Professional Documents

Culture Documents

OPM Response

Uploaded by

Sunlight Foundation0 ratings0% found this document useful (0 votes)

183 views18 pagesOCFO currently maintains two financial management systems. The modemized core accounting system for the administrative fill / ds was deployed on October 1, 2009. In FY 2012, CBIS Phase 2 intended to migrate the Trust Funds to the core financial system.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentOCFO currently maintains two financial management systems. The modemized core accounting system for the administrative fill / ds was deployed on October 1, 2009. In FY 2012, CBIS Phase 2 intended to migrate the Trust Funds to the core financial system.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

183 views18 pagesOPM Response

Uploaded by

Sunlight FoundationOCFO currently maintains two financial management systems. The modemized core accounting system for the administrative fill / ds was deployed on October 1, 2009. In FY 2012, CBIS Phase 2 intended to migrate the Trust Funds to the core financial system.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 18

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

[NOTE: OPM RESPONSE IN ITALICS]

1. Identify and briefly describe each of your agency's business and accounting systems. If

separate divisions, bureaus, or offices of your agency use separate systems, identify which

divisions, bureaus, or offices use each system.

OPM Response: OPM currently maintains two financial management systems: (1) the core

accounting system to manage the administrative filllds and (2) the core tn/st fimd

accounting system to manage our eamed benefit programs. To date, these two systems have

not yet been integrated. The modemized core accounting system for the administrative

fill/ds was deployed on October 1, 2009 as a part of the CBIS Project Phase 1

modemization effort. OCFO has experienced some transition issues. In FY 2012, CBIS

Phase 2 intended to migrate the Trust Funds to the core financial system that was

implemented during Phase I However, the project was placed on OMB's list of investments

requiring attention in December 2010. OPM's CBlS Executive Steering Committee

(comprised of OPM senior executives), in concert with OMB, placed an indefinite hold on

Phase 2. This hold was anticipated due to the challenges in transitioning to a new financial

system. The CFO organization, with the support of Senior Leadership is continuing to

address these challenges (i.e. centered on people, business processes, and data) as a part of

a larger remediation action.

In FY 2011, the CBlS Project team has developed and is executing remediation activities to

ensure a successfitl completion to Phase 1 and is planning activities to improve training to

close business process gaps. As a part of this specific activity, the CBlS Project is validating

roles and responsibilities across the various business processes, re-Iaunching a

comprehensive Change Management and COllllllunications strategy, and establishing

peliorll/ance measures to track progress. In addition to training, the CBlS Project is in the

process of refining testing and defect management strategies. The CBlS Project team is

incorporating stakeholder identified pain points and using this information to prioritize

issue resolution. Our stakeholders will be involved early in all testing efforts to include

peliorming usability and acceptance testing to ensure that business processes operate and

filllction according to our requirements. Lastly, we are formalizing our release management

planning and execution.

Our official response is noted under Sections I.A and I.B below.

J.A - Core Accounting and Business Systems (Administrative Fundsl

OPM's accounting, procurement, and business processes are integrated under CBlS and

assist OPM in managing its administrative processes relative to Salaries and Expense

(S&E) and Revolving Fund (RF) accounts. CBlS is a Commercial off the Shelf (COTS)

solution /Ising Oracle E-Business Suite forfinancialmanagement (which includes Accollnts

IIPage

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

Receivable, Assets, Projects, Accounts Payable, Purchasing, and General Oracle

Hyperionfor budgetformulation and reporting, Compl/Search PRISMfor contract

administration and management, and Oracle's Business Intelligence Enterprise Edition

(OBIEE) for data warehousing and ad-hoc reporting. CBIS is lIsed agency-wide by all

divisions and offices as the core accounting and business management system.

The components of the overall CBIS solution are comprised of a series of modules and

applications that support specific business jimctions and operations. These modules and

applications are listed below.

Oracle Purchasing Module - Manages the requisition and procurement of goods and

services. This includes creating RFQs, requisitions, and purchase orders, reviewing

requisitions against jimds and budgets, approving requisitions via a defined process,

transmitting purchase orders to suppliers via EDI or XML, defining shipment schedule

requirements, and recording supplier acceptance of purchase orders. The module also

includes controls for receiving goods, such as defining receipt and inspection

procedures, implementing routing controls based, recording returns to suppliers,

generating debit memos for returned items, and generating invoices. Finally, the module

transmits accounting transactions to the General Ledger module for encumbering

commitments, obligations, and accming expenditures, and transmits purchase orders

and receipts to the Payables module.

