Professional Documents

Culture Documents

Aviva Family Finances Report 4 - November 2011

Uploaded by

Aviva GroupCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aviva Family Finances Report 4 - November 2011

Uploaded by

Aviva GroupCopyright:

Available Formats

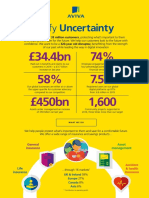

The Aviva Family

Finances Report

Autumn - 2011

FAM_REP_V4_33276_BRO.indd 1 09/11/2011 10:43

The typical UK family

While 84% of the UK population lives as part of a family, the

concept of the ‘traditional’ family is now outmoded. In its

Family Finances Report, Aviva recognises there are various

different types of modern families (see page two for groups

tracked) and looks at their individual approaches to finances

including wealth, debt and expenditure.

In addition, this report looks at how families often find themselves supporting

members of their own extended family or friends, both financially and practically.

This generosity can have a negative impact on their finances, with just under half

saying it hampered their ability to save, and almost a quarter suggesting that it

made repaying debts more difficult. Pensions also suffer and Aviva has calculated

that over 40 years, each family could be ‘giving away’ more than £70,000, almost

three times the typical pension pot at retirement.

Overview:

● Income – Incomes continue to fall as unemployment increases (pg 4).

● Spending trends – Families cut spending on luxuries as inflation bites (pg 7).

● Wealth – Savings pots fall to £967 (£982 - Aug 2011) as monthly savings hit lowest level

in 2011 (£19 – Nov) (pg 8).

● Product mix – Number of families with mortgages rises from 45% (Jan 2011) to 49%

(Nov 2011) as availability increases (pg 9).

● Debt – Typical family owes £10,604 or just under half of annual household income

(£23,796 – Nov 2011) (pg 11).

● Look to the future – Worries around the rising cost of living (61%) fall as consumers

acclimatise (pg 13).

● Families pull together – Almost a third (31%) provide financial support to their family

and friends (pg 14).

● Families give away 2% of income – Typical financial support to family and friends

amounts to £442 annually (pg 16).

● Finances take a knock – 46% said supporting family and friends meant they are less

able to save, 24% struggle to repay debts and 11% put less into their pension (pg 16).

The Aviva Family Finances Report 2

FAM_REP_V4_33276_BRO.indd 2 09/11/2011 10:43

The UK modern family

Thirty years ago, it was relatively safe to assume that a ‘nuclear family’

consisted of two parents and one or more children. However, as society has

changed, this is no longer the case. In this report, Aviva looks to recognise

the most common types of modern family based on customer profiles and

Government data.

1. Living in a committed 2. Living in a committed 3. Living in a committed

relationship* with no plans relationship with plans relationship with one child

to have children to have children

4. Living in a committed 5. Divorced/separated/widowed 6. Single parent raising one

relationship with two with one or more child or more child alone

or more children

* For the purposes of this report, a committed relationship is defined as either one where two people are married or living together.

The Aviva Family Finances Report 3

FAM_REP_V4_33276_BRO.indd 3 09/11/2011 10:43

Income

Average income continues to fall

The typical monthly net income of a UK family (i.e. the ‘median’ family in the middle of the sample) is now £1,983 (Aug 2011 –

£2,018) – revealing a slight drop (two percent) on the figures recorded in the previous quarter.

The main driver behind this fall appears to be the six percent drop recorded among those living in a committed relationship with

one child. Their income fell from £2,327 (Aug 2011) to £2,196 (Nov 2011).

The summer Family Finances Report explored the impact that children – especially young children – can have on family incomes and

parents’ earning capacities - so this may well be a contributing factor to this drop.

% of people on different income levels over four quarters (2011)

35% Q1

Q2

30%

Q3

25% Q4

20%

15%

10%

5%

0%

£750 or less £751-£1,250 £1,251-£2,500 £2,501-£5,000 More than £5,001

Income level

All other groups also recorded lower incomes than the last quarter – except for those in a committed relationship with no plans to

have children. These families actually saw an eight percent increase from £2,180 (Aug 2011) to £2,347 (Nov 2011). However, their

income is still lower than those in a committed relationship with plans to have children (£2,402 – Nov 2011).

It is interesting to note that these two groups have the highest number of people deriving income from a ‘primary job’ – i.e. full-

time employment held by the main breadwinner – so any salary increases would be felt most prominently here. Indeed, 85% of

those in a committed relationship with plans to have children and 77% of those in a committed relationship with no plans to have

children have this type of income.

At the other end of the scale, the number of families who survive on less than £1,250 per month has increased slightly to 30% (Nov

2011) from 29% (Aug 2011) – a worrying trend in the current high inflation environment.

The Aviva Family Finances Report 4

FAM_REP_V4_33276_BRO.indd 4 09/11/2011 10:43

Income sources second / part-time jobs are significant as employment decreases

The most common source of income for the typical UK family is the primary income earner’s salary (70% - Nov 2011) – although

this has dropped slightly since August 2011 (72%) as the UK experiences a 17-year high in unemployment.

