Professional Documents

Culture Documents

ThinkingAhead Aug10

Uploaded by

Raunaq KulkarniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ThinkingAhead Aug10

Uploaded by

Raunaq KulkarniCopyright:

Available Formats

Infation: What lies ahead?

August | Issue 17

www.commerzbank.com

THINKING AHEAD, AUGUST 2010 | ISSUE 17

2

08 PeterDixon

This month

04 Whatyoushouldknowabout

monetarypolicy

Una Pjanic

08 Infationisalwaysandeverywhere

Peter Dixon

15 Whereareweinthecorporate

leveragecycle?

Bernd Meyer

19 Theneedforcompetitionamong

exchanges

Tommy Fransson

21 FIMScandinaviaTeam

22 Ourworld

24 Equityfash

Alexander Krmer

26 Equitystrategy

Gunnar Hamann

30 HybridProducts

Anton Hong & Thomas Etheve

32 GettingexposedtoInfation

Dr. Oliver Brockhaus

34 ViewsfromtheTradingFloor

Oliver Sultan

38 SowhatisVega?

40 Commodityspotlight

Eugen Weinberg

44 Aneffcientinfationhedge?

Dr Konstantinos Kalligeros

48 Fundsplatform

Huw Price

50 NewETFinthefunduniverse

Daniel Briesemann

53 FundWatchlist

Xavier Burkhard

56 Indicesplatform

Alicia Kerbrat

58 StrategiesUpdate

60 Asiafocus

Ashley Davies

63 Growthvs.Infation

San Tam

66 Contacts

Infation is always and everywhere...

To read the latest version and access archived editions of Thinking Ahead, please visit:

http://fm.commerzbank.com/Docs/ThinkingAhead/Index.html

THINKING AHEAD, AUGUST 2010 | ISSUE 17

Editors letter

With a global economic recovery underway and the interest rates of the most important global economies at or near

historic record lows, the prospect of infation is beginning to occupy the minds of institutional investors, and central

bankers. While infation rates in both the US and the Euro zone are currently moving within very low levels, given the

aforementioned circumstances, infationary risks cannot be ruled out going forward. The Euro zone merits particular

consideration, where a prolonged weaker Euro relative to main trading currencies has the potential to diminish

purchasing power and demand for imported goods.

The US economy, despite some weaker economic data of late, is frmly entrenched in a virtuous cycle, with corporate

profts surging, employment stabilised and improving consumer sentiment. Interest rate increases are not likely in

the foreseeable future, and while core US infation is at a 40 plus year low, the loose monetary policy which will most

likely be unwound slowly, has the potential to tend consumer prices upwards.

In this issue, we discuss the contrasting historical experiences of Germany and the Anglo-Saxon economies.

We also discuss the effects of an infationary scenario from an asset allocation perspective.

What can one do to protect ones investment from infationary effects? Our product specialists propose a number

of products and solutions.

Wishing all our readers a pleasant summer,

Yours,

Jaime Uribe

Co-Head of Financial Institutions Marketing,

Equity Markets & Commodities

THINKING AHEAD, AUGUST 2010 | ISSUE 17

What you should know

about monetary policy

UNAPJANIC

FINANCIAL INSTITUTIONS MARKETING

THINKING AHEAD, AUGUST 2010 | ISSUE 17

Givingacentralbankaclearremitofmaintainingprice

stability,andholdingitaccountableforachievingthat,

isseenasasine qua nonofacrediblemonetarypolicy

regime.Thelanguageinwhichthatremitisembodied

variesfromcountrytocountry.Buttheviewthat

pricestabilityistheoverridingobjectiveofmonetary

policyisnowcommontobothindustrialisedcountries

andemergingmarkets.Italsorefectstheexperience

ofthepastwherehighandunstableinfationledto

greaterfuctuationsinoutputandemploymentthan

accompaniedperiodsoflowandstableinfation.

Acommitmenttopricestabilityisnowseenasthekey

toachievingbroadereconomicstability.

The way in which monetary policy infuences the economy can

be explained as follows. The central bank is the sole issuer

of banknotes and sole provider of bank reserves, ie it is the

monopoly supplier of the monetary base. By virtue of this

monopoly, the central bank is able to infuence money market

conditions and steer short-term interest rates.

In the short run, a change in money market interest rates

induced by the central bank sets in motion a number of

mechanisms and actions by economic agents, ultimately

infuencing developments in economic variables such as output

or prices. This process also known as the monetary policy

transmission mechanism is complex and, while its broad

features are understood, there is no unique and undisputed

view of all the aspects involved.

However, it is a widely accepted proposition in the economic

profession that, in the long run, ie after all adjustments in the

economy have worked through, a change in the quantity of

money in the economy (all other things being equal) will be

refected in a change in the general level of prices and will not

induce permanent changes in real variables such as real output

or unemployment. The explanation for this is straightforward:

A change in the quantity of money in circulation ultimately

represents a change in the unit of account, in much the same

way as changing the standard unit used to measure distance

(eg switching from kilometres to miles) would not alter the actual

distance between two locations.

THINKING AHEAD, AUGUST 2010 | ISSUE 17

THETrANSMISSIONMECHANISM

As the Governing Council of the ECB is responsible for taking

monetary policy decisions aimed at the maintenance of price

stability, it is crucial that the ECB develops a view about how

monetary policy affects developments in the price level. The

process through which monetary policy decisions affect the

economy in general, and the price level in particular, is known as

the transmission mechanism of monetary policy. The individual

links through which monetary policy impulses (typically) proceed

are known as transmission channels.

Astylisedillustrationofthetransmissionmechanismfrom

interestratestoprices

The transmission mechanism through which central banks

infuence prices is because of the numerous links and

interdependencies between different components of a developed

economy a complex process. The (long) chain of cause and

effect starts with a change in the offcial interest rates set by

the central bank on its own operations. In these operations, the

central bank typically provides funds to banks (base money).

Given its monopoly over the creation of base money, the central

bank can fully determine the interest rates on its operations.

Since the central bank thereby affects the funding cost of

liquidity for banks, banks need to pass on these costs when

lending to their customers. Through this process, the central

bank has a dominant infuence on money market conditions and

can thereby steer money market interest rates. Because of the

impact it has on fnancing conditions in the economy but also

because of its impact on expectations monetary policy can

affect other fnancial variables such as asset prices (eg stock

market prices) and exchange rates.

([DPSOHVRI

VKRFNVRXWVLGH

WKHFRQWURORI

WKHFHQWUDOEDQN

&KDQJHVLQ

JOREDOHFRQRP\

&KDQJHVLQ

VFDOSROLF\

&KDQJHVLQ

FRPPRGLW\SULFHV

:DJHVDQG

SULFHVHWWLQJ

'RPHVWLF

SULFHV

,PSRUW

SULFHV

0RQH\FUHGLW $VVHWSULFHV ([FKDQJHUDWH

([SHFWDWLRQV

%DQNDQG

PDUNHWLQWHUHVWUDWHV

35,&('(9(/230(176

2)),&,$/,17(5(675$7(6

6XSSO\DQGGHPDQG

LQJRRGVDQGODERXUPDUNHWV

THINKING AHEAD, AUGUST 2010 | ISSUE 17

7

For example, all other things being equal, higher interest rates

tend to make it less attractive for households or companies

to take out loans in order to fnance their consumption or

investment, thereby infuencing supply and demand in goods

markets. At the same time, the domestic currency is likely

to appreciate as Euro deposits and interest bearing assets

denominated in Euro become more attractive relative to

other currencies. Exchange rate movements, in turn, affect

the domestic price of imported goods. If the exchange rate

appreciates, the price of imported goods tends to fall, thus

helping to reduce infation directly, or, if these imports are

used as inputs into the production process, lower prices for

inputs might feed through into lower prices for fnal goods.

An appreciation of the exchange rate would thus tend to reduce

infationary pressures.

Other channels through which monetary policy can infuence

price developments work by infuencing the private sectors

longer term expectations. If a central bank enjoys a high degree

of credibility in pursuing its objective, monetary policy can exert

a powerful direct infuence on price developments by guiding

peoples expectations of future infation and thereby infuencing

their wage and price setting behaviour.

THEECBSqUANTITATIVEDEFINITIONOF

PrICESTABIlITy

The ECB has set itself an infation target of below but close to

2%. This defnition makes clear that not only infation above 2%

but also that defation (ie price level declines) is inconsistent with

price stability.

