Professional Documents

Culture Documents

Statistical sampling improves reliability of internal control testing

Uploaded by

umasankarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statistical sampling improves reliability of internal control testing

Uploaded by

umasankarCopyright:

Available Formats

Internal Auditor 8th July 2011

Print Close

Attribute Sampling Plans

A simple statistical application may dramatically improve the reliability of internal control testing.

DENNIS APPLEGATE

A reliability assessment of the organization's internal control system involves deciding how much evidence to gather. Because an examination of all underlying control data is not always feasible, auditors must often draw samples, audit the items selected, and extrapolate the results to the larger population. Either a statistical or nonstatistical approach to sampling is acceptable under The IIA's International Standards for the Professional Practice of Internal Auditing and The American Institute of Certified Public Accountants' (AICPA's) Professional Auditing Standards. The use of statistics, however, will help auditors develop sample plans more efficiently and assess sample results more objectively than nonstatistical methods alone. Even a well-designed nonstatistical sample cannot measure the risk that the sample is not representative of the population - a distinct advantage of statistically based sampling plans. Moreover, increased regulatory requirements to provide greater assurance over internal accounting controls and company demands for greater productivity from their audit shops make statistical sampling a necessary part of the internal auditor's tool kit. Fortunately, auditors can use statistical sampling techniques without any detailed knowledge of classical statistical theory and still accomplish their audit objectives.

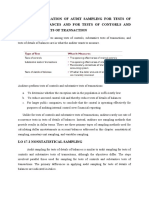

ATTRIBUTE SAMPLING

Attribute sampling plans represent the most common statistical application used by internal auditors to test the effectiveness of controls and determine the rate of compliance with established criteria. The results of these plans provide a statistical basis for the auditor to conclude whether the controls are functioning as intended, reflecting either control compliance or noncompliance - a binary (yes/no) proposition.

In developing an attribute sampling plan, the auditor must first define the audit test objective, population involved, sampling unit, and control items to be tested. For example, if the auditor's objective is to determine the percentage of sales orders lacking credit approval, the population will consist of all sales orders within a given period. Each sales order becomes the sampling unit, and sales order credit approval represents the control attribute to be tested.

STATISTICAL CRITERIA

The auditor must consider four statistical parameters to determine an appropriate sample size to select for the planned control test: confidence level, expected deviation rate, tolerable rate, and population. Although guided by assessed risk, inquiries of the audit client, and prior audit experience, each parameter is ultimately based on professional auditor judgment. Confidence Level The sample's confidence level refers to the reliability the auditor places on the sample results. Confidence levels of 90 percent to 99 percent are common. A 95 percent confidence level means the auditor assumes the risk that five out of 100 samples will not reflect the true values in the population. The auditor's assessment of the control environment contributes to the level of risk the auditor is willing to assume. At a 95 percent confidence level, 5 percent the complement of the confidence level reflects the auditor's risk of "assessing control risk too low." Expected Deviation Rate The expected deviation rate represents the auditor's best estimate of the actual failure rate of a control in a population. The rate usually is based on client inquiries, changes in personnel, process observations, prior year test results, or even the results of a preliminary sample. Tolerable Rate The tolerable rate defines the maximum rate of noncompliance the internal auditor will "tolerate" and still rely on the prescribed control. Many auditors will coordinate with their audit client before establishing a tolerable level. Client control objectives help determine

the nature and frequency of deviations that can occur and still allow reliance on the control. Population The population contains all items to be considered for testing. Each must have an unbiased chance of selection to ensure the final sample is representative of the population. For large populations containing thousands of items, population size will cause little impact on total sample size and is often irrelevant for audit sample planning.

