Professional Documents

Culture Documents

Imp Points Income Tax

Uploaded by

Farrukh MaqsoodOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Imp Points Income Tax

Uploaded by

Farrukh MaqsoodCopyright:

Available Formats

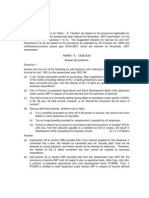

FATE Wing -FBR

Direct Tax - Frequently Asked Questions

Q. 1 A. What is the limit not chargeable to tax for Tax Year 2010? Rs. 300,000. 1st Schedule to the Income Tax Ordinance, 2001 Q. 2 Is tax to be withheld at the time of payment of salary by the employer? A. Yes. As per rates specified in Ist Schedule to the Income Tax Ordinance, 2001 Q. 3 What is the taxability of the amount received as self-hiring? A. It is taxable as Income from Property. Section 15 of Income Tax ordinance, 2001, Division VI, Part I of Ist Schedule. Q. 4 A. Q. 5 A. Is income from property included in Salary? No, it will be taxed as separate block of income. Section 15 of Income Tax ordinance, 2001

What are the tax rates for income derived from Salary? Tax rates applicable for Tax Year 2010 are as under: 1st Schedule to the Income Tax Ordinance, 2001 S. No. Taxable income (1) 1. 2. (2) Where taxable income does not exceed Rs.300,000 Rate of tax. (3) 0%

Where the taxable income exceeds Rs.300,000 but does 0.75% not exceed Rs.350,000

3.

Where the taxable income exceeds Rs.350,000 but does 1.50% not exceed Rs.400,000

4.

Where the taxable income exceeds Rs.400,000 but does 2.50% not exceed Rs.450,000

5.

Where the taxable income exceeds Rs.450,000 but does 3.50% not exceed Rs.550,000

6.

Where the taxable income exceeds Rs.550,000 but does 4.50% not exceed Rs.650,000

7.

Where the taxable income exceeds Rs.650,000 but does 6.00% not exceed Rs.750,000

8.

Where the taxable income exceeds Rs.750,000 but does 7.50% not exceed Rs.900,000,

9.

Where the taxable income exceeds Rs.900,000 but does 9.00% not exceed Rs.1,050,000,

10.

Where the taxable income exceeds Rs.1,050,000 but does 10.00% not exceed Rs.1,200,000,

11.

Where the taxable income exceeds Rs.1,200 ,000 but does 11.00% not exceed Rs.1,450,000,

12.

Where the taxable income exceeds Rs.1,450,000 but does 12.50% not exceed Rs.1,700,000,

13.

Where the taxable income exceeds Rs.1,700,000 but does 14.00% not exceed Rs.1,950,000,

14.

Where the taxable income exceeds Rs.1,950,000 but does 15.00% not exceed Rs.2,250,000,

15.

Where the taxable income exceeds Rs.2,250,000 but does 16.00% not exceed Rs.2,850,000,

16.

Where the taxable income exceeds Rs.2,850,000 but does 17.50% not exceed Rs.3,550,000,

17.

Where the taxable income exceeds Rs.3,550,000 but does 18.50% not exceed Rs.4,550,000,

18.

Where the taxable income exceeds Rs.4,550,000

20.00%

Q. 6 Is amount not chargeable to tax i.e. Rs. 300,000 deductible from taxable income? A. No, the tax payable will be calculated on taxable income as per slab rates without any deduction. Q. 7 Is pension of a Government employee exempt? A. Yes. Clasue-9 Part-I of 2nd Schedule to the Income Tax Ordinance, 2001 Q. 8 Is pension granted to the family of public servant expired during service is exempt? A. It is taxable w.e.f 01.07.2006. Tax Clause-18 Part I of 2nd Schedule to the Income Ordinance, 2001 Now omitted through Finance Act, 2006. 1st Schedule to the