While defation implies similar costs to the economy as

infation, avoiding defation is also important because, once it

occurs, it may become entrenched as a result of the fact that

nominal interest rates cannot fall below zero. In a defationary

environment monetary policy may thus not be able to suffciently

stimulate aggregate demand by using its interest rate instrument.

Any attempt to bring the nominal interest rate below zero would

fail, as the public would prefer to hold cash rather than to lend

or hold deposits at a negative rate. Although various monetary

policy actions are possible even when nominal interest rates

are at zero, the effectiveness of these alternative policies is not

certain. This makes it more diffcult for monetary policy to fght

defation than to fght infation.

The ECB decided to publicly announce a quantitative defnition of

price stability for a number of reasons. First, the defnition helps

to make the monetary policy framework easier to understand

(ie it makes monetary policy more transparent). Second, the

defnition of price stability provides a clear and measurable

yardstick against which the public can hold the ECB accountable.

Deviations of price developments from the defnition of price

stability can be identifed, and the ECB would then be required to

Una Pjanic

provide an explanation for such deviations and to explain how it

intends to re-establish price stability within an acceptable period

of time. Finally, the defnition provides guidance to the public for

forming expectations of future price developments.

CONClUSION

Appreciation of the fact that our present understanding of the

economy is limited should be central to the policy-making

process. It is precisely that lack of knowledge that makes

mechanical policy rules incredible. Perhaps one of the strongest

arguments for delegating decisions on interest rates to an

independent central bank is that, whereas democratically elected

politicians do not often receive praise when they say I dont

know, those words should be ever present on the tongues of

central bankers. And it is important for the central bank to be

transparent about both what it thinks it understands and what

it knows it does not understand. In so doing, it may reduce the

scale of wasted resources devoted to discovering the secrets

of central bank thinking, and reduce the number of players in

fnancial markets who fear that others have inside information.

THINKING AHEAD, AUGUST 2010 | ISSUE 17

According to the Nobel Prize laureate Milton Friedman

infation is always and everywhere a monetary

phenomenon. Given that prices over history have had

a tendency to rise, it is certainly a permanent feature

of economic systems. Given the wide range of goods,

services and assets whose prices have risen, it is certainly

everywhere. But whilst central bankers appear to accept

that it is a monetary phenomenon, the workhorse infation

model adopted by Anglo-Saxon central banks allows no

role for money in the infation process, and assume that

it is determined by the amount of spare capacity in the

economy. But if we instead widen the defnition of infation

to include asset prices, rather than simply goods and

services, Friedmans assertion holds a lot more water.

Infation is always

and everywhere...

PETErDIxON

GLOBAL EqUITIES ECONOMIST

THINKING AHEAD, AUGUST 2010 | ISSUE 17

THINKING AHEAD, AUGUST 2010 | ISSUE 17

10

ABrIEFHISTOryOFINFlATIONDETErMINATION

Ask a German central banker about why we need low and

stable infation and they will simply point you in the direction

of a history book and suggest you read about the history of the

Weimar Republic. In 1923, the central bank was issuing notes

with a denomination of 100 trillion Marks and postage stamps

had a face value of 50 billion Marks. (However, even this is not

the worst infation on record: The rate of Hungarian infation in

1946 was so bad that prices doubled every 13.5 hours and the

annual infation rate in July 1946 reached 4.19 x 10

16

%).

The root cause of hyperinfations is a huge rise in the quantity

of currency in circulation which far outstrips output growth a

simple case of too much money chasing too few goods. Given the

experience of the 1920s, it was thus no surprise that following

its foundation in 1948, the Bundesbank paid close attention to

monetary developments. This was particularly the case from the

mid-1970s, when it successfully combated the great infation

following the 1973 oil price shock by strictly controlling the rate

of monetary aggregate growth in order to provide an anchor for

infation expectations a policy which has since been continued

by the ECB.

But the experience in the Anglo-Saxon world has been rather

different. Neither the US nor the UK has ever experienced

hyperinfation, and although both the Federal Reserve and Bank

of England experimented with a policy of controlling monetary

aggregate growth in the 1970s and 1980s, this was soon

abandoned. There were two main reasons for this change of heart.

For one thing, fnancial liberalisation in the US and UK meant

that it was very diffcult to defne the correct monetary aggregate

to be targeted. It was very clear that money could no longer

simply be defned as notes and coin but it was less clear what

other forms of near money should be included. Second,

monetary aggregates became subject to a phenomenon known

as Goodharts Law which states that any observed statistical

regularity will tend to collapse once pressure is placed upon

it for control purposes. Thus, the stable relationship between

money and output, which was a key determinant of the infation

process, broke down. As a consequence, both the Fed and BoE

came to the conclusion that it was impossible to target infation

via control of the monetary aggregates.

In recent years, the Anglo-Saxon approach has placed more

weight on the New Keynesian infation formation process, in

which the rate of price growth can be determined by the degree

of spare capacity in the economy (subject to certain caveats

which, for those who care, include the assumption of rational

expectations and the existence of price rigidities). The key point,

however, is that there is no role whatsoever for money or credit

in the infation process at least in the short-term which is

anathema to the thinking of the ECB.

What all this goes to show is that there is clearly no unanimity

amongst economists about what causes infation it remains a

subject as controversial today as at the height of the bitter debate

between Keynesians and monetarists in the 1970s. Moreover,

it is striking that even major central banks have big ideological

differences and the reason this matters is that much of the

debate on whether we are about to enter a period of rising

infation or disinfation/defation is conditioned by the school of

thought (if any) to which the protagonist subscribes.

SOWHICHISITTOBE:HIGHErOrlOWEr

INFlATION?

For those of us not frmly wedded to either of these ideologies,

both models of infation contain some merit. Most practical

macroeconomists take the view that a large injection of liquidity

into the economy will produce infation if it leads to an increase

in demand for goods and services beyond the economys

capacity to produce them. In other words, money matters when

the output gap is close to zero but it is not clear how much it

contributes to infation otherwise particularly if the monetary

transmission mechanism is impaired.

A good example of this is provided by Japan, whose policy of

quantitative easing between 2001 and 2006 produced a 50% rise

in the monetary base. However, broader monetary aggregates

did not pick up because the injection of liquidity remained in

the banking system and did not translate into a rise in demand.

Similarly, those concerned that the recent central bank liquidity

injection will inevitably lead to a rise in infation are assuming

explicitly or otherwise that the banking system is in a position

to pass it on to consumers. In the UK case, where asset purchases

relative to the size of the economy are largest (around 15% of

GDP) it is clear that the credit transmission mechanism remains

impaired, and there is also little evidence that banks in the US are

boosting their credit supply. As for the ECB, bond purchases will

be sterilised in order to prevent an increase in bank reserves, thus

sidestepping the issue of a monetary impulse to infation.

From the monetary side, there would appear to be little

immediate reason to worry that liquidity injections are about to

generate a huge boost to demand growth. In any event, higher

infation will only result if demand outstrips the capacity of

the economy to supply which may take some time to occur

given the extent of spare capacity in the global economy. We

are consequently fairly relaxed about the near-term prospects

for infation in the industrialised world. Core infation rates in

the euro zone and US continue to head downwards, and it only

remains elevated in the UK as a result of higher indirect taxes

once this effect is stripped out, infation here is also on a

downward trend.

In the medium-term, it is possible that infation might pick up

more quickly than desired unless central banks are able to rein

THINKING AHEAD, AUGUST 2010 | ISSUE 17

11

Peter Dixon

in their quantitative easing strategies before they get out of

hand. But to the extent that the growing importance of the Asian

economies will boost global supply capacity, we do not see any

major medium-term threat to goods and services price infation.

BUTBEWArEOTHErFACTOrS

Even though we may have a relatively sanguine attitude towards

infation, there are a whole range of other issues to consider.

We will, for example, skip over the issue of expectations in the

infation process and will leave this for another day. But suffce

to say that the way in which expectations are formed can have a

decisive impact on infation trends, as the 1973 oil shock proved.

Instead, we wish to focus on the question of what exactly do

we mean when we talk about price infation: Which prices do

we mean? Much of the standard economic literature focuses

on the threat posed by goods and services price infation, but

this is far from the whole story since asset prices can have a

decisive impact on household and corporate decision-making.

Whilst central banks have focused all their efforts into reining

in consumer price growth over the last decade, there is a strong

case to be made that they have taken their eye off the ball with

regard to asset prices.

From the early-1990s onwards, consumer price infation in

the developed world began to slow considerably promoting

talk of the great moderation during which growth was strong

but infation low. Central banks were quick to take credit for

their role in curbing infation, but it is perhaps no coincidence

that global infation slowed at a time when Asian economies

were ramping up output. In other words, the global output gap

widened as Asian supply growth more than matched the pace of

demand growth in the industrialised world. Central banks were

emboldened to believe that the infation bogey had been laid to

rest and responded by keeping interest rates low.