APPLICATION OF THE METHODOLOGY

In a test of sales orders for appropriate credit approval, suppose the auditor estimates a 1.5 percent expected deviation rate of missing credit approvals relative to total sales orders, establishes a tolerable rate of 6 percent, and accepts a 95 percent confidence level that the sample results will reflect missing credit approvals fairly in the population. To calculate sample size, the auditor could use a variety of tools and techniques, including manual computations, statistical tables, and commercial software packages. For the statistical parameters provided, a sample size of 103 sales orders would be needed based on the "Statistical Sample Sizes for Test of Controls" chart below. Each of the sales orders selected for audit must be randomly drawn to prevent bias in the sample results. Simple random sampling, such as choosing sales orders based on a random-number table, is the most common selection technique. Systematic selection picking every nth sales order - is also acceptable if the first item sampled is randomly selected, though the results may be skewed if missing credit approvals occur in a systematic pattern. Because the random nature of the selection process will protect the validity of the statistical inferences, simple random sampling is normally the preferred method. After selecting a sample of sales orders, the auditor would compare the documented credit approvals against the operating procedures in place, noting exceptions and performing other audit steps as necessary in light of sales order protocols unique to the business. Special consideration should be given to data anomalies resulting from the selection process. For example, missing sales order documentation should be treated as an audit exception because the condition implies that control over credit approvals has not been applied as prescribed. Alternatively, voided sales orders should be replaced by orders that have not been voided. Mere voiding of a sales order does not alone suggest a weakness in control over credit approval.

Based on these procedures, suppose four sales orders lacked appropriate credit approval in the sample test. The auditor would project these results to the sales order population by calculating the upper deviation rate, a statistical estimate of the maximum deviation rate in the population. This rate can be determined using a simple statistical table or a manual or computer-generated computation. Based on the sample size and number of deviations found, the upper deviation rate in the sales example would be approximately 9 percent based on the "Statistical Sampling Results Evaluation Table for Tests of Controls" chart below.

AUDIT CONCLUSION

To form a statistical conclusion about the control tested, the auditor must compare the upper deviation rate to the tolerable rate in the sampling plan. If the upper deviation rate is less than the auditor's tolerable rate, the auditor would consider the control effective. Alternatively, if the upper deviation rate exceeds the auditor's tolerable rate, the auditor would consider the control ineffective. In the sales order example, the upper deviation rate(9 percent) exceeds the auditor's tolerable rate (6 percent). Therefore, the auditor would advise management not to rely on the control, concluding with 95 percent certainty that the rate of missed credit approvals exceeds the tolerable rate. All audit sampling plans use the upper deviation rate as the basis for an audit conclusion because it includes an allowance for sampling risk, which provides protection against undetected deviations. For nonstatistical sampling plans, only the sample deviation rate can form the basis for an audit conclusion - a limitation of the nonstatistical approach.

WORKPAPER OBJECTIVES

As with all audit procedures, the auditor must appropriately document the work performed. For a statistical sampling plan, the auditor's workpapers should include the essential elements, including the nature of the control tested (in the earlier example, sales order credit compliance with organizational procedure); details of the population and sampling unit (prior-year sales orders and related credit approvals); the control deviation (missing credit approvals); the statistical parameters used (including the deviation and tolerable rates); the sample size; and the evaluation of results. The auditor's documentation should also describe how the audit test steps were performed, and should provide a list of the actual deviations found (namely, in our example, the missing credit approvals).

AUDITOR JUDGMENT

Regardless of the sampling approach used, professional auditor judgment must always govern the quality of the audit evidence. Even with statistical sampling, auditors must exercise judgment in determining the appropriate statistical parameters to use for a valid audit conclusion. Nonetheless, a statistical approach to evidence gathering, such as attribute-based sampling, will normally provide a more objective basis for evaluating sample results than nonstatistical techniques and enhance the quality of auditors' reporting to management.

To comment on this article, e-mail the author at dennis.applegate@theiia.org.

