. -BlackrockN.J. Munic. (BN) Bonds Fund 416 -BP PLC -BristolMyers Squibb Com. -Chevron Texaco Corp. Com. -International Paper Com. -RoxiticusGolfClub Com. -Kimberly-Clark Com. -BlackrockLiquidity Funds ~ Margate City 4.75% due on 2/I/17 -Cape May Co. N.J. College due 8/15116 -GeneralDynamies Com. -Johnson & Johnson Com. -IBM -Exelon Corp. -Harbor Fund lntemational -United Technologies Com.

Interest

PI

Sold

06/25/10

Sold

06/25/10 J

See VIII

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1.000 orlcss F =$50.001- $100,000 J =$15,000 orless N =$250,001- $500,000 P3 =$25,000,001- $50,000.000 Q=Appraisal U =Book Value

B =$1,001- $2.500 G =$100,001- $1,000,000 K =$15,001- $50,000 O=$500,001- $1.000,000 R =Cost(Real Estate Only) V = Other

C =$2,501 - $5,000 H I =$ 1,000,001 - $5,000,000 L =$50.001 - $100,000 P I =$ 1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

=$5,001 -$15,000 H2 =Morethan $5,000,000 M=$100,001- $250,000 P2 =$5,000,001- $25,000,000 -Cash Markcl

E =$15,001- $50,000

FINANCIAL DISCLOSURE REPORT Page 6 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

D NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during repotting period (1) Amounl Code I (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (1) (2) Value Value Code 2 (J-P) Method Code 3 Transactions during reporting period

(l)

Type (e.g., buy, sell, redemption)

(2)

Date mrn/dd/yy

(3)

Value Code 2 (J-P)

(4) Gain Code 1 (A-H)

(Q-W)

35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. ,48. 49. 50. 51. -Coca Cola -Proctor & Gamble Com. -McDonald Com. -FederatedStrat. Value (SVAAX) -BankofN.Y. Mellon -AT&T Com. -J.P. Morgan Chase -Bergen Cty IMRT Auth 2014 -Chubb Corp. -General Mills -Heinz -Hudson City Bancorp -Intel Corp. -Southern Co. -Union County lmpt 9/01/18 -N.J. Sp0rts& Expstin 9/01/19 -Pfizer, Inc. Sold 06/25/10 J A

(5) Identity of buyer/seller (if private transaction)

See VIII

I. Income Gain {odes: (See Columns B 1 and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column {2)

A =$1,000 or less F =$50,001 - $ 100.000 J =$15,000 or less N =$250.001 - $500,000 P3 =$25,000,001 - $50.000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$ 100,001 - $1,000,000 K = $15,001 - $ 50,000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 H I =$1,000,001 - $5,000,000 L -$50.001 - $ 100,000 P I =$1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Asscssment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M -$ 100,001 - $250,000 P2 -$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 7 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

VII. INVESTMENTS and TRUSTS - i ..... e, value, t ..... ctlons (Includes those of spouse and dependent children; see pp. 34-60 of.filing lnstructlons.)

D NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (1) Amount Code 1 (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (1) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W) (1) Type (e.g., buy, sell, redemption)

Transactions during reporting period

(2) (3) Date Value mm/dd/yy Code 2 (J-P)

(4) Gain Code 1 (A-H)

(5) Identity of buyer/seller (if private transaction)

52. 53. 54. 55. 56. 57. 58. 59. 60. 61, 62. 63. 64. 65. 66. 67. 68.

-Wisdom Large Cap Fund -BlackrockEQDiv#383 -ISHARESBarclays Trust -Franklin Tax Free TR #171 -MFS Value Fund Class I -ISHARES Russell Midcap FD -Pimco Strategy Fund -Fidelity Advisor Income Funds UBS Pace Fixed Income Fund (Formerly P.W. Invest. Account) HartfordGPA V Management account at PNC Bank, See VII1 Blackrock Money Market Fund Verizon Com. (Bell Atl) Chevron Texaco Corp. Com. Johnson& Johnson Exxon MobiICorp. Com. N.J. EDL FACS Auth. Due 7/01/20 A B A A A B Interest Dividend Dividend Dividend Dividend Interest K K J K J K T T T T T T D A Dividend Interest M K T T See VIII Buy

