Professional Documents

Culture Documents

Annual Report Analysis of Allied Bank

Uploaded by

AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

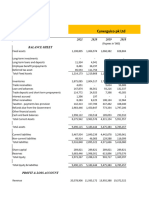

Annual Report Analysis of Allied Bank

Uploaded by

AhmedCopyright:

Available Formats

Horizontal Analysis

Rs. in Million

2010 10 Vs 09

2009 09 Vs 08

2008 08 Vs 07

Rs. M

Rs. M

Rs. M

2007 07 Vs 06

Rs. M

2006 06 Vs 05

2005 05 Vs 04

Rs. M

Rs. M

Balance Sheet

ASSETS

Cash and balances with treasury

and other banks

Lending to financial institutions

31,845 14.9% 27,716

7.6% 25,751 -15.3% 30,408 22.9% 24,745 37.2% 18,035 46.4%

11,489 -59.1% 28,123 78.1% 15,793 -14.3% 18,419 -3.3% 19,050 229.7%

Investments - Net

121,173 27.8% 94,789 14.7% 82,646 -1.6% 83,958 78.8% 46,953

Advances - Net

253,100

5,777 -64.3%

4.5% 44,927 -21.6%

6.6% 237,344 11.4% 212,972 26.5% 168,407 16.9% 144,033 29.5% 111,207 86.9%

Operating Fixed assets

15,360 23.4% 12,447 11.8% 11,134 47.5%

Other assets

16,965

Total assets

449,932

7,549 17.1%

-5.5% 17,955 -2.4% 18,399 61.9% 11,368

6,445 36.5%

4,721 85.0%

5.3% 10,800 36.6%

7,908 11.8%

7.5% 418,374 14.1% 366,695 14.6% 320,110 27.0% 252,026 30.9% 192,574 24.3%

LIABILITIES & EQUITY

Customer deposits

Inter bank borrowings

Bills payable

Other liabilities

Sub-ordinated loans

Total Liabilities

371,284 12.9% 328,875 10.6% 297,475 12.7% 263,972 28.1% 206,031 27.6% 161,410 27.7%

20,774 -47.8% 39,819 43.3% 27,778 21.1% 22,934 24.6% 18,410 89.9%

4,119 30.2%

3,162

7.1%

2,952 -15.5%

12,284 11.1% 11,061 -18.9% 13,636 86.0%

5,495

413,957

0.0%

5,497 120.1%

2,498

0.0%

3,494 53.4%

9,694 -22.7%

2,278 -7.0%

2,449 -3.4%

7,332 43.2%

5,119 14.5%

4,472 39.5%

2,499

2,500 100.0%

0.0%

6.6% 388,414 12.8% 344,340 14.7% 300,231 28.1% 234,339 31.6% 178,025 23.1%

Share capital

7,821 10.0%

7,110 10.0%

6,464 20.0%

5,386 20.0%

4,489

0.0%

4,489

Reserves

7,517 14.2%

6,583 13.4%

5,805 -4.1%

6,051 -1.3%

6,133

7.7%

5,693 -49.9%

Un - appropriated profit

15,829 29.8% 12,198 42.9%

8,537 22.5%

6,971 24.3%

5,608 105.3%

2,732 143.3%

Equity - Tier I

31,166 20.4% 25,891 24.5% 20,805 13.0% 18,408 13.4% 16,230 25.7% 12,914 36.7%

Surplus on revaluation of assets

Total Equity

4,808 18.2%

4,069 162.4%

1,550

5.5%

1,470

0.8%

1,458 -10.8%

1.9%

1,636 102.4%

35,975 38.6% 29,960 34.0% 22,356 12.5% 19,878 12.4% 17,688 21.6% 14,550 41.9%

Profit & Loss Account

Interest / Return / Non Interest

Income earned

Markup / Return / Interest earned

44,993

9% 41,122

35% 30,571

44% 21,201

23% 17,216

74%

9,892

89%

38%

11%

1,471

-3%

Fee, Commission, Brokerage and

Exchange income

Capital gain & Dividend income

Other income

Total

2,910

-16%

3,470

6%

3,266

45%

2,258

2,511

2%

2,452

56%

1,571

-1%

1,585 194%

251

598%

36

-39%

59

-24%

50,664

8% 47,080

33% 35,467

77

41% 25,122

-72%

1,636

540 175%

196 202%

273

273

76%

66% 11,832

69%

28% 19,665

0%

Markup / Return / Non Interest Expense

Markup / Return / Interest expensed

(22,428)