Income Tax Ordinance, 2001

Q. 9 What is the taxability of leave encashment? A. Only encashment of leave preparatory to retirement, in the case of a Government servant is exempt. Rest are taxable. Clause-19 Part I of 2nd Schedule to the Income Tax Ordinance, 2001 Q. 10 A. Q. 11 A. Q. 12 A. Q. 13 A. Yes, if it does not exceed 75% of the gross salary. Clause 35 Part I of 2nd Schedule to the Income Tax Ordinance, 2001 Q. 14 A. Q. 15 A. Q. 16 A. It is exempt up to 10% of the basic salary if employee is not entitled for free medical treatment or reimbursement of medical expenses. of 2nd Clause 139(b) Part I Schedule to the Income Tax Ordinance, 2001 Q. 17 A. Q. 18 A. No. No. Is special additional allowance exempt? Is entertainment allowance exempt? Utilities allowance is not exempt. Is medical allowance exempt? No. What is exemption limit for utilities? Is overtime allowance exempt? No. Is compensatory allowance of a Pakistani citizen recruited in Pak Mission abroad exempt? No. Is special pay exempt? Yes Is deputation pay exempt? Is leave encashment paid to an employee of private establishment taxable?

Q. 19 A. Q. 20 A. Q. 21 A.

What is exemption limit for house rent allowance?

HRA is not exempt. Whether accommodation provided by the employer is exempt?

No, it is taxable as a perquisite. What is the method of taxing the accommodation provided by employer?

The amount of house rent that would have been paid (if house was not provided) shall be taken as value of accommodation provided by employer.

Rule-4 of Income Tax Rules, 2002

Q. 22 A.

Is there any minimum limit for addition on account of accommodation provided by the employer?

The addition for perquisite of housing facility will not be less than 45% of minimum of the time scale or basic salary where there is no time scale.

Rule-4 of Income Tax Rules, 2002

Q. 23 A. Q. 24 A.

What is exemption limit for conveyance allowance?

Conveyance allowance is not exempt. Is motor vehicle provided by employer for personal and business use exempt?

No, it is taxable being a perquisite and requires addition to salary @ 5% of the cost of the vehicle.

Rule-5 of Income Tax Rules, 2002

Q. 25 A.

Is a leased motor vehicle provided by employer for personal and business use exempt?

No, it is taxable being a perquisite and requires addition @ 5% of the fair market value of vehicle at the commencement of the lease.

Rule-5 of Income Tax Rules, 2002

Q. 26 A.

Whether motor vehicle provided by employer, exclusively for personal use, exempt?

No, it requires addition to salary @ 10% of the cost of the vehicle.

Rule-5(ii) of Income Tax Rules, 2002

Q. 27 A.

Is leased motor vehicle provided by employer exclusively for personal use exempt?

No, it requires addition to salary @ 10% of the cost of the vehicle.

Rule-5(ii) of Income Tax Rules, 2002

Q. 28

Whether allowances are part of salary and what is their taxability?

A.

Allowances received in cash are part of salary and are to be included in salary for taxation purpose.

Section 12 of Income Tax Ordinance, 2001

Q. 29 A.

Whether teachers are entitled for rebate?

Yes, full time teachers and researchers are entitled for reduction @ 75% of the tax payable. of 2nd

Clause I(2) Part III Schedule to the Income Tax Ordinance, 2001

Q. 30 A. Q. 31 A. Q. 32 A.

Are headmasters/principals entitled for reduction available to teachers?

Yes. Is bonus income exempt?

No. Are full time teachers/researchers employed in Government training/research institutions entitled for 75% reduction? Yes. Clause I(2) Part III of 2nd Schedule to the Income Tax Ordinance, 2001

Q. 33 A. Q. 34 A.

Is flying allowance paid to pilots, flight engineer and navigators of Pakistan Armed Forces, Pak Airlines exempt? No. Is flying allowance included in total income?

No. Flying allowance will be taxed @ 2.5% as a separate block of income.

Clause (I)(a) Part III of 2nd Schedule to the Income Tax Ordinance, 2001

Q. 35 A.

Is flying allowance of JCOs of Armed Forces exempt?

