Professional Documents

Culture Documents

Bill Analysis and Fiscal Impact Statement: I. Summary

Uploaded by

Matt DixonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bill Analysis and Fiscal Impact Statement: I. Summary

Uploaded by

Matt DixonCopyright:

Available Formats

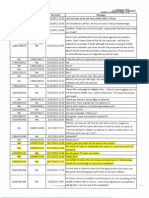

The Florida Senate

BILL ANALYSIS AND FISCAL IMPACT STATEMENT

(This document is based on the provisions contained in the legislation as of the latest date listed below.)

Prepared By: The Professional Staff of the Communications, Energy, and Public Utilities Committee

BILL: INTRODUCER: SUBJECT: DATE:

SB 238 Senator Evers Florida Renewable Fuel Standard Act November 2, 2011

ANALYST REVISED:

STAFF DIRECTOR

REFERENCE

ACTION

1. Willar 2. 3. 4. 5. 6.

Carter

CU CM

Pre-meeting

I.

Summary: The bill repeals the Florida Renewable Fuel Standard Act with its requirement that, with stated exemptions, on and after December 31, 2010, all gasoline sold or offered for sale in the State of Florida by a terminal supplier, importer, blender, and wholesaler must contain, at a minimum, 10 percent of agriculturally derived, denatured ethanol fuel by volume. The bill substantially amends section 206.43, and repeals the following sections, of the Florida Statutes: 526.201, 526.202, 526.203, 526.204, 526.205, 526.206, and 526.207.

II.

Present Situation: The State Legislature in 2008 determined that it is vital to the public interest and to the states economy to establish a market and the necessary infrastructure for renewable fuels in this state by requiring that all gasoline offered for sale in this state include a percentage of agriculturally derived, denatured ethanol. The Legislature further found that the use of renewable fuel reduces greenhouse gas emissions and dependence on imports of foreign oil, improves the health and quality of life for Floridians, and stimulates economic development and the creation of a sustainable industry that combines agricultural production with state-of-the-art technology.1 The Florida Renewable Fuel Standard Act was passed in 20082 requiring all gasoline sold or offered for sale in Florida by a terminal supplier, importer, blender, or wholesaler to contain 9 to 10

1 2

http://www.flsenate.gov/Laws/Statutes/2011/526.202 2008 HB 7135 http://laws.flrules.org/2008/227

BILL:

SB 238

Page 2

percent of agriculturally-derived denatured ethanol fuel by volume. It also provided a list of fuel sold or used for specified purposes that is exempt from the requirements.3 According to a 2008 article in the St. Petersburg Times, at that point the State of Florida had spent $50 million on ethanol production and research, including at least $13 million for projects that would use water such as tree trimmings and citrus peels and $20 million to a University of Florida project with Florida Crystals to make ethanol from sugar bagasse. So far, the projects underway in Florida have yet to produce a drop.4 The first plant proposed in Florida, U.S. EnviroFuels plan in Tampa, drew opposition when the local firm building the factory put in a request for 400,000 gallons a day of city water, which would have made the facility one of the citys top ten water consumers overnight at a time when Florida was suffering from a prolonged drought and rivers and lakes were at record lows.5 Since then, several Florida ethanol plans have been announced. Construction began in middle February, 2011, on the first ethanol plant to break ground in Florida. The plant is a joint venture between INEOS Bio and New Planet Energy. It is expected to be the first advanced waste-to-fuel biorefinery in the U.S., with expected annual ethanol production of as much as 8 million gallons and more than 6 megawatts of power from local yard, vegetative and household waste. Federal and state grants are funding the project. The company received a $2.5 million Florida Farm-toFuel grant and a $50 million federal grant in 2009. Recently, they have received a conditional commitment for a $75 million loan guarantee from the U.S. Department of Agriculture. Other proposed Florida ethanol projects are: Vercipia Biofuels, owned by BP, plans to build in highland County; and Fort Lauderdale based Renewable Fuels, LLC., and plans to build three sweetsorghum- to-ethanol plants in South Florida.6 Since 2010, the United States annual ethanol production has accounted for 13.23 billion gallons, representing 36 million gallons a day.7 Florida currently produces none of its ethanol used in the States blended fuel, but has a few ethanol production plants in construction. Since 2008 Florida has appropriated $50 million to these ethanol projects, and by 2017 Florida estimates an annual ethanol production of 200 million gallons.8 Florida imported about 505 million gallons of blended ethanol gasohol in July 2011. The Florida Department of Revenue (DOR) estimates that number is close to 100 percent due to situations when a taxpayer reports sales of gasoline when in actuality they sold gasohol.9 In the last fiscal year 8.2 Billion gallons of gasoline and 1.4 Billion gallons of diesel fuel were sold in Florida.10 Highlands Countys two ethanol projects estimated building costs at $170 million, and 60 high-paying jobs would be created, along with 480 indirect jobs in agriculture.11