Oracle Federal Administrator Module - Manages some of the cllstom federal

government requirements including maintaining treasulJI symbols (numeric codes which

contain unique accollnting information that identifY: 1) a Federal agency, 2) a period of

availability ofjimds, and 3) afour-digit and generatingfederal

reports (such as the SF-132, FMS-224, FACTS I reports, and FACTS II reports). In

addition, the module establishes and manages budgets including appropriations,

apportionments, allotments, rescissions, warrants, and deferrals.

Oracle General Ledger Module - Manages the general ledger and general journal for

the administrative fimds [i.e. Salaries and Expense (S&E) and Revolving Funds (RF)j,

including capturing and postingfinancial transactions, managing the financial account

hierarchy, controlling spending against the budget, and enabling online inquiries. Also

enables budgeting to compare actual balances with project results and to control actual

and anticipated expenditures.

Oracle Accounts Payables Module - Enables the AlP process, including managing and

tracking suppliers, controlling spending against the budget, entering and approving

invoices, creating accounting entries for Payable transactions, creating payment files

that go to the u.s. Treaswy to generate checkslelectronic transfers, and transferring

accounting entries to the General Ledger module.

Oracle Accounts Receivables Module - Enables the AIR process for the administrative

jilllds (S&E and RF), including managing and tracking customers, entering transactions

21 P age

OPM RESPONSE TO MARCH 8, 2011, INQillRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

such as invoices, commitments, and receipts, generating dunning letters, managing the

billing lifecycle, and transferring entries to the General Ledger module.

Oracle iProcurement Module - Enables OPM employees to initiate and track

requisitions via a web intel/ace. The application loads and displays supplier catalogs.

Employees can then requisition products ji-om the catalog or use pre-defined templates

to order products that are not in a catalog. Employees can allocate costs to olle or more

projects and validate fimds availability in real-time, while iProcurement enforces

purchasing policies and calculates pricing. Once created, the requisition is transferred

to the Purchasing module to go through the approval process, while employees can

track approvals and deliveJY status, change or cancel line items, and acknowledge

receipt of goods in iProcurement.

Oracle PaVl1lents Module - Receives payment requests ji-om the Accounts Payable

module and creates payment files that go to the U.S. TreasUlY to generate checks and

electronic transfers.

PRISM Web Procurement System - Manages the procurement lifecycle, including line-

item enfly, defining delivelY locations and fill/ding sources, lVorliflow for reviews and

approvals, and payment certification. The system also contains extensive document

management capabilities, such as document generation with agency-defined clauses and

rules, document numbering, and uploading of supportilig documentation into an

electronic case file. The system is customized to the business processes and forms of the

federal government, supportingforms and award types prescribed by FARS and

transmitting requisition opportunities to FedBizOpps.

Oracle Business Intelligence Enterprise Edition - An OLAP analysis and reporting

server that contains interactive dashboards, capability for ad hoc queries and analysis,

and alerts for changes to key metrics.

Oracle Proiect Costing Module - Processes expenditures to calculate their true costs by

project and determine the GL accounts to which the costs will be posted. This includes

entering expenditures and importing expenditures ji-om other systems, classifYing the

expenditures by cost types and project, calculating raw and burdened costs, determining

the accounts to post to, and transmitting transactions to Accounts Payable and General

Ledger modules. The system implements controls on these activities to limit the

expenditures that users can charge to specific projects or purchase order agreements,

and to manage spending against budgeted monies. With costs assigned, users are able to

compare both actuals and outstanding cOlllmitments to the original and current budgets.

Oracle Project Billing - Manages billing for projects purchased by cllstomers under

reimbursable agreements. The system allows fimding agreements to be created and

project billing cycles and resource billing rates to be defined. It then accrues revenue

based on a billing algorithm, applies billing controls and limits to prevent billings ji-Olll

exceedingfimding, generates invoices based on defined milestones (costs, events, or

work progress) and transfers them to the Receivables module, and transmits

31Page

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

transactions to the General Ledger module (open receivables, credit memos, etc.). The

project fimding can be monitored throughout the accounting cycle.