0% (22,422)

30% (17,273)

71% (10,093)

49% (6,793)

236% (2,025)

Operating expenses

(11,568)

19% (9,706)

14% (8,513)

37% (6,201)

17% (5,298)

24% (4,279)

Provisions

(4,326)

-2% (4,416)

24% (3,561)

24% (2,874)

Taxation

(4,118)

21% (3,414)

74% (1,964)

5% (1,877)

(42,439)

6% (39,957)

28% (31,311)

49% (21,045)

215%

(913)

31%

155%

4%

(694)

-56%

-17% (2,264)

30% (1,744)

502%

38% (15,267)

75% (8,742)

29%

Total expense - percentage of

total income

Profit after taxation

44

8,225

16%

7,122

71%

4,157

2%

4,076

-7%

4,397

42%

3,090 1511%

Annual Report of Allied Bank for the year 2010

Profit & Loss Horizontal Analysis

(Compounded average growth rate for the last Five years - annualised)

Markup / Return / Interest earned

Fee, Commission, Brokerage & Exchange income

Capital gain & Dividend income

Other income

Total income

Markup / Return / Interest expensed

Operating expenses

Provisions

Taxation

Total expenses

Profit / (loss) after taxation

-10

10

20

30

40

50

60

70

Statement of Financial Position Horizontal Analysis

(Compounded average growth rate for the last Five years - annualised)