3 4

http://energy.senate.gov/public/_files/RL342941.pdf http://www.sptimes.com/2008/03/02/Business/Are_Florida_ethanol_p.shtml 5 http://www.economist.com/node/10766882 6 http://basicfuels.com/2011/02/first-ethanol-plant-comes-to-vero-beach-florida/ 7 http://www.ethanolrfa.org/news/entry/2010-annual-ethanol-production-13.23-billion-gallons/ 8 http://www.sptimes.com/2008/03/02/Business/Are_Florida_ethanol_p.shtml 9 Email correspondence with Department of Revenue staff 10 http://dor.myflorida.com/dor/taxes/fuel/ 11 http://www2.highlandstoday.com/content/2011/oct/05/051547/ethanol-plant-touts-60-new-jobs/

BILL:

SB 238 Effect of Proposed Changes:

Page 3

III.

Section 1 repeals sections 526.201, 526.202, 526.203, 526. 204, 526.205, 526, 206, and 526.207 of the Florida Statues, removing: the act title,12 legislative findings regarding renewable fuel,13 renewable fuel standard exemptions, including definitions regarding blended gasoline requirements as a mixture of 90 to 91 percent gasoline and 9 to 10 percent ethanol by volume,14 waivers and suspensions,15 the enforcement on terminal suppliers, importers, blenders, or wholesalers that sell or distribute, or offer for sale or distribution of gasoline which fails to meet the requirements of this Act,16 the provisions authorizing the Department of Revenue and the Department of Agriculture and Consumer Services (DACS) to adopt rules in implementing provision of this Act,17 and the requirement that the DACS conduct a study to evaluate and recommend the life-cycle greenhouse gas emissions associated with all renewable fuels.18 Section 2 amends s. 206.43(2), F.S., to make a conforming change, deleting from this section the language Each terminal supplier, importer, blender, and wholesaler shall also include in the report to the department the number of gallons of blended and unblended gasoline, as defined in s. 526.203, sold. Section 3 provides that the bill takes effect July 1, 2012. IV. Constitutional Issues: A. Municipality/County Mandates Restrictions: None. B. Public Records/Open Meetings Issues: None. C. Trust Funds Restrictions: None. V. Fiscal Impact Statement: A. Tax/Fee Issues: None.

12 13

http://www.flsenate.gov/Laws/Statutes/2011/526.201 http://www.flsenate.gov/Laws/Statutes/2011/526.202 14 http://www.flsenate.gov/Laws/Statutes/2011/526.203 15 http://www.flsenate.gov/Laws/Statutes/2011/526.204 16 http://www.flsenate.gov/Laws/Statutes/2011/526.205 17 http://www.flsenate.gov/Laws/Statutes/2011/526.206 18 http://www.flsenate.gov/Laws/Statutes/2011/526.207

BILL:

SB 238 B. Private Sector Impact:

