Professional Documents

Culture Documents

Moudassir Assignment

Uploaded by

Fayaz KhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Moudassir Assignment

Uploaded by

Fayaz KhanCopyright:

Available Formats

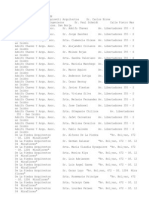

Student Name: Moudassir Habib Class: MBA - 3A Problem 4-20 SELZIK COMPANY Blending Department Production Report Quantity

Schedule and Equivalent Units Quantity Schedule Units to be accounted for: Work in process, July 1 Started into production Total units 10,000 170,000 180,000 Correct! Equivalent Units Materials Conversion Units accounted for as follows: Transferred to packaging: From beginning inventory Started and completed this month Work in process, July 31 Total units accounted for

9th e Problem 4-16

10,000 150,000 20,000

0 150,000 20,000 170,000 Correct!

7,000 150,000 8,000 165,000 Correct!

Costs per Equivalent Unit Cost to be accounted for: Work in process, July 1 Cost added during July Total cost to be accounted for Equivalent units Cost per equivalent unit Total Cost Materials Conversion Whole Unit $13,400 383,600 139,400 244,200 $397,000 170,000 165,000 $0.82 $1.48 $2.30 Correct! Correct! Correct!

Cost Reconciliation Total Cost Cost accounted for as follows: Transferred to packaging: From the beginning inventory: Cost in the beginning inventory Cost to complete these units Materials Conversion Total cost from beginning inventory Units started and completed this month Total cost transferred to packaging Work in process, July 31: Materials Conversion Total work in process, July 31 Total cost accounted for Equivalent Units Materials Conversion

$13,400 0 10,360 23,760 345,000 368,760 Correct! 16,400 11,840 28,240 $397,000 0 10,360 123,000 222,000 150000*2.3

16,400 11,840 Correct! Correct!

20000*.82 8000*1.48

Given Data P04-20: SELZIK COMPANY Production data: Units in process, July 1 Materials complete Conversion complete Units started into production Units completed & transferred Units in process, July 31 Materials complete Conversion complete Cost data: Work in process inventory, July 1: Materials cost Conversion cost Cost added during July: Materials cost Conversion cost Total cost Check figures: (2) Materials (per unit) (3) Work in process, July 31

10,000 100% 30% 170,000 ? 20,000 100% 40%

$8,500 4,900 139,400 244,200

$13,400

383,600 $397,000

$1.48 28,240

Student Name: Moudassir Habib Class: MBA - 3A Problem 4-23 WESTON PRODUCTS Grinding Department Production Report Quantity Schedule and Equivalent Units Quantity Schedule Pounds to be accounted for: WIP:B Started during the month Total pounds to be accounted for 18,000 167,000 185,000 Correct! Equivalent Units Labor & Materials Overhead Pounds accounted for as follows: Transfer out WIP:E Total pounds accounted for Costs per Equivalent Unit Cost to be accounted for: Materials $14,600 133,400 $382,000 $148,000 185,000 $0.80 Correct! Total Labor & Overhead Whole Unit $7,200 226,800 $234,000 180,000 $1.30 $2.10 Correct! Correct! 170,000 15,000 185,000 Correct! 170,000 10,000 180,000 Correct!

9th e Problem 4-21

185,000 Correct!

Total cost to be accounted for Equivalent units Cost per equivalent unit Cost Reconciliation

Costs Cost accounted for as follows: $357,000 Work in process, May 31

Equivalent Units Materials Labor and Overhead 170000*2.1 12,000 13,000 15000*.8 10000*1.3

Total work in process, May 31 Total cost accounted for

25,000 $382,000

Correct! Correct!

Student Name: Moudassir Habib Class: MBA - 3A Problem 4-30 PROVOST INDUSTRIES Finishing Department Production Report Quantity Schedule and Equivalent Units Quantity Schedule Units to be accounted for: WIP-Beginning (M:100%, C: 60%) Transferred in Total units to be accounted for 450 1,950 2,400 Correct! Equivalent Units Transferred In Materials Conversion Units accounted for as follows: Transferred Out Units WIP:E Total units accounted for 450 1,950 2,400 Correct! 1,800 600 2,400 Correct! 1,800 1,800 Correct! 1,800 210 2,010 Correct!