While the number of families who derive income from the primary income earner’s job has fallen, those who see financial

contributions from part-time or second jobs has risen from 16% (Aug 2011) to 18% (Nov 2011). Those who are married with two

or more children are most likely to have part-time or second jobs (22% - Nov 2011) – which suggests that employment which fits

around family commitments continues to be in high demand.

Benefits contribute to the monthly income of more than one in five families and there has been a slight increase in the dependence

on this type of funding – 21% (Aug 2011) to 23% (Nov 2011). This appears to support the theory that unemployment is affecting

some families, making them more reliant on the state.

Single parents (51% - Nov 2011) are most reliant on benefits for some or all of their family’s income but this figure has dropped

from 56% (Aug 2011) – potentially indicating that some of the Government’s benefit reforms are having an impact.

Despite the low interest rate environment, six percent (Nov 2011) of families derive part of their income from savings or investments.

However, whether this is using the income or the capital itself is not clear. In addition to this, two percent of families say rental

income contributes to their family’s finances – a slight decrease from August 2011 (3%) but in keeping with the general trend seen

throughout 2011.

The Aviva Family Finances Report 5

FAM_REP_V4_33276_BRO.indd 5 09/11/2011 10:43

Expenditure

Average expenditure – families maintain spending as inflation soars

At a glance, family expenditure appears to have remained relatively stable over the last quarter with housing (mortgage or rent)

remaining the largest single expenditure for most families (20% - Nov 2011).

There has been a very slight decrease in the amount spent on housing, quarter on quarter (21% - Aug 2011) but this may be due to

the increasing availability of good mortgage deals rather than any other factors.

Typical family expenditure:

Type of expenditure Average amount spent as % of monthly income

Jan 2011 May 2011 Aug 2011 Nov 2011

Housing (mortgage or rent) 20% 22% 21% 20%

Food 10% 11% 10% 10%

Debt repayment 8% 10% 9% 9%

Nursery care / out of school care 9% 10% 10% 9%

Fuel and light (e.g. gas and electricity bills) 6% 6% 5% 6%

Motoring 5% 6% 5% 5%

Entertainment, recreation and holidays 4% 5% 4% 3%

Public transport fares and other travel costs 4% 4% 4% 4%

Fees for children’s activities 4% 4% 3% 3%

Clothing and footwear 2% 3% 2% 2%

After housing, food (10% - Nov 2011) is the next largest expenditure for the average UK family and the percentage of income spent

on this has remained steady for much of 2011. Debt repayments (9% - Nov 2011) and nursery care / out of school care (9% - Nov

2011) also account for a significant percentage of many families’ outgoings.

It is surprising that the percentage of income spent on some household expenses has remained stable, considering that inflation on

some essential costs has risen significantly. Basics such as fuel and light (+18.8%), motoring (8.7%), public transport (8.5%) and

food (6.9%) have all seen considerable increases.

However, it appears that UK families are down-shifting their spending where at all possible. This hypothesis is born out by results

from ‘value retailers’ such as Poundland (+26% in profits to year ending 27 March 2011) and Aldi (profit of £18.7m on sales of

£2.1bn following a loss in 2010).

Not only are families down-shifting their spending but they are also cutting spending on non-essential purchases. For example,

spending on entertainment and holidays has fallen to the lowest level in 2011 during this quarter (3% - Nov 2011).

“This research clearly shows that UK families are working hard to maintain

their standard of living by down-shifting and economising where possible.

However, with significant inflation on some of the basic costs, we are

likely to see families cutting right down on non-essential spending.”

Paul Goodwin, director of workplace savings, Aviva

The Aviva Family Finances Report 6

FAM_REP_V4_33276_BRO.indd 6 09/11/2011 10:43

Spending trends:

In addition to tracking inflation and spending, this report also shows where UK families have stopped spending money. This provides

us with an excellent indication of both the essential fixed costs for families and also how people’s lifestyles are changing.

One fifth (21% - Nov 2011) of UK families claim they do not spend money on housing – either due to owning their own home

outright, receiving accommodation through employment or being supported by the Government. This figure has remained relatively

static since August (20%) as this is an essential rather than an optional cost.

However, fewer families are spending money on ‘luxuries’. In November 2011, we saw the number of families who spend nothing

on personal goods increase to 19% (17% - Aug 2011), entertainment/recreation/holidays to 25% (21% - Aug 2011) and leisure

goods to 39% (36% - Aug 2011) - clearly a picture of a nation cutting back.

Percentage of families who spend money on this expense on a monthly basis:

Type of expenditure Aug 2011 Nov 2011

Housing (mortgage or rent) 80% 79%

Debt repayment 58% 52%

Entertainment, recreation and holidays 79% 75%

Public transport fares and other travel costs 70% 67%

Fees for children’s activities 49% 48%

Leisure goods 64% 61%

Eating-out and takeaways 82% 80%

The Aviva Family Finances Report 7

FAM_REP_V4_33276_BRO.indd 7 09/11/2011 10:43

Family wealth

Savings and investments – savings fall slightly as families fight to keep pots stable

The mean average amount that families have in savings and investments (excluding pensions and property) rose to the highest level

seen in 2011 (£19,803 – Nov 2011). This is 26% higher than at the start of 2011 (£15,766 – Jan 2011) and a real indication that

some families are looking to safeguard their futures as much as possible. However, this saving comes at the expense of paying off

debts, and recently it was estimated that for every pound saved, just 10p of borrowing is repaid.