I.B - Benefits Financial Management Systems (Trust Funds)

Five prill/my systems and intelfaces support OPM's eal'lled benefit programs:

Federal Financial SYstem - OPM uses version 5.4 ofCGI-AMS' Federal Financial

System (FFS), a commercial ofJ--the-shelffinancial system, as the core of its Benefits

Financial Management Systems. Rather than /Ising all available FFS modules, OPM

IIses only the FFS accollnts receivable and budget execution modules.

FFS has been extended through a cllstom-built, integrated subsystem known as the

Investment Subledger, which is described below.

Financial Management Collection Deposit 2812 Svstem - Employee with holdings and

agency contributions to the Retirement, Health Benefits, and Life Insurance Programs

are due to OPM on the same day the participating employee is paid. Prior to

automation, all employee with holdings and agency contributions were remitted to OPM

on the hard-copy SF 2812 and SF 2812-A - "Report of With holdings and Contributions

for Health Benefits, Life Insurance, and Retirement to OPM " Most of this data is now

captured through the automated Retirement and Insurance Transfer System (R1TS).

Agency payroll providers that are technically unable to remit with holdings and

contributions to OPM via RITS, however, are permitted to remit withholding and

contribution information via the hard copy SF 2812 (and SF 2812-A) directly to OPM or

to OPM's lockbox depositmy. The 2812 system also provides the following

fUllctionality: (1) sorts total withholdings and contributions by account andfimd; (2)

maintains program contingency and administrative reserves though a "Health Benefits

Subledger"; (3) supports premiums payable to community-rated carriers; alld (4)

supports letter-ofcredit accounts for experience-rated carriers.

Retirement and Insurance Transfer System - The vast preponderance of with holdings

and contributions are received via the Retirement and Insurance Transfer System

(R1TS), which was jointly developed by OPM and TreaslllY. FMS partnered with the

Federal Reserve Bank of Richmond to re-engineer and improve the RITS application in

order to electronically transfer the "Report of Withholdings and Contributions for

Health Benefits, Life Insurance and Retirement" (SF2812) and the "Report of

Withholdings and Contributions for Health Benefits by Enrollment Code" (SF2812A)

data ji'OIll Govel'llment payroll providers to OPM RITS accumulates information from

Federal Program Agencies (FPA) about the total amount of with holdings alld related

agency contributions for retirement, health benefits and life insurance. Each user

agency defines one or //lore payrolls, associated pay cycles alld payroll start dates.

From these parameters RITS creates and maintains an automated payroll and reporting

schedule. This schedule gives the FPA and OPM the ability to calculate and track

41 P age

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

obligation due dates and payment timeliness. Agency submissions are monitored on a

regular basis by OPM In the event that a payment is delinquent, OPM staff andlor RITS

will automatically create an estimated report on the agency's behalf Estimated reports

are based on the most recent drawn down payments made by the agency that best

reflects the probable amount of the current obligation. Once an agency generates a

RITS transaction for a delinquent obligation, the RITS application automatically

reverses any estimated payment (these reversals are processed by OPM staff as needed).

On a daily basis, the OPM administrator initiates the process to collect all RITS

transactions due and submitted for payment. This process extracts all Retirement,

Health Benefits, and Life Insurance Program information for transmission to OPMfor

filrtherprocessing. At the same time, RITS generates IPAC transactions to transfer

fill/ds to satisfY the obligations incurred by each report.

FFS Investment Sub ledger - The Investment Sub ledger is a fit/ly integrated subsystem

of the FFS. It was developed for OPM to record trust fillld investments and to generate

related accounting transactions. Each business day, the Investment Subledger extracts

collections and disbursements by fimd fi'om the FFS general ledger. OPM uses this

extracted data to determine the amount of daily investments or redemptions, which is

then entered into the BPD 's FedInvest System.

Annuitv Roll Processing Svstem - The Annuity Roll Processing System (ARPS) is an

umbrella for a number of systems and processes used by OPM to adjudicate benefits for

retired federal employees, their dependents and survivors. ARPS represents the mqjor

inte/face for the Benefits Financial System providing daily and monthly accounting data

regarding annuity expenses and deductions withheld fi"om annuities.

These systems are collectively referred to as the Benefits Financial Management Systems

(BFMS). BFMS is the agency's core Tl1Ist Fund system and is used bystaffunder the

Retirement and Insurance divisions for administering the government-wide earned benefit

programs.

