Professional Documents

Culture Documents

Working Capital Finance 4 Infrastructure Sector

Uploaded by

Amit RoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Capital Finance 4 Infrastructure Sector

Uploaded by

Amit RoyCopyright:

Available Formats

WORKING

CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR

The project mainly deals with finance sources of working capital as fund-based & non-fund based. The major non- fund based sources include those of factoring, L/C, B/G, HP finance, Corporate Loan etc. These sources are applicable for different situations. AMIT KUMAR ROY 30/07/11

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR

PROJECT REPORT

Submitted in partial fulfillment of the requirements For Summer Internship By Mr. AMIT KUMAR ROY (Reg.No: 1014370005) Under the guidance of Miss. Punjika Rathee LECTURER, DEPARTMENT OF MBA

DEPARTMENT OF MBA SCHOOL OF MANAGEMENT IMS ENGINEERING COLLEGE JULY 2011

2 2

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

CERTIFICATE

Certified

that

the

project

report

entitled

WORKING

CAPITAL

FINANCE

FOR

INFRATRUCTURE SECTOR submitted by AMIT KUMAR ROY (1014370005) is a record of project work done by him under my supervision. This project has not formed the basis for the award of any degree, diploma, associateship, or fellowship.

Mr. S.I. Mehdi Sr. Manager Accounts C&C CONSTRUCTIONS LTD.

Internal Guide

Head Of TheDepartment MBA, IMSEC

3 3

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

DECLARATION

I do hereby declare that the dissertation entitled WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR is a record of original work carried out by me under the supervision of Miss. PUNJIKA RATHEE, Lecturer, Department of MBA, IMS ENGINEERING COLLEGE, Ghaziabad. This project has not been submitted earlier in part or full for the award of any degree, diploma, associateship or fellowship.

Ghaziabad, Date AMIT KUMARROY

4 4

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

ACKNOWLEDGEMENT

I hereby acknowledge all those who are related to this work either directly or indirectly. I express my deep sense gratitude to C&C CONSTRUCTIONS LTD. for their valuable guidance. I express my deep sense of gratitude to my project advisors Mr. A. S. PANDEY (C.A), Mr. RAJIV LAKHANI (CWA), Mr.VIKASH KUMAR SINGH (CWA), MISS RAVNEET KUKREJA (MBA) & MISS. KRISHNA CHHETRY (CWA) for their expert guidance, stimulating discussions throughout the period of this project. I gratefully convey my utmost regards to Mr. S.I. MEHNDI, Senior Manager accounts, C&C CONSTRUCTIONS LTD. Under whose exhilarating, inspiring, and precious advice the exploration was carried out. His immutable solacing, uniform enlivening, even motivating and painstaking deadlines decided by him have shaped it feasible to accomplish the project successfully. I express my deep sense of gratitude to Miss PUNJIKA RATHEEE, Department of MBA, IMSEC, Ghaziabad, for her encouragement and support. Last but not the least I am thankful to the almighty and I will be failing in my duty if I do not express my indebtedness to our Department Staffs, Parents, and Friends for their support and encouragement.

AMIT KUMAR ROY

5 5

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

TABLE OF CONTENTS

INTRODUCTION OBJECTIVE METHODOLOGY OF STUDY FACTORING LETTER OF CREDIT BANK GUARANTEE HYPOTHECATION FINANCE CORPORATE LOAN CONCLUSION INTERPRETATION BIBLIOGRAPHY APPENDIX v QUESTIONNAIRE

15 20 21 23 31 35 54 57 59 60 61 62

6 6

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

LIST OF SYMBOLS & ABBREVIATIONS

v v v v v v v v v v v v v v v v v

CCL- C&C CONSTRUCTIONS LTD. W/C- WORKING CAPITAL. F/B- FUND BASED FINANCING. NFB- NON-FUND BASED FINANCING. L/C- LETTER OF CREDIT. B/G- BANK GUARANTEE. H/P FINANCE: HYPOTHECATION PURCHASE FINACE. WCDL- WORKING CAPITAL DEMAND LOAN. C.C- CASH CREDIT. O/L- OPERATING LEASE. D/P- DRAWING POWER. MSOD- MONTHLY SELECT OPERATION DATA. CMA- CREDIT MONITORING ASSESSMENT. MPBF- MAXIMUM PERMISSIBLE BANK FINANCE. DSCR- DEBT SERVICE COVERING RATIO. ICB- INTER-CORPORATE BORROWING. PCFC- PRE-SHIPMENT CREDIT IN FOREIGN CURRENCY.

7 7

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

PROFILE OF THE COMPANY: C & C Constructions Ltd. has a unique business model, with proven expertise in innovative thinking, project and cost management. They are focused on delivering high quality work within budgeted time and costs, as evident in the various accolades and repeat business. A key objective has also been to continuously broad base the operating portfolio and enhances the order book, thus opening new avenues to growth and profitability. They have also developed an appropriate blend of entrepreneurs and hands on professionals, constantly thinking & executing innovative and cost effective solutions to clients' requirements. Professionals in the field of infrastructure development incorporated CCL Company in July 1996. Over the years, the management at CCL Company have acquired expertise in EPC contracts, and recently, forayed into urban infrastructure projects. CCL Company has top-notch management and highly qualified and experienced team of over 1772 employees. The company commended their construction projects by undertaking two contracts of Rs.0.3 million each in 1996 and presently has a prequalification capacity to quote for contracts over Rs.32 billion. Presently the turnover of company being around 1250 crore approx.. The major clients include: National Highways Authority of India Airports Authority of India Public Works Department of various State Governments Punjab Infrastructure Development Board Public Works Department, Afghanistan The Louis Berger Group, Inc. RITES Limited UNOPS

8 8

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

The Company is engaged mainly in the following activities:v Construction of highways for National Highway Authority of India (NHAI) and roads for State PWDs: in Bihar, Punjab, HP, Haryana, Delhi, and Overseas. v Construction of runways for Airports Authority of India (Port Blair). v Project Export: Construction of Roads in Afghanistan. v Telecom Cabling: Optic Fiber Cable laying for private telecom operators e.g. Bharti Infotel, Tata Teleservices and Tower Foundation and Erection. v Construction of high capacity bus service route for Delhi Govt. v Water sanitation, Irrigation Piping, Sewerage treatment etc. Industry Scenario: (Source: RMD Guidelines) In the year 2008-09, budget allocation for National Highway Development Program (NHDP) was enhanced to Rs.12, 600 crs. From Rs. 9995 crs. In 2007-08. The current size of the construction industry in India is estimated at Rs.3,18,600 crs., of which 87 key players account for nearly one third of the market share while rest is distributed amongst the 25,000 plus small players. The industry has witnessed a sustained growth of 30% per annum during the last four years. According to the 11th Five- Year plan, the core infrastructure sector comprising power, roads, highways, railways, ports etc. Will require massive investments to the tune of Rs.22,05,000 crs. The key programs under road development include the National Highway Development Programme (NHDP), Pradhan Mantri Gram Sadak Yojana (PMGSY), and Special Accelerated Road Development Programme for the North East (SARDP - NE), in addition to other state level projects. The company has entered into joint ventures for enhancing its business with firms such as BSC, SE & ISOLUX CORSAN.

9 9

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

Company strategy: The business and growth are dependent on the ability to bid for and secure larger and more varied projects. Bidding for infrastructure projects is dependent on various criteria, including, bid capacity and pre qualification capability. It has focused on increasing both these parameters and has continuously increased our bid capacity.

Performance highlights:

9M

Q

3

SALES GROWTH

2.5 % 3.4 % 29%

16 % 17 %

EBITDA GROWTH

PAT GROWTH

19 %

10 10

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

Financial Highlights, March 2011

900 800 700 600 500 400 300 200 100 0 Net sales EBITDA PAT 9M FY 10 9M FY 11

ORDER BOOK VERTICALWISE

BUILDINGS 14%

RAILWAY 9% WATER & SEVERAGE 3% TRANSMISSION 4%

ROADWAYS 70%

As we can see from the order book that companies major operations lies in road construction projects. The company structural framework consists of two major facets as C&C projects which is mainly concerned with road projects in BOT sector and C&C REALTORS which is mainly concerned with BOT in urban development. As per the requirements of BOT projects, the company operates through SPV (special purpose vehicle) format in the form of C&C TOWERS.

11 11

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

Key Balance-Sheet Perspectives As On 31st March, 2011:

PARTICULARS BOOK VALUE PER SHARE NET WORTH (in crore) DEBTOR DAYS DEBT (crore) CASH & CASH EQVALENT AVG. COST OF DEBT (%) DEBT: EQUITY ROCE (%) ROE (%)

VALUES 257.78 602.93 31 916.89 102.45 13.7 1.52 13.3 11.7

v 8 largest sites, which account for around 89% of the revenues of the Company, comprising: - C&C Construction sites: Zirakpur Manikpur Giriyak Yamuna Expressway - Joint Venture sites: BR-8 Darbhanga Ropar JV Ranigunj JV Kursela JV

12 12

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

COMPANY & ITS JOINT VENTURES (J.V):

C&C construc_ons ltd. c&c projects ltd. (100%) c&c Realtors ltd. (100%) BSC-C&C JV Nepal pvt. ltd. (50%) Un-incorporated joint ventures. (50%)

PWD Himachal MCD, DELHI PGCIL 3% Pradesh 3% 3% PWD Bihar 4% CPWD, Gov. of India 5%

Other 8%

BOT projects 27%

Jaiprakash Associates Ltd. 7% DFCCIL 9%

Isolux Corsan 15%

PWD, Meghalaya 16%

FIG: TOTAL ORDER BOOK AT C&C CONSTRUCTIONS, ON JUNE, 2011

13 13

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

EXECUTIVE SUMMARY

The current size of the construction industry in India is estimated at Rs. 3,18,600 crs, of which 87 key players account for nearly one third of the market share while rest is distributed amongst the 25,000 plus small players. The industry has witnessed a sustained growth of 30% per annum during the last four years. The C&C constructions ltd. Company carries out its projects both in India & abroad. The company carries out its process through two major structure as C&C projects (engaged in road projects) & C&C Realtors (BOT in urban development).

The Finance Department is committed to provide the highest levels of financial services and to ensure that proper controls and procedures are in place to manage the scarce resources of the company. Finance Department sources different alternatives of funding, evaluates them and adopts the best alternative of fund procurement that can fulfill the organizational requirement. Similarly, it deploys the surplus fund of the company in the best possible short-term liquid plan.

v Working capital Finance: Project finance structures are complex as to the very nature of the projects. Each project gives rise to its own unique risks and hence poses its own unique challenges. In every case, the Finance Department takes care of all those diversities and arranges finance for each Projects varying from Roadways, Railways to Sewerage and Transmission. Letter of Credit: The company issues letter of credit for its purchase orders from various nationalized banks based on credit limit issued by banks. Bank Guarantee: The Company offers security in the form of bid or performance or mobilization securities from 13 banks with each having different limits. Factoring Services: The Company carries out purchase bill discounting for its invoices from various banks. This process is actually Reverse Factoring. Corporate Loan facilities: The Company arranges its Fund based & Non Fund Based working capital through short & long term corporate loan facilities from either Consortium Banking or Multiple Banking Arrangements. Hypothecation purchase finance: HP finance is another mode of financing the equipments for CCL Company. In a HP transaction the loan amount is paid in installments over a fixed period of time. Often to secure a deal a down payment has to be paid by the borrower to the financer apart from hypothecating the equipment financed

14 14

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

INTRODUCTION:

WORKING CAPITAL MANAGEMENT: Working Capital is a financial metric, which represents operating liquidity available to a business, organization, or other entity, including governmental entity. Along with fixed assets such as plant & equipment, working capital is considered a part of operating capital. Net working capital is calculated as current assets less current liabilities. Decisions relating to working capital & short-term finance are referred to as working capital management. These involve managing the relationship between firms short-term assets & its shortterm liabilities. The goal of working capital management is to ensure that the firm is able to continue its operations and that it has sufficient cash flow to satisfy both maturing short-term debt and upcoming operational expenses.

WORKING CAPITAL

FUND BASED

NON-FUND BASED

v FUND BASED: It includes sources of immediate monetary accrual sources. These include the following: Cash Credit Working Capital Demand Loan (WCDL). Standby Line Of Credit (SLC). Debtors Bill Factoring. Inter-Corporate Borrowing (ICB). Pre-Shipment Credit in foreign currency (PCFC). v NON-FUND BASED: It includes the following: Letter Of Credit. Bank Guarantee. HP Finance. Term Loan. Operating Lease.

15

15

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

FINANCING WORKING CAPIAL FOR INFRASTRUCTURE PROJECTS: The availability of infrastructure facilities is imperative for the overall development of any country. Today, there is a need to focus on enhancing the quantity as well as improving the quality of infrastructure services provided in India. Roads constitute an important part of infrastructure of a country. India has the third largest road network in the world. But the growth of road network has not kept pace with the growth of road traffic. The percentage growth of road traffic from the year 1991 to 1995 has been about 42%, whereas the percentage growth of road length has been only 8.7%. This has led to severe congestion on the roads. Also, there is a need to improve and maintain the road network. Due to funds constraints, the government is assigning several projects on a Build-Operate-Transfer (BOT) basis. BOT is a type of project financing.

SALIENT FEATURES OF WORKING CAPITAL FINANCE:

The salient features of project finance are as follows:

v The lenders finance the project looking at the creditworthiness of the project, not the creditworthiness of the borrowing party. The repayment of the loans is made from the earnings of the project. v Project financing is also known as limited recourse financing as the borrower has a limited liability. The security taken by the lenders is largely confined to the project assets.

RISK STRUCTURE IN WORKING CAPITAL FINANCE

Most project finance structures are complex. The risks in the project are spread between the various parties; the party, which can most efficiently and cost-effectively control or handle it, usually assumes each risk. RISK ALLOCATION Once the projects risks are identified, the likelihood of their occurrence assessed and their impact on the project determined, the sponsor must allocate those risks.

BUILD, OPERATE AND TRANSFER (BOT) PROJECTS

BOT is a relatively new approach to infrastructure development, which enables direct private sector investment in large-scale infrastructure projects.

Build A private company (or consortium) agrees with a government to invest in a public infrastructure project. The company then secures their own financing to construct the project. Operate Transfer

the private developer then owns, maintains, and manages the facility for an agreed concession period and recoups their investment through charges or tolls. after the concessionary period the company transfers ownership and operation of the facility to the government or relevant state authority. 16

16

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

PARTIES TO BOT PROJECTS

There are a number of major parties to any BOT project and all of them have particular reasons to be involved in the project. The contractual arrangements between those parties, and the allocation of risks, can be complex. The major parties to a BOT project will usually include:

1. Government Agency A government department or statutory authority is a pivotal party. It

will:

v Grant the sponsor the "concession", that is the right to build, own and operate the facility, v Grant a long term lease of or sell the site to the sponsor, and v Often acquire most or all of the service provided by the facility.

The government's co-operation is critical in large projects. It may be required to assist in obtaining the necessary approvals, authorizations, and consents for the construction and operation of the project. It may also be required to provide comfort that the agency acquiring services from the facility will be in a position to honor its financial obligations. The government agency is normally the primary party. It will initiate the project, conduct the tendering process and evaluation of tenderers, and will grant the sponsor the concession, and where necessary, the off take agreement.

2. Sponsor

The sponsor is the party, usually a consortium of interested groups (typically including a construction group, an operator, a financing institution, and other various groups) that, in response to the invitation by the Government Department, prepares the proposal to construct, operate, and finance, the particular project. The sponsor may take the form of a company, a partnership, a limited partnership, a unit trust or an unincorporated joint venture.

3. Construction Contractor The construction company may also be one of the sponsors. It

will take construction and completion risks, that is, the risk of completing the project on time, within budget and to specifications.

4. Operation and Maintenance Contractor The operator will be expected to sign a long-term contract with the sponsor for the operation and maintenance of the facility. Again the operator may also inject equity into the project.

5. Financiers

In a large project there is likely to be a syndicate of banks providing the debt funds to the sponsor. The banks will require a first security over the infrastructure created. The same or different banks will often provide a stand-by loan facility for any cost overruns not covered by the construction contract.

7. Other Parties

Other parties such as insurers, equipment suppliers and engineering and design consultants will also be involved. Most of the parties too will involve their lawyers and financial and tax advisers. 17

17

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

ADVANTAGES OF BOT PROJECTS:

BOT projects have several advantages such asv The government gets the benefit of the private sector to mobilize finances and to use

the best management skills in the construction, operation, and maintenance of the project. v The private participation also ensures efficiency and quality by using the best equipment. v The projects are conducted in a fully competitive bidding situation and are thus completed at the lowest possible cost.

BOT PROJECTS IN INDIA

There is a tremendous thrust in the infrastructure sector in India. National Highway Development Programme (NHDP), consisting of The Golden Quadrilateral and The North-South, East-West corridors, has been launched. National Highways Authority of India (NHAI) is implementing NHDP. The NHDP is Indias largest ever highway projects. It involves four and six laning of 13,146 Km of roads with a total cost of Rs.54,000 crores. The NHDP consists of nine BOT projects of 456 Km with estimated cost of Rs.2, 700 crores. Apart from the BOT projects under NHDP, there are several other projects being done on BOT basis in India.

PROJECTS AT C&C CONSTRUCTIONS:

Presently the company is working on around 30 projects, mostly on BOT structure. The company organizes its finance through processes such as Factoring of purchase bills, issue of Letter of credit & Bank Guarantee along with corporate loan facilities in order to manage its working capital. The flow of capital through various SPV & joint ventures is carried out based on share holding agreements. The project work was mainly concerned with understanding the process of these financing processes and analyzing the finance functions of the company. The prime rationale behind this study was to find the best source of finance for Infrastructure Company and understanding the processes.

18 18

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30 Recent projections from NHAI allocations of projects as done by Deloitte :

BOT

PROJECTS

COMPLETED

27%

TO BE AWARDED 56% WORK IN PROGRESS 17%

Working Capital Borrowing: The borrowing working capital for capital-intensive infrastructure requires:

v v v v v v

Projections/Financials of 4 to 5 years. Credit Monitoring Assessment (CMA). NFB limit justification. Order Book. Debt Position. Bank security First charge in the current asset. Second charge on all Fixed Assets. PGSB (personal guarantee security bow). v Drawing Power statement.

19 19

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

OBJECTIVE

The infrastructure industry being a capital-intensive sector requires large amount of funding arrangements for its working capital. The fund based and non-fund based sources of finance are analyzed for the C&C Constructions ltd. The non-fund based sources such as letter of credit, bank guarantee, factoring of purchase bills, corporate loan & hypothecation purchase financing has to be analyzed in relation to processes and suitability of condition for financing working capital. This project work was primarily aimed at analyzing the processes and finance functions being practiced at C&C Constructions Ltd.

The study was carried out for:

v v v v

PURCHASE BILL FACTORING LETTER OF CREDIT. BANK GUARANTEE. HYPOTHECATION FINANCE. v CORPORATE LOAN FACILITY.

20 20

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

METHODOLOGY OF STUDY:

MANAGEMENT OF RECEIVABLES- FACTORING

Trade credit happens when a firm sells its products or services on credit and does not receive cash immediately. It is an essential marketing tool, acting as a bridge for the movement of goods through the production and distribution stages to customers. A firm grants trade credit to protect its sales from the competitors and to attract the potential customers to buy its products at favorable terms. Trade credit creates accounts receivable or trade debtors (also referred as book debts in India) that the firm is expected to collect in near future. The customers from whom receivables or book debts have to be collected in the future are called trade debtors or simply as debtors and represent the firms claim or asset.

A credit sale has three characteristics: v It involves an element of risk that must be carefully analyzed. v It is based on economic value. To the buyer, the economic value in goods or services passes immediately at the time of sale, while the seller expects an equivalent value to be received later on. v It implies futurity i.e. the buyer will make the cash payments for goods or services received by him, in future period. A firms investment in the accounts receivable depends on: v The volume of credit sales v The collection period. Avg. investment in accounts receivable = Daily credit sales Avg. collection period

21 21

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

The volume of credit sales is a function of firms total sales and the percentage of credit sales to total sales. The percentage of credit sales to total sales is mostly influenced by the nature of business and industry norms. The term credit policy is used to refer to combination of three decision variables viz. v Credit standards: the criteria to decide the types of customers to whom goods could be sold on credit. If a firm has slow paying customer, its investment in accounts receivable will increase. The firm will also be exposed to higher risk of default. v Credit terms: it specifies the duration of credit and terms of payment by customers. Investment will be high if customers are allowed extended time period for making payments. v Collection efforts: determines the actual collection period. The lower the collection period, the lower will be the investment and vice versa.

Goals of credit policy:

A firms credit policy is aimed at maximizing shareholders wealth through increase in sales leading to net improvement in profitability. Increased sales will not only increase operating profits but will also require additional investment and costs. Hence, a trade-off between incremental returns and cost of incremental investment is involved. Credit management is a specialized activity, and involves a lot of time and effort of a company. Collection of receivable poses a problem, particularly for small-scale enterprises. Banks have the policy of financing receivables. However this support is available for a limited period and the seller of goods and services has to bear the risk of default by debtors. One of the major mechanisms of managing, financing and collecting receivables is FACTORING.

22 22

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

FACTORING:

Factoring is the purchase of accounts receivable by a factoring company at a discount, in order to provide a business with immediate cash to fund its growth. By factoring its receivables, a business owner is no longer forced to wait for customers to pay. It is a widely used financing option used by many companies of all sizes. It may also be defined as financial transaction whereby a business sells its accounts receivable (i.e. invoices) to a third party (called a factor) at a discount in exchange for immediate money with which to finance continued business.

Nature of factoring:

Factoring is a unique financial innovation. It is both a financial as well as management support to clients. It is a method of converting a non-productive, inactive asset (i.e. receivables) into a productive asset (viz. cash) by selling receivables to a company that specializes in their collection and administration. The agreement between the supplier and the factor specifies the factoring procedure. Usually the firm sends the customer orders to the factor for evaluating the customers creditworthiness and approval. Once the factor is satisfied about the customers creditworthiness and agrees to buy the receivables, the firm dispatches goods to the customer. The customer will be informed that his account has been sold to the factor. To perform his function of credit evaluation and collection of large number of clients, a factor may maintain a credit department with specialized staff. Once the factor has purchased a firms receivables and if he agrees to own them, he will have to provide protection against any bad-debt losses to the firm. Factoring and Short Term Financing: Although factoring provides short term financial accommodation to the client, it differs from other types of short term credit in the following manner: v Factoring involves sale of book debts. Thus, the client obtains advance cash against the expected debt collection and does not incur a bad debt. v Factoring provides flexibility as regards credit facility to the client. He can obtain cash either immediately or on due date or from time to time as and when he needs cash. Such flexibility is not available in normal sources of credit.

23

23

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

v Factoring not only provides credit to the clients but also undertakes the total management of clients book debts.

TYPES OF FACTORING

The factoring facilities can broadly be classified as : v v v v Full service Non Recourse (old line). Full service Recourse factoring. Bulk/Agency factoring. Non-notification factoring.

Non-Recourse factoring- in this, the risk of customer repayment is assumed by the factor. Factoring fees are often higher and the client is still responsible for performance related responsibilities relative to the quality of products and or services rendered.

FACTORING

NON RECOURSE RECOURSE BULK/AGENCY

NON NOTIFICATION

Full-Recourse Factoring: In this type of factoring, the factor is protected against customer non-payment. If the customer does not ultimately pay the invoice, the client is responsible for reimbursing to the factor the funds advanced, in addition to fees and intrest. It is less risky from factors point of view. Bulk/Agency Factoring: It is basically used as a method of financing book debts. Under this the client continues to administer credit and operate sales

24

24

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

ledger. The factor finances the book debts against bulk either on recourse or without recourse. Non-Notification Factoring: Under this customer are not informed about the factoring agreement. It involves the factor keeping the account ledger in the name of sales company to which client sells his book debts. FACTORING DISCOUNT RATES AND FEES: Factoring companies charge a discount fee for the cash advances that they provide to their clients. The discount rate compensates factors for the risk inherent in factoring and for the work involved in collecting business outstanding invoices. The discount rate can range between 1% and 5% of face value of all submitted receivables, depending on the type of factoring. CLASSIFICATION OF FACTORING:

FACTORING

RECEIVABLES FACTORING

PURCHASE BILL DISCOUNTING

PURCHASE BILL DISCOUNTING: It is also known as REVERSE FACTORING, OR SUPPLY CHAIN FINANCE . Under this type, the buyer of goods and services issues bills of exchange against the invoices of the suppliers to the factoring organization with definite rate of interest payable for the invoice amount. The rate of interest

25

25

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

depends upon the credit risk of the buying party and varies from one factor to another. Bill factoring facilitates purchase of materials, spares and services.

MECHANISM OF PURCHASE BILL DISCOUNTING: 1) 2) 3) 4) 5) 6) 7) 8) Purchase order sent to the supplier for goods and services. Goods/services received from supplier. Invoices for the purchased goods/services are received from supplier. Purchaser issues bills of exchange for the invoice amount to the factor (bank). Bill of exchange and invoice along with post-dated cheque of bill of exchange amount is sent to the factor. Purchaser makes payment of interest amount and other charges to the factor (upfront payment). Factor/ bank makes payment to supplier. On due date factor/bank presents the cheque in the bank.

FACTORING AT C&C CONSTRUCTIONS LTD.:

Factors: The factoring agencies for discounting of purchase bills at C&C

infrastructure constitute banking sectors with each having their own rate of interest and margin on the invoice amount. Factoring limit refers to the maximum amount for which the firm can issue bills of exchange for discounting. This limit is fixed for a time period of three months for each factor and is regulated after every three months. Factor margin is the amount for which the factors offer discounting for the invoiced amount. SICOM & INDUSIND BANK LTD do not charge any margin. Interest rates are the amount of interest charged by the factor on the discounted amount. This interest is subject to vary depending on bank policies. Handling Charges are the expenses incurred by factor in payment and collection of discounted amount. They are charged to purchaser on defined percentage basis.

26 26

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

List of the factors:

Sr. no: 1. 2. 3. 4.

NAME FACTOR

OF LIMIT (INR CR.) IDBI BANK LTD. 25 SICOM LTD. 60 IFCI FACTORS 18 LTD. INDUSIND 25 BANK LTD.

MARGIN INTEREST HANDLING CHARGES 10% NIL 10% NIL 14.25% 12.5% 13.25% 11.25% 0.1% (MIN. Rs. 1000) NIL 0.2 % NOT DEFINED

NOTE:- Sales bill discounting is done by IFCI FACTORS LTD.

27 27

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

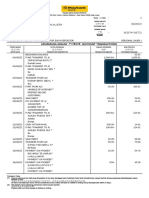

FORMAT OF BILL OF EXCHANGE:

Bill of Exchange Number: IDBI/10-11 BOE date: ------------ BOE Amount: ---------- BOE Due date: -----------

At 90 days from the date of Bill of Exchange, please pay to IDBI Bank Ltd, New Delhi. Or order a sum of Rs 2179206.=00 (RupeesTwenty One Lakhs Seventy Nine Thousand Two Hundred and Six only ) for the value of transportation services supplied against invoice details given below: Invoice No Date Bill Amount Less Deductions Net Payable EXP/2010-11/251A EXP/2009-10/071B EXP/2010-11/200 EXP/2010-11/180 EXP/2010-11/0133A 28-08-2010 02/07/2010 07/07/2010 02/07/2010 27,652 359039 210681 850114 71525 553 97181 4213 17002 1431 TOTAL 27099=00 261858=00 206468=00 833112=00 70094=00 2179206=00

Duly accepted copies of invoices attached. Right for presentment, Protest, Notice of Dishonor waived by all parties concerned. For Sealink Freight &Shipping Pvt Ltd

(Signature of the Drawer) C & C Constructions Gurgaon, Haryana 122001 (DIRECTOR)

28 28

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

APPLICATION FOR PURCHASE BILL DISCOUNTING:

To 25/06/2011 The Assistant General Manager IDBI Bank Limited New Delhi Dear Sir, Purchase bill discounting Facility We refer to your sanction Ref no IDBI/ICG/ New Delhi/42/08-09 dated 22/05/2008, for purchase bill discounting facility of Rs 25 Crores. In this connection we submit the following documents for the goods received/receivable in good condition, from the following suppliers and request you to make direct payment to the suppliers after discounting the same. Detail of Bill amount & net payable is as under. Bill Amount (Net Payable) 5,525,840=00 Due date Post dated Amount 90% cheque no. and date 4,73,256=00 Dated

Name of Supplier

the B.E. No

Mann Gas Station

Incidentally, we do waive our rights to take advantage of any default in presentation for payment of the captioned Bills of Exchange / Hundies or Service of notice of dishonor as required by law. Please debit our CC A\c No- . of the upfront money and issue the Pay Order/DD in favor of the above mentioned party. Yours faithfully For C&C Constructions Limited Director

29 29

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

BANK FINANCE FOR WORKING CAPITAL- L/C, B/G. Banks are the main institutional sources of working capital finance. After trade credit, bank credit is the most important source of financing working capital requirements. A bank considers a firms sales and production plans and desirable level of current assets in determining its working capital requirements. The amount approved by the bank for the firms working capital is called CREDIT LIMIT. Credit limit is the maximum amount of funds, which a firm can obtain from banking systems. LETTER OF CREDIT: It is also known as Documentary credit. It can be defined as an arrangement whereby bank acting at the request and on the instruction of a customer facilitates his purchase of goods. If the customer does not pay to the supplier within the credit period, the bank makes the payment under the L/C arrangement. This arrangement passes the risk of supplier to the bank. Unlike cash credit or overdraft, the L/C is an indirect financing; the bank will make payment to the supplier on behalf of customer only when he fails to meet the obligation. When a buyer wishes to acquire goods or services from a seller, the buyer can request his or her bank to issue a letter of credit. A financing instrument issued by a bank in favor of an exporter that substitute the bank's creditworthiness for that of the importer (also called a documentary credit). A letter of credit is a written document issued by the buyer's (or importer's) bank and addressed to a seller. The person or company that sells or arranges to transport goods out of a country. The letter of credit guarantees payment to the seller through the seller's bank when the seller, through his or her bank, presents certain documents to the buyer's bank. The letter of credit specifies where and what documents the seller must present, the amount of money. A medium of exchange; coined or stamped currency available, and the latest date for presenting the documents. The documents may vary, but their purpose is to assure that the goods have been "sold and are on their way to the buyer.

30 30

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

Parties to the letter of credit: v Applicant: also referred, as account party is normally a buyer or customer of the goods, who has to make the payments to the beneficiary. L/C is issued at his request and on his instruction. v Issuing bank: is the one, which creates a letter of credit and takes the responsibility to make the payments on receipt of documents from the beneficiary. The payment has to be made to the beneficiary within seven working days from the date of receipt of documents. v Beneficiary: is normally the seller of goods, who has to receive the payments from the applicants. A credit is issued in his favor to enable him or his agent to obtain payment on surrender of stipulated documents and comply with the terms & conditions of L/C.

Types Of Letter Of Credit: I. II. Revocable L/C: It may be revoked or modified for any reason, at any time by the issuing bank without notification. It is rarely used in international trade. Ir-Revocable L/C: It is not possible to revoke or amend a credit without the agreement of issuing bank, conforming bank and the beneficiary. It ensures beneficiary that, if the required document are presented and terms are complied with, payment will be made. Confirmed L/C: Under this another bank apart from the issuing bank has added its guarantee. Usance credit L/C: Drafts are drawn on the issuing bank or the correspondent bank at specified Usance period. Back-to-Back L/C: A credit is known as back-to-back when a L/C is opened with security of another L/C. it is used mainly when the ultimate buyer is not ready for a transferable credit.

III. IV. V.

31 31

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

Commercial

Letter

of

Credit

Flow:

Applicant (C&C Constructions Ltd, in this case) approaches Issuing/ Opening Bank (Indusind Bank) with LC application form duly filled and requests Issuing Bank to issue a Letter of Credit in favor of Beneficiary (ABC Ltd.) . 1. Issuing Bank issues a Letter of Credit as per the application submitted by an Applicant and sends it to the Advising Bank, which is located in Beneficiarys country, to formally advise the LC to the beneficiary. 2. Advising Bank advises the LC to the Beneficiary. 3. Once Beneficiary receives the LC and if it suits his/her requirements, he/she prepares the goods and hands over them to the carrier for dispatching to the applicant. 4. He/she then hands over the documents along with the Transport Document as per LC to the Negotiating Bank to be forwarded to the Issuing Bank. 5. Issuing Bank reimburses the Negotiating Bank with the amount of the LC post Negotiating Banks confirmation that they have negotiated the documents in strict conformity of the LC terms. Negotiating Bank makes the payment to the Beneficiary. 6. Simultaneously, the Negotiating Bank forwards the documents to the Issuing Bank to be released to the Applicant to claim the good from the carrier.

32 32

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

7. Applicant reimburses the Issuing Bank for the amount, which it had paid to the Negotiating Bank. 8. Issuing Bank releases all documents along with the titled Transport Documents to the Applicant. Fees & Reimbursements For L/C: The issuing bank charges the applicant fees for opening the letter of credit. The fee charged depends on the credit of the applicant, and primarily comprises of:

A. Opening charges: It comprises of commitment charges and

Usance charges to be charged upfront for the period of L/C. The fee charged by opening bank during the commitment period is referred to as commitment fees. Commitment period is the period from the opening the letter of credit till the last date of negotiation of documents under L/C.

B. Retirement Charges: This would be payable at the time of

retirement of L/C.

DOCUMENTS TO BE PREPARED FOR ISSUE OF L/C: v REQUEST LETTER. v BANK FORMAT. v COPY OF L/C.

33 33

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

BANK GUARANTEE: Introduction A bank guarantee is a written contract given by a bank on the behalf of a customer. By issuing this guarantee, a bank takes responsibility for payment of a sum of money in case, if it is not paid by the customer on whose behalf the guarantee has been issued. In return, a bank gets some commission for issuing the guarantee. Any one can apply for a bank guarantee, if his or her company has obligations towards a third party for which funds need to be blocked in order to guarantee that his or her company fulfills its obligations (for example carrying out certain works, payment of a debt, etc.). In case of any changes or cancellation during the transaction process, a bank guarantee remains valid until the customer dully releases the bank from its liability. In the situations, where a customer fails to pay the money, the bank must pay the amount within three working days. The bank can also refuse this payment, if the claim is found to be unlawful. Benefits of Bank Guarantees: For Governments 1. Increases the rate of private financing for key sectors such as infrastructure. 2. Provides access to capital markets as well as commercial banks. 3. Reduces cost of private financing to affordable levels. 4. Facilitates privatizations and public private partnerships. 5. Reduces government risk exposure by passing commercial risk to the private sector. For Private Sector 1. Reduces risk of private transactions in emerging countries. 2. Mitigates risks that the private sector does not control. 3. Opens new markets. 4. Improves project sustainability.

34 34

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

Legal Requirements Bank guarantee is issued by the authorized dealers under their obligated authorities notified vide FEMA 8/ 2000, 3rd May 2000. Only in case of revocation of guarantee involving US $ 5000 or more need to be reported to Reserve Bank of India (RBI).

Types of Bank Guarantees 1. Direct or Indirect Bank Guarantee: It is issued by the applicant's bank (issuing bank) directly to the guarantee's beneficiary without concerning a correspondent bank. This type of guarantee is less expensive and is also subject to the law of the country in which the guarantee is issued unless otherwise it is mentioned in the guarantee documents. With an indirect guarantee, a second bank is involved, which is basically a representative of the issuing bank in the country to which beneficiary belongs. This involvement of a second bank is done on the demand of the beneficiary. This type of bank guarantee is more time consuming and expensive too. Confirmed Guarantee : It is cross between direct and indirect types of bank guarantee. This type of bank guarantee is issued directly by a bank after which it is send to a foreign bank for confirmations. The foreign banks confirm the original documents and thereby assume the responsibility. Tender Bond: This is also called bid bonds and is normally issued in support of a tender in international trade. It provides the beneficiary with a financial remedy, if the applicant fails to fulfill any of the tender conditions. Performance Bonds: A types of bank guarantee which is used to secure the completion of the contractual responsibilities of delivery of goods and act as security of penalty payment by the Supplier in case of non delivery of goods. Advance Payment Guarantees: This mode of guarantee is used where the applicant calls for the provision of a sum of money at an early stage of the contract and can recover the amount paid in advance, or a part thereof, if the applicant fails to fulfill the agreement. Payment Guarantees: This type of bank guarantee is used to secure the responsibilities to pay goods and services. If the beneficiary has fulfilled his contractual

35

35

2.

3.

4.

5.

6.

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

obligations after delivering the goods or services but the debtor fails to make the payment, then after written declaration the beneficiary can easily obtain his money form the guaranteeing bank. 7. Loan Repayment Guarantees: This type of guarantee is given by a bank to the creditor to pay the amount of loan body and interests in case of nonfulfillment by the borrower. 8. B/L Letter of Indemnity: This is also called a letter of indemnity and is a type of guarantee from the bank making sure that the carrier will not suffer any kind of loss of goods. 9. Rental Guarantee: This is given under a rental contract. Rental guarantee is either limited to rental payments only or includes all payments due under the rental contract including cost of repair on termination of the rental contract. Procedure for Bank Guarantee: To obtain the bank guarantee one need to have a current account in the bank. A bank through its authorized dealers as per notifications mentioned in the FEMA 8/2000 date 3rd May 2000 can issue guarantees. Only in case of revocation of guarantee involving US $ 5000/ or more to be reported to Reserve Bank of India along with the details of the claim received. Bank Guarantees vs. Letters of Credit A bank guarantee is frequently confused with letter of credit (LC), which is similar in many ways but not the same thing. The basic difference between the two is that of the parties involved. In a bank guarantee, three parties are involved; the bank, the person to whom the guarantee is given and the person on whose behalf the bank is giving guarantee. In case of a letter of credit, there are normally four parties involved; issuing bank, advising bank, the applicant (importer) and the beneficiary (exporter). Also, as a bank guarantee only becomes active when the customer fails to pay the necessary amount where as in case of letters of credit, the issuing bank does not wait for the buyer to default, and for the seller to invoke the undertaking.

36 36

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

L/C, B/G AT C&C INFRASTRUCTURE: At C&C Infrastructure the primary forms of bank guarantees being carried out for financing are:

v BID SECURITY- carried out for acquisition of projects through bidding process. Under this the bank provides bid security to the beneficiary in monetary terms. v PERFORMANCE SECURITY- Under this the bank provides guarantee of performance by applicant to the beneficiary. This can extend up to period of five years or as stated in agreement.

v ADVANCE SECURITY- Bank provides guarantee in the form of advance. v FINANCIAL SECURITY- The bank provides financial security for payments due to the beneficiary for the supplied goods & spares.

Under L/C the applicant (purchaser) requests the issuing banker for issue of letter of credit for the concerned amount as made in the purchase order along with terms & conditions regarding Usance period or the period allowed for submission of documents to the advisory bank for claim for payments. This Usance period can extend up to period of one month or as stated in the agreement.

L/C & B/G At C&C Construction: The bankers at C&C Constructions include thirteen bankers, all of them being located in New Delhi. The suppliers prefer L/C from nationalized banks. The company decides on the basis of rate of margin offered by the bank, rate of interest charged and limit of credit sanctioned. These banks provide different credit limits for L/C, B/G & Foreign Bank Guarantee.

37

37

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

The list of bankers to C&C Construction:

Sr. No: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13.

NAME OF THE BANKS STATE BANK OF INDIA, NEW DELHI STATE BANK OF HYDERABAD, DELHI SBOP, NEW DELHI ORIENTAL BANK OF COMMERCE AXIS BANK, NEW DELHI IDBI BANK LTD, NEW DELHI INDUSIND BANK, NEW DELHI ICICI BANK, GURGAON DBS BANK, NEW DELHI ING VYSYA BANK, NEW DELHI BARCLAYS BANK, NEW DELHI STANDARD CHARTERED BANK HSBC, NEW DELHI

38 38

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

Sr. no

Name of bank

B/G margin Domestic Bid NIL NIL NIL NIL NIL NIL NIL 5% Export 5% 10%

B/G commission % 1.79% p.a 1.25% p.a 1.38% p.a 2.50% p.a 0.85%p.a 0.8% p.a payable qtrlyperformance 0.75% p.aPerformance

L/C margin

L/C commission %

1. 2. 3. 4. 5. 6. 7.

SBI SBOH SBOP OBC AXIS BANK IDBI INDUSIND

5% 5% 5% 5% NIL 5% 5%

5% 5% 5% 5% NIL 5% 5%material

2.34% 1.80% 1.80%

0.75%p.a 0.8% p.a qtrly 0.5% p.a

8. 9. 10. 11. 12. 13.

ICICI DBS Ing Vysya Barclays Std. Chartered HSBC

NIL NIL NIL 1% NIL 5%

NIL NIL NIL 1% NIL 5%

0.75% 1% p.a 1% p.a 1.25% p.a 1.50% p.a 1.25% p.a

NIL NIL NIL 1% p.a NIL 5%

0.75% p.a 1.0% p.a 1%- ILC Upfront. 1.25% p.a 1.50% p.a 1.25% p.a

The C&C constructions purchases raw materials such as bitumen, HSD, steel, cement & other spares from its vendors an makes payments through L/C or B/G or factoring. Recently the firm applied for issue of L/C for supply of rock breaker from SANDVIK ASIA LTD. for JAHU SITE.

39 39

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

The request letter for issue of L/C to INDUSIND BANK LTD:

Date: 17.06.2011 The Vice President Indusind Bank Limited, 28, Barakhamba Road,C P New Delhi 110 001 Reg.:- Opening of Letter of Credit Dear Sir, Please find enclosed herewith an application for opening a Letter of Credit of Rs. .. in favor of M/S Sandvik Asia Pvt. Ltd., Mumbai Pune Road, Dapodi, Pune, Maharashtra-411012. Also enclosed are Purchase Order & necessary Stamp Paper. Thanking you, Yours faithfully,

For C&C Constructions Ltd.

DIRECTOR

40 40

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

FORMAT OF LETTER OF GUARANTEE BY C&C ON STAMP PAPER TO M/S SNADVIK ASIA LTD.

To,

The Vice President Indusind Bank Limited, 28, Barakhamba Road. C. P New Delhi 110 001

This stamp paper forms an integral part of Letter of Credit Application & Guarantee, dated 17.06.2011 for .. Favoring M/S Sandvik Asia Pvt. Ltd., Mumbai Pune Road, Dapodi, Pune, Maharashtra-411012.

Place: Gurgaon

41 41

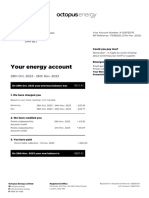

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30 L.C. No. : -----------------------------Date of Issue: ----------

Branch Office: Indusind Bank Limited Dr Gopaldas Bhavan, 28, Barakhamba Road, New Delhi, Tel:011 23738409, Fax: 011 23738041 Applicant : C & C Constructions Limited Plot No. 70, Institutional Sector 32, Gurgaon 122 001, Haryana. Advising Bank / Branch:

The Hongkong and Shanghai Banking Corporation Limited, Amar Avinash Corporate City, S.No. 11, Bund Garden Road, Pune 411001. SWIFT CODE : HSBCINBB

Date of Expiry: 15.09.2011 Last Date of Shipment : 16.08.2011

Beneficiary :

M/S SANDVIK ASIA LIMITED., Dapodi,Mumbai-Pune Road, Pune, India 411012.

Amount in Rs. 9,15,472/- (Rupees Nine Lacs

Fifteen Thousand Four Hundred Seventy Two Only).

Partial Dispatches

Allowed

Transshipment

Allowed

Credit available by negotiation of the beneficiarys drafts drawn on us a/c applicant and marked Drawn under this irrevocable LC for 100% of the invoice at 90 days Usance from the date of dispatch, accompanied by the following documents quoting this credit no.

Shipped From

RAJPURA/HYDERABAD

Shipped To

JAHU/UNA (HIMACHAL PRADESH)

Description of Goods :

1.Spares for Sandvik Rock Breaker for Jahu site as per P.O. No. 17149 Dtd. 13.06.2011 & P.O. No. 16808 Dtd. 31.05.2011 2. Spares for Sandvik Rock Breaker for UNA site as per P.O. No. 16994 Dtd. 07.06.2011

Documents required : 1. Draft for 100 % of invoice value in duplicate. 42 42

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30 2. Signed commercial Invoice in triplicate. 3. Lorry receipts in duplicate.

Additional Conditions: 1. All Documents must mention our L/c Number and date of issue. 2. Document for negotiation should be presented within 30 days from the date of dispatch but Within the validity of LC.. 3. 100% payment by L/C of 90 days Usance period. Interest for 60 days to be borne by Sandvik and for

30 days to be borne by the applicant.

4. Dispatch prior to the date of LC is permitted. We hereby engage with drawers, endorses and /or bonafide holders that draft(s) drawn under and negotiated in conformity with the terms of this credit will be duly honored or presentation and that draft(s) accepted within the terms of this credit will be duly honored at maturity. Except as otherwise expressly stated, this credit is subject to uniform Customs and Practice for Documentary Credits (2007 Revision) International Chamber of Commerce, Publication No. 600.

43 43

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

FD-SWIFT-700 APPLICATION & GUARANTEE FOR ISSUE OF DOCUMENTARY CREDIT

(To be stamped as an agreement; not to be attested)

(Importrs Code No._________________)

INDUSIND BANK LIMITED Dr Gopaldas Bhavan, 28, Barakhamba Road, New Delhi.

20: # 31 C: 23

L/C NO: 1211357 DATE: 17/06/11 PREADVISED ON: PREADV /

PLEASE ESTABLISH BY SWIFT/TELEX/AIRMAIL DOCUMENTARY CREDIT AS PER DETAILS BELOW: 40 TYPE OF L/C [ ] REVOCABLE; [ ] IRREVOCABLE & TRANSFERABLE

31 D#

DATE & PLACE/ COUNTRY OF EXPIRY

DATE: (YYMMDD) 11.09.15 PLACE/ COUNTRY : NEGOTIATING

50 #

NAME & ADDRESS OF THE APPLICANT

M/S C&C CONSTRUCTIONS LIMITED PLOT NO. 70, SECTOR-32, GURGAON-122001.

59 #

NAME & ADDRESS OF THE BENEFICIARY WITH TEL, TLX, & FAX NO.

M/S SANDVIK ASIA LIMITED., Mumbai-Pune Road, Pune, India 411012.

32 B#

CURRENCY & AMOUNT OF CREDIT (IN FIGURES & WORDS) VARIATION IN L/C AMT ADDITIONAL AMTS PERMITTED CREDIT AVAILABLE WITH CREDIT AVAILABLE BY

Rs. 9,15,472/- (Rupees Nine Lacs Fifteen Thousand Four Hundred Seventy Two Only).

39 A, 39 C, 41 A#

+/______ %

ANY BANK

PAYMENT; NEGOTIATION; ACCEPTANCE; DEF PAYMENT

44 44

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

DRAFTS REQUIRED 42 C 42A 42 M 42B DRAWEE MIXED PAYMENT DETAILS DEFERRED PAYMENT DETAILS PARTIAL SHIPMENTS TRANSHIPMENTS SHIPMENT FROM SHIPMENT TO [ ] YES [ ] NO

[ ] AT SIGHT; [ ] _90_DAYS FROM THE DATE OF SHIPMENT

INDUSIND BANK

43P

[ ] PERMITTED

[ ] PROHIBITED

43T 44A 44B

[ ] PERMITTED RAJPURA/HYDERABAD

[ ] PROHIBITED

JAHU/UNA (HIMACHAL PRADESH)

44C

LATEST SHIPMENT DATE: (YY MM DD) SHIPMENT PERIOD

10.08.16

44D 45A

DESCRIPTION OF GOODS: 1.Spares for Sandvik Rock Breaker for Jahu site as per P.O. No. 17149 Dtd. 13.06.2011 & P.O. No. 16808 Dtd. 31.05.2011 2. Spares for Sandvik Rock Breaker for UNA site as per P.O. No. 16994 Dtd. 07.06.2011 INCOTERMS : FOB/C&F/CIF. FOR

46A

DOCUMENTS REQUIRED: [ ] DRAFT FOR _100%_____ OF INVOICE VALUE [ ] COMPLETE SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE TO ORDER OF/ ENDORSED IN FAVOUR OF INDUSIND BANK LTD. A/C. APPLICANT QUOTING OUR L/C NO. & DATE MARKED FREIGHT PRE-PAID/ TO PAY AND NOTIFY APPLICANT AND INDUSIND BANK LIMITED. [ ] AIRWAY BILL SHOWING THE ABOVE GOODS CONSIGNED TO INDUSIND BANK LTD. A/C _______ C&C Constructions Ltd.____________ NOTIFY APPLICANT. [ ] CERTIFICATE OF ORIGIN ISSUED BY __________________________

45 45

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

[ ] INSURANCE POLICIES/ CERTIFICATES IN DUPLICATE COVERING MARINE/ AIR AND WAR RISKS AND ALSO SRCC AND MALICIOUS DAMAGES FOR CIF VALUE GIVE ___________ % OR ____________________________________________________ [ ] INSURANCE POLICIES/ CERTIFICATES IN DUPLICATE COVERING MARINE/ AIR INSURANCE AS PER II CARGO CLAUSE (FPA/WA/ALL RISKS) AND PERILS AS PER INSTITUTE SRCC CLAUSES, WAR RISKS INSTITUTE CLAUSE, COVER FOR CIF FOR CIF VALUE PLUS __________ % [ ] SIGNED COMMERCIAL INVOICES IN _1 ORIGINAL AND 2 DUPLICATE_ COPIES. 47A ADDITIONAL CONDITIONS: IMPORT IS COVERED UNDER NEGATIVE LIST/ NON NEGATIVE LIST. ALL DOCUMENTS MUST MENTION OUR L/C NUMBER. ALL TRANSPORT DOCUMENTS/ INVOICES MUST MENTION IMPORT LICENSE DETAILS. USANCE PERIOD INTEREST FOR 60 DAYS SHALL BE BORNE BY THE BENEFICIARY AND FOR 30 DAYS SHALL BE BORNE BY THE APPLICANT. 71B CHARGES [ ] ALL CHARGES : TO BENEFICIARYS A/C 48 49 # 57a CREDIT TO BE ADVICED TO THE BENEFICIARY THROUGH (BANK) The Hongkong and Shanghai Banking Corporation Limited, Amar Avinash Corporate City, S.No. 11, Bund Garden Road, Pune 411001. SWIFT CODE : HSBCINBB PERIOD OF PRESENTATION CONFIRMATION INSTRUCTION [ ] WITH CONFIRMATION [ ] WITHOUT CONFIRMATION [ ] (SPECIFY) TO APPLICANTS A/C __30___ DAYS FROM THE DATE OF SHIPMENT

IN CONSIDRATION OF YOUR OPENING A LETTER OF CREDIT AS ABOVE, I/WE HEREBY UNDERTAKE TO ACCEPT AND PAY IN DUECOURSE ALL DRAFTS DRAWN WITHIN THE TERMS THEREOF, AND/OR TO TAKE UP AND PAY FOR ALL DOCUMENTS NEGOTIATED THERE UNDER ON PRESENTATION, AND IN DEFAULT TO MY/OUR SO DOING YOU MAY SELL THE GOODS BEFORE OR AFTER ARRIVAL AND I/WE UNDERTAKE TO REIMBURSE YOU FOR ANY SHORTFALL THAT MAY OCCUR AND I/WE HEREBY FURTHER UNDERTAKE FORTHWITH ON DEMAND MADE BY YOU IN WRITING TO DEPOSIT WITH YOU SUCH SUM OR SECURITY OR FURTHER SUM OR SECURITY AS YOU MAY FROM TIME TO TIME SPESIFY AS SECURITY FOR THE DUE FULFILLMENT OF OUR OBLIGATION HEREUNDER AND ANY SECURITY SO DEPOSITED WITH YOU MAY BE SOLD BY YOU ON YOUR GIVING REASONABLE NOTICE OF SALE TO US AND THE SAID SUM OR THE

46 46

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

PROCEEDS OF SALE OF THE SECURITY MAY BE APPROPRIATED BY YOU IN OR TOWARDS SATISFACTION OF OUR SAID OBLIGATION AND ANY LIABILITY OF OURS ARISING OUT OF THE NON-FULFILLMENT THEREOF.

YOU ARE TO HAVE ALIEN ON ALL GOODS, DOCUMENTS AND POLICIES AND PROCEEDS THEREOF FOR ANY OBLIGATION OR LIABILITIES PRESENT OR FUTURE INCURRED BY YOU UNDER OR ARISING OUT OF THIS CREDIT.

I/WE APPROVE OF THE NEGOTIATION OF DRAFTS DRAWN UNDER THIS CREDIT BEING CONFINED TO YOUR BRANCHES.THE RELATIVE SHIPPING DOCUMENTS HAVE TO BE SURRENDERED TO ME/US AGAINST PAYMENT/ACCEPTANCE. IF AT ANY TIME AND FROM TIME TO HEREAFTER AND AT OUR REQUEST YOU ENHANCE THE AMOUNT OF THE LETTER OF CREDIT OR AMEND ANY OF THE TERMS THEREOF (INCLUDING EXTENTION OF THE VALIDITY OF THE CREDIT FOR SHIPMENT AND/OR NEGOTIATION OF DOCUMENTS). THEN NOTWITHSTANDING THE AMOUNT OF THE ENHANCED LETTER OF CREDIT ISSUED BY YOU AND ANY OTHER AMENDMENT EFFECTED THERETO AND OUR LIABILITY WILL BE FOR THE ENTIRE AMOUNT OF THE LETTER OF CREDIT TO BE ENHANCED AND/OR AMENDMENT AT OUR REQUESTED. I/WE HEREBY AGREE AND DECLARE IN THE EVENT OF MY/OUR FAILING TO RETIRE THE BILLS DRAWN UNDER L/C ON DUE DATES IN CASE OF USANCE BILLS WITH IN 10 DAYS FROM THE DATE OF RECEIPT OF DOCUMENTSBY YOU IN CASE OF SITE BILL, YOU SHALL BE AT LIBERTY TO CRYSTALISE THE FOREIGN CURRENCY RUPE LIABILITY THERE UNDER ON THE DUE DATE OR ON THE EXPIRY OF 10 TH DAYS AS THE CASE MAY BE END CONVERT THE SAME TO AFGHANI RUPEE AT THE PREVAILIGN BILL SELLING RATE AT THE CONTRACT RATE WHICHEVER APPLICABLE. I/WE UNDERTAKE TO REIMBURSE TO YOU ON DEMAND THE AFGHANI RUPEE EQUIVALENT SO DETERMIND TOGETHER WITH INTEREST THEREON AT NORMAL RATE FROM THE DATE OF NEGOTIATIONS TO THE DATE CRYSTALLISATION AND THEREAFTER PANEL RATE AS APPLICABLE THERETO. I/WE UNDERTAKE TO BOOK SUCH FORWARD CONTRACT WITH YOU IN AS MUCH AS THE BOOKING OF FORWARD CONTRACTS FROM THE PART OF ARRANGMENT BY YOU UNDER THE L/C. IF I/WE BOOK FORWARD CONTRACT WITH OTHER BANK AGAINS THIS LETTER OF CREDIT,I/WE AM.ARE LIABLE TO PAY TO YOU 1/4 % COMMISSION IN LIEU OF EXCHANGE IN EDITION TO SWAP COST AND INTEREST RATE OF NEGOTIATIONS AT THE FOREIGN CENTER TILL THE DATE OF CREDIT OF PROCEED IN YOUR NOSTRO ACCOUNT. IN CASE I/WE DO NOT BOOK THE FORWARD CONTRACT, I/WE UNDERTAKE TO BUY THE REPLATIVE FOREIGN EXCHANGE IN CONNECTION WITH RETIREMENT OF THE BILLS/ DOCUMENTS ETC., UNDER THE LETTER OF CREDIT FROM YOU AT THE RULING RATE OF EXCHANGE, IN CASE FOREIGN EXCHANGE IN CONNECTION WITH RETIREMENT OF THE BILLS/ DOCUMENTS ETC., IS BOUGHT COMMISSION IN LIEU OF EXCHANGE IN ADDITION TO SWAP COST AND INTEREST FROM THE DATE OF NEGOTIATION AT THE FOREIGN CENTRE TILL THE DATE OF PROCEEDS IN YOUR NOSTRO ACCOUNT. I/WE UNDERTAKE TO SUBMIT APPROPRIATE EVIDENCE OF IMPORT AS PER REGULATIONS UNDER FEMA 1999, AND RELATED EXCHANGE CONTROL REGULATIONS ISSUED BY RESERVE BANK OF INDIA, AS AMENDED FROM TIME TO TIME. NOTWITHSTANDING ANY OF ABOVE MENTIONED TERMS OF CREDIT, I/WE UNDERTAKE TO MAKE GOOD ANY SUCH CHARGES/ EXPENSES INCURRED BY YOU NOT RECOVERABLE/ HONOURED BY THE BENEFICIARY AS PER TERMS OF THIS CREDIT, IN THE COURSE OF ESTABLISHING THIS CREDIT/ NEGOTIATION OF DOCUMENTS UNDER THIS CREDIT AND / OR ANY OTHER RELATED EVENT.

PLACE:

SIGNATURE OF THE APPLICANT

47 47

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

BANK GUARANTEE FOR NHAI:

Date 27.06.2011 IDBI BANK LTD. Main Branch New Delhi

Dear Sir, You are requested to issue Bank Guarantee detailed below:

Name of Beneficiary NATIONAL HIGHWAYS AUTHORITY OF INDIA G-5 & G-6, Sector-10, Dwarka, New Delhi-110075

Amount(INR) ./-

Valid upto 26.01.2012

You are requested to Debit Guarantee Commission from our Account No. . Thanking you, Yours faithfully, For C&C Constructions Ltd.

Director

48 48

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30 BANK GUARANTEE FOR BID SECURITY

1. In consideration of you, National Highways Authority of India, having its office at G-5 & 6, Sector-10, Dwarka, New Delhi-110075, (hereinafter referred to as the "Authority", which expression shall unless it be repugnant to the subject or context thereof include its, successors and assigns) having agreed to receive the Bid of C&C Constructions Ltd. (a Company registered under the Companies Act, 1956) and having its registered office at G-11, Hemkunt Chamber, Nehru Place, New Delhi-110 019, (hereinafter referred to as the Bidder" which expression shall unless it be repugnant to the subject or context thereof include its/their executors administrators, successors and assigns), for Four Laning of Meerut-Bulandshahr section of NH-235 from km 7.469 (design chainage km 7.469) to km 66.482 design chainage km 73.512) in the State of Uttar Pradesh under NHDP Phase IVB through Public Private Partnership PPP) on Design, Build, Finance, Operate and Transfer (DBFOT) Toll Basis Project on DBFOT basis (hereinafter referred to as "the Project") pursuant to the RFP Document dated May, 2011 issued in respect of the Project and other related documents including without limitation the draft concession agreement (hereinafter collectively referred to as "Bidding Documents"), we IDBI Bank Ltd., having our registered office at IDBI Tower, WTC Complex, Cuffe Parade, Mumbai- 400 005 and one of its branches at 4th Floor, Indian Red Cross Society Building,1, Red Cross road, New Delhi- 110001 (hereinafter referred to as the "Bank"), at the request of the Bidder, do hereby in terms of Clause 2.1.7 read with Clause 2.1.8 of the RFP Document, irrevocably, unconditionally and without reservation guarantee the due and faithful fulfillment and compliance of the terms and conditions of the Bidding Documents (including the RFP Document) by the said Bidder and unconditionally and irrevocably undertake to pay forthwith to the Authority an amount of Rs. 5,08,00,000/- (Rupees Five Crores Eight Lakhs Only) (hereinafter referred to as the Guarantee) as our primary obligation without any demur, reservation, recourse, contest or protest and without reference to the Bidder if the Bidder shall fail to fulfill or comply with all or any of the terms and conditions contained in the said Bidding Documents. 2. Any such written demand made by the Authority stating that the Bidder is in default of the due and faithful fulfillment and compliance with the terms and conditions contained in the Bidding Documents shall be final, conclusive and binding on the Bank. 3. We, the Bank, do hereby unconditionally undertake to pay the amounts due and payable under this Guarantee without any demur, reservation, recourse, contest or protest and without any reference to the Bidder or any other person and irrespective of whether the claim of the Authority is disputed by the Bidder or not, merely on the first demand from the Authority stating that the amount claimed is due to the Authority by reason of failure of the Bidder to fulfill and comply with the terms and conditions contained in the Bidding Documents including failure of the said Bidder to keep its Bid open during the Bid validity period as setforth in the said Bidding Documents for any reason whatsoever. Any such demand made on the Bank shall be conclusive as regards amount due and payable by the Bank under this Guarantee. However, our liability under this Guarantee shall be restricted to an amount not exceeding Rs. 5,08,00,000/- (Rupees Five Crores Eight Lakhs Only). 4. This Guarantee shall be irrevocable and remain in full force for a period of 180 (one hundred and eighty) days from the Bid Due Date inclusive of a claim period of 60 (sixty) days i.e. 26th January, 2012 or for such extended period as may be mutually agreed between the Authority and the Bidder, and agreed to by the Bank, and shall continue to be enforceable till all amounts under this Guarantee have been paid, but on or before 26th January, 2012.

49 49

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30 5. We, the Bank, further agree that the Authority shall be the sole judge to decide as to whether the Bidder is in default of due and faithful fulfillment and compliance with the terms and conditions contained in the Bidding Documents including, inter alia, the failure of the Bidder to keep its Bid open during the Bid validity period set forth in the said Bidding Documents, and the decision of the Authority that the Bidder is in default as aforesaid shall be final and binding on us, notwithstanding any differences between the Authority and the Bidder or any dispute pending before any Court, Tribunal, Arbitrator or any other Authority. 6. The Guarantee shall not be affected by any change in the constitution or winding up of the Bidder or the Bank or any absorption, merger or amalgamation of the Bidder or the Bank with any other person. 7. In order to give full effect to this Guarantee, the Authority shall be entitled to treat the Bank as the principal debtor. The Authority shall have the fullest liberty without affecting in any way the liability of the Bank under this Guarantee from time to time to vary any of the terms and conditions contained in the said Bidding Documents or to extend time for submission of the Bids or the Bid validity period or the period for conveying acceptance of Letter of Award by the Bidder or the period for fulfillment and compliance with all or any of the terms and conditions contained in the said Bidding Documents by the said Bidder or to postpone for any time and from time to time any of the powers exercisable by it against the said Bidder and either to enforce or forbear from enforcing any of the terms and conditions contained in the said Bidding Documents or the securities available to the Authority, and the Bank shall not be released from its liability under these presents by any exercise by the Authority of the liberty with reference to the matters aforesaid or by reason of time being given to the said Bidder or any other forbearance, act or omission on the part of the Authority or any indulgence by the Authority to the said Bidder or by any change in the constitution of the Authority or its absorption, merger or amalgamation with any other person or any other matter or thing whatsoever which under the law relating to sureties would but for this provision have the effect of releasing the Bank from its such liability. 8. Any notice by way of request, demand or otherwise hereunder shall be sufficiently given or made if addressed to the Bank and sent by courier or by registered mail to the Bank at the address set forth herein. 9. We undertake to make the payment on receipt of your notice of claim on us addressed to at IDBI BANK LTD., at 4th Floor, Indian Red Cross Society Building,1, Red Cross road, New Delhi- 110001, and delivered at our above branch which shall be deemed to have been duly authorised to receive the said notice of claim. 10. It shall not be necessary for the Authority to proceed against the said Bidder before proceeding against the Bank and the guarantee herein contained shall be enforceable against the Bank, notwithstanding any other security which the Authority may have obtained from the said Bidder or any other person and which shall, at the time when proceedings are taken against the Bank hereunder, be outstanding or unrealised.

11. We, the Bank, further undertake not to revoke this Guarantee during its currency except with the previous express consent of the Authority in writing. 12. The Bank declares that it has power to issue this Guarantee and discharge the obligations contemplated herein, the undersigned is duly authorised and has full power to execute this Guarantee for and on behalf of the Bank.

50 50

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30 13. For the avoidance of doubt, the Banks liability under this Guarantee shall be restricted to Rs. .. The Bank shall be liable to pay the said amount or any part thereof only if the Authority serves a written claim on the Bank in accordance with paragraph 9 hereof, on or before 26th January, 2012.

Signed and Delivered by IDBI BANK LTD., at 4th Floor, Indian Red Cross Society Building,1, Red Cross road, New Delhi- 110001. By the hand of Mr./Ms ., its and authorized official.

(Signature of the Authorized Signatory)

(Official Seal)

51 51

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

Purchase under Hypothecation finance:

HP finance is another mode of financing the equipments for CCL Company. In a HP transaction the loan amount is paid in installments over a fixed period of time. Often to secure a deal a down payment has to be paid by the borrower to the financer apart from hypothecating the equipment financed. The down payment is 10-25 % of the cost of the equipment, which can be a large amount for the company to shell out at once. The asset is legally the property of the CCL. The lender also charges an interest on the amount borrowed and the borrower bears the cost of maintenance. However one of the important advantages of HP finance is that the borrower is allowed to claim the depreciation and finance charges (interest) for tax advantages.

MODE OF CAPEX FINANCING:

P.O. For Equipment Procurement

LC.

Own Fund.

Term Loan.

HP Finance.

Opera_ng Lease.

OPERATING LEASE: It is the contractual arrangement generally for a shorter period of time than the useful economic life of the leased resource, in which the lessor does not transfer all the risks and reward associated with ownership of the resource to the lessee. The lease rentals in an operating lease are considered to be revenue expenditure. Operating lease also normally

52

52

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

includes services related to the leased resource such as insurance, maintenance, operators, and technical advice. It is mainly considered as option when the term usage of machine is for shorter period of time. Leasing has grown by leaps and bounds in the eighties but it is estimated that hardly 1% of the industrial investment in India is covered by the lease finance. The prospects of leasing in India are good due to growing investment needs and scarcity of funds with public financial institutions.

STEPS OF HP FINANCE:

v Searching for available/potential financers. v Negotiation on deal Rate Tenure Terms v After negotiation, formal sanction letter given by the financer. v Documentation of loan: Loan application form Loan agreement Board resolution PGSB (personal guarantee security bow), if so required. Post dated cheques for loan repayment. Margin money cheques to be paid as down payment. v After documentation, financers responsibility is to: Issue D.O (delivery order) to the supplier of the equipment. Make payments to supplier on receipt of original invoices & insurance.

53 53

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

HP finance at C&C constructions: Financing for equipments to be applied in the construction firm is carried out by bankers or NBFC (non banking finance companies). The companies potential financers include a range of firms with each having its own terms and rate of interest. The potential financers of the company include: v v v v v v v Axis bank. ICICI bank HDFC bank Reliance capital ltd. Tata capital ltd. Tata motors finance ltd. Magma fincorp ltd.

Applicable interest rate: Rate of interest ranges from 9.5% to 12%.

Tenure: It ranges from 36 months to 60 months with one month to six-month principle moratorium period.

Terms: Broad terms of agreement are standard & are not negotiable. Terms related to rate, tenure, pre-closure charges (1% to 5%) can be negotiated to fit the companies financial requirement. However this mode of financing is practiced when the equipment cost is of large amount and working capital is inadequate to meet the requirements.

54 54

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

CORPORATE LOAN:

Achieving the goal of corporate finance requires that any corporate investment be financed appropriately. Financing of infrastructure projects at C&C constructions is carried out for star projects i.e. those projects which presently need investment so as to make them profitable in future. Presently these star projects include recently bagged BOT projects at Mohali, Mokama- Munger project, Patna- Bakhtiyarpur project, and Muzaffarpur- sonbarsa project. The ongoing cash cow projects include those of BR-6, BR-8, and BR-9 etc. These corporate loans are broadly of two types:

v Short term corporate loans- are the loans issued for a period of 12 months along with a moratorium period i.e. a period for which EMI is paid irrespective of interest. v Long-term corporate loans- is loans, which can range from a period exceeding 12 months Rate of interest: The rate of interest charged on such loans is determined by rating rationale of the body carrying out the rating process for e.g. in case of C&C construction rating is done by CARE, CRISIL etc. This rating as done by CARE for longterm loans is AAA and for short-term loans is PR-2+. Facilities with this rating have adequate capacity for timely payment of short-term debt obligations and carry higher credit risk. The rate of interest may broadly be classified as:v BASE RATE: The minimum rate of interest that is charged by the bank. For e.g. base rate for SBI is around 9.25%. v PRIME LENDING RATE: It is the average rate of interest charged by the bank. For e.g. L&T Infra PLR is 14.25% spread. Companies past performances, financial data, and ranking mainly determine the spread by external agencies etc. The working capital limits for FUND BASED AND NON FUND BASED units as on march 2011 were 440 crores & 3110 crores respectively. This is

55 55

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

carried out by consortium banking arrangement facility comprising of 13 banks with SBI being the lead bank.

PROCESS OF ISSUE OF CORPORATE LOAN:

v Searching for potential financers. In case of C&C constructions, it includes nationalized banks such as SBI, AXIS, HSBC, and STANDARD CHARTERED etc. or other private finance sources such as L&T infra, fincorp, Tata capital etc. v Formal proposal is made which includes: End use of loan amount. Rate of interest- may range between 11-13% Tenure- either short-term or long-term. Loan security. Financials. v Negotiations- Broad terms of agreement are standard & are not negotiable. Terms related to rate, tenure, pre-closure charges (1% to 5%) can be negotiated to fit the companies financial requirement. v Sanction letter from bank or NBFC.

56 56

WORKING CAPITAL FINANCE FOR INFRASTRUCTURE SECTOR Jul. 30

CONCLUSION