Professional Documents

Culture Documents

Entergy's Economic Trends October 2011 Analysis

Uploaded by

Charlie FoxworthCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Entergy's Economic Trends October 2011 Analysis

Uploaded by

Charlie FoxworthCopyright:

Available Formats

Entergys Economic Trends Analysis October 2011

Hints of sunlight have pierced the gloom of economic night recently. For one, weve actually been getting some decent economic reports, among them September employment. The data isnt great, mind you, but good enough to dampen fears that we have tipped into recession. The European Union is also taking another crack at fixing up its financial problems, which has notably cheered financial markets in recent weeks. For now, the economy seems to have been able to weather this years daunting slew of growth inhibiting events the energy and food price spikes, the Japanese natural disaster, the budget ceiling imbroglio, Europe without actually contracting. This isnt to say we are going gangbusters, however, since GDP growth during the quarter just ended was likely under 2%. We also continue to await the 20 pound turkey drop in the European financial crisis (well explain in a bit), recent cheery pronouncements of real progress in the negotiations notwithstanding. But for one month we get to be a little more optimistic. Its a measure of how low expectations have become that the September employment report was met with a near universal sigh of relief. The economy added 103,000 jobs and the unemployment rate stayed flat at 9.1%. The private/public Labor Market Indicators dichotomy continued, with the private Source: U.S. Dept. of Labor (in 000's) (in %) sector adding 137,000 jobs and the public 10.5 500 sector shedding 34,000. Almost half the 400 10.0 job gain was the result of strikers 300 200 returning to work at Verizon, so the report 9.5 100 isnt quite as optimistic as appears on the 9.0 surface. Some of the other details were (100) encouraging, however. The two prior 8.5 (200) months were revised upwards by a 8.0 (300) combined total of over 100,000 jobs, Aug-09 Nov-09 Feb-10 May-10 Aug-10 Nov-10 Feb-11 May-11 Aug-11 average wages and hours worked both Change in Non-farm Payrolls Unemploymen t Rate increased (after decreasing in August) and temporary employment increased for the third consecutive month after a long run of decreases. Since temporary hiring is often a precursor to permanent jobs, its an indication of a possible inflection point. Since May, or about the time we hit our economic rough patch, weve been adding an average of around 70,000 jobs a month. We need at least twice that rate to feel good about the economy. But, considering the recent headwinds, Automobile Sales adding anything at all feels like progress. Thousands of Units, Seasonally Adjusted Annual Rate

Source: U.S. Dept. of Commerce

Another pleasant surprise has been that car sales are bouncing back nicely from Japanese-related supply chain issues. The annualized seasonally-adjusted selling rate in September hit about 13 million units, which is right around the level from prior to the summertime troubles. Given the uncertainty that is hampering growth in so many other sectors of the economy its a little surprising that a big ticket category

14,000

13,000

12,000

11,000

10,000

9,000 Sep-09 Dec-09

Mar-10

Jun-10 Sep-10 Dec-10 Mar-11

Jun-11

Sep-11

Entergys Economic Trends Analysis October 2011

like autos is doing relatively well. It goes to show how much pent up demand there is for replacing worn out vehicles. We finally bit the bullet a couple of months ago ourselves and replaced a vehicle destroyed by Hurricane Katrina. No sense rushing things, thats our motto. But at a certain point youve got to bite the bullet and we think a lot of other people have hit that point too. It doesnt hurt that the product choices now are great across the board. In fact, a little too great. Since we last purchased an auto, during the late Mesozoic Era, car electronics have made a Retail Sales % Change Prior Mo. Seasonally Adjusted rather substantial leap forward. To the Source: U.S. Census Bureau point that we are anxious to touch anything 1.6% for fear that we might accidently launch 1.1% 1.2% some missiles or something. Also, it talks to us, although we have to say that it isnt a 0.8% 0.6% 0.5% very good conversationalist. Maybe thats 0.4% 0.4% 0.3% 0.3% 0.4% 0.3% 0.2% 0.2% an extra option. And yes, we know we 0.1% could read the owners manual, but for this 0.0% 0.0% car thats a 200 plus page document written -0.4% Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 by engineers who, although undoubtedly fine engineers and wonderful human Total Retail Total less Autos beings, flunked the Writing Clearly for a Non-technical Audience class at ISM Manufacturing Report engineering school. Source: Institute for Supply Management