2. Explain how the business and accounting systems identified in response to Request No. 1

interact with one another.

OPM Response: The listing defines holV the financial systems components relate and interact with

one another.

Oracle General Ledger Module-

o Posts transactions fi"om the sub-ledgers (i.e. Oracle Accollnts Payable, Accounts

Receivable, Oracle Projects, Oracle Purchasing) to generate and post GLjournals

against USSGL accounts and helps to manage financial account hierarchy,

controlling spending against the budget, and enables online inquiries.

Oracle Purchasing Module-

SIPage

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

o Oracle Purchasing intelfaces approved Purchase Requisitions data to the PRISM

Web Procurement System. The intelface sends suggested vendO/'S as well as all the

requisition information needed by PRISM to create an Obligation and solicit vendO/'S.

This is a real-time integration.

o Oracle Purchasing receives travel authorization data ji'om the GSA E2 Solutiolls (for

Travel Management) system which establishes the obligations within the jinancial

system upon confirmation of the availability of budget my resources. Thisjile is run

on nightly basis.

Oracle Accounts Payables Module -

o Daily intelface with GSA Central Contractor Reposito/y (CCR) to Oracle Accounts

Payable. The intelface updates vendor data for relevant changes contained in the

CCR daily extract jiles. The intelface supports the data dejinitions (e.g. data types;

jield names; jield lengths) used in CCRfor applicable CEIS vendorjile.

o Oracle Accounts Payable intelfaces vendor data to the PRISM Web Procurement

System. Vendor data updates ji-om the master vendor AP table are sent to update the

PRISM vendor data table. This is a real-time integration.

o Oracle Accollnts Payables receives credit card information ji-om JP Morgan Chase

Payment.Net on a daily basis.

o Oracle Accounts Payable inteifaces and accepts vendor payments ji'om the OPM

Personnel Investigations Processing System (PIPS), which tracks activity related to

casework conducted by OPM's Federal Investigative Services (FIS) division. PIPS

generates a jile daily that contains data for all open cases that had activity for that

day, including information for payments that need to be made to vendors who have

provided services. The data is loaded into Oracle Accounts Payable to generate

invoices. This information is intelfaced daily.

o Oracle Accounts Payable receives travel voucher data ji-om the GSA E2 Solutions

(for Travel Management) system which establishes the travel invoice within the

jinancial system, tying the voucher to the travel obligation established under Oracle

Purchasing. This jile is rUII on nightly basis.

Oracle Payments Module-

o Oracle Payments sends payment requests (inlllultiple payment formats) to us

Department ofTreaswy Secure Payment System, receives conjirmationji-om

Treasury of payments made to vendors.

Oracle Project Task/Costing Module-

o Oracle Project Costing receives customer-billing adjustments for closed investigation

cases ji'om PIPS and sends them to be reflected in CEIS Projects. These adjustments

can either be due to an increase or decrease from the original amount and the

appropriate change is then made to the cllstomer billing invoices. This information is

intelfaced daily.

o Oracle Project Costing extracts Project Agreement and Project Task data ji-Olll the

Projects and sends it to PIPS. The interface extracts all active agreements, and allY

new task that has been created since the last extract was run, which would include

61Page

OPM RESPONSE TO MARCH 8, 2011, INQillRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

any new cases added by the PIPS to Projects interface. The extract file includes both

PIPS specific as well as CBIS specific data elements. This information is intelfaced

daily.

o Oracle Project Costing receives Labor Costs through a nightly intelface which

processes the detail labor cost file that is produced for each pay cycle as part of the

GSA Payroll Accounting and Reporting (PAR) system, which receives information

recorded by OPM employees ill the Electronic Time and Attendance Management

System (ETAMS). Data fi'om this file is loaded into the Projects Transaction Open

Interface Table and then imported into Project Costing to record direct labor costs

for projects defined in the financial system.

Oracle Project Billing-

o Oracle Project Billing receives customer-billing adjustments for closed investigation

casesfi'om OPM PIPS and sends them to be reflected in CBIS Projects. These

adjustments can either be due to an increase or decrease from the original amount

and the appropriate change is then made to the cllstomer billing invoices. This

information is intelfaced daily.

o Oracle Project Billing receives cllstomer billillg alld revenue activity from PIPS,

which tracks activity related to casework conducted by OPM's FIS division. The data

is loaded into eBIS Projects to create or update the CBIS Project stl1lcture and

billing data. This information is illtelfaced daily.

