Professional Documents

Culture Documents

Analysis of Various Funds Offered by Canara Robeco Asset Management Company

Uploaded by

Vineet MahajanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Various Funds Offered by Canara Robeco Asset Management Company

Uploaded by

Vineet MahajanCopyright:

Available Formats

MIT College of Management (MITCOM), Pune

A PROJECT REPORT ON

VARIOUS FUNDS ANALYSIS OF

SUBMITTED TO MAEERs MIT COLLEGE OF MANAGEMENT (MITCOM)

BY MANOJ KUMAR MISHRA Roll No.198, FINANCE Batch No.1

IN PARTIAL FULFILLMENT OF POST GRADUATE PROGRAM (PGP) JUNE-JULY, 2008-09

MAEERs MIT COLLEGE OF MANAGEMENT (MITCOM) PUNE

Table of C O N T E N T S

Chapter No.

Title

Page No. Iv v vi vii ix ix xi xi xii xiii 1-27 2 2 5 12 13 14 14 16 28-31 29 29 30

Declaration from student Certificate from Company/Organization Certificate from Guide Acknowledgement Chapter Scheme List of Tables List of Charts List of Graph List if Abbreviations Executive Summary

I 1.1 1.2 1.3 1.4 1.5 1.6 1.7 1.8 II 2.1.1 2.1.2 2.1.3 INTRODUCTION BACKGROUND OF THE STUDY BACKGROUND OF THE TOPIC COMPANY PROFILE STATEMENT OF THE PROBLEM NEED OF THE STUDY SCOPE OF THE STUDY OBJECTIVE OF THE STUDY VARIOUS FUNDS INFORMATION RESEARCH METHODOLOGY MEANING OF THE RESEACRH METHODOLOGY RESEARCH DESIGN TYPE OF RESEARCH DESIGN

ii

2.1.4 2.1.5 2.1.5A 2.1.5B III A A3.1 A3.2 A3.3 A3.4 A3.5 B IV 4.1 4.2 V VI

SAMPLING DESIGN DATA COLLECTION TECHNIQUE COLLECTING PRIMARY DATA THROUGH INTERVIEW METHOD COLLECTING SECONDARY DATA DATA PROCESSING AND ANALYSIS INVESTORS ANALYSIS ANALYSIS OF DATA FOR AGE GROUP ANALYSIS OF DATA FOR INCOME GROUP PERCENTAGE OF SAVING OF INCOME CURRENT INVESTMENT PATTERN ANALYSIS SOME MORE QUESTIONNAIRE VARIOUS FUNDS ANALYSIS OF THE CANARA ROBECO FINDINGS FINDING OF THE PROJECT LIMITATION OF THE PROJECT CONCLUSIONS RECOMMENDATIONS BIBLIOGRAPHY ANNEXURE

30 31 31 31 32-59 33 33 34 35 36 37 46 60-62 61 62 63 66 69 71

iii

DECLARATION

I, Mr. /Ms _____ _Manoj Kumar Mishra____________________________________ hereby declare that this project report is the record of authentic work carried out by me during the period from etc. 10th June 08 to 30th July 08 and has not been submitted to any other University or Institute for the award of any degree / diploma

Signature Name of the student- Manoj Kumar Mishra Date

iv

vi

vii

I take immense pleasure in completing this project and submitting the final project report. The day at CANARA ROBECO ASSET MANAGEMENT COMPANY has been full of learning and sense of contribution toward the organization. I would like to thank for the same for giving me an opportunity of learning and contributing through this project. I also take this opportunity to thank all those people that made this experience a memorable one. A successful project can never be prepared by the single effort of the person to whom project is assigned, but it also demand the help and guardianship of some conversant person who helped the undersigned actively or passively in the completion of successful project. In this context as a student of MIT School of Management, Pune I would first of all like to express my gratitude to Mr.Chandan Verma , Assistant Manager, Nagpur, for assigning me such a worthwhile topic Various Fund Analysis of Canara Robeco to work upon in CANARA ROBECO ASSET MANAGEMENT COMPANY. During the actual project work, Mr. Dilip Khapre (Executive, Canara Bank) and Mr. Abhijeet Kumar has been a source of inspiration through his constant guidance; personal interest; encouragement and help. I convey my sincere thanks to him. In spite of his busy schedule he always find time to guide me through the project. I am also grateful to him for reposing confidence in my abilities and giving me the freedom to work on my project. The project couldnt have been completed without timely and vital help of other office staff.

