Professional Documents

Culture Documents

Benefits of Going GBI Green Presentation

Uploaded by

GreenScrub0 ratings0% found this document useful (0 votes)

31 views12 pagesIntroducing income tax exemption equivalent to 100% of additional capital expenditure incurred to obtain Green Building Index certificate. Buyers of buildings and residential properties awarded GBI certificates bought from real property developers are eligible for STAMP DUTY EXEMPTION on instruments on transfer of ownership of such buildings. The incentive is given only for the first GBI certificate issued in respect of the building.

Original Description:

Original Title

20091116 - Benefits of Going GBI Green Presentation

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIntroducing income tax exemption equivalent to 100% of additional capital expenditure incurred to obtain Green Building Index certificate. Buyers of buildings and residential properties awarded GBI certificates bought from real property developers are eligible for STAMP DUTY EXEMPTION on instruments on transfer of ownership of such buildings. The incentive is given only for the first GBI certificate issued in respect of the building.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

31 views12 pagesBenefits of Going GBI Green Presentation

Uploaded by

GreenScrubIntroducing income tax exemption equivalent to 100% of additional capital expenditure incurred to obtain Green Building Index certificate. Buyers of buildings and residential properties awarded GBI certificates bought from real property developers are eligible for STAMP DUTY EXEMPTION on instruments on transfer of ownership of such buildings. The incentive is given only for the first GBI certificate issued in respect of the building.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

WHY THE NEED FOR A MALAYSIAN GREEN RATING TOOL ?

BENEFITS OF GOING GBI GREEN

BENEFITS OF GOING GBI GREEN ENERGY EFFICIENCY (EE) & RENEWABLE ENERGY (RE) 1. Investment Tax Allowance (ITA) 2. Import Duty Waiver 3. Sales Tax Waiver (Subject to ST and PTM validation)

BENEFITS OF GOING GBI GREEN

Introduction of income tax exemption equivalent to 100% of additional capital expenditure incurred to obtain Green Building Index certificate. To encourage the construction of buildings using green technology, it is proposed that : i.) Owners of buildings awarded the Green Building Index (GBI) certificate be given tax exemption equivalent to 100% of the additional capital expenditure incurred to obtain the GBI certificate. The exemption is allowed to be set-off against 100% of the statutory income for each YA. The incentive is applicable for new buildings and upgrading of existing buildings. The incentive is given only for the first GBI certificate issued in respect of the building. The proposal is effective for buildings awarded with GBI certificates from 24 October 2009 until 31 December 2014.

INVESTMENT TAX ALLOWANCE (ITA)

BENEFITS OF GOING GBI GREEN

ii.) Buyers of buildings and residential properties awarded GBI certificates bought from real property developers are eligible for stamp duty exemption on instruments on transfer of ownership of such buildings. The amount of stamp duty exemption is on the additional cost incurred to obtain the GBI certificate. The incentive is given only once to the first owner of the building. The proposal is effective for sale and purchase agreements executed from 24 October 2009 until 31 December 2014.

STAMP DUTY EXEMPTION

BENEFITS OF GOING GBI GREEN

i.) Owners of buildings awarded the Green Building Index (GBI) certificate be given tax exemption equivalent to 100% of the additional capital expenditure incurred to obtain the GBI certificate. The exemption is allowed to be set-off against 100% of the statutory income for each YA. The incentive is applicable for new buildings and upgrading of existing buildings. The incentive is given only for the first GBI certificate issued in respect of the building. The proposal is effective for buildings awarded with GBI certificates from 24 October 2009 until 31 December 2014.

INVESTMENT TAX ALLOWANCE (ITA) FOR GBI CERTIFICATION

BENEFITS OF GOING GBI GREEN

i.) Owners of buildings awarded the Green Building Index (GBI) certificate be given tax exemption equivalent to 100% of the additional capital expenditure incurred to obtain the GBI certificate. The exemption is allowed to be set-off against 100% of the statutory income for each YA. The incentive is applicable for new buildings and upgrading of existing buildings. The incentive is given only for the first GBI certificate issued in respect of the building. The proposal is effective for buildings awarded with GBI certificates from 24 October 2009 until 31 December 2014.