The consequence was to produce a huge build-up of global

liquidity based on cheap credit. This helped to fuel an equity

bubble in the late-1990s and also helped promote a sharp rise in

house prices in the Anglo-Saxon world. Moreover, the fact that

central banks maintained a lax monetary policy after the bursting

of the equity bubble, in the mistaken belief that defation was

a threat in 2003, served only to shift the bubble into credit

markets. As this bubble began to unravel spectacularly in 2007

it has helped cause a chain of events which have contributed

to our current economic and market predicament. It is perhaps

unfair to lay all the blame for the boom and bust on the doorstep

of the worlds central banks. However, a deeper truth is that

central banks failed miserably to account for the impact of their

monetary decisions on asset markets and it is not as if this is

a criticism which we are making after the event, as some of us

were pointing out that this was an issue way back in 2003.

The moral of the story is that although consumer price infation

is clearly a key mandate for central banks, they cannot ignore

asset price infation given their responsibility for maintaining the

stability of fnancial markets. Whilst central banks may debate

over the extent to which consumer price infation is caused by

real economy or monetary factors, when we look at infation in

a wider context to include a whole variety of goods, services

and assets, the experience of the last decade appears to support

the claims of those who believe infation is caused by monetary

factors. We should, perhaps, allow the last word to Milton

Friedman, the father of modern monetarism, who stated that

infation is always and everywhere a monetary phenomenon.

That is a lesson which students of German (and Hungarian)

economic history may not need to learn, but it is one which

Anglo-Saxon central bankers may periodically need to revisit.

Most practical macroeconomists take

the view that a large injection of liquidity

into the economy will produce infation

if it leads to an increase in demand

for goods and services beyond the

economys capacity to produce them.

THINKING AHEAD, AUGUST 2010 | ISSUE 17

12

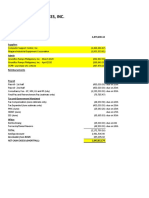

GrossDomesticproductatconstantprices,

percentagechangeonyear

Consumerprices

percentagechangeonyear

Forecast Forecast

2009 2010 2011 2009 2010 2011

Euro zone -.1 1.2 1. 0. 1. 1.7

Germany -. 2. 1. 0. 0. 1.

France -2. 1. 1. 0.1 1. 1.

Italy -.1 0.7 1. 0.7 1. 1.

Spain -. -0. 0. -0. 1. 1.

Netherlands -. 1. 1.7 1.2 1. 1.

Belgium -.0 1.1 1. -0.1 1. 1.

Austria -. 0. 1. 0. 1. 1.

Greece -2.0 -.0 -.0 1.2 .0 1.

Finland -7. 0. 1. 0.0 1.0 1.

Portugal -2.7 1.0 0. -0. 1.1 1.

Ireland -7. 0. 1. -1.7 -1. 0.

United Kingdom -. 1.1 2.0 2.2 2. 2.

Sweden -.1 .0 2. -0. 1. 2.0

Denmark -. 1. 1. 1. 2.0 1.

Switzerland -1. 1.7 1. -0. 1. 1.2

Norway -1. 1. 2. 2.2 2. 2.0

USA -2. . . -0. 1.7 1.

Canada -2. . .0 0. 2.0 2.0

Japan -.2 .0 1. -1. -0. 0.

Australia 1. 2. .0 1. 2. 2.

New Zealand -1.7 2. 2. 2.1 2.7 .

Poland 1.7 . . . 2.7 .

Hungary -. 1.0 .2 .2 .7 .2

Czech Republic -.1 1. .7 1.0 2.2 2.

Slovakia -.7 2. .0 1.7 1. 2.

China .7 10. .2 -0.7 2. .1

South Africa -1. . . .7 .1 .

Source: Global Insight, Commerzbank Research

Growth and infation

Source: Economic and Market Monitor, July/August 2010

To order, please contact: economic.research@commerzbank.com

Credits to: Chief Economist: Dr. Jrg Krmer

THINKING AHEAD, AUGUST 2010 | ISSUE 17

1

Interest rates

Table in per cent pa

1

Forecasthorizon

land 12.7.10 Sep10 Dec10 Mar11 Jun11 Sep11

Eurozone 10 years

2

2.1 2.0 2.7 2.0 .10 .2

months 0.2 0. 1.00 1.1 1. 1.7

Minimum bid rate 1.00 1.00 1.00 1.00 1.00 1.2

UnitedKingdom 10 years . .0 .7 .20 . .0

months 0.7 0.7 0.0 1.10 1.0 2.00

Repo rate 0.0 0.0 0.0 0.0 1.00 1.0

Sweden 10 years 2.7 2.0 2.70 2.0 2.0 .1

months 0. 0.0 1. 1. 1.0 2.0

Repo rate 0.0 0.0 1.00 1.2 1.0 2.00

Switzerland 10 years 1.2 1.0 1. 1. 1.7 1.

months 0.12 0.0 0.0 0. 1.10 1.2

Target rate for mo.Libor 0.2 0.2 0.0 0.7 1.00 1.2

USA 10 years .0 .0 .70 . .10 .0

month (T-Bills) 0.1 0.20 0.0 0. 1.20 1.0

month Eurodollar 0. 0. 0.0 1. 1.70 2.0

Fed funds rate 0.2 0.2 0.2 0.7 1.2 1.7

Canada 10 years .2 .1 .0 . .00 .0

months 0. 1. 1.7 2. .0 .

Overnight rate target 0.0 0.7 1.2 1.7 2.2 .00

Japan 10 years 1.1 1.0 1.0 1.0 1.70 1.0

months 0.2 0.0 0.0 0.0 0.0 0.0

Overnight rate target 0.10 0.10 0.10 0.10 0.10 0.10

Australia 10 years .12 .0 . . . .10

months . .10 .2 . .70 .

Overnight rate target .0 .0 .7 .00 .2 .0

Poland 10 years . .0 .00 .0 .0 .7

months .7 .0 .2 .7 .0 .10

Intervention rate (7 days) .0 .0 .7 .2 .0 .00

Hungary 10 years 7. 7.00 .7 7.00 7.2 7.7

months .2 .2 .0 .0 .0 .00

2 weeks deposit rate .2 .00 .00 .00 .00 .00

Czechrepublic 10 years .10 .00 .2 .7 .00 .00

months 1.2 1.0 1.7 1.7 2.00 2.2

Repo rate (2 weeks) 0.7 0.7 1.00 1.2 1.0 2.0

SouthAfrica 10 years .2 .70 .7 .00 .00 .0

months . . 7.00 7.2 7.0 .00

Repo rate .0 .0 .0 7.00 7.00 7.0

Source: Bloomberg, Commerzbank Research

1

10 years government bond yields; months money market rates

2

Bunds

THINKING AHEAD, AUGUST 2010 | ISSUE 17

1

Exchange rates

Forecasthorizon

Currency 12.7.10 Sep10 Dec10 Mar11 Jun11 Sep11

Dollar USD per EUR 1.2 1.17 1.17 1.1 1.1 1.1

Japanese yen JPY per EUR 112 112 117 121 12 10

JPY per USD 100 10 110 11

British pound GBP per EUR 0. 0.2 0.1 0.1 0.0 0.0

USD per GBP 1.0 1. 1. 1.2 1.1 1.1

Swiss franc CHF per EUR 1. 1.1 1.2 1.2 1.0 1.2

CHF per USD 1.07 1.12 1.10 1.12 1.1 1.17

Swedish krona SEK per EUR .7 .2 .0 .7 . .2

SEK per USD 7. .1 .12 .2 . .

Norwegian krone NOK per EUR .0 7.0 7. 7.0 7.77 7.7

NOK per USD . .7 .71 .7 . .

Canadian dollar CAD per EUR 1.0 1.21 1.22 1.21 1.20 1.22

CAD per USD 1.0 1.0 1.0 1.0 1.0 1.0

Australian dollar AUD per EUR 1. 1. 1. 1. 1. 1.

USD per AUD 0.7 0. 0. 0. 0. 0.

New Zealand dollar NZD per EUR 1.77 1.70 1.70 1. 1. 1.71

USD per NZD 0.71 0. 0. 0. 0.7 0.

Polish zloty PLN per EUR .0 .0 .0 .7 .70 .