Cash & Balances with Treasury & Other Banks

Lending to Financial Institutions

Investments - Net

Advances - Net

Operating Fixed Assets

Other Assets

Total Assets

Customer Deposits

Inter Bank Borrowings

Bills Payable

Other Liabilities

Sub-ordinated Loans

Total Liabilities

Share Capital

Total Reserves

Equity - Tier I

Surplus on Revaluation of Assets

Total Equity

12

15

18

21

24

27

30

45

Vertical Analysis

Rs. in Million

2010

Rs. M

2009 2008 2007 2006 2005

Rs. M

Rs. M

Rs. M

Rs. M

Rs. M

Balance Sheet

ASSETS

Cash and balances with treasury

and other banks

Lending to financial institutions

31,845

7%

27,716

7%

25,751

7%

30,408 9%

24,745 10%

11,489

3%

28,123

7%

15,793

4%

18,419 6%

19,050 8%

18,035 10%

5,777

3%

Investments - Net

121,173 27%

94,789 23%

82,646 23%

83,958 26%

46,953 19%

44,927 23%

Advances - Net

253,100 56%

237,344 56%

212,972 58%

111,207 58%

168,407 53%

144,033 56%

Operating Fixed assets

15,360

3%

12,447

3%

11,134

3%

7,549 2%

6,445 3%

4,721

2%

Other assets

16,965

4%

17,955

4%

18,399

5%

11,368 4%

10,800 4%

7,908

4%

366,695 100%

320,110 100%

252,026 100%

Total assets

449,932 100%

418,374 100%

192,574 100%

LIABILITIES & EQUITY

Customer deposits

Inter bank borrowings

Bills payable

Other liabilities

Sub-ordinated loans

Total Liabilities

371,284 82%

328,875 78%

263,972 83%

206,031 82%

27,778

8%

22,934 7%

18,410 7%

9,694

5%

1%

2,952

1%

3,494 1%

2,278 1%

2,449

1%

11,061

3%

13,636

4%

7,332 2%

5,119 2%

4,472

2%

5,497

1%

2,498

1%

2,499 1%

2,500 1%

- 0%

344,340 94%

300,231 94%

234,339 93%

178,025 92%

20,774

5%

4,119

1%

3,162

12,284

3%

5,495

1%

413,957 92%

39,819 10%

388,414 93%

297,475 80%

161,410 84%

Net assets

35,975

8%

29,960

7%

22,355

6%

19,878 6%

17,687 7%

14,550

8%

Represented by

Share capital

7,821

2%

7,110

2%

6,464

2%

5,386 2%

4,489 2%

4,489

2%

Reserves

7,517

2%

6,583

2%

5,804

2%

6,051 2%

6,133 2%

5,693

3%

Un - appropriated profit

15,829

3%

12,198

2%

8,537

2%

6,971 2%

5,608 2%

2,732

1%

Equity - Tier I

31,166

7%

25,891

6%

20,804

6%

18,408 6%

16,230 6%

12,914

7%

Surplus on revaluation of assets

Total Equity

4,808

1%

4,069

1%

1,550

0%

1,470 0%

1,458 1%

1,636

1%

35,975

8%

29,960

7%

22,355

6%

19,878 6%

17,688 7%

14,550

8%

Profit & Loss Account

Interest / Return / Non Interest

Income earned

Markup / Return / Interest earned

44,993 89%

41,122 88%

30,571 87%

21,201 85%

17,216 88%

9,892 84%

1,471 12%

Fee, Commission, Brokerage and

Exchange income

Capital gain & Dividend income

Other income

Total

2,910

6%

3,470

7%

3,266

9%

2,258 9%

1,636 8%

2,511

5%

2,452

5%

1,571

4%

1,585 6%

540 3%

196

2%

251

0%

36

0%

59

0%

77 0%

273 1%

273

2%

35,467 100%

25,122 100%

19,665 100%

50,664 100%

47,080 100%

11,832 100%

Markup / Return / Non Interest Expense

Markup / Return / Interest expensed

(22,428) -44%

(22,422) -48%

(17,273) -48%

(10,093) -41%

(6,793) -34%

(2,025) -17%

Operating expenses

(11,568) -23%

(9,706) -21%

(8,513) -24%

(6,201) -25%

(5,298) -27%

(4,279) -36%

Provisions

(4,326)

-9%

(4,416) -9%

(3,561) -10%

(2,874) -11%

(913) -5%

(694) -6%

Taxation

(4,118)

-8%

(3,414) -7%

(1,964) -6%

(1,877) -7%

(2,264) -12%

(1,744) -15%

(42,439) -84%

(39,957) -85%

(31,311) -88%

(21,045) -84%

(15,267) -78%

(8,742) -74%

Total expense - percentage of total income

Profit after taxation

46

8,225 16%

7,122 15%

4,157 12%

4,076 16%

4,397 22%

3,090 26%

Annual Report of Allied Bank for the year 2010

Statement of Financial Position Vertical Analysis - Assets

(Composition for the last six years)

2010

2009

2008

2007

2006

2005

0

20

40

60

Cash & Balances with Treasury & Other Banks

Advances - Net

Lending to Financial Institutions

Operating Fixed Assets

Investments - Net

Other Assets

80

100

Statement of Financial Position Vertical Analysis - Liabilities & Equity

(Composition for the last six years)

2010

2009

2008

2007

2006

2005

0

20

40

Customer Deposits

Sub-ordinated Loans

Inter Bank Borrowings

Share Capital

Bills Payable

Total Reserves

Other Liabilities

Surplus on Revaluation of Assets

60

80

100

60

80

100

80

100

Profit & Loss Vertical Analysis - Income

(Composition for the last six years)

2010

2009

2008

2007

2006

2005

0

20

40

Markup / Return / Interest earned

Capital gain & Dividend income

Fee, Commission, Brokerage & Exchange income

Other income

Profit & Loss Vertical Analysis - Expenses & Profit after Tax

(Composition for the last six years)

2010

2009

2008

2007

2006

2005

0

20

40

Markup / Return / Interest expensed

Taxation

Operating expenses

Profit / (loss) after taxation

60

Provisions

47

You might also like

- Bloomberg Commands Cheat SheetDocument2 pagesBloomberg Commands Cheat SheetDong SongNo ratings yet

- Ruble 4Document43 pagesRuble 4anelesquivelNo ratings yet

- National Roads Authority: Project Appraisal GuidelinesDocument15 pagesNational Roads Authority: Project Appraisal GuidelinesPratish BalaNo ratings yet