No, it will be taxed @ 2.5% as a separate block of income.

Clause (I)(b) Part III of 2nd Schedule to the Income Tax Ordinance, 2001

Q. 36 A.

Is gratuity received on retirement, under the scheme approved by CIT exempt?

Yes.

Clause (13)(ii) Part I of 2nd Schedule to the Income Tax

Ordinance, 2001 Q. 37 A. Is commutation of pension paid to an employee of Federal/Provincial Authority/Statutory Corporation taxable? Payment on account of commutation of pension received from Government or Clause (12) Part I of 2nd under any pension scheme approved by the FBR is not taxable. Schedule to the Income Tax Ordinance, 2001 Q. 38 A. What is exemption limit for commutation of pension or gratuity paid under the FBRs approved scheme for the purpose of clause 13(iii)? Rs. 200,000. Clause-(13)(iii) Part I of 2nd Schedule to the Income Tax Ordinance, 2001 Q. 39 A. Yes. Clause-(16) Part Ordinance, 2001 Q. 40 A. No. Clause-(51) Part Ordinance, 2001 Q. 41 A. No. Clause-(51) Part Ordinance, 2001 Q. 42 Is accommodation provided to the Chiefs of Staff, Pakistan Armed Forces taxable? No. Clause (51) Part I of 2nd Schedule to the Income Tax Ordinance, 2001 Q. 43 A. Yes. Clause-(55) Part Ordinance, 2001 I of 2nd Is accommodation provided to a judge of the Supreme Court Pakistan or High Court exempt? I of 2nd Is accommodation provided to the Provincial Governor taxable? I of 2nd Is accommodation provided to President of Pakistan taxable? I of 2nd Is childrens allowance paid to a Shaheeds family exempt? Government/Local

Schedule to the Income Tax

Schedule to the Income Tax

Schedule to the Income Tax

Schedule to the Income Tax

Q. 44 A.

Whether medical/hospital reimbursement charges exempt?

Yes, subject to payment under the terms of employment and the bills containing NTN of the hospital, certified and attested by the Employer. of

Clause-(139)(a) Part I 2nd Schedule to the Income Tax Ordinance, 2001

Q. 45 A.

Is free conveyance provided to the Federal Ministers taxable?

No.

Clause-(53)(c) Part I of 2nd Schedule to the Income Tax Ordinance, 2001

Q. 46 A.

Is free conveyance provided to the Chiefs of Staff, Pakistan Armed Forces taxable?

No.

Clause-(52) Part Ordinance, 2001

I of

2nd

Schedule to the Income Tax

Q. 47 A.

Is free conveyance provided to the Corp Commanders of Pak Army taxable?

No.

Clause-(52) Part Ordinance, 2001

I of

2nd

Schedule to the Income Tax

Q. 48 A. Q. 49 A.

Is conveyance allowance, paid in addition to vehicle provided by employer exclusively for business purpose taxable? Yes Is free conveyance provided to a Federal Minister taxable?

No.

Clause-(53)(c) Part I of 2nd Schedule to the Income Tax Ordinance, 2001

Q. 50 A.

Is free conveyance provided to a judge of the Supreme Court of Pakistan or High Court exempt?

Yes.

Clause-(56) Part Ordinance, 2001

I of

2nd

Schedule to the Income Tax

Q. 51 A.

Is entertainment allowance paid to Chiefs of Staff, Pakistan Armed Forces taxable?

No.