viii

Chapters Scheme

Chapter No 1 2 3 4 5 6

Title INTRODUCTION RESEARCH METHODOLOGY DATA PROCESS AND ANALYSIS FINDINGS CONCLUSION RECOMMENDATION

Page No 1 28 32 60 63 66

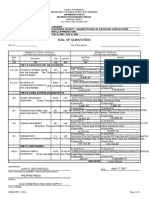

List of Tables

S. No Title A Product Table Fund Information Table 1.1 Canara Robeco Balance 1.2 Canara Robeco CIGO 1.3 Canara Robeco Emerging Equities 1.4 Canara Robeco Equity Diversified 1.5 Canara Robeco Equity Tax Saver 1.6 Canara Robeco Floating Rate 1.7 Canara Robeco GILT PGS 1.8 Canara Robeco Infrastructure 1.9 Canara Robeco Liquid Plus 1.10 Canara Robeco Liquid 1.11 1.12 Canara Robeco Multicap Canara Robeco Nifty Index Page No 15 16 17 18 19 20 21 22 23 24 25 26 27 46 48

Portfolio Statements Table (PST) PST 3.1 Canara Robeco Balance PST 3.2 Canara Robeco CIGO

ix

PST 3.3 PST 3.4 PST 3.5 PST 3.6 PST 3.7 PST 3.8 PST 3.9 PST 3.10 PST 3.11

Canara Robeco Emerging Equities Canara Robeco Equity Diversified Canara Robeco Equity Tax Saver Canara Robeco Floating Rate Canara Robeco Infrastructure Canara Robeco Liquid Plus Canara Robeco Liquid Canara Robeco Multicap Canara Robeco Nifty Index

49 51 52 54 54 56 56 57 58

Sectorial Investment Breakup(SIB) SIB 3.1 SIB 3.2 SIB 3.3 SIB 3.4 SIB 3.5 SIB 3.6 SIB 3.7 SIB 3.8 Canara Robeco Balance Canara Robeco CIGO Canara Robeco Emerging Equities Canara Robeco Equity Diversified Canara Robeco Equity Tax Saver Canara Robeco Infrastructure Canara Robeco Multicap Canara Robeco NIFTY Index 47 48 50 51 53 54 57 59

List of Charts

S.No

Investors Analysis Chart(IAC)

Title

Page No

IAC 3.1 IAC3.2 IAC 3.3 FAC 3.1 FAC 3.2 FAC 3.3 FAC 3.4 FAC 3.5 FAC 3.6 FAC 3.7 FAC 3.8

Mutual Funds Awareness Investors Opinion About Investment Stage Availing Personal Advisor Asset Composition of Canara Robeco Balance Asset Composition of Canara Robeco CIGO Asset Composition of Canara Robeco Emerging Equities Asset Composition of Canara Robeco Equity Diversified Asset Composition Canara Robeco Tax Saver Asset Composition of Canara Robeco Infrastructure Asset Composition of Canara Robeco Multicap Asset Composition of Canara Robeco Nifty Index

37 42 43 47 49 50 52 53 55 58 59

Fund Analysis Chart(FAC)

List of Graph

S. No Title Page No

33 34 35 36 38 39 40 41 44 45 46 Graphical Representation(GRT) of Findings GRT 3.1 Age Group GRT 3.2 Income Distribution GRT 3.3 Saving Pattern 35 GRT 3.4 Investment Pattern 36 GRT 3.5 Reasons Against MFs Investment 38 GRT 3.6 Investors Awareness About MFs Scheme GRT 3.7 Source of Purchasing MFs GRT 3.8 Investors Most Liked MFs Features GRT 3.9 Financial Advisor Expertise Demanded Most GRT 3.10 Reason to have Financial Advisor GRT 3.11 Reason for not using Financial Advisor

List of Abbreviations

Abbreviation

NAV ULIP MMI SIP AMC AUM CIGO GIC Net Asset Value Unit Linked Insurance Plan Money Market Instruments Systematic Investment Plan Asset Management Company Asset Under Management Compound Interest Growth Opportunities General Insurance Company