Page 4

Currently there are no working ethanol production plants in Florida, but there are plants under construction. The private sector could see a loss in market production if mandates are removed. This is, however, uncertain. According to DACS, the practical impact of the bill is uncertain because the 2007 Energy Independence and Security Act (EISA) requirements remain in place and effectively increase the use of ethanol.19 The 2007 EISA Renewable Fuel Standards require 9 billion gallons in 2008 and 36 billion gallons in 2022, which in turn could constitute a bigger market for ethanol resulting in higher demand for the product in the long run. Federal Environmental Protection Agency (EPA) emissions control requirements also may encourage expanded use of ethanol. The EPA requires reduced exhaust emissions of carbon monoxide, which can be accomplished by the addition of ethanol, which contains 35 percent oxygen by weight and promotes more complete combustion of the fuel. C. Government Sector Impact: The Department of Agriculture and Consumer Services do not anticipate any appreciable effect to state revenues if the bill were to pass. VI. Technical Deficiencies: None. VII. Related Issues: None. VIII. Additional Information: A. Committee Substitute Statement of Substantial Changes:

(Summarizing differences between the Committee Substitute and the prior version of the bill.)

None. B. Amendments: None.

This Senate Bill Analysis does not reflect the intent or official position of the bills introducer or the Florida Senate.

19

Email correspondence with DACS Staff

You might also like

- Senate Hearing, 114TH Congress - Oversight of The Renewable Fuel StandardDocument169 pagesSenate Hearing, 114TH Congress - Oversight of The Renewable Fuel StandardScribd Government DocsNo ratings yet

- Agriculture Law: RL33572Document14 pagesAgriculture Law: RL33572AgricultureCaseLawNo ratings yet

- Spend Baby SpendDocument19 pagesSpend Baby SpendColorado Ethics WatchNo ratings yet

- Supporting Biofuels: A Case Study On The Law of Unintended Consequences?Document14 pagesSupporting Biofuels: A Case Study On The Law of Unintended Consequences?LTE002No ratings yet

- Federal Funding ResourcesDocument4 pagesFederal Funding ResourcesjohnribarNo ratings yet

- WSJ On Biofuels - 2009 ArticleDocument4 pagesWSJ On Biofuels - 2009 ArticlePamela DixonNo ratings yet

- In This Issue: Hickenlooper: CNG Is Colorado's FutureDocument5 pagesIn This Issue: Hickenlooper: CNG Is Colorado's Futurea9495No ratings yet

- Crew Foia 2014-006851-0001875Document13 pagesCrew Foia 2014-006851-0001875CREWNo ratings yet

- Georgia Governor Petitions EPA To Limit Ethanol MandatesDocument11 pagesGeorgia Governor Petitions EPA To Limit Ethanol MandatesmfadegreeNo ratings yet

- Renewable Fuel Standard Primer Low ResDocument28 pagesRenewable Fuel Standard Primer Low ResBaronNo ratings yet

- Energy and Markets Newsletter 110811Document10 pagesEnergy and Markets Newsletter 110811choiceenergyNo ratings yet

- Battery Manufacturing For Hybrid and Electric Vehicles - Policy IssuesDocument31 pagesBattery Manufacturing For Hybrid and Electric Vehicles - Policy IssuesChuck Achberger100% (1)

- RC FrackingDocument16 pagesRC FrackingraptorebooksNo ratings yet

- CRS Issue Brief on Alternative Fuels and Advanced Technology VehiclesDocument14 pagesCRS Issue Brief on Alternative Fuels and Advanced Technology Vehiclesmailsk123No ratings yet

- 2009 Report on Ethanol Market ConcentrationDocument17 pages2009 Report on Ethanol Market ConcentrationChristopher LuedtkeNo ratings yet

- Director's Cut: Lynn Helms NDIC Department of Mineral ResourcesDocument3 pagesDirector's Cut: Lynn Helms NDIC Department of Mineral ResourcesbakkengeneralNo ratings yet

- 4478 Fact Sheet 061010Document4 pages4478 Fact Sheet 061010Steve CouncilNo ratings yet

- The Fight Over Using Natural Gas for Transportation: AntagonistsFrom EverandThe Fight Over Using Natural Gas for Transportation: AntagonistsRating: 5 out of 5 stars5/5 (1)