However, this sample is skewed by the four percent (Nov 2011) of people who have savings of more than £100,000. The typical

family (i.e. the family in the middle of the sample) has significantly fewer savings - £967 (Nov 2011) or just 49% of the average

monthly salary. This is a two percent drop from August (£982) and seems to indicate that most families are fighting hard to keep

their savings at current levels.

Almost a third (30% - Nov 2011) of families claim to have nothing set aside in savings which is a slight improvement from August

(31%) but still above the record low set in May (28%). However, the typical amount families are saving has fallen to £19 per month

(Nov 2011) – the lowest amount in 2011 and a clear indication that high inflation is starting to hit home.

Percentage of families saving nothing each month

60

50

% saving nothing

40

30

20

10

0

Couples Couples with Couples with Couples with Single, Divorced/

without plans plans to have one child two children raising one Separated/

to have children or more Widowed with

children children one or more

children

Type of family

The typical divorced/widowed/separated family unit with one or more children (£0 – Nov 2011) and single parents (£0 – Nov 2011)

continue to save nothing each month. These figures highlight the fact that while some people in this group are naturally saving

something each month, the vast majority are saving nothing at all.

More worrying still is the fact that women’s typical monthly savings have fallen from £16 (Jan 2011) to £4 (Nov 2011) – especially

when considering that men’s savings have actually risen (£39 – Jan 2011 to £58 – Nov 2011).

The number of families who say they don’t save on a monthly basis has risen to 39% (Nov 2011) from 36% (Aug 2011). This is

below the annual record set in January (40%) but appears to highlight the fact that there is a set of ‘hard core’ non-savers who are

either unwilling or unable to save.

The Aviva Family Finances Report 8

FAM_REP_V4_33276_BRO.indd 8 09/11/2011 10:43

Product mix – basic accounts dominate as

families fail to diversify

The majority of UK families (82% - Nov 2011) have a basic bank/

building society savings account. However, as 30% of people claim

to have no savings at all, this does raise the question of how many

of these accounts are active and contain viable amounts of savings.

In addition to basic savings accounts, ISAs (36% - Nov

2011), premium bonds (23% - Nov 2011), stocks and shares

investments (15% - Nov 2011) and bonds (6% - Nov 2011) are

all used by families to build their assets.

Typically, the more sophisticated products are used by those who

have the highest incomes. For example, people in a committed

relationship who plan to have children (43% - Nov 2011) are

more likely than single parents (27% - Nov 2011) to have an ISA.

With more accessible first-time buyer mortgage deals entering

the market over the past year, we have seen increasing numbers

with this type of borrowing – 45% (Jan 2011) to 49% (Nov

2011). The number of buy-to-let mortgages has also increased

marginally from 2% (Jan 2011) to 3% (Nov 2011).

Reviewing the product profile, it also appears that families are not

only trying to save in order to safeguard their futures, but are also

taking out protection products. The number of families with life

insurance has risen from 39% (Jan 2011) to 41% (Nov 2011) and

critical illness cover from 13% (Jan 2011) to 14% (Nov 2011).

“While this latest report shows that family finances are still tight, it’s reassuring to

see that more people are beginning to take steps to protect their families with life

insurance and critical illness cover. While there is still a significant protection gap across

the UK, this is a step in the right direction, and we would hope that more people will

follow this trend.”

Louise Colley, head of protection, Aviva

The Aviva Family Finances Report 9

FAM_REP_V4_33276_BRO.indd 9 09/11/2011 10:43

Housing wealth

Number of families with mortgages increases

Over half of families (64% - Nov 2011) own their own homes either with a mortgage (50% - Nov 2011) or outright (14% - Nov

2011). In addition, 19% (Nov 2011) of families live in rental accommodation and 15% (Nov 2011) live in social housing.

While the number of people who own their properties outright has remained the same since the start of the year (14% - Jan 2011),

the percentage of families with mortgages has actually risen from 47% (Jan 2011) to 50% (Nov 2011). This appears to correspond

with a drop in the number of people living in rental accommodation – 22% (Jan 2011) to 19% (Nov 2011).

This move has led to more families worried about mortgage rate increases - 14% in November 2011 compared to 13% in January 2011.

However, this is a very minor increase and a vote of confidence in the belief that the base rate will remain low for the foreseeable future.

The typical family home in the UK is worth £207,190. This is 25% higher than the average UK residential property (£166,256)

reflecting the fact that this population group tends to need larger properties than single people. The value of the family home has

remained relatively stable since January (£207,548).

Average value of house per demographic type

£250,000

Value of property (£)

£200,000

£150,000

£100,000

£50,000

£0

Couples Couples with Couples with Couples with Single, Divorced/

without plans plans to have one child two children raising one Separated/

to have children or more Widowed with

children children one or more

children

Type of family

While prices have remained stable, the average amount of equity has fallen from £139,218 (Jan 2011) to £132,275 (Nov 2011),

and the average mortgage has increased from £89,018 (Jan 2011) to £95,466 (Nov 2011).

