Professional Documents

Culture Documents

309871

Uploaded by

david_llewellyn_smithOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

309871

Uploaded by

david_llewellyn_smithCopyright:

Available Formats

Flashnote

abc

Global Research

Macro Australian Economics

Australias immunity to be tested

Data published this month will be critical

Financial market volatility is grinding down local confidence Effect on activity is not clear, but downside risks are rising This months confidence, employment and CPI indicators will be critical for assessing the RBAs next move

Just how immune?

A cold we can deal with, but pneumonia is another thing altogether. As we have highlighted recently, Australia is not entirely immune to the global woes (see Asian Economics Quarterly: Will Asia Crack, 6 October). This months confidence, employment and CPI indicators will be critical for assessing the level of immunity and the RBAs next move. Recall that in early August the RBA was on the cusp of raising interest rates to deal with Australias prospective inflation problems. Faced with a mining boom, weak productivity growth and rising inflation the RBA had been hawkish all year. Things have changed. This week the RBA have given us their first signal that they would now consider moving rates in the other direction. The intense period of financial market volatility over the past couple of months with as yet no definitive resolution is the clear catalyst. As we have been saying for some time, in order to cut rates the RBA would need to credibly revise down underlying inflation forecasts (published in early August) from above the target band, at 3.25%, to the lower half of the target band, below 2.50%. This is a high hurdle. But the longer financial market volatility persists, the more it grinds down confidence, and the more likely it is that economic activity slows and inflation comes down. RBA rhetoric has shifted from concern about the medium-term outlook for inflation to suggesting the path for inflation may now be more consistent with the 23 per cent target in 2012 and 2013. But more evidence is needed to see outright cuts. Key indicators to watch will be the labour market survey for September, out next week, and 3Q CPI, due on 26 October. Confidence surveys out next week are also important. A rise in the unemployment rate from its current 5.3% to 5.5% (or higher) would open the door for a rate cut. Combine it with a reading on the trimmed mean inflation measure that was in, or below, the target band and we could see the RBA willing to pull the trigger. Neither is our central forecast, so we still see the RBA on hold this year. We expect unemployment to be broadly steady and underlying inflation to print above the band. But these data are notoriously hard to forecast and critical indicators for the RBAs next move. Here we set out some views on recent indicators of employment, inflation and confidence.

7 October 2011

Paul Bloxham Economist HSBC Bank Australia Limited +612 435 966 522 paulbloxham@hsbc.com.au View HSBC Global Research at: http://www.research.hsbc.com

Issuer of report:

HSBC Bank Australia Limited

Disclaimer & Disclosures This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it

Australias immunity to be tested Australian Economics 7 October 2011

abc

Are we at a labour market turning point? (Sept data next week)

The unemployment rate ticked up in July and August

% 67

but other labour market indicators are less bearish

% 8

Labour Force

Participation Rate (LHS)

66

Employment has fallen modestly for the past two months and the unemployment rate has also ticked up, from 4.9% in June to 5.3% in August. We expect it to hold steady in September, though this measure is fiendishly hard to forecast. At the same time, there has been an increase in hours worked, suggesting there is plenty of work to be done; businesses just seem uncertain about taking on new workers. This could be the sort of behaviour brought on by significant financial concerns. There were other anomalies in the employment survey: the rise was mostly driven by Queensland, which could reflect the lagged effect of the floods; and, there is some question about the seasonality of the data.

65

64

63 Unemployment Rate (RHS) 62 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

Source: Datastream

Job advertisements held up well in August

% 3.0 2.5 2.0 1.5 1.0 Unemployment rate (inverted, RHS) 0.5 0.0 2003 2005 2007 2009 2011 6.0 6.5 Job Advertisements (% of labour force, LHS)

September reading is due next week

% 3.5 4.0 4.5 5.0 5.5

Job Advertisements

There are a number of timely partial indicators of labour market for Australia which are coincident indicators of conditions. Job advertisements are a fairly reliable and smooth indicator of labour market conditions. Indeed, as the chart to the left shows, they are smoother than the unemployment rate. When job advertisements fall decisively, they provide a strong signal that conditions have weakened. In the past few months, they have levelled out, but not fallen.

