Professional Documents

Culture Documents

Weekly Market Outlook 05 November 2011-Mansukh Investment and Trading

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Market Outlook 05 November 2011-Mansukh Investment and Trading

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

Weekly Market Outlook

8th Oct 2011

make more, for sure.

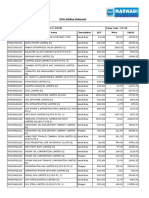

DATA MATRIX FOR THE WEEK 3rd Oct 2011 - 7th Oct 2011 Weekly Markets

Sensex Nifty Gold(US$/oz) Re/US$ Dow Nasdaq FX Res (US$ Bn) 16,233 4,888 1,640.0 49.03 11,103 2,479 311.482 -1.34% -1.11% 0.87% 0.04% 1.74% 2.63% -0.39%

SNAPSHOT

A week after showing some signs of recovery, Indian frontline equity indices went on to resume the declining trend and have even lost most part of the ground that they had gained last week. Though, the benchmarks snapped the truncated week with cuts of over a percent, however, the losses could have been even larger had the bourses not rallied on the last trading session of the week. It largely turned out to be a somber week for the frontline indices as they failed to settle in the positive territory for three straights sessions of the week and suffered colossal damage which the final day pull-back rally of close to three percent could not overcome. The concerns over the financial situation in Europe showed signs of easing after the European Central Bank announced various policy measures aimed at raising liquidity in European banks, including the offer to flood banks with any amount of one-year loans through 2013The BSE Sensex plunged by 221.22 points to 16232.54 during the week ended October 7, 2011. The BSE Mid-cap index was down by 170.31 points or 2.78% to 5959.28 and the Small-cap index down by 159.53 points to 6721.55. The S&P CNX Nifty shaved off 55.20 points to 4888.05. On NSE, Bank Nifty down 430.05 points or 4.54% to 9038.25, CNX IT down 37.95 points to 5640.95 while CNX mid- cap down 199.85 points to 6894.15 and CNX Nifty Junior down 303.30 points or 3.09% to 9518.90.

2500 2000 1500 1000 500 0

Volume* & Volatility Index (Nifty - Sep & Oct 2011)

40 30 20 10 0

Net FII / DII Equity Activity (Rs Cr) Upto 07.10.11

Total Oct 2011 Total 2011

S o urce: bs eindia.co m

FIIs

-2314.7 21,849

DIIs

1193.0 25,534

23-Sep 26-Sep 27-Sep 28-Sep 29-Sep 30-Sep *NSE Cash Volume (Rs bn)

3-Oct

4-Oct

5-Oct

7-Oct

F & O Volume (Rs bn)

Volatility Index %

Weekly Sector Movement

Sectors

Auto Bankex CD CG FMCG Healthcare IT Metal Oil & Gas PSU Realty

WEEK AHEAD

Close

8,488 10,348 6,346 10,823 3,900 5,845 5,241 10,910 8,451 7,305 1,736

%

-1.88 -6.39 0.78 -0.46 -1.59 -0.98 -1.82 -3.44 -1.17 -2.94 -3.58

India's weekly food inflation, measured by the WPI, surged to 9.41% for the week ended September 24 from 9.13% in the last week. India's foreign direct investment (FDI) inflow surged by 127.8% to $2.83 billion in August 2011, an over two-fold jump from $1.33 billion compared to that in the same month last year. Also India's trade deficit for August widened to $14.04 billion from last year's $10.09 billion as exports for the month surged 44.25% to $24.3 billion from a year earlier, while imports rose 41.82% to $38.4 billion for the same period.

In the coming week, investor's would like to watch out for two major economic data, first and the most important -Index of Industrial Production (IIP) data scheduled to be released on October 12, 2011, which could serve as a major clue over the RBI's action ahead of the mid quarterly monetary policy review on October 25, 2011. The coming week would also mark the start of the earning season, with IT bellwether- Infosys- reporting its Q2 results on October 12, 2011. Followed by, Housing finances major- HDFC and media major- Zee Entertainment Enterprises on 17 October 2011. On the global front, investors will be eying few major economic data from US, starting with the FOMC Minutes on October 11, 2011 followed by International Trade Data, Jobless Claims Data, and finally the retail sales data on October 14, 2011. Therefore 4680-4670 could be the crucial support in near term. On the flip side any break out above 5055-5070 with decent volumes may reap indices towards 5200-5230 where possibility of consolidation can't be rule out. HAPPY TRADING.