PLN per USD .2 . .2 .2 .27 .2

Hungarian forint HUF per EUR 20 2 2 2 20 20

HUF per USD 222 22 22 20 20 20

Czech koruna CZK per EUR 2.1 2.0 2.0 2.0 2.20 2.00

CZK per USD 20.1 22.0 21. 22.0 22.0 22.12

Romanian leu RON per EUR .2 .20 .10 .0 .0 .10

RON per USD .7 . .0 .2 . .

Russian rouble RUB per EUR .2 .1 .7 . .2 .2

RUB per USD 0.7 0. 0. 0.1 1.1 1.1

Ukrainian hryvnia UAH per EUR . . . .20 .0 .0

UAH per USD 7.0 .00 .00 .00 .00 .00

Turkish lira TRY per EUR 1. 1.0 1.2 1.1 1.0 1.1

TRY per USD 1. 1.2 1. 1. 1. 1.

South African rand ZAR per EUR .7 .7 . .1 .2 .1

ZAR per USD 7.1 7.0 7.0 7.0 7.0 7.20

Chinese Renminbi CNY per EUR .2 7.0 7. 7. 7. 7.0

CNY per USD .77 .7 .70 . .0 .

Source: Bloomberg, Commerzbank Research

THINKING AHEAD, AUGUST 2010 | ISSUE 17

1

During the past 12 months, corporate credit has been among the highest-yielding assets from

an investor point of view. However, our analysis of previous corporate leverage cycles reveals

that we are approaching a phase which, in the past, has tended to show fairly poor returns

on corporate bonds. Looking at various measures of fnancial leverage since 10, this article

identifes three phases of the leverage cycle, balance sheet repair, intentional re-leveraging

and blow-out. At present companies are in balance sheet repair mode. Assuming that double-

dip concerns which typically appear during this stage of the cycle are overcome, we believe the

leverage cycle will move into the phase of intentional re-leveraging over the next -12 months.

This tends to be the best phase for equity performance, while credit tends to move at best in-line

with government bonds.

Where are we in the

corporate leverage cycle?

BErNDMEyEr

HEAD OF CROSS ASSET STRATEGY

Corporate earnings have rebounded from their recession lows

and companies have started to repair their balance sheets. This

in turn leads to tighter credit spreads. This is typically a phase

in which credit tends to perform very well. This time around,

credit performance was additionally supported by declining

government bond yields. While in terms of absolute returns

credit performance did not keep pace with equity performance,

credit posted the highest risk-adjusted performance of all asset

classes over the last 12 months (see Chart 1). How will the credit

to equity performance progress going forward? To answer this

question, this article analyses the relationship between global

economic growth, the corporate fnancial leverage cycle and the

relative performance of credit, equity and government bonds.

THrEEPHASESOFTHECOrPOrATElEVErAGECyClE

Looking at various measures of corporate leverage, a clear

cyclical behaviour, related to global economic growth can

be observed. In our view the corporate leverage cycle can be

divided into in three phases.

Phase 1: Balance-sheet repair

Phase 1 follows a global recession or at least a strong

downturn in global economic growth. During this phase,

global growth bottoms out and recovers, to be followed by a

similar development in corporate proftability. Cash generation

picks up and earnings growth is strong, benefting from high

operational leverage at this stage of the cycle due to the typically

underutilised capacities. As balance sheets have suffered during

the recession/downturn and costs for debt fnancing are high,

companies now focus on debt reduction and healthy balance

sheets. As a consequence, Net debt/Equity and Net debt/EBITDA

ratios tend to decline (see Charts 2 and 3) and interest cover

rises. While return on equity and the net proft margin tend to

rise, the recovery of dividend growth tends to be limited due to

the debt reduction focus.

Phase 2: Intentional re-leveraging

Phase 2 of the leverage cycle is characterised by solid economic

growth. However, as growth momentum is fading and the

operational leverage is now limited due to already high capacity

utilisation, companies are looking to sustain solid earnings

momentum. As balance sheets look healthy, cash generation

is strong and debt fnancing costs have declined, companies

may try to keep earnings growth momentum high by expanding

their business organically, which requires CAPEX, or through

M&A. Alternatively, they may return excess cash to shareholders

THINKING AHEAD, AUGUST 2010 | ISSUE 17

1

Equly Volallly

REITS

Commodles

Credl

Inalonlnked Debl

Soveregn Debl

Equly

0

5

10

15

20

25

30

35

40

45

50

55

1

2

M

T

o

l

a

l

R

e

l

u

r

n

%

,

E

U

R

I

0 10 15 5 20 25 35 30 40

Volallly %, EURI

Cash

Eurodenomnaled lolal relurn and Sharpe ralo over lhe lasl 12 monlhs or assel classes

Chart1:Credithasthehighest12MEUrSharperatioofall

assetclassesbuttotalreturnonequityishigher

Source: Bloomberg, Markit, Datastream, Commerzbank Corporates & Markets, data as

at July 2010

1

0

1

2

3

4

5

6

180 183 186 18 12 15 18 2001 2004 2007 2010

0

10

20

30

40

50

60

Clobal real CDP growlh orecasls

or 2010 and 2011 rom IMl

1 2 3 1 2 3 1 2 3 1 3

O Clobal real CDP growlh %I

Nel debl/Equly %, rhsI

Medan or Sloxx600 comps. S global CDP growlh

Chart2:Netdebt/Equityratio

Source: IMF, Datastream, Commerzbank Corporates & Markets

1

0

1

2

3

4

5

6

180 183 186 18 12 15 18 2001 2004 2007 2010

0

20

40

60

80

100

120

140

160

Clobal real CDP growlh orecasls

or 2010 and 2011 rom IMl

1 2 3 1 2 3 1 2 3 1 3

O Clobal real CDP growlh %I

Nel debl/EBITDA %, rhsI

Medan or Sloxx600 comps. S global CDP growlh

Chart3:Netdebt/EBITDA

Source: IMF, Datastream, Commerzbank Corporates & Markets

by means of share-buybacks or higher dividends. Notice that

share-buybacks support EPS growth and RoE. Companies thus

intentionally increase fnancial leverage. As a consequence the

Net debt/Equity and Net debt/EBITDA ratios start to rise again

(see Charts 2 and 3) and interest cover stabilises, though at a

healthy level. Return on equity and the net margin continue to

rise and dividend growth is stable at a high level.

Phase 3: Unintentional rise in leverage (Blow-out)

Phase 2 continues with gradually increasing fnancial gearing

until economic growth weakens/collapses, triggering Phase 3.

As soon as this happens, the already higher geared companies

face a further unintentional rise in fnancial leverage as operating

profts plummet and losses eat into the existing equity. As a

consequence, the Net debt/EBITDA and the Net debt/Equity

ratios continue to rise (see Charts 2 and 3) while the interest

cover declines strongly. Return on equity, the net proft margin

and dividend growth all collapse.

ASSETClASSPErFOrMANCEDUrINGTHEPHASES

OFTHECOrPOrATElEVErAGECyClE

Phase 1: Investors should focus on credit and equity

Charts 4a and 4b depict the median performance for each of

the three asset classes in each phase of the corporate leverage

cycle in Europe and the US. As one would expect, Phase 1 of the

corporate leverage cycle tends to be the best for credit. Rising

corporate proftability and the focus on debt reduction result in

tightening credit spreads. Although credit performance cannot

fully keep pace with equity performance, the difference of the

average and median performance of credit and equity is limited

in Phase 1.

Phase 2: Investors should focus on equity

In Phase 2 credit is losing the support from tightening credit

spreads as (1) credits spreads tend to have come in substantially

already, and, (2) companies intentionally re-lever their balance

sheets which leads to gradually rising credit spreads. Corporate

focus thus clearly shifts from bondholder value to shareholder

value. Moreover, credit may start to suffer from another angle,

as tightening credit spreads no longer offset rising government

bond yields. Chart 3 shows that Phase 2 tends to be the weakest

phase of the corporate leverage cycle for credit. Median credit

performance is actually slightly weaker than government bond

performance during this phase.

Phase 2 of the corporate leverage cycle is clearly the best phase

for equity. Solid returns on invested capital coupled with higher

fnancial leverage tend to enhance RoE and EPS. As analysts

tend to underestimate the earnings impact from intentional

re-leveraging, they also tend to underestimate earnings growth

in Phase 2 of the leverage cycle. As re-leveraging occurs,

earnings forecasts need to be upgraded. This is one important

driver of continued earnings upgrades at this stage of the cycle.

THINKING AHEAD, AUGUST 2010 | ISSUE 17

17

Moreover, during this phase of the cycle, equities beneft

from solid net demand due to M&A, share buy-backs and the

necessary re-investment of solidly growing dividend payments.

