Professional Documents

Culture Documents

Assignment Question

Uploaded by

Xinyu YanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Question

Uploaded by

Xinyu YanCopyright:

Available Formats

Assignment Question: A married couple has come to you seeking your professional help in constructing a financial plan.

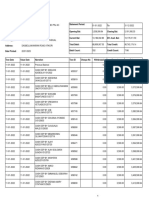

Their personal financial details are listed below: Deano and Tammy have two grown-up children (who do not live at home) and live in Sydney. Deano and Tammys ages are 60 and 59, respectively. Their risk profile is low, meaning they prefer to invest in defensive assets, although they are happy to also have some exposure to growth assets. Both Deano and Tammy are fully employed, earning $130,000 p.a. and $65,000 p.a. (before tax, respectively). Both receive superannuation contributions in addition these stated remuneration details at the rate of 9% p.a. of gross salary. The assets (and income) of the couple are all jointly held/received and include the following: o house valued at $1,000,000 o 2 cars (worth in total $120,000), one car is a 2011 Lexus IS 350 Prestige and one is a 1998 Honda NSX. o $120,000 invested in a cash management trust o $7,500 in a transactional bank account, for everyday living needs, which pays interest equal to 4.5% p.a. (interested credited monthly).

o $185,000 invested in 2 managed funds offered by two different investment institutions the first fund has 10% invested a balanced (multi-sector) fund (whose asset mix is 30% Australian shares, 20%

international shares, 15% listed property, 20% Australian fixed interest, 15% cash), and the other has remaining assets invested in another balanced fund with asset allocation as follows: 45% Australian shares, 25% international shares, 5% listed property, 10% Australian fixed interest, 5% international fixed interest, 10% cash) . o The couple own direct shares currently worth $173,000 - which were acquired from initial public offers or demutualisations Woolworths (20%), Telstra (13%), Commonwealth Bank (47%), NRMA (Insurance Australia Group) (10%, AMP (10%). Assume these companies all pay dividends that are fully franked (i.e. 100% imputed credit). (Visit the websites of these companies and obtain the dividend per share (DPS) information from their most recent annual report. Alternatively, visit the Australian Financial Reviews Market Wrap section to locate the DPS.) Value the shares as at Friday 26th August. Superannuation assets equal to $325,000 ($175,000 for Deano and $150,000 for Tammy) with a balanced asset allocation.

o Term deposit for 6 months, which matures in 3 months equal to $17,000, and pays interest at 7% p.a. o Both the House and Contents are fully insured. Contents are worth $157,000 to replace (if stolen or lost due to damage). No insurance cover exists for the cars, life insurance, health insurance, or income protection insurance. The liabilities of the couple are as follows:

o $300,000 mortgage (interest is paid at the variable rate of 7.21% p.a.) o $20,000 credit card liability (17% p.a. interest rate) o $30,000 personal loan (used for the new car) (rate is 12% p.a.). o $5,600 overdraft facility (i.e. a short-term debt) (15% p.a. interest rate) The estimated expenses of the couple amount to: o $3200 per week (includes all expenditure including debt repayments) o Plans for a round the world trip over 2 months which is estimated to cost them $A40,000 which needs to be provisioned in their savings plan. They plan to take the trip this year

Create a financial plan/statement of advice which will assist Deano and Tammy in achieving their life objectives. This should include but not be limited to: A) Clearly stating their short-term and long-term life objectives.

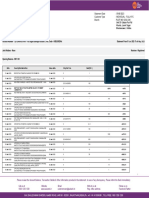

B) Using tables (which are clearly marked) provide the following review) a current budget (i.e. income and expenses) statement use assumptions if necessary but outline any of the assumptions); An aggregated asset/liability statement showing the financial position and net worth of the client. Using the current tax scales (available from the Australian Tax Offices website), calculate the income tax payable

by both Deano and Tammy (show all workings including the tax paid at each scale by both Deano and Tammy) for the last financial year. Assume (for simplicity) they have no allowable deductions or tax offsets. However, the dividend imputation issue needs to be included in your answer. Also include the Medicare levy as part of their tax assessments. What are the tax implications for couples who have no health insurance cover?

C) Show the asset allocation of Deano and Tammys total assets, decomposed into the areas of Australian shares, international shares, listed property, direct property, Australian fixed interest, international fixed interest and cash. You should also highlight which assets are directly held, and thoseassets which are indirect. To what extent might Tammy and Deano need to re-balance their asset allocation through time? Why might this be the case? D) Provide a brief discussion of the issues arising from their financial situation, including current strengths and weaknesses (problems). Incorporate ratio analysis in the discussion.