- MCA Syllabus Regulation 2009 Anna UniversityDocument61 pagesMCA Syllabus Regulation 2009 Anna UniversityJGPORGNo ratings yet

- Cheat Sheet Measuring ReturnsDocument1 pageCheat Sheet Measuring ReturnsthisisatrolNo ratings yet

- Harshad Mehta's Stock Market Scam - 3 Weeks AgoDocument9 pagesHarshad Mehta's Stock Market Scam - 3 Weeks AgoHardik ShahNo ratings yet

- Aqueous solutions and redox reactionsDocument1 pageAqueous solutions and redox reactionsDanielle GuindonNo ratings yet

- FMV Cheat SheetDocument1 pageFMV Cheat SheetAyushi SharmaNo ratings yet

- Cheat SheetDocument1 pageCheat Sheetsullivn1No ratings yet

- FFXV Comrades Cheat SheetDocument122 pagesFFXV Comrades Cheat SheetMissAphonicNo ratings yet

- Corporate Law - Cheat Sheet (Lecture 2) PDFDocument1 pageCorporate Law - Cheat Sheet (Lecture 2) PDFSarah CamilleriNo ratings yet

- Basics of Portfolio AnalysisDocument5 pagesBasics of Portfolio Analysisiqbal78651No ratings yet

- Acctg 581C - Fall 2011 - Test 2 Chapters 7-10 - Que-ADocument12 pagesAcctg 581C - Fall 2011 - Test 2 Chapters 7-10 - Que-Ajess_eng_1100% (1)

- Important Notes For Midterm 2Document11 pagesImportant Notes For Midterm 2Abass Bayo-AwoyemiNo ratings yet

- Cheat SheetDocument1 pageCheat Sheetheuwensze6831No ratings yet

- Managerial Fin - Midterm Cheat - Copy2Document2 pagesManagerial Fin - Midterm Cheat - Copy2JoseNo ratings yet

- Govt Agency Trader Sales Cheat SheetDocument1 pageGovt Agency Trader Sales Cheat SheetLoudie Lyn JunioNo ratings yet

- Tax Cheat Sheet AY1415 Semester 2 V2Document3 pagesTax Cheat Sheet AY1415 Semester 2 V2Krithika NaiduNo ratings yet

- Calculate Cost of Capital for Company Financing OptionsDocument4 pagesCalculate Cost of Capital for Company Financing OptionsRanjit SpNo ratings yet

- Business Enterprises Cheat SheetDocument37 pagesBusiness Enterprises Cheat Sheetmca1001No ratings yet

- Cheat Sheet V3Document1 pageCheat Sheet V3DokajanNo ratings yet

- Bond ValuationDocument17 pagesBond ValuationMatthew RyanNo ratings yet

- CH 13 SolutionsDocument7 pagesCH 13 SolutionsSyed Mohsin Haider0% (1)

- AUDIT - F8.8 (1 Prada D 3m n3rs CrestDocument6 pagesAUDIT - F8.8 (1 Prada D 3m n3rs CrestVeronica BaileyNo ratings yet

- Cheat Sheet Derivatif Securities UTSDocument2 pagesCheat Sheet Derivatif Securities UTSNicole sadjoliNo ratings yet

- Merger Analysis APV MethodDocument22 pagesMerger Analysis APV MethodPrashantKNo ratings yet

- Adidas Marketing Strategy AnalysisDocument15 pagesAdidas Marketing Strategy AnalysisTanuja MohapatraNo ratings yet

- FSM Cheat SheetDocument10 pagesFSM Cheat SheetVicky RajoraNo ratings yet

- Bloomberg Cheat Sheet - EnglishDocument5 pagesBloomberg Cheat Sheet - EnglishNilanjan MaityNo ratings yet

- FCFEDocument7 pagesFCFEbang bebetNo ratings yet

- Midterm Cheat Sheet For BUS280Document6 pagesMidterm Cheat Sheet For BUS280djdpa0No ratings yet

- 1 Accounting For Mutual FundDocument1 page1 Accounting For Mutual FundChethan Venkatesh100% (1)

