Professional Documents

Culture Documents

Fundamental Equity Analysis - S&P ASX 100 Members Australia)

Uploaded by

Chris HuangOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Equity Analysis - S&P ASX 100 Members Australia)

Uploaded by

Chris HuangCopyright:

Available Formats

19.09.

2011

AGL Energy Ltd

AGL Energy Limited sells and distributes gas and electricity. The Company

retails and wholesales energy and fuel products to customers throughout

Australia.

Price/Volume

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (25.10.2010)

52-Week Low (09.08.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 18.04.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AGK AT EQUITY YTD Change

AGK AT EQUITY YTD % CHANGE

06/2011

01/yy

16.92

12.50

1'456'704.00

14.46

-14.54%

15.68%

49.77%

461.3

6'670.57

1'171.20

0.0

0.0

753.10

7'088.67

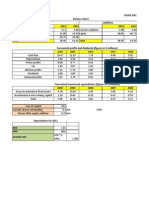

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

4.5 M

16

4.0 M

14

3.5 M

12

3.0 M

10

8

2.5 M

2.0 M

1.5 M

1.0 M

.5 M

0

f-10 m-10

30.06.2008

30.06.2009

5'424.0

5'953.9

1.54x

1.09x

439.3

(1'368.1)

19.07x

229.0

1'596.1

19.70x

8.35x

Profitability

30.06.2010

6'609.9

1.06x

544.5

12.92x

356.1

18.54x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

30.06.2011

7'071.8

1.01x

1'008.5

7.12x

558.7

11.97x

1'008.50

860.50

12.17%

11.22%

6.08%

9.20%

8.45%

0.77%

19.3%

14.3%

12.2%

7.9%

1.11

0.82

12.08%

18.47%

7.97

51.50

Price/ Cash Flow

LTM-4Q

LTM

01/yy

01/yy

-

j-10

j-10

a-10

s-10

o-10

n-10

d-10

j-11

FY+1

-

.0 M

f-11

4.08

0.66

456.63

3.88

-5.79%

-1.03%

0.661

15

4.333

2'099'321

2'023'515

1'668'686

FY+2

FQ+1

FQ+2

06/12 Y

06/13 Y

12/10 Q2 03/11 Q3

7'525.4

8'374.0

1.01x

0.92x

886.3

965.1

8.00x

7.35x

485.6

519.9

13.89x

12.97x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

20.10.2006

BBB

STABLE

13.43

6.44

0.41

1.16

18.5%

15.6%

0.77

2.76

45.80

7.09

54.23

-1.34

Sales/Revenue/Turnover

70.00

7'000.0

60.00

6'000.0

50.00

5'000.0

40.00

4'000.0

30.00

3'000.0

20.00

2'000.0

10.00

1'000.0

0.00

06.07.2007

a-10 m-10

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

30.06.2007

3'458.9

2.53x

804.9

10.86x

410.5

0.12x

18

0.0

06.01.2008

06.07.2008

06.01.2009

06.07.2009

06.01.2010

06.07.2010

06.01.2011

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

19.09.2011

AGL Energy Ltd

Holdings By:

All

Holder Name

BLACKROCK FUND ADVIS

AUSTRALIAN FOUNDATIO

VANGUARD GROUP INC

AMP LIFE LTD

BOND STREET CUSTODIA

ARGO INVESTMENTS LTD

VANGUARD INVESTMENTS

QUESTOR FINANCIAL SE

CUSTODIAL SERVICES L

BT PORTFOLIO SERVICE

AVANTEOS INVESTMENTS

ABERDEEN ASSET MANAG

PERPETUAL TRUSTEE CO

COHEN & STEERS CAPIT

INVIA CUSTODIAN PTY

MILTON CORP LTD

GWYNVILL INVEST PTY

HEXAVEST INC

MACQUARIE INVESTMENT

FIDELITY MANAGEMENT

Firm Name

Macquarie

Deutsche Bank

Morgan Stanley

Credit Suisse

UBS

JPMorgan

Goldman Sachs & Partners Australia

Nomura

E.L. & C. Baillieu

Daiwa Securities Capital Markets Co.

Commonwealth Bank

RBS

Citi

Portfolio Name

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

n/a

n/a

Multiple Portfolios

n/a

n/a

n/a

n/a

Multiple Portfolios

n/a

Multiple Portfolios

n/a

n/a

n/a

HEXAVEST INC

Multiple Portfolios

Multiple Portfolios

Analyst

IAN MYLES

JOHN HIRJEE

MARK BLACKWELL

SANDRA MCCULLAGH

DAVID LEITCH

JASON HARLEY STEED

AIDEN BRADLEY

DAVID FRASER

IVOR RIES

DAVID BRENNAN

PAUL JOHNSTON

JASON MABEE

MARIE MIYASHIRO

Source

MF-AGG

MF-AGG

MF-AGG

Co File

Co File

Co File

MF-AGG

Co File

Co File

Co File

Co File

MF-AGG

Co File

MF-AGG

Co File

Co File

Co File

13F

MF-AGG

MF-AGG

Recommendation

neutral

buy

Equalwt/In-Line

underperform

buy

overweight

buy

buy

buy

outperform

hold

buy

buy

Amt Held

4'468'857

4'287'000

3'638'353

3'555'155

3'338'224

2'453'787

2'334'801

2'152'620

2'033'213

1'955'463

1'862'110

1'551'485

1'534'436

1'515'100

1'383'658

1'368'500

1'263'150

678'894

566'911

556'142

% Out

0.98

0.94

0.79

0.78

0.73

0.54

0.51

0.47

0.44

0.43

0.41

0.34

0.33

0.33

0.3

0.3

0.28

0.15

0.12

0.12

Weighting

Change

3

5

3

1

5

5

5

5

5

5

3

5

5

Latest Chg

1'099

29'623

79'907

53'445

(5'000)

361'719

99'971

635

Target Price

M

M

M

M

M

M

M

M

U

M

U

M

U

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

16

17

15

16

17

17

17

18

16

16

16

17

17

File Dt

Inst Type

03.02.2011

Investment Advisor

30.06.2010

Investment Advisor

31.12.2010

Investment Advisor

11.08.2010

Investment Advisor

11.08.2010

Other

11.08.2010

Investment Advisor

31.12.2010 Mutual Fund Manager

11.08.2010

Private Equity

11.08.2010

Other

11.08.2010

n/a

11.08.2010

n/a

31.12.2010

Investment Advisor

11.08.2010

n/a

30.09.2010

Investment Advisor

11.08.2010

Investment Advisor

11.08.2010

Investment Advisor

11.08.2010

n/a

30.09.2010 Hedge Fund Manager

31.12.2010 Mutual Fund Manager

31.12.2010

Investment Advisor

Date

12 month

12 month

12 month

Not Provided

12 month

12 month

Not Provided

Not Provided

12 month

Not Provided

12 month

12 month

Not Provided

Date

08.02.2011

07.02.2011

07.02.2011

07.02.2011

07.02.2011

07.02.2011

07.02.2011

07.02.2011

07.02.2011

16.12.2010

07.12.2010

26.08.2010

22.03.2010

19.09.2011

Alumina Ltd

Alumina Limited is an Australian resource company that produces alumina. The

Company owns about 40% of Alcoa World Alumina and Chemicals through a joint

venture with Alcoa.