Single parents are most likely out of all the groups to be living with their families (4% - Nov 2011) or in social-housing (39% -

Nov 2011). In addition, they are the next most likely to live in private rental accommodation (29% - Nov 2011), after those with

plans to have children (33% - Nov 2011).

At the other end of the scale, those who live in a traditional nuclear family (i.e. in a committed relationship with two or more

children) are least likely to live in rental accommodation (11%) and most likely to own their own home (72% - Nov 2011).

In 2011, 15% of families claimed to own a second property – either a rental property, holiday home, second home or time-share.

The average value of this property was £177,415 and the typical mortgage was £135,840.

The Aviva Family Finances Report 10

FAM_REP_V4_33276_BRO.indd 10 09/11/2011 10:43

Family borrowing

Debt amounts to nearly half of annual household income

As part of the final Family Finances Report for 2011, Aviva has taken a more in-depth look at the different

types of family debt. More than half of UK families (52% - Nov 2011) have some form of debt which they

repay on a monthly basis, down from 58% in August 2011.

The average indebted family owes £10,604 (Nov 2011) which is just under half of its annual household

income (£23,796 – Nov 2011)*.

Those in a committed relationship with two or more children (£16,428 – Nov 2011) have the highest debts

while those in a committed relationship with no plans to have children (£3,577) have the lowest. As those in

relationships with two or more children tend to have the lowest household income (£2,178 – Nov 2011) of

all two-adult families, this perhaps suggests they are more likely to use credit to maintain their lifestyle than

some other groups. The most common type of family borrowing is using credit cards (43% - Nov 2011),

followed by overdrafts (26% - Nov 2011) and personal loans (25% - Nov 2011).

Household income compared with debt

£18000 Average

£16000 debt

Average

£14000

monthly

£12000 household

income

£10000

£8000

£6000

£4000

£2000

£0

Couples without Couples with Couples with Couples with Single, raising Divorced/

plans to have plans to have one child two children one or more Separated/

children children children Widowed with

one or more

Type of family children

* This is not possible to compare to the previous quarter due to changes in the reporting process but does reveal a significant debt burden.

The Aviva Family Finances Report 11

FAM_REP_V4_33276_BRO.indd 11 09/11/2011 10:43

When the borrowing practices of the various families are

investigated further, it appears that single parents tend to use more

informal forms of borrowing. This group is the most likely to use

doorstep lenders (9% - Nov 2011) and ‘other informal borrowing’

(9% - Nov 2011) such as pay-day loans and pawn brokers.

The group most likely to use ‘family or friend finance’ are those

in a committed relationship with plans to have children

(23% - Nov 2011) – potentially because they are at the start

of their careers and likely to have received some help to attain

their financial goals.

Indebted families spend £224 (Nov 2011) on debt repayment

each month which is up from the previous quarter (£218 – Aug

2011). Those in a committed relationship with two children

(£254 - Nov 2011) spend the most and those widowed/

divorced/separated with children (£162 - Nov 2011) spend

the least.

However, the amount of money borrowed does not appear to be

a big concern to most families. In January 2011, 13% of families

said it was a concern, but this had dipped to 11% in November.

“Debt is a normal part of many

families’ financial management

strategies and as long as people can

service their loans, they can serve them

well. However, minimum payments

need to be maintained, or people may

find that what seemed like sensible

borrowing could become an increasing

drain on their financial resources.”

Paul Goodwin, director of workplace savings, Aviva

The Aviva Family Finances Report 12

FAM_REP_V4_33276_BRO.indd 12 09/11/2011 10:43

Look to the future

Short term – fears about cost of living fall as worries about unexpected expenses rise

The top three biggest fears of UK families over the next three months are: increases in the basic cost of necessities (61% - Nov

2011), losing my/our jobs (45% - Nov 2011) and meeting unexpected expenses (42% - Nov 2011).

While consumers have learnt to live with the impact of high inflation and are marginally less worried about increases to the cost of

basic necessities (61% - Nov 2011 vs. 64% - Aug 2011), they are increasingly concerned about meeting unexpected expenses (42%

- Nov 2011 vs. 40% - Aug 2011). Low levels of saving, high levels of borrowing and the approach of winter and the festive season

are likely to be some of the drivers behind this move.

While 45% of families are worried about the loss of their jobs, a new category has revealed that 8% of families are concerned

about continued unemployment. Single parents – who have the lowest incomes and are likely to feel inflationary pressure the most

– are most worried about this prospect (19% - Nov 2011).

“While the high cost of living is certainly an issue for many families, the fact

that they appear less worried than before indicates that they may be starting to

acclimatise to today’s economic environment.”

Paul Goodwin, director of workplace savings, Aviva

Long term – concerns persist about the general economy

Significant increases to the basic cost of necessities (59% - Nov 2011), redundancy (52% - Nov 2011), and unexpected expenses

(40% - Nov 2011) remain the top worries for UK families for the next five years.

More than one in five (22% - Nov 2011) families has taken the Government warnings over cutbacks to heart and are worried about

changes or loss of benefits. This level has remained relatively constant during 2011 - January (22%), May (22%) and August (20%).