9th e Case 4-26

Costs per Equivalent Unit Total Cost Cost to be accounted for: Cost of Inventory WIP:O Cost added during this period Total cost to be accounted for Equivalent units Cost per equivalent unit Cost Reconciliation Equivalent Units Transferred Total Cost In Materials Conversion Cost accounted for as follows: Cost of Transferred out Units Work in process, April 30: tranferred in Material Conversion Total work in process Total cost accounted for $39,096 5,502 0 1,680 7,182 $46,278 5,502 0 1,680 Correct! Correct! 1880*21.72 $8,208 38,070 $46,278 Transferred In $4,068 17,940 $22,008 2,400 $9.17 Correct! Materials $1,980 6,210 $8,190 1,800 $4.55 Correct! Conversion $2,160 13,920 $16,080 2,010 $8.00 Correct! Whole Unit

$21.72 Correct!

1880*21.72

Given Data P04-23: WESTON PRODUCTS Inventory, May 1 Pounds Complete May costs added: Raw materials Pounds Labor and overhead Work in process inventory: Materials cost Labor and overhead cost Check figures: Materials per unit Work in process, 5/31 21,800 18,000 1/3

133,400 167,000 226,800

$14,600 $7,200

$0.80 25,000

Student Name: Moudassir Habib Class: MBA - 3A Problem 4-24 SUPERIOR BRANDS, INC. Cracking Department Production Report Quantity Schedule and Equivalent Units Quantity Schedule Gallons to be accounted for: WIP:B Added during the month Total gallons to be accounted for 10,000 140,000 150,000 Correct! Equivalent Units Materials Conversion Gallons accounted for as follows: Transferred to Mixing: WIP:B Started and Completed Work in process, April 30 Total gallons accounted for

9th e Problem 4-20

10,000 110,000 30,000 150,000 Correct!

0 110,000 30,000 140,000 Correct!

2,000 110,000 18,000 130,000 Correct!

Costs per Equivalent Unit Cost to be accounted for: WIP:B Cost added during the month Total cost to be accounted for Equivalent units Cost per equivalent unit Cost Reconciliation Total Cost Cost accounted for as follows: Transferred to Mixing: From the beginning inventory: Cost of Inventory Cost to complete these units: WIP:C Total cost from beginning inventory Gallons started & completed in April Total cost transferred to Mixing Work in process, April 30: Cost of DM Cost of Conversion Total work in process, April 30 Total cost accounted for Equivalent Units Materials Conversion Total Materials Conversion Whole Unit $39,000 571,000 $259,000 $312,000 $610,000 140,000 130,000 $1.85 $2.40 $4.25 Correct! Correct! Correct!

$39,000 0 4,800 43,800 467,500 511,300 55,500 43,200 98,700 $610,000 Correct! Correct! 4,800 2000*2.4

110000*4.25

Given Data P04-24: SUPERIOR BRANDS, INC. Inventory, April 1 Gallons Complete April costs added: Materials Gallons Labor and overhead Inventory, July 31 Gallons Complete Check figures Materials (per equivalent unit) Work in process, April 30 39,000 10,000 80%

259,000 140,000 312,000 ? 30,000 60%

$1.85 $98,700

Given Data P04-30: PROVOST INDUSTRIES Finishing department costs: Work in process inventory, April 1 Costs transferred in Materials cost Conversion costs Units Complete as to conversion costs Costs transferred in from the Molding department Units Material added during April Added when Finishing department has partially completed Conversion costs added during April Total departmental costs Finishing department costs assigned to: Units completed and transferred to finished goods Units Unit cost Work in process inventory, April 30 (units) Complete as to conversion costs Total departmental costs assigned Check figures: (1) Work in process, April 30

