Professional Documents

Culture Documents

A Study of Small and Medium Enterprises Loans Ing Vsaya Bank

Uploaded by

Silvi KhuranaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study of Small and Medium Enterprises Loans Ing Vsaya Bank

Uploaded by

Silvi KhuranaCopyright:

Available Formats

SME Banking

A Study on

SMALL AND MEDIUM ENTERPRISES LOANS (SME)

A Project report submitted in partial fulfillment of the requirements of MBA program 2006-08 of

GURU GOBIND SINGH INDRAPRASTH UNIVERSITY KASHMIRI GATE, DELHI SUBMITTED BY: GAURAV GUPTA ENROLLMENT NO. - 01641253906 Under the guidance of Ms. RICHA BHATNAGAR

DELHI SCHOOL OF PROFESSIONAL STUDIES AND RESEARCH ROHINI, DELHI-85

SME Banking

ACKNOWLEDGEMENT

The entire project from the vary idea of it to the reality would not have been possible without the guidance and support of many people. I would therefore like to take the golden opportunity to express my sincere and wholehearted sense of gratitude to all those people who have helped me throughout the project. My sincere and special thanks are due to Ms. Richa Bhatnagar, internal project supervisor who has been a wonderful guide and helped me in successfully completion of my project. I also express my thanks to all my classmates, friends and family members who have been a great help at times for providing necessary support towards completing this project. I would also like to thanks to all those faculty members and staff members who have share their valuable time, experience, knowledge and provide their unconditional support and guidance in completing my studies including this project.

Gaurav Gupta

SME Banking

CERTIFICATE

This is to certify that the project entitled Small and Medium Enterprises (SME) Loans is a bonafied account of work carried out by Mr. Gaurav Gupta, under my supervision for the award of the degree of MASTER IN BUSINESS ADMINISTRATION. The student has also made his project report to my entire satisfactions as per the requirements of the course. This is to certify that this work has not been submitted anywhere else for the award of Degree.

Ms. RICHA BHATNAGAR (PROJECT SUPERVISOR)

SME Banking

EXECUTIVE SUMMARY

Background

Banks in India are casting aside shibboleths and increasingly acquiring a global flavor. Some are already rivaling the best in the world in terms of technology and product offerings. Others are fine-tuning their services and products to get there. A significant paradigm shift has occurred in the banking industry in recent times. The banks are now realizing that servicing the Small and Medium Enterprises (SMEs) is no longer unviable. In fact SME Banking is emerging as the new profit centre and this is in contrast to the last decade when the banks had to finance this segment because of government diktats regarding the Priority Sector Lending. The demand supply ratio of very less large firms and many banks that are willing to lend to them explains it all.

Highlights of the Report

The report has been divided into 4 phases as explained below PHASE 1 - Significance of SMEs to the country and SME Banking to ING This section aims at establishing whether or not this banking are holds any importance in the current scenario or not. PHASE 2 - Process mapping and analysis from various stakeholder perspectives o Employee Perspective o Customer Perspective o Competition Scenario PHASE 3 - Strategies for a more efficient and effective process This section extends recommendations, both strategic and tactical, for the winning edge.

SME Banking

TABLE OF CONTENTS

1. Project Brief .6 2. Company Profile....7 3. Objectives.12 4. Research Design and Methodology..........13 5. Limitations14 6. Introduction Phase 1...15 7. Process Mapping and Findings Phase 2..25 8. Observations..37 9. Recommendations Phase 3..46 10. Findings.56 11. Annexure...66 12. References.82

SME Banking

PROJECT BRIEF

Title SME Medium Enterprise Market Analysis Assessing the market potential for the existing products Assessment of competition offerings and understanding their nuances Positioning of ING Vysya Bank product offering

The deliverables included a detailed report analyzing the SME Banking Segment, in depth benchmarking with the competition and recommendations for ING to improve its process and increase its share of the market pie.

SME Banking

COMPANY PROFILE

ING Vysya Bank Ltd., is an entity formed with the coming together of erstwhile, Vysya Bank Ltd, a premier bank in the Indian Private Sector and a global financial powerhouse, ING of Dutch origin, during Oct 2002. The origin of the erstwhile Vysya Bank was pretty humble. It was in the year 1930 that a team of visionaries came together to found a bank that would extend a helping hand to those who weren't privileged enough to enjoy banking services. It's been a long journey since then and the Bank has grown in size and stature to encompass every area of present-day banking activity and has carved a distinct identity of being India's Premier Private Sector Bank. In 1980, the Bank completed fifty years of service to the nation and post 1985; the Bank made rapid strides to reach the coveted position of being the number one private sector bank. In 1990, the bank completed its Diamond Jubilee year. At the Diamond Jubilee Celebrations, the then Finance Minister Prof. Madhu Dandavate, had termed the performance of the bank Stupendous. The 75th anniversary, the Platinum Jubilee of the bank was celebrated during 2005.

SME Banking

HISTORICAL DEVELOPMENT IN ING Vysya

193 Set up in Bangalore 0 194 Scheduled Bank 8 198 Largest Private Sector Bank 5 198 The Vysya Bank Leasing Ltd. Commenced 7 198 Pioneered the concept of Co branding of Credit Cards 8 199 Promoted Vysya Bank Housing Finance Ltd. 0 199 Deposits cross Rs.1000 crores 2 199 Number of Branches crossed 300 3 199 Signs Strategic Alliance with BBL., Belgium. Two National Awards by Gem & Jewellery Export 6 Promotion Council for excellent performance in Export Promotion Cash Management Services, & commissioning of VSAT. Golden Peacock Award - for the best HR 199 Practices by Institute of Directors. Rated as Best Domestic Bank in India by Global Finance 8 (International Financial Journal - June 1998) 200 State -of - the -art Date Centre at ITPL, Bangalore. 0 RBI clears setting up of ING Vysya Life Insurance Company 200 ING-Vysya commenced life insurance business. 1 The Bank launched a range of products & services like the Vys Vyapar Plus, the range of loan 200 schemes for traders, ATM services, Smartserv, personal assistant service, Save & Secure, an 2 account that provides accident hospitalization and insurance cover, Sambandh, the International Debit Card and the mi-b@nk net banking service. 200 ING takes over the Management of the Bank from October 7th , 2002 2 200 RBI clears the new name of the Bank as ING Vysya Bank Ltd, vide their letter of 17.12.02 2 200 Introduced customer friendly products like Orange Savings, Orange Current and Protected Home 3 Loans 200 Introduced Protected Home Loans - a housing loan product 4 200 Introduced Solo - My Own Account for youth and Customer Service Line Phone Banking Service 5 200 Bank has networked all the branches to facilitate AAA transactions i.e. Anywhere, Anytime & 6 Anyhow Banking

SME Banking

Business Banking - Small & Medium Enterprises

ING Vysya Bank has a track record of serving SME Customers for over 75 years. We understand how much of hard work goes into establishing a successful SME and that establishing and running a successful business takes hard work, money and planning. ING Vysya Bank looks not only at your immediate banking requirement, but also the long-term needs of your business as it expands. Our approach is to make banking easy, timely and reliable so that you could focus on your business safe in the knowledge that we would be there to take care of all your banking requirements. Our solutions are designed to meet your varying needs. We offer a complete range of banking services to small & medium sized corporates such as Business Accounts, Working capital, Cash Management Services, Trade Finance, Other Non Funded Facilities and Term Loans for Business Expansion for your business. In addition we also offer specific structured products to SSI's, Traders, Distributors and other SME customers.

Business Loans - MPower Business Loans Trade

Small business entrepreneurs often encounter problems regarding finance. ING Vysya Bank presents a unique banking loan, specially customized for Small & Medium Business Enterprises. These loans are available for Small Business Entrepreneurs, Retailers, Shop owners, Contractors, Commission Agents and Transport Operators as well as practicing professionals like Doctors, Lawyers, Consultants, Women Entrepreneurs and any others with a credit requirement ranging from Rs. 5 lakhs upto Rs. 50 lakhs.