- Battery Manufacturing For Hybrid and Electric Vehicles CRSDocument34 pagesBattery Manufacturing For Hybrid and Electric Vehicles CRSsgsg100% (1)

- GOTION, INC., v. GREEN CHARTER TOWNSHIPDocument20 pagesGOTION, INC., v. GREEN CHARTER TOWNSHIPBrandon ChewNo ratings yet

- 7.20.2023 - Letter To Ford - China Select Ways and MeansDocument5 pages7.20.2023 - Letter To Ford - China Select Ways and MeansBen OrnerNo ratings yet

- Ethanol SubsidiesDocument14 pagesEthanol Subsidiesd3cubedNo ratings yet

- Energy and Markets Newsletter 0802611Document8 pagesEnergy and Markets Newsletter 0802611choiceenergyNo ratings yet

- Waxman-Markey Bill: Florida State Fact SheetDocument4 pagesWaxman-Markey Bill: Florida State Fact SheetEnergy TomorrowNo ratings yet

- Hr6sap HDocument2 pagesHr6sap HlosangelesNo ratings yet

- Biofuels Annual - Manila - Philippines - RP2023-0041Document25 pagesBiofuels Annual - Manila - Philippines - RP2023-0041magijNo ratings yet

- House Hearing, 111TH Congress - Subcommittee Hearing On Impacts of Outstanding Regulatory Policy On Small Biofuels Producers and Family FarmersDocument92 pagesHouse Hearing, 111TH Congress - Subcommittee Hearing On Impacts of Outstanding Regulatory Policy On Small Biofuels Producers and Family FarmersScribd Government DocsNo ratings yet

- Energy Data Highlights: Big Gas Find For Italy's EniDocument9 pagesEnergy Data Highlights: Big Gas Find For Italy's EnichoiceenergyNo ratings yet

- Federal Register / Vol. 77, No. 149 / Thursday, August 2, 2012 / Rules and RegulationsDocument15 pagesFederal Register / Vol. 77, No. 149 / Thursday, August 2, 2012 / Rules and RegulationsMarketsWikiNo ratings yet

- House Hearing, 112TH Congress - Adrift in New Regulatory Burdens and Uncertainty: A Review of Proposed and Potential Regulations On Family FarmersDocument157 pagesHouse Hearing, 112TH Congress - Adrift in New Regulatory Burdens and Uncertainty: A Review of Proposed and Potential Regulations On Family FarmersScribd Government DocsNo ratings yet

- NSTP Pecha Kucha Group 5 RA 9367 SCRIPTDocument3 pagesNSTP Pecha Kucha Group 5 RA 9367 SCRIPTPreccyNo ratings yet

- GableGotwals Ok'n 8-14-14Document1 pageGableGotwals Ok'n 8-14-14Price LangNo ratings yet

- Gillespie Letter To General Counsel Ferrentino-Seminole Electric Coop-Jun-01-2016Document38 pagesGillespie Letter To General Counsel Ferrentino-Seminole Electric Coop-Jun-01-2016Neil GillespieNo ratings yet

- SB 12-063: Severance Tax Revenues For Rural Institutions of Higher EducationDocument3 pagesSB 12-063: Severance Tax Revenues For Rural Institutions of Higher EducationSenator Mike JohnstonNo ratings yet

- Application For An Alcohol Fuel Producer Under 26 U.S.C. 5181Document4 pagesApplication For An Alcohol Fuel Producer Under 26 U.S.C. 5181reiNo ratings yet

- Weekly Coal Monitoring Report Coal Burning Utilities and Independent Power Producers (Instructions)Document1 pageWeekly Coal Monitoring Report Coal Burning Utilities and Independent Power Producers (Instructions)Anda LankuNo ratings yet

- Director's Cut: Lynn Helms NDIC Department of Mineral ResourcesDocument3 pagesDirector's Cut: Lynn Helms NDIC Department of Mineral ResourcesbakkengeneralNo ratings yet