- Strand 500 Key Cheat SheetsDocument6 pagesStrand 500 Key Cheat SheetsXaleDmanNo ratings yet

- Discount Factor TemplateDocument5 pagesDiscount Factor TemplateRashan Jida ReshanNo ratings yet

- CIQ Excel Cheat Sheet June 2012Document2 pagesCIQ Excel Cheat Sheet June 2012osogboandrew_9480574No ratings yet

- Cheat SheetDocument2 pagesCheat SheetAnonymous ODAZn6VL6No ratings yet

- Oracle Soa Maturity Model Cheat SheetDocument8 pagesOracle Soa Maturity Model Cheat Sheethelpmyinternet100% (2)

- The Price-Volume Behavior of An Equity: Theoretical ApproachDocument11 pagesThe Price-Volume Behavior of An Equity: Theoretical ApproachSudhansu SinghNo ratings yet

- Business ModelDocument111 pagesBusiness ModelShai BurnovskiNo ratings yet

- Estimating A Firm's Cost of Capital: Chapter 4 OutlineDocument17 pagesEstimating A Firm's Cost of Capital: Chapter 4 OutlineMohit KediaNo ratings yet

- Cheat Sheet Exam 4Document2 pagesCheat Sheet Exam 4adviceviceNo ratings yet

- Vertical Analysis FS Shell PHDocument5 pagesVertical Analysis FS Shell PHArjeune Victoria BulaonNo ratings yet

- MSFTDocument83 pagesMSFTJohn wickNo ratings yet

- 2006 To 2008 Blance SheetDocument4 pages2006 To 2008 Blance SheetSidra IrshadNo ratings yet

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- Astra International TBK.: Balance Sheet Dec-2006 Dec-2007Document18 pagesAstra International TBK.: Balance Sheet Dec-2006 Dec-2007sariNo ratings yet

- Income Statement Analysis and Projections 2005-2010Document5 pagesIncome Statement Analysis and Projections 2005-2010Gullible KhanNo ratings yet

- Account Title 2014 (In ) 2013 (In ) Peso Change Percent Change 2013 (In ) 2012 (In ) Peso Change Perce NT Chan GeDocument4 pagesAccount Title 2014 (In ) 2013 (In ) Peso Change Percent Change 2013 (In ) 2012 (In ) Peso Change Perce NT Chan GeadsNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- Baru Baru - PT X - Study Case 5Document98 pagesBaru Baru - PT X - Study Case 5Kojiro FuumaNo ratings yet

- United Tractors TBK.: Balance Sheet Dec-06 DEC 2007 DEC 2008Document26 pagesUnited Tractors TBK.: Balance Sheet Dec-06 DEC 2007 DEC 2008sariNo ratings yet

- HABT Model 5Document20 pagesHABT Model 5Naman PriyadarshiNo ratings yet

- Pak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Document14 pagesPak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Abdul RehmanNo ratings yet

- Astra Otoparts Tbk. Financial PerformanceDocument18 pagesAstra Otoparts Tbk. Financial PerformancesariNo ratings yet

- Apple V SamsungDocument4 pagesApple V SamsungCarla Mae MartinezNo ratings yet

- Hindustan Petrolium Corporation LTD: ProsDocument9 pagesHindustan Petrolium Corporation LTD: ProsChandan KokaneNo ratings yet

- Private Sector Banks Comparative Analysis 1HFY22Document12 pagesPrivate Sector Banks Comparative Analysis 1HFY22Tushar Mohan0% (1)

- Gross ProfitDocument25 pagesGross ProfitMinzaNo ratings yet

- PHILEX - V and H AnalysisDocument8 pagesPHILEX - V and H AnalysisHilario, Jana Rizzette C.No ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- ApDocument2 pagesApAhmedNo ratings yet

- 003 III MIS TelecommunicationsDocument23 pages003 III MIS TelecommunicationsAhmedNo ratings yet

- FundsDocument39 pagesFundsAhmedNo ratings yet

- Guideline ErgonomicDocument13 pagesGuideline ErgonomicAhmedNo ratings yet

- Leading Issues in Economic DevelopmentDocument23 pagesLeading Issues in Economic DevelopmentAhmed0% (2)