Source: Datastream; ANZ Bank

Other indicators are stronger than the unemployment rate

Employment question in business conditions survey

30 20 10 0 -10 -20 -30 1997 2000 2003 2006 2009 30 20 10 0 -10 -20 -30

a very different signal from that in late 2008, so far There are a host of other timely measures of labour market conditions in Australia, including a count of unemployment benefit recipients, the official quarterly measure of vacancy rates and a range of business surveys. Most of these indicators are more positive than the unemployment rate. The NAB monthly business conditions survey has a component on employment (shown left), which was sitting around its average in August and is still well above the levels reached in late 2008. We get the September reading next week. Job vacancies rose in 3Q and unemployment benefits have held broadly steady.

Source: Datastream; National Australia Bank

Australias immunity to be tested Australian Economics 7 October 2011

abc

Inflation is expected to be elevated (3Q print on 26 October)

Seasonal reanalysis lowered underlying inflation

%ye 5 New* 4 4

but reweighting of index is upside risk for future prints

%ye 5

Underlying inflation

The statistics bureau has taken over the seasonal analysis of the RBAs preferred measures of underlying inflation, and deemed that more of the components are seasonal than previously thought. This has seen revisions to the trimmed mean and weighted median measures of inflation the RBAs favourites. The average of these two measures is now running closer to the middle of the target band than previously (2.55% vs. 2.70%). But, as a part of the regular re-benchmarking of the CPI they have also increased the weight of housing, health and household services all items that have been running ahead of average recently.

3 Old* 2 RBA target band 1

0 2002 2004 2006 2008 2010

*Average of trimmed mean and weighted median

Source: ABS; RBA

We still expect inflation to be elevated

% 6 5 4 3 2 1 0 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 *Trimmed Mean Quarterly Year-ended

which would make the RBA reluctant to cut rates There are a number of supply-side factors that are expected to continue to see inflation rise in 2H. Electricity prices have been increasing solidly due to lack of distributive capacity, which is expected to see persistent inflation. Water prices have also been rising, which is putting upward pressure on inflation. Housing rents have been growing above the middle of the target band, due to relatively low vacancy rates. Rising unit labour costs, due to increasing wages and weak productivity growth, have put upward pressure on services prices (now carrying a higher weight than before). Global inflation has been rising and the recent depreciation of the exchange rate will see further upward pressure.

Inflation*

Source: ABS; RBA; HSBC

View on unemployment impacts the inflation outlook

Lower unemployment drives higher inflation

5 4 3 2 1 0 3 4 5 6 7 8 9 Unemployment rate (%) 10 11 12

if unemployment stays above 5%, it will reduce inflation Estimates of the natural rate of unemployment in Australia vary through time, particularly as the nature of the industrial relations environment changes. Given recent policy changes and weak productivity growth it seems that unemployment below 5% is quite clearly unsustainable. Recent history suggests, however, that when the unemployment rate falls below 5% it tends to put upward pressure on inflation. The recent rise to above 5% will see less upward pressure on inflation from the labour market. The more it rises, the more downward pressure is applied.

Source: ABS

Inflation (%, 4Q advanced)

Australias immunity to be tested Australian Economics 7 October 2011

abc

Financial woes weaken sentiment (more prints next week)

Consumer sentiment low but buying conditions positive

Consumer Survey Questions

Long run average = 100

RBA have been highlighting a focus on buying conditions Consumer sentiment has weakened over recent months as households have seen large declines in their equity portfolios, and have received a continued battering from negative global financial news. Sentiment bounced back in September, as the negative news was offset by the expectation that the RBA would not be lifting interest rates this year, due to the financial market woes. October reading is due next week. The RBA have focused less on sentiment in recent months and more on the question about buying conditions, which has held up much better than it did in 2008. Households may be unhappy but they are still cashed up and happy to spend. RBA have recently highlighted that household unemployment expectations are a watch point, as they have risen.

