Professional Documents

Culture Documents

The Balance Scorecard - Summarry

Uploaded by

Dare LekutiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Balance Scorecard - Summarry

Uploaded by

Dare LekutiCopyright:

Available Formats

The Balance Scorecard: Norreklit paper The paper then examines whether the balanced scorecard can link

strategy to operational metrics which managers can understand and influence. Finally, it discusses and suggests some improvements to the balanced scorecard. It contains outcome measures and the performance drivers of outcomes, linked together in cause-andeffect relationships, and thus aims to be a feed-forward control system. Furthermore, the balanced scorecard is intended not only as a strategic measurement system but also as a strategic control system which can align departmental and personal goals to overall strategy. Thus, the competitive strategy of a firm should be driven by its environment and not by its core competencies_ (Prahalad and Hamel, 1990, pp. 79]91.or resources _Collis and Montgomery, 1995, pp. 118]128., which, quite the contrary, should be adapted to the environment. The scorecard translates the vision and strategy of a business unit into objectives and measures in four different areas: the financial, customer, internal-business-process and learning and growth perspectives. The financial perspective identifies how the company wishes to be viewed by its shareholders. The customer perspective determines how the company wishes to be viewed by its customers. The internalbusiness-process perspective describes the business processes at which the company has to be particularly adept in order to satisfy its shareholders and customers. The organizational learning and growth perspective involves the changes and improvements which the company needs to realize if it is to make its vision come true _Kaplan and Norton, 1996a, pp. 30]31 The balanced scorecard_Kaplan and Norton, 1996a.is another model which integrates financial and nonfinancial strategic measures. It is distinct from other strategic measurement systems in that it contains outcome measures and the perfor- mance drivers of outcomes, linked together in cause-and-effect relationships _Kaplan and Norton, 1996a, p. 31; Kaplan and Norton, 1996b, p. 53., making the performance measurement system a feed-forward control system _de Haas and Kleingeld, 1999.. the balanced scorecard is a strategic control tool In total, the scorecard is a tool whose purpose is to align the strategy expressed in the actions actually undertaken to the strategy expressed in the plan.

The criticism has, in part, focused on their historic nature, which ensures that they reveal a great deal about the companys past actions but nothing about its future alertness One of the problems with accounting figures is that the financial consequences of the uncompleted chains of action extend beyond the time of measurement. For instance, the performance measures of accounting systems ignore the financial value of a companys intangible assets such as research in progress, human resources and the goodwill as well as the bad-will which the company has built. In order to reduce the problem involved, strategic measures are required which indicate the companys future earnings potential. The aggregate financial measures of the accounting system are not sufficient to ensure goal congruence between staff decisions and actions _Parker, 1979; Merchant, 1985; Maciariello and Kirby, 1994..

Criticism: The relationship with external stakeholders and the environment Not all stakeholders have been included It is even more problematic that the scorecard does not monitor the competition or technological developments. The model does not take into consideration any strategic uncertainty in terms of the risk involved in events which may threaten or invalidate present strategy. For example, IBMs margin on mainframes, was large, but the company lost an exploding market due to a fairly sudden event. The balanced scorecard risks being too rigid because it measures what is required to set a strategy without asking what may block or shock the strategy. The relationship with the management and employees The top-down control points to another problematic area of the balanced scorecard: the relationship with internal stakeholders. 3.3. Conclusion on the analysis of the strategic control model

We may now conclude that Kaplan and Nortons control model is a hierarchical top-down model and that it is not easily rooted in a dynamic environment or in the organization. If the balanced scorecard is to become more realistic, then its control methods need to be adjusted. The control processes should be more interactive during strategy formulation, during the building of the scorecard and during the subsequent implementation.

Summary First, there is not a causal but rather a logical relationship among the areas analyzed. Customer satisfaction does not necessarily yield good financial results. Chains of action which yield a high level of customer value at low costs lead to good financial results.. Therefore, the balanced scorecard makes invalid assumptions, which may lead to the anticipation of performance indicators which are faulty, resulting in sub-optimal performance. Second, the balanced scorecard is not a valid strategic management tool, mainly because it does not ensure any organizational rooting, but also because it has problems ensuring environmental rooting. Consequently, it creates a gap between the strategy expressed in the actions actually undertaken and the strategy planned.