Single parents with one or more children (42% - Nov 2011) are the most worried about these potential changes as 51% (Nov 2011)

derive part of their income from this source.

The Aviva Family Finances Report 13

FAM_REP_V4_33276_BRO.indd 13 09/11/2011 10:43

Spotlight – families pull together

financially and materially

As the tough economic climate begins to bite, the Aviva Family

Finances Report has found that 31% of families have provided

financial support to family and friends outside their immediate

family – in the last year. In addition, 34% have provided practical

assistance such as babysitting, cleaning or help with cooking.

Reciprocal support:

Divorced/separated/widowed people and single parents (both

49%) are the most likely to provide practical support for their

network of family and friends. While these groups are typically

less well-off than others, they are more likely to live closer to

their families and also may need to rely heavily on their network

of family and friends at times - so it may be that in turn they are

more likely to provide assistance to others.

In addition, single parents (45%) are also most likely to

provide financial assistance. At the other end of the scale,

committed couples with no plans to have children (18%)

and those with one child (25%) are the least likely to provide

financial assistance.

Taking time out:

Help with cooking, cleaning or baby-sitting (21%) are the most

common types of non-financial inter-family support, followed

by lending people items to avoid the need to purchase (8%)

and letting people live in the family home (5%).

The most common types of financial support are providing

cash to help with day-to-day expenses (26%) and paying bills

on behalf of family members or friends (9%). Providing cash for

day-to-day expenses is either via a loan (10%) or more commonly

(16%) a gift, which shows how family and friend networks are

prepared to assist those who are finding times tough.

The Aviva Family Finances Report 14

FAM_REP_V4_33276_BRO.indd 14 09/11/2011 10:43

Parental responsibility:

While inter-generational gifts are often discussed in the media with older parents supporting their children financially, this is not a

one-way street.

The most likely recipients of financial assistance from families interviewed for this report (whose heads are aged between 18 and 55)

are parents. This breaks down as: mother (10%) and father (7%). Children over 18 who do not live at home (7%) and sisters (5%)

are also likely recipients.

As family dynamics change and evolve, some people are more likely to financially support their friends (3%) than other members of

their extended family – aunt (0.34% - Nov 2011) and uncle (0.34%). Again single parents (6%) are the most likely to provide some

type of financial support to close friends.

Financial assistance focuses on immediate family and friends:

Regular contact or legal compulsion appears to be the driver behind the largest amounts of inter-family financial support – be it

regular or on an ad hoc basis. Former partners receive the biggest annual pay-outs annually (£1,447) followed by adult children

over-18 (£1,278) and children under 18 (£1,175) who are not living at home.

The importance of friendship – and proximity – is evident as close friends receive the next highest amount of financial assistance

(£893 – Nov 2011) from UK families. While UK families are more likely to help their parents than other relations, the amount

provided annually is still relatively modest – mother (£597) and father (£588).

Typical amount provided annually by those who lend / give to family and friends

Children over 18 who

do not live at home

Children under 18 who

Amount lent/given - £

do not live at home

Ex-partner

Close friends

Brother

Mother

£0 £300 £600 £900 £1200 £1500

Triggers behind inter-family financing:

The main triggers behind this type of assistance are unexpected changes to financial circumstances (25%) and unexpected one-off

costs (21%). Help due to changes in employment (20%) or poor financial management (19%) were also cited as key reasons.

Providing assistance to family and friends who are ‘unable to cope financially on their income’ is also a key reason behind giving

(16%). Women (18%) are more likely than men (13%) to provide this type of help.

The Aviva Family Finances Report 15

FAM_REP_V4_33276_BRO.indd 15 09/11/2011 10:43

Some tough decisions:

While many people expect to provide some support to their extended network of family and friends, increasingly squeezed family

incomes make this hard. Indeed, 15% of families have made cut-backs in order that they can continue to provide assistance and

11% have been less able to support their extended family this year as they themselves are struggling.

Conversely, 10% report that they have had to provide more support than previously – something that is sure to be felt keenly in

the current inflationary environment. Divorced/separated/widowed families with one or more children (13%) are most likely to have

experienced these increased requests.

Negative impact on family finances:

While it is often seen as a duty to help relations and friends if they need assistance, this can have a negative impact on a family’s

own finances.

Families said that due to providing this type of support, they were less able to save (46%), repay debts (24%), put aside money for

their own children (14%) or invest in stocks and shares investments (14%).

Not only were their short-term financial plans compromised, but 11% said this familial support had limited their ability to invest in

their own pension and 10% said it had a negative impact on their property investment aspirations.

It is interesting to note that 18% of those in a committed relationship with two or more children said that supporting their family

had a detrimental impact on their pension provision. This may be because these families tend to be older and are more likely to be

focusing on this goal.

Lifetime impact:

While admittedly £442 (typical annual inter-family subsidy) does not sound a lot, this is two percent of annual household income

(£23,796 – Nov 2011) for a typical family – rising to six percent of income (£13,778) for divorced/widowed and separated parents.