You might also like

- Is Audit Report TemplateDocument12 pagesIs Audit Report Templatececil_jr100% (2)

- WCMDocument35 pagesWCMAmit100% (2)

- GDPR Data Protection AuditDocument23 pagesGDPR Data Protection AuditLuis80% (10)

- NITSL SQA 2005 02r1Document27 pagesNITSL SQA 2005 02r1diNo ratings yet

- MANUAL AUDIT SAMPLING TECHNIQUESDocument16 pagesMANUAL AUDIT SAMPLING TECHNIQUESవెంకటరమణయ్య మాలెపాటిNo ratings yet

- Audit Sampling TechniquesDocument4 pagesAudit Sampling TechniquesBony Feryanto Maryono100% (1)

- Guidelines Tools Used in Gathering Audit EvidenceDocument4 pagesGuidelines Tools Used in Gathering Audit EvidenceregenNo ratings yet

- Audit SamplingDocument31 pagesAudit SamplingSamratNo ratings yet

- Information Systems Auditing: The IS Audit Testing ProcessFrom EverandInformation Systems Auditing: The IS Audit Testing ProcessRating: 1 out of 5 stars1/5 (1)

- Auditing Ii Resume CH 17 Audit Sampling For Tests of Details of Balances (Contoh Audit Untuk Menguji Detail Dari Saldo)Document22 pagesAuditing Ii Resume CH 17 Audit Sampling For Tests of Details of Balances (Contoh Audit Untuk Menguji Detail Dari Saldo)juli kyoyaNo ratings yet

- Lo 17-1 Comparation of Audit Sampling For Tests of Details of Balances and For Tests of Contorls and Substantive Tests of TransactionDocument11 pagesLo 17-1 Comparation of Audit Sampling For Tests of Details of Balances and For Tests of Contorls and Substantive Tests of TransactionAlfiya PutriNo ratings yet

- 3 Auditing Techniques and Internal AuditDocument30 pages3 Auditing Techniques and Internal Audit3257 Vibhuti WadekarNo ratings yet

- TufDocument14 pagesTufHoàng VũNo ratings yet

- Nonprobabilistic Sample Selection MethodsDocument10 pagesNonprobabilistic Sample Selection MethodsDiah Dwi FitrianiNo ratings yet

- Audit Sampling in Substantive TestingDocument4 pagesAudit Sampling in Substantive TestingBea TrinidadNo ratings yet

- Uol Aa Notes (l6 l10) .May2021Document121 pagesUol Aa Notes (l6 l10) .May2021Dương DươngNo ratings yet

- Basic Audit Sampling ConceptsDocument36 pagesBasic Audit Sampling ConceptsAldrin DagamiNo ratings yet

- 17 - Chapter 11Document34 pages17 - Chapter 11Carey HillNo ratings yet

- Chapter 17 - Answer PDFDocument5 pagesChapter 17 - Answer PDFjhienellNo ratings yet

- Audassprin 15Document110 pagesAudassprin 15Frances AgustinNo ratings yet

- Audit sampling risks and how to reduce themDocument6 pagesAudit sampling risks and how to reduce themFuturamaramaNo ratings yet

- Attribute SamplingDocument18 pagesAttribute SamplingIcolyn Coulbourne100% (2)

- Audit Documentation GuideDocument12 pagesAudit Documentation Guideagnymahajan100% (1)

- Audit SamplingDocument6 pagesAudit SamplingIvan TrifkovićNo ratings yet

- Chapter 9 Audit SamplingDocument17 pagesChapter 9 Audit SamplingCzarmae DumalaonNo ratings yet

- Audit Sampling TechniquesDocument17 pagesAudit Sampling TechniquesMAG MAGNo ratings yet

- Assessing and Responding To Risks in A Financial Statement Audi Part IIDocument10 pagesAssessing and Responding To Risks in A Financial Statement Audi Part IIGerman Chavez100% (1)

- Audit Sampling NotesDocument18 pagesAudit Sampling Noteschananakartik1No ratings yet

- Sampling (UK Stream) and ISA 530, Audit Sampling and Other Selective Testing Procedures (International Stream)Document15 pagesSampling (UK Stream) and ISA 530, Audit Sampling and Other Selective Testing Procedures (International Stream)Denyiel YambaoNo ratings yet

- Auditing Revenue Cycle ProceduresDocument30 pagesAuditing Revenue Cycle ProceduresIsmail MarzukiNo ratings yet

- Auditing Practices & Procedures Class Test 2 Summary (40Document12 pagesAuditing Practices & Procedures Class Test 2 Summary (40Sadman Ar RahmanNo ratings yet

- CH 13Document26 pagesCH 13Elin Hellina100% (1)