PRISM Web Procurement System -

o The PRISM Web Procurement System exports obligation data /I'om PRISM to Oracle

Purchasing using a web service. It generates document detail at the document line

alld sub-line levels. This is a real-time integration.

Federal Financial System (FFS)-

o FFS sends and receives subsystem data 5 different financial activities. The FFS

subsystems in use at OPM are accounts receivable, budget execution,financial

reporting, general ledger, alld investments subsidimy ledger. The following sections

describe each of these subsystems.

o FFS integrates to custom-built subsystemlalOwn as the Investment which

is described below. TFG posts the investment premium and discount totals to the

general ledger in FFS.

3. For each system identified in response to Request No.1, state whether the information

found in that system is regularly or periodically submitted to any ofthe govermnent-wide

accounting systems maintained by the Department of the Treasury, e.g., GFRS, FACTS I,

FACTS II, IFCS, etc., and explain how and at what intervals those submissions occur,

including descriptions of both manual and automated processes.

OPM Response:

7jPage

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

Oracle Purchasing Module - Data ji-om this system component is not directly (regularly

or periodically) submitted to any of the government-wide accounting systems maintained

by the Department of the Treaslll)'.

Oracle Federal Administrator Module - Data ji-om this system component directly (on

monthly, quarterly, or annual basis) generates federal reports (such as the SF-i32,

FMS-224, FACTS I reports, and FACTS Jl reports) to government-wide accounting

systems maintained by the Department of the Treasury. Data is downloadedji-om the

system into spreadsheets using queries and then govel'llment forms such as the SF-i32,

FMS-224, FACTS I reports, and FACTS Jl reports are manual entered with information

and submitted to the Department ofTreaslllY.

Oracle General Ledger Module - Data ji-om this system component not directly

(regularly or periodically) submitted to any of the government-wide accounting systems

maintained by the Department of the TreaslllY.

Oracle Accounts Pavables Module - Data ji-om this system component not directly

(regularly or periodically) submitted to any of the government-wide accounting systems

maintained by the Department of the TreaslllY.

Oracle Accounts Receivables Module - Data from this system component not directly

(regularly or periodically) submitted to any of the government-wide accounting systems

maintained by the Department of the Treasury.

Oracle iProcurement Module - Data from this system component not directly (regularly

orperiodically) submitted to any of the government-wide accounting systems maintained

by the Department of the Treasury.

Oracle Payments Module - Data fi'om this system component directly (on daily basis)

sends payment requests (ill multiple paymentformats) to US Department ofTreaslllY

Secure Payment System, and receives confirmation ji-om Treaswy of payments made to

vendOl'S.

PRiSM Web Procurement Svstem - Data ji-om this system component not directly

(regularly or periodically) submitted to any of the government-wide accounting systems

maintained by the Department of the TreaslllY.

Oracle Business Intelligence Enterprise Edition - Data ji'om this system component not

directly (regularly orperiodically) submitted to any of the government-wide accounting

systems maintained by the Department of the Treaswy.

Oracle Project Costing Module - Data ji-om this system component not directly

(regularly or periodically) submitted to any of the govel'llment-wide accounting systems

maintained by the Department of the TreasU/)'.

Oracle Project Billing - Data ji-om this system component not directly (regularly or

periodically) submitted to any of the government-wide accounting systems maintained

by the Department of the Treasury.

Federal Financial System - Data ji-om this system component directly (Oil monthly,

quarterly, or annual basis) generates federal reports to govel'lllllent-wide accounting

systems maintained by the Department of the Treasury. Specifically, FFS:

81Page

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

o Sends budgetmy accollnting data required to generate the quarterly Report on

Budget Execution and Budgetmy Resources (SF-133), the Year-End Closing

Statement (FMS-2108) to the Federal Agencies' Centralized Trial-Balance System

(FACTS 11).

o Receives CA$HLINK II data of payments received through OPM's lockbox service

provider, Us. Bank of daily deposits made through FMS-managed collection

mechanisms. These collection mechanisms include the TreaslllY's General Account,

Lockbox, Pay.gov, Credit Card, Paper Check Conversion, and the Fedwire Deposit

System.