Over 40 years this sum would provide a useful nest egg (£17,680 – excluding inflation and any interest). Indeed, this figure of

£17,680 is two thirds (66%) of the typical UK pension pot (£26,940 – source ABI Q2 2011) – which really highlights how familial

support can impact on people’s own futures.

Furthermore, over an average 40 year working life, this sum (if matched by an employer contribution in a typical workplace pension

scheme) would provide a valuable nest egg (£71,757) and an income of over £3,000 per year*.

* This assumes a 25-year old male on a salary of £25k saves £442pa in a pension until age 65 (matched by employer) and takes no tax free cash at retirement.

Source – www.aviva-pensioncalculator co.uk

The Aviva Family Finances Report 16

FAM_REP_V4_33276_BRO.indd 16 09/11/2011 10:43

The view across

the UK

Regional overview – incomes flat and

savings down, but families look to help

each other financially

Families in London have the highest (median)

average monthly incomes (£2,628), followed by

those in the South East (£2,149). They also own

the most expensive properties (£335,841 and

£247,406 respectively).

However, families in London also have the highest amount

of debt too (£23,609). At the other end of the scale, families in Wales have the

lowest average monthly incomes (£1,249), but also the lowest amount of debt on

average (£3,476) – much lower than the national average of £10,604.

While the average income of UK families has dropped, some regions have

seen increases: London (up from £2,477 to £2,628), Scotland (up from

£1,952 to £2,004), the South West (up from £1,796 to £1,862), South East

(£1,894 to £1,994) and Yorkshire (up from £1,853 to £1,886).

Families in London currently save the most each month (£58), whereas

families in the North West (average £1) save the least of those who

save. Half (50%) of families in the North East say they don’t manage

to save anything each month, compared with just 27% of families in

London, 34% in the West Midlands and 35% of families in Scotland.

The cost of living has had a significant impact on families in London, where

42% say that in the last twelve months, they have provided financial

support to family members outside of their immediate family. Families

from the South West (27%) and from Yorkshire (27%) are the least likely

to have provided financial support to their wider families. Typical inter-family

debt stands at an average of £442; however families in the West Midlands have proved

most generous, having provided an average of £796 to their wider family.

% of people in the region % of people living in the Typical House

Region who are living in a committed region living in a committed Income interfamily

prices

relationship and want children relationship with one child debt

1. East 10% 12% £1,994 £498 £225,538

2. London 18% 21% £2,628 £463 £335,841

3. East Midlands 8% 16% £1,722 £410 £172,446

4. West Midlands 10% 23% £2,036 £796 £184,633

5. North East 11% 12% £1,713 £299 £154,365

6. North West 8% 16% £1,852 £443 £169,853

7. Scotland 9% 20% £2,004 £420 £163,235

8. South East 10% 13% £2,149 £422 £247,406

9. South West 9% 15% £1,862 £388 £207,222

10. Wales 15% 16% £1,249 £408 £165,313

11. Yorkshire 13% 9% £1,886 £305 £177,103

UK 11% 16% £1,983 £442 £207,190

The Aviva Family Finances Report 17

FAM_REP_V4_33276_BRO.indd 17 09/11/2011 10:43

So what does this tell us?

“The final Family Finances Report for 2011 shines a spotlight on a nation of families who are

actively cutting spending to the bone. People are ruthlessly removing luxuries from budgets in

order to not only make ends meet, but also to provide additional security in the form of savings –

savings pots have increased 26% since January.

Unfortunately, while the number of people who are saving has improved slightly quarter on

quarter, the amount saved has actually fallen. This is unsurprising considering that essential costs

such as fuel and light (+18.8%), motoring (+8.7%) and food (+6.9%) have seen substantial

annual inflation.

It’s perhaps to be expected that almost half of UK families provide close friends and relations

with practical or financial assistance, in addition to emotional support. However it is a shock that

people are giving up two percent of their annual household income on average and – over 25

years – 41% of a typical pension pot

Some people are legally bound to provide financial support to their ex-partners and others choose

to help their children who do not live at home. However, in this increasingly tough economic

climate, people may need to draw a line and consider their own financial wellbeing – especially

when 19% of financial borrowing is due to the recipient having poor financial management.”

Paul Goodwin, director of workplace savings, Aviva

The Aviva Family Finances Report 18

FAM_REP_V4_33276_BRO.indd 18 09/11/2011 10:43

Methodology

The Aviva Family Finances Report was designed and produced by Wriglesworth Research. As part of this 8,097* UK

consumers – aged between 18 and 55 – who live as part of one of six family groups were interviewed by Opinion

Matters between December 2010 and October 2011. This data was combined with additional information from the

sources listed below and used to form the basis of the Aviva Family Finances Report.

Additional data sources include:

● Unemployment Figures – Office of National Statistics – October 2011

● Poundland and Aldi Results – companies own reporting

● Nationwide – September House Price Figures

● www.aviva-pensioncalculator.co.uk – 31 October 2011

● Unbiased – Q2 savings vs. debt levels – September 2011

Technical Notes

● A median is described as the numeric value separating the upper half of a sample, a population, or a probability

distribution, from the lower half. Thus for this report, the median represents the family who is at the utter middle of

a sample.

