Professional Documents

Culture Documents

Beverage

Uploaded by

Dwayne Dujon ReidOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Beverage

Uploaded by

Dwayne Dujon ReidCopyright:

Available Formats

The beverage industry was significantly changed during the mid 2000's from being dominated by carbonated soft

drinks to alternative beverages such as energy drinks, sports drinks, and vitamin-enhanced beverages. The carbonated soft drink sector faced ash criticism from health official about the health risk their products creates for customers. With the health official lashing out on carbonated soft drinks and consumer consumption decreasing, global beverage companies had to shift up its production, and started to focus more on alternative beverages. The introduction of alternative beverages saw blistering growth during its first quarter, and the global beverage industry was projected to gain a $20 billion increase by 2014. Sales of alternative beverages rocketed in the global industry, and if it wasn't for America's economic meltdown the numbers would be relatively higher. In the United States companies was suffering during the recession; the sports drinks sector recorded the second biggest lost with a sales decrease of 12.3 percent between 2008 and 2009. Flavored water suffered the most with its lost on sales coming in at 12.5 percent. The United States is very important to the beverage industry because its responsible for 42.3 percent of sales from the $40.2 billion the global beverage industry accumulated in 2009; before the recession the alternative industry saw a increase of sales by 13 percent from 2005 - 2007. The market for alternative beverages is constantly improving with competitors pushing each other to the gain the trust of consumers. This is not just good in terms of sales and market growth but also health wise. Alternative beverages didn't just had an effect on market shares and sales but also health risk. Companies are well aware of the fact that consumers are starting to pay close attention to label on their products, which in return forces beverage companies to make a more "healthier decision" when creating their products. The energy drinks and other products with a high level of caffeine provides health risk and could lead to negligent demeanor by consumers. This then caused manufactures to introduce warning on the their product labels such as "do not consume more than 3 bottles of energy drink within a 3 hour span", another warns about the great health risk consumer would be taking if they were to mix the product with alcohol. As consumer preference changes beverage companies must change also to meet the expectation of the consumers. The biggest successor of the alternative beverages is PepsiCo with a global market share of 26.5 percent and a 47.8 share percentage in the geographic leader for consumption (U.S.A) market share in 2009. PepsiCo's number 1 competitor Coca-Cola was behind by 15.5 percent in the global beverage industry. It seems as if PepsiCo forced Coca-Cola to a grounding second place in almost all categories; With both companies selling their brands in over 20 countries, PepsiCo has been the better of the two. PepsiCo and Coca-Cola expanded their line of products, but PepsiCo holds the number 1 spot for sales in all categories except carbonated soft drinks. The sports drink sector was clearly dominated by the PepsiCo brand Gatorade, has too was Tropicana, frappuccino and aquafina as product leaders in their respective categories. PepsiCo holds a

2-1 ratio in the worldwide market share. PepsiCo saw their Net revenue increase by $6 million in 2009 from the 2007 $39 million. PepsiCo and Coca-Cola has a great advantage when it comes to product distribution, with an already established distribution channel from their Pepsi and Coke soft drinks. Its relatively easy for them to get alternative beverages to supermarkets and other stores where ever Pepsi or Coke can be purchase.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- PESTLE Analysis of ChinaDocument4 pagesPESTLE Analysis of ChinaAmit Pathak67% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Filetype PDF Journal of Real Estate Finance and EconomicsDocument2 pagesFiletype PDF Journal of Real Estate Finance and EconomicsJennaNo ratings yet

- Cyber Nations User Player GuideDocument13 pagesCyber Nations User Player GuideOzread100% (1)

- Example of A Project CharterDocument9 pagesExample of A Project CharterHenry Sithole100% (1)

- Chicago 'Buycks' Lawsuit PlaintiffsDocument6 pagesChicago 'Buycks' Lawsuit PlaintiffsThe Daily CallerNo ratings yet

- Anser Key For Class 8 Social Science SA 2 PDFDocument5 pagesAnser Key For Class 8 Social Science SA 2 PDFSoumitraBagNo ratings yet

- Long Tom SluiceDocument6 pagesLong Tom SluiceJovanny HerreraNo ratings yet

- Report Sugar MillDocument51 pagesReport Sugar MillMuhammadAyyazIqbal100% (1)

- 5th Sanction Letter 2Document2 pages5th Sanction Letter 2Tamalika DasNo ratings yet

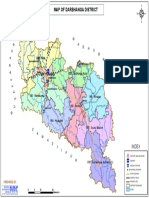

- DARBHANGA MapDocument1 pageDARBHANGA MapRISHIKESH ANANDNo ratings yet

- Portfolio October To December 2011Document89 pagesPortfolio October To December 2011rishad30No ratings yet

- Travel Through SpainDocument491 pagesTravel Through SpainFrancisco Javier SpínolaNo ratings yet

- Economics Environment: National Income AccountingDocument54 pagesEconomics Environment: National Income AccountingRajeev TripathiNo ratings yet

- Chapter 2Document18 pagesChapter 2FakeMe12No ratings yet

- Table of ContentsDocument6 pagesTable of ContentsRakeshKumarNo ratings yet

- Master Coin CodesDocument19 pagesMaster Coin CodesPavlo PietrovichNo ratings yet

- Data Sheet Machines & MaterialDocument2,407 pagesData Sheet Machines & MaterialPratham BhardwajNo ratings yet

- HL HP 05338 BWDocument1 pageHL HP 05338 BWErzsébetMészárosnéGyurkaNo ratings yet

- HBA - 25 Lakhs Order PDFDocument4 pagesHBA - 25 Lakhs Order PDFkarik1897No ratings yet

- The Impact of Globalisation On SMDocument25 pagesThe Impact of Globalisation On SMDaniel TaylorNo ratings yet

- Secure QualityDocument15 pagesSecure QualityAnonymous e2wolbeFsNo ratings yet

- Industriya NG AsukalDocument12 pagesIndustriya NG AsukalJhamela Ann ElesterioNo ratings yet

- Case Studies Management 4 SamsungDocument2 pagesCase Studies Management 4 Samsungdtk3000No ratings yet

- SLC-Contract Status-20080601-20080630-ALL-REPORTWMDocument37 pagesSLC-Contract Status-20080601-20080630-ALL-REPORTWMbnp2tkidotgodotid100% (1)

- Wedding BlissDocument16 pagesWedding BlissThe Myanmar TimesNo ratings yet

- Chapter 6 - An Introduction To The Tourism Geography of EuroDocument12 pagesChapter 6 - An Introduction To The Tourism Geography of EuroAnonymous 1ClGHbiT0JNo ratings yet

- Primus Case SolutionDocument28 pagesPrimus Case SolutionNadya Rizkita100% (1)

- API CAN DS2 en Excel v2 10038976Document458 pagesAPI CAN DS2 en Excel v2 10038976sushant ahujaNo ratings yet

- Scitech Prelim HandoutsDocument12 pagesScitech Prelim Handoutsms.cloudyNo ratings yet

- The Political Economy of Communication (Second Edition)Document2 pagesThe Political Economy of Communication (Second Edition)Trop JeengNo ratings yet