Professional Documents

Culture Documents

Challeges of Underwriting in USA

Uploaded by

tanvisingh_2007Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Challeges of Underwriting in USA

Uploaded by

tanvisingh_2007Copyright:

Available Formats

Challenges of underwriting and actuaries in US

Challenge 1 : Mitigating risks of noncompliance with evolving regulations U.S. Healthcare is among the world's most heavily regulated industries. The insurance organizations have to comply with a myriad of federal and state laws and regulations. These include rigorous auditing and reporting requirements, HIPAA privacy and security mandates, complex and restrictive rules and payment formulas for Medicare and Medicaid products and ICD-10 coding requirements. Assuring compliance on so many fronts severely strains resources of the insurance organizations.

Despite the efforts of payers to reduce waste, fraud and abuse, and to encourage cost-effective, evidence-based treatments, healthcare costs continue to rise to unsustainable levels. The insuring organizations must continue their leadership role in driving quality up and costs down. Regulators and other stakeholders demand transparency and value. Mere compliance with regulations will not suffice. Payers need rigorous financial controls to prevent fraud and reporting errors. A corporate culture that weaves compliance and risk management into business operations is needed. Employees who take personal responsibility for regulatory compliance and intelligent risk management.

Solution : Reactive compliance solutions that only the law will not suffice to achieve the cost reductions and performance improvements you need to stay competitive. Compliance programs should integrate with business processes to discover risks and vulnerabilities. Controls and monitoring must be embedded into business operations to prevent noncompliance, fraud and abuse and security breaches. Proper balance of risk and reward tuned to organization's tolerance for risk. Risk management should be aligned with performance management to help ones organization make business decisions based on a complete understanding of risks and benefits. Key performance indicators should link to corresponding risk indicators.

Analysis of a broad spectrum of risks - strategic, financial, operational and regulatory - and determine their likelihood of occurrence. Put plans in place to mitigate these risks if they occur.

Challenge 2 : Responding to a changing marketplace with new products

There is an increase in aging population with longer life expectancy. Demographic changes are expanding the market for health insurance. But who will pay? Corporations are cutting health benefits, most of all to retirees. Health insurance is being driven into a direct-to-consumer business. Rising unemployment is shrinking the commercial insurance market. And reforms from the US government such as a new public health plan or expansion of Medicare will crowd private plans out of the market and reduce the pool of potential customers. Insurance organisations need to adapt to these epochal changes in the commercial insurance marketplace. Introduce new benefit models to proactively anticipate and address the needs of targeted submarkets such as retirees, young workers and the growing ranks of the unemployed. Develop new products and reshape existing ones to attract consumers demanding quality and value. Consumers who want to stay healthier longer, for less money. The right products can bring new customers to insurance companies and deepen relationships with existing ones. Solution : Market share can be grown by developing products that meet the medical needs of retirees and address the financial constraints of retirees and their employers. Innovative benefit plans must be made that address current and future retiree health issues. Assessment of each plan's risks and liabilities must be done and they must be priced appropriately. Companies can attract health- and value-conscious customers with new plans incorporating wellness, preventive medicine and integrated health management. One must incorporate wellness initiatives, personalized medicine and disease management practices into an overall health management program. Managing federal Medicare and state/federal Medicaid programs continues to be a growth area for many insurance organizations. To profitably manage complex government programs, one must carefully consider benefit design and pricing, alignment of plans with business strategy, preparation of applications and competitive bids, sales and marketing analysis, plan implementation, network development and medical management. Examples : Lowered co-pays for preferred brand medicines.,Insurance against loss of coverage Plans that incorporate disease management and preventive medicine Once market-savvy plans are developed, one must carefully assess risks to price them appropriately, and then devise strategies to market them effectively. The efforts of product development must be developed to get to market more swiftly than competitors with quality products that add value to the consumer's healthcare experience.

Challenge 3 : Minimizing costs and maximizing operational efficiencies

Consumer choices, government mandates, loss of key accounts to a troubled economy and the possibility of healthcare reform all amplify the relentless pressure on insurance companies to grow revenue and shrink costs. Restrictions on coverage options and premiums will challenge insurers to profit from these new members. Keeping plans attractive and affordable will mean driving value up and costs down. To remain competitive, the companies need to improve operational performance. Integrate information systems throughout their enterprise. Conduct transactions more collaboratively and seamlessly with other stakeholders. Streamline the administrative processes and understand that performance improvement is more than a strategy for growth - it is a tactic for survival.