Features and Benefits

Competitive interest rates along with an added concession of 0.5% on the interest rate on purchase of a Life Insurance Policy Personalized attention from exclusively assigned Relationship Managers Simplified documentation Added benefits of a current account *

SME Banking

Life and non-life insurance coverage Doorstep banking through Cash/Cheque Pickup and Delivery-extended at important locations under a separate agreement with the bank Free SMS alerts on Debit to an Account, Credit to the Account and Balance below specified amount Concessional Demand Drafts/Pay Orders/Payable at par (PAP) facilities International Debit Card Online Banking services Phone Banking (Customer Service Line)

Business Loans (Small Scale Industries) CGTSI

ING Vysya Bank offers loans to Small Scale Industries at competitive interest rates without any collateral security Credit Guarantee Fund Trust for Small Industries [CGTSI] ING Vysya Bank is one of the member lending banks for CGTSI. ING Vysya Bank Ltd offers loans of up to Rs 25 lakhs to SSI units under CGTSI at competitive interest rates without any collateral security and / or third party guarantee. In addition the guarantee fee payable to CGTSI would be debited to the account. Minimum Loan Amount: No Minimum Amount Maximum Loan Amount: Rs 25 lakhs Eligibility: The SSI units engaged in activities like manufacturing, processing or SSSBEs, including Information Technology and / or Software industry are eligible.

Business Loans (Small Scale Industries) - MPower SSI

ING Vysya Bank presents a banking solution for SSI's who need specialised support for their business, both for their daily business needs and for the future growth of their business. This product is tailor made for SSI units engaged in activities like manufacturing, processing or SSSBEs, including Information Technology and / or Software industry. Maximum Loan Amount: No maximum limit

10

SME Banking

MPower Business Account (MBA)

MPower truly empowers you to create the business empire of your dreams. It is a working capital account that enriches small and medium business enterprises by making optimum use of your banking facility, and meeting the day-to-day needs of your business, quite like you would personally do, if you had more time. Thus, you are now free to focus on other business needs, while your MPower Business Account works hard, along with a host of conveniences to give you maximum value and benefits.

GROWTH CURVES OF ING Vysya BANK

100 80 60 Rs. in crore 40 20 0

719 98 81 19 99 99 9 -2 20 00 00 0 -2 20 00 01 1 -2 20 00 02 2 -2 20 00 03 3 -2 20 00 04 4 -2 20 00 05 5 -2 20 00 06 6 -2 00 7

Series1

-20 -40 -60

19 9

19 9

year

11

SME Banking

60000 50000 Rs. in crore 40000 30000 20000 10000 0

19 97 -1 99 19 8 98 -1 99 19 9 99 -2 00 20 0 00 -2 00 20 1 01 -2 00 20 2 02 -2 00 20 3 03 -2 00 20 4 04 -2 00 20 5 05 -2 00 20 6 06 -2 00 7

Series3 Series2 Series1

year

OBJECTIVES

Introduction of SME Loans The functioning of SME loans in ING Vysya Comparative study of SME Loan procedure of ING Vysya Bank with other banks. To study the growth of SMEs

12

SME Banking

RESEARCH DESIGN AND METHODOLOGY

Primary data has been obtained from the direct customer feedbacks. Secondary data has been collected from the websites given in the references. All the pie charts and bar graphs have been obtained from the under listed sites.

13

SME Banking

LIMITATIONS

1) As I have collected the data through the primary as Well as the secondary sources, so, there is a Possibility to have some discrepancies in the data. 2) Time Span: - 2 months is small time frame given to us. 3) The data collected were totally depending on the respondents views, which could be biased in nature. 4) The sample size is small, so it does not actually represent the views of the whole population 5) Some people were not willing to disclose the investment profile.

14

SME Banking

INTRODUCTION Phase 1

Sector Background and Emergence

The definition of SMEs has taken many forms in the recent times. The concept took birth with the term SSI (Small Scale Industries) which engulfed all organizations with an initial investment in machinery and capital of up to 20 lacs with the limit later being revised to a crore and even later to 5 Cr. The earlier definition of SSI based on investment in plant

Delineationdetermined by and machinery, excludes the rapidly-growing service criteria like turnover, net initial capital sector. In the past decade, the services sector contributed worth, investment or number of almost half the countrys GDP. This led to the origin of employees the term SME which was defined to include all

15

SME Banking

organizations with delineation between them and larger enterprises being determined by criteria like turnover, net worth, initial capital investment or number of employees. Most banks and financial institutions follow their own definition of SMEs. The CII defines SMEs through characteristics peculiar to them. These are Owner-managed Small work force Predominantly non-professionals and find it difficult to retain professionals Financial information is auditor-driven and restricted to financial statements, and the only planning they do is in relation to taxes. Primarily are suppliers to bigger companies Experience constant pressure from customers to reduce prices Have an in-built weakness in accessing new markets or expanding their market share Do not have the drive for product development or diversification

But looking at the scale of their spread and contribution (as shown below), many believe that Small and medium enterprises play a catalytic role in the development of any country and are the engines of growth in developing and transition economies. In India they account for a significant proportion of manufacturing, exports and employment, and are major contributors to GDP.

16

SME Banking

Figure 4.1.1(GDP statistics for the year 2002-2003) The above pi-charts depict that 99.7% of all organizations in India fall under the SME category SMEs contribute up to 80% of the GDP Table 4.1.1 (Source 1)

Performance of Small Scale Enterprises

No. of units (lakh) Year 200001 200102 Regd. 13.1 13.75 Unregd. 88 91.46 Total 101.1 (4.1) 105.21 (4.1) Production (Rs. in crore) (at current prices) 261289 (11.5) 282270 (8.0) (at constant prices)* 184401 (8.2) 195613 (6.1) Employment in lakh 239.09 (4.4) 249.09 (4.2) Exports (Rs. crore) 69797 (28.8) 71244 (2.1)

17

SME Banking

200203 200304 200405

14.68 15.54 16.57

94.81 98.41 102.02

109.49 (4.1) 113.95 (4.1) 118.59 (4.1)

311993 (10.5) 357733 (14.7) 418263 (16.9)

210636 (7.7) 228730 (8.6) 251511 (10.0)

260.13 (4.4) 27136 (4.3) 282.91 (4.3)

86013 (20.7) 97.644 (13.5) N.A.

Note: Figures in parenthesis indicate percentage growth over previous years. * 1993-94 prices.

Between 2000 and 2005, SMEs registered continuous growth in the number of units, production, employment and exports. During this period Annual growth in the number of units was around 4.1% Annual growth in employment was 4.3% annually. Annual growth in production, at current and constant prices, was 12.4% and 8.1% respectively. Thus, there has been a significant increase in the contribution of this sector to the economic development and employment generation in the country.

Banks foray into the SME space

The future of SMEs is considered to be in need of major policy initiative given their strategic importance in reshaping the economy. The biggest problem the SMEs face is the non-availability of adequate financing facilities. Following reasons have made it important for the SMEs to get access to good credit lines from the banks Advent of rapid globalization and WTO commitments The opening up of national economies, the arrival of new products, and the introduction of ever new processes of production and service provision. Banks, like other businesses, concentrate on creating value under a controlled risk milieu. When a business applies for a service, a bank focuses on the risks involved and the methods to mitigate those risks. The banks were reluctant to lend to the SMEs for a number of reasons, including the following: (Source-2) When a business applies for a service, a bank focuses on the risks involved and the methods to mitigate those risks.

18

SME Banking

The information asymmetry that arises from lack of financial information and standardized financial statements. Limited assets that can be used as collateral, high failure rates, low capitalization and vulnerability to market risks. Inability to determine whether the borrower possesses the technical, managerial and market skills to generate adequate cash flows and service the loan.