Price/Volume

3

70.0 M

60.0 M

50.0 M

Latest Fiscal Year:

LTM as of:

52-Week High (11.04.2011)

52-Week Low (14.09.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.06.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AWC AT EQUITY YTD Change

AWC AT EQUITY YTD % CHANGE

12/2010

01/yy

2.72

1.46

15'692'778.00

1.495

-45.04%

2.75%

6.72%

2'440.2

3'648.09

463.90

0.0

0.0

112.10

4'155.90

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

30.0 M

20.0 M

10.0 M

0

f-10 m-10

a-10

m-10

j-10

j-10

a-10

s-10

o-10

n-10

d-10

.0 M

f-11

j-11

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.12.2006

0.0

(8.0)

385.1

14.47x

40.0 M

Valuation Analysis

31.12.2007

31.12.2008

0.0

0.0

(11.6)

(16.3)

366.0

143.1

16.68x

10.78x

Profitability

31.12.2009

0.0

(14.7)

(20.6)

-

31.12.2010

0.0

34.6

181.23x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

-14.70

0.98%

1.15%

1.85%

0.00%

0.56

0.50

13.10%

15.10%

-

Price/ Cash Flow

LTM-4Q

LTM

01/yy

01/yy

-

FY+1

-

4.57

1.38

2'309.94

24.62

-18.86%

-37.83%

1.382

16

4.188

16'294'630

20'229'520

17'507'620

FY+2

12/11 Y

12/12 Y

1'003.8

1'002.7

4.11x

4.08x

148.8

199.3

27.93x

20.86x

185.4

253.1

20.70x

15.96x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

FQ+1

FQ+2

18.04.2011

BBB

STABLE

21.11.2001

NR

15.1%

13.1%

0.00

0.00

-

Sales/Revenue/Turnover

2'000.0

30.00

1'800.0

25.00

1'600.0

1'400.0

20.00

1'200.0

15.00

1'000.0

800.0

10.00

600.0

400.0

5.00

0.00

05.01.2007

200.0

0.0

05.07.2007

05.01.2008

05.07.2008

05.01.2009

05.07.2009

05.01.2010

05.07.2010

05.01.2011

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

19.09.2011

Alumina Ltd

Holdings By:

All

Holder Name

BLACKROCK INVESTMENT

COOPER INVESTORS PTY

WELLINGTON MANAGEMEN

NWQ INVESTMENT MANAG

MAPLE-BROWN ABBOTT L

FRANKLIN RESOURCES I

BLACKROCK FUND ADVIS

VANGUARD GROUP INC

BLACKROCK GROUP LIMI

JOHN HANCOCK INVESTM

AUSTRALIAN FOUNDATIO

VANGUARD INVESTMENTS

CHINA INTERNATIONAL

NORTHERN TRUST CORPO

PHILLIPS HAGER & NOR

MASON STREET ADVISOR

NUVEEN ASSET MANAGEM

SCHRODER INVESTMENT

UCA FUNDS MANAGEMENT

JPMORGAN ASSET MANAG

Firm Name

Goldman Sachs & Partners Australia

HSBC

BMO Capital Markets

Macquarie

Morgan Stanley

Credit Suisse

Commonwealth Bank

RBS

Deutsche Bank

UBS

JPMorgan

E.L. & C. Baillieu

Citi

CLSA Asia Pacific Markets

Investec

Portfolio Name

n/a

n/a

n/a

n/a

n/a

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Analyst

IAN PRESTON

DANIEL KANG

TONY ROBSON

LEE BOWERS

CRAIG CAMPBELL

PAUL MCTAGGART

ANDREW KNUCKEY

LYNDON FAGAN

PAUL-D YOUNG

GLYN LAWCOCK

FRASER JAMIESON

RAY CHANTRY

CLARKE WILKINS

HAYDEN BAIRSTOW

TIM GERRARD

Source

EXCH

EXCH

EXCH

Co File

Co File

13G

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

Recommendation

hold

neutral

market perform

neutral

Overwt/Attractive

neutral

buy

hold

hold

buy

overweight

accumulate

sell

buy

buy

Amt Held

130'606'616

127'237'415

111'400'552

102'017'042

73'439'925

33'195'405

23'304'780

20'277'185

17'493'948

14'433'823

14'323'000

12'614'290

10'000'000

8'668'040

8'519'213

7'791'350

6'857'126

5'983'081

5'738'623

5'069'900

% Out

5.35

5.21

4.57

4.18

3.01

1.36

0.96

0.83

0.72

0.59

0.59

0.52

0.41

0.36

0.35

0.32

0.28

0.25

0.24

0.21

Weighting

Change

3

3

3

3

5

3

5

3

3

5

5

4

1

5

5

Latest Chg

(11'765'729)

100'466

(3'054'391)

(1'547'922)

534'132

10'000'000

4'839'862

(7'064'100)

251'797

(3'230'100)

Target Price

M

M

M

M

M

D

M

D

M

M

M

M

D

M

U

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

Inst Type

22.09.2010

Investment Advisor

19.08.2010

n/a

23.02.2010

Investment Advisor

23.02.2009

Investment Advisor

23.02.2009

Investment Advisor

31.12.2009

Investment Advisor

31.12.2010

Investment Advisor

31.12.2010

Investment Advisor

29.10.2010

Investment Advisor

31.12.2009 Mutual Fund Manager

30.06.2010

Investment Advisor

31.12.2010 Mutual Fund Manager

30.06.2010

Investment Advisor

31.12.2010

Investment Advisor

30.11.2010

Investment Advisor

30.06.2010

Investment Advisor

30.11.2010

Investment Advisor

30.06.2010

Investment Advisor

31.12.2010 Mutual Fund Manager

30.09.2010

Investment Advisor

Date

3

3

3

3

3

3

3

3

3

3

3

3

2

2

2

Not Provided

Not Provided

Not Provided

12 month

12 month

Not Provided

12 month

12 month

12 month

12 month

12 month

12 month

Not Provided

Not Provided

12 month

Date

02.02.2011

24.01.2011

21.01.2011

18.01.2011

17.01.2011

12.01.2011

12.01.2011

11.01.2011

11.01.2011

11.01.2011

06.01.2011

10.12.2010

08.11.2010

29.10.2010

20.10.2010

19.09.2011

Amcor Ltd/Australia

Amcor Limited is an international integrated packaging company offering

packaging and related services. Amcor primarily produces a wide range of

packaging products which include corrugated boxes, cartons, aluminum and steel

cans, flexible plastic packaging, PET plastic bottles and jars, and multi-wall

sacks.