66

Retail sales in general were surprisingly robust during September, rising 1.1% from prior month and 0.6% after backing out the strong auto sales. This one month of yeah followed five months of meh, however, so lets not get too hyped just yet. Much of the increase likely resulted from retailers clearance sales at the end of what turned out to be a so-so back-to-school season. Its hard to see how that will continue given weak employment and income trends, but we shall see. Yet another positive surprise lately was the relative strength of the supply chain reports from the Institute of Supply Management. Again, the key word is relative since, in most circumstances, readings in the low 50s would be considered so-so. But >50 indicates at least some growth, so everybodys psyched. Some of the details werent so great, however. On the

65 60 55 50 45 40 35

62 58 54 50 46 42 38 34 30 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 ISM Expanding Economy Expanding Manuf acturing

ISM Services Report Source: Institute for Supply Management

>50 Indicates Service Sector Expansion

30 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Services ISM Expanding Economy

Entergys Economic Trends Analysis October 2011

manufacturing side, both the new orders and the order backlog components contracted, indicating some potential cutbacks in production looming down the road. On the non-manufacturing side, the weak points were the employment and import components, indicating a certain lack of confidence in the durability of the expansion on the part of businesses. Also notable was that every single comment included in the non-manufacturing report from respondents was negative, which is highly unusual. Most times somebody is having a good month somewhere. This month it was all "Business volume outlook and confidence across many market areas in North America appear to be softening" type comments. If we have a recession soon, it might well be because weve talked ourselves into it. Not to completely shift gears or anything, but one of the better shows on television is MythBusters on the Discovery Channel, where teams of special effects experts scientifically test whether certain urban legends are true. Basically its just an excuse to blow things up and/or crunch large metal things into other large metal things. Its great. One of the first shows we saw, for example, tested the old adage that you shouldnt take a shower during a thunderstorm. Turns out thats true if a lightning bolt hits your house and goes to ground through the plumbing system while you are in the shower then you will get cleaner than you can possibly imagine. You should also stay off the phone during a thunderstorm, by the way, unless you are keen to have your ear wax melted. Along with your head. One of their best shows tested various legends about how people (guys) use duct tape for purposes the manufacturer didnt intend and included the successful voyage of a boat made completely of duct tape across San Francisco Bay. If you can find that show on the internet somewhere we highly recommend its viewing, although youll laugh so hard that duct tape will be necessary to reattach various body parts afterwards. At any rate, during a recent show they tested an old movie stunt where a car perched on the edge of a cliff can be made to tumble off by a bird landing on its hood. So they took an old Ford Crown Vic out to their testing area, balanced it on the edge of a shipping container (standing in for a cliff), strapped a couple of the hosts into the car with helmets (standing in for crash test dummies) and had the third host chuck live birds onto the hood. They started out with a couple of well trained pigeons. Nothing the car didnt budge. They upped the ante with successively larger birds until they got to an owl. None of that worked either. Since pterodactyls died out around 150 million years ago they had no larger live birds (we confess this was their joke) so they resorted to simulated birds in the form of packaged poultry. They were up to 80 pounds of chicken by the time they resorted to the big guns in the form of a 20 pound turkey. S&P 500 Index That finally did the trick. Source: Moody's Analytics We think that particular show was an excellent metaphor for the European financial crisis. While the financial ministers and central bankers are huddled in the car negotiating the 148th version of a bailout plan (this time theyre really serious), the global financial system is chucking poultry onto the hood. One of these days the 20 pound turkey will show

1400 1350 1300 1250 1200 1150 1100 1050 1000

3-Jan 3-Feb 3-Mar 3-Apr 3-May 3-Jun 3-Jul 3-Aug 3-Sep 3-Oct

Entergys Economic Trends Analysis October 2011

up and then its game over. Two big issues for us: 1) when does this happen, and 2) how bad do we get dinged on this side of the pond? Its hard to believe that we can escape unscathed if our largest trading and banking partner goes off the edge. At least some of this risk has been priced into financial markets already, although its hard to judge how much of the impact on equity prices this year, for example, derives from our domestic slowdown and how much is European risk. The bounce in stock prices weve seen since the beginning of October is largely due to Risk Spread for Corporate Bonds hopes for a calm resolution to the debt Source: The Federal Reserve Annual % crisis, but it also has coincided with better 7.0 than expected economic news. Whats 6.0 maybe a better measure than the stock 5.0 market of the risks embedded in the 4.0 financial system are spreads between 3.0 different classes of risky assets. When 2.0 those start to widen out, the crisis will be 1.0 truly upon us. Weve seen a little 0.0 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 widening of late, but nothing to indicate a th Aaa minus 10 Yr T-Bond Baa minus 10 Yr T-Bond blow-out as of yet. So maybe the 148 time will be a charm after all.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SMC Simplified by TJRTRADESDocument37 pagesSMC Simplified by TJRTRADESmangoz1224No ratings yet