o Transfers cases to FedDebt, a system under Us. TreaslllY's Debt Management

Services division in accordance with the requirements of the Debt Collection

Improvement Act of 1996 (DCIA), to refer debts delinquent over to TreaslllY for

cross-servicing. FedDebt is the web-based system used to enter and track each debt

case referred to DMS.

o Receives case status information and accepts debt cases transferred from DMS

back to OPM

o Receives current holdings and balances by account number of Government Account

Series (GAS) securities from Fedlnvest. Users can also receive a list of currently

available GAS securities allowing market-based and par value special issue

secllrities to be purchased in $1,000.00 increments. One day (i.e., overnight)

securities may be purchased in any increment.

o Sends and Receives data ji'om US. Treasury's Financial Management Service

GOALS II applications: (1) Inter-Governmental Payment and Collection - IPAC,

(2) Treasll/y Receivable Accounting and Collection System - TRACS, (2) SF-224,

(3) Federal Centralized Trial-Balance Systems - FACTS I, (4) RFC Agency Link,

(5) Statement of Difference - SOD, and (6) UND.

o Receives data ji'Olll TreaslllY's Payments, Claims, and Enhanced Reconciliation

(PACER) system where OPM attempted to (1) stop payment on a previously issued

check, (2) reclaim erroneously issued EFT payments, (3) view digital check images,

and (4) trace EFT payments.

4. For each system identified in response to Request No, 1, state whether information found in

that system is regularly or periodically submitted to the Office of Management and Budget

occur, including descriptions of both automated and manual processes.

OPM Response: The CBIS Federal Administration 11l0dule maintains the data of the

explanation required ill the Standard Form132, Apportionment and Reapportionment

Schedule to assist in generating the SF-133 Report on Budget Execution and Budgetmy

Resources. The submission to MAX Information Syste11lremains a manual process.

91Page

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

5. For each system identified in response to Request No, I, describe recent, current, and

planned migration or modernization projects.

OPM Response: As indicated in our Response under Question #1, the CBlS Project team

has developed and is executing remediation activities to ensure a successjiil completion to

Phase 1 and is planning activities to improve training to close business process gaps. As a

part of this specific activity, the CBlS Project is validating roles and responsibilities across

the various business processes, relaunching a comprehensive Change Management and

Comlllunications strategy, and establishing pel/ormance measures to track progress. In

addition to training, the CBlS Project is in the process of refining testing and defect

management strategies. The CBlS Project team is incorporating stakeholder identified pain

points and using this information to prioritize issue resolution. Our stakeholders will be

involved early in all testing efforts to include pel/orming usability and acceptance testing to

ensure that business processes operate and jimction according to our requirements. Lastly,

we are formalizing our release management planning and execution.

As a part of our release management planning, OPM is currently evaluating the benefit of

upgrading to Oracle release 12.1 and PRlSMversion 6.5 SP3. Afinaljimctionalupgrade

assessment deliverable was submitted and delivered by the System Integrator on March 4,

2011. Thisjilllctionalupgrade assessment documents the existing CBlS issues to be

addressed by the upgrade, new capabilities provided by the upgrade, the impact of the

upgrade on key areas of CBlS, a recommended upgrade approach, an estimated the level of

effort including a list of deliverables, schedule, and cost pricing, and risks associated with

deferring the upgrade. OPM is currently evaluating the jilllctional upgrade assessment

deliverable and the Executive Steering Committee will determine if the upgrade to CBlS

benefits the end-users and agency business operations.

6. In addition to your agency's submissions to government-wide accounting systems

maintained by the Department ofthe Treasury and OMB, as described in response to

Requests Nos. 3 and 4, does your agency publish any ofthe same information online for

public viewing? If so, describe how and in what format that information is published.

OPM Response: OPM publishes information online for public viewing for the following as

listed below.

OPM provides contract data to be published on 2 segments of USA Spending. go v: the

Federal Procurement Data System - Next Generation (FPDS-NG) and Federal Funding

Accountability and Transparency Act (FFATA). FPDS-NG and FFATA provides data on

contracts and purchases made by the Agency. Information can be accessed by the public

in various formats (i.e. Excel, PDF, etc.).

IOIPagc

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

OPM provides cost, schedule and pelformance data on OPM IT investment projects to

be published on 1 segment ITSpending.gov. Information can be accessed by the public in

variollsformats (i.e. downloads into Excel, etc.).

Financial reporting under the American Reinvestment and RecovelY Act (RecovelY

Act)-OPM received no direct RecovelY Act appropriations but has been reporting to

the web site forfinancial activity where it provides requested assistance to other

agencies who use their identified Recovel)1 Act fund. For OPM, transactional data is

extracted and summarized based upon expenditures, alldlorpayroll costs that are

associated with a reimbursable project task that is beingfilllded with RecovelY Act

monies fi'0/1/ a cllstomer agency.

Annual OPM Consolidated Financial Statements-controls over those statements are

covered by the existing OPM A-123 Appendix A program as well as the annualfinancial

statement audit (published to the OPM public website in PDF format).

7. Identify and briefly describe each system that your agency uses to manage grants, direct

loans, and/or loan guarantees. If separate divisions, bureaus, or offices of your agency use

separate systems, identify which divisions, bureaus, or offices use each system.

OPM Response: OPM does not administer or manage grants, direct loans, and lor loan

guarantees.

8. For each system identified in response to Request No.7, explain how it interacts with any

business or accounting system identified in response to Request No. I.

OPM Response: Please refer to our response to Request No.7. OPM does not administer

or manage grants, direct loans, andlor loan guarantees.

9. For each system identified in response to Request No.7, state whether information found in

that system is regularly or periodically submitted to the Catalogue of Federal Domestic

Assistance (CFDA), and describe how and at what intervals those submissions occur,

including descriptions of both automated and manual processes.

OPM Response: Please refer to our response to Request No.7. OPM does not administer

or manage grants, direct loans, andlol' loan guarantees.

10. For each system identified in response to Request No.7, state whether infonnation found in

that system is regularly or periodically submitted to any of the govemment -wide grants

management and reporting systems, egg., FAADS, FAADS , PLUS, etc., and describe how

and at what intervals those submissions occur, including descriptions of both automated and

manual processes.

lllP age

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

OPM Response: Please refer to our response to Request No.7. OPM does not administer

or manage grants, direct loans, andlor loan guarantees.

11. For each system identified in response to Request No.7, describe recent, current, and

planned migration or modemization projects.

OPM Response: Please refer to our response to Request No.7. OPM does not administer

or manage grants, direct loans, andlor loan guarantees.

12. In addition to your agency's submissions to government-wide grants management and

reporting systems, described in response to Requests Nos. 9 and 10, does your agency

publish any of the same information online for public viewing? If so, describe how and in

what format that infOlmation is published.

OPM Response: Please refer to our response to Request No.7. OPM does not administer

or manage grants, direct loans, alldlor loan guarantees.

13. Identify and briefly describe each system that your agency uses to manage contracts. If

separate divisions, bureaus, or offices of your agency use separate systems, identify which

divisions, bureaus, or offices use each system.

OPM Response:

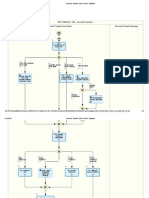

CompuSearch PRISM: PRISM Procurement is a web-based application capable of

fldly supporting the procurement process fi"om requisitioning to closeout. GBIS utilizes

PRISM to create contracts fi"om purchase requisitions while capturing all the relevant

data for internal and external reporting. Please see diagram example of process

between Oracle and PRISM below.

AcqTrack: This is OPM's Acquisition Tracking system which provides:

1. Worliflow capabilities that route documents, track approvals and rejections;

121 P age

OPM RESPONSE TO MARCH 8, 2011, INQillRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

2. Order tracking where customers and PMO Officials can track progress of

acquisitions ji'OIll submittal to award;

3. Management information to allow Contracting Group managers to easily manage

group workload (better customer service) and allows RMOs and PMO Official to

track acquisitions across their organization; and

4. Reports to aid in strategic planning, tracking, and business process improvement.

14. For each system identified response to Request No. 13, explain how it interacts with any

business or accounting system identified in response to Request No.1.

OPM Response: Contract actions are interfilced fro/11 PRISM to the Oracle Purchasing and

Oracle Accounts Payable modules at the transaction level. More specifically:

The PRISM Web Procurement System exports obligation datafi'om PRISM to Oracle

Purchasing lIsing a web service. It generates document detail at the document line and

sub-line levels. This is a real-time integration.

