Professional Documents

Culture Documents

Risk and Return

Uploaded by

Piyush RathiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk and Return

Uploaded by

Piyush RathiCopyright:

Available Formats

Risk and Return: A look at CAPM

1. Suppose you are an investor that wants to limit your interest rate risk and default risk. Supposing that you want to invest in corporate bonds, which of the possible bonds would be the best to purchase? a. AAA bond with 15 years to maturity. b. BBB perpetual bond. c. BBB bond with 10 years to maturity. d. AAA bond with 10 years to maturity. e. BBB bond with 15 years to maturity. 2. A highly risk-averse investor is considering the addition of an asset to a 10stock portfolio. The two securities under consideration both have an expected return equal to 15 percent. However, the distribution of possible returns associated with Asset A has a standard deviation of 12 percent, while Asset B's standard deviation is 8 percent. Both assets are correlated with the market with r = 0.75. Which asset should the risk-averse investor add to his/her portfolio? a.. Asset A. b. Asset B. c. Both A and B. d. Neither A nor B. e. Cannot tell without more information. 3. The Security Market Line (SML) relates risk to return, for a given set of financial market conditions. If investors conclude that the inflation rate is going to increase, which of the following changes would be most likely to occur? a. The required return on an average stock would increase. b. Beta would increase. c. The slope of the SML would increase. d. The market risk premium would increase. e. None of the indicated changes would be likely to occur. 4. Which of the following statements is most correct? a. When investors require higher rates of return for investments that demonstrate higher variability of returns, this is evidence that is consistent with risk aversion. b. Risk aversion implies that investors will not diversify. c. Risk aversion implies a general dislike for risk, thus, the lower the standard deviation the higher the risk premium. d. In comparing two firms that differ from each other only with respect to risk,

the expected returns on the stock of the firms should be equal. e. All of the above statements are false. 5. Assume CAPM is correct. You are holding a stock, which has a beta of 2.0 and is currently in equilibrium. The required return on the stock is 15 percent, and the expected return on the market is 10 percent. Suddenly due to economic conditions, the expected return on the market increases by 30 percent. If nothing else changes, how much does the expected return on your stock change? a. +20% b. +30% c. +40% d. +50% e. +60% 6. Which of the following is false? a. The definition and measurement of the market portfolio is a controversial topic. b. Several anomalies led people to question the validity of the CAPM. c. The small-firm effect suggests that over the past 70 years, small firms have on average outperformed CAPM estimates. d .CAPM assumes that all investors hold diversified portfolios. e. Fama and French in their 1992 paper conclude that beta is the only measure of risk that is needed to predict future returns. 7. Which of the following is a problem with the CAPM? a. In testing the model we are also testing the reliability of our market proxies and also the market efficiency. b. The model can not describe the higher than predicted returns for small stocks. c. Fama and French found that when size and the MB ratio are included, beta is insignificant. d. All of the above are problems with CAPM. 8 . Beta _______. a. is a measure of firm specific risk. b. is a measure of market risk. c. is a measure of total risk. d. is calculated by regressing the market return on the historical market dividend yield. e. All of the above are true. 9. Firm specific risk is also called _______.

a. Market risk b. Macro risk c. Undiversifiable risk d. Non-Systematic risk e. Unavoidable risk. 10. Which of the following is TRUE? a. A stock with a beta of 3 will always have a higher return than a stock with a beta of 1. b. Testing CAPM must be done after the fact while CAPM measures EXPECTED returns. c. The Beta of a portfolio is the beta of the individual stocks multiplied by the standard deviation of each stock. d. Generally speaking stocks with higher betas tend to have lower total risk. e. all of the above are true. Don't cheat :-) Answers: 1. D 2. B 3. A 4. A 5. C 6. E 7. D 8. B 9. D 10. B

You might also like

- Investment (Index Model)Document29 pagesInvestment (Index Model)Quoc Anh NguyenNo ratings yet

- Risk Types Market PortfoliosDocument18 pagesRisk Types Market PortfoliosRezzan Joy MejiaNo ratings yet

