Professional Documents

Culture Documents

Table 1 Determinants of CSH and FCFS Monthly Returns

Uploaded by

msalmangulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Table 1 Determinants of CSH and FCFS Monthly Returns

Uploaded by

msalmangulCopyright:

Available Formats

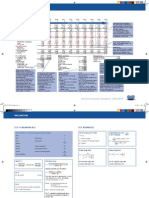

Table 1 Determinants of CSH and FCFS Monthly Returns CSH -0.2022 (-1.7934) Oil Price -0.2770 (-1.

1985) Consumer Credit -0.0003 (-0.2460) CPI -0.0092 (-0.4125) Unemployment Rate 0.0176 (1.6411) Consumer Confidence 0.0043 (1.0541) S&P 500 1.5691 (4.6192)** Gold Price -0.9060 (-3.2709)** Sample Size 34 R-squared 0.651 ** The coefficient is significant at the 1% level t-statistics are reported in parentheses Variable Intercept FCFS 0.0055 (0.0577) -0.3395 (-1.7268) -0.0003 (-0.2260) -0.0029 (-0.1539) -0.0027 (-0.2908) 0.0028 (0.8003) 1.1549 (3.9976)** -0.3985 (-1.6916) 34 0.457

The dependent variables in these regressions are the log monthly returns of CSH and FCFS. The S&P 500, oil price, and gold price have also been converted into log monthly returns. In this regression, we use the Federal Reserve Consumer Credit Index as an indicator of credit that consumers have access to in the US economy. For consumer confidence, we used the Conference Board Consumer Confidence Index. All of the economic data that were used in this regression are reported monthly and obtained from Bloomberg. The data is from August 2008 to September 2011. These regressions hope to capture the effect of various macroeconomic variables on the monthly returns of CSH and FCFS stocks. The only factors that are relevant to monthly returns of CSH stock are the monthly returns of the S&P 500 and gold. It is surprising to see that an increase in gold price decreases the monthly return of CSH stock. This result may arise from the short time series data that we have. For FCFS, the only significant factor is the monthly return of the S&P 500.

Table 2 CSH CAPM & 4-Factor Model Variable Alpha Beta S&P 500 Beta CRSP Index Size Growth Momentum CAPM 1 0.006 (0.961) 0.891 (5.732)** CAPM 2 0.006 (0.815) 0.965 (6.309)** 4-Factor 0.004 (0.620) 0.858 (5.260)** 0.856 (4.139)** 0.499 (2.215)* -0.192 (-1.402) 276 0.189

Sample Size 285 276 R-squared 0.104 0.127 * The coefficient is significant at the 5% level ** The coefficient is significant at the 1% level t-statistics are reported in parentheses

These regressions use monthly returns of CSH, S&P 500, and CRSP Index since the inception of CSH. The Size variable is the difference between the returns of small and large market capitalization companies in the CRSP Index. Hence, the coefficient for the Size variable is the exposure that the stock has to the excess return that small companies have over large ones. The Growth variable is the excess return that value companies have over growth companies. We define value companies as high book to market ratio and growth companies as those that have low book to market ratio. The coefficient for this variable is the exposure that the stock has to changes in this excess returns. The Momentum variable captures the idea that winning stocks tend to keep winning and losing stocks tend to keep losing. The variable is the return on the trading strategy that calibrates the portfolio every month such that we hold the winners and short the losers. Hence, this variable captures the long/short spread between winning stocks and losing stocks over time. CSHs beta to the S&P 500 is 0.891 and to the CRSP Index is 0.965. CSH has significant exposure to the excess return that small companies have over large ones and the excess return that value companies have over growth companies. The beta of the size factor is 0.856 and the beta to the growth factor is 0.499. CSH monthly returns do not have significant exposure to the momentum factor.

Table 3 FCFS CAPM & 4-Factor Model Variable Alpha Beta S&P 500 Beta CRSP Index Size Growth Momentum CAPM 1 0.015 (1.676) 0.603 (2.952)** CAPM 2 0.014 (1.5) 0.665 (3.3)** 4-Factor 0.01 (1.106) 0.568 (2.598)* 0.942 (3.41)** 0.503 (1.737) -0.043 (-0.246) 276 0.099

Sample Size 285 276 R-squared 0.037 0.048 * The coefficient is significant at the 5% level ** The coefficient is significant at the 1% level t-statistics are reported in parentheses

These regressions use monthly returns of FCFS, S&P 500, and CRSP Index since the inception of FCFS. The variables in this table are the same as those in the previous table. FCFSs beta to the S&P 500 is 0.603 and to the CRSP Index is 0.665. FCFS has significant exposure to the excess return that small companies have over large ones and the excess return that value companies have over growth companies. The beta of the size factor is 0.942. FCFS has no significant exposure to the growth or momentum factor.