INVESTMENT TAX ALLOWANCE (ITA) FOR GBI CERTIFICATION

PRE-REQUISITES AND PROCESS

1. GBI CERTIFICATION (ANY LEVEL CERTIFIED, SILVER, GOLD OR PLATINUM) 2. GBI GREEN COST SUM TO BE VALUED BY QUANTITY SURVEYOR AND ARCHITECT THIS IS THE COST TO ACHIEVE THE GBI CERTIFICATION AND IS BASED ON THE LIST OF APPROVED GBI GREEN COST ITEMS 3. THIS GBI GREEN COST SUM IS SUBMITTED AS PART OF THE CVA AND WILL BE CHECKED BY THE GBI CERTIFIER AND THE APPROVED GBI GREEN COST SUM WILL BE LISTED IN THE FINAL GBI CERTIFICATION 4. COPY OF GBI CERTIFICATION IS GIVEN TO APPLICANT, MAINTAINED BY GBIAP AND ALSO LODGED WITH LAM

BENEFITS OF GOING GBI GREEN

INVESTMENT TAX ALLOWANCE (ITA) FOR GBI CERTIFICATION EXAMPLE

1. BASIC BUILDING COST = RM100mil 2. BUILDING COST TO ACHIEVE GBI CERTIFICATION = RM108mil 3. GBI GREEN COST COMPONENT = RM8mil (This sum to be valued by Quantity Surveyor and certified by Architect based on the list of GBI Green Cost items. This is submitted as part of the CVA and checked by the GBI Certifier) 4. THE GBI GREEN COST IS LISTED IN THE FINAL GBI CERTIFICATION

BENEFITS OF GOING GBI GREEN

ii.) Buyers of buildings and residential properties awarded GBI certificates bought from real property developers are eligible for stamp duty exemption on instruments on transfer of ownership of such buildings. The amount of stamp duty exemption is on the additional cost incurred to obtain the GBI certificate. The incentive is given only once to the first owner of the building. The proposal is effective for sale and purchase agreements executed from 24 October 2009 until 31 December 2014.

STAMP DUTY EXEMPTION FOR GBI CERTIFICATION

BENEFITS OF GOING GBI GREEN

ii.) Buyers of buildings and residential properties awarded GBI certificates bought from real property developers are eligible for stamp duty exemption on instruments on transfer of ownership of such buildings. The amount of stamp duty exemption is on the additional cost incurred to obtain the GBI certificate. The incentive is given only once to the first owner of the building. The proposal is effective for sale and purchase agreements executed from 24 October 2009 until 31 December 2014.

STAMP DUTY EXEMPTION FOR GBI CERTIFICATION PRE-REQUISITES AND PROCESS

1. GBI CERTIFICATION (ANY LEVEL CERTIFIED, SILVER, GOLD OR PLATINUM) 2. GBI GREEN COST SUM TO BE VALUED BY QUANTITY SURVEYOR AND ARCHITECT THIS IS THE COST TO ACHIEVE THE GBI CERTIFICATION AND IS BASED ON THE LIST OF APPROVED GBI GREEN COST ITEMS 3. THIS GBI GREEN COST SUM IS SUBMITTED AS PART OF THE CVA AND WILL BE CHECKED BY THE GBI CERTIFIER AND THE APPROVED GBI GREEN COST SUM WILL BE LISTED IN THE FINAL GBI CERTIFICATION 4. COPY OF GBI CERTIFICATION IS GIVEN TO APPLICANT, MAINTAINED BY GBIAP AND ALSO LODGED WITH LAM