- DocDocument6 pagesDoctai nguyenNo ratings yet

- 재무관리 ch13 퀴즈Document53 pages재무관리 ch13 퀴즈임키No ratings yet

- Investment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)Document17 pagesInvestment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)its_different17No ratings yet

- Chapter 18 - Portfolio Performance EvaluationDocument53 pagesChapter 18 - Portfolio Performance EvaluationMarwa HassanNo ratings yet

- TestDocument47 pagesTestsamcool87No ratings yet

- FIN622 Online Quiz - PdfaDocument531 pagesFIN622 Online Quiz - Pdfazahidwahla1100% (3)

- Chapter 27 The Theory of Active Portfolio ManagementDocument41 pagesChapter 27 The Theory of Active Portfolio ManagementmaryjoybarlisncalinaNo ratings yet

- Review Extra CreditDocument8 pagesReview Extra CreditMichelle de GuzmanNo ratings yet

- 1Document10 pages1Sai Krishna DhulipallaNo ratings yet

- Part - IDocument75 pagesPart - Icpe MaterialNo ratings yet

- Chapter Five Investment PolicyDocument14 pagesChapter Five Investment PolicyfergiemcNo ratings yet

- Results Reporter: Multiple Choice QuizDocument2 pagesResults Reporter: Multiple Choice QuizBinod ThakurNo ratings yet

- Combinepdf PDFDocument65 pagesCombinepdf PDFCam SpaNo ratings yet

- QuizDocument26 pagesQuizDung Le100% (1)

- Optimal Risky Portfolios MCQsDocument62 pagesOptimal Risky Portfolios MCQsJerine TanNo ratings yet

- Sample Questions - Challenge Status - CFPDocument13 pagesSample Questions - Challenge Status - CFPBronil W DabreoNo ratings yet

- Risk and Return: 1. Chapter 11 (Textbook) : 7, 13, 14, 24Document3 pagesRisk and Return: 1. Chapter 11 (Textbook) : 7, 13, 14, 24anon_355962815100% (1)

- Buad 804 Sourced MCQ LQADocument21 pagesBuad 804 Sourced MCQ LQAAbdulrahman Adamu AhmedNo ratings yet

- SAPMDocument6 pagesSAPMShivam PopatNo ratings yet

- FinanceDocument86 pagesFinanceJawed AhmedNo ratings yet

- Answers To End-of-Chapter Questions - Part 2: SolutionDocument2 pagesAnswers To End-of-Chapter Questions - Part 2: Solutionpakhijuli100% (1)

- Investment Planning (Finally Done)Document146 pagesInvestment Planning (Finally Done)api-3814557100% (2)

- Answwr of Quiz 5 (MBA)Document2 pagesAnswwr of Quiz 5 (MBA)Wael_Barakat_3179No ratings yet

- Mutual Fund Question Bank-2Document33 pagesMutual Fund Question Bank-2api-3773732No ratings yet

- Manage Portfolio ReturnsDocument20 pagesManage Portfolio ReturnsHannah Jane Umbay100% (1)

- Coombs Clyde HDocument21 pagesCoombs Clyde HAlinde CostarNo ratings yet

- Bonds Questions ExplainedDocument2 pagesBonds Questions ExplainedHassan Awais100% (1)

- Chap 7 End of Chap SolDocument13 pagesChap 7 End of Chap SolWan Chee100% (1)

- Answer 3Document7 pagesAnswer 3Quân LêNo ratings yet

- Multiple Choice Questions Please Circle The Correct Answer There Is Only One Correct Answer Per QuestionDocument39 pagesMultiple Choice Questions Please Circle The Correct Answer There Is Only One Correct Answer Per Questionquickreader12No ratings yet

- Chapter 2 - Investment AlternativesDocument12 pagesChapter 2 - Investment AlternativesSinpaoNo ratings yet

- Study Questions Risk and ReturnDocument4 pagesStudy Questions Risk and ReturnAlif SultanliNo ratings yet

- Understanding Mutual Funds Through Key ConceptsDocument67 pagesUnderstanding Mutual Funds Through Key ConceptsVirag67% (3)

