Professional Documents

Culture Documents

Financial Calendar 2011-12

Uploaded by

Delma SebastianOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Calendar 2011-12

Uploaded by

Delma SebastianCopyright:

Available Formats

Financial Calendar 2011-12

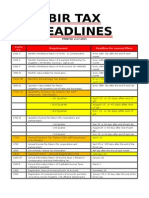

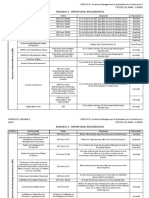

MONTH April 2011 Payment of TDS/TCS deducted/collected in previous month Submission of Form for no deduction of TDS/ TCS to IT Commissioner Filing of monthly VAT return for the previous month Service Tax Return for the half year ending on 31.03.2011 Issue of Monthly TDS/TCS certificate for previous month. Payment of TDS of 31st March 2011 May 2011 Payment of Service Tax of previous month by Companies Submission of Form for no deduction of TDS/ TCS to IT Commissioner Payment of TDS/TCS deducted/collected in previous month Filing of monthly VAT return for the previous month Filing of Quarterly TDS /TCS returns for March Quarter Issue of Monthly TDS/TCS certificate for previous month. Issue of TDS certificates F-16A for Quarter Issue of consolidated TDS certificates F-16 June 2011 Payment of Service Tax of previous month by Companies Submission of Form for no deduction of TDS/ TCS to IT Commissioner Payment of TDS/TCS deducted/collected in previous month Filing of monthly VAT return for the previous month Payment of Advance Income Tax : Companies (15%). Issue of Monthly TDS/TCS certificate for previous month. Issue of Form 16 A for Quarter July 2011 Payment of Service Tax of June Quarter by Firms & proprietors. Payment of Service Tax of previous month by Companies Payment of TDS/TCS deducted/collected in previous month Submission of Form for no deduction of TDS/ TCS to IT Commissioner Filing of Quarterly TDS return of NRIs for June Quarter Filing of monthly VAT return for the previous month Filing of Quarterly VAT return for the Qtr April to June Filing of Quarterly TDS /TCS returns for June Quarter Issue of Monthly TDS/TCS certificate for previous month. Filing of I.T. Returns by Individuals , HUF (without Audit) Filing of I.T. return by Firms, AOPs, BOIs(inc FBT) (without audit) Filing of I.T. Return by Trusts, Political party etc.(inc FBT) DUE DATE 7-Apr-11 7-Apr-11 15-April-11 25-Apr-11 30-Apr-11 30-Apr-11 5-May-11 7-May-11 7-May-11 15-May-11 15-May-11 31-May-11 30-May-11 31-May-11 5-June-2011 7-June-2011 7-June-2011 15-June-11 15-June-2011 30-June-2011 30-June-2011 5-Jul-11 5-Jul-11 7-Jul-11 7-Jul-11 14-Jul-11 15-Jul-11 15-Jul-11 15-Jul-11 31-Jul-11 31-Jul-11 31-Jul-11 31-Jul-11