BENEFITS OF GOING GBI GREEN

STAMP DUTY EXEMPTION FOR GBI CERTIFICATION EXAMPLE

1. BASIC BUILDING (OR UNIT OF BUILDING) COST = RM100,000 2. BUILDING COST TO ACHIEVE GBI CERTIFICATION = RM120,000 3. GBI GREEN COST COMPONENT = RM20,000 (This sum to be valued by Quantity Surveyor and certified by Architect based on the list of GBI Green Cost items. This is submitted as part of the CVA and checked by the GBI Certifier) 4. THE GBI GREEN COST IS LISTED IN THE FINAL GBI CERTIFICATION 5. SALE PRICE ON SPA = RM200,000. STAMP DUTY WILL BE EXEMPTED FOR RM20,000.

THANK YOU

WHY THE NEED FOR A MALAYSIAN GREEN RATING TOOL ?

You might also like

- Act 53 - Income Tax Act 1967 (Malaysia Tax)Document601 pagesAct 53 - Income Tax Act 1967 (Malaysia Tax)lcs1234678100% (1)

- Uem GST Roadshows Faq 12 12 2013Document35 pagesUem GST Roadshows Faq 12 12 2013kumanqatarNo ratings yet

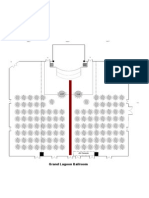

- Dec20 - Shin Etsu Polymer (M) SDN BHD - Dinner - 120tablesDocument1 pageDec20 - Shin Etsu Polymer (M) SDN BHD - Dinner - 120tableskumanqatarNo ratings yet

- GST List of Sundry GoodsDocument76 pagesGST List of Sundry GoodsshidasyakirinNo ratings yet

- New Ffsb's Dal 2013-FinalDocument17 pagesNew Ffsb's Dal 2013-FinalkumanqatarNo ratings yet

- Jiran Bina SDN BHDDocument6 pagesJiran Bina SDN BHDkumanqatarNo ratings yet

- General GuideDocument105 pagesGeneral GuidekumanqatarNo ratings yet

- Ujian Bertulis: Oktober ArahanDocument12 pagesUjian Bertulis: Oktober ArahanNurhidayah Ahmad Fuad58% (12)

- Map To Taman SentosaDocument5 pagesMap To Taman SentosakumanqatarNo ratings yet

- PWC Alert Issue 86 - Green TechDocument8 pagesPWC Alert Issue 86 - Green TechIdrus IsmailNo ratings yet

- Benefits of Going GBI Green PresentationDocument12 pagesBenefits of Going GBI Green PresentationkumanqatarNo ratings yet

- Benefits of Going GBI Green PresentationDocument12 pagesBenefits of Going GBI Green PresentationkumanqatarNo ratings yet

- Benefits of Going GBI Green PresentationDocument12 pagesBenefits of Going GBI Green PresentationkumanqatarNo ratings yet

- AP13 - IAS 12 - Recognition of DTA When An Entity Is LossDocument19 pagesAP13 - IAS 12 - Recognition of DTA When An Entity Is LosskumanqatarNo ratings yet

- Birthday CalculatorDocument26 pagesBirthday CalculatorkumanqatarNo ratings yet

- Tax Incentives and Facilities Presentation (MIDA)Document41 pagesTax Incentives and Facilities Presentation (MIDA)kumanqatarNo ratings yet

- SOP Petty CashDocument5 pagesSOP Petty Cashkumanqatar100% (2)

- Metafizik in EnglishDocument3 pagesMetafizik in EnglishkumanqatarNo ratings yet

- General GuideDocument105 pagesGeneral GuidekumanqatarNo ratings yet

- Metafizik in EnglishDocument3 pagesMetafizik in EnglishkumanqatarNo ratings yet

- Allowable Costs MatrixDocument2 pagesAllowable Costs MatrixkumanqatarNo ratings yet

- Metafizik in EnglishDocument3 pagesMetafizik in EnglishkumanqatarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)