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

Weekly Market Outlook

make more, for sure.

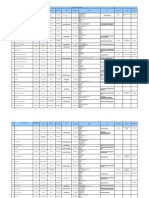

SENSEX 30-TECHNICAL LEVELS FOR THE UPCOMING WEEK ENDED 14th Oct 2011

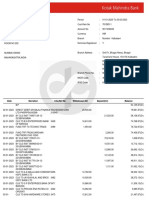

SUPPORT SCRIP Bajaj Auto Ltd Bharat Heavy Electricals Ltd. Bharti Airtel Ltd. Cipla Ltd. Coal India Ltd. DLF Ltd. HDFC Bank Ltd. Hero MotoCorp Ltd. Hindalco Industries Ltd. Hindustan Unilever Ltd. Housing Development Finance Corporation Ltd. ICICI Bank Ltd. Infosys Ltd. ITC Ltd. Jaiprakash Associates Ltd. Jindal Steel & Power Ltd. Larsen & Toubro Ltd. Mahindra & Mahindra Ltd. Maruti Suzuki India Ltd. NTPC Ltd. Oil & Natural Gas Corpn. Ltd. Reliance Industries Ltd. State Bank Of India Sterlite Industries (India) Ltd. Sun Pharmaceutical Inds. Ltd. Tata Consultancy Services Ltd. Tata Motors Ltd. Tata Power Company Ltd. Tata Steel Ltd. Wipro Ltd. 3rd 1402 307 304 276 324 202 426 1782 120 319 610 792 2350 189 67 402 1339 770 1059 159 246 760 1700 105 438 978 144 89 396 307 2nd 1457 315 332 281 330 210 439 1867 123 324 628 808 2436 193 70 438 1363 783 1086 163 255 779 1728 109 453 1016 150 94 407 322 1st 1481 319 343 283 334 214 444 1904 124 326 636 816 2472 196 72 460 1378 790 1099 165 260 790 1740 111 461 1033 155 96 413 328 CLOSE PRICE 07.10.11 1503.75 323.90 354.80 285.20 337.25 218.45 449.80 1941.05 125.95 329.20 645.10 824.30 2507.05 199.20 72.85 481.95 1393.45 795.95 1113.10 166.60 264.45 801.45 1751.85 113.45 469.45 1048.70 158.80 98.35 419.60 333.80 1st 1536 327 371 288 340 222 458 1989 127 331 654 832 2559 201 75 496 1403 804 1126 169 269 809 1768 115 477 1071 161 102 424 342 RESISTANCE 2nd 1568 330 388 292 343 225 465 2037 129 333 663 839 2610 203 77 510 1413 811 1138 171 275 816 1784 116 485 1094 164 105 428 351 3rd 1623 338 416 297 349 233 479 2122 131 338 681 855 2697 208 80 546 1438 825 1164 175 284 835 1812 120 501 1133 171 111 439 366

INCLINATION

Neutral Negative Negative Positive Positive Neutral Positive Neutral Negative Neutral Neutral Neutral Positive Positive Neutral Neutral Neutral Neutral Neutral Positive Negative Neutral Negative Neutral Positive Positive Neutral Neutral Neutral Neutral

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

Weekly Market Outlook

make more, for sure.