- ICFAI University MBA Paper 2Document18 pagesICFAI University MBA Paper 2Rihaan ShakeelNo ratings yet

- 0810 FM (Cfa540)Document26 pages0810 FM (Cfa540)CAVIENCRAZY10No ratings yet

- Fin 455 Fall 2017 FinalDocument10 pagesFin 455 Fall 2017 FinaldasfNo ratings yet

- NBFI-Course Outline-2020Document2 pagesNBFI-Course Outline-2020Umair NadeemNo ratings yet

- BOOST UP PDFS - Quantitative Aptitude - SI & CI Problems (Hard Level Part-1)Document23 pagesBOOST UP PDFS - Quantitative Aptitude - SI & CI Problems (Hard Level Part-1)ishky manoharNo ratings yet

- CF McqsDocument44 pagesCF McqsManish GuptaNo ratings yet

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayayaNo ratings yet

- RTPBDocument87 pagesRTPBKr PrajapatNo ratings yet

- Chapter 06 - Test Bank MCQsDocument50 pagesChapter 06 - Test Bank MCQsannie100% (1)

- Chapter 12 Test BankDocument49 pagesChapter 12 Test BankMariA YAGHINo ratings yet

- Chap 007Document40 pagesChap 007ducacapupuNo ratings yet

- 9 CFP Exam5-Afp-2008 Case Studies PDFDocument130 pages9 CFP Exam5-Afp-2008 Case Studies PDFankur892No ratings yet

- Spiral 2 - FPSB CasesDocument66 pagesSpiral 2 - FPSB CasesAditya LohiaNo ratings yet

- Q&aDocument70 pagesQ&apaulosejgNo ratings yet

- Financial Markets and Institutions Test Bank (021 030)Document10 pagesFinancial Markets and Institutions Test Bank (021 030)Thị Ba PhạmNo ratings yet

- FIN 3331 Risk and Return AssignmentDocument2 pagesFIN 3331 Risk and Return AssignmentHelen Joan BuiNo ratings yet

- Chap 019Document36 pagesChap 019skuad_024216No ratings yet

- Understanding Interest RatesDocument8 pagesUnderstanding Interest Ratesc0wboy21No ratings yet

- Testbank - Multinational Business Finance - Chapter 12Document15 pagesTestbank - Multinational Business Finance - Chapter 12Uyen Nhi NguyenNo ratings yet

- QuizDocument12 pagesQuizPiyush RathiNo ratings yet

- Valuation Method ExamsDocument75 pagesValuation Method ExamsRhejean Lozano100% (2)

- FRM Test 16 QsDocument15 pagesFRM Test 16 QsKamal BhatiaNo ratings yet

- Studocudocument 2Document17 pagesStudocudocument 2Kathleen J. GonzalesNo ratings yet

- 8230 Sample Final 1Document8 pages8230 Sample Final 1lilbouyinNo ratings yet

- Finance Applications and Theory 2Nd Edition Cornett Test Bank Full Chapter PDFDocument62 pagesFinance Applications and Theory 2Nd Edition Cornett Test Bank Full Chapter PDFheulwenvalerie7dr100% (11)

- Secondary DataDocument6 pagesSecondary DataPiyush RathiNo ratings yet

- QuizDocument12 pagesQuizPiyush RathiNo ratings yet

- Piyush StraDocument6 pagesPiyush StraPiyush RathiNo ratings yet

- Data Pivot TableDocument5 pagesData Pivot TablePiyush RathiNo ratings yet

- Unit 3 Activity 1-1597187907Document3 pagesUnit 3 Activity 1-1597187907Bryan SaltosNo ratings yet

- Radical Acceptance Guided Meditations by Tara Brach PDFDocument3 pagesRadical Acceptance Guided Meditations by Tara Brach PDFQuzzaq SebaNo ratings yet

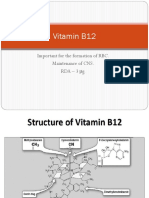

- Vitamin B12: Essential for RBC Formation and CNS MaintenanceDocument19 pagesVitamin B12: Essential for RBC Formation and CNS MaintenanceHari PrasathNo ratings yet

- Economic History Society, Wiley The Economic History ReviewDocument3 pagesEconomic History Society, Wiley The Economic History Reviewbiniyam.assefaNo ratings yet

- What is a Literature ReviewDocument21 pagesWhat is a Literature ReviewJSPNo ratings yet

- Planning Levels and Types for Organizational SuccessDocument20 pagesPlanning Levels and Types for Organizational SuccessLala Ckee100% (1)

- Emotion and Decision Making: FurtherDocument28 pagesEmotion and Decision Making: FurtherUMAMA UZAIR MIRZANo ratings yet

- Essay A Level Drama and Theatee Studies A LevelDocument2 pagesEssay A Level Drama and Theatee Studies A LevelSofia NietoNo ratings yet

- Leibniz Integral Rule - WikipediaDocument70 pagesLeibniz Integral Rule - WikipediaMannu Bhattacharya100% (1)

- Awareness Training On Filipino Sign Language (FSL) PDFDocument3 pagesAwareness Training On Filipino Sign Language (FSL) PDFEmerito PerezNo ratings yet

- Compiler Design Lab ManualDocument24 pagesCompiler Design Lab ManualAbhi Kamate29% (7)

- Portal ScienceDocument5 pagesPortal ScienceiuhalsdjvauhNo ratings yet

- Reducing Healthcare Workers' InjuriesDocument24 pagesReducing Healthcare Workers' InjuriesAnaNo ratings yet

- Bhavartha Ratnakara: ReferencesDocument2 pagesBhavartha Ratnakara: ReferencescrppypolNo ratings yet

- Red ProjectDocument30 pagesRed ProjectApoorva SrivastavaNo ratings yet

- Ganzon Vs CADocument3 pagesGanzon Vs CARaymond RoqueNo ratings yet

- Veerabhadra Swamy MantrasDocument6 pagesVeerabhadra Swamy Mantrasगणेश पराजुलीNo ratings yet

- Chapter 3Document6 pagesChapter 3Nhi Nguyễn Ngọc PhươngNo ratings yet

- Score:: A. Double - Napped Circular ConeDocument3 pagesScore:: A. Double - Napped Circular ConeCarmilleah FreyjahNo ratings yet

- Diversity and InclusionDocument23 pagesDiversity and InclusionJasper Andrew Adjarani80% (5)

- Influence of Contours On ArchitectureDocument68 pagesInfluence of Contours On Architecture蘇蘇No ratings yet

- How To Create A MetacogDocument6 pagesHow To Create A Metacogdocumentos lleserNo ratings yet

- LAWHIST - Week1 - Codamon Lim Tan PDFDocument32 pagesLAWHIST - Week1 - Codamon Lim Tan PDFMargell TanNo ratings yet

- Great Mobile Application Requirement Document: 7 Steps To Write ADocument11 pagesGreat Mobile Application Requirement Document: 7 Steps To Write AgpchariNo ratings yet

- Coek - Info Anesthesia and Analgesia in ReptilesDocument20 pagesCoek - Info Anesthesia and Analgesia in ReptilesVanessa AskjNo ratings yet

- Analyzing Evidence of College Readiness: A Tri-Level Empirical & Conceptual FrameworkDocument66 pagesAnalyzing Evidence of College Readiness: A Tri-Level Empirical & Conceptual FrameworkJinky RegonayNo ratings yet

- North American Indians - A Very Short IntroductionDocument147 pagesNorth American Indians - A Very Short IntroductionsiesmannNo ratings yet

- Downloaded From Uva-Dare, The Institutional Repository of The University of Amsterdam (Uva)Document12 pagesDownloaded From Uva-Dare, The Institutional Repository of The University of Amsterdam (Uva)Iqioo RedefiniNo ratings yet

- Exodus Post Apocalyptic PDF 10Document2 pagesExodus Post Apocalyptic PDF 10RushabhNo ratings yet

- Converting Units of Measure PDFDocument23 pagesConverting Units of Measure PDFM Faisal ChNo ratings yet