Professional Documents

Culture Documents

Trinidad & Tobago

Uploaded by

Kelz YouknowmynameOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trinidad & Tobago

Uploaded by

Kelz YouknowmynameCopyright:

Available Formats

Trinidad & Tobago

Goods

Household goods

Documents required

Valid passport Work permit (non resident) Inventory Original B/L or express release Import Licence for refrigerator, freezer, air condition unit and motor vehicle to importation (to be obtained from Ministry of Trade & Industry) Bill of Lading Inventory

Customs Prescriptions

A customer interview is required, followed by customs examination at the container examination station situated at the ports. Shippers presence is needed at the customs interview and examination Used household goods and personal effects can be imported duty-free, provided the items are used and in possession for at least one year

Remarks

Shipper needs to be present for Customs interview and examination. For shipments to Tobago it is recommended that port of Spain should be the port of entry. The bill of Lading must include final destination Tobago

Diplomatic removals

Used motor vehicles and motorcycles

In order to benefit from the tax concessions, the returning national must provide: Proof of residence aboard, e.g. passport, employment records. Proof of ownership of vehicle, e.g. registration certificate, insurance certification of vehicle in country aboard, purchase bill of sale and/or official certificate of title. Affidavit sworn before a local Commissioner. Two (2) passport size photos

Returning nationals importing left hand drive vehicles should reside aboard for a period of five years or more and must own the vehicle for at least six (6) months prior to shipping. Vehicles are allowed entry by qualified returning national and diplomats only. Right hand drive, returning nationals importing vehicles should reside aboard for a period of one year or more and must own the vehicle for at least three (3) months prior to shipping. The vehicle should not be more than five years old. Returning Nationals who resided aboard for a continuous period of at least five years immediately prior to his return, and intends to reside in Trinidad & Tobago permanently, would qualify for a relief form Customs Duty as follows:

Documents are required prior to arrival of the shipment so diplomatic agencies can apply for the exemption certificate required for customs clearance. Persons importing vehicles should reside abroad for a period of five years or more and must own the vehicle for the last six months prior to shipping. In case of right hand drive vehicles, returning nationals importing vehicles should reside abroad for a period of three months prior to shipping. The vehicle should not be more than five years old Left hand drive vehicles are allowed entry by qualified returning nationals and diplomats only

Updated version October 2006

All rights reserved. This publication may not be reproduced in any form without the permission ofThe FIDI Global Alliance. 1

This document is produced based on the information supplied at the mentioned date. It is recommended to verify this information with a FIDI-FAIM agent prior to shipping. The FIDI Global Alliance cannot take responsibility for the contents of this publication.

Trinidad & Tobago

Goods Documents required Customs Prescriptions

Where he is the registered owner of the vehicle for more than six months but not more than one year, 25% of the duty payable. In other words, the importer pays 75% of the duty payable. Where he is the registered owner of the vehicle for more than one year but not more then two years, 50% relief of the duty payable. Where he is the registered owner of the vehicle for more than two years, 90% relief of the duty payable. In other words, the importer pays 10% of the duty payable. With regards to household effects a relief of 10% on new items. Prohibited articles: Fire Arms and Ammunition

Remarks

Prohibited Articles

Police and Government permit required before importation and must be strictly adhered to.

Narcotics

Fumigation of Imported and Exported Wooden Crates

Strictly prohibited The government has been established the International Standards for Phytosanitary Measures - NIMF N 15, with the purpose of almost eliminating in its totality the risk of entrance of most of pests that are in quarantine and considerably reducing the risk of other pests. The phytosanitary measure approved for the treatment of wood packing should be treated as follows: a) Heat Treatment (HT) to a minimum wood core temperature of 56C for a minimum of 30 minutes, or

his regulation DOES NOT apply to the wood packing materials manufactured of: a) Raw wood of 6mm thickness or less. b) Processed wood produced by glue, heat and pressure, or a combination thereof.

Updated version October 2006

All rights reserved. This publication may not be reproduced in any form without the permission ofThe FIDI Global Alliance. 2

This document is produced based on the information supplied at the mentioned date. It is recommended to verify this information with a FIDI-FAIM agent prior to shipping. The FIDI Global Alliance cannot take responsibility for the contents of this publication.

Trinidad & Tobago

Goods Documents required Customs Prescriptions

b) Fumigation with Methyl Bromide (MT). The minimum temperature should not be less than 10C and the minimum exposure time should be 16 hours. The wood packing material must be marked in a visible location on each article, on at least two opposite sides of the article, with a legible and permanent mark. The mark can be painted with permanent black painting. The colours red and orange, do not have to be used as colour of the mark. Labels or adhesive are not allowed. The approved format for the mark is as follows, where XX would be replaced by the country code, 000 by the producer number, YY by the treatment type (HT or MB) and AAA by the inspection agency logo. The treatments established in the present regulation that have the intention to reduce the introduction and/or dissemination of quarantine plagues associated to the wood packing.