Buy

06/25/10 J

06/25/I 0 K

Buy

06/29/10 K

I. Income Gain Codes: (See Columns B 1 and D4) 2. Value Codes ( See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100.000 J =$I5,000 or less N =$250,001 - $500,000 P3 $25,000.001 - $50,000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1,000.000 K =$15,001 - $50.000 O =$500,00 t - $ 1,000,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5.000 HI =$1,000,001 - $5,000,000 L =$50,001 o $100,000 P I =$1,000.001 - $5,000,000 P4 =More than $50,000,000 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M $100,001-$250.000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 8 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

VII. INVES TMENTS and TRU S TS - i.come, vatue, transactions (Includes those of spouse and dependent children; see pp. 34-60 of fillng instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure 13. Income during reporting period (1) (2) Amount Type (e.g., Code I div., rent, (A-H) or int.) C. Gross value at end of reporting period (t) (2) Value Value Code 2 Method (J-P) Code 3

(Q-W) Transactions during reporting period

0) Type (e.g., buy, sell, redemption)

(2) (3) Date Value mm/dd/yy Code 2 (J-P)

(4) Gain Code 1 (A-H)

(5) Identity of buyer/seller (if private transaction)

69.

IBM Corp. Com.

A B B A B B B B A B A A A A D A B

Dividend Interest Interest Dividend Interest Interest Interest Dividend Dividend Interest Dividend Dividend Dividend Dividend Interest Dividend Interest

J L K J L L K K L K K J J K N K

T T T T T T T T T T T T T T T T Sold 06/25/10 K A

70, [~Margate City 4,75% due 2/01/17 I 71. ~ Middlesex Co. Due 6/15/18 72. General Dynamics Corp. Com.

73. [~ Cape May Cnty, 4.50% due 8/15/20 74. ~ New Brunswick Pkg. Auth. 4.25% 9/1/15 75. ~ Old Bridge Twp. Bd. of Ed. 4.75% due 7/15/18 76. 77. 78. 79. 80. 81. 82. 83. 84. 85. BAC CAP Trust 11 PFD Harbor lntrlFund 11 U.S. Treas Notes4.25% 8115113 Coca Cola United Technologies Proctor & Gamble AT&T, Inc. Blackrock N.J. Munn. Fd. 416 Dupont ISHARES Barclays I-3yr treas

I. Income Gain Codes: ( See Columns B l a nd D4) 2. Value Codes (See Columns CI and D3) 3. Value Method (?odes (See Colunul C2)

A =$1,000 or less F = $ 50.001 - $ 100,000 .I =$15,000 or less N =$250.001 - $500,000 P3 =$25,000,001 - $50.000.000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$ 100,001 - $1,000,000 K =$15,001 - $50.000 O =$500,001 - $1,000,000 R =Cost (Real Estate Only) V -Olhcr

C =$2,501 - $5,000 H I = $ 1,000,001 - $5,000,000 L -$50,001 - $100,000 PI =$1,000,001 - $5,000,000 P4 =More than $50,000,000 S =Asscssmem W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$ | 00,00 t - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 9 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

VII. INVESTMENTS and TRUSTS - i.co,.e, votuc, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period (l) Amount Code 1 (A-H) (2) Type (e.g., div., rent, or int.) Gross value at end of reporting period (l) (2) Value Value Code 2 Method (J-P) Code 3 (Q-W) Transactions during reporting period

(l)

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code 1 (J-P) (A-H)

(5)

Identity of buyer/seller (if private transaction)

86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99.

MacDonalds Corp. Com. T. Rowe Price Summit Mun FED Strategic Value CLA J.P. Morgan Chase Bergen County Impt Auth Franklin Tax Free Fd 171 Blackrock Munic Bond Fund 324 Bristol Myers General Mills HeinzHJ Co. lntel Corp. Southern Co. Pimco Commodity Fund Pfizer, Inc.

A B B A A A B A A A A A A A B

Dividend Interest Interest Dividend Interest Interest Interest Dividend Dividend Dividend Dividend Dividend Dividend Dividend Interest

J L

T T

Buy (addl) Sold 02/18/101 06/25/10 J J A

J K K L J J J J J K J K

T T T T T T T T T T T T

Buy 06/25/10 K Buy (addl) 02/18/10 J Buy (addl) 02/18/10 L

100. Fidelity Advisor Inc. 279 FD

I. Income Gain Codes: (See Columns B 1 and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1.000 or less F =$50,001 - $ 100,000 J =$15.000 or less N =$250,001 - $500.000 P3 =$25,000,001 - $50.000.000 Q ~Appraisal U =Book Value

B =$1,001 - $2.500 G =$ 100,001 - $1,000.000 K =$15,001 - $50.000 O =$500,001 - $1.000,000 R =Cost (Real Eslale Only) V -Other

C =$2,501 - $5,000 H 1 =$1,000,001 - $5,000,000 L =$50,001 - $100,000 P 1 =$ 1,000,001 - $5.000,000 P4 =More than $50,000,000 S =Asscssmcnt W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M =$100,001 - $250,000 P2 =$5,000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 10 of 11

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

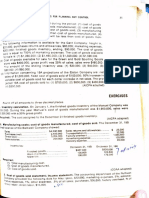

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS. (lndlcate part of report.)