E Filing of KVAT Annual Return August 2011 Payment of Service Tax of previous month by Companies Submission of Form for no deduction of TDS/ TCS to IT Commissioner Payment of TDS/TCS deducted/collected in previous month Filing of monthly VAT return for the previous month Annual Information Return by Banks, Credit card companies etc. Issue of Monthly TDS/TCS certificate for previous month. Sept 2011 Payment of Service Tax of previous month by Companies Submission of Form for no deduction of TDS/ TCS to IT Commissioner Payment of TDS/TCS deducted/collected in previous month Filing of monthly VAT return for the previous month Payment of Advance Income Tax: Companies & Others : (30%) Issue of Monthly TDS/TCS certificate for previous month. Obtaining Tax Audit Report Filing of I.T. Returns by Individuals ,HUFs (Audit applicable) Filing of I.T. Return by Firms,AOPs, BOIs(inc FBT) (Audit applicable) Filing of I.T. Returns by Companies (including FBT) Filing of I.T. Return for Trusts, Political party etc.(inc FBT) (Audit applicable) Filing of FBT return of Audit Cases (Only FBT Return) Filing of Wealth Tax Return October 2011 Payment of Service Tax of previous month by Companies Payment of Service Tax of September Quarter by Firms & proprietors Payment of TDS/TCS deducted/collected in previous month Submission of Form for no deduction of TDS/ TCS to IT Commissioner Filing of Quarterly TDS return of NRIs for September quarter Filing of monthly VAT return for the previous month Filing of Quarterly VAT return for the Qtr July to Sept. Filing of Quarterly TDS /TCS returns for September quarter Filing of Half Yearly Service Tax return. ( April to September) Issue of Monthly TDS/TCS certificate for previous month. November 2011 Payment of Service Tax of previous month by Companies Payment of TDS/TCS deducted/collected in previous month Submission of Form for no deduction of TDS/ TCS to IT Commissioner Filing of monthly VAT return for the previous month

31-Jul-11 5-Aug-11 7-Aug-11 7-Aug-11 15-Aug-11 31-Aug-11 31-Aug-11 5-Sep-11 7-Sep-11 7-Sep-11 15-Sep-11 15-Sep-11 30-Sep-11 30-Sep-11 30-Sep-11 30-Sep-11 30-Sep-11 30-Sep-11 30-Sep-11 30-Sep-11 5-Oct-11 5-Oct-11 7-Oct-11 7-Oct-11 14-Oct-11 15-Oct-11 15-Oct-11 15-Oct-11 25-Oct-11 31-Oct-11 5-Nov-11 7-Nov-11 7-Nov-11 15-Nov-11

Issue of Monthly TDS/TCS certificate for previous month. December 2011 Payment of Service Tax of previous month by Companies Submission of Form for no deduction of TDS/ TCS to IT Commissioner Payment of TDS/TCS deducted/collected in previous month Filing of monthly VAT return for the previous month Payment of Advance Income Tax : Companies & Others (60%) Issue of Monthly TDS/TCS certificate for previous month. Last date of filing Annual Return FC-3 under FCRA Filing of KVAT Audit Report January 2012 Payment of Service Tax of previous month by Companies Payment of Service Tax of December Quarter by Firms & proprietors Payment of TDS/TCS deducted/collected in previous month Submission of Form for no deduction of TDS/ TCS to IT Commissioner Filing of Quarterly TDS return of NRIs for December quarter Filing of monthly VAT return for the previous month Filing of Quarterly VAT return for the Qtr Oct. to Dec. Filing of Quarterly TDS /TCS returns for December quarter Issue of Monthly TDS/TCS certificate for previous month. February 2012 Payment of Service Tax of previous month by Companies Payment of TDS/TCS deducted/collected in previous month Submission of Form for no deduction of TDS/ TCS to IT Commissioner Filing of monthly VAT return for the previous month Issue of Monthly TDS/TCS certificate for previous month. March 2012 Payment of Service Tax of previous month by Companies Submission of Form for no deduction of TDS/ TCS to IT Commissioner Payment of TDS/TCS deducted/collected in previous month Filing of monthly VAT return for the previous month Payment of Advance Income Tax : Companies & Others (100%) Issue of Monthly TDS/TCS certificate for previous month. Last date of filing Annual Return FC-3 under FCRA

30-Nov-11 5-Dec-11 7-Dec-11 7-Dec-11 15-Dec-11 15-Dec-11 31-Dec-11 31-Dec-11 31-Dec-11 5-Jan-12 5-Jan-12 7- Jan -12 7- Jan -12 14- Jan -12 15-Jan-12 15-Jan-12 15- Jan -12 31- Jan -12 5-Feb-12 7-Feb-12 7-Feb-12 15-Feb-12 30-Feb-12 5-Mar-12 7-Mar-12 7-Mar-12 15-Mar-12 15-Mar-12 31-Mar-12 31-Mar-12