Price/Volume

8

15.0 M

Latest Fiscal Year:

LTM as of:

52-Week High (07.04.2011)

52-Week Low (09.08.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 11.08.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AMC AT EQUITY YTD Change

AMC AT EQUITY YTD % CHANGE

06/2011

01/yy

7.43

5.87

3'659'395.00

6.49

-12.65%

10.56%

53.21%

1'227.6

7'966.94

3'442.60

0.0

60.2

224.40

11'245.34

10.0 M

3

2

5.0 M

1

0

f-10 m-10

a-10

m-10

j-10

j-10

a-10

s-10

o-10

n-10

d-10

.0 M

f-11

j-11

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

20.0 M

Valuation Analysis

30.06.2007

9'710.5

0.98x

936.3

10.19x

533.7

30.49x

25.0 M

30.06.2008

30.06.2009

9'234.9

9'535.4

0.71x

0.73x

1'052.6

1'037.8

6.20x

6.68x

258.8

211.7

18.77x

19.65x

Profitability

30.06.2010

9'849.5

1.11x

1'132.1

9.64x

183.0

40.38x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

30.06.2011

12'412.3

0.98x

1'299.2

9.33x

356.7

24.74x

1'299.20

788.20

6.35%

4.43%

3.24%

9.20%

7.00%

1.13%

17.1%

10.5%

6.4%

2.9%

1.09

0.48

31.51%

93.34%

8.55

6.74

Price/ Cash Flow

LTM-4Q

LTM

01/yy

01/yy

-

FY+1

-

5.39

0.71

1'222.73

4.19

0.91%

1.21%

0.711

12

4.833

4'267'728

5'371'294

4'329'774

FY+2

06/12 Y

06/13 Y

12'463.9

13'180.5

0.89x

0.83x

1'641.4

1'794.0

6.85x

6.27x

650.7

749.5

12.20x

10.59x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

FQ+1

FQ+2

18.09.2009

BBB

STABLE

18.09.2009

A-2

6.20

3.22

2.48

2.65

93.3%

47.9%

1.13

2.67

42.68

54.15

62.33

34.51

Sales/Revenue/Turnover

12'000.0

10.00

9.00

10'000.0

8.00

7.00

8'000.0

6.00

6'000.0

5.00

4.00

4'000.0

3.00

2.00

2'000.0

1.00

0.00

06.07.2007

0.0

06.01.2008

06.07.2008

06.01.2009

06.07.2009

06.01.2010

06.07.2010

06.01.2011

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

19.09.2011

Amcor Ltd/Australia

Holdings By:

All

Holder Name

CAPITAL GROUP COMPAN

BLACKROCK INVESTMENT

IOOF HOLDINGS LTD

COMMONWEALTH BANK OF

HARRIS ASSOCIATES L

VANGUARD GROUP INC

AUSTRALIAN FOUNDATIO

BLACKROCK FUND ADVIS

MONDRIAN INVESTMENT

VANGUARD INVESTMENTS

PRUDENTIAL ASSET MGM

MACQUARIE INVESTMENT

DELAWARE MANAGEMENT

FRANK RUSSELL TRUST

UCA FUNDS MANAGEMENT

AMERICAN CENTURY COM

PRINCIPAL FINANCIAL

RCM CAPITAL MANAGEME

RBC ASSET MANAGEMENT

BLACKROCK ASSET MANA

Firm Name

Macquarie

Deutsche Bank

Nomura

CLSA Asia Pacific Markets

Citi

Credit Suisse

JPMorgan

Goldman Sachs & Partners Australia

Commonwealth Bank

UBS

Portfolio Name

n/a

n/a

n/a

n/a

HARRIS ASSOC LP

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Analyst

JOHN PURTELL

MARK WILSON

RICHARD J JOHNSON

SCOTT HUDSON

ANDREW BOWLEY

ROHAN GALLAGHER

KEITH CHAU

ANDREW GIBSON

MICHAEL WARD

SAM THEODORE

Source

EXCH

Co File

EXCH

EXCH

13F

MF-AGG

MF-AGG

MF-AGG

EXCH

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

Recommendation

outperform

buy

neutral

buy

buy

neutral

overweight

buy

buy

neutral

Amt Held

76'861'369

73'027'792

62'954'089

61'999'603

20'596'100

13'535'441

12'624'000

12'384'399

8'565'659

6'215'634

5'213'159

4'712'534

4'261'994

2'924'762

2'299'261

1'801'900

1'799'090

1'748'920

1'693'500

1'643'687

% Out

6.27

5.96

5.14

5.06

1.68

1.1

1.03

1.01

0.7

0.51

0.43

0.38

0.35

0.24

0.19

0.15

0.15

0.14

0.14

0.13

Weighting

Change

5

5

3

5

5

3

5

5

5

3

Latest Chg

15'460'551

(11'998'722)

15'538'900

607'426

(1'775'000)

(59'508'128)

255'535

81'249

171'470

(403'383)

734'833

(978'000)

24'711

102'000

-

Target Price

M

M

D

M

U

M

M

M

M

M

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

14.12.2010

11.08.2010

07.12.2010

22.11.2010

31.12.2010

31.12.2010

30.06.2010

04.02.2011

26.10.2010

31.12.2010

15.04.2010

31.12.2010

31.12.2010

31.08.2010

31.12.2010

30.09.2010

30.12.2010

30.09.2010

31.08.2010

04.02.2011

Date

7

8

7

8

8

7

8

8

8

7

12 month

12 month

Not Provided

Not Provided

Not Provided

Not Provided

6 month

Not Provided

12 month

12 month

Inst Type

Investment Advisor

Investment Advisor

Investment Advisor

Bank

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Hedge Fund Manager

Mutual Fund Manager

Investment Advisor

Mutual Fund Manager

Investment Advisor

Investment Advisor

Mutual Fund Manager

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Date

07.02.2011

04.02.2011

02.02.2011

02.02.2011

13.01.2011

22.10.2010

21.10.2010

21.10.2010

21.10.2010

01.10.2010

19.09.2011

AMP Ltd

AMP Limited provides life insurance, superannuation, asset management products,

pensions, retirement planning and other diversified financial services

throughout Australia and New Zealand. The Company services individual

customers, small businesses, corporations and associated superannuation funds.