Full Form

xi

SEBI BOB CRISIL CRMF FIIs FDI MFs MFI FIs ELSS IPO PPF NSC POP

Stock Exchange Board of India Bank of Baroda Credit Rating Information System of India Limited Canara Robeco Mutual Funds Foreign Institutional Investors

Foreign Direct Investment Mutual Funds Mutual Fund Industry Financial Institutions Equity Linked Saving Scheme Initial Public Offering People Provident Fund National Saving Certificate Point of Purchase

xii

The project titled Fund Analysis of Canara Robeco is being carried out at CANARA ROBECO ASSET MANAGEMENT COMPANY, NAGPUR. CANARA ROBECO ASSET MANAGEMENT COMPANY operates in various financial products and services like Stock Broking and Mutual Fund. The evaluation of financial planning has been increased through decades, which is best seen in customer rise. Now a days investment of saving has assumed great importance. According to the study of the markets, it is being observed that markets are doing well in Mutual fund. In near future a proper financial planning is required to invest money in all type of financial product because there is good potential in market to invest. In this project the great emphasis is given to the investors mind in respect to investment in Mutual Fund .The needs and wants of the client is taken into consideration. The main objective of this project is to know the Awareness of Mutual Fund among investors and also to know the investing pattern of people in different Financial xiii

Project. Mutual Funds are one of the safe ways to invest, particularly for retail investors. Every investor has their own financial situation and financial temperament with varied degree of risk tolerance level. After analyzing the feedback the conclusion has been made that the Indian financial market is having lots of potential customer the only thing is to give a proper guidance to the prospective customers. Presently when market has become very choppy and is full of uncertainties, investing through Mutual funds is relatively safe way. There is intense competition amongst Mutual Funds of different companies. All of them are trying to attract more and more investors and for the same they are customizing their funds in order to suit their needs. ULIPs plan of Insurance industry is creating challenge for Mutual Fund Industry. Apart from industry initiatives, market regulator and Government are playing their pivotal role. In the same race, recently Goldman Sachs has got the approval to start their own business of asset management. The MF business is highly concentrated fund-wise and scheme-wise. Many MFs are sponsored by public sector banks and FIs and so investors are assumed of some security in their investments. MFs had been able to inspire confidence among investors. However with the proliferation of MFs, this is changing. Various studies on risk analysis of MFs have shown that many schemes are characterized by high risk. The experience from a country like US indicates that the growth of MFI has increased the potential for creating systematic volatility. The regulations of MFs will have to be undertaken not only for eliminating abuses and frauds but also for shielding the whole financial system from the collapse of confidence in MFs The Indian MFI has not performed well in gaining the small individual investors confidence and trust by offering better products, better processes, and better services. MFs are popular mainly with the urban, high and middle income groups only. They are yet to penetrate the rural areas in a big way. Many investors have low opinion about the investment efficiency of MFs, which are often seen as momentum chasers rather that true professional investment managers. They do not have a good set-up to reach the retail investors and to collect money from small towns. They have lacked in systematic evaluations of investors requirements; they have become a kind of trading instruments rather than investment vehicles. There have been frequent miscalculations of returns and premature closure of schemes by them. xiv

xv

You might also like

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- Indonesia’s Technology Startups: Voices from the EcosystemFrom EverandIndonesia’s Technology Startups: Voices from the EcosystemNo ratings yet

- Mutual Fund Industry Analysis and Performance ComparisonDocument102 pagesMutual Fund Industry Analysis and Performance ComparisonSiddharth MalikNo ratings yet

- Investing in Mutual FundsDocument37 pagesInvesting in Mutual FundsRajesh Kumar roulNo ratings yet

- S F S & W A L - V B F ": Summer Internship ONDocument79 pagesS F S & W A L - V B F ": Summer Internship ONMadhu AgarwalNo ratings yet

- A Study On Investors Buying Behaviour Towards Mutual FundDocument143 pagesA Study On Investors Buying Behaviour Towards Mutual Fundjyoti dabhi100% (5)

- SIP PROJECT - Praveen AgarwalDocument90 pagesSIP PROJECT - Praveen AgarwalRohit SachdevaNo ratings yet