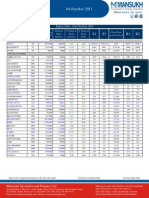

NSE MIDCAP 50-TECHNICAL LEVELS FOR THE UPCOMING WEEK ENDED 14th Oct 2011

SUPPORT SCRIP 3rd 2nd

72 141 495 115 24 117 37 449 245 259 397 714 243 226 15 27 34 91 96 68 191 68 35 549 15 435 29 20 318 55 1866 88 144 340 69 53 69 66 111 99 291 81 16 528 196 1051 118 51 101 107

CLOSE PRICE 1st

75 143 504 116 24 118 37 458 251 263 402 719 249 232 15 27 35 92 97 70 194 68 36 557 15 448 30 21 320 56 1899 90 149 345 70 54 70 68 113 99 294 82 16 546 202 1072 123 52 103 108

RESISTANCE 1st

82 148 520 120 25 123 38 473 262 269 412 730 260 243 15 28 37 94 100 73 200 70 36 576 15 476 31 22 326 60 1955 97 161 356 72 55 74 72 117 101 302 83 17 573 212 1127 133 54 107 111

Market Cap

3rd

93 154 542 125 26 130 40 494 280 278 428 746 277 258 16 30 40 99 105 78 210 73 38 607 16 518 32 23 335 65 2034 108 178 373 75 57 80 78 123 103 314 86 18 611 225 1216 148 56 115 115

07.10.11

78.15 145.35 513.95 117.75 24.75 120.20 37.50 467.60 255.90 266.85 406.25 723.50 254.80 239.00 15.15 27.95 36.30 92.95 98.90 71.25 197.10 68.90 36.05 564.45 15.20 461.00 30.35 21.50 322.60 57.50 1931.30 92.85 154.40 350.15 70.90 54.20 71.65 68.95 115.55 99.95 297.40 82.60 16.55 563.40 207.80 1093.35 128.10 53.05 104.70 109.85

2nd

86 150 526 122 26 125 39 479 269 272 418 736 266 248 16 29 38 96 102 75 204 71 37 588 16 491 31 22 329 62 1978 102 167 362 73 56 76 74 119 102 306 84 17 583 215 1161 138 55 110 112

(Rs Crore)

17037 6922 3445 6589 6585 3499 2569 1947 5957 3334 11261 9599 2446 3640 2393 1695 1408 3895 9738 2189 8471 5233 963 12594 3660 20584 1912 362 6775 1475 16211 648 11580 5855 1310 1800 1156 3212 3154 5730 7576 5108 3140 7166 18448 29964 5916 2507 3464 2502

Adani Power Ltd. 65 Allahabad Bank 137 Alstom Projects India Ltd. 479 Andhra Bank 111 Ashok Leyland Ltd. 23 Aurobindo Pharma Ltd. 112 Bajaj Hindusthan Ltd. 35 BEML Ltd. 434 Bharat Forge Ltd. 233 CESC Ltd. 252 Cummins India Ltd. 387 Divi'S Laboratories Ltd. 704 Educomp Solutions Ltd. 232 Great Eastern Shipping Company Ltd. 215 GVK Power & Infrastructure Ltd. 14 Hindustan Construction Company Ltd. 26 Hotel Leela Venture Ltd. 32 Housing Development & Infrastructure Ltd. 88 IDBI Bank Ltd 93 India Cements Ltd. 64 Indian Bank 184 Indian Hotels Company Ltd. 66 IVRCL Ltd. 35 JSW Steel Ltd. 529 Lanco Infratech Ltd. 15 Lupin Ltd. 408 Mahanagar Telephone Nigam Ltd. 28 Moser Baer India Ltd. 20 Mphasis Ltd. 312 NCC Ltd. 51 Oracle Financial Services Software Ltd 1810 Patel Engineering Ltd. 81 Petronet LNG Ltd. 133 Piramal Healthcare Ltd. 329 Praj Industries Ltd. 67 Punj Lloyd Ltd. 51 Rolta India Ltd. 65 Shipping Corpn. Of India Ltd. 62 Sintex Industries Ltd. 107 Syndicate Bank 97 Tata Chemicals Ltd. 283 Tata Global Beverages Ltd 80 Tata Teleservices (Maharashtra) Ltd. 15 Tech Mahindra Ltd. 500 Titan Industries Ltd. 187 Ultratech Cement Ltd. 996 United Phosphorus Ltd. 109 Vijaya Bank Ltd 50 Voltas Ltd. 97 Welspun Corp Ltd. 104