Solution: The insurance companies need to reduce bottom-line costs and increase top-line revenue. They can reduce costs by improving financial processes and operating more efficiently. The revenues can be enhanced by improving the quality, value and relevance of the products offered to customers. The organizations need to establish a disciplined approach to continuous, long-term performance improvement. They must identify global best practices and use them as benchmarks to analyze and evaluate operating and management processes. Systematically adopt or adapt best practices to its operations to reduce costs and increase efficiency of its key business functions. The insurers need to anticipate and capitalize on margin-enhancing opportunities presented by evolving market conditions and regulatory mandates. One must identify short- and long-term opportunities to improve the effectiveness and efficiency of ones organization and position it for the future. Enable these initiatives with integrated information technology. Accelerate them through enterprise-wide change management.

Challenge 4 : Deriving value from M&A and marketplace changes

A worldwide economic recession, A constricting marketplace, New global competitors, A shrinking commercial insurance market, Proposed policy reforms that could potentially reshape every aspect of the health insurance industry. The Insurance organizations face daunting challenges. In today's volatile economic and political climate, the insurance companies share with other stakeholders the burden of transforming an unsustainable healthcare system. Stakeholders are still working to reach consensus on the nature of the transformation and the details of how to achieve it. The insurers balance between public and private has yet to be determined. New regulations and new marketplace realities are already changing the way insurance companies sell their products, and to whom.

Economic and demographic trends drive the transition away from employer-based health plans to an individual-based market for health benefits. Although proposed mandates and tax credits would enlarge the insurers customer base, there will also be constraints on profit margins. The federal government's likely expanding role in healthcare could lead to caps on premium increases, coverage mandates, limits on insurance underwriting strategies and other regulatory burdens. Solution: The insurance organizations need to protect the markets in which they sell their products. New markets and new revenue sources must be developed by the firm. The benefit of new models must be explored to meet the needs of targeted sub-markets including retirees, young workers and the unemployed. The product portfolio must be diversified. Innovative new lines of business must be developed; new products and new care models (wellness initiatives, e-prescribing, disease management, etc.) that keep patients healthier for less cost. The conversion to ICD-10 and the implementation of standardized electronic health records (EHRs) will require one to adapt - and invest in upgrading - clinical processes and IT infrastructure. One must initiate a strategic plan for integrating clinical and business processes and IT infrastructure for better outcomes and competitive advantage. Expansion into new territories to tap new and growing private insurance markets. Companies should explore new business arrangements with providers and other insurers. Seek global partners and pipelines, and new customers. Consolidate market position through mergers and acquisitions. They can develop arrangements with off-shore partners and non-health companies to expand capabilities, reduce costs and tap emerging markets such as personalized and preventive medicine.

Challenge 5 : Leveraging IT for competitive advantage

Market forces are converging on Payer IT organizations as evidenced by the Health Information Technology for Economic and Clinical Health (HITECH) Act, healthcare reform, ICD-10, privacy and security regulations, cost-reduction strategies, clinical information systems and secondary use of data. These and other market forces make it more important than ever to have a high-performing IT organization. Solution : Insurance companies must leverage IT for competitive advantage. Employers, members, providers and many other stakeholders can all benefit from enhanced information technology. Insurers want to use enabling technologies to increase customer loyalty, improve quality, reduce costs and add value to the healthcare ecosystem-plan, prioritize and execute IT projects to align with business strategy.

You might also like

- Healthcare Staffing Income Generation Strategies HandbookFrom EverandHealthcare Staffing Income Generation Strategies HandbookNo ratings yet

- Textbook of Urgent Care Management: Chapter 22, Health Plan ContractingFrom EverandTextbook of Urgent Care Management: Chapter 22, Health Plan ContractingNo ratings yet

- Employee Health InvestmentsDocument5 pagesEmployee Health InvestmentsAnuNo ratings yet

- EDITED - Chris' 10-K SampleDocument14 pagesEDITED - Chris' 10-K SampleChristian LucasNo ratings yet

- Value Innovation in Pharmaceutical MarketingDocument4 pagesValue Innovation in Pharmaceutical Marketingkapilharit20056130No ratings yet