Clause-(52) Part

I of

2nd

Schedule to the Income Tax Ordinance, 2001 Q. 52 A. No. Clause-(52) Part Ordinance, 2001 Q. 53 A. No. Clause-(53) Part Ordinance, 2001 Q. 54 A. Yes, If payable from a recognized fund. Clause-(23) Part Ordinance, 2001 Q. 55 A. Payment received from a fund established under Provident Fund Act, 1925 or a Clause-(22) Part recognized fund is exempt. Ordinance, 2001 Q. 56 A. Yes, employers have been empowered to adjust tax withheld under other heads. Section 149 of Income Tax Ordinance, 2001 Q. 57 A. Yes, employers have been empowered to allow tax credit available to an Section 149 of Income Tax employer under the law. Q. 58 A. Ordinance, 2001 Whether employers are authorized to allow tax credit available to an employer? Whether employers are authorized to adjust tax withheld under other heads? I of 2nd Is provident fund exempt? I of 2nd Is accumulated balance of Provident Fund exempt? I of 2nd Is entertainment allowance paid to Federal Minister taxable? I of 2nd Is entertainment allowance paid to the Provincial Governor taxable?

Schedule to the Income Tax

Schedule to the Income Tax

Schedule to the Income Tax

Schedule to the Income Tax

In case of provincial govt. employees working in small cities, what amount will be added on account of house rent allowance? Amount actually received as house rent allowance is taxable. However, for Circular No: 06 of 2008. employees posted in Mufasal areas to whom the house rent allowance is admissible at 30% of the minimum time scale of their basic salary the value of house perquisite taken for the purpose of taxation shall be an amount not less

than 30% of minimum of time scale of basic salary or the basic salary where there is no time scale. Q. 59 A. In case of a taxpayer deriving income from salary only, the prescribed annual Section 115 of Income Tax statement filed by the employer will be considered as sufficient discharge of Ordinance, 2001 liability and shall be treated as a return of income furnished under section 114. Q. 60 A. Q. 61 A. Q. 62 A. Return of Total Income/Statement of Final Taxation. (IT-2) Whether employer is empowered to adjust withholding tax collected and to allow tax credit available to employee while making deduction of tax from salary paid to employees? Employer (i) is empowered to; Section 149 of Income Tax Ordinance, 2001 Return of Total Income/Statement of Final Taxation. (IT-2) Which return form should be filed if an employee has more than one employer? Which return form should be filed if an employee has income from other source? Whether a salaried person having no other source of income is required to file return of income?

adjust tax withheld under the following heads:

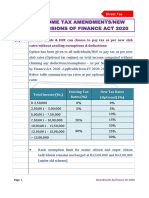

1. Motor Vehicle u/s 234 in respect of motor vehicles registered in the employees name. 2. Telephone bills as a subscriber of telephone u/s 236. 3. Cash withdrawals form banks u/s 231A. 4. Registration of new motor car/jeep u/s 231B. (ii) allow tax credits available to an employee on:1. donations to approved NPOs (section 61) 2. investment in shares (section 62) 3. contribution to approved pension funds (section 63); and 4. profit on debt (section 64) Q. 63 A. Every person whose salary income is Rs: 500,000/- or more and withholding Section 116 of Income Tax statement has been treated as return of income, whether or not the employer Ordinance, 2001 ha furnished the statement of deduction of tax. Q.64 What is the concept of Marginal Relief on Salary? A. Presently income from salary is charged to tax at different flat rates ranging from 0% to 20% on progressive income slabs. The salaried person whose income slab changes marginally due to increase in the pay and Who are required to file wealth statement?

allowances etc. face hardship as with marginal switching over to next slab tax liability increases disproportionately. To address the hardship, the concept of marginal tax relief has been introduced through the following provision, inserted in Para 1-A of Part-1 of the First Schedule to the Income Tax Ordinance, 2001. Provided further that where the total income of a taxpayer marginally exceeds the maximum limit of a slab in the table, the income tax payable shall be the tax payable on the maximum of that slab plus an amount equal to 1. (i) 20% of the amount by which the total income exceeds the said limit where the total income does not exceed 500,000 2. (ii) 30% of the amount by which the total income exceeds in each slab but total income does not exceed 10,50,000 3. (iii) 40% of the amount by which the total income exceeds in each slab but total income does not exceed 20,00,000 4. (iv) 50% of the amount by which the total income exceeds in each slab but total income does not exceed 44,50,000 5. (v) 60% of the amount by which the total income exceeds in each slab but the total income exceeds 44,50,000 By virtue of aforesaid provisions if income of a salaried person marginally exceeds the maximum limit of a slab and tax is charged at a high rate, he would calculate his tax liability by applying the above formula and get marginal relief in tax. The calculation of marginal relief and tax payable under these provisions of law is explained through the following examples:-