150 Consumer sentiment 125

150

125

100

100

75

Good time to buy a household item

75

50 2000 2002 2004 2006 2008 2010

50

Source: Datastream; Westpac-Melbourne Institute

Business conditions average but confidence has fallen

NAB Business Survey

105 90 75 60 45 30 15 0 -15 -30 -45 1997 2000 2003 2006 2009 30 15 0 -15 -30

spectre of 2008 has risen, with local businesses worried Being a small open economy Australia is highly tied into global developments and business surveys have begun to reflect concern about the global financial woes. Business conditions in August were a little below average. Across industries there has been significant divergence, with most industries still positive. Those exposed to mining have been positive, while those that are exchange rate exposed have been less so. Retail has been very weak, reflecting that households are spending more on non-retail items. Confidence has fallen sharply, though remains well above levels reached in late 2008. Confidence is more fickle than conditions and, while generally interpreted as a leading indicator, its lead is weak. September reading next week.

Conditions

Confidence

-45 -60 -75 -90 -105 -120

Source: Datastream; National Australia Bank

Dont forget the mining boom

USD per tonne 200

spot traded commodities have fallen but bulks have not Spot traded commodities have fallen sharply in recent weeks on the back of global financial woes, but as yet, commodities that traded largely on a contract basis are still holding firm. Australias largest exports are iron ore and coal, which are largely traded on contract. Prices in spot markets for these commodities a timely guide to current prices have come down a little in recent weeks, but are still at very high levels. Spot traded commodities can often be unduly influenced by speculative flows and the general global risk environment, rather than supply and demand dynamics for the deliverable commodity. Bulk commodities are less susceptible to these bouts of emotion.

Iron Ore Spot Price

160

120

80

40

0 Dec 2008 Jun 2009 Dec 2009 Jun 2010 Dec 2010 Jun 2011

Source: Bloomberg

Australias immunity to be tested Australian Economics 7 October 2011

abc

Disclosure appendix

Analyst Certification

The following analyst(s), economist(s), and/or strategist(s) who is(are) primarily responsible for this report, certifies(y) that the opinion(s) on the subject security(ies) or issuer(s) and/or any other views or forecasts expressed herein accurately reflect their personal view(s) and that no part of their compensation was, is or will be directly or indirectly related to the specific recommendation(s) or views contained in this research report: Paul Bloxham

Important Disclosures

This document has been prepared and is being distributed by the Research Department of HSBC and is intended solely for the clients of HSBC and is not for publication to other persons, whether through the press or by other means. This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Advice in this document is general and should not be construed as personal advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to their objectives, financial situation and needs. If necessary, seek professional investment and tax advice. Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products. The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results. Analysts, economists, and strategists are paid in part by reference to the profitability of HSBC which includes investment banking revenues. For disclosures in respect of any company mentioned in this report, please see the most recently published report on that company available at www.hsbcnet.com/research. * HSBC Legal Entities are listed in the Disclaimer below.

Additional disclosures

1 2 3 This report is dated as at 07 October 2011. All market data included in this report are dated as at close 06 October 2011, unless otherwise indicated in the report. HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