- Main Challenges and Issues For Health InsuranceDocument2 pagesMain Challenges and Issues For Health InsuranceOmkar PimpalkhuteNo ratings yet

- Assignment HRDocument6 pagesAssignment HRAnuNo ratings yet

- Top Global Risks: Illuminating The IN 2020Document12 pagesTop Global Risks: Illuminating The IN 2020Mohammed OsmanNo ratings yet

- Ahm250 l18 PDFDocument10 pagesAhm250 l18 PDFVinayaka KumarNo ratings yet

- Imprortance, Research Methdology, Objectives and Hypothesis: Chapter - IiDocument23 pagesImprortance, Research Methdology, Objectives and Hypothesis: Chapter - Iisacred54No ratings yet

- Example Case StudyDocument4 pagesExample Case Studymyc1No ratings yet

- Faster, Better, Cheaper: Creating Opportunities in A Converging Healthcare IndustryDocument10 pagesFaster, Better, Cheaper: Creating Opportunities in A Converging Healthcare IndustryAnkit SrivastavaNo ratings yet

- Managed Healthcare: Industry OverviewDocument11 pagesManaged Healthcare: Industry Overviewt6166asNo ratings yet

- Managing The Health Benefits Supply ChainDocument12 pagesManaging The Health Benefits Supply ChainJim RoseNo ratings yet

- AHIPDocument5 pagesAHIPPeter SullivanNo ratings yet

- Strategic Management Processes in Healthcare Organizations: Abdulaziz Saddique Pharm.D., CPHQ, CSSMBBDocument10 pagesStrategic Management Processes in Healthcare Organizations: Abdulaziz Saddique Pharm.D., CPHQ, CSSMBBtheresia anggitaNo ratings yet

- Health Insurance and Risk ManagementDocument7 pagesHealth Insurance and Risk ManagementPritam BhowmickNo ratings yet

- Healthcare Environment Strategic Business PlanningDocument6 pagesHealthcare Environment Strategic Business PlanningKarol ZarorNo ratings yet

- Cost Control in Health Care......................................Document11 pagesCost Control in Health Care......................................Rifat ParveenNo ratings yet

- B-School Case Studies - ConsolidatedDocument11 pagesB-School Case Studies - ConsolidatedAkhil SoniNo ratings yet

- Human Resources and Surviving Health Reform: by Mike TurpinDocument4 pagesHuman Resources and Surviving Health Reform: by Mike TurpinMuhammad UsmanNo ratings yet

- Pulse Redefining Medical Technology InnovationDocument64 pagesPulse Redefining Medical Technology InnovationAdvaMedLCINo ratings yet

- PWC Top Health Industry Issues of 2014Document17 pagesPWC Top Health Industry Issues of 2014daveawoodsNo ratings yet

- SM Value Chain Group 2 Assignment ReportDocument10 pagesSM Value Chain Group 2 Assignment ReportSashivNo ratings yet

- Mis Selling: CompetitionDocument3 pagesMis Selling: Competitionmeggie123No ratings yet

- IA Script Phase - 3Document9 pagesIA Script Phase - 3prakhar guptaNo ratings yet

- OptumDocument12 pagesOptumantonettereynoldsNo ratings yet

- AHM 520: Risk Management in Health PlansDocument17 pagesAHM 520: Risk Management in Health PlansRahul KoulNo ratings yet

- Healthcare White PaperDocument4 pagesHealthcare White Paperramakanta_sahu100% (1)

- Research PaperDocument10 pagesResearch PaperrahulNo ratings yet

- 8973308Document9 pages8973308Anonymous mWI4Hktm50% (2)

- Engaging Commercial Payers On Multi-Payer Alignment:: Key Issues For SIM StatesDocument8 pagesEngaging Commercial Payers On Multi-Payer Alignment:: Key Issues For SIM StatesSHADACNo ratings yet

- Abstract PorfolioDocument5 pagesAbstract Porfolioapi-271900931No ratings yet

- Effective Work ManagementDocument18 pagesEffective Work ManagementaddisNo ratings yet

- OIG Compliance Program For Third-Party Medical Billing CompaniesDocument15 pagesOIG Compliance Program For Third-Party Medical Billing CompaniesaaronborosNo ratings yet

- Commercial Models For A New Healthcare Ecosystem: by Paul DarlingDocument3 pagesCommercial Models For A New Healthcare Ecosystem: by Paul Darlingakhil pratapNo ratings yet