EXAMPLE NO. 1 Income Slab No. Rate of tax Tax 450,000 05 465,000 06 2.5% 3.5% Increase in tax Percentage of tax on marginal income 34%

11250 5025/16275

Marginal relief according to formula (i)

Tax 20% maximum Total Relief Effective of

payable of

on the of tax

the the

maximum marginal payable

of increase slab

the : :

slab of

: Rs. Rs.

Rs.

11250 over 3000 14250

Rs.15000

( Rs.465000

16275 rate would

of be

14250 tax :

) 3%

= on

Rs. against

2025 income 3.5%

EXAMPLE NO. 2 Income Slab No. Rate of tax Tax 550,000 06 3.5% Increase in tax Percentage of tax on marginal income 60%

19250 5950/-

560,000 07 Marginal Tax 30% maximum Total Relief Effective (

4.5% relief

25200 according the the payable 25200 rate of 22250 tax maximum marginal of increase slab : ) = on : Rs. Rs. to the slab of formula : Rs. Rs. Rs.10000 (ii) 19250 over 3000 22250 2950 income

payable of

on the of tax

of Rs. 560,000 would be : 3.97% against 4.5% Q 65 Is flying allowance included in total income? A No. Flying allowance will be taxed @ 2.5% as a separate block of income. Clause (I)(a) Part III of 2nd Schedule to the Income Tax Ordinance, 2001

You might also like

- The Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketFrom EverandThe Fast Plan for Tax Reform: A Fair, Accountable, and Simple Tax Plan to Chop Away the Federal Tax ThicketNo ratings yet

- 10-Practical Questions of Individuals (78-113)Document38 pages10-Practical Questions of Individuals (78-113)Sajid Saith0% (1)

- Government of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECDocument19 pagesGovernment of Pakistan Federal Board of Revenue (Revenue Division) No.C.4 (1) ITP/2008-ECAhsan RazaNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- CA Final Revision MaterialDocument477 pagesCA Final Revision Materialsathish_61288@yahooNo ratings yet

- CBDT e Filing ITR 2 Validation RulesDocument34 pagesCBDT e Filing ITR 2 Validation RulesRaju BhaiNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- FAQ On Budget FY 2020-21Document9 pagesFAQ On Budget FY 2020-21GUNANo ratings yet

- ICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Document150 pagesICAB Knowledge Level Taxation-I Suggested Answer May June 2010 - Nov Dec 2017Optimal Management Solution91% (11)

- Fin623 Solved MCQs For EamsDocument24 pagesFin623 Solved MCQs For EamsSohail Merchant79% (14)

- Labour Laws Compliance Checklist-GratuityDocument5 pagesLabour Laws Compliance Checklist-Gratuityairline_maniNo ratings yet

- Tax Icsi 2012Document84 pagesTax Icsi 2012Janani ParameswaranNo ratings yet

- Past Paper Inspector Inland Revenue FBR IIR Jobs in FPSCDocument4 pagesPast Paper Inspector Inland Revenue FBR IIR Jobs in FPSCRaJa71% (14)

- Supplementary Study Paper - 2011 TaxationDocument0 pagesSupplementary Study Paper - 2011 TaxationcharlakevalNo ratings yet

- Tax Certainty CanonDocument18 pagesTax Certainty CanonRameez AbbasiNo ratings yet

- Nepal Budget Highlights - 79-80 - APM & AssociatesDocument89 pagesNepal Budget Highlights - 79-80 - APM & Associatesaasthapoddar155No ratings yet

- Finance Act 2010 Explanatory NotesDocument24 pagesFinance Act 2010 Explanatory NotesNiraj JainNo ratings yet