- API Climate Fact SheetDocument2 pagesAPI Climate Fact Sheetlmogablog100% (2)

- Energy and Markets Newsletter 111511Document9 pagesEnergy and Markets Newsletter 111511choiceenergyNo ratings yet

- Smart Grid Deployment FloridaDocument2 pagesSmart Grid Deployment FloridaLance LegelNo ratings yet

- Hydraulic Fracturing and California's Energy FutureDocument27 pagesHydraulic Fracturing and California's Energy Futureapi-239871642No ratings yet

- Biofuels Incentives A Summary of Federal Programs, December 23, 2010Document18 pagesBiofuels Incentives A Summary of Federal Programs, December 23, 2010Chuck AchbergerNo ratings yet

- Waxman-Markey Bill: Colorado State Fact SheetDocument4 pagesWaxman-Markey Bill: Colorado State Fact SheetEnergy TomorrowNo ratings yet

- CSAPR Reconideration and Administrative Stay Request 10-5-11 - FinalDocument6 pagesCSAPR Reconideration and Administrative Stay Request 10-5-11 - FinalNational Association of Manufacturers (NAM)No ratings yet

- Why Is Shale Gas ImportantDocument2 pagesWhy Is Shale Gas ImportantChristopher RamirezNo ratings yet

- US Gasification DatabaseDocument9 pagesUS Gasification DatabaseKhairi Maulida AzhariNo ratings yet

- Alabama - Denial of State Coal Combustion Residuals Permit ProgramDocument123 pagesAlabama - Denial of State Coal Combustion Residuals Permit ProgramErica ThomasNo ratings yet

- Agriculture Law: RS22013Document6 pagesAgriculture Law: RS22013AgricultureCaseLawNo ratings yet

- MPCA Policy Bill FactsheeDocument2 pagesMPCA Policy Bill FactsheeMinnesota Senate Environment and Energy CommitteeNo ratings yet

- Waxman-Markey Bill: North Dakota State Fact SheetDocument4 pagesWaxman-Markey Bill: North Dakota State Fact SheetEnergy Tomorrow100% (2)

- Hr6sap SDocument3 pagesHr6sap SlosangelesNo ratings yet

- Icast - Seed Crushing Pilot - Final ReportDocument10 pagesIcast - Seed Crushing Pilot - Final ReportDa VuNo ratings yet

- Waxman-Markey Bill: Rhode Island State Fact SheetDocument4 pagesWaxman-Markey Bill: Rhode Island State Fact SheetEnergy Tomorrow100% (2)

- Autos Report FinalDocument5 pagesAutos Report Finaltxt147No ratings yet

- FinalbillDocument3 pagesFinalbillapi-303094377No ratings yet

- Energy and Markets Newsletter 091611Document7 pagesEnergy and Markets Newsletter 091611choiceenergyNo ratings yet

- Colombia Oil & Gas Industry: Ecopetrol Privatization and Sector OutlookDocument60 pagesColombia Oil & Gas Industry: Ecopetrol Privatization and Sector OutlookOladiran OlatokunboNo ratings yet

- Agenda Item 8 Oct 21 2010Document58 pagesAgenda Item 8 Oct 21 2010srust2792No ratings yet

- NYT PollDocument4 pagesNYT PollMatt DixonNo ratings yet

- NYT PollDocument4 pagesNYT PollMatt DixonNo ratings yet

- MailerDocument2 pagesMailerMatt DixonNo ratings yet

- Email From Jeffrey Brown To Ed Garrett 02-04-14 1154 AM 1349H Workover ProcedureDocument76 pagesEmail From Jeffrey Brown To Ed Garrett 02-04-14 1154 AM 1349H Workover ProcedureMatt DixonNo ratings yet

- FDOT Letter To All Aboard Florida July 2014Document1 pageFDOT Letter To All Aboard Florida July 2014Matt DixonNo ratings yet

- Burwell Fugate LetterDocument1 pageBurwell Fugate LetterMatt DixonNo ratings yet