The Williams College Pooled Income Fund #3. I have set forth the December 3 I, 2010 market value of my payment into the Fund. I receive the income from the Fund, but upon my death it goes to Williams College. The value to me would be the value of my life interest. During 2006 I transferred six tax exempt bonds into a revocable trust of which I am trustee and over which I have complete powers of disposition. The purpose is to ensure that upon my death, as in my lifetime, the assets will be available to help pay for~ education. Because I retain complete control over the assets I have not listed them separately as part of a trust. As the assets have been used to pay college expenses some have been sold. The remaining assets are listed in lines 9-14 of Part VII. The~ Trust reflects that shares of IBM and Proctor and Gamble are still part of the assets even though my April 6, 2010 Report shows that they were "Sold" in 2009. The Report should have stated "sold (part)" and is corrected accordingly. This explains the continuing presence of these assets as part ofthe~ Trust. In the Trust and Management Accounts the Blackrock Money Market and Liquidity Funds are the equivalent of cash. The Trustee or Fund Manager purchases and sells (deposits and withdraws) money from the Funds frequently. I b.ave not listed each deposit and withdrawal and have set forth the December 31, value ranges in the Management Account. Line 62 of Part VII is simply a header for the assets listed in lines 63 to 100.

FINANCIAL DISCLOSURE REPORT Page 11 ofll IX. CERTIFICATION.

Name of Person Reporting Debevoise, Dickinson R.

Date of Report 4/15/2011

I certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. I further certify that earned income from outside employment and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Dickinson R. Debevoise

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FAILS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

You might also like

- Opinion - JW V NavyDocument7 pagesOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- 1488 09032013Document262 pages1488 09032013Judicial Watch, Inc.100% (1)

- 2161 DocsDocument133 pages2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Document17 pages1878 001Judicial Watch, Inc.100% (5)

- Holder Travel Records CombinedDocument854 pagesHolder Travel Records CombinedJudicial Watch, Inc.No ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- 11 1271 1451347Document29 pages11 1271 1451347david_stephens_29No ratings yet

- State Dept 13-951Document4 pagesState Dept 13-951Judicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Stamped Complaint 2Document5 pagesStamped Complaint 2Judicial Watch, Inc.No ratings yet

- Stamped ComplaintDocument4 pagesStamped ComplaintJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- Gitmo Freezer Inspection ReportsDocument4 pagesGitmo Freezer Inspection ReportsJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Navy Water Safety ProductionDocument114 pagesNavy Water Safety ProductionJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- Gitmo Water Test ReportDocument2 pagesGitmo Water Test ReportJudicial Watch, Inc.No ratings yet

- Visitor Tent DescriptionDocument3 pagesVisitor Tent DescriptionJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JW Cross Motion v. NavyDocument10 pagesJW Cross Motion v. NavyJudicial Watch, Inc.No ratings yet

- SouthCom Water Safety ProductionDocument30 pagesSouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- JTF GTMO Water Safety App W ExhDocument13 pagesJTF GTMO Water Safety App W ExhJudicial Watch, Inc.No ratings yet

- Cover Letter To Requester Re Response Documents130715 - 305994Document2 pagesCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.No ratings yet

- May 2007 BulletinDocument7 pagesMay 2007 BulletinJudicial Watch, Inc.No ratings yet

- CVR LTR SouthCom Water Safety ProductionDocument2 pagesCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.No ratings yet

- December 2005Document7 pagesDecember 2005Judicial Watch, Inc.No ratings yet

- July 2007 BulletinDocument23 pagesJuly 2007 BulletinJudicial Watch, Inc.No ratings yet