- Income Tax Deduction GuideDocument26 pagesIncome Tax Deduction GuideMohmad Yousuf100% (1)

- IT Assignment - MDocument8 pagesIT Assignment - Mrushabh pareetNo ratings yet

- Direct Taxes Semester 3 Roll No: 19P0310307: Filing Your Income Tax ReturnDocument5 pagesDirect Taxes Semester 3 Roll No: 19P0310307: Filing Your Income Tax ReturnPriya KudnekarNo ratings yet

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- ALEKYA - Tax Saving SchemsDocument14 pagesALEKYA - Tax Saving SchemsMOHAMMED KHAYYUMNo ratings yet

- Frequently Asked Questions (Faqs) : TPL DivisionDocument5 pagesFrequently Asked Questions (Faqs) : TPL DivisionVigneshwar Raju PrathikantamNo ratings yet

- Filing Your Tax ReturnDocument39 pagesFiling Your Tax ReturnmuktadeepsNo ratings yet

- RSM India Newsflash - Employees Guidance On New Vs Old Tax Regime Individuals April 2020Document17 pagesRSM India Newsflash - Employees Guidance On New Vs Old Tax Regime Individuals April 2020Rohan JainNo ratings yet

- Revenue Memorandum Circular No. 50-2018: Quezon CityDocument18 pagesRevenue Memorandum Circular No. 50-2018: Quezon CityKyleZapanta100% (1)

- When Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Document6 pagesWhen Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Biswabandhu PalNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

- Tax Updates For June 2012 ExamsDocument37 pagesTax Updates For June 2012 ExamsShanky MalhotraNo ratings yet

- Important Changes Brought in by The Budget 2011Document5 pagesImportant Changes Brought in by The Budget 2011harvinder thukralNo ratings yet

- INSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN ASSIGNMENTSDocument8 pagesINSTITUTE OF COST AND MANAGEMENT ACCOUNTANTS OF PAKISTAN ASSIGNMENTSAdil HashmiNo ratings yet

- Income Not Part of Total Income Full NotesDocument93 pagesIncome Not Part of Total Income Full NotesCA Rishabh DaiyaNo ratings yet

- Test 6 PDFDocument3 pagesTest 6 PDFHåris Khån MøhmånďNo ratings yet

- PCC Tax Supplementary 09Document65 pagesPCC Tax Supplementary 09kannnamreddyeswarNo ratings yet

- Introduction To Taxation: Hamza Hashmi Advocate Hight Court Partner at Hashmi AssociatesDocument31 pagesIntroduction To Taxation: Hamza Hashmi Advocate Hight Court Partner at Hashmi AssociatesArham SheikhNo ratings yet

- Exemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Document5 pagesExemptions Under Various Sections of The Income Tax, India: 1) Section 80 C (Limit: Rs. 1,00,000)Ramakoteswar NampalliNo ratings yet

- Salient Features For The Budget 2010-11Document11 pagesSalient Features For The Budget 2010-11kaashifhassanNo ratings yet

- Nepal TaxationDocument19 pagesNepal TaxationVijay AgrahariNo ratings yet

- Finance Bill, 2012: Provisions Relating To Direct TaxesDocument36 pagesFinance Bill, 2012: Provisions Relating To Direct TaxessangeetsindanNo ratings yet

- Salient Features For Income TaxDocument6 pagesSalient Features For Income TaxRimsha AslamNo ratings yet

- Salient Features Income Tax)Document5 pagesSalient Features Income Tax)bbaahmad89No ratings yet

- Tool Kit Salary 2015Document11 pagesTool Kit Salary 2015Farhan JanNo ratings yet

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamNo ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Dhananjai SharmaNo ratings yet

- MockDocument18 pagesMockSmarty ShivamNo ratings yet

- IT Circular1 - 2015 PDFDocument59 pagesIT Circular1 - 2015 PDFSellanAnithaNo ratings yet