You might also like

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Do RememberDocument6 pagesDo RememberRohit KariwalaNo ratings yet

- 12 Compliance ChartDocument19 pages12 Compliance CharttabrezullakhanNo ratings yet

- Tax Alert June 11Document1 pageTax Alert June 11nightsaraNo ratings yet

- Financial Calendar 2010 - 2011: Month Due DateDocument3 pagesFinancial Calendar 2010 - 2011: Month Due Daterichard_paradise7625No ratings yet

- Tax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableDocument1 pageTax Alert - Due Date Wise Month Mar-10: S.No. Due Date Act Event Frequency Period Form ApplicableCA Arpit YadavNo ratings yet

- Compliance Due Date Event Name: Compliance Calender For The Month of November 2012Document6 pagesCompliance Due Date Event Name: Compliance Calender For The Month of November 2012kumar_anil666No ratings yet

- Calender 09 Service TaxDocument4 pagesCalender 09 Service TaxkingindiaNo ratings yet

- SN Vertical Due Dates Particular Consequence of Non ComplianceDocument1 pageSN Vertical Due Dates Particular Consequence of Non ComplianceNikhil KasatNo ratings yet

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Corporate CalenderDocument12 pagesCorporate CalenderNikhil DaroliaNo ratings yet

- Interest 234abc CalculatorDocument8 pagesInterest 234abc CalculatorcraszysaurabhNo ratings yet

- Due Dates For Filing Various Statutory Returns ACT Due Date Particulars TDSDocument1 pageDue Dates For Filing Various Statutory Returns ACT Due Date Particulars TDSMandira KollaliNo ratings yet

- Tax CalenderDocument13 pagesTax CalenderAtul KawaleNo ratings yet

- Key Dates November 2014 DUE Dates Particulars Form / Challan NumberDocument2 pagesKey Dates November 2014 DUE Dates Particulars Form / Challan NumberAnkur AroraNo ratings yet

- TAX PAYER GUIDE MannualDocument7 pagesTAX PAYER GUIDE MannualLevi Lazareno EugenioNo ratings yet

- ITR3Q11Document67 pagesITR3Q11Klabin_RINo ratings yet

- Important Financial Date(s) Reminder For Fin. Year-2014-2015Document16 pagesImportant Financial Date(s) Reminder For Fin. Year-2014-2015SureshArigelaNo ratings yet

- Reminders - Due DatesDocument7 pagesReminders - Due Datesdhuno teeNo ratings yet

- Briefing MADE EASY-LUCILLEDocument51 pagesBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezNo ratings yet

- Statutory Compliances - GeneralDocument25 pagesStatutory Compliances - GeneralajaydhageNo ratings yet

- New TDS RulesDocument1 pageNew TDS RulesShrenik VoraNo ratings yet

- How To Calculate Ur Income TaxDocument3 pagesHow To Calculate Ur Income TaxrazeemshipNo ratings yet

- Deadline For Govt Reports & FormsDocument6 pagesDeadline For Govt Reports & FormsKrisha AlcozerNo ratings yet

- Tax 2015Document12 pagesTax 2015Mohamad Nazmi Shamsul KamalNo ratings yet

- G4-Strataxman-Bir Form and DeadlinesDocument4 pagesG4-Strataxman-Bir Form and DeadlinesKristen StewartNo ratings yet

- Witholding TaxDocument68 pagesWitholding TaxReynante GungonNo ratings yet

- Bir Filings When To FileDocument1 pageBir Filings When To FileJehiel ImbocNo ratings yet

- BIR - Invoicing RequirementsDocument17 pagesBIR - Invoicing RequirementsCkey ArNo ratings yet

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezNo ratings yet

- What Is Payroll?Document12 pagesWhat Is Payroll?vishnukant mishraNo ratings yet