Remarks

Updated version October 2006

All rights reserved. This publication may not be reproduced in any form without the permission ofThe FIDI Global Alliance. 3

This document is produced based on the information supplied at the mentioned date. It is recommended to verify this information with a FIDI-FAIM agent prior to shipping. The FIDI Global Alliance cannot take responsibility for the contents of this publication.

You might also like

- Dominican Republic: Goods Documents Required Customs Prescriptions RemarksDocument4 pagesDominican Republic: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: ChileDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: ChileKelz YouknowmynameNo ratings yet

- Costa Rica: Goods Documents Required Customs Prescriptions RemarksDocument4 pagesCosta Rica: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- UgandaDocument2 pagesUgandaKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: EgyptDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: EgyptKelz Youknowmyname0% (1)

- Vietnam: Goods Documents Required Customs Prescriptions RemarksDocument6 pagesVietnam: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Oman (Sultanate) : Goods Documents Required Customs Prescriptions RemarksDocument4 pagesOman (Sultanate) : Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: United KingdomDocument6 pagesGoods Documents Required Customs Prescriptions Remarks: United KingdomKelz YouknowmynameNo ratings yet

- NigeriaDocument4 pagesNigeriaKelz YouknowmynameNo ratings yet

- Assignment On Current Export and Import Situation in BangladeshDocument42 pagesAssignment On Current Export and Import Situation in BangladeshZim-Ud -Daula81% (31)

- Iii. Trade Policies and Practices by Measure (1) O: Trinidad and Tobago WT/TPR/S/151Document48 pagesIii. Trade Policies and Practices by Measure (1) O: Trinidad and Tobago WT/TPR/S/151hinbox7No ratings yet

- GhanaDocument2 pagesGhanaKelz YouknowmynameNo ratings yet

- BoliviaDocument6 pagesBoliviaKelz YouknowmynameNo ratings yet

- NamibiaDocument3 pagesNamibiaKelz YouknowmynameNo ratings yet

- NetherlandsDocument3 pagesNetherlandsKelz YouknowmynameNo ratings yet

- HondurasDocument3 pagesHondurasKelz YouknowmynameNo ratings yet

- Thailand: Goods Documents Required Customs Prescriptions RemarksDocument5 pagesThailand: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Sri Lank ADocument6 pagesSri Lank AKelz YouknowmynameNo ratings yet

- Import Procedures On Used ItemsDocument12 pagesImport Procedures On Used ItemsTricia Aguila-MudlongNo ratings yet

- JamaicaDocument3 pagesJamaicaKelz YouknowmynameNo ratings yet

- Angola Cotecna DatasheetDocument10 pagesAngola Cotecna DatasheetIssa NshaiwatNo ratings yet

- Import Documentation For Custom ClearanceDocument7 pagesImport Documentation For Custom ClearanceValeria RomanelliNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: TaiwanDocument6 pagesGoods Documents Required Customs Prescriptions Remarks: TaiwanKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: South AfricaDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: South AfricaKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: IrelandDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: IrelandKelz YouknowmynameNo ratings yet

- GermanyDocument4 pagesGermanyKelz YouknowmynameNo ratings yet

- Temporary Entry and Prohibited and Restricted ImportsDocument23 pagesTemporary Entry and Prohibited and Restricted ImportsAndrey MontecilloNo ratings yet

- Coffee Importers in KoreaDocument22 pagesCoffee Importers in KoreazmahfudzNo ratings yet

- Evidence 6 Video Steps To ExportDocument7 pagesEvidence 6 Video Steps To ExportMonika RendónNo ratings yet

- GuamDocument2 pagesGuamKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: MartiniqueDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: MartiniqueKelz YouknowmynameNo ratings yet

- Import Documents and Procedure: Submitted byDocument46 pagesImport Documents and Procedure: Submitted byprateek gandhiNo ratings yet

- Bah RainDocument2 pagesBah RainKelz YouknowmynameNo ratings yet

- Types of Permit Applications 19nov15Document25 pagesTypes of Permit Applications 19nov15Albert LeeNo ratings yet

- Customs HouseholdDocument3 pagesCustoms HouseholdMayur JainNo ratings yet

- Export Incentives in IndiaDocument12 pagesExport Incentives in IndiaFasee NunuNo ratings yet

- Uruguay: Goods Documents Required Customs Prescriptions RemarksDocument9 pagesUruguay: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- SVG ConcessionDocument16 pagesSVG ConcessionShanica Paul-RichardsNo ratings yet

- Qatar Import RulesDocument10 pagesQatar Import RulesSakib AyubNo ratings yet

- DumpingDocument27 pagesDumpingScribdNo ratings yet

- Bangladesh Exporter GuidelinesDocument27 pagesBangladesh Exporter GuidelinesBaki HakimNo ratings yet