The diverging development of credit and equity in Phase 1 and

Phase 2 of the corporate leverage cycle also becomes obvious

when looking at fund fow data in Chart 5. Despite the limited

available data history, we fnd that during the last occurrence

of Phase 2, credit funds faced redemptions while equity funds

enjoyed infows. In contrast, in Phase 1 since 2009, credit funds

have seen strong infows while infows into equity funds have

been limited. Note however, that the momentum of fows into

credit funds has started to weaken recently. In Phase 3, it is not

surprising to observe outfows for both equity and credit funds.

Phase 3: Investors should focus on government bonds

Phase 3 is obviously the best phase for government bonds.

As sales growth and earnings collapse with the deterioration

of economic growth, this is the weakest phase for equity.

Credit tends to perform worse than government bonds.

Though corporate debt enjoys the same decline of bond yields as

government bonds, part of this performance is eaten up by rising

credit spreads. During 2008 the latter effect more than offset

the beneft from declining government bond yields resulting in a

clearly negative performance of credit

FrOMBAlANCE-SHEETrEPAIrTOINTENTIONAl

rE-lEVErING

So, where are we in the current leverage cycle? Given the decline

of Net debt/Equity and Net debt/EBITDA in 2009 (see Charts 2

and 3), we have classifed 2009 as the frst year of the balance

sheet repair phase, despite interest cover, corporate proftability

and economic growth still declining. This classifcation though is

also suggested by the asset class performance observed during

2009. In 2010 economic growth recovers, earnings grow strongly

and balance sheet repair has so far remained in the focus of

companies. As can be seen in Chart 6, 2010 dividend growth is

expected to remain limited despite the solid growth of earnings.

Thereafter however, dividend growth is expected to reach

double digit territory in 2011 and 2012, while earnings growth

is levelling off.

If corporate proftability comes in as forecasted by analysts,

companies will likely start to intentionally re-lever from 2011

onwards, supporting EPS growth and ROE. This suggests

that within the next 6 -12 months corporate focus shifts from

bondholder value to shareholder value and the corporate

leverage cycle enters Phase 2. This in turn suggests that the

strong performance of credit observed over the last 12 months

should level off and equity should clearly move into investors

16.5

14.3

15.1

7.5

11.

4.7

7.1

6.6

5.8

6.6

.0

23.5

20

15

10

5

0

5

10

15

20

25

All Phase 1 Phase 2 Phase 3

(XURSH

0HGLDQ

O Equly O Credl O Covernmenl bonds

Chart4a: Medianannualtotalreturnofassetclassesinthe

differentphasesofthecorporateleveragecycle

Source: Bloomberg, Datastream, Commerzbank Corporates & Markets

20

15

10

5

0

5

10

15

20

25

All Phase 1 Phase 2 Phase 3

86

0HGLDQ

O Equly O Credl O Covernmenl bonds

14.6

10.1

16.3

3.1

.1 .3

8.7

.1

8.7

5.

.1

.

Chart4b: Medianannualtotalreturnofassetclassesinthe

differentphasesofthecorporateleveragecycle

Source: Bloomberg, Datastream, Commerzbank Corporates & Markets

13

11

7

5

3

1

1

3

5

7

11

13

1an 05 1ul 05 1an 06 1ul 06 1an 07 1ul 07 1an 08 1ul 08 1an 0 1ul 0 1an 10

30

20

10

0

10

20

30

2 3 1

12M Clobal equly und ows % o AuMI

12M HY bond und ows % o AuM, rhsI

Chart5:12Mfowsintoglobalequityfundsandglobal

Hybondfundsas%ofAuM

Source: EPFR, Commerzbank Corporates & Markets

THINKING AHEAD, AUGUST 2010 | ISSUE 17

1

focus. The currently attractive valuation of equities does indeed

allow solid equity market performance going forward as long

as the expected earnings and dividend development shown in

Chart 5 is realised. An obvious precondition for this to happen

is that the double dip worries currently dominating the markets

are overcome as predicted by our economists in their baseline

scenario. In this case we believe investors should in the next

6 -12 months use phases of tighter credit spreads (see Chart 7)

to reduce credit positions to the beneft of equity positions.

Bernd Meyer

In 2010 economic growth recovers,

earnings grow strongly and balance

sheet repair has so far remained in

the focus of companies.

Chart6a:Bottom-upconsensusearningsanddividend

growthexpectations

30

20

10

0

10

20

30

40

200 2010 2011 2012

O Sloxx 600 earnngs growlh %I

O SSP 500 earnngs growlh %I

Earnngs growlh or Sloxx 600 and SSP 500

Source: Thomson Financial IBES, Commerzbank Corporates & Markets

30

25

20

15

10

5

0

5

10

15

20

200 2010 2011 2012

O Sloxx 600 dvdend growlh %I

O SSP 500 dvdend growlh %I

Earnngs growlh or Sloxx 600 and SSP 500

Chart6b:Bottom-upconsensusearningsanddividend

growthexpectations

Source: Thomson Financial IBES, Commerzbank Corporates & Markets

0

50

100

150

200

250

300

1 2000 2001 2002 2003 2004 2005 2006 2007 2008 200 2010

70

0

110

130

150

170

10

210

Boxx Corp nonnancals Asselswap Spread bpI

Nel debl/EBITDA medan o nonnancal Sloxx 600 comps. %, rhsI

3 x Nel debl/Equly medan o nonnancal Sloxx 600 comps. %, rhsI

Corporale Nonnancal Asselswap Spreads and medan Nonnancal

Sloxx600 Nel debl/Equly and Nel debl/EBITDA

2 3 1 2 3 1

Chart7:CorporateleverageandcreditspreadsinEurope

Source: Markit, Datastream, WorldScope, Commerzbank Corporates & Markets

THINKING AHEAD, AUGUST 2010 | ISSUE 17

1

The infrastructure in Sweden for securitised derivatives in the early 200 was not

conducive to sound market development. The cost involved in bringing a product

to market was extremely high and the segment in general got little attention. It took

one week for issuers to reach the market with a product and the number of possible

listings was restricted. In addition to this, the general presentation of securities

by the exchange, brokers and information system as equities and other fnancial

instruments. There was a need for competition among exchanges!

The need for competition

among exchanges

TOMMyFrANSSON

HEAD OF NORDIC DERIVATIVES EXCHANGE

THINKING AHEAD, AUGUST 2010 | ISSUE 17

20

Tommy Fransson

THElAUNCHOFNDx

The situation encouraged issuers to contact Nordic Growth

Market NGM- at that time a small cap equity exchange to

discuss possibilities to list and trade securitised derivatives at

NGM. The Nordic Derivatives eXchange NDX was launched on

13 March 2003, as a business segment for securitised derivatives

at the NGM exchange. The business model of NDX was to offer

a fexible market with strong infuence by issuers and other

market participants. The prices were reduced for listing by up

to 90% and for trading by up to 30%. The cost for market data

was also drastically reduced as a step to develop the market. The

frst products to be listed at NDX were Hit warrants, issued by

the local bank Handelsbanken in March 2003. A Hit warrant was

a barrier warrant with a predefned possible payout of 10 SEK.

During the whole year 2003, there was only one issuer at NDX,

offering only Hit warrants. At the end of the year, 24 instruments

were listed at NDX and the total turnover for the year was SEK17m.

The development of NDX started to take off in December 2004,

when Carnegie Investment Bank and Socit Gnrale started

to list plain vanilla warrants. At the same time, NDX launched

a segment for capital protected certifcates NDX Bonds, with

Handelsbanken as issuer. At the end of the year, 85 instruments

were listed at NDX and the total turnover for the year was SEK20m.

NDxTODAy

Today NDX has 18 issuers, eg Commerzbank, RBS, Nordea,

Carnegie Investment Bank, UBS, Socit Gnrale and Deutsche

Bank. The total number of listed products is over 2,600 and

the turnover for June 2010 was over SEK1.4bn. The product

range has increased to include plain vanilla warrants, turbo

warrants, Mini Futures, Constant Leverage certifcates, Discount

certifcates, Tracker certifcates, Capital protected certifcates

and more. The ambition of NDX is to build and develop the

market together with market participants through promoting

transparency, conveying information and knowledge to private

investors and offering a powerful platform for marketing issuers

products. This shared business philosophy and the success of

NDX contributed to the Boerse Stuttgart acquisition of NGM in

November 2008.