- Abstract - Jaipuria2 - Re-Engineering The Revenue CycleDocument2 pagesAbstract - Jaipuria2 - Re-Engineering The Revenue Cyclemunish_tiwari2007No ratings yet

- MICRO ENVIRONMENT Includes The Following FactorsDocument6 pagesMICRO ENVIRONMENT Includes The Following FactorsUchral TseNo ratings yet

- Healthcare EntrepreneurshipDocument4 pagesHealthcare EntrepreneurshipEE-B 085 Pritam BiswasNo ratings yet

- MarriottDocument12 pagesMarriottShakalya NagNo ratings yet

- SālsLetterV3 3 PDFDocument8 pagesSālsLetterV3 3 PDFMuhammad Tariq KhanNo ratings yet

- DI Health Plan of TomorrowDocument24 pagesDI Health Plan of Tomorrowmaja basketballclubNo ratings yet

- Marketing AssDocument5 pagesMarketing AssAkmel JihadNo ratings yet

- DRAFT PolymedicaDocument5 pagesDRAFT PolymedicaCharldon L. Tan50% (4)

- Avant Garde Case StudyDocument7 pagesAvant Garde Case StudyTanmayNo ratings yet

- Understanding Strategic Risks: by Bob Stephen, Director of Financial Advisory Services June 2007Document2 pagesUnderstanding Strategic Risks: by Bob Stephen, Director of Financial Advisory Services June 2007Amna MushtaqNo ratings yet

- Kastur I J Bao Spring 2006Document16 pagesKastur I J Bao Spring 2006Ħøşęħ ÖżįlNo ratings yet

- Wir 2007Document48 pagesWir 2007joofowNo ratings yet

- Unit 2Document35 pagesUnit 2Pallavi KapoorNo ratings yet

- 103 - Marketing ManagementDocument14 pages103 - Marketing ManagementRiyaz BabwaniNo ratings yet

- Medical Device Trends: Increased Regulation Healthcare Provider Consolidation Aging Population Emerging MarketsDocument6 pagesMedical Device Trends: Increased Regulation Healthcare Provider Consolidation Aging Population Emerging MarketsexperioNo ratings yet

- Ph2020 Tax Times FinalDocument28 pagesPh2020 Tax Times FinalOscar Antonio EcheverriNo ratings yet

- BCG Next Generation Medical Management - v3Document14 pagesBCG Next Generation Medical Management - v3Sumit Kumar AwkashNo ratings yet

- Financial Decision-Making Theory and The Small Employer Health Insurance Market in TexasDocument17 pagesFinancial Decision-Making Theory and The Small Employer Health Insurance Market in TexasSajid AnothersonNo ratings yet

- Glaxosmithkline Case SolutionDocument5 pagesGlaxosmithkline Case SolutionUmar Faruq EftiNo ratings yet

- Towers Watson Healthcare Survey 2010Document14 pagesTowers Watson Healthcare Survey 2010Shankar GhoshNo ratings yet

- A Critical Makeover For Pharmaceutical Companies PDFDocument28 pagesA Critical Makeover For Pharmaceutical Companies PDFAylin PolatNo ratings yet

- The Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesDocument3 pagesThe Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesPhoebe MwendiaNo ratings yet

- 9 External Environment Factors That Affect BusinessDocument5 pages9 External Environment Factors That Affect BusinessHasan NaseemNo ratings yet

- Module 6 - SummaryDocument13 pagesModule 6 - Summary98b5jc5hgtNo ratings yet

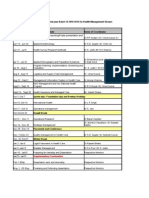

- Time Table PGDHM Yr2Document10 pagesTime Table PGDHM Yr2tanvisingh_2007No ratings yet

- TISS SHSS Brochure 2010 - 12Document35 pagesTISS SHSS Brochure 2010 - 12tanvisingh_2007No ratings yet

- Structural Analysis of FMCG IndustryDocument4 pagesStructural Analysis of FMCG Industrytanvisingh_2007No ratings yet

- Temporary Preview BajajDocument4 pagesTemporary Preview Bajajtanvisingh_2007No ratings yet

- Get Rid of Your Belly Fat!: Work OutDocument11 pagesGet Rid of Your Belly Fat!: Work Outtanvisingh_2007No ratings yet