Australias immunity to be tested Australian Economics 7 October 2011

abc

Disclaimer

* Legal entities as at 04 March 2011 UAE HSBC Bank Middle East Limited, Dubai; HK The Hongkong and Shanghai Banking Corporation Limited, Hong Kong; TW HSBC Securities (Taiwan) Corporation Limited; CA HSBC Securities (Canada) Inc, Toronto; HSBC Bank, Paris Branch; HSBC France; DE HSBC Trinkaus & Burkhardt AG, Dsseldorf; 000 HSBC Bank (RR), Moscow; IN HSBC Securities and Capital Markets (India) Private Limited, Mumbai; JP HSBC Securities (Japan) Limited, Tokyo; EG HSBC Securities Egypt SAE, Cairo; CN HSBC Investment Bank Asia Limited, Beijing Representative Office; The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch; The Hongkong and Shanghai Banking Corporation Limited, Seoul Securities Branch; The Hongkong and Shanghai Banking Corporation Limited, Seoul Branch; HSBC Securities (South Africa) (Pty) Ltd, Johannesburg; GR HSBC Securities SA, Athens; HSBC Bank plc, London, Madrid, Milan, Stockholm, Tel Aviv; US HSBC Securities (USA) Inc, New York; HSBC Yatirim Menkul Degerler AS, Istanbul; HSBC Mxico, SA, Institucin de Banca Mltiple, Grupo Financiero HSBC; HSBC Bank Brasil SA Banco Mltiplo; HSBC Bank Australia Limited; HSBC Bank Argentina SA; HSBC Saudi Arabia Limited; The Hongkong and Shanghai Banking Corporation Limited, New Zealand Branch Issuer of report HSBC Bank Australia Limited Level 32 HSBC Centre 580 George Street Sydney, NSW 2000, Australia Telephone: +61 2 9006 5888 Fax: +61 2 9255 2205 Website: www.research.hsbc.com

In Australia, this publication has been distributed by The Hongkong and Shanghai Banking Corporation Limited (ABN 65 117 925 970, AFSL 301737) for the general information of its wholesale customers (as defined in the Corporations Act 2001). Where distributed to retail customers, this research is distributed by HSBC Bank Australia Limited (AFSL No. 232595). These respective entities make no representations that the products or services mentioned in this document are available to persons in Australia or are necessarily suitable for any particular person or appropriate in accordance with local law. No consideration has been given to the particular investment objectives, financial situation or particular needs of any recipient. This material is distributed in the United Kingdom by HSBC Bank plc. In the UK this material may only be distributed to institutional and professional customers and is not intended for private customers. Any recommendations contained in it are intended for the professional investors to whom it is distributed. This publication is distributed in New Zealand by The Hongkong and Shanghai Banking Corporation Limited, New Zealand Branch. This material is distributed in Japan by HSBC Securities (Japan) Limited. This material may be distributed in the United States solely to "major US institutional investors" (as defined in Rule 15a-6 of the US Securities Exchange Act of 1934); such recipients should note that any transactions effected on their behalf will be undertaken through HSBC Securities (USA) Inc. in the United States. Note, however, that HSBC Securities (USA) Inc. is not distributing this report, has not contributed to or participated in its preparation, and does not take responsibility for its contents. In Singapore, this publication is distributed by The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch for the general information of institutional investors or other persons specified in Sections 274 and 304 of the Securities and Futures Act (Chapter 289) (SFA) and accredited investors and other persons in accordance with the conditions specified in Sections 275 and 305 of the SFA. This publication is not a prospectus as defined in the SFA. It may not be further distributed in whole or in part for any purpose. In Korea, this publication is distributed by either The Hongkong and Shanghai Banking Corporation Limited, Seoul Securities Branch ("HBAP SLS") or The Hongkong and Shanghai Banking Corporation Limited, Seoul Branch ("HBAP SEL") for the general information of professional investors specified in Article 9 of the Financial Investment Services and Capital Markets Act (FSCMA). This publication is not a prospectus as defined in the FSCMA. It may not be further distributed in whole or in part for any purpose. Both HBAP SLS and HBAP SEL are regulated by the Financial Services Commission and the Financial Supervisory Service of Korea. The Hongkong and Shanghai Banking Corporation Limited Singapore Branch is regulated by the Monetary Authority of Singapore. Recipients in Singapore should contact a "Hongkong and Shanghai Banking Corporation Limited, Singapore Branch" representative in respect of any matters arising from, or in connection with this report. HSBC Mxico, S.A., Institucin de Banca Mltiple, Grupo Financiero HSBC is authorized and regulated by Secretara de Hacienda y Crdito Pblico and Comisin Nacional Bancaria y de Valores (CNBV). HSBC Bank (Panama) S.A. is regulated by Superintendencia de Bancos de Panama. Banco HSBC Honduras S.A. is regulated by Comisin Nacional de Bancos y Seguros (CNBS). Banco HSBC Salvadoreo, S.A. is regulated by Superintendencia del Sistema Financiero (SSF). HSBC Colombia S.A. is regulated by Superintendencia Financiera de Colombia. Banco HSBC Costa Rica S.A. is supervised by Superintendencia General de Entidades Financieras (SUGEF). Banistmo Nicaragua, S.A. is authorized and regulated by Superintendencia de Bancos y de Otras Instituciones Financieras (SIBOIF). This material is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. This document has been prepared without taking account of the objectives, financial situation or needs of any specific person who may receive this document. Any such person should, before acting on the information in this document, consider the appropriateness of the information, having regard to the personal objectives, financial situation and needs. In all cases, anyone proposing to rely on or use the information in this document should independently verify and check its accuracy, completeness, reliability and suitability and should obtain independent and specific advice from appropriate professionals or experts. HSBC has based this document on information obtained from sources it believes to be reliable but which it has not independently verified; HSBC makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of HSBC only and are subject to change without notice. HSBC and its affiliates and/or their officers, directors and employees may have positions in any securities mentioned in this document (or in any related investment) and may from time to time add to or dispose of any such securities (or investment). HSBC and its affiliates may act as market maker or have assumed an underwriting commitment in the securities of any companies discussed in this document (or in related investments), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform banking or underwriting services for or relating to those companies. This material may not be further distributed in whole or in part for any purpose. No consideration has been given to the particular investment objectives, financial situation or particular needs of any recipient. (070905) Copyright. HSBC Bank Australia Ltd 2011, ALL RIGHTS RESERVED. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Bank Australia Limited. MICA (P) 208/04/2011 and MICA (P) 040/04/2011