You might also like

- Confirmation - Delta Air LinesDocument5 pagesConfirmation - Delta Air LinesAkinoJohnkennedyNo ratings yet

- Supply Chain Management - Darden's RestaurantDocument26 pagesSupply Chain Management - Darden's RestaurantShameen Shazwana0% (1)

- Balance ScoreboardDocument8 pagesBalance ScoreboardRj Fashionhouse100% (1)

- The Balanced Scorecard: Turn your data into a roadmap to successFrom EverandThe Balanced Scorecard: Turn your data into a roadmap to successRating: 3.5 out of 5 stars3.5/5 (4)

- Balanced Scorecard For Law FirmsDocument4 pagesBalanced Scorecard For Law Firmssambhavahuja100% (1)

- BalancedBalanced Score For The Balanced Scorecard A Benchmarking Tool Score For The Balanced Scorecard A Benchmarking ToolDocument25 pagesBalancedBalanced Score For The Balanced Scorecard A Benchmarking Tool Score For The Balanced Scorecard A Benchmarking ToolPhuongDx100% (1)

- Balanced Scorecard 5Document44 pagesBalanced Scorecard 5Cicy AmbookenNo ratings yet

- Store 24 Balanced ScorecardDocument44 pagesStore 24 Balanced Scorecardk,mg0% (1)

- Aon Corp Identity Standards-RevDec2004Document22 pagesAon Corp Identity Standards-RevDec2004ChiTownITNo ratings yet

- MCQ On Marketing ManagementDocument39 pagesMCQ On Marketing ManagementtusharNo ratings yet

- BSC - Chadwick Case StudyDocument7 pagesBSC - Chadwick Case Studyrgaeastindian100% (4)

- Auditor TesDocument19 pagesAuditor TesRinto Erwiansa PutraNo ratings yet

- BSC Balanced Business ScorecardDocument16 pagesBSC Balanced Business ScorecardcarleslaraUOCMarketiNo ratings yet

- The Performance PyramidDocument11 pagesThe Performance Pyramidhannan100% (1)

- Production SystemDocument5 pagesProduction SystemPratiksinh VaghelaNo ratings yet

- Chap - 11 Evaluation of Strategies and Performance MesurementDocument40 pagesChap - 11 Evaluation of Strategies and Performance MesurementMd. Mamunur RashidNo ratings yet

- Critical Analysis of Balanced ScorecardDocument24 pagesCritical Analysis of Balanced ScorecardDaegal LeungNo ratings yet

- Volumes and Surface Area: GcseDocument26 pagesVolumes and Surface Area: GcseDare LekutiNo ratings yet

- 2.SK EO SK Inventory SK Pob. Zone 3Document3 pages2.SK EO SK Inventory SK Pob. Zone 3Barangay BotongonNo ratings yet

- 15 Bankers and Manufacturers Vs CA DigestDocument2 pages15 Bankers and Manufacturers Vs CA DigestCharisseCastilloNo ratings yet

- What Is The Balanced ScorecardDocument21 pagesWhat Is The Balanced ScorecardAndi Yanuar100% (1)

- Post Merger Integration Dashboard Performance MetricsDocument14 pagesPost Merger Integration Dashboard Performance MetricsDisha Talreja Bhavna Makar50% (2)

- Strategic Cost ManagementDocument9 pagesStrategic Cost ManagementPreethi PadmanabhanNo ratings yet

- Balance Score CardDocument9 pagesBalance Score Cardsathishsep18100% (1)

- The Balanced ScorecardDocument6 pagesThe Balanced Scorecardvikramdsmani100% (1)

- Assignment TwoDocument3 pagesAssignment TwoCharles MachuvaireNo ratings yet

- Assignment On BSCDocument18 pagesAssignment On BSCginnz66No ratings yet

- Assignment On BSCDocument18 pagesAssignment On BSCKomalJindalNo ratings yet

- SCS Key PointsDocument6 pagesSCS Key PointstataxpNo ratings yet

- Testing The Linkage of Multiple Scorecard Measures To A Single Strategy EngDocument5 pagesTesting The Linkage of Multiple Scorecard Measures To A Single Strategy EngMuhammad Fajri100% (1)

- The Balanced ScorecardDocument17 pagesThe Balanced Scorecardagustine96gmailcomNo ratings yet

- Managerial Accounting EssayDocument8 pagesManagerial Accounting EssayPatrick PetitNo ratings yet

- 5 SummaryDocument4 pages5 Summaryhappy everydayNo ratings yet

- Balanced Scorecard 513Document8 pagesBalanced Scorecard 513shahidul alamNo ratings yet

- Toward A Balanced Scorecard For Higher Education: Rethinking The College and University Excellence Indicators FrameworkDocument10 pagesToward A Balanced Scorecard For Higher Education: Rethinking The College and University Excellence Indicators FrameworkAmu CuysNo ratings yet