SME Banking Growth Engine: Myth or Reality

Earlier, SMEs preferred personal savings and retained earnings over other forms of financing but a major shift has been observed in this trend as the industry is maturing. Recognizing the vast potential of the SME sector, banks have positively responded by providing adequate credit to SMEs. Following statistics elucidate the favorable response of the banks Bank credit to SMEs - Rs 16,800 Cr in March 1991 In 2004-05 o Public Sector Banks - Rs 58,300 Cr o PSBs and foreign banks - Rs 10,000 crore. Projection An expected 20% year-on-year growth in the funding of SMEs will take the total exposure close to Rs.1,35,000 Cr by 2009-2010

Banks are now better equipped to handle the varied needs of the SME sector due to better technology and risk management. As recommended by the Ganguly Committee, the Government has asked banks to adopt the 4-C approach to cater to the diverse needs of the SME sector. The 4-Cs are: customer focus, cost control, cross-selling and containing risk.

Offering to SMEs

19

SME Banking

A variety of offerings are extended by banks and other institutions to SMEs to enable them to meet their needs. These can broadly be divided into fund-based, non fund-based and value added services. These include a whole gamut of services and products ranging from term loans, overdrafts to letter of credits, cash management services etc.

Figure 4.4.1 A few of these are in their nascent stages namely Credit Guarantee Fund, Consulting to SMEs and Business Credit Card. But nevertheless these services seem to be promising and are expected to be used heavily by SMEs in times to come.

20

SME Banking

Since Credit Guarantee Fund and Leasing are new to Indian Banking, they have been explained below. Credit Guarantee Fund - This fund provides guarantees to commercial financial institutions on behalf of SMEs that do not have collaterals to offer. This would encourage many SMEs to avail financial assistance and would increase the outreach of the Banks. Leasing - Providing sound collateral is beyond the ability of many SMEs and that its unavailability leaves entrepreneurs unfit for financial assistance. Hence, the Bank can offer leasing products. These are asset backed, tailor made and involve lesser documentation & processing time and hence a viable deal for both the parties.

SME Banking International Perspective

Learning from SME banking industry in more mature markets will facilitate in future policy decision. Here Canadian and Korean markets have been looked at briefly. Canada (Source 5) The figure below depicts the various products and services used by Canadian SMEs and also the % of SMEs using these products. This list also has some products that we dont have in the Indian banking industry. Some such products along with their % usage are Personal Credit Cards for owners: 33% Commercial Credit Cards: 26% Leasing: 16% Factoring: 3% Learning from SME banking industry in more mature markets will facilitate in future policy decision

21

SME Banking

Figure 4.5.1 South Korea The diagram below depicts a trend of lending to SMEs as a % of total outstanding lending to all businesses in South Korea. The highlight is that this is a rising curve and

Figure 4.5.3

22

SME Banking

has

started

forming

the

bulk

of

the

lending

carried

out

by

bank.

Takeaways from developed markets SME lending will overtake Non SME lending in the years to come Instead of traditional TL and WC, SME Banking will be more driven by more customized and sector specific products and services. This also guides us in a way towards clustering Loans from friends and relatives are increasingly becoming less attractive for SMEs

SME Banking in ING Portfolio (Source-4)

GE/McKinsey Matrix

Competitive Strength Low Medium High High

23

SME Banking

AttractivenessMarket

Medium

Low

Figure 4.6.1

*The size of the circle represents the size of the market and the pie depicts the market share of the SBU. The arrow depicts the direction of movement on the matrix.

The McKinsey matrix is a model to perform a business portfolio analysis on the Strategic Business Unit of a corporation. It displays the importance of an SBU in the portfolio of an organization and helps in determining if and how much investment should be pumped into the SBU.

The two axes have been labeled in the figure. Market (Industry) attractiveness is used as the dimension of industry attractiveness. It includes a broad range of factors other than just the market growth rate that can determine the attractiveness of an industry. Market size Market growth rate Market profitability Pricing trends as in Competitive Overall risk to and of returns in the industry Opportunity differentiate products services Distribution structure as in branch locations

fee and rate of interest intensity/ rivalry

24

SME Banking

Competitive strength likewise includes a broader range of factors over and above just the market share. These factors are Strength of assets and competencies Relative strength (marketing) Market share and its growth Customer loyalty Relative position structure cost (cost brand compared competitors) Relative margins (compared competitors) Record technological other innovation Quality of service Management strength of or to profit with

Finding

ING Vysya Bank holds less than 1% market share in the SME banking business which is very low considering the potential the market has to offer. Although our product portfolio does not have a wide gamut of products matching every specific need of SMEs but we have a generic product that to a large extent covers the needs of the clients. We are a small player in this industry but are growing by the day thanks to the brand name. ING Vysya Bank holds less than 1% market share in the SME banking business

25

SME Banking

PROCESS MAPPING AND FINDINGS Phase 2

Three major stakeholders for the internal process followed at ING were identified. These players either influence or are influenced by the process in one way or the other. They are Employee Customer Competitor

The perspectives of all these three have been captured in the findings below to understand the improvement areas in various dimensions.

Process Map for T L and WC Facilities @ ING

Any processing to provide a facility like term loan or overdraft, passes through 4 phases (life cycle of the process) which are as mentioned below. 1. Pre-sanction 2. Sanction or Approval 3. Disbursement 4. Account Servicing or Monitoring The C Map depicts players, tasks performed and deliverables. The arrows depict flow of information. Map Legend

Player Player in the process (human role) Major Process Flow Activity or characteristic of a document

26

SME Banking

Information Transfer

Documentation at that step

27

SME Banking

Pre-sanction Phase

The RM sources a customer from either of o Client References o Freelancer CAs o Cross Selling to existing customers o Cold Calls (this involves calling up people whose details are picked up from a database maintained by the bank) A request in the Negative Databases is sent to determine if at all the prospective client is black listed anywhere. The search is predominantly carried out with the following databases/ service providers. o CIBIL (an external organization maintaining black listed clients of all banks) o DEDUP (this checks for any record of default within the bank) o SATYAM (this checks if the prospective client belongs to one of those caution categories such as IPS, Politicians, IAS etc) Based on the results of this search, further actions are determined. Either the case is discarded or else further processing is carried out. In most cases, which are valid (as per the PDD norms) the process of document collection is initiated. Following is the list of documents that is required. o 3 year financials o 6 months bank statements o IT Returns

28

SME Banking

o Audit Report o Personal Returns of Directors, Proprietors, Partners if any It is established that the client can offer an acceptable collateral and the documents for the same are collected from the client and a valuation of the same is ordered. RM requests a Valuation Organization (in contract with the bank) to value the collateral and revert with a report.

The Credit Analysts generated the following documents in turn o One pager (to check the eligibility and compliance with PDD norms) o MFA (Moodys Financial Analyst Report) o ESC (Electronic Score Card) o Corporate Grade (BORG)

The Credit Analyst also calculates the LGD from the Valuation Report to see if the PDD norm in this respect is abided by or not. All the mathematics (calculation of limit for each category, pricing, exposure etc) is carried out here.

These are sent back to the RM who generates the following documents o LA Part-1&2 o Breach Form o Compliance Report o Call Report

A limit is determined taking into consideration both what the client needs and the bank can put on offer. 29

SME Banking

The RM prepares a proposal and sends it the to Credit Team for evaluation. This also marks the end of the pre-sanction phase. Minimum pre sanction time is 20 days

Approval/Sanction Phase

Once the proposal is received by the Credit Team they verify all the documents for compliance with PDD norms. They may recommend some modifications, may approve or even reject the proposal. In case of approval, they prepare an Approval Letter and Conditions for Approval (certain conditions subject to which a facility will be honored) The RM then forwards the case documents to the CAPU to obtain the LoBA (Letter of Bank Approval). 30

SME Banking

Post sanction time is 1 week.

31

SME Banking

Disbursal Phase

On receiving the response from the Credit team, the RM organizes for legal documents and other compliance documents with the help of the client (signature, stamp, seal etc) These are then sent to the Centralized Asset Processing Unit (CAPU) and Credit Team for further processing. The CAPU checks for errors in the documents and any other compliance issues and reverts with the same to the RM The RM rectifies the errors if any and the documents are sent back to the CAPU for the final approval. With all requirements in place, the CAPU loads the limits for the respective client into the MIS (System). It further orders the generation of a DD for the client to the respective branch.