- Week 10 Audit Sampling - ACTG411 Assurance Principles, Professional Ethics & Good GovDocument6 pagesWeek 10 Audit Sampling - ACTG411 Assurance Principles, Professional Ethics & Good GovMarilou Arcillas PanisalesNo ratings yet

- Student Accountant Hub Page: Analytical ProceduresDocument4 pagesStudent Accountant Hub Page: Analytical ProceduresKevin KausiyoNo ratings yet

- Statistical Sampling - A Useful Audit ToolDocument7 pagesStatistical Sampling - A Useful Audit ToolHBL AFGHANISTANNo ratings yet

- Statistical and Non Statistical SamplingDocument5 pagesStatistical and Non Statistical Samplingsymnadvi8047No ratings yet

- AdttttttttttttttDocument32 pagesAdttttttttttttttFarhad AhmedNo ratings yet

- ACC415 Section 1Document15 pagesACC415 Section 1194098 194098No ratings yet

- Audit SamplingDocument85 pagesAudit SamplingCarla Jean Cuyos100% (1)

- Advantages of statistical sampling over judgement samplingDocument4 pagesAdvantages of statistical sampling over judgement samplingchunlun87No ratings yet

- Chapter 11 Illustrative SolutionsDocument7 pagesChapter 11 Illustrative SolutionsSamantha Islam100% (2)

- Chapter-3 Auditing Techniques 3.1 Test Checking 1.meaningDocument13 pagesChapter-3 Auditing Techniques 3.1 Test Checking 1.meaningRajshahi BoardNo ratings yet

- Tugas AuditingDocument51 pagesTugas AuditingMuhammad Rizqi AndriyantoNo ratings yet

- Riftyvally University College: Auditing Principles and Practice Ii Assignment Group 9Document9 pagesRiftyvally University College: Auditing Principles and Practice Ii Assignment Group 9FekaduNo ratings yet

- At.114 Audit SamplingDocument8 pagesAt.114 Audit SamplingmiolataNo ratings yet

- This Type of Audit Risk Affects Audit EfficiencyDocument12 pagesThis Type of Audit Risk Affects Audit EfficiencyJBNo ratings yet

- Psa 530Document25 pagesPsa 530ceilhyn100% (1)

- Unit 6 Tests of ControlsDocument14 pagesUnit 6 Tests of ControlsVincent LyNo ratings yet

- Audit Strategy 516Document6 pagesAudit Strategy 516Diane Marie DuterteNo ratings yet

- Topic 5Document20 pagesTopic 5shinallata863No ratings yet

- Audit Chap 13Document3 pagesAudit Chap 13Nana MooNo ratings yet

- Unit 3 Audit Risk & Internal Control PDFDocument10 pagesUnit 3 Audit Risk & Internal Control PDFRomi BaaNo ratings yet

- Statistical Sampling QuestionDocument4 pagesStatistical Sampling QuestionNad Adenan100% (1)

- Audit SamplingDocument5 pagesAudit SamplingpateljhNo ratings yet

- Audit Sampling TechniquesDocument17 pagesAudit Sampling TechniquesCykee Hanna Quizo LumongsodNo ratings yet

- Auditing II NoteDocument47 pagesAuditing II Notenegussie birieNo ratings yet

- Artical of F8Document103 pagesArtical of F8AhmadzaiNo ratings yet

- Aeb SM CH15 1 PDFDocument25 pagesAeb SM CH15 1 PDFAdi SusiloNo ratings yet

- CC13 2 (Book/static) : Risk Assessment ProceduresDocument94 pagesCC13 2 (Book/static) : Risk Assessment Proceduresmonika1yustiawisdanaNo ratings yet

- Gather Audit Evidence Solutions Ch 8Document34 pagesGather Audit Evidence Solutions Ch 8Karen BalibalosNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18From EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18No ratings yet

- Supply Chain Strategy Audit A Complete Guide - 2020 EditionFrom EverandSupply Chain Strategy Audit A Complete Guide - 2020 EditionNo ratings yet

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19From EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19No ratings yet