- Model UNDocument2 pagesModel UNJudicial Watch, Inc.No ratings yet

- LAUSD Semillas AckDocument1 pageLAUSD Semillas AckJudicial Watch, Inc.No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ferdinand A. Cruz, Petitioner, Versus Alberto Mina, Hon. Eleuterio F. Guerrero and Hon. Zenaida Laguilles, RespondentsDocument5 pagesFerdinand A. Cruz, Petitioner, Versus Alberto Mina, Hon. Eleuterio F. Guerrero and Hon. Zenaida Laguilles, RespondentsJarvin David ResusNo ratings yet

- September 21 Sales Digests PDFDocument23 pagesSeptember 21 Sales Digests PDFAnonymous bOG2cv3KNo ratings yet

- Digest - Arigo Vs SwiftDocument2 pagesDigest - Arigo Vs SwiftPing KyNo ratings yet

- Lottery Result Tender DCT8773P19Document50 pagesLottery Result Tender DCT8773P19Dheeraj KapoorNo ratings yet

- 2013 The Spirit of Corporate Law - Core Principles of Corporate Law in Continental Europe PDFDocument3 pages2013 The Spirit of Corporate Law - Core Principles of Corporate Law in Continental Europe PDFbdsrl0% (1)

- Module 4 Criminal Law 1Document7 pagesModule 4 Criminal Law 1Frans Raff LopezNo ratings yet

- Engineering Mechanics Syllabus - Fisrt BtechDocument2 pagesEngineering Mechanics Syllabus - Fisrt BtechfotickNo ratings yet

- Gendering Caste Through A Feminist LensDocument6 pagesGendering Caste Through A Feminist LenssansaraNo ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- Cooperative BankDocument70 pagesCooperative BankMonil MittalNo ratings yet

- App3 Flexographic Ink Formulations and StructuresDocument58 pagesApp3 Flexographic Ink Formulations and StructuresMilos Papic100% (2)

- Trump Presidency 33 - May 5th, 2018 To May 14th, 2018Document513 pagesTrump Presidency 33 - May 5th, 2018 To May 14th, 2018FW040100% (1)

- Sandra Revolut Statement 2023Document9 pagesSandra Revolut Statement 2023Sandra MillerNo ratings yet

- PTC Mathcad Prime Installation and Administration GuideDocument60 pagesPTC Mathcad Prime Installation and Administration GuideHector Ariel HNNo ratings yet

- Trip ID: 230329124846: New Delhi To Gorakhpur 11:15 GOPDocument2 pagesTrip ID: 230329124846: New Delhi To Gorakhpur 11:15 GOPRishu KumarNo ratings yet

- Company: ManufacturingDocument8 pagesCompany: Manufacturingzain khalidNo ratings yet

- Pt4onlinepresentation Medina 170815105639Document19 pagesPt4onlinepresentation Medina 170815105639Roxas Marry GraceNo ratings yet

- Regional Ethics Bowl Cases: FALL 2018Document2 pagesRegional Ethics Bowl Cases: FALL 2018alyssaNo ratings yet

- Maharashtra Public Trust ActDocument72 pagesMaharashtra Public Trust ActCompostNo ratings yet

- Spicer: Dana Heavy Tandem Drive AxlesDocument34 pagesSpicer: Dana Heavy Tandem Drive AxlesPatrick Jara SánchezNo ratings yet

- 25 RESA vs. MO 39Document37 pages25 RESA vs. MO 39George Poligratis Rico100% (2)

- Environmental Law: End-Term AssignmentDocument18 pagesEnvironmental Law: End-Term AssignmentSadhvi SinghNo ratings yet

- Letter To JP Morgan ChaseDocument5 pagesLetter To JP Morgan ChaseBreitbart NewsNo ratings yet

- Nation State System Definition Characteristics and Historical BackgroudDocument3 pagesNation State System Definition Characteristics and Historical BackgroudEmaan Shah0% (1)

- Your Utilities Bill: Here's What You OweDocument3 pagesYour Utilities Bill: Here's What You OweShane CameronNo ratings yet

- Excerpt From The Mystery of Marriage New Rome Press PDFDocument16 pagesExcerpt From The Mystery of Marriage New Rome Press PDFSancta Maria ServusNo ratings yet

- Napoleon The ManDocument6 pagesNapoleon The Manlansmeys1498No ratings yet

- Shah Amin GroupDocument11 pagesShah Amin GroupNEZAMNo ratings yet

- Rigsby Jessica Resume FinalDocument1 pageRigsby Jessica Resume Finalapi-506330375No ratings yet

- AptitudeDocument2 pagesAptitudedodaf78186No ratings yet