32

SME Banking

Account Monitoring Phase

For any discrepancies and for general queries the Service Manager assists the Client. All the Client Requests are handled here, and many services are also backed by one of RM, CA or Credit. The Service Manager also bears the responsibility of migrating the client to better services.

33

SME Banking

RM Chakra

The drawn concept map can also be looked at from another perspective which is as shown below in the RM Chakra. On observing the process closely and interacting with the employees, it was found that the process is entirely RM Centric. The RM owns the case (not just the relationship) and takes it through its life from sourcing to disbursement. He becomes the hub in the process and coordinates all the other processes as listed in the spokes.

Source case RM backed servicing Collect DOX & pass to Cr A

Get approval from CAPU

RM

Prepare LA, Call Report etc.

Post approval documentation Forward to CAPU

Figure 5.2.1 The process needs a revamping where in the RMs responsibility can be reallocated. This will help not only in

Get approval from credit

34

SME Banking

increasing the productivity of the RM but will also help him focus in raking in more business for the bank.

Turn-Around-Time Analysis

An analysis spanning all the RMs of the department was carried out so as to gain an understanding about the average time taken by the bank from login to disbursement. The rationale was to be able to identify the bottle necks in the process. Please refer to Annexure-D for the TAT Sheet as prepared

under this exercise. It contains the average number of days taken by various RMs for their respective cases divided on activity basis.

The two most time consuming activities in the process are documents collection in the pre and the post sanction phases which take an average of 10 and 8 days respectively. The overall average time for a case disbursal at ING Vysya is 38

Days Activity Figure 5.3.1

12.0 35

SME Banking

working days. Various other surveyed banks have TATs as low as 25-30 days. So, it is clearly evident that we have a large scope of improvement there. A brief idea about how this function is carried out in other organizations with lower TATs could be obtained by studying the ICICI model in this respect.

Core Competence Model

The Core Competence model of Hamel and Prahalad is a corporate strategy model that starts the strategy process by thinking about the core strengths of an organization. It is very insightful for a business to understand as to what really attracts customers to it either fresh from the market or from the competition. That something forms the core strategy of an organization. After having taken into consideration the dynamics of the SME Banking market, our proposition and competitors offerings it can be concluded that account servicing and the convenience provided through the same form the core competence of SME Banking at ING. After sales service id a clich in the world of management but is very relevant for the customers of this fast growing market. Customers are looking for convenience when it comes to their day to day requirements. This was also gathered from the respondents in the customer feedback survey as presented in an earlier section. Lets carry out a check of INGs core competence on the basis of the Hamel Prahalad model. Potential Access to a wide variety of markets

36

SME Banking

On this criterion the servicing of an account fits in a generic fashion. Not that there are some specific markets that it provides access to, but it helps in garnering newer customers and satisfying the existing ones. Contribution to the benefits of the product as perceived by the customer The customer perception about an offering from a bank is largely influenced by the kind of service that can be expected from the bank. Talking about the product, most banks are offering similar products and competitive rates. So if a customer perceives a convenient after-purchase use of a banks offering, he is half hooked. Difficult for competitors to imitate This criterion may or may not hold. Many experienced employees perceive that the customers ING has been getting are mostly attracted by our competitive pricing and excellent services. Although this aspect is not too difficult to copy but capturing the market through this trait in our offering can give us the first mover and claimer advantage.

Customer Feedback

A questionnaire was administered to the existing customers of the bank so as to determine their levels of satisfaction and gain an understanding about the psyche of a customer in the SME arena. A sample is presented in Annexure-B. The data obtained from the survey has been coded and presented in Annexure-C. 37

SME Banking

Inferences The most preferred source of finance for a small or medium sized business remains family. Most of the businesses derive their seed income through this route and also trust this source the most. It is followed by state-owned and private banks. The criteria for evaluation were - availability ease, convenience of use and pay back conditions

Figure 5.5.1

NRI Investm en 6%

Venture Capital characteristics of the bank that an SME considers while choosing its banker. Pricing came out to be 6% the most

The following figure depicts the importance of various important factor that affects a clients choice of a bank. This also is an important factor that makes people switch their banks. This is followed by relationship with the bank as a criterion. Factor not fully visible in the figure are

Governm initiatives ent timeliness of response, facilitating understanding of 6% procedures, assistance in preparation of documents.

38

SME Banking

Figure 5.5.2 To be able to gauge the customer satisfaction level with ING, the respondents were asked to rate various characteristics of ING vis--vis their previous bank. This sheds light on which areas need concentration as far as the customer satisfaction is concerned. The most important factors that contribute towards INGs growing market share are the prices that we have at offer and the convenience in terms of account servicing and other value added services that we provide. Respondents seemed not to happy about the approachability of the RMs and the flexibility of policies. ING Previous bank

39

120

SME Banking

Figure 5.5.3 All the respondents seemed satisfied with the services that they have been availing from ING. One cause of concern that all the respondents showed was that ING required a lot of documents for case evaluation.

Competition Benchmarking

Four other banks namely ICICI Bank, HDFC Bank, CITIBANK and SBI were visited to understand their process so as to benchmark our process with them. Refer to AnnexureF for questionnaire for bankers. These banks were selected on the following grounds SBI is the market leader in SME Lending and the largest public bank CITIBANK is not too large in the SME Banking sector, but provides for a good comparison as its in direct competition with us being a foreign bank HDFC and ICICI are home grown giants and have also seen good growth graphs in the near past

40

SME Banking

OBSERVATIONS

Major analysis from competitor benchmarking are presented below. For detailed comparison refer to Annexure-A.

1. SME Definition Criteria Table 5.6.1

SME Definition Criterion ING Only Turnover if net worth is nil then the proposal is rejected Minimum Turnover =25laks ICICI Net Worth HDFC Turnover CITIBANK Turnover SBI Turnover

Requisite Company Size

Net Worth is the eligibility criteria. Defined Ranges 50-75Cr ME <50Cr SE

Turnover should be between 40 lacs to 100 Cr.

Turnover is the eligibility criteria. They even entertain companies upto a 1000 Cr. Dont have a separate Middle Market Group. Commercial Banking Group encompasses both SMEs and MMIs.

Turnover between 0-5 Cr go under the SE Dept and those between 5100 Cr go under ME Dept

All banks apart from ICICI use turnover as the SME definition criteria. The difference this creates fundamentally lies in the fact that, it helps them cater to a far wider range of clients. A client with a small net worth may have a very high turnover. This factor distorts the market share analysis.

41

SME Banking

2. Organizational Structure ING Vysya(ING)

Figure 5.6.1 SME department serves clients with turnover of up to 110 Cr. The basic structure of the organization is as shown in the figure above. The SME Banking arm is divided into four regions that are East, West, North and South. Every region has a Regional Sales Manager and a Regional Credit Manager. An RM reports into the ASM who in turn reports into the RSM. The ACM can only recommend cases and the RCM can approve cases of worth up to 5 Cr locally beyond which the case is escalated to the National Credit Head.

42

SME Banking

Figure 5.6.2

ICICI Bank

Figure 5.6.3 Clients of net-worth less than 50 Cr are handled by the Small Enterprises Department and those between 50-75 Cr by the Middle Enterprises Group. These are further divided into regions that are East, West, North and South. ICICI has segmentation within its SME Banking arm based on the clusters each segment caters to. The hierarchy at the first two levels is as shown in the figure below with an AGM and a 43

SME Banking

Group Cluster Head at the national level. Each region thereon has an RSM, RCM and a Risk Manager. Every region also has an associated Operations Team to assist the RMs in issues relating to documentation. The RCM looks at macro credit related issues of the case say sector risk, geographical risk etc. and the Risk Manager concentrates more on micro issues relating to the financials of the case.