- Goods Documents Required Customs Prescriptions: JordanDocument4 pagesGoods Documents Required Customs Prescriptions: JordanKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: VenezuelaDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: VenezuelaKelz YouknowmynameNo ratings yet

- Customs Advisory On Import Regulations in IndiaDocument6 pagesCustoms Advisory On Import Regulations in IndiaAspiNo ratings yet

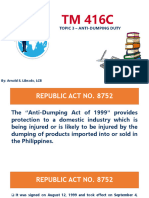

- Ra 8752 Gr1 OutlineDocument5 pagesRa 8752 Gr1 OutlineIELTSNo ratings yet

- BulgariaDocument3 pagesBulgariaKelz YouknowmynameNo ratings yet

- MozambiqueDocument1 pageMozambiqueKelz YouknowmynameNo ratings yet

- FinlandDocument5 pagesFinlandKelz YouknowmynameNo ratings yet

- DumpingDocument19 pagesDumpingSahil Sharma100% (1)

- FranceDocument3 pagesFranceKelz YouknowmynameNo ratings yet

- Anti DumpingDocument52 pagesAnti DumpingSamuelNo ratings yet

- Understanding anti-dumping duties and their role in fair tradeDocument6 pagesUnderstanding anti-dumping duties and their role in fair trademuhammad usamaNo ratings yet

- Papua New GuineaDocument2 pagesPapua New GuineaKelz YouknowmynameNo ratings yet

- QatarDocument2 pagesQatarKelz YouknowmynameNo ratings yet

- Switzerland: Goods Documents Required Customs Prescriptions RemarksDocument4 pagesSwitzerland: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Wto 4Document24 pagesWto 4Tabish AhmedNo ratings yet

- Changes to Philippine Excise Taxes and VATDocument6 pagesChanges to Philippine Excise Taxes and VATGf NavarroNo ratings yet

- Car Importation RequirementsDocument6 pagesCar Importation Requirementsbfac2024No ratings yet

- Foreign Trade Policy 2004-09Document53 pagesForeign Trade Policy 2004-09manishsingh1601No ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Receipt For Court DocumentsDocument1 pageReceipt For Court DocumentsKelz YouknowmynameNo ratings yet

- Statutory Declaration To CourtDocument3 pagesStatutory Declaration To CourtKelz Youknowmyname100% (1)

- Right of Access WINDOW NOTICE 2Document1 pageRight of Access WINDOW NOTICE 2Truth seeker67% (3)

- Notice of Service For Bailiffs Regarding Council TaxDocument2 pagesNotice of Service For Bailiffs Regarding Council TaxKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: TunisiaDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: TunisiaKelz YouknowmynameNo ratings yet

- Council CEO Proof of Claim LetterDocument6 pagesCouncil CEO Proof of Claim LetterKelz YouknowmynameNo ratings yet

- Council Fee ScheduleDocument9 pagesCouncil Fee ScheduleKelz Youknowmyname100% (1)

- Right of Access WINDOW NOTICE 2Document1 pageRight of Access WINDOW NOTICE 2Truth seeker67% (3)

- Nouicor Fee Schedule Covering LetterDocument3 pagesNouicor Fee Schedule Covering LetterKelz YouknowmynameNo ratings yet

- Nouicor Fee ScheduleDocument8 pagesNouicor Fee ScheduleKelz YouknowmynameNo ratings yet

- TurkeyDocument1 pageTurkeyKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: SwazilandDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: SwazilandKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: TaiwanDocument6 pagesGoods Documents Required Customs Prescriptions Remarks: TaiwanKelz YouknowmynameNo ratings yet

- Thailand: Goods Documents Required Customs Prescriptions RemarksDocument5 pagesThailand: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions RemarksDocument6 pagesGoods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- TanzaniaDocument1 pageTanzaniaKelz YouknowmynameNo ratings yet

- Syria: Goods Documents Required Customs Prescriptions RemarksDocument4 pagesSyria: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Vietnam: Goods Documents Required Customs Prescriptions RemarksDocument6 pagesVietnam: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: SwedenDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: SwedenKelz YouknowmynameNo ratings yet

- SudanDocument2 pagesSudanKelz YouknowmynameNo ratings yet

- Switzerland: Goods Documents Required Customs Prescriptions RemarksDocument4 pagesSwitzerland: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- Sri Lank ADocument6 pagesSri Lank AKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: VenezuelaDocument4 pagesGoods Documents Required Customs Prescriptions Remarks: VenezuelaKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: ZimbabweDocument3 pagesGoods Documents Required Customs Prescriptions Remarks: ZimbabweKelz YouknowmynameNo ratings yet