E) Discuss their superannuation and insurance arrangements and whether or not these are satisfactory.

F) Given the high level of tax paid by the couple, discuss possible options available to them to legally minimise their tax. In your assessment, identify the benefits/constraints of these strategies.

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BS Wira SartikaDocument1 pageBS Wira SartikaJGL MOTORNo ratings yet

- Uttar Pradesh Police - Employee Salary System2Document1 pageUttar Pradesh Police - Employee Salary System2aadi.klj.mahindra1998No ratings yet

- UntitledDocument485 pagesUntitledTowolawi AkeemNo ratings yet

- BACS Files For BarclaysDocument2 pagesBACS Files For BarclaysSunil GNo ratings yet

- SOC Branchless Banking APR JUN 2023 W.E - .F 01 Apr 2023 Final English VersionDocument2 pagesSOC Branchless Banking APR JUN 2023 W.E - .F 01 Apr 2023 Final English VersionOmer KhurshidNo ratings yet

- 49m Dr.gabriel_29may2020 EffendyDocument5 pages49m Dr.gabriel_29may2020 EffendyFaith Wave driveNo ratings yet

- 2023 01 20 23 09 42 PDFDocument13 pages2023 01 20 23 09 42 PDFSantosh Kumar GuptaNo ratings yet

- Liberty OnlineDocument1 pageLiberty OnlineKhushi AgarwalNo ratings yet

- Richwell Cash Balance UPDATEDDocument12 pagesRichwell Cash Balance UPDATEDRichwell AccountingNo ratings yet

- Source of CreditDocument2 pagesSource of Creditkhaireyah hashim100% (1)

- Internship Report HBLDocument93 pagesInternship Report HBLMuhammad AyanNo ratings yet

- Payment Advice SwathiSugarcaneJuice Qualcomm-20230619-20230621Document3 pagesPayment Advice SwathiSugarcaneJuice Qualcomm-20230619-20230621spraju1947No ratings yet

- Marathon 1 - Time Value of MoneyDocument116 pagesMarathon 1 - Time Value of Moneypriyanshusingh.inboxNo ratings yet

- Statement 1Document15 pagesStatement 1Adri antoNo ratings yet

- ADP - Direct - Deposit - Editable2Document1 pageADP - Direct - Deposit - Editable2MOHAMMED ALSHUAIBINo ratings yet

- G EJy BNK IXYJry 9 W VDocument1 pageG EJy BNK IXYJry 9 W Vdurga workspotNo ratings yet

- Payslip Mar 2023Document1 pagePayslip Mar 2023Hitesh ChauhanNo ratings yet

- A1170870172 - 23417 - 30 - 2019 - Worksheet - SICI PDFDocument2 pagesA1170870172 - 23417 - 30 - 2019 - Worksheet - SICI PDFadarsh rajNo ratings yet

- Interest - Definition and Types of Fees For Borrowing MoneyDocument16 pagesInterest - Definition and Types of Fees For Borrowing MoneyKimino NawaNo ratings yet

- Discuss How The Three Prime Bureaus (Experian, Equifax, and Transunion) - Differ in Credit Scoring?Document5 pagesDiscuss How The Three Prime Bureaus (Experian, Equifax, and Transunion) - Differ in Credit Scoring?Rianna DileNo ratings yet

- Form 12BB tax deductionsDocument2 pagesForm 12BB tax deductionsMayank JainNo ratings yet

- Cooperative AssignmentDocument2 pagesCooperative AssignmentWhite WhiteyNo ratings yet

- Compound InterestDocument29 pagesCompound InterestNicole Roxanne RubioNo ratings yet

- EDGAR Search Results for Foreign GovernmentsDocument2 pagesEDGAR Search Results for Foreign Governmentsgiacca90No ratings yet

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- HDFC Bank - Salary Account Offer Letter - Premium With Millennia DebitDocument16 pagesHDFC Bank - Salary Account Offer Letter - Premium With Millennia DebitSrinivasan candbNo ratings yet

- IBC Project AbhinavMathur 7B 1256Document5 pagesIBC Project AbhinavMathur 7B 1256Abhinav MathurNo ratings yet

- WEEK 1 - TVM and GrowthDocument32 pagesWEEK 1 - TVM and GrowthowenNo ratings yet

- Employee'S Provident Fund: Electronic Challan Cum Return (Ecr)Document3 pagesEmployee'S Provident Fund: Electronic Challan Cum Return (Ecr)manicsenthilNo ratings yet

- Uiopwaiver 263Document5 pagesUiopwaiver 263mike_mckeown_3No ratings yet