Figure 5.6.4 HDFC Bank

Figure 5.6.5 The SME Banking arm at HDFC has four vertical viz. - MMI, Business Banking, Commodities and Transactional Banking. Each of these is further divided into East, West, North and South. The Business Banking Division directly corresponds to

44

SME Banking

the SME Department at ING. The organization of Business Banking is as shown in the figure below. At HDFC, along with the hierarchies of the Relationship and Credit managers, there is a third vertical running in parallel which is the Operations Team. The Operations Team here unlike ICICI, does not prepare the documents; rather it examines the documents for any discrepancies. Their job is more of the kind that is carried out by the CAPU at ING.

Figure 5.6.6 State Bank of India (SBI)

Figure 5.6.7 The division between SE and ME is based on the turnover of the client as shown in the figure. There are 14 regions in which the country is divided and each region has modules within it. Every module has its own centralized SME Credit Cell. All 45

SME Banking

branches in this module are connected to the SME CC through a Hub and Spoke Model. The clients that come to the branch are broadly screened by a credit manager there. The relevant documents are collected and are sent to the SME CC from where the approval/rejection is received within 10 working days.

Figure 5.6.8 Highlights The arrangement of ICICI into clusters. ICICI has a separate team that carries out the documentation related to cases lifting this burden off the RMs shoulders. The RM does the jobs of both the RM and the CA as compared to ING at ICICI The Operations Team at HDFC carries out the verification of documents for discrepancies i.e. in a way localizing the functionality of CAPU at ING. 3. Job Designations and Teams Table 5.6.2 46

SME Banking

Profile

ING 4 Profiles (RM, CA, Credit, Service Manager) Centralized Asset Processing Unit (Outsourced SCOPE) 4 Regions

RM sources clients, is supported by CA for preparation of proposal. About 90% of cases are takeover cases.

ICICI Profiles SM, ASM, RSM, RCM, Risk Manager, Service Manager

HDFC Cluster Manager with RMs working under him CA attached to RMs for financial support RCM who approves the limits with recommendations made by CMs working under him City Ops Mgr who ensures that all dox related to a case are ok

Acquisition Structure

SM sources clients, is supported by the operations team for proposal preparation.

99% of cases taken up by HDFC are takeover cases from other banks. Most of these are obtained through branch leads. Other traditional methods like Freelancer CA, client references, tele-calling etc are also used but constitute a very small % of the total business.

4. Special Services to SME Clusters Table 5.6.3

ING

Special Services to SME Clusters None

ICICI

Yes. Many clusters defined namely Logistics Construction Pharmacy Gems & Jewelers IT Those clients that do not fall under any group are handled by Emerging Clusters Group None

HDFC

ICICI has the aforementioned clusters and has offerings specific to them. Specific offerings mostly contain sector specific collaterals and consideration of certain financial ratios that are in a particular range as an industry wide trend. Also, this helps the bank in the way that their employees working in a particular cluster gain expertise in that sector and are thus enabled to handle client needs better. This also helps the banks to manage their portfolio in a more systematic fashion

5. Offering Characteristic 47

SME Banking

Table 5.6.4

Parameterized offering or Discretionary Credit ING Parameterized Offering (follow Product Development Document Norms) ICICI Both offerings available (EC and FC). Some limits are straight away calculated using pre-determined percentages. HDFC Parameterized but many deviations are permissible. HDFC itself claims to have a low risk appetite. CITIBANK More or less discretionary credit. Although there are defined limits, ranges, ratios etc but all these do not deter the organization to lend a facility.

With the huge gamut of available offerings, ICICI can bend and mould their product as per the client needs. They have both discretionary (Enterprise and Flexi Credit) and parameterized products on offer. As far as CITIBANK is concerned, although they have well defined parameters for client evaluation but nevertheless a large number and extent of deviations are allowed. 6. Sourcing Methods Table 5.6.5

Sourcing Methods ING Freelancer CA, Client References, Own Clients, Cold Calls ICICI Freelancer CA, Client References, Own Clients, Cold Calls Transaction Details - the bank tracks people who have taken loans for CV/CE etc. Their banking behavior is analyzed and they are contacted. This is well organized through an internal database. HDFC Branch Leads Client References Tele-calling Cross Selling SBI Branch Leads

Most of the banks use similar sourcing methods, but a striking difference between ING and other banks is that we have not been able to use our existing resources of customers well. Most of the other banks have access to their own banks data of current account holders. This enables them to cross sell their products in a smooth fashion. 48

SME Banking

7. Vintage Requirement Deviations Table 5.6.6

Vintage Requirement Deviations Allowed ING Those not meeting limits can be considered provided the lending is fully securitized by cash/ marketable securities/ SBLC/ BG or if the borrower belongs to a larger group which has a vintage of greater than 3yrs in the same business. ICICI Companies with vintage of 1n1/2 yrs are also allowed only if the bank receives a corporate guarantee from the owning group. HDFC Deviations in this are allowed depending upon the bank's comfort with the client. CITIBANK All deviations allowed as there is no fixed criteria SBI No limit on vintage so no scope of deviation

8. Financial Analysis Table 5.6.7

Financial analysis ratios considered ING Gearing Ratio = External Debt/Net Worth Leverage Ratio = Total Liabilities/Net Worth Net Profit Margin = Net Profit/Sales Asset Turnover = Sales/Assets Debt Service Ratio = Interest Expense/Sales Current ratio=1.33:1 Debt equity ratio ICICI Current Ratio = Cur. Assets/Cur. Liab. ICOR = (Interest + PBT)/Interest Leverage Ratio = Total Liabilities/Net Worth Net Profit Margin = Net Profit/Sales Debt Service Ratio = Interest Expense/Sales This ratio is important for term loans HDFC All ratios are considered. Profitability, Leverage, Turnover, Liquidity. All ratios hold some weightage. HDFC uses software specially created for them by CRISIL called RAM (Risk Assessment Model). This software especially designed for SMEs incorporates financial, management and all other subjective information about a prospective client. All information is quantified and scores are generated which help create a risk profile of the client. Gearing: 2 Leverage: <3 ICR: >2 DSCR: >1.5 Current Ratio: >1.33

49

SME Banking

Although all the banks consider more or less all the financial ratios but some ratios hold more importance as compared to others for each bank. Current Ratio holding the most importance at ICICI needs notice here. 9. Acceptable Collaterals Table 5.6.8

ING Acceptable Property types and Residential level of Commercial collateral Quasi type of Commercial properties & (Warehouses/ resp LTV% Godowns) Industrial Property ICICI Property Residential Commercial Warehouses Plot - only if its residential and the surroundings are covered Equipment (construction), Assets (Road Rollers), Vehicles HDFC Agricultural Land, Plots, Farm Houses, Property under Construction is not acceptable. CRRs are recommended in the product but they are also flexible e.g. from case to case basis the LTV could vary from 200% to 50%. There can even be cases where the bank decides not to take any collateral. CITIBANK Property Farmhouses and industrial plots are not acceptable. Defined margins on collaterals. Limits not disclosed.

10. Limit Calculation Table 5.6.9

Calculation of Limit - MPBF, cash cycle, turn over% etc and how much deviation allowed ING Limit is calculated using the MPBF method in non LGD cases Cash Cycle is used in LGD cases 20% of turnover ICICI Limit is calculated using both % of Turnover and MPBF HDFC % of turnover and MPBF are the two most important methods. But the RM also uses the cash-cycle method to support his cases through credit approval (not used technically). CITIBANK All these calculations are carried out but the limit is also finally decided by the banker. The calculations are only done so that the banker knows the numbers to make the assessment.

Both ICICI and HDFC also calculate limits on the basis of % of turnover method. This reduces a lot of internal processing for financially sound cases.

50

SME Banking

RECOMMENDATIONS Phase 3

Strategy Map

Strategy Maps are diagrams that describe how an organization can create value, by connecting strategic objectives in explicit cause and effect relationship with each other via the four perspectives that are financial, customer, internal and learning & growth.

Figure 6.1.1

51

SME Banking

The above drawn map provides an overview of the strategy of ING. The following sections delineate the process improvement suggestions and strategies that look at all these perspectives.