- Strategy Mapping: An Interventionist Examination of a Homebuilder's Performance Measurement and Incentive SystemsFrom EverandStrategy Mapping: An Interventionist Examination of a Homebuilder's Performance Measurement and Incentive SystemsNo ratings yet

- AAT Code of EthicsDocument56 pagesAAT Code of EthicskbassignmentNo ratings yet

- SRP Annual Report 2019-20Document73 pagesSRP Annual Report 2019-20Nihit SandNo ratings yet

- Arias v. SandiganbayanDocument10 pagesArias v. SandiganbayanAmicah Frances AntonioNo ratings yet

- Best Leader That I Admired The MostDocument4 pagesBest Leader That I Admired The MostRachel DelgadoNo ratings yet

- CIA P1 SI Foundations of Internal AuditingDocument102 pagesCIA P1 SI Foundations of Internal AuditingJayAr Dela RosaNo ratings yet

- ICM Certification (P) LTD.: STANDARD: - ISO 9001: 2015 Audit ReportDocument18 pagesICM Certification (P) LTD.: STANDARD: - ISO 9001: 2015 Audit ReportRohit AttriNo ratings yet

- Group 3 Midterm Case Studies EnronDocument14 pagesGroup 3 Midterm Case Studies EnronWiln Jinelyn NovecioNo ratings yet

- GPRO - 330 - 1 - Monthly Process AuditDocument1 pageGPRO - 330 - 1 - Monthly Process Auditsantosh kumarNo ratings yet

- Supplier Assessment Checklist 110448Document45 pagesSupplier Assessment Checklist 110448manno200100% (1)

- Auditing 12th Ed EbookDocument659 pagesAuditing 12th Ed EbookSyed Rizvi100% (1)

- Annual Report 0506Document192 pagesAnnual Report 0506BenJenSalemNo ratings yet

- Gap Analysis ISO 14001-2015Document8 pagesGap Analysis ISO 14001-2015Arun ByakodNo ratings yet

- QA On Secretarial PracticeDocument9 pagesQA On Secretarial PracticeRam IyerNo ratings yet

- Bayambang Water District Executive Summary 2020Document5 pagesBayambang Water District Executive Summary 2020Paul De LeonNo ratings yet

- Lesson 2 Quiz MaterialDocument4 pagesLesson 2 Quiz Materiallinkin soyNo ratings yet

- Civ Pro Group 4 Jurisprudence Collection of Sum of MoneyDocument64 pagesCiv Pro Group 4 Jurisprudence Collection of Sum of MoneyJernel JanzNo ratings yet

- Cross-Examination: Sharpstein/TabernackiDocument222 pagesCross-Examination: Sharpstein/TabernackiWashington Free BeaconNo ratings yet

- Week 3 - Corporate Governance Responsibilities and AccountabilitiesDocument28 pagesWeek 3 - Corporate Governance Responsibilities and Accountabilitiessharielles /No ratings yet

- I190378914 1Document6 pagesI190378914 1Appie KoekangeNo ratings yet

- Quality Management System OverviewDocument58 pagesQuality Management System Overviewamerkhan5678No ratings yet

- City of Edmonton - Admin Response To Waste AuditDocument6 pagesCity of Edmonton - Admin Response To Waste AuditAnonymous TdomnV9OD4No ratings yet

- Telstra Cyber Security Report 2017 - WhitepaperDocument52 pagesTelstra Cyber Security Report 2017 - WhitepaperllNo ratings yet

- PUP Taguig CPA Licensure Exam ReviewDocument10 pagesPUP Taguig CPA Licensure Exam ReviewAbraham Mayo MakakuaNo ratings yet

- StatCon Finals Set 2Document16 pagesStatCon Finals Set 2Ali BastiNo ratings yet

- JS23PWA00046盐城神威(认可证书)Document3 pagesJS23PWA00046盐城神威(认可证书)SIG BarranquillaNo ratings yet

- Annual Compliance Calendar - Companies Act, 2013 LISTED COMPANY - Series 527 PDFDocument13 pagesAnnual Compliance Calendar - Companies Act, 2013 LISTED COMPANY - Series 527 PDFGaurav SharmaNo ratings yet