Professional Documents

Culture Documents

NDB Daily Market Update 13.09

Uploaded by

LBTodayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NDB Daily Market Update 13.09

Uploaded by

LBTodayCopyright:

Available Formats

Tel: 0112314170 Website: www.ndbs.

lk

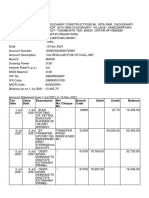

Date: 13 September 2011

Turnover ASPI MPI

Negative sentiment prevails

75,000 60,000 45,000

7,500

Indices

6,000

4,500

30,000

The negative momentum continued to close ASPI in red while MPI closed almost unchanged supported by the price appreciation of John Keells Holdings. Interest was witnessed in penny stocks while the credit clearance requirement triggered force selling to a certain extent. Beverage Food & Tobacco sector was the main contributor to the market turnover (due to Lanka Milk Foods) and the sector index decreased by 0.36%. Lanka Milk Foods was the main contributor to the market turnover with eleven crossings (5,000,000 shares at Rs 105 and 200,000 shares at Rs 107). The share price of Lanka Milk Foods increased by Rs 0.20 (0.18%) and closed at Rs 110. Foreign holding of the company decreased by 3,006,700 shares. Banks, Finance & Insurance sector also contributed significantly to the market turnover and the sector index decreased by 0.43%. Interest was witnessed in penny stocks such as Muller and Phipps (Ceylon), Tess Agro and Free Lanka Holdings. The share price of Muller and Phipps (Ceylon) increased by Rs 0.30 (10%) and closed at Rs 3.40.

3,000

15,000

1,500 6-Jan-09 11-Jun-095-Nov-09 8-Apr-10 8-Sep-10 9-Feb-11 15-Jul-11

Daily Market Update

ASPI MPI Volume (Shares) Turnover (Rs) Foreign Purchases (Rs) Foreign Sales (Rs) PER PBV Positive Contributors John Keells Holdings Ceylinco Insurance Sathosa Motors Negative Contributors Srilanka Telecom Valibell One Dialog Axiata Top Turnover Contributors Lanka Milk Foods Muller and Phipps Tess Agro Free Lanka Holdings Ascot Holdings

Today 6,930.04 6,270.41 297,304,207 3,074,304,436 98,282,650 438,151,563 18.90 2.40 Closed (Rs) 218.50 799.00 379.90 Closed (Rs) 49.70 28.20 8.40 Volume 5,611,340 74,792,700 31,183,000 31,007,200 743,400

Previous Day 6,967.62 6,271.04 191,800,256 2,303,273,066 76,384,090 309,287,656 18.99 2.42 Change (Rs) 3.60 28.00 86.80 Change (Rs) (1.60) (0.80) (0.10) Turnover 590,437,470 276,584,440 170,815,360 134,805,260 130,455,370

Change (%) -0.54% -0.01% 55.01% 33.48% 28.67% 41.66% -0.47% -0.83% Change (%) 1.68 3.86 31.00 Change (%) (3.12) (2.76) 1.18 % 19.21% 9.00% 5.56% 4.38% 4.24%

Turnover Rs Mn.

COMPANY BRIEFING THE BUSINESS

Multi Finance Company (MFL) Acceptance of deposits from the general public, including regular savings accounts / minor savings accounts, granting of lease, hire purchase facilities and other small to medium scale consumer / business loans, mortgage loans & pawning. Mr. A. H. M Riyaz- Counts nearly twenty one years experience in the field of Investment Management. He has also gained training exposure attending several overseas programmes conducted by the Euromoney Training Institute in Singapore and UK. Recorded a profit growth of 334% for the year ended 31 March 2011. Lending portfolio grew by 72% while deposit base expanded by 18%. Non- Performing Loans (NPL) ratio at below 2%, is the lowest in the market this year. Expansion of the branch network in strategically viable geographical regions islandwide. Pawning business will be further strengthened with pawning products and services being extended to all the branches.