Table 4 CSH & FCFS APT Model CSH FCFS 0.011 0.020 (1.638) (2.238)* Beta S&P 500 0.923 0.506 (6.368)** (2.455)* Gold -0.017 -0.085 (-0.120) (-0.449) Peso -0.063 -0.219 (-0.416) (-1.080) Sample Size 290 231 R-squared 0.137 0.042 * The coefficient is significant at the 5% level ** The coefficient is significant at the 1% level t-statistics are reported in parentheses This regression uses monthly returns on CSH, FCFS, S&P 500, and gold since the inception of CSH and FCFS. The Peso variable is the monthly USD to Peso exchange rate. In this model, the only significant exposure that CSH and FCFS have is to the risk premium of the S&P 500. The two stocks have no significant exposure to changes in gold prices and USD to Peso exchange rate. The fact that the alpha for FCFS is statistically significant can indicate that these three factors do not fully explain the monthly returns of the stock because some excess return remains. Variable Alpha

You might also like

- Summative Assignment 1Document3 pagesSummative Assignment 1Han XiaNo ratings yet

- International Bond Pricing Homework: OutputDocument7 pagesInternational Bond Pricing Homework: OutputvikbitNo ratings yet

- IT Sector Update: Demand Improvement Key for UpsideDocument20 pagesIT Sector Update: Demand Improvement Key for UpsidePritam WarudkarNo ratings yet

- Fidelity SnapshotDocument1 pageFidelity SnapshotAnanya DasNo ratings yet

- 2015 q1 Crescent FundDocument20 pages2015 q1 Crescent FundCanadianValue0% (1)

- Delta Life Insurance Company LTDDocument5 pagesDelta Life Insurance Company LTDAk TanvirNo ratings yet

- Opening Bell: Key Points Index Movement (Past 5 Days)Document14 pagesOpening Bell: Key Points Index Movement (Past 5 Days)Sandeep AnandNo ratings yet

- Value and Momentum During RecessionsDocument3 pagesValue and Momentum During RecessionsZerohedgeNo ratings yet

- Sainsbury Vs Tesco: Sainsbury'S Strategic Recovery PlanDocument15 pagesSainsbury Vs Tesco: Sainsbury'S Strategic Recovery PlanAdnan ShafiqueNo ratings yet

- Global Financial Managemnt Project Report ON: Beyond CAPM Beta: Measures of Risk in Portfolio Risk-Return AnalysisDocument10 pagesGlobal Financial Managemnt Project Report ON: Beyond CAPM Beta: Measures of Risk in Portfolio Risk-Return Analysissayandas87No ratings yet

- Quatitative AnalysisDocument24 pagesQuatitative AnalysisGarick BhatnagarNo ratings yet

- Welcome TO Project SeminorDocument18 pagesWelcome TO Project SeminorRamNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- CompensationDocument14 pagesCompensationAnshu SethiaNo ratings yet

- Nestle IndiaDocument38 pagesNestle Indiarranjan27No ratings yet

- AgilityDocument5 pagesAgilityvijayscaNo ratings yet

- Credit Suisse (Incl. NPV Build Up)Document23 pagesCredit Suisse (Incl. NPV Build Up)rodskogjNo ratings yet

- Feruz BelarusDocument2 pagesFeruz BelarusabdulazizbakhshilloevNo ratings yet

- III. Estimating Growth: DCF ValuationDocument48 pagesIII. Estimating Growth: DCF Valuationiqrajawed11No ratings yet

- (1.1) Returns and RisksDocument14 pages(1.1) Returns and Riskspv007rocksNo ratings yet

- Corporate Finance 9th Edition Ross Solutions ManualDocument33 pagesCorporate Finance 9th Edition Ross Solutions Manualtaylorhughesrfnaebgxyk100% (25)

- Tesla (TSLA) - WedbushDocument9 pagesTesla (TSLA) - WedbushpachzevelNo ratings yet

- Radford Alert Iss Burn Rate Limits For 2014 PDFDocument5 pagesRadford Alert Iss Burn Rate Limits For 2014 PDFjoeymcyoungNo ratings yet

- Singapore Company Focus: HOLD S$3.70Document9 pagesSingapore Company Focus: HOLD S$3.70LuiYuKwangNo ratings yet

- BKM Chapter 7Document43 pagesBKM Chapter 7Isha0% (1)

- Full-Information Forecasting, Valuation, and Business Strategy AnalysisDocument56 pagesFull-Information Forecasting, Valuation, and Business Strategy AnalysisRitesh Batra100% (4)