- India's Auto Finance Industry GrowthDocument7 pagesIndia's Auto Finance Industry GrowthVikram KharviNo ratings yet

- Sme Study Modules For Quick Reference PDFDocument180 pagesSme Study Modules For Quick Reference PDFNilima ChowdhuryNo ratings yet

- Caro Expectation by MP Vijay PDFDocument47 pagesCaro Expectation by MP Vijay PDFAnirudh GudavalliNo ratings yet

- 002 Initial Letter To Lender1Document9 pages002 Initial Letter To Lender1Armond TrakarianNo ratings yet

- US Mortgage LoanDocument12 pagesUS Mortgage LoanmailsendNo ratings yet

- Solid Builders vs. China BankDocument1 pageSolid Builders vs. China BankAngelica BernardoNo ratings yet

- 26 Orfila VS ArellanoDocument16 pages26 Orfila VS ArellanoZonix LomboyNo ratings yet

- Customer Satisfaction at SBIDocument43 pagesCustomer Satisfaction at SBIManeesh SharmaNo ratings yet

- CA Short Form Deed of TrustDocument3 pagesCA Short Form Deed of TrustAxisvipNo ratings yet

- Insurance Companies Provide Financial ProtectionDocument9 pagesInsurance Companies Provide Financial ProtectionLevi Emmanuel Veloso BravoNo ratings yet

- NMIMS Banking Industry Analysis ReportDocument35 pagesNMIMS Banking Industry Analysis ReportGovind Chandvani100% (1)

- The Role of SACCOs in Financial IntermediationDocument108 pagesThe Role of SACCOs in Financial IntermediationwedjefdbenmcveNo ratings yet

- Solid Investment, The HYIPDocument48 pagesSolid Investment, The HYIPshastaconnect0% (1)

- Property Assessed Clean Energy ProgramsDocument14 pagesProperty Assessed Clean Energy Programsdfong27No ratings yet

- Tally Ledger ListDocument7 pagesTally Ledger ListShaluNo ratings yet

- TOPSIM - Tent Participants 1Document22 pagesTOPSIM - Tent Participants 1Александър КикаринNo ratings yet

- 415 - Abubakar Sirajo Business Plan.Document10 pages415 - Abubakar Sirajo Business Plan.UmarSaboBabaDoguwaNo ratings yet

- Simple Interest Asynchronous1 Answer KeyDocument4 pagesSimple Interest Asynchronous1 Answer KeyAriane GaleraNo ratings yet

- NoidaDocument23 pagesNoidaAmmar Tambawala100% (1)

- Loan Application FormDocument6 pagesLoan Application FormJohn Okong'oNo ratings yet

- NHBRC Home - Builders - ManualDocument24 pagesNHBRC Home - Builders - Manualcmak67% (3)

- Cibil Report RAM BABU VISHWKARMA1579275405637Document7 pagesCibil Report RAM BABU VISHWKARMA1579275405637MONISH NAYAR100% (1)

- SC rules in favor of petitioner in BP 22 case, finds checks time-barredDocument2 pagesSC rules in favor of petitioner in BP 22 case, finds checks time-barredCzarianne Golla0% (1)

- Autumn Leaves Offical StatementDocument278 pagesAutumn Leaves Offical StatementFernando BusteloNo ratings yet

- Principle of Management: Final Project PresentationDocument18 pagesPrinciple of Management: Final Project PresentationHaad AftabNo ratings yet

- Contract PDFDocument49 pagesContract PDFAli Requiso MahmudNo ratings yet

- LGU Receipts and Expenditures ReportDocument6 pagesLGU Receipts and Expenditures ReportSan Fabian DILGNo ratings yet

- The Need For International Accounting StandardsDocument1 pageThe Need For International Accounting StandardsYuvaraj RajNo ratings yet

- (CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)Document12 pages(CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)jamNo ratings yet

- 4 A's Lesson Plan in General Mathematics 11: 1. ActivityDocument3 pages4 A's Lesson Plan in General Mathematics 11: 1. ActivityclaudineNo ratings yet