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

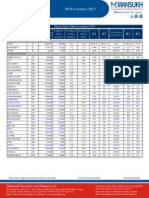

Weekly Market Outlook

make more, for sure. FORTHCOMING CORPORATE ACTIONS

Ex-Date

19-Oct-11 19-Oct-11 20-Oct-11 20-Oct-11 20-Oct-11 21-Oct-11 21-Oct-11 24-Oct-11 24-Oct-11 25-Oct-11 25-Oct-11

Company Name

Pantaloon Retail (India) Limited Pantaloon Retail (India) Limited Infosys Limited Gillette India Limited Gateway Distriparks Limited Globus Spirits Limited HCL Technologies Limited Nelcast Limited Farmax India Limited JIK Industries Limited Asian Paints Limited

NSE- Symbol

PANTALOONR PRETAILDVR INFY GILLETTE GDL GLOBUSSPR HCLTECH NELCAST FARMAXIND JIKIND ASIANPAINT

Purpose

DIVIDEND-RE.0.90 PER SHARE DIVIDEND-RE.1/- PER SHARE INTERIM DIVIDEND DIVIDEND-RS.15/- PER SHARE INTERIM DIVIDEND AGM AND DIVIDEND RE.1/- PER SHARE AGM AND DIVIDEND RS.2/- PER SHARE

INTERIM DIVIDEND

ANNUAL GENERAL MEETING ANNUAL GENERAL MEETING INTERIM DIVIDEND

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

Weekly Market Outlook

make more, for sure.

EQUITY CALLS PERFORMANCE FOR THE WEEK ENDED 7th Oct 2011

Total No. of Calls

18

Profitable Calls

11

Positional/Hold

1

Exit/Stop Loss

6

Success Rate

64.71%

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@moneysukh.com pashupatinathjha@moneysukh.com vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002 Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com Website: www.moneysukh.com

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431 PMS Regn No. INP000002387

You might also like

- Lic Housing Finance LimitedDocument19 pagesLic Housing Finance Limitedsoujanya_nagarajaNo ratings yet

- NSDL HoldingDocument5 pagesNSDL HoldingJaydeep DoshiNo ratings yet

- Financial Modeling of TCS LockDocument62 pagesFinancial Modeling of TCS LocksharadkulloliNo ratings yet

- The Forex Trading Course: A Self-Study Guide to Becoming a Successful Currency TraderFrom EverandThe Forex Trading Course: A Self-Study Guide to Becoming a Successful Currency TraderNo ratings yet

- TOP CEOsDocument10 pagesTOP CEOsfamtaluNo ratings yet

- Business Man BangloreDocument19 pagesBusiness Man BanglorevishalNo ratings yet

- WEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Document6 pagesWEEKLY MARKET OUTLOOK For 30 July CAUTIOUSLY OPTIMISTIC..Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 11.03.13Document5 pagesWeekly Market Outlook 11.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 29.04.13Document5 pagesWeekly Market Outlook 29.04.13Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 23.04.12Document5 pagesWeekly Market Outlook 23.04.12Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 25.03.13Document5 pagesWeekly Market Outlook 25.03.13Mansukh Investment & Trading SolutionsNo ratings yet

- Weekly Market Outlook 11.05.13Document5 pagesWeekly Market Outlook 11.05.13Mansukh Investment & Trading SolutionsNo ratings yet

- MOSt Market Roundup SummaryDocument7 pagesMOSt Market Roundup SummaryBhupendra_Rawa_1185No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-221305449No ratings yet

- Premarket MorningCall AnandRathi 30.11.16Document5 pagesPremarket MorningCall AnandRathi 30.11.16Rajasekhar Reddy AnekalluNo ratings yet

- Weekly Equity Market Report For 14 MayDocument8 pagesWeekly Equity Market Report For 14 MayTheequicom AdvisoryNo ratings yet

- Daily market update and analysisDocument3 pagesDaily market update and analysisAyush JainNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 12/07/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 12/07/2010MansukhNo ratings yet

- Institutional Research Technical ReportDocument4 pagesInstitutional Research Technical ReportRajasekhar Reddy AnekalluNo ratings yet

- NDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-InDocument30 pagesNDTV Profit: NDTV Profit Khabar Movies Cricket Doctor Good Times Social Register Sign-Inpriyamvada_tNo ratings yet

- Daringderivatives-Nov11 11Document3 pagesDaringderivatives-Nov11 11Shahid IbrahimNo ratings yet

- Domestic Equity Outlook - Indices Continue To Gain Ground Amidst VolatilityDocument9 pagesDomestic Equity Outlook - Indices Continue To Gain Ground Amidst Volatilitygaganbiotech20No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Equity Analysis Equity Analysis - Weekl WeeklyDocument8 pagesEquity Analysis Equity Analysis - Weekl WeeklyTheequicom AdvisoryNo ratings yet

- Results Tracker: Friday, 21 Oct 2011Document8 pagesResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Analysis Equity Analysis - Daily Daily: Weekly Newsletter Ly Newsletter-EquityDocument8 pagesEquity Analysis Equity Analysis - Daily Daily: Weekly Newsletter Ly Newsletter-EquityTheequicom AdvisoryNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Nse Top 5 Gainers: Dear Must Take Tis in Ur PresentationDocument7 pagesNse Top 5 Gainers: Dear Must Take Tis in Ur Presentationomi159No ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - WeeklyTheequicom AdvisoryNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 17/06/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 17/06/2010MansukhNo ratings yet

- Results Tracker: Wednesday, 02 Nov 2011Document8 pagesResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Accounts AssignmentDocument15 pagesAccounts AssignmentGagandeep SinghNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Daily Equity Newsletter by Market Magnify 07-03-2012Document7 pagesDaily Equity Newsletter by Market Magnify 07-03-2012IntradayTips ProviderNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Market Analysis For The Day 13 AugDocument7 pagesMarket Analysis For The Day 13 AugTheequicom AdvisoryNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Daily Equity Report 8 January 2015Document4 pagesDaily Equity Report 8 January 2015NehaSharmaNo ratings yet

- Equity Weekly Technical Report by Trifid ResearchDocument6 pagesEquity Weekly Technical Report by Trifid ResearchSunil MalviyaNo ratings yet

- Special Report by Epic Reseach 08 August 2013Document4 pagesSpecial Report by Epic Reseach 08 August 2013EpicresearchNo ratings yet

- Go Ahead For Equity Morning Note 01 June 2012-Mansukh Investment and Trading SolutionDocument3 pagesGo Ahead For Equity Morning Note 01 June 2012-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 - Results Tracker 28.10.11Document7 pagesQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Daily Equity ReportDocument4 pagesDaily Equity ReportNehaSharmaNo ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-210648926No ratings yet

- Daily Equity Newsletter: Indian MarketDocument4 pagesDaily Equity Newsletter: Indian Marketapi-196234891No ratings yet

- Report On Stock Trading by Mansukh Investment & Trading Solutions 18/05/2010Document5 pagesReport On Stock Trading by Mansukh Investment & Trading Solutions 18/05/2010MansukhNo ratings yet

- Equity Analysis Equity Analysis - Weekl WeeklyDocument8 pagesEquity Analysis Equity Analysis - Weekl WeeklyTheequicom AdvisoryNo ratings yet

- Equity Analysis - WeeklyDocument8 pagesEquity Analysis - Weeklyapi-182070220No ratings yet

- Presentation On Bse & Nse: Submitted To:-Chanchal SirDocument28 pagesPresentation On Bse & Nse: Submitted To:-Chanchal SirChandan KarreNo ratings yet

- Presentation On Bse & Nse: Submitted To:-Chanchal SirDocument28 pagesPresentation On Bse & Nse: Submitted To:-Chanchal SirSubhash SoniNo ratings yet

- Analysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010Document5 pagesAnalysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010MansukhNo ratings yet

- Market - Outlook - 09 - 09 - 2015 1Document14 pagesMarket - Outlook - 09 - 09 - 2015 1PrashantKumarNo ratings yet

- Results Tracker 22.10.11Document14 pagesResults Tracker 22.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 04 Aug 2012Document7 pagesResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- ReportDocument17 pagesReportMadhur YadavNo ratings yet

- 17 Sep MorningDocument5 pages17 Sep MorningMansukhNo ratings yet

- Analysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 09/08/2010Document5 pagesAnalysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 09/08/2010MansukhNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- KYC (Know Your Client) Registration Agency Registered With SEBI As On Apr 17 2017Document8 pagesKYC (Know Your Client) Registration Agency Registered With SEBI As On Apr 17 2017VenkatGuruNo ratings yet

- Yuvraj Scope of Capital Market in IndiaDocument59 pagesYuvraj Scope of Capital Market in IndiaNeha ChafeNo ratings yet

- The Economic RevolutionDocument8 pagesThe Economic RevolutionsandeshNo ratings yet

- The Most Decisive Period in The History of The BSE Took Place After 1992Document3 pagesThe Most Decisive Period in The History of The BSE Took Place After 1992snehachandan91No ratings yet

- Summer Internship ProjectDocument90 pagesSummer Internship ProjectAchyut Saxena40% (5)

- Live Banks in API E-Mandate 11 Oct 19Document2 pagesLive Banks in API E-Mandate 11 Oct 19Amit SinghNo ratings yet

- Bank Statement Request LetterDocument8 pagesBank Statement Request LetterAshokaCattleAnd PoultryFeedsPvtLtdNo ratings yet

- Full FormDocument7 pagesFull FormRachit Dixit100% (1)

- Objectives and Introduction to Derivatives StudyDocument78 pagesObjectives and Introduction to Derivatives Studysk_gnaNo ratings yet

- Share Market: by Ankit Avasthi SirDocument11 pagesShare Market: by Ankit Avasthi SirMonty SharmaNo ratings yet

- Demutualisation of Ludhiana Stock ExchangeDocument129 pagesDemutualisation of Ludhiana Stock Exchangeanchal1987No ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSiddhant A. KhankalNo ratings yet

- Understanding Stock MarketsDocument69 pagesUnderstanding Stock MarketsKinnari SinghNo ratings yet

- Natwarlal & CompanyDocument17 pagesNatwarlal & Companysunil jadhavNo ratings yet

- Mba RojectDocument55 pagesMba RojectArun Kumar NaikNo ratings yet

- A Study On Customer Satisfaction Towards On-Line Share Trading With Special Reference To Coimbatore CityDocument47 pagesA Study On Customer Satisfaction Towards On-Line Share Trading With Special Reference To Coimbatore CityVISHNU141289% (37)

- Adjudication Order in Respect of Crosseas Capital Services PVT LTD in The Matter of Essdee Aluminium LimitedDocument14 pagesAdjudication Order in Respect of Crosseas Capital Services PVT LTD in The Matter of Essdee Aluminium LimitedShyam SunderNo ratings yet

- Pharma Top 100 CompaniesDocument10 pagesPharma Top 100 Companiesaltaf khaziNo ratings yet

- Headquarters ITC Green Centre 10 Institutional Area, Sector 32Document1 pageHeadquarters ITC Green Centre 10 Institutional Area, Sector 32najakatNo ratings yet

- Comparative Study of Capital MarketDocument80 pagesComparative Study of Capital MarketHassan Ali KhanNo ratings yet

- Mrunal Sir Latest 2020 Handout 4 PDFDocument21 pagesMrunal Sir Latest 2020 Handout 4 PDFdaljit singhNo ratings yet

- All Alerts For 17 Jan - ChartinkDocument17 pagesAll Alerts For 17 Jan - Chartinkkashinath09No ratings yet

- Prestorming Csat: T.B.C: P-Sia-D-Upgi Serial: 737246 Test BookletDocument33 pagesPrestorming Csat: T.B.C: P-Sia-D-Upgi Serial: 737246 Test BookletArjun ZmNo ratings yet

- Assignment UploadingDocument24 pagesAssignment UploadingSamraat Ravi100% (1)

- SIP REPORT On Angel BrokingDocument80 pagesSIP REPORT On Angel BrokingPrajwal BNo ratings yet

- Asian Paints Vs Berger Paints: Top Indian Paint CompaniesDocument16 pagesAsian Paints Vs Berger Paints: Top Indian Paint CompaniesSoniya DhyaniNo ratings yet