$8,208 4,068 1,980 2,160 450 60% 17,940 1,950 6,210 50% 13,920 $46,278

$46,278 1,800 $25.71 600 35% $46,278

$7,182

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Mission: Mission, Vision and Business StrategyDocument2 pagesMission: Mission, Vision and Business StrategyJasmine AroraNo ratings yet

- The Beauty of The GP Co-Investment Structure - CrowdStreetDocument6 pagesThe Beauty of The GP Co-Investment Structure - CrowdStreetJerry WilliamsonNo ratings yet

- The Beer Industry in The NetherlandsDocument2 pagesThe Beer Industry in The NetherlandsAliceLeNo ratings yet

- Q&A StratMngmtDocument3 pagesQ&A StratMngmtamitsinghbdnNo ratings yet

- Lucian A 1Document17 pagesLucian A 1keylaelizabehtNo ratings yet

- Monday To Friday: - Solihull To Coventry Via Catherine-de-Barnes, Hampton-in-Arden & MeridenDocument2 pagesMonday To Friday: - Solihull To Coventry Via Catherine-de-Barnes, Hampton-in-Arden & MeridenanuragrathoreNo ratings yet

- AP Micro Ch. 5 Study GuideDocument14 pagesAP Micro Ch. 5 Study GuidecrazybowseatNo ratings yet

- CV in World BankDocument8 pagesCV in World BankNydzerNo ratings yet

- National Review Center (NRC)Document3 pagesNational Review Center (NRC)Malou Almiro SurquiaNo ratings yet

- Duke Energy Coal AllocationDocument4 pagesDuke Energy Coal AllocationSatish Kumar100% (1)

- Quiz 3032Document4 pagesQuiz 3032PG93No ratings yet

- 8294 PDFDocument174 pages8294 PDFManjeet Pandey100% (1)

- 2016 HSC Maths General 2Document40 pages2016 HSC Maths General 2HIMMZERLANDNo ratings yet

- Basic Documents and Transactions Related To Bank DepositsDocument15 pagesBasic Documents and Transactions Related To Bank DepositsJessica80% (5)

- Dental Practice Training With Tracy StuartDocument2 pagesDental Practice Training With Tracy StuartChris BarrowNo ratings yet

- Deregulation of Energy Sector in NigeriaDocument15 pagesDeregulation of Energy Sector in NigeriaWilliam BabigumiraNo ratings yet

- Topic 6-Cash Flow in Capital BudgetingDocument61 pagesTopic 6-Cash Flow in Capital BudgetingBaby KhorNo ratings yet

- North Sea Oil and Gas Wall MapDocument1 pageNorth Sea Oil and Gas Wall Mapbarnibar1No ratings yet

- Terex LiftaceDocument2 pagesTerex LiftaceEduardo SaaNo ratings yet

- P.7 - Cost AccumulationDocument8 pagesP.7 - Cost AccumulationSaeed RahamanNo ratings yet

- Econ Practice Exam 2Document15 pagesEcon Practice Exam 2MKNo ratings yet

- TKM Training ManualDocument34 pagesTKM Training ManualRajaraamanSrinivasNo ratings yet

- Business London's 20 Under 40 - London's New Economic TrailblazersDocument2 pagesBusiness London's 20 Under 40 - London's New Economic TrailblazersrtractionNo ratings yet

- Decisions by Quarter SCMDocument5 pagesDecisions by Quarter SCMudelkingkongNo ratings yet

- Overview of The Hotel IndustryDocument3 pagesOverview of The Hotel IndustryBrandon WaltersNo ratings yet

- Hilado v. CIRDocument5 pagesHilado v. CIRclandestine2684No ratings yet

- CadburyDocument11 pagesCadburyAnkita RajNo ratings yet

- Lecture 04Document35 pagesLecture 04Stojan BozhinovNo ratings yet

- Ec-101 - Final PDFDocument2 pagesEc-101 - Final PDFarjunv_14No ratings yet

- Financing Feasibility Analysis - PresentationDocument42 pagesFinancing Feasibility Analysis - PresentationabulyaleeNo ratings yet