52

SME Banking

Clustering Approach

The bank must plan to switch to a clustering approach in servicing its customers. We can not adopt this today or in the near future because of the lower number of customers in our portfolio. But it is inevitable that we have to plan a shift. By the time we have the size, if we dont have a plan, it will be too late. There are various reasons why clustering should be planned for at this stage. a. The competition has been proactive Some of the biggies in the market have already adopted or have planned to adopt this structure. ICICI is already working with 5 cluster banking groups (for names refer to Annexure-A) and those clients that do not fit into any of these are serviced by the Emerging Clusters Group. Citigroup, which has an exposure of about 4500 Cr to SMEs has picked up a 5% stake in SMERA. Although not confirmed from internal sources but the market feel reflects that they plan to switch to clustered services sometime in the future. b. SMERA ratings to be cluster based Most of the banks today function on their internal risk assessment of SMEs, but this trend is slowly changing with SMERA ratings spanning more and more of these enterprises. Some banks namely Bank of India, Andhra Bank and Union Bank of India have already started evaluating their clients based on these ratings and are also offering them 53

SME Banking

discounts of up to 2.5% on the rate of interest. The purpose of these ratings is to make available cheap credit for genuine SMEs and help them grow. In this arrangement, the bank approaches SMERA for the credit rating of it customer. A good rating will entail a better rate of interest and vice versa or else case rejection. A lot of subjectivity that prevails in the market in the rating aspect is removed. c. Clustering attracts more clients and helps bank service them better For any SME that requires a bank service, the bank that offers services especially meant for businesses from that particular segment is obviously more attractive. The SME has the assurance that the bank will understand well the nature of the business, will have specific business friendly policies and offer good rates & services. Specific policies include collaterals that otherwise the bank would not consider e.g. a road-roller as collateral for an SME in the construction business. Also from the banks point of view, clustering helps it work more efficiently because the employees become specialists and the turn around time comes down largely. ING must plan to make separate verticals of these clusters in its organizational structure. The officially defined clusters can be used as segmenting criteria for the target market.

54

SME Banking

Refer to Annexure-E for a list of clusters in Delhi divided region wise. Issues Infrastructural issues Will require a change in the organization at the macro level, thus it is recommended to plan at this stage so as to be prepared when it needs to be executed. Change Management The working style of the employees will more or less remain the same, so no real threat there.

55

SME Banking

Hunter-Farmer Model and Operations Group

According to our role definition, we are following a model where the RM sources cases and takes them to the stage of disbursement, post which they are passed on to the Service Manager. The RM remains busy throughout the process and this affects his efficiency in sourcing more cases with the fact holding that he is the only profile responsible for getting in business. Following are the reasons that lead to inefficiency and lack of motivation in the current system All the RMs are supposed to carry out the entire process right from the sourcing to disbursement and the process being long hauled and complicated affects their efficiency. The process also involves a lot of documentation work which can be carried out by specialists in a lesser and more efficient way. The industry is easier to tap for those RMs who have an experience of at least 2-3 years.

Figure 6.3.1 56

SME Banking

The model drawn above depicts the Hunter-Farmer model as it can be followed in SME at ING. The hunter here will be SRMs whose major concentration will be on to rake in business for the bank. He will be supported by the CAs and the Sales Executives to take the case up to the approval stage. During this period he may be supported by the Operations Team for the pre-sanction document collection. Once the cases are approved, they will be handed over to the RMs shown towards the right of the model. These RMs will take over the relationship and take the case to the disbursement stage. The SRM will ensure that all the relevant knowledge transfer takes place. The Portfolio Manager will manage the disbursed cases and ensure proper renewal and enhancement procedures as and when needed. These up gradations will be carried out by the RMs in association with CAs. The operations team will be a separate vertical just like sales and credit. These managers will specialize in documentation and will support the SRMs and the RMs both in the pre and the post disbursement stages. The functions of the Credit Analyst and the Credit Team remain the same as in the current model. In the above model the RMs who are working in co-ordination with the PM will report to specific SRMs. This will ensure 57

SME Banking

proper ownership of the cases sourced by SRMs. Also here, the target of the SRM will be complete disbursals but the target of the RMs wil be limited to disbursements and renewals. This model is also futuristic in nature. Once ING starts following the clustering approach, the SRMs can be allotted specific clusters; they and their respective teams can then work accordingly.

Process Automation using Information Technology

IT usage in the entire process followed at ING Vysya is limited to MFA, ESC and e-mails. We are basically low on IT and are facing a lot of blockages in the process. We have a system of paper based case proposals that are stored manually as physical files. Areas of concern arising due to low automation in the process No access to the database of current accounts of bank customers to Relationship Managers, for a particular region, preventing access to a large number of existent customers to whom SME offerings can be cross sold. Absence of a formal IT enabled mechanism to pass on branch leads to RMs. This leads to a loss of a huge client base that can be tapped if and only if a formal linkage to pass on case-leads is established with all branches in the region. Non-existence of formal interdepartmental data access. SME Banking could benefit a lot if they have access to the Mid and the Large Corporate 58

SME Banking

clients databases. Through this data the SME Arm can tap the suppliers and distributors of these clients who more often than not would be SMEs. Also an unacceptable deviation on company size for Mid Corporate Segment could throw a client to SME Banking, in presence of a system that enables this with ease. Thick and unmanageable files need to be maintained for each case that presents a lot of difficulty in accessing any required detail. A lot of time simply gets wasted in trying to locate a particular document that has already been filed. This happens because of absence of proper indexing and orderly maintenance. All physical documents need to be scanned and sent as e-mail attachments to the CAPU. This adds to the wasted man hours. Retrieval of an old file for a case renewal or enhancement entails a manual search of files in a closet room which may or may not result in success. This further requires a re-preparation of all those documents that could have been reused from the previous file. This not only is inconvenient for the banker but also so for the client.

59

SME Banking

Figure 6.4.1 The figure drawn above present a birds eye view of the model that can be used for automating the process followed at ING. Some details for the process are as follows The RM on sourcing a case will log it into the system feeding in some basic details that he has been able to gather (contact information etc.) He can also carry out a check at this time to verify that the case does not already exist. The Operations Team on direction from the RM will collect the documents required in the presanction phase and put them into the system. This would be in the scanned format. The CA will access the documents and prepare the financials. These will be uploaded in the system and will be accessible from there in. The do-ability of 60

SME Banking

the case will have been determined by then. A positive result moves the case forward and a negative one will stop the process here. The negative data can still be maintained for future references. The RM will prepare the requisite documents whose soft copies will be accessible through the system (LA, Call Report, Breach Form etc.) A message will then be fired to credit informing that they should look into a particular case as requested. An approval will entail a mail. At all times, the status of case will be available in the system as in pre-sanction document collection, credit scrutiny, disbursal etc. All the documents would by now already be in soft copies and would be easily sent to the CAPU. An approval will entail the post-sanction documentation that will be carried out in a similar way as the pre-sanction documentation. The system will have defined rights restricting access for each entity e.g. RMs and CAs will be able to access details related only to their own cases, a credit manager will have access to details of all cases etc. The system will also help keep a check on the performance of each RM and help foresight the disbursals for the month. The system could also be enabled to generate some analytical reports using the data it maintains e.g. month on month disbursals growth etc.

61

SME Banking

All communications that face blockages now will flow smoothly and a seamless integration of the organization will be achieved.

Other Recommendations

All current account data of all branches should be made accessible to the SME Banking arm. A Data Mining procedure can then be run on this database that evaluates certain parameters which helps in determining the eligibility of customers for the SME Banking Arm. This will be a very good sourcing method for SME as they will be trying to tap the existing customers of the bank. This cross selling is happening across all other competitors and is a major source of business for most banks SME arms.

62

SME Banking

Leads given by bank employees to the same department or some other department must be incentives in either cash or kind. This gives the employee a reason to pass on business that the bank could tap. This could turn out to be one of the major sources of leads because most business in the SME segment works through references. It has been seen as a trend through experience that very little cold calls get converted into business for the bank.