- Nepal TaxDocument7 pagesNepal Taxsanjay kafleNo ratings yet

- Reportorial RequirementsDocument5 pagesReportorial RequirementsMelaine A. FranciscoNo ratings yet

- 25 - MCQ Late Filing Fees and PenaltyDocument12 pages25 - MCQ Late Filing Fees and PenaltyParth UpadhyayNo ratings yet

- Memorandum Order No. 2016-003 - PEZADocument19 pagesMemorandum Order No. 2016-003 - PEZAYee BeringuelaNo ratings yet

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiNo ratings yet

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

- August Month CompliancesDocument1 pageAugust Month CompliancesNikhil KasatNo ratings yet

- 2551Q Jan 2018 ENCS Final Rev 3 - Copy BIR WebsiteDocument9 pages2551Q Jan 2018 ENCS Final Rev 3 - Copy BIR Websitedindi genilNo ratings yet

- BIR RDO 113 Taxpayers' Compliance Guide 2019Document4 pagesBIR RDO 113 Taxpayers' Compliance Guide 2019Noli Heje de Castro Jr.100% (1)

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- IT-2 2011 With Formula and Surcharge and Annex DDocument15 pagesIT-2 2011 With Formula and Surcharge and Annex DPatti DaudNo ratings yet

- Valu E-Adde D TaxDocument18 pagesValu E-Adde D TaxXavier Hawkins Lopez ZamoraNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- BIR 1702Q FormDocument3 pagesBIR 1702Q FormyellahfellahNo ratings yet

- 2011quiz4-Deferred Tax PDFDocument2 pages2011quiz4-Deferred Tax PDFSandhya91No ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- Annual Corporate Tax Reports Due Last Month, and Failure To Report Will Face FinesDocument2 pagesAnnual Corporate Tax Reports Due Last Month, and Failure To Report Will Face FinesIntan Rahma DhiantiNo ratings yet

- Scenario 1# You Do Not Have Outstanding Tax LiabilityDocument7 pagesScenario 1# You Do Not Have Outstanding Tax LiabilityBhupendra SharmaNo ratings yet

- WTAXESDocument31 pagesWTAXESlance757No ratings yet

- (Return To Index) : DescriptionDocument13 pages(Return To Index) : DescriptionTara ManteNo ratings yet

- Additonal Disclosure RR 15 2010Document5 pagesAdditonal Disclosure RR 15 2010Emil A. MolinaNo ratings yet

- The Following Information Is Required For Tax Auditaddress Where Books of AccountsDocument3 pagesThe Following Information Is Required For Tax Auditaddress Where Books of AccountsJasmeet DhamijaNo ratings yet

- Due Dates April 2014Document1 pageDue Dates April 2014Ramesh KrishnanNo ratings yet

- B9-057-VanshPatel-Assignment 2Document9 pagesB9-057-VanshPatel-Assignment 2Vansh PatelNo ratings yet

- DSCN - Shree AutomotiveDocument24 pagesDSCN - Shree AutomotiveNikhilesh BhattacharyyaNo ratings yet

- Value Added TaxDocument22 pagesValue Added TaxJ-Lem CachoNo ratings yet

- RMC No 15-2015 Deferment of Implementation On Identified Withholding Tax FormsDocument2 pagesRMC No 15-2015 Deferment of Implementation On Identified Withholding Tax FormsphilippinecpaNo ratings yet

- LESCO - Web Bill-February 2023Document2 pagesLESCO - Web Bill-February 2023MudassirNo ratings yet

- Midterm Exam - TaxationDocument5 pagesMidterm Exam - TaxationGANNLAUREN SIMANGANNo ratings yet

- Swatantra High School Lucknow: Total Salary (Amount in Word) :-Rs. One Lakh Eight Thousand One Hundred Fifty Four OnlyDocument1 pageSwatantra High School Lucknow: Total Salary (Amount in Word) :-Rs. One Lakh Eight Thousand One Hundred Fifty Four Onlyashu singhNo ratings yet