- 7 18 2014 Letter From Florida CFO Atwater To Governor CuomoDocument2 pages7 18 2014 Letter From Florida CFO Atwater To Governor CuomoMatt DixonNo ratings yet

- Blue Ribbon CommissionersDocument7 pagesBlue Ribbon CommissionersMatt DixonNo ratings yet

- 1349H Application - Collier-Hogan 20-3H (Revised Dec 2012)Document125 pages1349H Application - Collier-Hogan 20-3H (Revised Dec 2012)Matt DixonNo ratings yet

- 1349H Workover Plan-Acid StimulationDocument10 pages1349H Workover Plan-Acid StimulationMatt DixonNo ratings yet

- Dan A. Hughes Company, L.P. Interim Spill Prevention, Control & Countermeasure PlanDocument49 pagesDan A. Hughes Company, L.P. Interim Spill Prevention, Control & Countermeasure PlanMatt DixonNo ratings yet

- 1349H Cease and DesistDocument3 pages1349H Cease and DesistMatt DixonNo ratings yet

- Dan A. Hughes Company, L.P. Interim Spill Prevention, Control & Countermeasure PlanDocument49 pagesDan A. Hughes Company, L.P. Interim Spill Prevention, Control & Countermeasure PlanMatt DixonNo ratings yet

- Welcome Letter From Chair MillsDocument1 pageWelcome Letter From Chair MillsMatt DixonNo ratings yet

- 1349 DEP Confidential Inspection RptsDocument36 pages1349 DEP Confidential Inspection RptsMatt DixonNo ratings yet

- 1349 Confidentail Company Daily Drilling ReportsDocument41 pages1349 Confidentail Company Daily Drilling ReportsMatt DixonNo ratings yet

- Charlie Crist FormsDocument7 pagesCharlie Crist FormsMatt DixonNo ratings yet

- 2013 07 09 Parallel CongressDocument10 pages2013 07 09 Parallel CongressMatt DixonNo ratings yet

- 1349 Collier-Hogan 20-3H Drilling Permit ChecklistDocument2 pages1349 Collier-Hogan 20-3H Drilling Permit ChecklistMatt DixonNo ratings yet

- 1349 & 1350 Bond - FM 2a Mult BondDocument5 pages1349 & 1350 Bond - FM 2a Mult BondMatt DixonNo ratings yet

- 2012 03 17 Gibbs SusieDocument1 page2012 03 17 Gibbs SusieMatt DixonNo ratings yet

- 09 #1349-H 2012 (Prelim. Site Insp.)Document4 pages09 #1349-H 2012 (Prelim. Site Insp.)Matt DixonNo ratings yet

- 06-12-14 Priv. Log PRR 5-8-14 EmailsDocument1 page06-12-14 Priv. Log PRR 5-8-14 EmailsMatt DixonNo ratings yet

- 1349 Confidentail Company Daily Drilling ReportsDocument41 pages1349 Confidentail Company Daily Drilling ReportsMatt DixonNo ratings yet

- 1-22-14 V4-Comments On Draft Hughes Consent OrderDocument14 pages1-22-14 V4-Comments On Draft Hughes Consent OrderMatt DixonNo ratings yet

- Station Manager - RPOF - 06 23 2014Document6 pagesStation Manager - RPOF - 06 23 2014Matt DixonNo ratings yet

- 2013 06 25 DOT LeaseDocument1 page2013 06 25 DOT LeaseMatt DixonNo ratings yet

- 2012 03 22 MAH ThanksDocument1 page2012 03 22 MAH ThanksMatt DixonNo ratings yet

- 06-12-14 Priv. Log PRR 5-8-14 EmailsDocument1 page06-12-14 Priv. Log PRR 5-8-14 EmailsMatt DixonNo ratings yet

- 2014 02 17 Oia ReleaseDocument2 pages2014 02 17 Oia ReleaseMatt DixonNo ratings yet

- E385 GB1Document24 pagesE385 GB1FranciscoOliveira100% (1)