Company Distilleries John Keells Holdings

No. of Crossings 2 1

Shares 480,000 100,000

Price (Rs) 175.00 219.50

CHIEF EXECUTIVE

Source: Colombo Stock Exchange Money Market T-Bond % Maturity 15-04-2012 01-02-2013 01-04-2014 15-03-2015 01-08-2016 Excess Liquidity Exchange Rate Rs 27.648 Bn Rs 110.09-110.10 per US $ Source: MVS Money Brokers

THE RESULTS

Bid (Closing) 7.23 7.60 8.08 8.40 8.66 Ask (Closing) 7.30 7.65 8.12 8.48 8.70

THE FUTURE

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Galle HotelDocument3 pagesGalle HotelLBTodayNo ratings yet

- NDB 2012 Budget Proposal HighlightsDocument9 pagesNDB 2012 Budget Proposal HighlightsLBTodayNo ratings yet

- Index Charts October 10thDocument8 pagesIndex Charts October 10thLBTodayNo ratings yet

- Brs-Ipo Document Peoples Leasing Company LimitedDocument13 pagesBrs-Ipo Document Peoples Leasing Company LimitedLBTodayNo ratings yet

- FitchDocument6 pagesFitchLBTodayNo ratings yet

- DNH Sri Lanka Weekly 24 Oct - 28 OctDocument11 pagesDNH Sri Lanka Weekly 24 Oct - 28 OctLBTodayNo ratings yet

- Onsite WTM Industry Report 2011Document60 pagesOnsite WTM Industry Report 2011LBTodayNo ratings yet

- Budget Speech 2012Document74 pagesBudget Speech 2012yusufariffNo ratings yet

- FitchDocument6 pagesFitchLBTodayNo ratings yet

- NDB 2qfy11Document14 pagesNDB 2qfy11LBTodayNo ratings yet

- Capital Alliance PLC The Biggest Where Size MattersDocument31 pagesCapital Alliance PLC The Biggest Where Size MattersLBTodayNo ratings yet

- Capital Trust Research 249 Peoples Leasing Company LTD IpoDocument11 pagesCapital Trust Research 249 Peoples Leasing Company LTD IpoLBTodayNo ratings yet

- Index Charts October 10thDocument8 pagesIndex Charts October 10thLBTodayNo ratings yet

- Peoples Leasing Co. IPODocument18 pagesPeoples Leasing Co. IPOLBTodayNo ratings yet

- Index Charts October 10thDocument8 pagesIndex Charts October 10thLBTodayNo ratings yet

- Focus: Colombo Stock ExchangeDocument24 pagesFocus: Colombo Stock ExchangeLBTodayNo ratings yet

- Sri Lanka Inter Bank Offered Rates-1Document1 pageSri Lanka Inter Bank Offered Rates-1LBTodayNo ratings yet

- CSE 16-2011 - Dialog Axiata PLC - Q3 2011 Financial StatementsDocument13 pagesCSE 16-2011 - Dialog Axiata PLC - Q3 2011 Financial StatementsLBTodayNo ratings yet

- Call & Market 14.10Document2 pagesCall & Market 14.10LBTodayNo ratings yet

- Oil 14.09Document1 pageOil 14.09LBTodayNo ratings yet

- NDB Daily Market Update 27.10.11Document1 pageNDB Daily Market Update 27.10.11LBTodayNo ratings yet

- Call & Market 14.10Document2 pagesCall & Market 14.10LBTodayNo ratings yet

- Asia Wealth 27th Oct '11Document8 pagesAsia Wealth 27th Oct '11LBTodayNo ratings yet

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayNo ratings yet

- DNH Market Watch Daily 27.10.2011Document1 pageDNH Market Watch Daily 27.10.2011LBTodayNo ratings yet

- Sri Lanka Inter Bank Offered Rates-1Document1 pageSri Lanka Inter Bank Offered Rates-1LBTodayNo ratings yet

- Price List 1Document4 pagesPrice List 1LBTodayNo ratings yet

- Daily Exchange Rates-20092011Document1 pageDaily Exchange Rates-20092011LBTodayNo ratings yet

- Index Charts October 10thDocument8 pagesIndex Charts October 10thLBTodayNo ratings yet