You might also like

- GlobalDocument2 pagesGlobaldavid_llewellyn_smithNo ratings yet

- Aus Tin 20104493Document166 pagesAus Tin 20104493david_llewellyn_smithNo ratings yet

- Psi Oct11 ReportDocument2 pagesPsi Oct11 Reportdavid_llewellyn_smithNo ratings yet

- Euro ZoneDocument3 pagesEuro Zonedavid_llewellyn_smithNo ratings yet

- MBS September 2011Document12 pagesMBS September 2011david_llewellyn_smithNo ratings yet

- Tradoc 113366Document11 pagesTradoc 113366david_llewellyn_smithNo ratings yet

- Trade Statistics: Ministry of Finance Release October 24. 2011Document25 pagesTrade Statistics: Ministry of Finance Release October 24. 2011david_llewellyn_smithNo ratings yet

- TD-MI PR Oct11 - PRDocument1 pageTD-MI PR Oct11 - PRdavid_llewellyn_smithNo ratings yet

- Aus Tin 20104493Document166 pagesAus Tin 20104493david_llewellyn_smithNo ratings yet

- Commercial Finance ABS 5671Document1 pageCommercial Finance ABS 5671david_llewellyn_smithNo ratings yet

- Melbourne Institute Monthly Bulletin of Economic Trends: October 2011Document10 pagesMelbourne Institute Monthly Bulletin of Economic Trends: October 2011david_llewellyn_smithNo ratings yet

- Aus Tin 20103394Document46 pagesAus Tin 20103394david_llewellyn_smithNo ratings yet

- Bulletin: Jobs by Sector and by StateDocument6 pagesBulletin: Jobs by Sector and by Statedavid_llewellyn_smithNo ratings yet

- View Press ReleaseDocument4 pagesView Press Releasedavid_llewellyn_smithNo ratings yet

- IMF - Australia Article IV Consultation ReportDocument59 pagesIMF - Australia Article IV Consultation Reportrryan123123No ratings yet