- 1647 Ibdkhaxambf6ktvhyrpw Form 16-2018-2019Document10 pages1647 Ibdkhaxambf6ktvhyrpw Form 16-2018-2019sossmsNo ratings yet

- Invoice 1Document1 pageInvoice 1Subham AgarwalNo ratings yet

- Bid 1323433Document2 pagesBid 1323433Amit SharmaNo ratings yet

- CSTC College of Sciences Technology and Communication, IncDocument35 pagesCSTC College of Sciences Technology and Communication, IncJohn Patrick MercurioNo ratings yet

- GST in IndiaDocument13 pagesGST in IndiaDeepesh SinghNo ratings yet

- Tan v. Del Rosario G.R. No. 109289 October 3, 1994: Vitug, J.: FactsDocument2 pagesTan v. Del Rosario G.R. No. 109289 October 3, 1994: Vitug, J.: FactsNinya SaquilabonNo ratings yet

- Department of Labor: Uc2Document2 pagesDepartment of Labor: Uc2USA_DepartmentOfLaborNo ratings yet

- 2 - Nike (Apparel)Document2 pages2 - Nike (Apparel)Matt BrownNo ratings yet

- 1575614292325Document8 pages1575614292325Kalimuddin KhanNo ratings yet

- Description From Currency To Currency Recipient Receive Exchange Rate Amount DueDocument1 pageDescription From Currency To Currency Recipient Receive Exchange Rate Amount DueJOMBANG TIMOERNo ratings yet

- AsiaPay Company Profile 2022Document28 pagesAsiaPay Company Profile 2022Firman MuntenaarNo ratings yet

- Guide Relevant Life InsuranceDocument8 pagesGuide Relevant Life Insurancepderby1No ratings yet

- Income Tax Schemes, Accounting Periods, Accounting Methods and ReportingDocument32 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods and ReportingSassy GirlNo ratings yet

- Debit Mastercard For Single Message System Guide: 25 October 2018Document83 pagesDebit Mastercard For Single Message System Guide: 25 October 2018Fernando NiscaNo ratings yet

- Chandra Enterprises CRN-3Document1 pageChandra Enterprises CRN-3Aarvee FoodNo ratings yet

- FINAL 2011 Sponsor PacketDocument7 pagesFINAL 2011 Sponsor PacketRich CarrNo ratings yet

- Gra Nhil ReturnDocument2 pagesGra Nhil ReturnpapapetroNo ratings yet

- AX Educted at Ource - I: KPPM & AssociatesDocument67 pagesAX Educted at Ource - I: KPPM & AssociatesSaksham JoshiNo ratings yet

- Dealers Name Gstin Invoice No Invoice Date Invoice Value Taxable Value Tax Rate CGST SGSTDocument1 pageDealers Name Gstin Invoice No Invoice Date Invoice Value Taxable Value Tax Rate CGST SGSTMohd. Irfan AnsariNo ratings yet

- Solved Comet Operates Solely Within The United States It Owns Two PDFDocument1 pageSolved Comet Operates Solely Within The United States It Owns Two PDFAnbu jaromiaNo ratings yet

- PrintDocument3 pagesPrintAmirul SyakirNo ratings yet

- South African Airways V CIRDocument4 pagesSouth African Airways V CIRJerico Godoy0% (1)

- Jan-19 PDFDocument2 pagesJan-19 PDFPriya Gujar100% (1)

- Hotel Voucher - B0723B0ETQDocument1 pageHotel Voucher - B0723B0ETQBouka VoyagesNo ratings yet

- My Sip 2021-22Document28 pagesMy Sip 2021-22Xenqiyj XyenttukNo ratings yet

- Real Estate GuruDocument26 pagesReal Estate GuruRaghu Ram100% (3)

- Invoice: Bill NoDocument16 pagesInvoice: Bill NoGihan DissanayakaNo ratings yet