- Southeast Texas EmploymentDocument1 pageSoutheast Texas EmploymentCharlie FoxworthNo ratings yet

- Southeast Texas Economic Update Jan 2012Document4 pagesSoutheast Texas Economic Update Jan 2012Charlie FoxworthNo ratings yet

- Dr. Ted Jones Economic Update Beaumont January 2012Document51 pagesDr. Ted Jones Economic Update Beaumont January 2012Charlie FoxworthNo ratings yet

- Southeast Texas Employment January 2012Document1 pageSoutheast Texas Employment January 2012Charlie FoxworthNo ratings yet

- HowHotAirRises REMAXDocument2 pagesHowHotAirRises REMAXCharlie FoxworthNo ratings yet

- Beaumont Port Arthur MSA Labor Stats November 2011Document1 pageBeaumont Port Arthur MSA Labor Stats November 2011Charlie FoxworthNo ratings yet

- National Economic Trends March 2011 ExternalDocument5 pagesNational Economic Trends March 2011 ExternalCharlie FoxworthNo ratings yet

- May Statistics For Beaumont MLSDocument1 pageMay Statistics For Beaumont MLSCharlie FoxworthNo ratings yet

- The Setx Times: EconomicDocument4 pagesThe Setx Times: EconomicCharlie FoxworthNo ratings yet

- Beaumont/Port Arthur Employment Data For AprilDocument1 pageBeaumont/Port Arthur Employment Data For AprilCharlie FoxworthNo ratings yet

- Employment Beaumont Port Arthur May 2011Document1 pageEmployment Beaumont Port Arthur May 2011Charlie FoxworthNo ratings yet

- Economic Trends December 2010 by Richard Haley From EntergyDocument4 pagesEconomic Trends December 2010 by Richard Haley From EntergyCharlie FoxworthNo ratings yet

- TrackingTxEcon3 11Document2 pagesTrackingTxEcon3 11Charlie FoxworthNo ratings yet

- SETEDF Newsletter 2011.2Document4 pagesSETEDF Newsletter 2011.2Charlie FoxworthNo ratings yet

- Dr. Mark Dotzour Presentation To Beaumont Board of RealtorsDocument21 pagesDr. Mark Dotzour Presentation To Beaumont Board of RealtorsCharlie FoxworthNo ratings yet

- Census Cities in Jefferson CountyDocument78 pagesCensus Cities in Jefferson CountyCharlie FoxworthNo ratings yet

- Southeast Texas January Unemployment ReportDocument1 pageSoutheast Texas January Unemployment ReportCharlie FoxworthNo ratings yet

- Southeast Texas Labor StatisticsDocument1 pageSoutheast Texas Labor StatisticsCharlie FoxworthNo ratings yet

- Economic Trends From Entergy's Richard LynchDocument3 pagesEconomic Trends From Entergy's Richard LynchCharlie FoxworthNo ratings yet

- Southeast Texas Regional Economic ReportDocument5 pagesSoutheast Texas Regional Economic ReportCharlie FoxworthNo ratings yet

- Beaumont Port Arthur Labor StatisticsDocument1 pageBeaumont Port Arthur Labor StatisticsCharlie FoxworthNo ratings yet

- November National Economic Trends Report - by Richard Lynch - From EntergyDocument4 pagesNovember National Economic Trends Report - by Richard Lynch - From EntergyCharlie FoxworthNo ratings yet

- SETEDF Newsletter 2011.1Document4 pagesSETEDF Newsletter 2011.1Charlie FoxworthNo ratings yet

- Cash Budget PracticeDocument4 pagesCash Budget PracticeSavana AndiraNo ratings yet

- D&D 5.0 - Aventura (Nível 7) O Refúgio Perdido Do ArquimagoDocument30 pagesD&D 5.0 - Aventura (Nível 7) O Refúgio Perdido Do ArquimagoMurilo TeixeiraNo ratings yet

- MainstaySuites FF&EDocument77 pagesMainstaySuites FF&ELi WangNo ratings yet

- OLA BillDocument3 pagesOLA BillPradeepNo ratings yet

- Crop and Seed Identification Removal Examination ResultDocument2 pagesCrop and Seed Identification Removal Examination ResultYvonnee LauronNo ratings yet