- A380 Airbus: Power Plant 71 80Document476 pagesA380 Airbus: Power Plant 71 80Diego Andres Rangel BeltranNo ratings yet

- DMI Super 6-20Document2 pagesDMI Super 6-20Darko KljajićNo ratings yet

- 2009 RAV4 New FeaturesDocument168 pages2009 RAV4 New FeaturesGuillaume GodfroyNo ratings yet

- Industrial BoilersDocument32 pagesIndustrial BoilersNipun SabharwalNo ratings yet

- GBRICAMBIGROUPDocument6 pagesGBRICAMBIGROUPAshraf MostafaNo ratings yet

- Kitchen Improvised FertilizerDocument68 pagesKitchen Improvised Fertilizerjohn smith100% (1)

- EFFICIENT BIODIESEL PRODUCTIONDocument9 pagesEFFICIENT BIODIESEL PRODUCTIONmuhamad ilhamNo ratings yet

- Pajero EngineDocument54 pagesPajero Engineschumiizz2bestNo ratings yet

- Master Ride 150 Manual de Serviços (Ingles) TRES150 PDFDocument255 pagesMaster Ride 150 Manual de Serviços (Ingles) TRES150 PDFCharles SaraivaNo ratings yet

- Benham RiseDocument24 pagesBenham RiseRhea CelzoNo ratings yet

- Fired Heater Design and Heat Transfer FundamentalsDocument32 pagesFired Heater Design and Heat Transfer FundamentalsNelly SalgadoNo ratings yet

- Chapter 5 - Steam Power PlantDocument123 pagesChapter 5 - Steam Power PlantOnline EducatorNo ratings yet

- 966H-972H - Serv1815 - TXTDocument233 pages966H-972H - Serv1815 - TXTBrahim Rabia100% (7)

- ZX330 Series ZX330W Workshop ManualDocument676 pagesZX330 Series ZX330W Workshop ManualFernando Sabino100% (1)

- Brochure Hyundai Oil & Gas PlantDocument63 pagesBrochure Hyundai Oil & Gas PlantGerman Jaramillo Villar100% (1)

- Cummins QSL-9 Operation and Maintenance Manual1Document341 pagesCummins QSL-9 Operation and Maintenance Manual1gladys huaraya100% (5)

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument16 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationAbdulBasitBilalSheikhNo ratings yet

- Technique 897269Document382 pagesTechnique 897269claudeNo ratings yet

- AFORE 2014-Abstrack Book PDFDocument430 pagesAFORE 2014-Abstrack Book PDFxman4243No ratings yet

- Timelines Part 1Document24 pagesTimelines Part 1Jamie JordanNo ratings yet

- MR P Chandra Mohan, Nagarjuna Fertilizers & Chemicals LTDDocument14 pagesMR P Chandra Mohan, Nagarjuna Fertilizers & Chemicals LTDJose DenizNo ratings yet

- KML Power Plant Internship ReportDocument39 pagesKML Power Plant Internship Reportmohsin100% (1)

- MNPTP - 01 - 8-16A Ton IntroductionDocument20 pagesMNPTP - 01 - 8-16A Ton IntroductionGlobal Teknik Abadi100% (1)

- Calado Árbol de Levas VW t4Document4 pagesCalado Árbol de Levas VW t4Radulf PugnusNo ratings yet

- Combustion Heavy DutyDocument28 pagesCombustion Heavy DutyIvan Poma Montes100% (1)

- N.V. Bergerat Monnoyeur S.A.: InformationDocument2 pagesN.V. Bergerat Monnoyeur S.A.: InformationMohammad FathiNo ratings yet

- Uranium Pakistan Report PDFDocument278 pagesUranium Pakistan Report PDFZia KhanNo ratings yet

- Exhaust GasDocument6 pagesExhaust Gaschinnasamy76No ratings yet

- Tds Lukoil Super v.1.4 06.04.2016 EngDocument1 pageTds Lukoil Super v.1.4 06.04.2016 EngWaqas AhmadNo ratings yet