- Chapter 13 Strategy, Balanced Scorecard, and Strategic Profitability AnalysisDocument5 pagesChapter 13 Strategy, Balanced Scorecard, and Strategic Profitability AnalysisdamayNo ratings yet

- Accounts: Critically Evaluate The Evolution in The Role of Management Accounting in Assisting Decision Makers in OrganisationsDocument7 pagesAccounts: Critically Evaluate The Evolution in The Role of Management Accounting in Assisting Decision Makers in OrganisationsPrabina PoudelNo ratings yet

- Balanced ScorecardDocument14 pagesBalanced ScorecardLand DoranNo ratings yet

- Assignment No-5: Q. What Are The Evaluation Criteria of Benefits of Innovation For BussinessDocument9 pagesAssignment No-5: Q. What Are The Evaluation Criteria of Benefits of Innovation For BussinessPROFESSIONAL SOUNDNo ratings yet

- SM Module Note 4Document2 pagesSM Module Note 4Priyanka NayakNo ratings yet

- Balanced ScorecardDocument8 pagesBalanced ScorecardParag100% (1)

- Rada College-Kombolcha Campus Department of Accounting and FinanceDocument5 pagesRada College-Kombolcha Campus Department of Accounting and FinanceabateNo ratings yet

- HBS 2006Document32 pagesHBS 2006yarareNo ratings yet

- Strategic EvaluationDocument2 pagesStrategic EvaluationJungkook RapmonNo ratings yet

- Balanced Scorecard Basics: Edscorecard/Tabid/55/Default - AspxDocument9 pagesBalanced Scorecard Basics: Edscorecard/Tabid/55/Default - AspxNaveen Kumar NaiduNo ratings yet

- Business Matrics Research ArticleDocument13 pagesBusiness Matrics Research ArticleSufyan AneesNo ratings yet

- Balanced ScorecardDocument6 pagesBalanced ScorecardAppadurai MuthukrishnanNo ratings yet

- Chapter 6Document7 pagesChapter 6Michael Angelo MoboNo ratings yet

- Balanced Scorecard: Similarity To Hoshin PlanningDocument8 pagesBalanced Scorecard: Similarity To Hoshin PlanningmxjormerNo ratings yet

- Performance ManagementDocument25 pagesPerformance ManagementIkmal IshamudinyyNo ratings yet

- PCM Term PaperDocument22 pagesPCM Term Paper8130089011No ratings yet

- Broken Budgets - Strategic FinanceDocument13 pagesBroken Budgets - Strategic FinanceGks06No ratings yet

- Balance ScorecardDocument21 pagesBalance Scorecardfixs2002100% (1)

- Balanced Scorecard: Basics: The Balanced Scorecard Is A Strategic Planning and Management System That Is UsedDocument4 pagesBalanced Scorecard: Basics: The Balanced Scorecard Is A Strategic Planning and Management System That Is Usedprakar2No ratings yet

- Balanced Score Card SubhajitDocument4 pagesBalanced Score Card SubhajitSubhajit DasNo ratings yet

- Target Costing As A Strategic Cost Management Tool For Success of BSCDocument16 pagesTarget Costing As A Strategic Cost Management Tool For Success of BSCAda AlamNo ratings yet

- A Balanced Scorecard For Small BusinessDocument22 pagesA Balanced Scorecard For Small BusinessFeri100% (1)

- The Balance Score CardDocument2 pagesThe Balance Score CardvclarNo ratings yet

- The Balanced ScorecardDocument8 pagesThe Balanced ScorecardCaleb GetubigNo ratings yet

- ACCY312 Essay Balanced ScorecardDocument9 pagesACCY312 Essay Balanced ScorecardhuatchuanNo ratings yet

- A Study of Performance Management System in WiproDocument11 pagesA Study of Performance Management System in WiproSahajada Alam100% (1)

- 568066067-The-Performance-Pyramid للاستفادةDocument11 pages568066067-The-Performance-Pyramid للاستفادةworood.khalifih90No ratings yet

- Project Report AnshulDocument25 pagesProject Report AnshulAnshul GoelNo ratings yet

- A Proposed Framework For Integrating The Balanced Scorecard Into The Strategic Management ProcessDocument11 pagesA Proposed Framework For Integrating The Balanced Scorecard Into The Strategic Management ProcessphilirlNo ratings yet

- Transforming The Balanced Scorecard From Performance Measurement To Strategic ManagementMHDocument3 pagesTransforming The Balanced Scorecard From Performance Measurement To Strategic ManagementMHVirencarpediemNo ratings yet

- Resume Balance ScorecardDocument17 pagesResume Balance ScorecardNatya PratyaksaNo ratings yet

- Balanced Score CardDocument19 pagesBalanced Score CardIwora AgaraNo ratings yet

- Probability 2Document15 pagesProbability 2Dare LekutiNo ratings yet

- NN CA ME HD: Venn Diagram Negative Numbers Sequences Metric Units - Volume Metric Units - Mass RoundingDocument2 pagesNN CA ME HD: Venn Diagram Negative Numbers Sequences Metric Units - Volume Metric Units - Mass RoundingDare LekutiNo ratings yet

- What Is A NOUNDocument9 pagesWhat Is A NOUNDare LekutiNo ratings yet

- Roks 2Document1 pageRoks 2Dare LekutiNo ratings yet

- Auxiliary Verbs Do Does Am Is AreDocument24 pagesAuxiliary Verbs Do Does Am Is AreDare LekutiNo ratings yet

- Auxiliary Verbs Do-Does-Am-Is-Are PDFDocument2 pagesAuxiliary Verbs Do-Does-Am-Is-Are PDFDare Lekuti100% (1)

- Apple Inc. - Julia-Aya Reineke-KrieteDocument1 pageApple Inc. - Julia-Aya Reineke-KrieteDare LekutiNo ratings yet

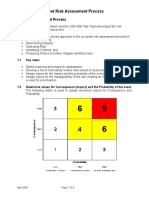

- 4 Fleet Risk Assessment ProcessDocument4 pages4 Fleet Risk Assessment ProcessHaymanAHMEDNo ratings yet

- PC-13518 - Aquaflow BrochureDocument8 pagesPC-13518 - Aquaflow Brochuremark nickeloNo ratings yet

- International Business NotesDocument28 pagesInternational Business NotesLewis McLeodNo ratings yet

- Nationalization of Oil in Venezuela Re-Defined Dependence and Legitimization ofDocument23 pagesNationalization of Oil in Venezuela Re-Defined Dependence and Legitimization ofDiego Pérez HernándezNo ratings yet

- Resource Based Theory (RBT) - AK S1Document9 pagesResource Based Theory (RBT) - AK S1cholidNo ratings yet

- Impact of Celebrity Endorsed Advertisements On ProductDocument29 pagesImpact of Celebrity Endorsed Advertisements On ProductKeyur SoniNo ratings yet

- Management Concepts - The Four Functions of ManagementDocument13 pagesManagement Concepts - The Four Functions of ManagementsanketNo ratings yet

- Fact Sheet en June 2019 1 PDFDocument3 pagesFact Sheet en June 2019 1 PDFalexandru_cornea01No ratings yet

- 220221-Atom Diesel-Vietnam..Document1 page220221-Atom Diesel-Vietnam..Tonny NguyenNo ratings yet

- Solved Astrostar Inc Has A Board of Directors Consisting of Three Members PDFDocument1 pageSolved Astrostar Inc Has A Board of Directors Consisting of Three Members PDFAnbu jaromiaNo ratings yet

- IIT TenderDocument10 pagesIIT TenderB DroidanNo ratings yet

- Q1. Comment On The Future of Rural Marketing in The Lights of This Case StudyDocument5 pagesQ1. Comment On The Future of Rural Marketing in The Lights of This Case StudySarthak AroraNo ratings yet

- Accra Investments Corp Vs CADocument4 pagesAccra Investments Corp Vs CAnazhNo ratings yet

- Case Study The Wedding Project Marketing EssayDocument10 pagesCase Study The Wedding Project Marketing EssayHND Assignment HelpNo ratings yet

- Guidance To BS 7121 Part 2 2003Document4 pagesGuidance To BS 7121 Part 2 2003mokshanNo ratings yet

- ICON Brochure Low ResDocument4 pagesICON Brochure Low ResLuis Adrian Gutiérrez MedinaNo ratings yet

- PDF Rq1 With AnswersDocument9 pagesPDF Rq1 With AnswersCaleb GetubigNo ratings yet

- Retail BankingDocument11 pagesRetail Banking8095844822No ratings yet

- Session 13 - Brand Management PDFDocument32 pagesSession 13 - Brand Management PDFpeeking monkNo ratings yet

- Capital One's Letter To The Federal ReserveDocument15 pagesCapital One's Letter To The Federal ReserveDealBookNo ratings yet

- HSRPHR3Document1 pageHSRPHR3ѕᴀcнιn ѕᴀιnιNo ratings yet

- MR Smart Has 75 000 Invested in Relatively Risk Free Assets ReturningDocument1 pageMR Smart Has 75 000 Invested in Relatively Risk Free Assets ReturningAmit PandeyNo ratings yet