- Mathematical Economics - Economics Stack ExchangeDocument5 pagesMathematical Economics - Economics Stack ExchangeJoseph JungNo ratings yet

- Cost Accounting Tutorial 8 - PROBLEMDocument3 pagesCost Accounting Tutorial 8 - PROBLEMelgaavNo ratings yet

- NEXO Sliding SleeveDocument3 pagesNEXO Sliding SleevetongsabaiNo ratings yet

- (Advances in Strategic Management) SZULANSKI ET AL - Strategy Process (Advances in Strategic Management Vol. 22) - Emerald Group Publishing Limited (2005)Document553 pages(Advances in Strategic Management) SZULANSKI ET AL - Strategy Process (Advances in Strategic Management Vol. 22) - Emerald Group Publishing Limited (2005)Andra ModreanuNo ratings yet

- holorib en-1.25mm厚铝板参考Document8 pagesholorib en-1.25mm厚铝板参考石银雷No ratings yet

- Penilaian Tengah Semester (PTS) Ganjil: Madrasah Ibtidaiyah Al-Islamiyyah Campurejo Sambit PonorogoDocument9 pagesPenilaian Tengah Semester (PTS) Ganjil: Madrasah Ibtidaiyah Al-Islamiyyah Campurejo Sambit PonorogoJadon SancoNo ratings yet

- Transunion Cibil ReportDocument39 pagesTransunion Cibil ReportSHREYAS KHANOLKARNo ratings yet

- Slope Word Problems: Name: - Class: - Date: - Id: ADocument5 pagesSlope Word Problems: Name: - Class: - Date: - Id: ACece SantosNo ratings yet

- Subject: GEC 8 The Contemporary World Chapter 1: Introduction To Globalization (3 Hours)Document6 pagesSubject: GEC 8 The Contemporary World Chapter 1: Introduction To Globalization (3 Hours)Cj DasallaNo ratings yet

- Transport Geography White H P and Senior M L London Longman 1983Document1 pageTransport Geography White H P and Senior M L London Longman 1983Sorin DinuNo ratings yet

- Professional Abridgement Previous Organizational Highlights: Jindal Naturecure Institute, Bangalore, IndiaDocument3 pagesProfessional Abridgement Previous Organizational Highlights: Jindal Naturecure Institute, Bangalore, IndiaAdditya ChauhanNo ratings yet

- TCS Health Insurance - Contact Matrix - Address For Claim SubmissionDocument2 pagesTCS Health Insurance - Contact Matrix - Address For Claim SubmissionKarthikNo ratings yet

- Profit & Loss - Maruti Suzuki India LTD.: PrintDocument5 pagesProfit & Loss - Maruti Suzuki India LTD.: PrintPushkar VermaNo ratings yet

- Elasticity of DemandDocument6 pagesElasticity of DemandVaibhav MishraNo ratings yet

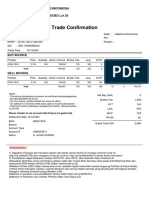

- Trade ConfirmationDocument1 pageTrade ConfirmationHavid KurniaNo ratings yet

- Edited - No Claim BonusDocument1 pageEdited - No Claim BonuslupolupoNo ratings yet

- Application Format For Scheme For Creation/expansion of Food Processing & Preservation CapacitiesDocument3 pagesApplication Format For Scheme For Creation/expansion of Food Processing & Preservation CapacitiesA RahmanNo ratings yet

- Unit 6 - Comparing and Scaling: HW: 2.3 ACEDocument4 pagesUnit 6 - Comparing and Scaling: HW: 2.3 ACEAditya SahuNo ratings yet

- Economics A: Thursday 16 May 2019Document32 pagesEconomics A: Thursday 16 May 2019Afifa At SmartEdgeNo ratings yet

- COSMDocument2 pagesCOSMRuchi Rabuya BaclayonNo ratings yet

- Especificacion Palas (Cucharas para Pala)Document1 pageEspecificacion Palas (Cucharas para Pala)jose chaveroNo ratings yet

- Ahsanullah University of Science and Technology: AssignmentDocument7 pagesAhsanullah University of Science and Technology: AssignmentSudip TalukdarNo ratings yet

- Cost Acc. Final-CollierDocument15 pagesCost Acc. Final-CollierKathya SilvaNo ratings yet

- Data Interpretation - 02 Handout - 1756591Document3 pagesData Interpretation - 02 Handout - 1756591Girish KumarNo ratings yet