- 2015-2018 Tax Bar QuestionsDocument42 pages2015-2018 Tax Bar QuestionsDenver Dela Cruz PadrigoNo ratings yet

- Taxation (Nov. 2007)Document17 pagesTaxation (Nov. 2007)P VenkatesanNo ratings yet

- The Budget 2011 - A Glimpse: Shetty Prabhu & AshokDocument15 pagesThe Budget 2011 - A Glimpse: Shetty Prabhu & AshokMadhusudan MagajiNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- IPCE May 2013 Taxation Suggested AnswerDocument13 pagesIPCE May 2013 Taxation Suggested AnswerParasuram IyerNo ratings yet

- Income Tax Amendments/New Provisions of Finance Act 2020Document46 pagesIncome Tax Amendments/New Provisions of Finance Act 2020shubhamworkNo ratings yet

- India Budget Statement 2023 PDFDocument31 pagesIndia Budget Statement 2023 PDFSatyaki RoyNo ratings yet

- 3 MarksDocument8 pages3 MarksAaleyahIamarNo ratings yet

- Section 115BAC Tax RatesDocument22 pagesSection 115BAC Tax RatesMonalisa BagdeNo ratings yet

- NIRC V. TRAInDocument11 pagesNIRC V. TRAInJin De GuzmanNo ratings yet

- Midterm Assignment BBA 4 8 M Morning Taxation 17052020 101153amDocument4 pagesMidterm Assignment BBA 4 8 M Morning Taxation 17052020 101153amWaseem AkramNo ratings yet

- Business Plan - PASS DMCCDocument13 pagesBusiness Plan - PASS DMCCFarrukh Maqsood100% (1)

- Product Profitability AnalysisDocument2 pagesProduct Profitability AnalysisAvinash KumarNo ratings yet

- Business Plan - PASS DMCCDocument13 pagesBusiness Plan - PASS DMCCFarrukh Maqsood100% (1)

- Literature ReviewDocument4 pagesLiterature ReviewFarrukh MaqsoodNo ratings yet

- Muhammad Sohail, Adamjee House Division. Adamjee Insurance Co. Ltd. 5th Floor, Mackinnons Building, I.I. Chundrigar Road, KarachiDocument1 pageMuhammad Sohail, Adamjee House Division. Adamjee Insurance Co. Ltd. 5th Floor, Mackinnons Building, I.I. Chundrigar Road, KarachiFarrukh MaqsoodNo ratings yet

- Expertise With EnergyDocument40 pagesExpertise With EnergyFarrukh MaqsoodNo ratings yet

- Fernando Medical Enterprises, Inc. v. Wesleyan University Phils., Inc.Document10 pagesFernando Medical Enterprises, Inc. v. Wesleyan University Phils., Inc.Clement del RosarioNo ratings yet

- TASKalfa 2-3-4 Series Final TestDocument4 pagesTASKalfa 2-3-4 Series Final TesteldhinNo ratings yet

- Eng10 LPQ3_4 Coherence and CohesionDocument2 pagesEng10 LPQ3_4 Coherence and CohesionNiña RasonableNo ratings yet

- CLNC 2040 Reflection of Assistant ExperiencesDocument4 pagesCLNC 2040 Reflection of Assistant Experiencesapi-442131145No ratings yet

- Mini Lecture and Activity Sheets in English For Academic and Professional Purposes Quarter 4, Week 5Document11 pagesMini Lecture and Activity Sheets in English For Academic and Professional Purposes Quarter 4, Week 5EllaNo ratings yet

- Presentation 1Document13 pagesPresentation 1lordonezNo ratings yet

- KPMG The Indian Services Sector Poised For Global AscendancyDocument282 pagesKPMG The Indian Services Sector Poised For Global Ascendancyrahulp9999No ratings yet

- KINGS OF TURKS - TURKISH ROYALTY Descent-LinesDocument8 pagesKINGS OF TURKS - TURKISH ROYALTY Descent-Linesaykutovski100% (1)