- Parkin Laboratories Sales Target Dilemma: Submitted To-Dr.. Sandeep Puri Submitted byDocument13 pagesParkin Laboratories Sales Target Dilemma: Submitted To-Dr.. Sandeep Puri Submitted byRomharshit KulshresthaNo ratings yet

- Integrated Auditing of ERP Systems (PDFDrive)Document289 pagesIntegrated Auditing of ERP Systems (PDFDrive)Chaima LejriNo ratings yet

- Principles of Management Vansh Lamba GucciDocument10 pagesPrinciples of Management Vansh Lamba Guccivansh lambaNo ratings yet

- SDLC ResearchgateDocument10 pagesSDLC ResearchgateAlex PitrodaNo ratings yet

- Cary Siegel, Why Didn't They Teach Me This in School 99 Personal Money Management Principles To Live By. ReportDocument6 pagesCary Siegel, Why Didn't They Teach Me This in School 99 Personal Money Management Principles To Live By. ReportDaniel50% (2)

- Working Capital Ultra Tech CementDocument91 pagesWorking Capital Ultra Tech CementGnaneswari GvlNo ratings yet

- Impact X Workbook ToolDocument15 pagesImpact X Workbook ToolAkash DasNo ratings yet

- SME Guide For The Implementation of ISO/IEC 27001 On Information Security ManagementDocument38 pagesSME Guide For The Implementation of ISO/IEC 27001 On Information Security Managementjorgegutierrez810% (1)

- TPM PDFDocument18 pagesTPM PDFSaad Khadur EilyesNo ratings yet

- Case Study (Solved)Document10 pagesCase Study (Solved)Aditya DsNo ratings yet

- E-Tendering Srs 5 JulyDocument9 pagesE-Tendering Srs 5 Julyanon-510114100% (2)

- Impact of Packaging On Generation Y's Consumer BehaviourDocument76 pagesImpact of Packaging On Generation Y's Consumer BehaviourRohith Thampi100% (3)

- Brush Up - Slide 1Document1 pageBrush Up - Slide 1Jasmine AlucimanNo ratings yet

- Ebook Essentials of Investments 12E Ise PDF Full Chapter PDFDocument67 pagesEbook Essentials of Investments 12E Ise PDF Full Chapter PDFjanet.cochran431100% (22)

- XYZ Investing INC. Trial BalanceDocument3 pagesXYZ Investing INC. Trial BalanceLeika Gay Soriano OlarteNo ratings yet

- Soal Uts Abm 2 - Sesi 1Document2 pagesSoal Uts Abm 2 - Sesi 1alyaa rabbaniNo ratings yet

- 2021 Jce Business StudiesDocument6 pages2021 Jce Business StudiesMalack Chagwa100% (2)

- Eaas Executive SummaryDocument15 pagesEaas Executive SummarystarchitectNo ratings yet

- HS ComProDocument7 pagesHS ComProgabrielNo ratings yet

- SSR Stock Analysis SpreadsheetDocument33 pagesSSR Stock Analysis Spreadsheetpvenky100% (1)

- Iii. The Sales Presentation Ben Feldman: The Package Concept RevisitedDocument12 pagesIii. The Sales Presentation Ben Feldman: The Package Concept RevisitedCherryber Urdaneta100% (2)

- Lesson 4 MARKET STRUCTURESDocument21 pagesLesson 4 MARKET STRUCTURESJet SonNo ratings yet

- Health and Beauty Specialist Retailers in SingaporeDocument11 pagesHealth and Beauty Specialist Retailers in SingaporeSneha BasuNo ratings yet

- Chris Sloan ResumeDocument2 pagesChris Sloan ResumeChris SloanNo ratings yet

- Report On Askari BankDocument64 pagesReport On Askari Bankzorish87% (15)

- Business EthicsDocument29 pagesBusiness Ethicslalith kumarNo ratings yet

- Imperfect CompetitionDocument24 pagesImperfect CompetitionRupa Pant Balekundri100% (1)

- Chapter 1 - Indian Financial System - IntroductionDocument26 pagesChapter 1 - Indian Financial System - IntroductionsejalNo ratings yet

- Accounting Principles: Second Canadian EditionDocument37 pagesAccounting Principles: Second Canadian EditionAfsar AhmedNo ratings yet