Price/Volume

7

45.0 M

40.0 M

35.0 M

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (12.04.2011)

52-Week Low (09.08.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 31.05.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AMP AT EQUITY YTD Change

AMP AT EQUITY YTD % CHANGE

12/2010

01/yy

5.82

3.61

6'931'005.00

3.97

-31.79%

9.97%

19.00%

2'811.7

11'162.42

11'136.00

0.0

60.0

3'158.00

18'057.42

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

25.0 M

20.0 M

15.0 M

10.0 M

5.0 M

0

f-10 m-10

31.12.2007

31.12.2008

10'693.0

(8'677.0)

2.62x

985.0

580.0

21.63x

24.52x

Profitability

31.12.2009

10'742.0

2.21x

739.0

18.45x

31.12.2010

7'462.0

2.54x

775.0

14.53x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

22.55%

11.81%

0.87%

28.14%

9.83%

0.08%

10.4%

12.48%

379.03%

-

Price/ Cash Flow

m-10

LTM-4Q

LTM

01/yy

01/yy

-

j-10

j-10

a-10

s-10

o-10

n-10

d-10

.0 M

f-11

j-11

FY+1

-

5.29

1.12

2'743.35

39.29

-16.62%

-20.08%

1.120

12

4.500

13'886'750

12'867'950

13'796'510

FY+2

12/11 Y

12/12 Y

853.3

1'026.5

21.95x

17.72x

1'106.0

1'256.5

16.33x

14.37x

898.8

1'062.4

11.92x

10.91x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

FQ+1

FQ+2

379.0%

78.8%

0.08

-

Sales/Revenue/Turnover

8.00

35'000.0

7.00

30'000.0

25'000.0

6.00

20'000.0

5.00

15'000.0

4.00

10'000.0

3.00

5'000.0

2.00

0.0

1.00

-5'000.0

0.00

05.01.2007

a-10

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.12.2006

14'011.0

2.00x

915.0

21.00x

30.0 M

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

-10'000.0

05.07.2007

05.01.2008

05.07.2008

05.01.2009

05.07.2009

05.01.2010

05.07.2010

05.01.2011

-15'000.0

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

19.09.2011

AMP Ltd

Holdings By:

All

Holder Name

BLACKROCK INVESTMENT

CAPITAL WORLD INVEST

AMP LTD

CAPITAL RESEARCH GLO

BLACKROCK FUND ADVIS

BANK OF NEW YORK MEL

FIDELITY MANAGEMENT

VANGUARD GROUP INC

AUSTRALIAN FOUNDATIO

VANGUARD INVESTMENTS

MORGAN STANLEY & CO

MACQUARIE INVESTMENT

NEW JERSEY DIVISION

FIDELITY INTERNATION

PRUDENTIAL ASSET MGM

UBS STRATEGY FUND MG

OPPENHEIMERFUNDS INC

MELLON GLOBAL MANAGE

SUMITOMO MITSUI ASSE

SJUNDE AP FONDEN

Firm Name

RBS

Southern Cross

Daiwa Securities Capital Markets Co.

UBS

Macquarie

Credit Suisse

CLSA Asia Pacific Markets

Goldman Sachs & Partners Australia

JPMorgan

Deutsche Bank

Citi

Portfolio Name

n/a

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Analyst

RICHARD COLES

LAFITANI SOTIRIOU

JOHAN VANDERLUGT

JAMES COGHILL

TONY JACKSON

JOHN HEAGERTY

DANIEL TOOHEY

RYAN FISHER

SIDDHARTH PARAMESWARAN

KIEREN CHIDGEY

NIGEL PITTAWAY

Source

EXCH

MF-AGG

EXCH

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

Recommendation

buy

buy

hold

buy

restricted

neutral

outperform

hold

underweight

restricted

buy

Amt Held

102'739'746

34'510'401

33'577'089

22'054'313

20'262'786

20'182'238

19'841'299

16'650'150

10'768'000

10'625'438

10'088'338

7'471'538

7'237'960

5'645'868

4'526'119

4'440'242

3'251'762

2'813'578

2'205'661

2'154'899

% Out

4.91

1.65

1.6

1.05

0.97

0.96

0.95

0.79

0.51

0.51

0.48

0.36

0.35

0.27

0.22

0.21

0.16

0.13

0.11

0.1

Weighting

Change

5

5

3

5

#N/A N/A

3

5

3

1

#N/A N/A

5

U

M

M

M

M

M

M

M

M

M

M

Latest Chg

(4'418'679)

446'212

(66'859)

(1'057'031)

231'412

437'000

353'226

(307'798)

166'779

(427'226)

70'540

2'629'023

401'789

(26'068)

7'600

28'030

Target Price

6

7

6

6

#N/A N/A

6

6

6

6

#N/A N/A

6

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

07.05.2010

30.09.2010

02.02.2011

30.09.2010

03.02.2011

04.02.2011

31.12.2010

31.12.2010

30.06.2010

31.12.2010

30.09.2010

31.12.2010

30.09.2010

30.06.2010

15.04.2010

29.10.2010

31.10.2010

31.12.2010

12.05.2010

30.09.2010

Date

12 month

12 month

Not Provided

12 month

Not Provided

Not Provided

Not Provided

Not Provided

6 month

Not Provided

Not Provided

Inst Type

Investment Advisor

Investment Advisor

Insurance Company

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Mutual Fund Manager

Investment Advisor

Mutual Fund Manager

Pension Fund (ERISA)

Investment Advisor

Investment Advisor

Investment Advisor

Investment Advisor

Mutual Fund Manager

Mutual Fund Manager

Investment Advisor

Date

03.02.2011

02.02.2011

28.01.2011

25.01.2011

25.01.2011

22.01.2011

17.01.2011

07.01.2011

16.12.2010

15.11.2010

19.08.2010

19.09.2011

Ansell Ltd

Ansell Limited is a latex manufacturing company. The Company produces

industrial and service gloves, protective clothing, medical gloves and condoms

with operations in Asia, North America and the United Kingdom. Ansell also is

involved in the South Pacific Tires partnership with the Goodyear Tire and

Rubber Company.

Price/Volume

16

2.0 M

10

8

06/2011

01/yy

14.70

11.82

802'002.00

13.25

-9.86%

12.10%

58.68%

133.1

1'763.60

227.40

0.0

13.7

239.00

1'765.70

1.5 M

1.0 M

4

.5 M

2

0

f-10 m-10

a-10

m-10

j-10

j-10

a-10

s-10

o-10

n-10

d-10

.0 M

f-11

j-11

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

2.5 M

12

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (21.04.2011)

52-Week Low (09.08.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 18.08.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

ANN AT EQUITY YTD Change

ANN AT EQUITY YTD % CHANGE

30.06.2007

1'239.2

1.55x

154.0

12.44x

100.0

18.05x

3.0 M

14

30.06.2008

30.06.2009

1'244.7

1'360.6

1.13x

0.98x

164.0

177.1

8.59x

7.54x

102.6

121.4

12.53x

9.83x

Profitability

30.06.2010

1'230.6

1.47x

164.8

10.94x

119.4

14.65x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

30.06.2011

1'219.8

1.55x

155.2

12.15x

122.7

15.32x

155.20

134.00

10.99%

11.04%

9.76%

18.67%

14.60%

0.97%

38.9%

12.7%

11.0%

10.1%

1.46

0.95

18.70%

34.25%

7.27

3.77

Price/ Cash Flow

LTM-4Q

LTM

01/yy

01/yy

-

FY+1

-

2.49

0.69

132.73

2.46

0.77%

7.04%

0.693

11

3.727

1'236'601

1'010'932

763'200

FY+2

06/12 Y

06/13 Y

1'262.9

1'352.0

1.41x

1.26x

171.4

193.2

10.30x

9.14x

128.5

144.5

13.55x

11.86x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

FQ+1

FQ+2

09.11.2007

BBBSTABLE

08.02.2005

NR

14.37

10.24

-0.07

1.47

34.3%

25.1%

0.97

8.00

50.21

96.83

72.66

74.38

Sales/Revenue/Turnover

7'000.0

20.00

18.00

6'000.0

16.00

14.00

5'000.0

12.00

4'000.0

10.00

3'000.0

8.00

6.00

2'000.0

4.00

1'000.0

2.00

0.00

06.07.2007

0.0

06.01.2008

06.07.2008

06.01.2009

06.07.2009

06.01.2010

06.07.2010

06.01.2011

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

19.09.2011

Ansell Ltd

Holdings By:

All

Holder Name

PRUDENTIAL PLC

PERPETUAL LTD

BLACKROCK GROUP

COMMONWEALTH BANK OF

MAPLE-BROWN ABBOTT L

CAPITAL WORLD INVEST

CAPITAL RESEARCH GLO

HARRIS ASSOCIATES L

VANGUARD GROUP INC

MACQUARIE INVESTMENT

VANGUARD INVESTMENTS

AXA ROSENBERG INTL

MASSACHUSETTS FINANC

LFP

TRANSAMERICA INVESTM

BLACKROCK FUND ADVIS

JILLA RUSTOM F

GOLDMAN SACHS GROUP

GAM INTERNATIONAL MA

ING INVESTMENT MANAG

Firm Name

Morgan Stanley

JPMorgan

Macquarie

Deutsche Bank

Goldman Sachs & Partners Australia

Citi

RBS

UBS

Austock Securities

Southern Cross

Moelis & Company

Portfolio Name

Multiple Portfolios

#N/A N/A

n/a

n/a

n/a

Multiple Portfolios

Multiple Portfolios

HARRIS ASSOC LP

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Analyst

JAMES RUTLEDGE

STEVEN D WHEEN

CRAIG COLLIE

DAVID A LOW

IAN ABBOTT

ALEXANDER SMITH

DEREK JELLINEK

ANDREW GOODSALL

CRAIG STRANGER

STUART ROBERTS

TODD W GUYOT

Source

MF-AGG

EXCH

Co File

EXCH

EXCH

MF-AGG

MF-AGG

13F

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

Co File

MF-AGG

MF-AGG

MF-AGG

Recommendation

Overwt/Cautious

overweight

outperform

buy

hold

hold

hold

sell

hold

buy

sell

Amt Held

21'800'000

14'197'819

9'203'625

7'956'073

6'563'295

3'950'000

3'800'000

3'598'100

1'380'435

1'027'921

685'344

590'500

465'414

337'800

285'561

186'472

182'476

178'803

170'670

126'762

% Out

16.38

10.67

6.92

5.98

4.93

2.97

2.86

2.7

1.04

0.77

0.51

0.44

0.35

0.25

0.21

0.14

0.14

0.13

0.13

0.1

Weighting

Change

5

5

5

5

3

3

3

1

3

5

1

Latest Chg

450'000

(1'421'661)

1'323'168

(1'326'033)

(500'000)

(150'000)

3'217'045

(158'783)

(41'523)

23'414

2'600

337'800

(39'613)

(7'108)

(18'486)

Target Price

M

N

M

M

M

M

M

M

M

M

N

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

13

15

15

15

14

14

13

12

14

15

9

File Dt

Inst Type

30.09.2010

Investment Advisor

04.02.2011

Investment Advisor

31.07.2010

Investment Advisor

03.08.2010

Bank

14.05.2010

Investment Advisor

30.06.2010

Investment Advisor

30.09.2010

Investment Advisor

31.12.2010

Investment Advisor

31.12.2010

Investment Advisor

31.12.2010 Mutual Fund Manager

31.12.2010 Mutual Fund Manager

30.09.2010

Investment Advisor

30.11.2010

Investment Advisor

29.10.2010 Mutual Fund Manager

30.09.2010

Investment Advisor

31.12.2010

Investment Advisor

30.06.2010

n/a

31.10.2010

Investment Advisor

31.10.2010

Investment Advisor

30.09.2010

Investment Advisor

Date

12 month

12 month

12 month

12 month

Not Provided

Not Provided

12 month

12 month

Not Provided

12 month

14 month

Date

07.02.2011

03.02.2011

27.01.2011

25.01.2011

21.01.2011

20.01.2011

19.01.2011

03.11.2010

24.08.2010

23.08.2010

14.05.2009

19.09.2011

APA Group

APA Group has interests in a portfolio of high-pressure gas transmission

pipelines in Australia covering four states and two territories which transport

natural gas.

Price/Volume

5

3.5 M

3.0 M

2.5 M

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (27.04.2011)

52-Week Low (09.08.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 01.07.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

APA AT EQUITY YTD Change

APA AT EQUITY YTD % CHANGE

06/2011

01/yy

4.43

3.53

849'338.00

4.06

-8.35%

15.01%

63.33%

634.1

2'574.51

2'890.45

0.0

0.3

95.37

5'369.87

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

2.0 M

1.5 M

1.0 M

.5 M

1

0

f-10 m-10

30.06.2008

30.06.2009

848.9

908.0

4.98x

4.65x

398.4

437.1

10.61x

9.66x

67.2

78.8

17.52x

16.98x

Profitability

30.06.2010

953.0

5.11x

428.7

11.35x

100.4

18.56x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

30.06.2011

1'049.5

5.12x

432.6

12.43x

108.5

20.66x

432.65

332.30

31.66%

13.79%

2.08%

7.09%

6.69%

0.20%

41.2%

31.7%

10.3%

0.22

0.18

53.25%

173.33%

9.90

-

Price/ Cash Flow

m-10

LTM-4Q

LTM

01/yy

01/yy

-

j-10

j-10

a-10

s-10

o-10

n-10

d-10

.0 M

f-11

j-11

FY+1

-

8.47

0.74

539.77

6.38

11.60%

4.79%

0.745

13

4.231

1'795'361

2'045'087

1'869'278

FY+2

06/12 Y

06/13 Y

984.5

1'033.2

5.69x

5.47x

532.8

565.5

10.08x

9.50x

123.3

138.8

20.93x

19.15x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

FQ+1

FQ+2

1.71

0.80

6.46

6.68

173.3%

63.4%

0.20

0.29

36.89

-

Sales/Revenue/Turnover

12.00

1'200.0

10.00

1'000.0

8.00

800.0

6.00

600.0

4.00

400.0

2.00

200.0

0.00

06.07.2007

a-10

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

30.06.2007

507.4

9.16x

295.1

15.75x

50.3

28.00x

0.0

06.01.2008

06.07.2008

06.01.2009

06.07.2009

06.01.2010

06.07.2010

06.01.2011

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

19.09.2011

APA Group

Holdings By:

All

Holder Name

PETRONAS AUSTRALIA P

BANK OF NEW YORK MEL

VANGUARD INVESTMENTS

BLACKROCK FUND ADVIS

MACQUARIE INVESTMENT

MORGAN STANLEY & CO

VANGUARD GROUP INC

BLEASEL LEONARD FRAN

FRANK RUSSELL TRUST

SKANDIA INVESTMENT M

US BANCORP

UBS STRATEGY FUND MG

ELLIOTT & PAGE LIMIT

THOMPSON SIEGEL & WA

MCCORMACK MICHAEL JO

UBS AG

SMARTSHARES LIMITED

PRINCIPAL LIFE INSUR

JOHN HANCOCK INVESTM

CRANE STEVEN

Firm Name

Credit Suisse

JPMorgan

Citi

Morgan Stanley

Wilson HTM Investment Group

Deutsche Bank

Macquarie

RBS

Commonwealth Bank

Goldman Sachs & Partners Australia

E.L. & C. Baillieu

UBS

Portfolio Name

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

PRINCIPAL LIFE INSUR

Multiple Portfolios

n/a

Analyst

SANDRA MCCULLAGH

JASON HARLEY STEED

MARIE MIYASHIRO

MARK BLACKWELL

NATHAN LEAD

JOHN HIRJEE

IAN MYLES

JASON MABEE

PAUL JOHNSTON

AIDEN BRADLEY

IVOR RIES

DAVID LEITCH

Source

Co File

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

EXCH

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

EXCH

MF-AGG

MF-AGG

Sch-D

MF-AGG

EXCH

Recommendation

neutral

neutral

buy

Overwt/In-Line

buy

buy

neutral

hold

hold

hold

hold

neutral

Amt Held

93'317'200

9'000'000

2'352'993

1'318'006

1'239'867

665'200

502'441

367'795

336'171

217'941

193'000

191'706

184'776

180'000

163'778

154'000

149'372

148'771

114'250

100'000

% Out

16.91

1.63

0.43

0.24

0.22

0.12

0.09

0.07

0.06

0.04

0.03

0.03

0.03

0.03

0.03

0.03

0.03

0.03

0.02

0.02

Weighting

Change

3

3

5

5

5

5

3

3

3

3

3

3

Latest Chg

1'000'000

195'215

28'866

26'284

8'024

(339'234)

8'499

9'076

5'000

149'372

7'855

62'310

-

Target Price

M

M

M

M

M

M

M

D

M

M

M

M

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

01.09.2010

30.11.2010

31.12.2010

04.02.2011

31.12.2010

30.09.2010

31.12.2010

15.09.2010

30.11.2010

30.11.2010

30.09.2010

29.10.2010

31.12.2010

30.09.2010

05.11.2010

12.07.2010

31.03.2010

30.06.2010

31.12.2009

01.01.2011

Date

4

4

4

4

4

4

3

4

4

4

4

4

Not Provided

12 month

Not Provided

12 month

Not Provided

12 month

12 month

12 month

12 month

Not Provided

12 month

12 month

Inst Type

Holding Company

Investment Advisor

Mutual Fund Manager

Investment Advisor

Mutual Fund Manager

Investment Advisor

Investment Advisor

n/a

Investment Advisor

Mutual Fund Manager

Investment Advisor

Investment Advisor

Mutual Fund Manager

Investment Advisor

n/a

Investment Advisor

Investment Advisor

Insurance Company

Mutual Fund Manager

n/a

Date

04.02.2011

04.02.2011

03.02.2011

31.01.2011

28.01.2011

19.01.2011

19.01.2011

12.01.2011

30.12.2010

21.12.2010

30.11.2010

08.10.2010

19.09.2011

Aquarius Platinum Ltd

Aquarius Platinum Limited is a platinum group metals producer Africa. Through

its wholly owned subsidiary Aquarius Platinum South Africa, the Company operates

the Kroondal and Marikana mines and also has a fifty percent stake in the Mimosa

Platinum Mine in Zimbabwe.

Price/Volume

8

7.0 M

6.0 M

5.0 M

Latest Fiscal Year:

LTM as of:

52-Week High (14.02.2011)

52-Week Low (12.09.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.06.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AQP AT EQUITY YTD Change

AQP AT EQUITY YTD % CHANGE

06/2011

09/yy

6.81

3.22

924'753.00

3.33

-51.10%

3.42%

6.69%

470.2

1'565.66

292.18

0.0

0.0

328.08

1'568.42

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

3.0 M

3

2

2.0 M

1.0 M

0

f-10 m-10

a-10

m-10

j-10

j-10

a-10

s-10

o-10

n-10

d-10

j-11

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

30.06.2007

690.0

3.67x

419.7

6.04x

187.2

13.98x

4.0 M

Valuation Analysis

30.06.2008

30.06.2009

890.9

298.9

4.79x

5.19x

569.6

(2.6)

7.49x

236.5

(45.7)

18.48x

Profitability

LTM-4Q

30.06.2010

457.9

4.77x

134.3

16.26x

27.8

82.17x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

30.06.2011

643.4

3.62x

(10.4)

122.66

19.06%

3.95%

-0.73%

-1.23%

-1.83%

0.45%

21.1%

19.1%

-1.6%

4.03

3.65

20.05%

34.32%

6.89

10.89

Price/ Cash Flow

12/yy

0.0

#DIV/0!

0.0

0.00x

0.0

0.00x

LTM

09/yy

442.6

5.41x

0.0

0.00x

81.8

0.00x

FY+1

.0 M

f-11

2.34

1.48

381.14

5.06

-36.93%

-36.69%

1.484

18

4.167

1'203'339

1'297'417

1'353'545

FY+2

FQ+1

FQ+2

06/12 Y

06/13 Y

09/11 Q1 12/11 Q2

864.9

956.6

194.0

207.0

1.72x

1.42x

328.0

380.4

57.1

64.3

4.78x

4.12x

5.80x

5.18x

170.2

205.1

26.7

31.9

9.51x

7.63x

9.75x

8.84x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

34.3%

25.6%

0.45

0.86

52.94

33.53

43.38

43.09

Sales/Revenue/Turnover

1'000.0

120.00

900.0

100.00

800.0

700.0

80.00

600.0

60.00

500.0

400.0

40.00

300.0

200.0

20.00

0.00

06.07.2007

100.0

0.0

06.01.2008

06.07.2008

06.01.2009

06.07.2009

06.01.2010

06.07.2010

06.01.2011

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

19.09.2011

Aquarius Platinum Ltd

Holdings By:

All

Holder Name

SAVANNAH CONSORTIUM

BLACKROCK INVESTMENT

BLACKROCK INV MGMT A

FIDELITY MANAGEMENT

AEGON UK PLC

BLACKROCK GROUP LIMI

CAPITAL RESEARCH GLO

CAPITAL WORLD INVEST

FIDELITY INTERNATION

CAPITAL INTERNATIONA

T ROWE PRICE ASSOCIA

JPMORGAN ASSET MANAG

FRANKLIN RESOURCES I

SCHRODER INVESTMENT

OPPENHEIMERFUNDS INC

MACQUARIE INVESTMENT

SKAGEN FUNDS

ARTIO GLOBAL MANAGEM

FRANKFURT TRUST INVE

VANGUARD INVESTMENTS

Firm Name

Evolution Securities

Seymour Pierce

Arbuthnot Securities

RBC Capital Markets

Goldman Sachs & Partners Australia

Investec

BMO Capital Markets

Deutsche Bank

Canaccord Genuity Corp

Macquarie

Panmure Gordon & Co Limited

Renaissance Capital

MF Global Equities Research

E.L. & C. Baillieu

Citi

GMP

Mirabaud Securities

Portfolio Name

n/a

n/a

n/a

n/a

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Analyst

LOUISE COLLINGE

ASA BRIDLE

CHARLES GIBSON

LEON ESTERHUIZEN

IAN PRESTON

WILLIAM BLACK

EDWARD STERCK

PAUL-D YOUNG

TYLER BRODA

JUSTIN FRONEMAN

ALISON TURNER

EMMA TOWNSHEND

ANDREW GARDNER

RAY CHANTRY

CRAIG SAINSBURY

MARK SMITH

ALEX WOOD

Source

Co File

EXCH

EXCH

EXCH

EXCH

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

Recommendation

neutral

add

neutral

outperform

buy

hold

outperform

buy

hold

outperform

sell

buy

buy

hold

buy

hold

overweight

Amt Held

63'254'371

36'698'628

31'407'066

23'539'823

20'110'593

11'717'042

11'370'332

9'347'190

8'820'399

5'347'018

4'947'595

4'282'474

4'056'200

3'877'927

3'419'402

2'811'791

2'595'119

2'487'346

2'235'000

1'974'418

% Out

13.65

7.92

6.78

5.08

4.34

2.53

2.45

2.02

1.9

1.15

1.07

0.92

0.88

0.84

0.74

0.61

0.56

0.54

0.48

0.43

Weighting

Change

3

4

3

5

5

3

5

5

3

5

1

5

5

3

5

3

5

M

M

M

M

M

M

M

M

M

M

M

M

U

M

M

M

M

Latest Chg

(5'291'562)

(72'106)

367'687

(1'126'904)

268'826

14'000

440'500

(37'253)

105'890

(261'372)

208'820

5'203

Target Price

5

7

#N/A N/A

8

8

6

6

7

6

7

4

8

#N/A N/A

7

7

6

6

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

Inst Type

01.09.2010

n/a

16.04.2010

Investment Advisor

20.07.2010

n/a

25.01.2011

Investment Advisor

30.03.2010

n/a

29.10.2010

Investment Advisor

30.09.2010

Investment Advisor

30.06.2010

Investment Advisor

30.06.2010

Investment Advisor

31.10.2010

Investment Advisor

31.12.2010

Investment Advisor

30.09.2010

Investment Advisor

31.12.2010

Investment Advisor

30.06.2010

Investment Advisor

31.10.2010

Investment Advisor

31.12.2010 Mutual Fund Manager

31.12.2010

Investment Advisor

31.10.2010

Investment Advisor

30.11.2010 Mutual Fund Manager

31.12.2010 Mutual Fund Manager

Date

12 month

12 month

Not Provided

12 month

Not Provided

Not Provided

Not Provided

12 month

12 month

12 month

12 month

Not Provided

Not Provided

Not Provided

Not Provided

Not Provided

12 month

Date

07.02.2011

07.02.2011

07.02.2011

06.02.2011

02.02.2011

31.01.2011

28.01.2011

27.01.2011

27.01.2011

18.01.2011

14.01.2011

11.01.2011

09.11.2010

27.10.2010

12.10.2010

20.11.2009

23.04.2009

19.09.2011

Aristocrat Leisure Ltd

Aristocrat Leisure Limited manufactures and sells gaming machines in Australia

and internationally. The Company also supplies gaming systems, software, table

gaming equipment and other gaming related products and services to casinos,

clubs and hotels.

Price/Volume

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (21.09.2010)

52-Week Low (14.09.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.03.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

ALL AT EQUITY YTD Change

ALL AT EQUITY YTD % CHANGE

12/2010

01/yy

3.83

1.93

1'995'539.00

1.98

-48.30%

2.59%

6.32%

536.5

1'062.23

305.66

0.0

(2.0)

24.46

1'348.55

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

45.0 M

40.0 M

35.0 M

30.0 M

25.0 M

20.0 M

15.0 M

10.0 M

5.0 M

a-10

m-10

j-10

j-10

a-10

s-10

o-10

n-10

d-10

.0 M

f-11

j-11

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

31.12.2006

1'074.5

6.95x

394.5

18.92x

239.0

31.05x

5

5

4

4

3

3

2

2

1

1

0

f-10 m-10

31.12.2007

31.12.2008

1'122.0

1'079.9

4.72x

1.98x

374.8

267.1

14.14x

8.02x

247.2

101.2

21.23x

17.64x

Profitability

31.12.2009

908.6

2.43x

(144.7)

(157.8)

-

31.12.2010

680.5

2.76x

140.2

13.38x

77.2

20.62x

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

140.18

103.27

15.18%

14.87%

10.18%

44.79%

23.00%

0.90%

53.6%

20.6%

15.2%

11.3%

1.86

1.14

43.12%

160.98%

3.37

4.15

Price/ Cash Flow

LTM-4Q

LTM

01/yy

01/yy

-

FY+1

-

2.02

0.74

535.35

22.85

-46.17%

-32.66%

0.735

10

4.000

3'221'349

2'869'417

3'707'029

FY+2

12/11 Y

12/12 Y

671.8

804.9

1.92x

1.58x

137.4

194.2

9.81x

6.94x

58.6

96.0

18.00x

11.25x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

FQ+1

FQ+2

28.03.2011

NR

8.85

6.45

2.01

2.18

161.0%

61.9%

0.90

6.17

108.39

87.95

58.49

137.85

Sales/Revenue/Turnover

40.00

1'400.0

35.00

1'200.0

30.00

1'000.0

25.00

800.0

20.00

600.0

15.00

400.0

10.00

200.0

5.00

0.00

05.01.2007

0.0

05.07.2007

05.01.2008

05.07.2008

05.01.2009

05.07.2009

05.01.2010

05.07.2010

05.01.2011

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

19.09.2011

Aristocrat Leisure Ltd

Holdings By:

All

Holder Name

COMMONWEALTH BANK OF

LAZARD ASSET MANAGEM

MAPLE-BROWN ABBOTT L

IOOF HOLDINGS LTD

NATIONAL AUSTRALIA B

CAPITAL WORLD INVEST

CAPITAL RESEARCH GLO

UBS STRATEGY FUND MG

VANGUARD GROUP INC

FIDELITY INTERNATION

VANGUARD INVESTMENTS

FIDELITY MANAGEMENT

IG INVESTMENT MANAGE

MIRAE ASSET INVESTME

VAN ECK ASSOCIATES C

UBS FUND MANAGEMENT

SJUNDE AP FONDEN

JOWETT W P

STATE STREET CORP

MACQUARIE INVESTMENT

Firm Name

RBS

Deutsche Bank

Austock Securities

Credit Suisse

JPMorgan

Macquarie

UBS

Citi

Goldman Sachs & Partners Australia

Telsey Advisory Group

Portfolio Name

n/a

n/a

n/a

n/a

n/a

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

Multiple Portfolios

n/a

Multiple Portfolios

Multiple Portfolios

Analyst

HARRY THEODORE

MARK WILSON

ROHAN SUNDRAM

LARRY GANDLER

STUART JACKSON

ANDREW LEVY

SAM THEODORE

JENNY OWEN

ADAM ALEXANDER

CHRISTOPHER E JONES

Source

EXCH

EXCH

Co File

EXCH

EXCH

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

MF-AGG

Co File

MF-AGG

MF-AGG

Recommendation

buy

hold

sell

outperform

overweight

underperform

buy

hold

sell

no rating system

Amt Held

65'031'253

40'872'775

40'126'516

33'326'255

32'824'612

18'658'761

6'350'000

3'404'905

2'969'713

2'566'228

2'215'704

1'050'221

652'229

628'237

493'957

451'902

372'164

361'561

292'166

284'502

% Out

12.18

7.65

7.51

6.24

6.15

3.49

1.19

0.64

0.56

0.48

0.41

0.2

0.12

0.12

0.09

0.08

0.07

0.07

0.05

0.05

Weighting

Change

5

3

1

5

5

1

5

3

1

#N/A N/A

M

M

M

M

M

M

M

M

M

M

Latest Chg

5'417'672

(6'640'491)

5'797'508

1'500'000

(70'851)

5'335

(7'514'948)

(110'533)

(62'177)

15'112

-

Target Price

4

3

3

4

4

3

4

3

3

#N/A N/A

Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

File Dt

Inst Type

01.12.2010

Bank

02.12.2010

Investment Advisor

23.02.2010

Investment Advisor

17.12.2010

Investment Advisor

14.04.2010

Bank

30.09.2010

Investment Advisor

30.09.2010

Investment Advisor

29.10.2010

Investment Advisor

31.12.2010

Investment Advisor

31.10.2009

Investment Advisor

31.12.2010 Mutual Fund Manager

31.12.2010

Investment Advisor

30.09.2010

Investment Advisor

30.09.2010

Investment Advisor

04.02.2011

Investment Advisor

30.11.2010

Investment Advisor

30.09.2010

Investment Advisor

31.12.2009

n/a

04.02.2011

Investment Advisor

31.12.2010 Mutual Fund Manager

Date

12 month

12 month

Not Provided

Not Provided

12 month

12 month

12 month

Not Provided

Not Provided

Not Provided

Date

01.02.2011

19.01.2011

20.12.2010

29.11.2010

29.11.2010

27.11.2010

26.11.2010

26.11.2010

26.11.2010

26.08.2009

19.09.2011

Asciano Ltd

Asciano Ltd owns and operates transportation infrastructure. The Company owns

and operates container terminals, bulk export facilities, stevedoring equipment

and rail assets. Asciano operates in Australia and New Zealand.

Price/Volume

3

140.0 M

120.0 M

100.0 M

Valuation Analysis

Latest Fiscal Year:

LTM as of:

52-Week High (05.04.2011)

52-Week Low (09.08.2011)

Daily Volume

Current Price (9/dd/yy)

52-Week High % Change

52-Week Low % Change

% 52 Week Price Range High/Low

Shares Out 30.06.2011

Market Capitalization

Total Debt

Preferred Stock

Minority Interest

Cash and Equivalents

Enterprise Value

Relative Stock Price Performance

AIO AT EQUITY YTD Change

AIO AT EQUITY YTD % CHANGE

06/2011

01/yy

1.80

1.34

13'685'892.00

1.55

-13.65%

16.10%

55.43%

2'926.1

4'535.46

2'658.40

0.0

10.6

398.50

6'805.96

Total Revenue

TEV/Revenue

EBITDA

TEV/EBITDA

Net Income

P/E

30.06.2008

-

80.0 M

60.0 M

40.0 M

20.0 M

0

f-10 m-10

a-10 m-10

j-10

j-10

a-10

s-10

o-10

n-10

d-10

j-11

.0 M

f-11

Market Data

Dividend Yield

Beta

Equity Float

Short Int

1 Yr Total Return

YTD Return

Adjusted BETA

Analyst Recs

Consensus Rating

Average Daily Trading Volume

Average Volume 5 Day

- Average Volume 30 Day

- Average Volume 3 Month

Fiscal Year Ended

30.06.2007

Profitability

30.06.2009

2'797.3

2.04x

634.4

8.99x

71.8

14.05x

30.06.2010

2'849.9

2.71x

1'829.2

4.22x

(788.5)

-

EBITDA

EBIT

Operating Margin

Pretax Margin

Return on Assets

Return on Common Equity

Return on Capital

Asset Turnover

Margin Analysis

Gross Margin

EBITDA Margin

EBIT Margin

Net Income Margin

Structure

Current Ratio

Quick Ratio

Debt to Assets

Tot Debt to Common Equity

Accounts Receivable Turnover

Inventory Turnover

30.06.2011

3'056.3

2.31x

686.9

10.29x

176.8

27.33x

686.90

467.80

15.31%

7.21%

2.65%

6.06%

5.35%

0.46%

22.5%

15.3%

5.8%

0.87

0.72

39.04%

82.89%

11.64

-

Price/ Cash Flow

LTM-4Q

LTM

01/yy

01/yy

-

FY+1

-

1.29

0.93

2'812.49

18.23

-4.05%

-1.64%

0.931

16

4.563

16'488'980

19'004'060

17'949'960

FY+2

06/12 Y

06/13 Y

3'450.9

3'796.7

2.06x

1.89x

937.9

1'053.3

7.26x

6.46x

297.6

356.4

14.62x

12.30x

S&P Issuer Ratings

Long-Term Rating Date

Long-Term Rating

Long-Term Outlook

Short-Term Rating Date

Short-Term Rating

Credit Ratios

EBITDA/Interest Exp.

(EBITDA-Capex)/Interest Exp.

Net Debt/EBITDA

Total Debt/EBITDA

Reference

Total Debt/Equity

Total Debt/Capital

Asset Turnover

Net Fixed Asset Turnover

Accounts receivable turnover-days

Inventory Days

Accounts Payable Turnover Day

Cash Conversion Cycle

FQ+1

FQ+2

22.02.2010

BBBPOS

2.70

1.11

3.29

3.87

82.9%

45.2%

0.46