- Performane Evaluation of Mutual FundsDocument64 pagesPerformane Evaluation of Mutual FundsheavenqueenpareeNo ratings yet

- SUMMER TRAINING PROJECT REPORT ON StudyDocument55 pagesSUMMER TRAINING PROJECT REPORT ON StudyVijay MNo ratings yet

- Summer Internship Project - Sharang Dev - CMBA2Y3Document55 pagesSummer Internship Project - Sharang Dev - CMBA2Y3Kausik BhagatNo ratings yet

- Project ReportDocument44 pagesProject ReportSubha LakshmiNo ratings yet

- Inverting The Pyramid 3rd Edition-PrintDocument69 pagesInverting The Pyramid 3rd Edition-PrintRohit GarhwalNo ratings yet

- Thesis Performance of Mutual Funds in IndiaDocument110 pagesThesis Performance of Mutual Funds in IndiaAnuj Kumar Singh50% (2)

- Basic Terms to Know for FP&A CareerDocument61 pagesBasic Terms to Know for FP&A Careeraryait099No ratings yet

- Systematic Investment Plan - SIP Project ReportDocument109 pagesSystematic Investment Plan - SIP Project ReportCarmen Alvarado64% (11)

- Comparative Analysis of Equity and Derivative Market 120329210338 Phpapp01Document71 pagesComparative Analysis of Equity and Derivative Market 120329210338 Phpapp01Rahul KadamNo ratings yet

- Sbi Project ReportDocument54 pagesSbi Project ReportVikas Choudhary100% (1)

- Sbi ProjectDocument91 pagesSbi ProjectSanjeev BhatiaNo ratings yet

- Summer Training Project Report: Master of Business AdministrationDocument55 pagesSummer Training Project Report: Master of Business AdministrationHimanshu ShokeenNo ratings yet

- Lecturer of Business Management Project Report Submitted in Partial Fulfillment For The Award of Degree ofDocument93 pagesLecturer of Business Management Project Report Submitted in Partial Fulfillment For The Award of Degree ofsohailsamNo ratings yet

- Angel Broking LTD Project 03Document82 pagesAngel Broking LTD Project 03Akshay SinghNo ratings yet

- Firoz ProjectDocument104 pagesFiroz ProjectRishi GoyalNo ratings yet

- Mutual Fund PREMDocument89 pagesMutual Fund PREMprem1616No ratings yet

- Portfolio Management & Mutual Fund Analysis ProjectDocument56 pagesPortfolio Management & Mutual Fund Analysis ProjectYv Vardar100% (1)

- Project Report On SIP in Mutual FundsDocument76 pagesProject Report On SIP in Mutual FundsAnubhav Sood100% (5)

- Changing Profile of Indian InvestorsDocument24 pagesChanging Profile of Indian InvestorsManav gargNo ratings yet

- Top Performing Equity 2009-10Document96 pagesTop Performing Equity 2009-10Srishty ShuklaNo ratings yet

- Research Project Report of Nidhi SoniDocument104 pagesResearch Project Report of Nidhi SoniVipin VermaNo ratings yet

- A Summer Training Project Report ON: Submitted in Partial Fulfillment of The Requirement For The Award of Degree ofDocument9 pagesA Summer Training Project Report ON: Submitted in Partial Fulfillment of The Requirement For The Award of Degree ofbuddysmbdNo ratings yet

- Equity Market-Indian Investment ScenerioDocument64 pagesEquity Market-Indian Investment ScenerioaurobindanavajyotiNo ratings yet

- Capstone ProjectDocument57 pagesCapstone ProjectPankaj KothariNo ratings yet

- A Project Report On: Study of Derivatives in Indian Stock Market PERIOD (2009-2012)Document8 pagesA Project Report On: Study of Derivatives in Indian Stock Market PERIOD (2009-2012)Harsh GuptaNo ratings yet

- Reliance Final DhakaDocument82 pagesReliance Final DhakaPummy SongraNo ratings yet

- Security Analysis and Online Trading: Nitesh PatelDocument32 pagesSecurity Analysis and Online Trading: Nitesh PatelNitesh Patel50% (4)