● An average or mean is a single value that is meant to typify a list of values. This is derived by adding all the values

on a list together and then dividing by the number of items on the said list. This can be skewed by particularly high

or low values.

For further Information on the report or for a comment, please contact Sarah Poulter at the Aviva Press Office on

01904 452828 or sarah.poulter@aviva.co.uk

* = Minimum of 2,000 per quarter

The Aviva Family Finances Report 19

FAM_REP_V4_33276_BRO.indd 19 09/11/2011 10:43

FAM_REP_33276 11/2011 © Aviva plc

FAM_REP_V4_33276_BRO.indd 20 09/11/2011 10:43

You might also like

- Family Finances Report (December 2014)Document28 pagesFamily Finances Report (December 2014)Aviva GroupNo ratings yet

- Squeezed: BritainDocument33 pagesSqueezed: Britainapi-214019691No ratings yet

- FPI IFS Austerity Jan 2012Document33 pagesFPI IFS Austerity Jan 2012Sylvia LimNo ratings yet

- Household Disposable Income and Inequality in The UK Financial Year Ending 2016Document23 pagesHousehold Disposable Income and Inequality in The UK Financial Year Ending 2016jessicaNo ratings yet

- INGD Financial Wellbeing Index Q1 2011Document9 pagesINGD Financial Wellbeing Index Q1 2011Ian MossNo ratings yet

- LSE BREXIT - Economic Inequalities in Britain - From The 2008 Financial Crisis To BrexitDocument3 pagesLSE BREXIT - Economic Inequalities in Britain - From The 2008 Financial Crisis To BrexitAnonymous 9FOneuPy0No ratings yet

- Children Can't WaitDocument8 pagesChildren Can't Waitm defterNo ratings yet

- Topic 3 NotesDocument7 pagesTopic 3 NotesjeremythamanNo ratings yet

- Key Benefit ChangesDocument15 pagesKey Benefit ChangescraigyboystewartNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Multiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformDocument16 pagesMultiple Cuts For The Poorest Families: 1.75 Million of The Poorest Families Have Seen Their Benefits Cut To Date Due To Welfare ReformOxfamNo ratings yet

- Aviva 2018 Key Metrics InfographicDocument1 pageAviva 2018 Key Metrics InfographicAviva GroupNo ratings yet

- Aviva 2018 Interim Results AnnouncementDocument10 pagesAviva 2018 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva PLC 2016 Results InfographicDocument2 pagesAviva PLC 2016 Results InfographicAviva GroupNo ratings yet

- Aviva HY16 Results Summary - InfographicDocument1 pageAviva HY16 Results Summary - InfographicAviva GroupNo ratings yet

- Aviva 2017 Interim Results AnnouncementDocument131 pagesAviva 2017 Interim Results AnnouncementAviva GroupNo ratings yet

- Aviva PLC 2016 Interims Results AnnouncementDocument127 pagesAviva PLC 2016 Interims Results AnnouncementAviva GroupNo ratings yet

- Aviva 2017 Interim Results Analyst PresentationDocument64 pagesAviva 2017 Interim Results Analyst PresentationAviva GroupNo ratings yet

- Aviva PLC - at A Glance March 2018Document2 pagesAviva PLC - at A Glance March 2018Aviva GroupNo ratings yet

- 2017 Preliminary Results AnnouncementDocument143 pages2017 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Enabling Europe To Compete in The Global World of FinTechDocument2 pagesEnabling Europe To Compete in The Global World of FinTechAviva GroupNo ratings yet

- Aviva PLC 2016 ResultsDocument71 pagesAviva PLC 2016 ResultsAviva GroupNo ratings yet

- Aviva PLC Capital Markets DayDocument2 pagesAviva PLC Capital Markets DayAviva GroupNo ratings yet

- Mark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptDocument4 pagesMark Wilson Aviva PLC 2016 Half Year Results Interview TranscriptAviva GroupNo ratings yet

- Aviva 2015 Full Year Results TranscriptDocument3 pagesAviva 2015 Full Year Results TranscriptAviva GroupNo ratings yet

- What Are We in Business For? Being A Good AncestorDocument22 pagesWhat Are We in Business For? Being A Good AncestorAviva GroupNo ratings yet

- Aviva 2015 Preliminary AnnouncementDocument10 pagesAviva 2015 Preliminary AnnouncementAviva GroupNo ratings yet

- Aviva at A Glance InfographicDocument2 pagesAviva at A Glance InfographicAviva GroupNo ratings yet

- Aviva 2015 Results InfographicDocument1 pageAviva 2015 Results InfographicAviva GroupNo ratings yet

- 2015 Half Year Results Interview With Group CEO Mark WilsonDocument4 pages2015 Half Year Results Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva Half Year 2015 AnnouncementDocument163 pagesAviva Half Year 2015 AnnouncementAviva GroupNo ratings yet

- Aviva 2014 Results PresentationDocument26 pagesAviva 2014 Results PresentationAviva GroupNo ratings yet

- Aviva Half Year 2015 Analyst PresentationDocument30 pagesAviva Half Year 2015 Analyst PresentationAviva GroupNo ratings yet

- Aviva Q1 IMS 2015 PDFDocument17 pagesAviva Q1 IMS 2015 PDFAviva GroupNo ratings yet