A very major cause of concern at this moment is the usage of the Middle Markets Electronic Scorecard by the SME Arm. Here the financial ratio weights and their definition for the scoring of a client differ and could take a very different meaning for SMEs. This results in faulty calculation of limits and rates of interest which are generated using the Corporate Grade. Most other banks that are using scorecards have specially designed SME scorecards e.g. HDFC uses software for SME client risk appraisal that has been specially designed by CRISIL for them.

There are some products that are not a part of the SME ING portfolio as of now but will see huge usage in the times to come in the Indian SME Market. Payment in businesses using credit cards is fast gaining ground today. In mature industries more or less all business transactions occur with payment happening through credit cards. 63

SME Banking

As an example from a mature SME industry 55% of all SMEs using services from banks used Business Credit Cards (as compared to 53% using O/D limits). Public Sector Banks are offering Business Credit Cards to their clients already e.g. SBI which offers BCC (Business Credit Cards) and KCC (Kisaan Credit Cards.) Planning for rolling out futuristic products at this time could be a good idea. Currently our system requires us to forward all credit underwritten cases to the Centralized Asset Processing Unit. This requires a lot of wasted manpower because all requisite documents need to be scanned and sent across as e-mail attachments. A better model can be where we have regional LPUs. The city in each region that makes the maximum business could be the location for the LPU for that region. effort. A plan dividing the market either on the basis of geography or sector must be devised for allocation of targets to SRMs and RMs. This will allow them to focus their energy in set directions and will also allow them to understand particular industries and This will help reduce the turnaround time and also reduce a lot of wasted

64

SME Banking

their needs well. This could be pre-cursor to a full fledged clustering approach.

65

SME Banking

FINDINGS

MPower-BLT was launched in the Bank during November 2003 there were lot of modifications in the product. Hence, a comprehensive circular incorporating all the modifications till January 2006 in hereby issued.

I.

PREAMABLE:

Over the years, the Bank has developed necessary core strength in lending to SME segment where the yields are attractive and the risk is widespread. The Bank intends to leverage the network of branches particularly in urban & semi-urban areas to give the desired thrust for growth of the SME segment. This product aims at retaining the small value credits presently with SME and for acquisition of this potential segment across the branch network. Launching of this product is to provide necessary Working Capital and Term loans / Composite loans to the small and Medium Enterprise engaged in Trading, Small Business and Service activities with simplified procedures / process / appraisal and concessional pricing. The product does not cover manufacturing activities including SSI units. The maximum exposure is proposed to be capped at Rs. 25 lakhs per borrower. The key factors considered for the credit decision will be o Track record of their business promoter should have background experience of at least 3 years to consider the exposure should have background accounts among family members or starting of new units in same line of business to avail loans under the scheme is not permissible. o Acceptable level of trade activity & its consistency, o Market reputation of the borrower, o Past banking transactions, o Adequate security for the proposed exposure.

66

SME Banking

Initially, the Bank has launched the product at 100 profile branch and over time extended it to other profile & Non- profile Branches. Presently, the product is being implemented in 201 Branches Any new potential branch identified for implementation can be approved by RECO & RCO.

A simple, realistic, practical and programmatic approach will enable the branch officers to take the decision on loan exposures upto Rs. 25 lakhs, taking advantage of the knowledge of the market/s gained over a period of time. The bank plans to build a qualitative asset of approximately Rs. 400 Crores at 10.5% to 11% pa, in the ensuing financial year.

II. CLIENT / ACTIVITY TARGETS:

a. Eligible borrowers Necessarily, shall consider ING Vysya Band as their Sole Bankers Individuals Self-Employed persons, Women Entrepreneurs, Agra-businessmen, etc. Proprietorship concerns / Partnership concerns, HUF, Limited Companies. b. Eligible Activities Retail Traders and Small Business Professionals including Practicing Doctors / Advocates / Consultancy Units / Travel Agencies / Advertising and Publicity agencies etc. Wholesale Distributors & Dealers / Stockiest, Commissions Agents. Jewellery Shops, Nursing homes. Contractors Transport operators [only for working capital] 67

SME Banking

Other thriving commercial activities characterized by major share of cash transactions.

Activities kept under Negative List as per credit policy should not be financed under this scheme. Separate Score-Cards have been designed for existing & new customers, with a prescribed minimum score of `20` and 14 respectively. Manufacturing & SSI units are not covered under this product and in case of such credit requirements, the relevant loan proposal shall be consider under the existing product [CGTSI] after detailed appraisal and on merits. c. Purpose of the Loan Make sure that the purpose of the loan is strictly for business purpose for working capital or acquiring assets to be used for business activity. Under no circumstances personal loans of any kind should be considered under this scheme.

III. PRODUCT APPLICABILITY:

EXPOSURE (a) All existing SME relationship without any irregularity upto & inclusive of Rs.25 lakhs [please note that no minimum limit has been prescribed for existing clients]. (b) New relationships, minimum of Rs5 lakhs, upto & inclusive of Rs.25 lakhs [please note that for new relationship, minimum amount of limit is Rs.5 lakhs].

Note: Splitting of transaction and of more than 1 loan to avoid reference to higher authority, is strictly prohibited.

NATURE OF FACILITIES 68

SME Banking

(a) Funds Based Limits I. Secured Overdrafts limits (SOD) II. Term Loans III. Composite Loans covering both working capital as well as Term Loan Existing Overdraft Accounts may also be consider for conversion as Term Loans ore convenience & mutual understanding. Sanction of Truck Loans is not covered under this product as the same is being dealt by our Retail SBU. However, working Capital facility can be considered provided all other eligibility criterion is met. (b) I. Non Fund Based Limits

Bank Guarantees favoring Govt./ Quasi Govt. bodies, Public Sector Undertakings Performance as well as Financial Guarantees. Gtees to be issued in approved as well as Financial Guarantees can also be issued in favour of reputed Public Ltd. Companies who supply goods to our borrowers. II. Lcs are not to be covered under this product unless it is backed by 1005 margin by way of deposits. (c) Solvency Certificate Solvency Certificates to the Contractors to the extent of 100% net worth as per the latest financial statements can be issued by following the extant guidelines . The same need not be considered for the exposure under this product.

BRANCH COVERAGE Initially for the first phase of the product implementation, (a) At all Implementing branches, the SME Representatives or Branch Heads as applicable, will entertain & consider the new business relationships and also existing relationships by way of review / renewal with or without enhancements.

69

SME Banking

(b) All the other metro / Urban / Semi Urban Branches will entertain and consider only the existing relationship by way of review / renewal with or without enhancements . Until the implementation of this product in all the Branches, the prevailing norms and lending procedures as applicable for existing as well as the new SME loan clients at all other branches will continue as per the extant arrangements. APPROVING AUTHORITIES (a) At all 201 branches , the SME Representatives and Branch heads, as applicable will consider new relationship as well as the review / renewal / enhancement of the existing relationships, Lending upto & inclusive of Rs.25 lakhs with single signature of the Branch Manager of Lion Branch as per the delegated L level powers. Lending upto & Inclusive of Rs.10 lakhs with single signature of the Relationship Manager or the Branch Head, as per the delegated L Level powers. Lending above Rs.10 lakhs upto & inclusive of Rs.25 lakhs with joint approval of the

(i) (j)

Branch head with appropriate L powers and, Concerned CRMD Officials with appropriate C lavel powers.

Necessary delegation of discretionary powers for all the implementing branches, as and where required to facilitate the above credit decisions appropriately, will be ensured by the respective Regional Offices, in line with procedures in force. Reporting Procedure In order to ensure close monitoring of the product implementation and observing the requisite credit discipline at

70

SME Banking

the field level, the following reporting procedures shall be observed. In respect of all the approvals accorded by single signature, I.e., the relationship Manager or the branch head, a coy of the loan application cum process note with the score card as prescribed, shall be submitted for review in respect of all the loans approved, to the next immediate reporting official in the respective SME division at the Regional Office. The submission by the approving should be within 5 days of the close of respective reporting month. In respect of joint approvals, the existing procedure of reporting the delegated powers exercised shall be followed.