- NAS Drive User ManualDocument59 pagesNAS Drive User ManualCristian ScarlatNo ratings yet

- A Comparative Look at Jamaican Creole and Guyanese CreoleDocument18 pagesA Comparative Look at Jamaican Creole and Guyanese CreoleShivana Allen100% (3)

- EDUC 5240 - Creating Positive Classroom EnvironmentsDocument5 pagesEDUC 5240 - Creating Positive Classroom EnvironmentsMay Phyo ThuNo ratings yet

- Evirtualguru Computerscience 43 PDFDocument8 pagesEvirtualguru Computerscience 43 PDFJAGANNATH THAWAITNo ratings yet

- Death and DickinsonDocument12 pagesDeath and DickinsonHarshita Sohal100% (1)

- Management of Dyspnoea - DR Yeat Choi LingDocument40 pagesManagement of Dyspnoea - DR Yeat Choi Lingmalaysianhospicecouncil6240No ratings yet

- Homologation Form Number 5714 Group 1Document28 pagesHomologation Form Number 5714 Group 1ImadNo ratings yet

- APFC Accountancy Basic Study Material For APFCEPFO ExamDocument3 pagesAPFC Accountancy Basic Study Material For APFCEPFO ExamIliasNo ratings yet

- Young Man Seeks Book to Contact Girl He MetDocument1 pageYoung Man Seeks Book to Contact Girl He MetJessie WattsNo ratings yet

- Class Homework Chapter 1Document9 pagesClass Homework Chapter 1Ela BallıoğluNo ratings yet

- Krittika Takiar PDFDocument2 pagesKrittika Takiar PDFSudhakar TomarNo ratings yet

- 4 FIN555 Chap 4 Prings Typical Parameters For Intermediate Trend (Recovered)Document16 pages4 FIN555 Chap 4 Prings Typical Parameters For Intermediate Trend (Recovered)Najwa SulaimanNo ratings yet

- ISO 9001 internal audit criteria and examples guideDocument22 pagesISO 9001 internal audit criteria and examples guideMukesh Yadav100% (2)

- Engaged Listening Worksheet 3 - 24Document3 pagesEngaged Listening Worksheet 3 - 24John BennettNo ratings yet

- PERDEV - Lesson 3 ReadingsDocument6 pagesPERDEV - Lesson 3 ReadingsSofiaNo ratings yet

- Lantern October 2012Document36 pagesLantern October 2012Jovel JosephNo ratings yet

- CH 2 Short Questions IXDocument2 pagesCH 2 Short Questions IXLEGEND REHMAN OPNo ratings yet

- Compilation of Activities UBCVDocument13 pagesCompilation of Activities UBCVRenell Vincent RamosNo ratings yet

- Scholarship For Yemeni StudentsDocument45 pagesScholarship For Yemeni Studentshilal_lashuel80% (10)

- MAT 1100 Mathematical Literacy For College StudentsDocument4 pagesMAT 1100 Mathematical Literacy For College StudentsCornerstoneFYENo ratings yet

- New Member OrientationDocument41 pagesNew Member OrientationM.NASIRNo ratings yet

- The Man of Sorrows Wednesday of Holy Week Divine IntimacyDocument5 pagesThe Man of Sorrows Wednesday of Holy Week Divine IntimacyTerri ThomasNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsFrom EverandTax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C CorporationsRating: 4 out of 5 stars4/5 (1)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- The Hidden Wealth Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth Nations: The Scourge of Tax HavensRating: 4.5 out of 5 stars4.5/5 (40)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Owner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistFrom EverandOwner Operator Trucking Business Startup: How to Start Your Own Commercial Freight Carrier Trucking Business With Little Money. Bonus: Licenses and Permits ChecklistRating: 5 out of 5 stars5/5 (6)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.From EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.No ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreFrom EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreNo ratings yet

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Streetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessFrom EverandStreetwise Incorporating Your Business: From Legal Issues to Tax Concerns, All You Need to Establish and Protect Your BusinessNo ratings yet