- Bansi Khakhkhar PDFDocument74 pagesBansi Khakhkhar PDFVishu MakwanaNo ratings yet

- A Study of Attitude of Investors' Towards Mutual Fund As An Investment ToolDocument47 pagesA Study of Attitude of Investors' Towards Mutual Fund As An Investment ToolAarati Ghokhle79% (29)

- Project On Mutual FundDocument109 pagesProject On Mutual FundPrajwal AlvaNo ratings yet

- Feasiblity Study of Customer Analysis in Mutual FundsDocument71 pagesFeasiblity Study of Customer Analysis in Mutual Fundsabhishek narayanNo ratings yet

- Karvy Report On Mutual FundsDocument96 pagesKarvy Report On Mutual FundsNeetu shrivastavaNo ratings yet

- Akshit Lse InvestmentDocument45 pagesAkshit Lse InvestmentAbhay RanaNo ratings yet

- Investors' Attitude Towards UTI Mutual FundsDocument134 pagesInvestors' Attitude Towards UTI Mutual FundsRavi RikkiNo ratings yet

- Final Study On Factors Influencing Investment Decision On Mutual FundsDocument76 pagesFinal Study On Factors Influencing Investment Decision On Mutual FundsDinesh Katarmal100% (2)

- TYBAF Amit Santosh Kanade Roll No. 2 Div. A (VP) Black BookDocument82 pagesTYBAF Amit Santosh Kanade Roll No. 2 Div. A (VP) Black BookÂmît JâdhâvNo ratings yet

- Nidhi Mittal ReportDocument123 pagesNidhi Mittal Reportarjun_gupta0037No ratings yet

- Investment Patterns in Indian Stock Market: Project Report OnDocument112 pagesInvestment Patterns in Indian Stock Market: Project Report OnSalman Syed MohdNo ratings yet

- B.K. School of Business Management Gujarat UniversityDocument77 pagesB.K. School of Business Management Gujarat UniversityMAHESHNo ratings yet

- Customer Relationship Management in Religare Securities With Special Reference To Equities EquitiesDocument55 pagesCustomer Relationship Management in Religare Securities With Special Reference To Equities EquitiesAbhishek JacobNo ratings yet

- Anand Rathi GroupDocument100 pagesAnand Rathi GroupRenu MahayachNo ratings yet

- Submitted in The Partial Fulfillment For The Requirement of The Award of Degree ofDocument66 pagesSubmitted in The Partial Fulfillment For The Requirement of The Award of Degree ofJyoti YadavNo ratings yet

- Investors' Attitude Towards Mutual FundsDocument76 pagesInvestors' Attitude Towards Mutual FundsAkshaysinh RathodNo ratings yet

- Atharva Uppalwar Mms A Sip ReportDocument39 pagesAtharva Uppalwar Mms A Sip ReportAtharva UppalwarNo ratings yet

- An Analysis On Systematic Investment Plan: AT Karvy Stock Broking LimitedDocument99 pagesAn Analysis On Systematic Investment Plan: AT Karvy Stock Broking LimitedShiaa NamdeoNo ratings yet

- Study of Mutual Fund As AnDocument69 pagesStudy of Mutual Fund As AnSTAR PRINTINGNo ratings yet

- Awareness N Perception of Reliance Mutual Fund by Ajay RathoreDocument66 pagesAwareness N Perception of Reliance Mutual Fund by Ajay RathoreAjay Singh Rathore100% (4)

- Stock Market Study at Tata SecuritiesDocument75 pagesStock Market Study at Tata SecuritiesAjay sharmaNo ratings yet

- Waseem Project Roll No 07Document81 pagesWaseem Project Roll No 07Omii BandalNo ratings yet

- Indian Stock Market and Investors StrategyFrom EverandIndian Stock Market and Investors StrategyRating: 3.5 out of 5 stars3.5/5 (3)

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesNo ratings yet

- MARKET TIMING FOR THE INVESTOR: Picking Market Tops and Bottoms with Technical AnalysisFrom EverandMARKET TIMING FOR THE INVESTOR: Picking Market Tops and Bottoms with Technical AnalysisRating: 2 out of 5 stars2/5 (2)

- Green Bond Market Survey for Malaysia: Insights on the Perspectives of Institutional Investors and UnderwritersFrom EverandGreen Bond Market Survey for Malaysia: Insights on the Perspectives of Institutional Investors and UnderwritersNo ratings yet

- Secretary of Finance vs. Lazatin GR No. 210588Document14 pagesSecretary of Finance vs. Lazatin GR No. 210588Gwen Alistaer CanaleNo ratings yet

- Chapter 8 - National IncomeDocument34 pagesChapter 8 - National IncomePhranxies Jean Loay BlayaNo ratings yet

- Biblioteca Ingenieria Petrolera 2015Document54 pagesBiblioteca Ingenieria Petrolera 2015margaritaNo ratings yet

- The Utopian Realism of Errico MalatestaDocument8 pagesThe Utopian Realism of Errico MalatestaSilvana RANo ratings yet

- Adv Statement LegalDocument2 pagesAdv Statement LegalAMR ERFANNo ratings yet

- US Internal Revenue Service: f945 - 1996Document3 pagesUS Internal Revenue Service: f945 - 1996IRSNo ratings yet

- HANDLING | BE DESCHI PROFILEDocument37 pagesHANDLING | BE DESCHI PROFILECarlos ContrerasNo ratings yet

- Civpro Cases FinalsDocument4 pagesCivpro Cases FinalsMc DalayapNo ratings yet

- Local Educator Begins New Career With Launch of Spaulding Decon Franchise in FriscoDocument2 pagesLocal Educator Begins New Career With Launch of Spaulding Decon Franchise in FriscoPR.comNo ratings yet

- PRQNP 11 FBND 275 HXDocument2 pagesPRQNP 11 FBND 275 HXjeevan gowdaNo ratings yet

- 2.kristian Agung PrasetyoDocument32 pages2.kristian Agung PrasetyoIin Mochamad SolihinNo ratings yet

- Title:-Home Service at A Click: Presented byDocument14 pagesTitle:-Home Service at A Click: Presented byPooja PujariNo ratings yet

- Finance Manager Reporting Planning in Los Angeles, CA ResumeDocument2 pagesFinance Manager Reporting Planning in Los Angeles, CA ResumeRCTBLPONo ratings yet

- Answer DashDocument6 pagesAnswer DashJeffrey AmitNo ratings yet

- Apcs ProceduresDocument97 pagesApcs Proceduresmoh_essamoNo ratings yet

- Globalization 4Document7 pagesGlobalization 4umamaheshcoolNo ratings yet

- Microeconomics Chapter 1 IntroDocument28 pagesMicroeconomics Chapter 1 IntroMc NierraNo ratings yet

- IntroductionDocument3 pagesIntroductionHîmäñshû ThãkráñNo ratings yet

- Proposal Letter of B 2 B Redeifined Angel (2) (1) 3 (New)Document3 pagesProposal Letter of B 2 B Redeifined Angel (2) (1) 3 (New)Hardy TomNo ratings yet

- IFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TDocument10 pagesIFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TomprakashNo ratings yet

- Accounting equation problems and solutionsDocument2 pagesAccounting equation problems and solutionsSenthil ArasuNo ratings yet

- Annual Review Pitch Deck by SlidesgoDocument7 pagesAnnual Review Pitch Deck by SlidesgoALJOHARA KHALID HAMAD ALSULIMANNo ratings yet

- PerdiscoDocument10 pagesPerdiscogarytrollingtonNo ratings yet

- Managing in Global EnvironmentDocument21 pagesManaging in Global EnvironmentShelvy SilviaNo ratings yet

- Enactus ProposalDocument5 pagesEnactus Proposalhana alkurdi0% (1)

- What is Economics? - The study of production, distribution and consumption /TITLEDocument37 pagesWhat is Economics? - The study of production, distribution and consumption /TITLEparthNo ratings yet

- Indigo by Louis FischerDocument6 pagesIndigo by Louis Fischermitasha_saini100% (5)

- Report PDFDocument2 pagesReport PDFGauriGanNo ratings yet

- 17FG0045 BoqDocument2 pages17FG0045 BoqrrpenolioNo ratings yet

- Why education and facilities are better than laws for increasing home recyclingDocument1 pageWhy education and facilities are better than laws for increasing home recyclingFadli AlimNo ratings yet