- Current T Bill Press Release 25-03-2013Document1 pageCurrent T Bill Press Release 25-03-2013Randora LkNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Dhiraj's Final ReportDocument93 pagesDhiraj's Final Reportraazoo19No ratings yet

- File BRPD Circular No 05Document3 pagesFile BRPD Circular No 05Arifur RahmanNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument12 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit Balancevijay choudharyNo ratings yet

- 03 Interchange Pricing Grids Presentation Feb 2012Document99 pages03 Interchange Pricing Grids Presentation Feb 201288quiznos88100% (1)

- Account ProjectDocument31 pagesAccount ProjectAayush ShNo ratings yet

- 50 Top World Prime Banks: Rank Country Fiscal Year Assets in $billions USDDocument5 pages50 Top World Prime Banks: Rank Country Fiscal Year Assets in $billions USDSumantri On LineNo ratings yet

- November 14,2011 VAT Number:PHV/24002311718 Customer: Eleme Petrochemical Limited Eleme, Port Harcourt Rivers StateDocument2 pagesNovember 14,2011 VAT Number:PHV/24002311718 Customer: Eleme Petrochemical Limited Eleme, Port Harcourt Rivers StateDaku JoelNo ratings yet

- BANK3011 Week 13 Lecture - Full Size SlidesDocument36 pagesBANK3011 Week 13 Lecture - Full Size SlidesJamie ChanNo ratings yet

- SB - Kishore and Tarun PDFDocument1 pageSB - Kishore and Tarun PDFsheetalNo ratings yet

- 11th Commerce Centum MaterialDocument4 pages11th Commerce Centum MaterialMylai Artz KumarrNo ratings yet

- Summer Internship Project Report-FOREXDocument46 pagesSummer Internship Project Report-FOREXJyoti Singh100% (1)

- CPIO contact details for SBI Hyderabad regionDocument252 pagesCPIO contact details for SBI Hyderabad regionVishal YadavNo ratings yet

- 159 310 1 SMDocument14 pages159 310 1 SMKeanu TaufanNo ratings yet

- Tata Motors Limited Issue of Commercial Paper (CP) Letter of OfferDocument2 pagesTata Motors Limited Issue of Commercial Paper (CP) Letter of OfferANAPARTI NaveenNo ratings yet

- SLBCDocument1 pageSLBCyogesh shingareNo ratings yet

- Research Project On ATM SystemDocument8 pagesResearch Project On ATM Systemgenuinespot100% (1)

- Types of Letter of CreditDocument3 pagesTypes of Letter of CreditMd Abusaied AsikNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBalajiNo ratings yet

- Project Financing & Loan SyndicationDocument34 pagesProject Financing & Loan SyndicationMostak AhmedNo ratings yet

- JPMorgan Chase Mortgage Settlement DocumentsDocument291 pagesJPMorgan Chase Mortgage Settlement DocumentsFindLaw100% (1)

- Monetary Policy and It's InstrumentsDocument19 pagesMonetary Policy and It's InstrumentsSagar SunuwarNo ratings yet

- E Banking of Sonali BankDocument37 pagesE Banking of Sonali Bankmd shadab zaman RahatNo ratings yet

- Proforma Invoice To Poland PDFDocument1 pageProforma Invoice To Poland PDFTommy DwijayaNo ratings yet

- Brockman Guitar Company Is in The Business of Manufacturing Top PDFDocument1 pageBrockman Guitar Company Is in The Business of Manufacturing Top PDFAnbu jaromiaNo ratings yet

- Going To The BankDocument6 pagesGoing To The BankFigen ErgürbüzNo ratings yet

- Grameen Bank PDFDocument31 pagesGrameen Bank PDFDodon Yamin100% (2)

- Виписка з банкуDocument1 pageВиписка з банкуЛаріна ТетянаNo ratings yet

- Myanmar Financial Institutions LawDocument70 pagesMyanmar Financial Institutions LawNelson100% (1)

- Official Receipt: Global Indian International SchoolDocument1 pageOfficial Receipt: Global Indian International SchoolBadal BhattacharyaNo ratings yet

- Banks in The PhilippinesDocument17 pagesBanks in The PhilippinesRosel Aubrey RemigioNo ratings yet