Professional Documents

Culture Documents

You Can Do It!

Uploaded by

Center for Economic ProgressOriginal Description:

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

You Can Do It!

Uploaded by

Center for Economic ProgressCopyright:

THE 2014 VOLUNTEER ANSWER GUIDE

GENERAL INFORMATION

CONTENTS

General Information .................................................................................3

2014 Tax Sites Locations and Hours ...................................................4

Tax Clinic Referral ..................................................................................6

Federal Refund Timeline ........................................................................7

Financial Services Information ................................................................9

On-Site Financial Services & Referrals ................................................10

Talking Points for Promoting Financial Services ...................................10

Health Insurance Enrollment................................................................11

Site Assistant Information .....................................................................12

Site Assistant Responsibilities .............................................................13

Client Intake Process ...........................................................................14

Intake Guidlines ...................................................................................15

Sorting ................................................................................................16

Requesting Donations..........................................................................18

Tax Preparation Information..................................................................20

Seven Basic Steps of Tax Preparation .................................................21

Common Tax Forms .............................................................................22

All Those Kids ......................................................................................24

All Those Kids-Part 2 ............................................................................26

Qualifying Relatives .............................................................................28

Income Chart ......................................................................................30

Child Tax Credit & Additional Child Tax Credit ......................................32

Child & Dependent Care Credit............................................................33

Benets Related to Education ............................................................ 34

Printing .................................................................................................36

ITIN Tax Returns .................................................................................36

You Can Do It! is a work product of the Center for Economic Progress and

cannot be used, reproduced or distributed without the written consent of the

Center for Economic Progress, 567 W. Lake, Suite 1150, Chicago, IL 60661.

Contact volunteer@economicprogress.org for more information.

2013 Center for Economic Progress

VOLUNTEER ANSWER GUI DE 2014 // GENERAL INFORMATION

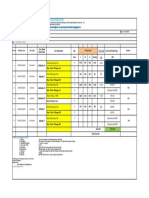

2014 TAX SITES LOCATIONS AND HOURS*

N

O

R

T

H

E

R

N

C

H

I

C

A

G

O

SITE SITE PARTNER ADDRESS OPENING DAY

GENERAL INFORMATION // VOLUNTEER ANSWER GUI DE 2014

4

* Some one-day closures not included; site schedules may change without notice. You will always be notied of

changes to your scheduled volunteer dates.

DAYS OPEN WEEKDAY HOURS SATURDAY HOURS CLOSURES

5

Auburn Gresham

Brighton Park

Bronzeville

Lawndale

Loop

Pilsen

Uptown

Aurora

Chicago Heights

Elgin

Evanston

Joliet

Waukegan

Springeld

St. Sabina Employment

Resource Center

Shields Middle School

Dawson Technical Institute

Neighborhood Housing

Services of Chicago, Inc.

Harold Washington College

Instituto del Progreso Latino

Truman College

Waubonsee Community

College

Bloom Township

Gail Borden Public Library

Evanston Public Library

University of St. Francis

Father Gary Graf Center

Family Service Center

7903 S. Racine

Chicago, IL 60620

2611 W. 48th St.

Chicago, IL 60632

3901 S. State

Chicago, IL 60609

3555 W. Ogden Avenue

Chicago, IL 60623

30 E. Lake Street

Chicago, IL 60601

2570 S. Blue Island

Chicago, IL 60608

1145 W. Wilson

Chicago, IL 60640

18 S. River St.

Aurora, IL 60506

425 S. Halsted St.

Chicago Heights, IL

60411

270 N. Grove Ave.

Elgin, IL 60120

1703 Orrington Ave

Evanston, IL 60201

605 Taylor Street

Joliet, IL 60435

510 10th Street

Waukegan, IL 60085

730 E. Vine St.

Springeld, IL 62703

1/22

1/28

1/21

1/25

1/21

1/22

1/21

1/29

1/25

1/22

1/25

1/22

1/25

1/21

D

O

W

N

S

T

A

T

E

M/W/Sa

T/Th all season

Saturdays in February

M/T/W/Th/Sa

M/W/Sa

M/T/W/Th/ Sa

M/W/Th/Sa

M/T/W/Th/Sa

W/Sa

T/Th/Sa

M/W/Th/Sa

T/Th/Sa

W/Th/Sa

T/Th/Sa

T/Th/Sa

5:30 PM - 8 PM

5:30 PM - 8 PM

5:30 PM - 8 PM

5:30 PM - 8 PM

10 AM - 8 PM

5:30 PM - 8 PM

5:30 PM - 8 PM

5:30 PM - 8 PM

5:30 PM - 8 PM

5:30 PM - 8 PM

5:30PM - 8PM

5:30 PM - 8 PM

5:30 PM - 8 PM

5:30 PM - 8 PM

10 AM - 1 PM

10 AM - 1 PM

10 AM - 1 PM

10 AM - 1 PM

10 AM - 1 PM

10 AM - 1 PM

10 AM - 1 PM

10 AM - 1 PM

10 AM - 1 PM

1 PM - 4 PM

10AM -1PM

10 AM - 1 PM

10 AM - 1 PM

10 AM - 1 PM

TBD

TBD

2/17, 4/14, 4/15

2/17

2/17, 4/14, 4/15

TBD

2/17, 4/14, 4/15

3/19 and 3/22

TBD

2/17

TBD

TBD

TBD

TBD

FEDERAL REFUND TIMELINE

Clients who le And receive refund by Can expect their refund in

Electronically Direct deposit 2 weeks

Electronically Paper check 34 weeks

On paper (by mail) Direct deposit 56 weeks

On paper (by mail) Paper check 68 weeks

Note: This is a very general guideline. Many factors determine when a client

receives a refund: USPS, IRS delays, time of ling and rejects due to errors on the

return.

Clients can check on their refund by going to www.irs.gov and clicking on the

Wheres My Refund? link, or calling 800.829.1954.

Prior year and amended returns are subject to longer time frames.

Clients can help by double checking ALL information on their returnnames, social

security numbers, birthdates, and bank information.

7

VOLUNTEER ANSWER GUI DE 2014 // GENERAL INFORMATION

TAX CLINIC REFERRAL

CEPs tax clinic represents individual tax payers in tax disputes with the IRS and

Illinois Department of Revenue (IDR). The clinic assists clients with the following

types of matters:

Audits, collections, appeals, and tax court matters

Garnishments: bank, wage and social security levies

1099-A and 1099-C cancellation of indebtedness issues

Payment arrangements/debt negotiation

Pre-2010 original returns and 1040Xs (subject to staff availability)

The Clinic does not assist clients with the following types of matters:

Property tax

IDR matters only (a federal matter must exist as well)

Business entities, including S Corporations. However, if the taxpayer

is personally responsible for a tax owed by a business entity (sole

proprietorship, S-corporation or LLC), the tax clinic may provide assistance

with the tax controversy.

Disputes with paid preparers over rapid refunds

To refer a client to the Tax Clinic:

Ask the client to call 312.252.0280 to leave a message on the clinic voicemail line.

Calls will be returned as soon as practicable.

GENERAL INFORMATION // VOLUNTEER ANSWER GUI DE 2014

6

FINANCIAL SERVICES INFORMATION

VOLUNTEER ANSWER GUI DE 2014 // FINANCIAL SERVICES INFORMATION FINANCIAL SERVICES INFORMATION // VOLUNTEER ANSWER GUI DE 2014

ON-SITE FINANCIAL SERVICES & REFERRALS

Many tax clients are concerned about their nances, and some are on the brink

of serious nancial crisis. The Center for Economic Progress offers free on-site

nancial services and takes referrals for year-round nancial coaching.

By promoting nancial services, you can make a long-term impact by helping Illinois

families move toward nancial security. Encourage every client to take one

positive step toward nancial stability at tax time.

TALKING POINTS FOR PROMOTING FINANCIAL SERVICES

Our new Supplemental Intake Form includes a number of questions to facilitate

conversations about nancial services with clients.

Financial Product &

Supplemental Intake

Sheet Question

Savings Bond

Q9: Would you like to

set aside some of your

tax refund to meet

emergency expenses

or have for your familys

future

Bank Account

Q8: Do you have a bank

account or prepaid debit

card?

Talking Points

Everyone needs money set aside for the

future.

You can choose the amount you want to

save, starting with as little as $50.

The amount will be deducted from your

refund today, and the bond comes in the

mail.

Bonds will never lose value, they are backed

by the U.S. Government, there are no fees,

and they start earning interest immediately.

A bank account is best if you want to be

afliated with a bank and can manage your

money to avoid fees.

A currency exchange charges a 3% fee

to access your own money. For a $2000

tax refund, you could save $60 with direct

deposit.

Once you have an account, you can direct

deposit your paychecks and government

benet checks to save money and time at

currency exchanges.

Action Steps

Offer a savings bond to

clients receiving a refund.

If your client says yes to

a savings bond, complete

Part II of Form 8888.

Encourage clients

without a bank account

to open one with the

on-site bank partner.

After the client opens the

account with the bank

representative, enter

their new routing and

account number on their

tax return.

11 10

Financial Coaching

Q10 How often do you

have trouble paying for

housing, medical care,

transportation, medicine

or food?

Q7 If you are self-

employed, would you

like to attend a workshop

about taxes and record

keeping?

Q11 Would you like to

speak with a nancial

coach to help you

manage your money?

Tax Clinic

Q12 Do you need to

talk to an attorney or

tax professional about

an issue with the IRS or

Illinois Department of

Revenue?

If you are worried about overdue bills or

debt, want to learn new nancial skills,

or access tools to improve your nances,

CEP nancial coaches can help you:

Set your nancial goals.

Create a spending plan.

Access banking products, including:

bank accounts, prepaid debit cards,

and small dollar loans.

Review and correct credit report;

improve credit scores.

We know that thinking about money

is stressful. Our coaches listen to your

challenges and help you nd solutions that

work for you.

CEP can offer free help if you have a

tax issue with audits, garnishments,

cancellation of debt, and debt negotiation.

If the client gives any hint

that she is interested in

working on nancial goals or

is in nancial crisis, strongly

encourage them to call or

e-mail CEP to schedule an

appointment with a nancial

coach.

Show the client the contact

information on the CEP

nancial capability yer and

encourage the client to

contact CEP at 312.252.0280.

Make sure the client received

the CEP nancial capability

yer, and encourage the

client to call CEPs tax clinic

at 312.252.0280.

ACA

Health Insurance Enrollment

CEP is providing outreach and enrollment assistance to our clients as a participant in

the Affordable Care Act (ACA) In-Person Counselor Program. You will see a question

on the Supplemental Intake Sheet, asking clients if they are interested in receiving such

assistance. As a CEP volunteer, your role in this outreach is to refer interested clients

to the appropriate referral phone number or program, so that they may receive the

assistance they desire.

For sites located in the city of Chicago, you can refer clients to CEP to schedule an

appointment with one of our In Person Counselors. Information, including the phone

number to schedule appointments, can be found in the Programs brochure being

distributed at Intake.

For sites located outside the city of Chicago, you can refer clients to a partner agency

in your area. Further information will be provided at your site orientation, or can be

obtained from your site manager.

SITE ASSISTANT RESPONSIBILITIES

Site assistants are extremely important in keeping the site running efciently. There

are a variety of roles that site assistants ll; please consult with your site manager

to determine the best ways to help out.

Beginning/End of Shift

Post/take down income guidelines, site signs, and IRS posters

Prepare/le client sign-in sheet and set up/clean up intake area

Assist with site setup/cleanup, including laptops at laptop sites

Throughout Shift

Greeting

Welcome each client, notify them of income guidelines, ask them to sign in

and give them intake sheets to complete while they wait.

Intake

Distribute and assist clients with intake documents. Ensure clients meet

both income and return type guidelines, taking care to identify blue rib-

bon issues as outlined on page 15. Ensure clients receive the CEP, paying

particular attention to clients who have received a letter from IRS, or indicate

an interest in meeting with a nancial coach, or are interested in assistance

with health care options

Sorting

Sort completed returns, get client signatures on required documents and

give client their copies. Tell them when and how to expect their refund and

address any questions they may have before leaving.

Translating

If procient in another language, assist with translation as needed.

Filing

File completed client folders according to social security number.

Shredding

Shred all extra print jobs, unneeded copies of documents and erroneous tax

returns.

Child care

Keep the site calm by entertaining clients children. Share crayons and color-

ing pages as well as picture books. Invite children to draw a picture for the

volunteer completing their familys return.

13

VOLUNTEER ANSWER GUI DE 2014 // SITE ASSISTANT INFORMATION

SITE ASSISTANT INFORMATION

CLIENT INTAKE PROCESS

Review the Intake Sheet and Supplemental Intake Sheet carefully to ensure the

clients answers to the questions are clear. If anything is unclear, ask about it.

Social Security Cards To e-le, clients must bring the actual social

& Picture ID security cards (or ITIN letter) for everyone on the

return and IDs for all adults on the tax return.

Income Guidelines We serve individuals with income under

$25,000 and families (more than one person in

the household) with income under $50,000

Income Documents Clients need to bring W-2s and 1099s for all

jobs they or their spouse worked last year, as

well as 1099s for social security payments,

unemployment, interest income and any

pensions or retirement income.

Spouses We cannot le a return electronically if the

spouse is not present to sign the e-le

authorization.

Childcare Provider EIN/SSN This is necessary to claim the child care credit.

Supporting Documents These are documents that are related to

expenses they paid over the year, such as

mortgage interest statements, property taxes,

student loan interest, expenses related to

self-employment, tuition and fees and book

expenses for college.

Complex Returns There are certain types of tax returns we

cannot complete. See next page for details.

Additional Advice Be sure the client receives the CEP programs

brochure. Make sure the client, and spouse,

has read, understands, and signs the Consent

to Use and Consent to Disclose form (both

sides).

INTAKE GUIDELINES

These guidelines will help match the type of return to the experience level of

the tax preparation volunteer. These guidelines help identify complex returns

(Blue Ribbon Returns) by using a blue client folder. Place the return folder in

the appropriate location for the volunteer preparers to retrieve. The Blue Ribbon

volunteers can be identied by the blue ribbon attached to their name tags. Intake

staff will have annotated copies of page 2 of Form 13614-C to use as reference for

making the proper determination.

If any of the following questions on Form 13614-C, Intake/Interview & Quality

Review Sheet, is answered YES CEP will not prepare the tax return and clients

should be advised to seek tax preparation service elsewhere:

Part I (Your Personal Information) Question 12b (Adopted a child?)

Part III (Income) Question 14 (Income from rental property)

Part V (Life Events) Question 3 (Buy/sell/foreclosure of your home)

Part V (Life Events) - Question 5 (Purchase and install energy efcient home items)

If any of the following questions is answered YES the return should be

labeled Blue Ribbon:

Part III (Income) Question 6 (Alimony Income)

Part III (Income) Question 9 (Income or loss from sale of stocks, bonds,

or real estate)

Part III (Income) Question 10 (Disability income)

Part IV (Expenses) Question 1 (Alimony)

Part IV (Expenses) Question 2 (Contributions to an IRA)

Part IV (Expenses) Question 4 (Unreimbursed employee expenses)

Part V (Life Events) Question 1 (Health Savings Account)

Part V (Life Events) Question 2 (Debt from mortgage or credit card

cancelled/forgiven)

Part V (Life Events) Question 6 (Live in an area affected by natural disaster)

Part V (Life Events) Question 7 (Receive First Time Homebuyers Credit in 2008)

Part V (Life Events) Question 10 (Has a capital loss carryover from a prior year)

Check the Job Title line on page 1 of the 13614-C. If answered with Child

Care Provider or Taxi/Cab Driver the return should be labeled Blue

Ribbon.

And/Or

Ask if the client took depreciation on last years return (or check last years

Schedule C, Part II, Line 13) if they did, the return should be labeled Blue

Ribbon.

SITE ASSISTANT INFORMATION // VOLUNTEER ANSWER GUI DE 2014

14

VOLUNTEER ANSWER GUI DE 2014 // SITE ASSISTANT INFORMATION

15

IMPORTANT:

PLEASE MAKE SURE ALL FORMS ARE COMPLETED FULLY AND SIGNED BY THE CLIENT.

PRE-ADDRESSED ENVELOPES ARE AVAILABLE AT THE SORTING TABLE.

17

VOLUNTEER ANSWER GUI DE 2014 // SITE ASSISTANT INFORMATION SITE ASSISTANT INFORMATION // VOLUNTEER ANSWER GUI DE 2014

Sorting Amended Returns

In the folder, in this order:

Same as current year returns, previous page

To the client, in this order:

Client letter from CEP

1 copy Federal Tax Return1040X pgs 1-2, original 1040 pgs 1-2 and all

schedules or forms

1 copy Illinois Tax ReturnIL-X pgs 1-2, 1040X pg 1, original IL1040 pgs 1-2

and all schedules or forms

All of clients original documents

Client to mail:

To IRS:

1040X pgs 1-2, 1040 pgs 1-2, all schedules and forms and any new

supporting documents attached

Address: (same for refunds and balances due)

Department of Treasury

Internal Revenue Service

Fresno, CA 93888-0422

To IDOR:

IL-X pgs 1-2, 1040X pg 1, original IL-1040 pgs 1-2, all schedules or forms and

any new supporting documents attached

Address:

Located at bottom of page 2 of the IL-X

Note: If the client is ling more than one year of returns, mail each year in a

separate envelope.

16

SORTING

Have the client review names, SSNs, addresses and dates of birth for all

persons on the return.

Double check direct deposit information for accuracy (1040, pg 2).

Ensure Use & Disclosure Form is signed by the client on front and back

when necessary.

The exterior of the client folder should be lled out completely, including

indication of a signed 8879 for e-led tax returns.

Sorting Current Year Returns

In the folder, in this order:

1 signed (front and back) Use & Disclosure Form (all returns)

Intake Sheet (Form 13614-C) and Supplemental Intake Sheet (all returns)

1 copy of each W-2, 1099 and any other supporting documents (all returns)

To the client, in this order:

Client letter from CEP

1 signed copy Form 8879, IRS e-le Signature Authorization

1 copy Federal Tax Return1040 pgs 1-2 and all schedules or forms

1 copy Illinois Tax ReturnIL1040 pgs 1-2 and all schedules or forms

All of clients original documents

If client is mailing returns:

To IRS (ensure correct refund or payment envelope is used):

Full copy of 1040 - pgs 1-2, all schedules or forms that have an Attachment

Sequence Number in the upper right corner, W-2s/1099s attached

To IDOR (ensure correct refund or payment envelope is used):

Full copy IL1040 pgs 1-2, all schedules or forms, W-2s/1099s attached

Note: When the client has retirement income, attach a copy of page 1

of the Form 1040 to the Illinois tax return.

Note: If a client is mailing multiple years of returns, use separate envelopes

to mail each year.

DONATIONS

Clients who wish to make a monetary donation to the Center for Economic Progress

can do so by:

Taking a paper envelope to mail a donation; or

Visiting www.economicprogress.org to make a donation online.

Each tax site will have pledge envelopes available for interested clients. Making

a donation is completely voluntary, and clients should be offered the opportunity

to donate only after the tax preparation is complete. Thank clients warmly and let

them know that their donations will be used to provide better services for clients in

need.

19

SITE ASSISTANT INFORMATION // VOLUNTEER ANSWER GUI DE 2014

18

21

VOLUNTEER ANSWER GUI DE 2014 // TAX PREPARATION INFORMATION

SEVEN BASIC STEPS OF TAX PREPARATION

1. Review Client Intake Forms: Form 13614-C, Supplemental Intake Sheet and

Consent to Use/Disclose

Make sure all are complete.

Check for the client signature on the consent forms.

Talk to the client and get all of your questions answered!

2. Complete the TaxWise Intake Forms

Main Information Sheet: Pay close attention to the dependent/nondependent

section.

Preparer Use Form: Enter the answers to the questions asked on the

Supplemental Intake Sheet.

3. Enter all income

Enter W-2s,1099s, and other income.

Complete any Schedule C-EZs or Cs.

4. Enter all adjustments, deductions and credits

Enter adjustments, such as student loan interest and/or tuition and fees

deduction.

Enter property tax paid and determine if client should itemize using

Schedule A.

Enter child care payments and child care provider information.

If client or clients dependent attended college, enter education expenses.

5. Get the red out!

Address all red exclamation points.

Do not override.

6. Review

Run TaxWise diagnostics and correct any errors.

Click the create e-le button if the client is ling electronically.

Have a site manager/quality reviewer review the return.

Print the return and ask the client to look it over.

7. Counsel

If there is a balance due, discuss prevention: W-4 or estimated tax options.

If the client cant pay the balance due and discuss payment options.

When the client has a refund, discuss direct deposit: back account, savings

bond, and debit card options.

Make sure the client received the CEP programs brochure and invite the

client to make an appointment for nancial coaching.

If the client would like to enroll in health insurance, provide them with the

referral information available on site.

TAX PREPARATION INFORMATION

23

VOLUNTEER ANSWER GUI DE 2014 // TAX PREPARATION INFORMATION

Federal income tax return N/A Yes

Itemized deductions Tax and Credits, p.2 No

Interest and dividend income Income, p.1 No

Self-employed income & expenses (short) Income, p.1 No

EITC with qualifying child Payments, p.2 Yes

Self-employment tax Other Taxes, p.2 Yes

Child and dependent care credit Tax and Credits, p.2 Yes

Additional child tax credit Payments, p.2 Yes

Education credits Tax and Credits, p.2 No

Retirement savings credit Tax and Credits, p.2 Yes

Adjustment for tuition and fees Adjusted Gross Income, p. 1 No

Illinois income tax return N/A N/A

Property tax credit, K-12 education credit IL-1040 Yes

Illinois earned income tax credit IL-1040, p.2 Yes

ISSUE LINK FROM 1040, SECTION... OPENS AUTOMATICALLY?

TAX PREPARATION INFORMATION // VOLUNTEER ANSWER GUI DE 2014

22

COMMON TAX FORMS

Federal 1040 U.S. Individual Income Tax Return

Federal Sch A Itemized Deductions

Federal Sch B Interest and Ordinary Dividends

Federal Sch C-EZ Net Prot from Business

Federal Sch EIC Earned Income Credit

Federal Sch SE Self-Employment Tax

Federal 2441 Child and Dependent Care Expenses

Federal 8812 Additional Child Tax Credit

Federal 8863 Education Credits

Federal 8880 Credit for Qualied Retirement Savings Contributions

Federal 8917 Tuition and Fees Deduction

State IL-1040 Illinois Individual Income Tax Return

State Sch ICR Illinois Credits

State Sch ICR Illinois EITC

TYPE OF FORM FORM NUMBER FORM TITLE

25

VOLUNTEER ANSWER GUI DE 2014 // TAX PREPARATION INFORMATION

Child must have lived in the U.S. with the

taxpayer for more than half the tax year.

Some temporary absences count as time

lived at home.

Child must have lived with the taxpayer for

more than half the tax year. Some temporary

absences count as time lived at home.

Child must have lived in the U.S. with the

taxpayer for more than half the tax year.

Some temporary absences count as time

lived at home.

Child must have lived with the taxpayer for

more than half the tax year. Some temporary

absences count as time lived at home.

Child must have lived with the taxpayer for

more than half the tax year. Some temporary

absences count as time lived at home.

No support test.

Note: There is an exception for a married

child that cannot provide over 1/2 of his/her

own support for the tax year.

Child did not provide over 1/2 of his/her own

support for the tax year.

Child did not provide over 1/2 of his/her own

support for the tax year.

Note: Child must also be claimed as the

taxpayers dependent.

Child did not provide over 1/2 of his/her own

support for the tax year.

Note: Taxpayer must provide over half the

cost of maintaining the home.

Child did not provide over 1/2 of his/her own

support for the tax year.

RESIDENCY SUPPORT

TAX PREPARATION INFORMATION // VOLUNTEER ANSWER GUI DE 2014

24

ALL THOSE KIDS

At the end of the tax year, the child

must be under 19, or under age 24

if a full time student, and must be

younger than the taxpayer. The

child can be any age if the child is

disabled.

At the end of the tax year, the child

must be under 19, or under age 24

if a full time student, and must be

younger than the taxpayer. The

child can be any age if the child is

disabled.

Child must be under age 17 at

the end of the year and must be

younger than the taxpayer.

Note: There is no exception for

students or the disabled.

At the end of the tax year, the child

must be under 19, or under age 24

if a full time student, and must be

younger than the taxpayer. The

child can be any age if the child is

disabled.

Child must be under age 13 or

disabled at the time of the child

care.

Child must be taxpayers child,

stepchild, adopted child, foster

child, sibling, stepsibling, or

descendent of any of these. If the

taxpayer is not the childs parent,

special restrictions may apply.

Child must be taxpayers child,

stepchild, adopted child, foster

child, sibling, stepsibling, or

descendent of any of these. If the

taxpayer is not the childs parent,

special restrictions may apply.

Child must be taxpayers child,

stepchild, adopted child, foster

child, sibling, stepsibling, or

descendent of any of these. If the

taxpayer is not the childs parent,

special restrictions may apply.

Child must be taxpayers child,

stepchild, adopted child, foster

child, sibling, stepsibling, or

descendent of any of these. If the

taxpayer is not the childs parent,

special restrictions may apply.

Child must be taxpayers child,

stepchild, adopted child, foster

child, sibling, stepsibling, or

descendent of any of these. If the

taxpayer is not the childs parent,

special restrictions may apply.

AGE RELATIONSHIP

Earned Income Tax Credit

Dependency Exemption

Child Tax Credit

Head of Household

Child Care Credit

Warning! This chart is a summary. Please refer to Publication 17, VITA Resource Guide 4012 or other resource material.

27

VOLUNTEER ANSWER GUI DE 2014 // TAX PREPARATION INFORMATION

Yes

Yes

No

Yes

Yes

No

No

No

Yes

Yes

A DISABLED

CHILD CAN BE

ANY AGE?

CAN THE TAXPAYER

BE A QUALIFYING

CHILD?

CITIZENSHIP

Child must be U.S. citizen or a legal resident of

the US.

Child must be U.S. citizen or a resident of the

U.S., Canada or Mexico.

Child must be U.S. citizen or a resident of the U.S.

for more than six months of the tax year.

Child must be U.S. citizen or a resident of the

U.S., Canada or Mexico.

Child must be U.S. citizen or a resident of the

U.S., Canada or Mexico.

TAX PREPARATION INFORMATION // VOLUNTEER ANSWER GUI DE 2014

26

ALL THOSE KIDS PART 2

EITC

Dependent

Child Tax Credit

Head of Household

Child Care Credit

Yes

No

No

No

No

No

(Child must have lived

with the taxpayer)

Yes

Yes

No

(Child must have lived

with the taxpayer)

No

(Child must have lived

with the taxpayer)

No

Yes

No

Yes

(Must be dependents

that are related)

Yes

(Certain disabled

dependents)

CHILD MUST HAVE EXCEPTION FOR QUALIFYING RELATIVE

SSN (NOT ITIN)? DIVORCED/SEPARATED RULES CAN BE USED

PARENTS CAN BE USED? TO GET OR INCREASE

THIS BENEFIT?

29

VOLUNTEER ANSWER GUI DE 2014 // TAX PREPARATION INFORMATION

If the QR is not related to the tax-

payer, QR must have lived with

the taxpayer all year. If the QR

is related there is no residency

requirement.

QR lived with the taxpayer more

than 6 months of the tax year.

Exception: a taxpayers parent is

not required to reside with the

taxpayer.

QR must have lived with the

taxpayer more than 6 months of

the tax year.

The taxpayer provided over 1/2

of the QRs nancial support for

the tax year. Exception: multiple

support agreements.

The taxpayer provided over 1/2 of

the QRs nancial support for the

tax year. Note: Also, the taxpayer

must have paid more than 1/2 the

cost of maintaining the home.

The taxpayer provided over 1/2 of

the QRs nancial support for the

tax year.

RESIDENCY SUPPORT INCOME

Note: Qualifying Relative

rules do not apply.

Note: Qualifying Relative

rules do not apply.

QR had income less than

$3,800.

QR had income less than

$3,800.

There is no income test.

TAX PREPARATION INFORMATION // VOLUNTEER ANSWER GUI DE 2014

28

QUALIFYING RELATIVES

EITC

Dependency Exemption

Child Tax Credit

Head of Household

Child & Dependent Care

Credit

QR is not a qualifying child of

another taxpayer who has a ling

requirement or claims EITC.

QR is not a qualifying child of

another taxpayer who has a ling

requirement or claims EITC.

QR is not a qualifying child of

another taxpayer who has a ling

requirement or claims EITC.

QR is a descendent, sibling,

ascendant, niece/nephew or in-law

OR lived with the taxpayer all year.

QR is a descendent, sibling,

ascendant, niece/nephew or

in-law.

QR is a descendent, sibling,

ascendant, niece/nephew or in-law

OR lived with the taxpayer all year.

CANNOT BE QUALIFYING CHILD RELATIONSHIP

Warning! This chart is a summary. Please refer to Publication 17, VITA Resource Guide 4012 or other resource material.

Note: Qualifying Relative

rules do not apply.

Note: Qualifying Relative

rules do not apply.

31

VOLUNTEER ANSWER GUI DE 2014 // TAX PREPARATION INFORMATION

7 If cant get W-2, use substitute, Form 4852.

21 Must itemize to deduct gambling expenses, which cannot exceed

winnings.

13 Enter on TaxWise capital gain worksheet.

9 Enter on TaxWise dividend statement.

13 Enter on TaxWise dividend statement.

10 Link to state tax refund worksheet. Report only if client itemized for

2011 & deducted state income tax.

19 Link to 1099-G worksheet.

8 Enter on TaxWise interest statement.

12 Link from 1040 to Sch. C-EZ/C; then link from line 1 of C-EZ/C. Can

deduct expenses; net income subject to SE tax.

21 See the site manager.

20 Always enter! Link to 1040 worksheet 1.

16 & 20 See IRS Pub. 4012, yellow tab TaxWise Income or go to TaxWise

help and search for RRB-1099.

16 See the site manager if taxable amount is not on 1099-R. Not

taxable for IL.

12 Link from 1040 to Sch. C-EZ/C; then link from line 1 of C-EZ/C to a

scratch pad. Can deduct expenses; net income subject to SE tax.

1040, LINE COMMENTS

TAX PREPARATION INFORMATION // VOLUNTEER ANSWER GUI DE 2014

30

INCOME CHART

FORM DESCRIPTION TYPE

W-2 Wages Earned

W-2G Gambling winnings Unearned

1099-B Proceeds from broker transactions Unearned

1099-DIV Dividends Unearned

1099-DIV Capital gain distributions Unearned

1099-G State tax refund Unearned

1099-G Unemployment Unearned

1099-INT Interest Unearned

1099-MISC Nonemployee compensation (box 7) Earned

1099-MISC Other income (box 3) Unearned

SSA-1099 Social security benets Unearned

RRB-1099-R Railroad retirement Unearned

1099-R Pension Unearned

None Cash for work not on W-2 or 1099-MISC Earned

33

VOLUNTEER ANSWER GUI DE 2014 // TAX PREPARATION INFORMATION

CHILD & DEPENDENT CARE CREDIT

The credit is nonrefundable. If there is zero taxable income (form 1040, Tax

and Credits section) there is no reason to claim the credit.

The qualifying child must be under age 13 or disabled at the time of the child

care.

In some cases, the cost of care for a disabled spouse or other dependent

qualies.

The child care generally must be work-related; that is, babysitting that en-

ables the client to work.

For married couples, both taxpayers generally must be working and le a

joint return.

The credit is claimed using Form 2441, Child and Dependent Care Expenses.

The providers name, address and identifying number must be reported on

Form 2441.

TaxWise Hint: Mark the DC box next to the childs name on the Main Information

Sheet.

TAX PREPARATION INFORMATION // VOLUNTEER ANSWER GUI DE 2014

32

CHILD TAX CREDIT & ADDITIONAL CHILD TAX CREDIT

Both credits:

The maximum amountfor both credits combinedis $1,000/child.

Credits based on the number of qualifying children, amount of income tax

and the amount and type of income on the return.

The child/children must be a qualifying child who is under age 17 at the end

of the tax year. There is no exception to the age requirement.

Schedule 8812 must be led with the tax return.

Specic to Child Tax Credit:

The child tax credit is nonrefundable and appears on Form 1040, page 2, Tax

and Credits section.

The child tax credit is applied to income tax after other nonrefundable credits

have been used.

Specic to Additional Child Tax Credit:

The additional child tax credit is refundable and appears on Form 1040, page

2, Payments section.

A client generally receives the additional child tax credit when two tests are

met:

1. The full child tax credit, $1,000 per child, is more than is needed to

offset income tax.

2. At least one of the following is true:

The client has earned income over $3,000.

The client has three or more qualifying children.

Note: TaxWise automatically computes both credits and prepares Schedule 8812.

Remember to complete the dependent section of the Main Information Sheet cor-

rectly. Do not override! TaxWise will do the rest.

35

VOLUNTEER ANSWER GUI DE 2014 // TAX PREPARATION INFORMATION

STUDENT REQUIRED YEARS EXPENSES HOW TO CLAIM?

REQUIREMENT TO ATTEND AVAILABLE ELIGIBLE

AT LEAST

HALF-TIME?

Must be pursuing

undergraduate

degree.

Does not need to be

in degree program if

class improves job

skills.

Does not need to be

pursuing a degree

Loan used for

undergraduate or

graduate school, in a

degree program.

N/A

Attending elementary

or secondary school

Yes

No

No

Yes, at the

time when

the borrower

was attending

school

N/A

N/A

Four years

Unlimited

Unlimited

Unlimited

Unlimited

Unlimited

Tuition, fees,

books, course

materials

Tuition & fees only

Tuition and fees

only

Loans used to pay

tuition, fees, books,

course materials,

room & board,

transportation

Books, supplies,

equipment for

classroom use

Tuition and

required book and

lab fees in excess

of $250

Form 1040, page 2,

link to Form 8863

Form 1040, page 2,

link to Form 8863

Form 1040, page 1,

link to worksheet

Form 1040, page 1,

link to worksheet

Form 1040, page 1,

link to worksheet

Form IL-1040,

link to

IL-Schedule ICR

TAX PREPARATION INFORMATION // VOLUNTEER ANSWER GUI DE 2014

34

BENEFITS RELATED TO EDUCATION

WHOS LIKELY MAXIMUM ANNUAL EXPENSES

TO BENEFIT? ANNUAL BENEFIT NEEDED FOR

MAXIMUM BENEFIT

American

Opportunity Credit

Lifetime Learning

Tuition and Fees

Deduction

Student Loan

Interest Deduction

Educator Expense

Adjustment

Illinois Education

Credit

Full time

undergraduate in a

degree program

Taking just 1-2

classes or in

graduate school

Taking just 1-2

classes or in

graduate school; zero

taxable income

Former student

paying on loans

School teachers,

grades K-12

Parents with children

in private school,

K-12

$1,000 refundable

credit plus $1,500

nonrefundable credit

$2,000 nonrefundable

credit

$4,000 adjustment to

income

$2,500 adjustment to

income

$250 adjustment to

income ($500 on joint

return if both taxpayers

are teachers)

$500 nonrefundable IL

state credit

$4,000

$10,000

$4,000

$2,500

$250 ($500 on joint

return if both

taxpayers are

teachers)

$2,250

Caution! An education expense can only be used once, for one type of tax benet. See your site

manager if you are unsure how to determine the appropriate benet to claim.

ITIN TAX RETURNS

An Individual Taxpayer Identication Number (ITIN) is a 9-digit number assigned by

the IRS for taxpayers who do not qualify for an SSN. ITIN returns can be e-led, just

like any other return.

Start the return using the taxpayers ITIN number instead of an SSN. If the

spouse has an ITIN, enter that number on the Main Information screen.

In the TaxWise W-2 screen, use the SSN as it appears on the taxpayers

W-2.

If a client or a member of a clients family needs to apply for an ITIN, talk to

your site manager.

TAX PREPARATION INFORMATION // VOLUNTEER ANSWER GUI DE 2014

36

PRINTING

Step 1: Print the Client Letter

1. Select from the toolbar while the tax return is open in TaxWise

Online.

2. Select 1040 Client Letter English or 1040 Client Letter Spanish.

3. Click Print.

Step 2: Print the Tax Return

1. Select from the toolbar while the tax return is open in TaxWise

Online. A PDF will be generated in TaxWise Online.

2. When your PDF is ready, click Open in a new window. Select Open if

asked to open or save the return.

3. Print one copy for an e-le return or two copies for a paper return.

4. Do not save a pdf of the return.

Step 3: Retrieve Documents

1. When retrieving documents from the printer, make sure that you have

both the client letter and tax return for your client.

2. Prevent mix-ups at the printer by checking your clients name on both

documents.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Advanced Scenario 7: Quincy and Marian Pike (2017)Document10 pagesAdvanced Scenario 7: Quincy and Marian Pike (2017)Center for Economic Progress100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Skip LarsonNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Payslip For 16831fwDocument1 pagePayslip For 16831fwomkassNo ratings yet

- Icse Class X Maths Practise Sheet 1 GST PDFDocument2 pagesIcse Class X Maths Practise Sheet 1 GST PDFHENA KHANNo ratings yet

- Sutherland Global Services Philippines, Inc. - Philippine BranchDocument3 pagesSutherland Global Services Philippines, Inc. - Philippine BranchShunui SonodaNo ratings yet

- f6744 (2018)Document208 pagesf6744 (2018)Center for Economic Progress0% (2)

- p4012 - Tab - H (2018)Document33 pagesp4012 - Tab - H (2018)Center for Economic ProgressNo ratings yet

- Advanced Scenario 5 - Samantha Rollins (2018)Document10 pagesAdvanced Scenario 5 - Samantha Rollins (2018)Center for Economic Progress0% (1)

- p4012 (2018)Document349 pagesp4012 (2018)Center for Economic ProgressNo ratings yet

- Advanced Scenario 7 - Austin Drake (2018)Document8 pagesAdvanced Scenario 7 - Austin Drake (2018)Center for Economic Progress100% (2)

- Advanced Certification - Study Guide (For Tax Season 2017)Document7 pagesAdvanced Certification - Study Guide (For Tax Season 2017)Center for Economic Progress100% (4)

- Basic Scenario 7: Gordon Ferris (2018)Document7 pagesBasic Scenario 7: Gordon Ferris (2018)Center for Economic Progress100% (1)

- Basic Scenario 8: Valerie Sinclair (2018)Document8 pagesBasic Scenario 8: Valerie Sinclair (2018)Center for Economic Progress0% (1)

- You Can Do It Guide (Tax Season 2017)Document54 pagesYou Can Do It Guide (Tax Season 2017)Center for Economic Progress67% (3)

- Advanced Scenario 6 - Quincy and Marian Pike (2018)Document10 pagesAdvanced Scenario 6 - Quincy and Marian Pike (2018)Center for Economic ProgressNo ratings yet

- Basic Certification - Study Guide (For Tax Season 2017)Document6 pagesBasic Certification - Study Guide (For Tax Season 2017)Center for Economic ProgressNo ratings yet

- Basic Scenario 9: Justin Reedley and Jenna Washington (2018)Document9 pagesBasic Scenario 9: Justin Reedley and Jenna Washington (2018)Center for Economic ProgressNo ratings yet

- Basic Scenario 9: Justin Reedley (2017)Document8 pagesBasic Scenario 9: Justin Reedley (2017)Center for Economic Progress100% (1)

- Basic Scenario 7: Gordon Ferris and Ellen Mercer (2017)Document8 pagesBasic Scenario 7: Gordon Ferris and Ellen Mercer (2017)Center for Economic Progress100% (1)

- Advanced Scenario 6: Samantha Rollins (2017)Document9 pagesAdvanced Scenario 6: Samantha Rollins (2017)Center for Economic Progress0% (1)

- Standards of Conduct Training (2017)Document25 pagesStandards of Conduct Training (2017)Center for Economic ProgressNo ratings yet

- Basic Scenario 8: Teresa Martin (2016)Document8 pagesBasic Scenario 8: Teresa Martin (2016)Center for Economic ProgressNo ratings yet

- Basic Scenario 8: Valerie Sinclair (2017)Document8 pagesBasic Scenario 8: Valerie Sinclair (2017)Center for Economic Progress0% (1)

- CEP Wage HandoutDocument1 pageCEP Wage HandoutCenter for Economic ProgressNo ratings yet

- Basic Scenario 7: Warren and Shirley Graves (2016)Document8 pagesBasic Scenario 7: Warren and Shirley Graves (2016)Center for Economic ProgressNo ratings yet

- Advanced Scenario 8: Enrique Clayton (2016)Document8 pagesAdvanced Scenario 8: Enrique Clayton (2016)Center for Economic ProgressNo ratings yet

- Advanced Scenario 5: Lamar Wharton (2017)Document9 pagesAdvanced Scenario 5: Lamar Wharton (2017)Center for Economic ProgressNo ratings yet

- SoC Training (2016)Document25 pagesSoC Training (2016)Center for Economic ProgressNo ratings yet

- Basic Scenario 9: Evan James Swift (2016)Document8 pagesBasic Scenario 9: Evan James Swift (2016)Center for Economic ProgressNo ratings yet

- Advanced Scenario 7: Elliot and Kathy Blackburn (2016)Document10 pagesAdvanced Scenario 7: Elliot and Kathy Blackburn (2016)Center for Economic ProgressNo ratings yet

- Advanced Scenario 5: Matthew Clark (2016)Document9 pagesAdvanced Scenario 5: Matthew Clark (2016)Center for Economic ProgressNo ratings yet

- Restructuring The EITC: A Credit For The Modern WorkerDocument11 pagesRestructuring The EITC: A Credit For The Modern WorkerCenter for Economic ProgressNo ratings yet

- Advanced Scenario 6: Kelly Floyd (2016)Document7 pagesAdvanced Scenario 6: Kelly Floyd (2016)Center for Economic ProgressNo ratings yet

- Biocon Biologics India Limited Biocon Park, Plot Nos. 2,3,4 & 5 Bangalore-560099 Tel:+91 28082808 Fax: +91Document1 pageBiocon Biologics India Limited Biocon Park, Plot Nos. 2,3,4 & 5 Bangalore-560099 Tel:+91 28082808 Fax: +91Siddiq MohammedNo ratings yet

- Accomplishment Report (Summer Job)Document2 pagesAccomplishment Report (Summer Job)aileendavadellomosNo ratings yet

- 2ADocument14 pages2ADarshan gowdaNo ratings yet

- Imprisonment For Six Months Imprisonment For One Year A Fine Equal To The Amount of Tax PayableDocument2 pagesImprisonment For Six Months Imprisonment For One Year A Fine Equal To The Amount of Tax Payablectgshabbir3604No ratings yet

- Estate Tax Return 1801: Actual Funeral Expenses or 5% of Gross EstateDocument2 pagesEstate Tax Return 1801: Actual Funeral Expenses or 5% of Gross EstateMauro Cabading IIINo ratings yet

- Chapter 12Document4 pagesChapter 12Valentina Tan DuNo ratings yet

- Improperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaDocument3 pagesImproperly Accumulated Earnings Tax Return: Mac Arthur Highway, Brgy. Dolores, City of San Fernando, PampangaTrisha Mae Mendoza MacalinoNo ratings yet

- DGT Form&COR-TerrascopeDocument3 pagesDGT Form&COR-TerrascopeNovi IndrianiNo ratings yet

- College Accounting Chapters 1-27-23rd Edition Heintz Solutions ManualDocument23 pagesCollege Accounting Chapters 1-27-23rd Edition Heintz Solutions Manualthomasgillespiesbenrgxcow100% (24)

- Detailed Analysis of Section 115BAA & Section 115BABDocument3 pagesDetailed Analysis of Section 115BAA & Section 115BABdamanoberoiNo ratings yet

- Notification No-15d-2018 (ST)Document1 pageNotification No-15d-2018 (ST)Pramod JainNo ratings yet

- At The Time of AdjustmentDocument4 pagesAt The Time of AdjustmentLavkesh SinghNo ratings yet

- Policy Deposit Receipt: Plan Component Premium Service Tax Applicable Cess Revival Charge (Late Fee) Total Premium PaidDocument1 pagePolicy Deposit Receipt: Plan Component Premium Service Tax Applicable Cess Revival Charge (Late Fee) Total Premium PaidMohit NarangNo ratings yet

- Minimum Corporate Income Tax (MCIT) Improperly Accumulated Earnings Tax (IAET) Gross Income Tax (GIT)Document18 pagesMinimum Corporate Income Tax (MCIT) Improperly Accumulated Earnings Tax (IAET) Gross Income Tax (GIT)Anne Mel Bariquit100% (1)

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDocument2 pagesVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Bsa 2105 Atty. F. R. Soriano Value-Added TaxDocument2 pagesBsa 2105 Atty. F. R. Soriano Value-Added Taxela kikayNo ratings yet

- Rev .MPL Qut - V30 & Bio Model (11.03.23)Document1 pageRev .MPL Qut - V30 & Bio Model (11.03.23)Er Raj VeerNo ratings yet

- 1 Ironwood Corporation Has Ordinary Taxable Income of 40 000 ForDocument1 page1 Ironwood Corporation Has Ordinary Taxable Income of 40 000 Forhassan taimourNo ratings yet

- 246 Sales Invoice Vrundavan ConstructionDocument1 page246 Sales Invoice Vrundavan ConstructionTikaram PatelNo ratings yet

- Assignment 4.2 Accounting For Income TaxDocument2 pagesAssignment 4.2 Accounting For Income TaxMon RamNo ratings yet

- 06.2 - LiabilitiesDocument2 pages06.2 - LiabilitiesDonna Abogado100% (1)

- Tax InvoiceDocument1 pageTax InvoicetestNo ratings yet

- Annexure V FDSSDocument5 pagesAnnexure V FDSSpmNo ratings yet

- Income Statement Vertical Analysis TemplateDocument2 pagesIncome Statement Vertical Analysis TemplateSope DalleyNo ratings yet

- Questions 2Document12 pagesQuestions 2venice cambryNo ratings yet

- Sample Self Certification FormDocument1 pageSample Self Certification FormSai PastranaNo ratings yet