- ANZ Job Ads September 2011Document15 pagesANZ Job Ads September 2011david_llewellyn_smithNo ratings yet

- CR 11301Document41 pagesCR 11301david_llewellyn_smithNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Travel & Tourism Economic Impact To Indonesia (2018)Document24 pagesTravel & Tourism Economic Impact To Indonesia (2018)Anonymous sYOiHL7No ratings yet

- Forming The Partnership DIgestsDocument2 pagesForming The Partnership DIgestsmelaniem_1No ratings yet

- Roland Berger Wealth Management in New Realities 20131023Document92 pagesRoland Berger Wealth Management in New Realities 20131023Muthu Barathi ParamasivamNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisSandesha Weerasinghe0% (1)

- General Awareness PDFDocument72 pagesGeneral Awareness PDFDildar JahangirNo ratings yet

- Integrated Report & Annual Accounts 2015 16 (109th Year)Document300 pagesIntegrated Report & Annual Accounts 2015 16 (109th Year)pavan94825100% (1)

- Betas 2017Document3 pagesBetas 2017Abraham Huachos GutierrezNo ratings yet

- Knowledge Bank ORIGINAL 2Document18 pagesKnowledge Bank ORIGINAL 2Prakarsh SharmaNo ratings yet

- Edcl 5322190311Document73 pagesEdcl 5322190311csudhaNo ratings yet

- ITR 4 Sugam Form For Assessment Year 2018 19Document9 pagesITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshNo ratings yet

- Macro Economic Policy MBADocument63 pagesMacro Economic Policy MBABabasab Patil (Karrisatte)0% (1)

- Valuation Report Sample FormatDocument6 pagesValuation Report Sample FormatParas Niraula0% (1)

- Fin 542Document3 pagesFin 542hanuman001No ratings yet

- ReportDocument5 pagesReportumaganNo ratings yet

- DB Guide To FX IndicesDocument84 pagesDB Guide To FX Indicesmzanella82No ratings yet

- Toll Media Release FY19 Results 16.05.2019Document2 pagesToll Media Release FY19 Results 16.05.2019Kendrik LimNo ratings yet

- XiaoMi Financial StatementsDocument19 pagesXiaoMi Financial StatementsLesterNo ratings yet

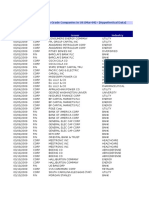

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Document10 pagesIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainNo ratings yet

- Commercial Power 2013Document103 pagesCommercial Power 2013NewYorkObserverNo ratings yet

- The HP Business Intelligence Maturity Model: Describing The BI JourneyDocument8 pagesThe HP Business Intelligence Maturity Model: Describing The BI Journeyaiamb4010No ratings yet

- Paper 3-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 3 - UnlockedDocument19 pagesPaper 3-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 3 - UnlockedHirak Jyoti DasNo ratings yet

- McMahon - Natural Resource Curse-Myth or RealityDocument39 pagesMcMahon - Natural Resource Curse-Myth or RealityGary McMahonNo ratings yet

- Serving Humanity, Saving LivesDocument72 pagesServing Humanity, Saving LivesDavid LeongNo ratings yet

- FSAP ManualDocument7 pagesFSAP ManualJose ArmazaNo ratings yet

- 2019-04-01 North & South PDFDocument124 pages2019-04-01 North & South PDFMichel HaddadNo ratings yet

- Uncertainty and Consumer Behavior - Chapter 5Document17 pagesUncertainty and Consumer Behavior - Chapter 5rizzzNo ratings yet

- Ratio AnalysisDocument61 pagesRatio AnalysisHariharan KanagasabaiNo ratings yet

- Full Report Ubs Group Ag and Ubs Ag Consolidated 2019 en PDFDocument776 pagesFull Report Ubs Group Ag and Ubs Ag Consolidated 2019 en PDFMakuna NatsvlishviliNo ratings yet