THENEEDFOrEDUCATION

In the beginning of 2009, NDX launched the education platform

NDX Education. Flow providers, issuers and media use the

platform to give information and education about investment

products to their end clients. Today, the electronic platform has

over 10,000 members and has had over 45,000 unique visitors.

In addition to the electronic education platform, NDX has an

established cooperation with the leading newspaper in Sweden

Dagens Nyheter. In Dagens Nyheter, NDX produced educational

articles about the segment every Sunday, throughout 2010. The

third part of the education activities NDX conduct is seminars.

These are arranged with product specialists from the issuers,

describing different investment opportunities offered in the

market. During 2010, NDX has held over 40 seminars in cities all

over Sweden.

NDx2010

Elasticia In October 2010, NGM will launch a new trading

system Elasticia. A major reason for the development of

Elasticia is the increased demand from the product side.

Issuers want to be able to offer a much larger product range

and Elasticia is therefore built to handle all future capacity

required for facilitating this markets next phase of growth.

Also, a feature know as quote validation a function to verify

a correct transaction price and much improved market data

will ensure that NGM has a next generation trading system for

a dynamic and growing market.

Finland and Norway With the launch of Elasticia, NDX will

start to offer listing and trading for Finnish and Norwegian

end clients. This will enable issuers to have one exchange

for distribution of their products to greater parts of the

Scandinavian market. NDX will provide these markets with

education and tools to develop the market in the same way

as has been done in Sweden.

ETPs NDX is also in the process of launching a segment for

trading in Exchange Traded Products (ETPs). The interest

from investors in this investment form is continuously rising.

The combination of retail clients having easy access to

internet banking, sophisticated investors and a tradition of

investing in traditional funds, creates a good foundation for

Sweden as a ETPs market.

THINKING AHEAD, AUGUST 2010 | ISSUE 17

21

Financial Institutions Marketing

Scandinavia Team

We, the FIM Scandinavian Team, deliver investment and hedging solutions to fnancial

institutional clients in Sweden, Norway, Denmark, Finland and Iceland. Our clients include other

Banks, Asset Managers, Independent Financial Advisors and Insurance Companies. The level of

investor sophistication throughout the region is generally high and as a result we are involved in

a variety of projects which require bespoke and/or innovative solutions.

From left to right: Christian Malmberg, Per Ingvoldstad, Frederik Borreschmidt, Jakob Palmqvist, Karl-Fredrik Hansson

TEAMMEMBErS

Although based in London, we remain in constant contact

with our clients, travelling frequently for face-to-face

meetings. Thanks to this close contact we have built strong

relationships and gained a deep insight into client needs, market

developments and trends. Supported by Commerzbanks trading,

structuring, product specialists and research platforms, we strive

to deliver a high-quality, value-added service to our clients.

We have built our team around the following principles:

Client focus

Integrity

Commitment

Results focus

We wish all Thinking Ahead magazine readers every success in

H2 2010 and beyond.

Yours Sincerely

FIM Scandinavia

For further information contact:

Email: FIMscandi@commerzbank.com

Phone: +44 207 444 9389

THINKING AHEAD, AUGUST 2010 | ISSUE 17

22

FOREIGN BRANCHES

REPRESENTATIVE OFFICES

SUBSIDIARIES AND

HOLDINGS

NUMBER OF EMPLOYEES 2012

GREAT BRITAIN POLAND UKRAINE

> 1,000 EMPLOYEES:

LUXEMBOURG

SINGAPORE

CZECH REPUBLIC

USA

2501,000 EMPLOYEES:

BELGIUM

CHINA

FRANCE

HONG KONG

ITALY

JAPAN

NETHERLANDS

AUSTRIA

RUSSIA

SWITZERLAND

SPAIN

HUNGARY

25250 EMPLOYEES:

EGYPT

ETHIOPIA

ARGENTINA

AZERBAIJAN

AUSTRALIA

BRAZIL

CHILE

GREECE

INDIA

INDONESIA

IRAN

IRELAND

KAZAKHSTAN

CROATIA

LATVIA

LEBANON

LIBYA

MALAYSIA

NIGERIA

PANAMA

PORTUGAL

ROMANIA

SERBIA

SLOVAKIA

SOUTH AFRICA

SOUTH KOREA

TAIWAN

THAILAND

TURKEY

TURKMENISTAN

UZBEKISTAN

UAE

VENEZUELA

VIETNAM

BELARUS

< 25 EMPLOYEES:

NOVOSIBIRSK

ALMATY

ASHGABAT

TEHRAN

BEIRUT

CAIRO

TRIPOLI

DUBAI

LAGOS

ADDIS ABEBA

JOHANNESBURG

MUMBAI

BANGKOK

SINGAPORE

JAKARTA

MELBOURNE

HONG KONG

SHANGHAI

TAIPEI

TIANJIN

BEIJING

TOKYO

BAKU

SEOUL

KUALA LUMPUR

HO CHI MINH CITY

DUBLIN

LONDON

BRUSSELS

LUXEMBOURG

AMSTERDAM

PARIS

BARCELONA

MADRID

MILAN

ZAGREB

BUDAPEST

BRATISLAVA VIENNA

BRNO KOSICE

HRADEC KRLOV

OSTRAVA

WARSAW

PRAGUE

PLZE

BELGRADE

BUCHAREST

ISTANBUL

KIEV

MINSK

RIGA

MOSCOW

TASHKENT

NEW YORK

CARACAS

SO PAULO

BUENOS AIRES

SANTIAGO

DE CHILE

PANAMA CITY

ZURICH

Around 1,000 employees at 100 locations in countries did you

know how big Commerzbanks world really is? This map shows you

all the locations at which the new Commerzbank is represented.

It also offers you an insight into how many colleagues we have in

place to support our customers at these locations.

Our world

THINKING AHEAD, AUGUST 2010 | ISSUE 17

2

FOREIGN BRANCHES

REPRESENTATIVE OFFICES

SUBSIDIARIES AND

HOLDINGS

NUMBER OF EMPLOYEES 2012

GREAT BRITAIN POLAND UKRAINE

> 1,000 EMPLOYEES:

LUXEMBOURG

SINGAPORE

CZECH REPUBLIC

USA

2501,000 EMPLOYEES:

BELGIUM

CHINA

FRANCE

HONG KONG

ITALY

JAPAN

NETHERLANDS

AUSTRIA

RUSSIA

SWITZERLAND

SPAIN

HUNGARY

25250 EMPLOYEES:

EGYPT

ETHIOPIA

ARGENTINA

AZERBAIJAN

AUSTRALIA

BRAZIL

CHILE

GREECE

INDIA

INDONESIA

IRAN

IRELAND

KAZAKHSTAN

CROATIA

LATVIA

LEBANON

LIBYA

MALAYSIA

NIGERIA

PANAMA

PORTUGAL

ROMANIA

SERBIA

SLOVAKIA

SOUTH AFRICA

SOUTH KOREA

TAIWAN

THAILAND

TURKEY

TURKMENISTAN

UZBEKISTAN

UAE

VENEZUELA

VIETNAM

BELARUS

< 25 EMPLOYEES:

NOVOSIBIRSK

ALMATY

ASHGABAT

TEHRAN

BEIRUT

CAIRO

TRIPOLI

DUBAI

LAGOS

ADDIS ABEBA

JOHANNESBURG

MUMBAI

BANGKOK

SINGAPORE

JAKARTA

MELBOURNE

HONG KONG

SHANGHAI

TAIPEI

TIANJIN

BEIJING

TOKYO

BAKU

SEOUL

KUALA LUMPUR

HO CHI MINH CITY

DUBLIN

LONDON

BRUSSELS

LUXEMBOURG

AMSTERDAM

PARIS

BARCELONA

MADRID

MILAN

ZAGREB

BUDAPEST

BRATISLAVA VIENNA

BRNO KOSICE

HRADEC KRLOV

OSTRAVA

WARSAW

PRAGUE

PLZE

BELGRADE

BUCHAREST

ISTANBUL

KIEV

MINSK

RIGA

MOSCOW

TASHKENT

NEW YORK

CARACAS

SO PAULO

BUENOS AIRES

SANTIAGO

DE CHILE

PANAMA CITY

ZURICH

2

Equities

EURO STOXX Autos:

Technically ready for take-off

EURO STOXX Automobiles & Parts was experiencing a bear

market trend, the course of which was distorted by temporary

price fuctuation in Volkswagen ordinary shares, and fell to 143

index points. During the frst recovery period, the index freed itself

from its bearish trend and rose to 233. After a brief consolidation

(technical fag below 233) during which the recovery trend was

concluded as well, the index experienced another boost from 193

to 260 in July 2009. We have been seeing a medium-term, volatile,

Large blue-chip indices such as the S&P 00 and the DAX appear, from a technical point

of view, to be stuck in a medium-term, sideways pendulum movement (with positive touch

in some cases). While this is true for selected sector indices as well, eg the STOXX Europe

Telecommunications, which has entered a medium-term stabilisation phase, others, for example

the EURO STOXX Automobiles & Parts, where interest focuses on the resistance below 20, are

about to conclude their sideways movement.

sideways pendular movement that initially appears to have the

character of a moderate downward triangle (lower triangle line

currently at 200), but in the last few weeks has transitioned into

a consolidation below 248. In the wake of this consolidation the

index, which, as an export-led sector is benefting from the recent

weakness of the Euro, was able to build up relative strength

against the STOXX Europe 600. Since the end of February 2010

there has also been an upward trend (trend line currently at 228),

which has taken the future into the tiered resistance between 248

and 260. Therefore it would not be surprising if the index were

to come up with a new buy signal with medium-term potential at

least to test the (next) resistance at 280 to 285.

O N D M A M J J A S O N D M A M J J A S O N D M A M J J A S O N

200-day

m.a.

2008 2009 2010

B = Buy signal S = Sell signal TP = Take-prot signal

150

200

250

300

350

400

450

New all-time high

TP

425

S

S

VW price

movement

distorted

automobile sector

228

161

405

190

270

S

143

S

S

B

248

233

Recovery

trend

260

TP

193 200

Relative

strength

196

B

Support

262

228

280

Chart1:EUrOSTOxxAutomobiles&Parts

Source: Commerzbank Corporates & Markets

During the frst recovery period,

the index freed itself from its

bearish trend and rose to 233.

AlExANDErKrMEr

TECHNICAL & INDEX ANALYST Equity fash

2

EqUITIES

STOXX Europe

Telecommunications:

Stabilisation above the

200-day line

Following the mini-sell-off, the STOXX Europe Telecommunications

found itself in a technical bottom formation at 202 index points.

Whereas the overall market began to recover as early as March

2009, the sector index followed suit only after a delay and ended

its 10-month bottom formation in July 2009 with a buy signal.

In January 2010 the process of working off the bear market

was aborted at 265 index points. At the same time the sector

developed relative weakness against the STOXX Europe 600. This

is also refected in the fact that the markets rose to new heights

in April 2010, while the sector remained stuck in a sideways

pendulum movement below 265. In May the sector slid below the

200-day line to 224 index points. After this slide, which from a

technical point of view ended in a wedge, not only did the index

lose its relative weakness, it also established a short-term upward

trend which took it back over the 200-day line. This points to a

stabilisation above the 200-day line, with a renewed attempt on

the resistance at 265 being the next item on the technical agenda

in the medium term.

O N D M A M J J A S O N D M A M J J A S O N D M A M J J A S O N

200-day

m.a.

2008 2009 2010

B = Buy signal S = Sell signal TP = Take-prot signal

200

220

240

260

280

300

320

340

360

380

400

Bull

market trend

since 03

253

390

S Bear market

trends

TP

S

Mini

sell-off

202

S

251

S

200

Mini

wedge

224

B

207

307

Upchannel

TP

243

265

B

TP

224

Stabilisation

S

Chart2:STOxxEuropeTelecommunications

Source: Commerzbank Corporates & Markets

In May the sector slid below the

200-day line to 224 index points.

Alexander Krmer

THINKING AHEAD, AUGUST 2010 | ISSUE 17

Equity strategy

GUNNArHAMANN

EqUITY STRATEGIST

2

27

EqUITIES

The expected proft comeback of German

MidCaps looks breathtaking at least when

judged by the latest consensus forecasts

for this year. Operating profts for the

MDAX, the German MidCap index which

includes the largest 50 stocks by market

cap and turnover below the DAX30,

collapsed during 2009. According to an

aggregation of current consensus forecasts

however, MDAX operating profts in 2010

are expected to be close to previous peaks

(see Chart 1).

While several defensives are among those companies for

which forecasts are expected to exceed their recent peaks,

many German cyclical midcap stocks proft levels still remain

substantially below peak levels (see Chart 2). However, one should

not underestimate how quickly earnings expectations could move

higher as restructuring programmes, coupled with a demand

recovery, provide a powerful cocktail for profts. By the time

this article is published, the Q2 reporting season will be in full

swing and further upgrades to 2010 proft estimates, primarily for

midcap German cyclicals, should be well within reach.

While this sounds promising, it is unfortunately the proft

outlook for next year that investors have started worrying about.

This looks understandable on the back of softening economic

indicators in China and the US, and almost synchronised

(though hardly coordinated) austerity programmes in many

European countries that all look clearly growth-negative. Indeed,

it would be hard to reject these concerns from a directional point

of view, and the key question remains as to whether currently

low equity market valuations can buffer potential earnings

downgrades suffciently.

Consequently, we have stress-tested valuation levels of the

German midcap MDAX. Based on current I/B/E/S consensus

estimates for 2010 and 2011, we calculate a fair value for the

MDAX by discounting expected earnings (at the time of writing:

548 for 2010, 719 for 2011) based on a discount rate of 8%,

Concerns in capital markets remain plentiful as leading indicators start rolling-over, fostering

debate about a potential growth slowdown or, worse, a renewed recession. No wonder that

investors are questioning the validity of earnings forecasts in this environment. However, for

German MidCaps, we have stress-tested proft estimates and conclude that the current MDAX

level is justifed even if we were to shave off close to 20% of current earnings expectations.

We still consider many of the cyclical laggards, which have recently shown the strongest

earnings upgrade momentum, to be attractive.

Source: Datastream, Commerzbank Research

Chart1:MDAxconsensusoperatingproftestimates(m)

0

1

2

3

4

5

6

7

8

1

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

2

0

1

0

2

0

1

1

2

0

1

2

0

4,000

8,000

12,000

16,000

20,000

O EBIT margn %I, lhs

EBIT mI, rhs

Source: Bloomberg, Commerzbank Corporates & Markets

Chart2:MDAxoperatingproftsbacktopre-crisislevels

0

20

40

60

80

100

120

140

160

K

a

b

e

l

D

.

P

r

o

S

e

b

e

n

B

r

e

n

n

l

a

g

M

T

U

H

o

c

h

l

S

y

m

r

s

e

l

a

n

x

e

s

s

R

h

o

n

K

l

.

R

h

e

n

m

e

l

a

l

l

S

d

z

u

c

k

e

r

l

e

l

m

a

n

n

l

u

c

h

s

P

e

l

r

.

V

o

s

s

l

o

h

R

a

l

o

n

a

l

S

l

a

d

a

C

e

r

r

e

s

h

e

m

l

r

a

p

o

r

l

B

a

y

W

a

C

o

n

l

n

e

n

l

a

l

H

u

g

o

B

o

s

s

D

o

u

g

l

a

s

W

a

c

k

e

r

C

h

.

P

u

m

a

W

n

c

o

r

B

.

B

e

r

g

e

r

C

e

l

e

s

o

T

U

I

A

u

r

u

b

s

E

l

r

n

g

K

l

n

g

e

r

C

E

A

B

a

u

e

r

T

o

g

n

u

m

l

e

o

n

P

r

a

k

l

k

e

r

H

H

l

A

E

A

D

S

D

e

m

a

g

C

r

.

K

r

o

n

e

s

S

C

l

K

l

o

e

c

k

n

e

r

S

C

l

d

e

m

e

s

l

e

r

S

a

l

z

g

l

l

e

r

0

20

40

60

80

100

120

140

160

Average

Consensus EBIT 2010 as a % o lalesl peak levels belween 2005 and 200I

THINKING AHEAD, AUGUST 2010 | ISSUE 17

2

Gunnar Hamann

Source: Datastream, I/B/E/S, Commerzbank Corporates & Markets

Chart5:butledtoacompressionofP/Eratios

DAX 30 vs 12monlh orward P/E

10

12

14

16

18

Aug 02 Nov 02 leb 03 May 03 Aug 03 Nov 03 leb 04 May 04 Aug 04 Nov 04 leb 05

2,000

2,500

3,000

3,500

4,000

4,500

5,000

12m wd. P/E

DAX30, rhs

Source: Datastream, I/B/E/S, Commerzbank Corporates & Markets

Chart4:Aroll-overofifoexpectationsdidnotpreventa

furtherriseinforwardearningsexpectations

80

0

100

110

120

130

140

150

Aug 02 Nov 02 leb 03 May 03 Aug 03 Nov 03 leb 04 May 04 Aug 04 Nov 04 leb 05

88

2

6

100

104

12m wd. earnngs March 2002 = 100I

o busness expeclalons, rhs

DAX 30 12monlh orward earnngs vs o busness expeclalons

Source: Datastream, I/B/E/S, Commerzbank Corporates & Markets

Chart3:MDAxfairvalueestimateindifferentearnings

scenarios

4,000

5,000

6,000

7,000

8,000

,000

10,000

11,000

12,000

13,000

14,000

30% 20% 10% Base case 10% 20% 30%

Currenl MDAX ndex level

Derenl earnngs scenaros vs. currenl I/B/E/S consensus eslmale

2

EqUITIES

coupled with modest earnings growth assumptions (up 1%).