QUANTUM OF LOAN & MARGIN

For secured overdrafts, the exposure should be lower of the following: 20% of Gross Projected Sales* (or) (c) 3 times of the promoters Net Owned Funds in the business. For computation of Net Owned Funds, eligible Quasi Capital component developed in the business on a longterm basis can be included. *In case of Commission Agents, 15 times of the projected commission earnings may be taken in to consideration. For Terms Loans with a margin of 25% based on the total project costs. Term Loans should be disbursed directly to the supplier of asset duly collecting the margins and not to be disbursed to the borrower. For Composite Loans : This consist of both the Working Capital + Term Loans. Hence, the abovementioned criteria shall be adopted for deciding the working capital component and the Term Loan Component to arrive at the total composite loan. For Bank Guarantee Limits, a minimum margin of 20% by way Deposits under lien to the bank. The credit decision will be based on the following key factors : Past track record of the entrepreneur in the business Overall financial standing of the business enterprise 71

SME Banking

Market reputation and integrity of the borrower Acceptable level of trade activity Credit needs for stock in trade and credit sales Risk coverage by way of the adequate securities offered for the proposed credit exposure.

IV.

SECURITY

(a) Primary: hypothecation of the stocks / book debts / assets financed. (b) Collateral : i. Equitable mortgage of the immovable landed properties , (other than agricultural properties), situated in metro / urban/ semi urban, in such a way that 125% of the limits sanctioned is covered . However , in deserving cases , officials at mega region can approve relaxation upta 100% cover. Market value of the properties as determined by the banks approved valuer . Clear title by the property owner/ mortgager should be established by legal opinion as prescribed. Simple mortgage is not necessary under this product, if valid equitable mortgage can be created . In view of the difficulties expressed in obtaining the approved plan for very old building( of over 20 yrs age ) , the same can be waived on a case to case basis by mega regional head- SBU & RCO. Easily realizable securities like creation of the lien on deposits of our bank, NSCs which have come out of the lockin period (paid up value plus accrued interest only should be considered), assigning the life insurance policies (surrender value) and govt. securities. These should cover 100% of the credit exposure. 72

ii.

iii.

SME Banking

iv. v.

A combination of the above (i) or / and (ii) by parts , ensuring the overall security coverage proportionately. The deposits kept as the margin money for bank guarantees can be considered towards the part of collateral securities.

Third party properties/ securities can be accepted in the exceptional cases. However, the orbit of the third parties should be restricted to spouse, children, parents (/ in- law), brother (/ in-law), sister (/in-law). In such a case, the provider of the property should also be taken as guarantor.

VI. VALIDITY OF THE SANCTION:

Facility 1) Secured Overdrafts 2) Term Loans 3) Composite Loans Validity 2 years Not exceeding 4 years Renewal / Review To be reviewed once in a year by the respective sanctioning authority.

Limits sanctioned stand cancelled in case of nonavailment within 3 months from the date of the sanction. No request should be considered for re-scheduling or re- phasing of the repayment. No ad-hoc enhancement or excess drawings or operations under lapsed sanctions are permitted under the overdraft limits. However, the temporary excess drawing may be allowed as per the existing guidelines of the credit policy.

VII. RATES OF INTEREST:

1. SOD LIMITS 2. Term Loans 3. Composite Loans MINIMUM 1.5% pa 1.25% pa 1.25% pa

No further concessions are to be allowed. Further, discretion vested with various Executives to reduce the rates on products will not be made applicable to this product. However, 0.5% reduction for purchase of Life Insurance Policy will be conducted as per guidelines.

73

SME Banking

Guidelines issued by RBI from time to time in respect of the loan accounts of limits less than Rs 2 lakhs (existing) shall be allowed.

VIII. OTHER CHARGES / PENALTY:

In the default / delay in payment of interest (or) principle, penalty of 2% applicable rates on the default / overdue amounts to be levied. Pre-closure Charges of 2% on the outstanding balance in the case of TLs, to be levied Processing charges @ 0.5% of the loan amount, with a minimum of Rs 2000/-per facility. 50%of the Processing Fee to be collected with the communication of the sanction, which is non-refundable in case of nonavailment. RCEO may permit to collect 0.25% during the first year and 0.25%at the time of review of the accounting deserving cases. Commission @ 2% and 3% on the amount of BGs, respectively for the Performance and Financial Guarantees issued.

IX. GUARANTEES:

Personal Guarantee of all the promoters viz. Partners / Directors / Members, etc. Personal Guarantee of all the Property Owners taken as security as per norms of the Bank.

X. OTHERS:

Inspection of the Units has to be conducted on half yearly basis and the findings should be recorded with specific reference to the turnover and scale of operation of the unit.

74

SME Banking

Application Cum Process Note and Score Card as per the prescribed formats designed exclusively for this product. Branches / Approving Authorities to report all the sanction to the next immediate reporting official, forwarding the copy of the Application cum Process Note by 5th of succeeding month. Score card system to be allowed to rate the clients, ensuring the minimum scoring while accepting the relationship for initial lending as well as for the periodical review / renewal and enhancement.

XI. The maximum exposure under the product is enhanced from Rs. 25 lakhs to Rs. 50 lakhs at Selected Branches with the following terms and conditions:

RCEO along with the Regional credit officer will jointly finalise the list of Branches where the enhanced limit will be implemented and inform the same to SME, C.O. The accounts to be approved shall not have any deviation and shall be strictly in accordance with the norms of the product. The application cum appraisal presently under use for BLT upto INR 25 lakhs will apply for the exposures beyond 25 lakhs also i.e., 50 lakhs under BLT. The approval authority for the loans in excess of 25 lakhs shall be the appropriate L and C level authorities and such loans should not be approved under the single signature authority.

75

SME Banking

XII. Purchase of Life Insurance Policy:

An interest rate concession of 0.50% can be extended to the borrowers who buy a life cover from any Life Insurance Company and assign the policy in favour of the Bank. They may advice the borrowers of Rs. 5lakhs loan/ overdraft component to buy Life Insurance Policy where the minimum premium will be rs.5000 p.a. for loan amount of Rs.5 lakhs ad in case of loans / overdrafts above Rs.5 lakhs, the premium would be Rs.5000 + in multiples of Rs.1000 for every additional amount of Rs.1lakh over and above Rs.5lakhs, by giving interest concession of 0.5% over the rate of interest The concession of 0.5% may be given by the Branch Head / Relationship Manager only after the policy is issued and assigned in favour of the Bank. The concession may be given with effect from the date of payment of the premium. In case of partnership firms / Ltd. Companies, the Insurance Policy may be taken in the names of partners / or firm and Directors / company in case of companies as per convenience of the borrower.

XIII. Documentation:

Documentation as per the extent guidelines Regarding obtention of enforceability certificate the following procedures to be adopts. In case of Metro Branches, where CAPU is functioning the enforceability certificate need not be obtained from Legal Advisor and CAPU can certify the documents since the amount of loan involved under this product is limited to a maximum of Rs.25 lakhs. In all other Branches, enforceability certificate is to be obtained from the Legal Advisor as per they extent procedure.

76

SME Banking

XIV. MIS & Monitoring:

All the accounts to be opened under the scheme have to be captured under the new field created specially for the purpose i.e., Account Sub-Type.

XV. Annual Review of OD Accounts:

Though the validity period of Working Capital Loan is for 2 years, the account has to be reviewed once in a year. A simplified format designed for the purpose of review has been enclosed. For quick and easy disposal of yearly review, the review notes can be disposed at the SBU level wherever the unit is functioning normally without any irregularities and the account is classified as A Standard account. CRMD at Sub- Region level shall make random verification of 5% of such proposals reviewed by SBU. In respect of accounts [other than standard] where any irregularities are noticed, the SBU shall review and place the same to CRMD, Sub-Region for their clearance. The renewal of proposals i.e., after completion of 2years, shall be as per the existing guidelines.

77

SME Banking

ANNEXURE

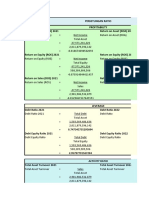

(1) Parameters for Term Loan Assessment: