Professional Documents

Culture Documents

HSBC BT

Uploaded by

Alonzo Marquez DomagasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HSBC BT

Uploaded by

Alonzo Marquez DomagasCopyright:

Available Formats

Please transfer my balance from my non-HSBC to my HSBC credit card.

My Complete name:

IMPORTANT NOTES:

1. My home phone number: My office number: The computation below will only serve as your guide. HSBC at its sole discretion shall approve the final Balance Transfer amount and repayment term to be applied to your card without need to inform you beforehand.

My mobile phone number: (IMPORTANT)

My existing HSBC credit card:

2. If your Balance Transfer application is approved, this serves as your written authorization to HSBC to execute the Balance Transfer transaction, unless otherwise indicated by you hereunder. 3. The Balance Transfer application will be processed within 13 banking days. For follow-ups, please call 5 banking days following your submission of this application at (02) 85-800 (for Metro Manila) or 1-800-1-888-8555 (for domestic toll-free where available). Expiry date: 4. This offer may not be availed in conjunction with other HSBC Balance Transfer offers.

My non-HSBC credit card number:

Name of the bank that issued my non-HSBC credit card:

My chosen payment option

Tenor (months)

14 20 26

My Monthly BT Installment Amount

Factor Rate

0.07743 0.05600 0.04446

Add-on interest per month

Minimum BT Amount

Php7 ,000 Php10,000 Php13,000

Effective Rate per Annum

13.13% 13.25% 13.26%

BT Amount (amount to be transferred)

0.60%*

Factor Rate (from table) Monthly BT Installment Amount

Balance Transfer Declaration and Signature

*Per DTI-NCR Permit No. 6091. Series of 2010

I hereby make the following declarations in respect of each of my applications for Balance Transfer contained in this Form. In case HSBC will approve a lower Balance Transfer amount and/or different repayment terms from that applied for ---I authorize HSBC to proceed with the repayment of my non-HSBC credit card I do not authorize HSBC to proceed with the repayment of my non-HSBC credit card I understand that my failure to tick any of the options above gives HSBC the right to pay the approved Balance Transfer amount to the relevant credit card company that issued my non-HSBC credit card even if the approved amount is less than the Balance Transfer amount applied for. I understand that my Balance Transfer application is non-transferable and that should it be rejected, HSBC has no obligation to disclose the reason of rejection. By signing this application, I acknowledge that I have read and understood and agree to be bound by the HSBCs Balance Transfer Terms and Conditions; and I agree to pay at least the monthly Minimum Amount Due on my HSBC credit card

Applicants Name and Signature Date Applied

For banks use only

Fax your application to (02) 755-5070 Or Call (02) 580-7676

Apply now!

* Note that the Balance Transfer Installment Amount shall be posted as a regular transaction and shall form part of the Total Amount Due on each account statement. If you revolve any portion of the Total Amount due in any given month, your Balance Transfer Installment Amount shall be included in the computation of finance charges for that month. The Terms and Conditions of HSBCs Installment Plan/RED Installment Apply.

Balance Transfer Declaration and Signature

1. The Balance Transfer facility of HSBC allows a cardholder in good standing to transfer his outstanding card balances with other banks or credit card companies to his HSBC credit card. The approved Balance Transfer amounts will be subject to the prevailing monthly add-on interest rates, depending on the chosen repayment period. 2. The cardholder may only transfer balances from a primary, non-HSBC credit card under his/her name to his/her primary HSBC credit card. Balance Transfers from one HSBC credit card to another HSBC credit card are not allowed. 3. The Balance Transfer amount must result to a monthly installment amount of at least Php500.00. 4. Only the amount of transactions posted that form part of your total outstanding balance on your non-HSBC credit card at the time of application may be subject to Balance Transfer. In the case of installment transactions, only the monthly installment amount posted to the card at the time of application will be covered by the Balance Transfer transaction. 5. Maximum Balance Transfer amount is 80% of the assigned limit on the HSBC credit card less the outstanding balance at the time of approval. HSBC shall have the absolute and exclusive right to approve or reject all Balance Transfer applications. Should the cardholders available credit limit not be sufficient to cover the Balance Transfer amount applied for, HSBC shall, at its sole discretion, determine and approve only a portion of the Balance Transfer amount applied for without need to inform the Cardholder beforehand. The Cardholder shall be responsible for following up with HSBC on the status of his application. In case of disapproval of a Balance Transfer application, HSBC is not required to notify the cardholder of such rejection and the reason thereof. For this purpose, the cardholder may call (02) 85-800 (for Metro Manila) or 1-800-1-888-8555 (for domestic toll-free where available). HSBC shall not be liable for delinquency of the cardholders non-HSBC card, interest or any penalty charge imposed upon the cardholder as a result of the disapproval by HSBC of his application. 6. The monthly Balance Transfer installment amount shall be posted as a regular transaction on the HSBC Credit Card account and shall form part of the Total Amount Due on each statement of account. Cardholders shall have the option to pay the Minimum Amount Due, which is computed as 4% of the Total Amount Due, every month. If he does so, or if the Cardholder does not pay the Total Amount Due in any given month on the due date, the Balance Transfer installment amount shall be included in the computation of the finance charge and late payment charges (if applicable) for that month. 7 Cardholders may inquire about the status of their Balance Transfer application by calling 85-800 or 976-8000 (within Metro Manila), (02) 85-800 or (02) 976-8000 (for local mobile phones), 1-800-1-888-8555 (for domestic calls outside . of Metro Manila), + [63] (2) 85-800-00 for international calls. 8. Once a Balance Transfer application is approved, HSBC shall pay, on behalf of the Cardholder, to the nearest payment center of the non-HSBC credit card the amount of the approved Balance Transfer amount. HSBC shall not be liable for interest, or any over-payment of the credit card outstanding, nor for any late payment or other finance charge that the Cardholder may incur as a result of failure or delay by HSBC in making the payment before the due date of the cardholders non-HSBC credit card. 9. Once approved, the Balance Transfer transaction can no longer be cancelled. In case of pre-termination or cancellation of the approved Balance Transfer transaction before the end of the chosen repayment period, HSBC reserves the right to charge to the cardholders account Three Hundred Pesos (Php300.00) or 5% of the Balance Transfer amount remaining unpaid as of the date of pre-termination, whichever is higher, as a processing fee for the pre-termination of the Balance Transfer transaction. 10. The Terms & Conditions governing the issuance and use of the HSBC Credit Card and the HSBCs Installment Plan/RED Installment are incorporated herein by reference and made an integral part thereof.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Big Red StampDocument3 pagesBig Red Stampthenjhomebuyer100% (11)

- Insurance Cases CENIZADocument50 pagesInsurance Cases CENIZANate AlfaroNo ratings yet

- 26 1165 01 Prototype Leather Care Formulation Ip 540Document2 pages26 1165 01 Prototype Leather Care Formulation Ip 540Regs AccexNo ratings yet

- National Marketing vs. AtlasDocument1 pageNational Marketing vs. AtlasJanlo FevidalNo ratings yet

- Relinqueshment DeedDocument2 pagesRelinqueshment DeedParul SinghNo ratings yet

- Frank V KosuyamaDocument2 pagesFrank V KosuyamaPablo Jan Marc FilioNo ratings yet

- August 2015 - Meralco Vs City Assessor of Lucena Gr. No. 166102 - Ciar, Julie Anne Princess A.Document16 pagesAugust 2015 - Meralco Vs City Assessor of Lucena Gr. No. 166102 - Ciar, Julie Anne Princess A.Cessy Ciar Kim100% (1)

- Metropolitan Bank V Perez (Dos Santos)Document3 pagesMetropolitan Bank V Perez (Dos Santos)Tippy Dos SantosNo ratings yet

- Frederick Felipe Vs MGM and AyalaDocument2 pagesFrederick Felipe Vs MGM and AyalaDi ko alamNo ratings yet

- GR No 91332 16-07-1993Document11 pagesGR No 91332 16-07-1993Mary LeandaNo ratings yet

- Dumlao vs. Quality PlasticsDocument2 pagesDumlao vs. Quality PlasticsNeptaly P. ArnaizNo ratings yet

- Cooperatives - Articles of CooperationDocument1 pageCooperatives - Articles of Cooperationcapamar100% (2)

- PDFDocument2 pagesPDFtyndylsNo ratings yet

- Legal Ethics - Cases 3Document133 pagesLegal Ethics - Cases 3Rian Lee TiangcoNo ratings yet

- 3chassi PDFDocument2 pages3chassi PDFUS BatteryNo ratings yet

- Form of Meta DataDocument2 pagesForm of Meta DataDiya MittalNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument7 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- p2890v11 0Document28 pagesp2890v11 0ShapolaNo ratings yet

- Article Ix - Constitutional Commissions A. Common ProvisionsDocument34 pagesArticle Ix - Constitutional Commissions A. Common ProvisionsJezen Esther PatiNo ratings yet

- Paresh Patel v. Diplomat 1419VA Hotels, LLC, 11th Cir. (2015)Document5 pagesParesh Patel v. Diplomat 1419VA Hotels, LLC, 11th Cir. (2015)Scribd Government DocsNo ratings yet

- Nestaway Tenant Agreement PDF SD PDFDocument11 pagesNestaway Tenant Agreement PDF SD PDFPankaj SinghNo ratings yet

- How It Feels To Be Forcibly FedDocument4 pagesHow It Feels To Be Forcibly Fedmfb1949No ratings yet

- DEED OF ABSOLUTE SALE Franchise (Cabrera)Document1 pageDEED OF ABSOLUTE SALE Franchise (Cabrera)Arkim llovitNo ratings yet

- 2002 S C M R 1294Document2 pages2002 S C M R 1294Sehr AsifNo ratings yet

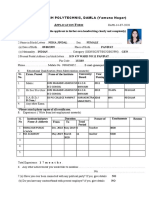

- Seth Jai Parkash Polytechnic, Damla (Yamuna Nagar) : PhotographDocument2 pagesSeth Jai Parkash Polytechnic, Damla (Yamuna Nagar) : PhotographDeepak MittalNo ratings yet

- Issuance of A Temporary Electrical Permit and Permit For Temporary Service ConnectionDocument2 pagesIssuance of A Temporary Electrical Permit and Permit For Temporary Service Connectionshin17111No ratings yet

- Before: Team Code T-6Document21 pagesBefore: Team Code T-6hindalNo ratings yet

- Comito V Breathe Ecig CorpDocument8 pagesComito V Breathe Ecig Corpdiannedawn100% (1)

- Tender 016 Fresh Cut FlowersDocument34 pagesTender 016 Fresh Cut FlowersState House Kenya0% (1)

- Delmar vs. PVADocument1 pageDelmar vs. PVAfrankieNo ratings yet