- Case Background: Bhupesh Kumar (B18018)Document7 pagesCase Background: Bhupesh Kumar (B18018)Bhupesh KumarNo ratings yet

- Max KotakDocument26 pagesMax KotakMary GonsalvesNo ratings yet

- Daily Equity Report 3 February 2015Document4 pagesDaily Equity Report 3 February 2015NehaSharmaNo ratings yet

- Multiple Logistic Regression Model-LPDocument7 pagesMultiple Logistic Regression Model-LPmanjushreeNo ratings yet

- Financial RatiosDocument78 pagesFinancial Ratiospun33tNo ratings yet

- Forecasting Bangladesh Inflation Using ARIMADocument27 pagesForecasting Bangladesh Inflation Using ARIMAAronno TonmoyNo ratings yet

- Solution MT PS 02Document2 pagesSolution MT PS 02asukachan8059No ratings yet

- 1.+returns+exercise 1 2021 1 - 1 - 1Document3 pages1.+returns+exercise 1 2021 1 - 1 - 1sanchiNo ratings yet

- Oversubscription and IPO Underpricing: Evidence From IndiaDocument15 pagesOversubscription and IPO Underpricing: Evidence From IndiaSumit SharmaNo ratings yet

- (Turn In) Homework 3 EconometricsDocument3 pages(Turn In) Homework 3 EconometricsSiti Maghfirotul UlyahNo ratings yet

- Chapter 10Document14 pagesChapter 10Vidyasagar Ayyappan100% (1)

- An Empirical Analysis of The Capital Asset Pricing ModelDocument12 pagesAn Empirical Analysis of The Capital Asset Pricing ModelSai ReddyNo ratings yet

- Corporate Finance Term Paper on Bangas LimitedDocument14 pagesCorporate Finance Term Paper on Bangas LimitedAshikur Rahman ShikuNo ratings yet

- Price-Book Value Ratio: DefinitionDocument25 pagesPrice-Book Value Ratio: DefinitionRajvachan ManiNo ratings yet

- BM&F Bovespa 2Q08 Earnings Conference Call August 15thDocument31 pagesBM&F Bovespa 2Q08 Earnings Conference Call August 15thBVMF_RINo ratings yet

- DCF FCFF ValuationDocument0 pagesDCF FCFF ValuationSneha SatyamoorthyNo ratings yet

- Aria 2Document5 pagesAria 2Susan LaskoNo ratings yet

- Ishares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummaryDocument3 pagesIshares Core S&P Mid-Cap Etf: Historical Price Performance Quote SummarywanwizNo ratings yet

- Steelpath MLP InfographicDocument2 pagesSteelpath MLP Infographicapi-247644767No ratings yet

- Financial Economics Assignment 1Document20 pagesFinancial Economics Assignment 1Diana CarilloNo ratings yet

- Data-Driven Marketing Strategy OptimizationDocument13 pagesData-Driven Marketing Strategy Optimizationtiger_71100% (2)

- Boost savings and returns with Axis Long Term Equity FundDocument2 pagesBoost savings and returns with Axis Long Term Equity FundAmandeep SharmaNo ratings yet

- Four Factor Performance AttributionDocument15 pagesFour Factor Performance AttributionSuraj PadhyNo ratings yet

- HDFC Life Crest IllustrationDocument0 pagesHDFC Life Crest IllustrationAnkur SrivastavNo ratings yet

- ValuEngine Weekly Newsletter September 30, 2011Document12 pagesValuEngine Weekly Newsletter September 30, 2011ValuEngine.comNo ratings yet

- Multiplier Method: Business Analysis and ValuationDocument53 pagesMultiplier Method: Business Analysis and Valuationchinum1No ratings yet

- K-REIT Acquires Additional Stake in Ocean Financial CentreDocument5 pagesK-REIT Acquires Additional Stake in Ocean Financial Centrecentaurus553587No ratings yet

- CQF January 2023 M1L1 BlankDocument52 pagesCQF January 2023 M1L1 BlankAntonio Cifuentes GarcíaNo ratings yet

- List of Tables and Figures Page NoDocument18 pagesList of Tables and Figures Page NoNaila MehboobNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Stock Evaluation PDFDocument11 pagesStock Evaluation PDFmaxmunirNo ratings yet

- Portfolio Project Final Report WordfileDocument18 pagesPortfolio Project Final Report WordfileAwais (F-Name Jan Muhammad)No ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Matching Funds Statement: Heather MizeurDocument236 pagesMatching Funds Statement: Heather MizeurJeff QuintonNo ratings yet