- Aviva PLC 2014 Preliminary Results AnnouncementDocument9 pagesAviva PLC 2014 Preliminary Results AnnouncementAviva GroupNo ratings yet

- Inflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallDocument5 pagesInflation Drop Gives Over-55s An Extra 1,032 A Year in Disposable Income As Essential Costs FallAviva GroupNo ratings yet

- Aviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsDocument4 pagesAviva: Whiplash Costs 2.5bn Per Year, Adding 93 To Motor PremiumsAviva GroupNo ratings yet

- 2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonDocument7 pages2014 Full Year Results Film Transcript - Interview With Group CEO Mark WilsonAviva GroupNo ratings yet

- Pandayan Bookshop: Strategic Objectives Key Performance Indicators Targets InitiativesDocument7 pagesPandayan Bookshop: Strategic Objectives Key Performance Indicators Targets InitiativesSed ReyesNo ratings yet

- Cost AccountingDocument13 pagesCost AccountingJoshua Wacangan100% (2)

- Solution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviDocument5 pagesSolution Manual For Designing and Managing The Supply Chain 3rd Edition by David Simchi LeviRamswaroop Khichar100% (1)

- Statement of Comprehensive Income Worksheet 1 SampleDocument6 pagesStatement of Comprehensive Income Worksheet 1 SampleKim Shyen BontuyanNo ratings yet

- Fundamentals of Accounting 2 - PrefinalsDocument3 pagesFundamentals of Accounting 2 - PrefinalsCary JaucianNo ratings yet

- Act 248 Innkeepers Act 1952Document10 pagesAct 248 Innkeepers Act 1952Adam Haida & CoNo ratings yet

- Bfi AssignmentDocument5 pagesBfi Assignmentrobliao31No ratings yet

- Saral Gyan Stocks Past Performance 050113Document13 pagesSaral Gyan Stocks Past Performance 050113saptarshidas21No ratings yet

- HTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFDocument99 pagesHTTPSWWW Sec GovArchivesedgardata1057791000105779114000008ex991 PDFДмитрий ЮхановNo ratings yet

- ch03 - Free Cash Flow ValuationDocument66 pagesch03 - Free Cash Flow Valuationmahnoor javaidNo ratings yet

- Jump Start Co JSC A Subsidiary of Mason Industries ManufactDocument1 pageJump Start Co JSC A Subsidiary of Mason Industries ManufactAmit PandeyNo ratings yet

- Non-current Liabilities - Bonds Payable Classification and MeasurementDocument4 pagesNon-current Liabilities - Bonds Payable Classification and MeasurementhIgh QuaLIty SVTNo ratings yet

- Ali Mousa and Sons ContractingDocument1 pageAli Mousa and Sons ContractingMohsin aliNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- Palepu - Chapter 5Document33 pagesPalepu - Chapter 5Dương Quốc TuấnNo ratings yet

- Project Report On "Role of Banks in International Trade": Page - 1Document50 pagesProject Report On "Role of Banks in International Trade": Page - 1Adarsh Rasal100% (1)

- Maximizing Advantages of China JV for HCFDocument10 pagesMaximizing Advantages of China JV for HCFLing PeNnyNo ratings yet

- Acquisition Analysis and RecommendationsDocument49 pagesAcquisition Analysis and RecommendationsAnkitSawhneyNo ratings yet

- Wealth X Family Wealth Transfer ReportDocument28 pagesWealth X Family Wealth Transfer ReportStuff NewsroomNo ratings yet

- Vip No.8 - MeslDocument4 pagesVip No.8 - Meslkj gandaNo ratings yet

- Consistent Compounders: An Investment Strategy by Marcellus Investment ManagersDocument27 pagesConsistent Compounders: An Investment Strategy by Marcellus Investment Managersvra_pNo ratings yet

- Office Stationery Manufacturing in The US Industry ReportDocument40 pagesOffice Stationery Manufacturing in The US Industry Reportdr_digital100% (1)

- Simple Annuity Activity (Math of Investment)Document1 pageSimple Annuity Activity (Math of Investment)RCNo ratings yet

- Online Transfer Claim FormDocument2 pagesOnline Transfer Claim FormSudhakar JannaNo ratings yet

- Chapter 8 Risk and Return: Principles of Managerial Finance, 14e (Gitman/Zutter)Document24 pagesChapter 8 Risk and Return: Principles of Managerial Finance, 14e (Gitman/Zutter)chinyNo ratings yet

- Medical Reimbursemen APPLICATION SETDocument5 pagesMedical Reimbursemen APPLICATION SETLeelakrishna GvNo ratings yet

- Extinguishment of Obligations by Confusion and CompensationDocument38 pagesExtinguishment of Obligations by Confusion and CompensationMaicah Marie AlegadoNo ratings yet

- Inside Job Movie ReviewDocument4 pagesInside Job Movie ReviewThomas Cornelius AfableNo ratings yet

- CVP - Quiz 1Document7 pagesCVP - Quiz 1Jane ValenciaNo ratings yet

- Accounting For CorporationDocument5 pagesAccounting For CorporationZariyah RiegoNo ratings yet