- Uruguay: Goods Documents Required Customs Prescriptions RemarksDocument9 pagesUruguay: Goods Documents Required Customs Prescriptions RemarksKelz YouknowmynameNo ratings yet

- ZambiaDocument2 pagesZambiaKelz YouknowmynameNo ratings yet

- Goods Documents Required Customs Prescriptions Remarks: United KingdomDocument6 pagesGoods Documents Required Customs Prescriptions Remarks: United KingdomKelz YouknowmynameNo ratings yet

- United Arab EmiratesDocument3 pagesUnited Arab EmiratesKelz YouknowmynameNo ratings yet

- Cargo LinersDocument5 pagesCargo Linersa.gueyeNo ratings yet

- National Ports Plan 2019 Update focuses on infrastructureDocument236 pagesNational Ports Plan 2019 Update focuses on infrastructurewestsiderNo ratings yet

- HOBA Special ProbDocument19 pagesHOBA Special ProbRujean Salar AltejarNo ratings yet

- Justification of Unit Costs For Construction Materials: I. Portland CementDocument29 pagesJustification of Unit Costs For Construction Materials: I. Portland CementLstrNo ratings yet

- Case Federal ExpressDocument18 pagesCase Federal ExpressRizky RahmanNo ratings yet

- Shipping TermsDocument12 pagesShipping TermsHugo PerniaNo ratings yet

- Adrm11 Toc EN 20190215Document8 pagesAdrm11 Toc EN 20190215wahyu33% (9)

- Container Ship NoteDocument22 pagesContainer Ship NoteSandeep ChandhuNo ratings yet

- Wireless Temperature Monitoring for Perishable Goods TransportDocument11 pagesWireless Temperature Monitoring for Perishable Goods TransportGonzalo ADS LogicNo ratings yet

- IHS Port Terminals Guide Brochure PDFDocument2 pagesIHS Port Terminals Guide Brochure PDFEdzarliandoNo ratings yet

- Oracle Transportation Management DetailsDocument29 pagesOracle Transportation Management Detailsshrinaw100% (2)

- Worldfoodreceipt 99Document11 pagesWorldfoodreceipt 99itavsaNo ratings yet

- Mnfsto ExpoDocument48 pagesMnfsto Expoyeferson becerra lopezNo ratings yet

- Eastern Shipping Vs PrudentialDocument2 pagesEastern Shipping Vs PrudentialPrincess Kimberly Ubay-ubayNo ratings yet

- Group 5 - Big Data Analysis On TransportationDocument16 pagesGroup 5 - Big Data Analysis On TransportationDarshil ShahNo ratings yet

- Wa0011.Document1 pageWa0011.Gemma BennyNo ratings yet

- Modern cargo ships: An overview of dry, liquid and specialized vessel typesDocument16 pagesModern cargo ships: An overview of dry, liquid and specialized vessel typesMarina TsynovaNo ratings yet

- Transportation & Planning AssignmentDocument34 pagesTransportation & Planning AssignmentMalik ZainNo ratings yet

- FM 10-27 General Supply in The Theater of OperationsDocument107 pagesFM 10-27 General Supply in The Theater of OperationsJared A. Lang100% (3)

- KARACHI PORT TRUST SRO GUIDEDocument37 pagesKARACHI PORT TRUST SRO GUIDEnomanjavid88No ratings yet

- 1951 Ford F 1 SeriesDocument8 pages1951 Ford F 1 SeriesToto RosarinoNo ratings yet

- The Future of Courier Services in An Increasingly Technological Age: Predicting The Future Up To 2035 by Speedy FreightDocument5 pagesThe Future of Courier Services in An Increasingly Technological Age: Predicting The Future Up To 2035 by Speedy FreightPR.comNo ratings yet

- Nyein's CV For Shipping - Arrow JobDocument4 pagesNyein's CV For Shipping - Arrow JobYe Ko HtetNo ratings yet

- Eagle Report 4Document34 pagesEagle Report 4Priya Pawar100% (1)

- BOM RoutingDocument3 pagesBOM RoutingGuru PrasadNo ratings yet

- Purolator Service Guide EnglishDocument37 pagesPurolator Service Guide EnglishGrace Youzan LouNo ratings yet

- Export Transport Logistics Cost: by MR Manoj Aglawe, BSC., Mba, PGDFTDocument10 pagesExport Transport Logistics Cost: by MR Manoj Aglawe, BSC., Mba, PGDFTJibran SakharkarNo ratings yet

- Cargo Securing - Concepts, Rules and ForcesDocument12 pagesCargo Securing - Concepts, Rules and ForcesSebastian ZarzyckiNo ratings yet

- Market LogisticsDocument38 pagesMarket Logisticsjaideep khatak100% (1)

- UPS Daily RatesDocument179 pagesUPS Daily Ratesviolaviolin13No ratings yet