- TVOM and Equivalent Cash Flow ProblemsDocument3 pagesTVOM and Equivalent Cash Flow ProblemsAnonymous XybLZfNo ratings yet

- Estmt - 2020-01-09 (1) ESTADODECUENTABOFADocument10 pagesEstmt - 2020-01-09 (1) ESTADODECUENTABOFAfranvi100% (1)

- ACC101 - Accounting for ReceivablesDocument15 pagesACC101 - Accounting for Receivablesinfinite_dreamsNo ratings yet

- Cyprus Isn't Even Such A Big Offshore Bank HavenDocument2 pagesCyprus Isn't Even Such A Big Offshore Bank HavenAna MariaNo ratings yet

- Investment FormulasDocument14 pagesInvestment Formulasgatete samNo ratings yet

- Economics+3 04+Making+a+Budget+and+Savings+PlanDocument6 pagesEconomics+3 04+Making+a+Budget+and+Savings+Plansylvia seletoNo ratings yet

- Book ListDocument10 pagesBook Listdj1284No ratings yet

- Case Study Legal Aspects & NI ActDocument23 pagesCase Study Legal Aspects & NI Actvarun_bathula100% (1)

- Friday, 26 Aug 2016, 03:55Pm: Efixed Deposit/Eterm Deposit-I: Account Number: Principal AmountDocument4 pagesFriday, 26 Aug 2016, 03:55Pm: Efixed Deposit/Eterm Deposit-I: Account Number: Principal AmountIDA MUSZNo ratings yet

- Cryptocurrency - Tips & Strategies For Your Investing Success by Dexter SanchezDocument75 pagesCryptocurrency - Tips & Strategies For Your Investing Success by Dexter SanchezgfgfgfgNo ratings yet

- Cash Flow AssumptionDocument3 pagesCash Flow AssumptionEsperas KevinNo ratings yet

- Financing Your New VentureDocument33 pagesFinancing Your New Venturetytry56565No ratings yet

- 3 - FINREP - EBA ITS - v2.8Document34 pages3 - FINREP - EBA ITS - v2.8Miguel Angel OrtizNo ratings yet

- CGTMSE - Scheme Document CGS I - Updated As On March 31, 2022 PDFDocument26 pagesCGTMSE - Scheme Document CGS I - Updated As On March 31, 2022 PDFkarthik kvNo ratings yet

- Statement of Purpose: Gurupdesh Kaur, A Prospective Student For Canada. I Am A Permanent Resident ofDocument3 pagesStatement of Purpose: Gurupdesh Kaur, A Prospective Student For Canada. I Am A Permanent Resident ofajayNo ratings yet

- Financial Analysis of Britannia and DaburDocument8 pagesFinancial Analysis of Britannia and DaburBiplab MondalNo ratings yet

- 8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Document8 pages8.2 Assignment - Regular Income Tax For Individuals (For Discussion)Roselyn LumbaoNo ratings yet

- Philstocks - PH: Customer Account Information FormDocument3 pagesPhilstocks - PH: Customer Account Information FormJayson Moreto VillavicencioNo ratings yet

- (VAL. METH.) I. Fundamental Principles of Valuation & II. Asset Valuation MethodsDocument15 pages(VAL. METH.) I. Fundamental Principles of Valuation & II. Asset Valuation MethodsJoanne SunielNo ratings yet

- pp16Document64 pagespp16Mousami BanerjeeNo ratings yet

- Forex Hedging Handout 1Document9 pagesForex Hedging Handout 1Sheira Mae GuzmanNo ratings yet

- Principle of Macro-Economics Mcq'sDocument6 pagesPrinciple of Macro-Economics Mcq'sSafiullah mirzaNo ratings yet

- Income Tax DepartmentDocument22 pagesIncome Tax DepartmentAkash GuptaNo ratings yet

- Sample ExamDocument5 pagesSample Exam范明奎No ratings yet

- Hotel Real Estate Investments & Asset Management CertificateDocument2 pagesHotel Real Estate Investments & Asset Management CertificateAsrarNo ratings yet

- 01 - Test - Emp 1Document15 pages01 - Test - Emp 1inderjeetkumar singhNo ratings yet

- 2p Kap Kcom 5102-6102 PDFDocument32 pages2p Kap Kcom 5102-6102 PDFbilalNo ratings yet

- Forex robot Leprechaun v 2.2 manualDocument25 pagesForex robot Leprechaun v 2.2 manualSimamkele Ntwanambi100% (1)

- CFAS Chapter 4 Q&ADocument1 pageCFAS Chapter 4 Q&ACINDY BALANONNo ratings yet