We also calculate the sensitivities of our fair value calculation

to varying earnings levels. Chart 3 highlights our fair value

estimates for the MDAX. Our base case, ie current consensus

forecasts, implies a fair value for the MDAX of c. 10,000%.

Interestingly, index levels at the time of writing would be

consistent with market expectations of a c. 20% reduction in

proft estimates (see Chart 3).

One of the reasons why investors have started worrying about

future profts is a roll-over of leading indicators. Undoubtedly,

the recovery in business sentiment indicators in the recent

past has been remarkably strong. One should not, however,

lose sight of the fact that business surveys have probably been

strongly impacted by the year-on-year comparison, which over

recent months has been looking very favourable. Nevertheless,

the levelling off of this benign impact could adversely weigh on

sentiment indicators.

However, this does not automatically bode ill for future earnings

estimates, which we illustrate for the case of DAX 30 proft

estimates and valuation ratios in Charts 4 & 5. Indeed, when

looking at the 200305 post-recession phase, ifo business

expectations started to come off the boil at the end of 2003. The

earnings trend, however, continued its ascent well into a period

of softer sentiment indicators (see Chart 4). Falling leading

indicators, however, brought about heightened uncertainty as to

the further progression of the cycle, consequently compressing

multiples. As depicted in the right-hand chart below, the DAX 30

P/E declined from c. 16x to a little over 12x over a year.

Undeniably, the current environment does not look that different

from the post-recession years 200405. This time around however,

starting valuation multiples are signifcantly below those seen

during previous recovery cycles. Indeed, while price\earnings

multiples were c.16x during the 20032004 recovery cycle,

current multiples for the DAX 30 are at just c. 11x. This would

argue strongly against substantial multiple contraction on the

back of a turn in leading indicators this time around!

On balance, it would be premature to reject concerns over

the further progression of the economic cycle. But, like most

post-recession years, the road to recovery remains bumpy, as

mirrored by swings in capital markets. The roll-over of leading

indicators might indeed signal softening growth ahead that

could jeopardise earnings forecasts, and for the coming years in

particular. While in previous periods, this uncertainty started a

process of multiple compression, equity markets in the current

cycle are starting from signifcantly lower valuation levels,

which should prevent equity multiples from contracting too

Source: Datastream, I/B/E/S, Commerzbank Corporates & Markets

Chart7:valuationmultiplesarestartingfroma

signifcantlylowerbasethanin2003/05

6

8

10

12

14

16

leb 08 May 08 Aug 08 Nov 08 1an 0 Apr 0 1ul 0 Ucl 0 Dec 0 Mar 10 1un 10

3,000

4,000

5,000

6,000

7,000

8,000

DAX 30 vs 12monlh orward P/E

12m wd. P/E

DAX30, rhs

Chart6: Evenifforwardearningsstarttoleveloff

Source: Datastream, I/B/E/S, Commerzbank Corporates & Markets

leb 08 May 08 Aug 08 Nov 08 1an 0 Apr 0 1ul 0 Ucl 0 Dec 0 Mar 10 1un 10

12m wd. earnngs leb 2008 = 100I

o busness expeclalons, rhs

DAX 30 12monlh orward earnngs vs o busness expeclalons

60

70

80

0

100

110

70

75

80

85

0

5

100

105

110

strongly. Our stress-test for German midcaps (MDAX) reveals

that signifcantly lower earnings levels are already embedded

in current expectations. We still consider many of the cyclical

laggards, which have recently shown the strongest earnings

upgrade momentum, to be attractive.

THINKING AHEAD, AUGUST 2010 | ISSUE 17

0

While the global economy appears to be set for a strong rebound, more and more

investors are concerned that in the medium to long term infation might erode

real returns on their investments. If positive returns on the equity market do not

beat the rate of infation, real returns are in fact negative, resulting in decreased

purchasing power. It is possible however to introduce explicit protection in

structured products in order to ensure a return that is signifcantly in excess of

the infation experienced over the investment lifetime. The proposed structures

protect investors purchasing power and investment returns by linking the payout

at maturity to the development of a well-known Euro zone infation index

(Bloomberg: CPTFEMU Index).

Hybrid Products

ANTONHONG

HEAD OF EXOTICS STRUCTURING (EMC)

THOMASETHEVE

EXOTICS STRUCTURING (EMC)

1

EqUITIES

INFlATIONlINKEDBONUSNOTE

Maturity: 5 years

Underlyings: Eurostoxx 50 Index (Bloomberg: SX5E Index) &

Eurostat Euro zone Infation Index (Bloomberg: CPTFEMU Index)

Currency: EUR

European Barrier: 55%

The Infation-linked Bonus Note offers full equity participation

and soft capital protection, together with the reassurance that the

product will generate a positive return on an infation-adjusted

basis. As long as the Eurostoxx 50 Index closes above 55% of its

initial level at maturity, investors receive the highest of the full

upside performance of the Eurostoxx 50 Index and ten times the

annualised infation rate since inception. Only if the Eurostoxx 50

Index closes below 55%, investors become long the index.

INFlATIONPrOTECTEDEqUITyPArTICIPATION

WITH90%CAPITAlGUArANTEE

Maturity: 5 years

Underlyings: Eurostoxx 50 Index (Bloomberg: SX5E Index) &

Eurostat Euro zone Infation Index (Bloomberg: CPTFEMU Index)

Currency: EUR

90% capital guaranteed

This product combines the benefts of partial capital guarantee,

infation protection and participation in the equity market.

Investors receive at maturity 90% of the notional amount plus

the higher of a Eurostoxx 50 Index performance above 90% and

any infation index performance above 13.14% (2.5% pa), both

up to a cap of 45%:

Payoff = 90% + Min(45%, Max (SX5Ef 90% , CPTFEMUf

113.14% , 0%))

BESTOFEqUITy/INFlATIONNOTE

Underlyings: Eurostoxx 50 Index (Bloomberg: SX5E Index) &

Eurostat Euro zone Infation Index (Bloomberg: CPTFEMU Index)

Currency: EUR

MaturityBarrier

years 70%

years 0%

years 0%

As long as the underlying equity index does not close below

the barrier at maturity, this product will pay out the higher of

the Eurostoxx 50 Index performance and the infation index

performance. Otherwise, investors are long the equity index.

5yEArINCOMENOTElINKEDTOEqUITy&INFlATION

Maturity: 5 years

Underlyings: Eurostoxx 50 Index (Bloomberg: SX5E Index) &

Eurostat Euro zone infation index (Bloomberg: CPTFEMU Index)

Currency: EUR

Barrier: 60% (European)

Annual coupon: 150% of the European infation rate

European infation rate: year-on-year increase of the infation index

Minimum guaranteed coupon: 5% pa

The 5 year Income Note, linked to equity & infation, offers

investors an annual coupon equal to 150% of the European

infation rate (measured as the year-on-year increase of the

infation index) subject to a foor of 5%. Thus, investors will

receive infation-beating returns with a foor at more than three

times the current market rates in EUR. At maturity, in addition

to the fnal coupon, investors will receive 100% of their invested

capital unless the DJ Eurostoxx 50 Index closes below 60% of

its initial level. If the underlying index closes below the barrier

the investor will participate 100% in the performance of the

underlying index.

THINKING AHEAD, AUGUST 2010 | ISSUE 17

2

Dr.OlIVErBrOCKHAUS

HEAD OF qUANTITATIVE INNOVATION

Getting exposed to Infation

Inthisnotewediscussvariousaspectsofconsumer

priceindicessuchastheUSCPIandtheECB

harmonisedconsumerpriceindexHICP.Thesecond

partofthenotedescribesequityandinfationlinked

hybridproducts.

SOMEASPECTSOFPrICEINDICES

There seems to be no consensus as to where infation is going.

On the one hand low interest rates and weak growth in Europe

may hold infation down. On the other hand large debt burden