Oracle Purchasing intelfaces data to the PRISM Web Procurement System where

approved Purchase Requisitions are retrieved ji'O/l/ CBIS Oracle Purchasing and sent to

CBIS PRISM using the PRISM Web Service. The interface sends suggested vendors as

well as all the requisition informationlleeded by PRISM to create an Obligation and

solicit vendors. This is a real-time integration.

Oracle Accounts Payable intelfaces vendor data to the PRISM Web Procurement

System. Vendor data updates from the master vendor AP table are sent to update the

PRISM vendor data table. This is a real-time integration.

15. For each system identified in response to Request No. 13, state whether information found

in that system is regularly or periodically submitted to any of the govemment-wide contract

management and reporting systems, e.g., FPDS, FPDS-NG, FAPIIS, etc., and describe how

and at what intervals those submissions occur, including descriptions of both automated and

manual processes.

OPM Response:

CompuSem'ch PRISM: Datafi'om this system component is periodically entered into

the FPDS government-wide contract management and reporting system. The process

used to get data into FPDS is manual. Contracts, task orders, modifications are all

entered manually into FPDS by OPM Contracting Officials after they are jillly awarded

in the PRISM contract administration system. While there is all automated process

available through the PRISM application, it is not currently being used because PRISM

is not configured to produce a unique Procurement Instrument Identifier document

(PIID) number per FAR guidance. OPM is currently reviewing new conftguration

I3IPage

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

recommendations that lVould provide for use of an automated process to inteiface

contract data to FPDS thereby eliminating the current manual entl)1 process .

AcqTr({ck: Datafrom this system component is not regularly or periodically submitted

to any of the government-wide contract management and reporting systems (e.g., FPDS,

FPDS-NG, FAPIIS, etc.).

16. For each system identified in response to Request No. 13, describe recent, current, and

planned migration 01' modemizations projects.

OPM Response: Our procurement solution consists of OPM's AcqTrack and Oracle

Purchasing that closely integrate with CompuSearch 's PRISM Acquisition Solution. OPM

is currently assessing a possible upgrade of the PRISM contract administration software

ji'DlIl the existing version 6.1 to version 6.5 or version 6.5 Service Pack which includes nelV

jililctiollality and enhancements specifically for FPDS-NG.

17. In addition to your agency's submissions to govemment-wide contract management and

reporting systems, described in response to Request No. 15, does your agency publish any of

the same information online for public viewing? If so, describe how and in what format that

information is published.

OPM Response:

ComplISearclt PRISM: Data from this system component is not directly published

(regularly or periodically) online for public viewing. Data ji-om this system component

is periodically entered into the FPDS govel'llment-wide contract management and

reporting system. The process used to get data into FPDS is manual. The

data/information entered into FPDS is then made available to the public through

USASpending.gov.

AcqTrack: Dataji'ol1l this system is not published (regularly orperiodically) online for

public viewing.

18. Briefly describe your agency's efforts to comply with OMB's memorandum one the Open

Govemment Directive - Federal Spending Transparency, dated April 6, 2010. In particular,

describe whether and how your agency has begun to collect and report on sub-award data, as

required by the memorandum; and describe how your agency's reports on OMB's data

quality metrics, as required by the memorandum, are generated.

OPM Response: As recommended in the guidance, OPM is leveraging existing processes

and oversight groups organized pursuant to OMB's Circular No. A-123, Management's

Responsibilitv fOr Internal Control and the statute it implements, the Federal Managers'

Financial Integrity Act of 1982 (FMFIA). OPM's Senior Assessment Boardfor Internal

141 P age

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

Control over Financial Reporting oversees the documentation and testing of controls

relevant to federal spending data quality.

To implement a successfid data quality ji'amewol'k, OPM uses its existing intemal control

program. Specifically, to assess the effectiveness of intemal controls over the quality of

Federal spending data, OPM uses the gove/'llance structure and processes established for

Appendix A of A-i23 on Intemal Control over Financial Reporting. The Appendix A

requirements, which became effective in FY 2006, require evaluation and testing of

financial controls similar to that required in the private sector by the Sarbanes-Oxley Act.

Sarbanes-Oxley was implemented after private sector scandals occurred that went

undiscovered despite annual audits offinancial statements. The Intemal Control program

at OPM has been successfi" in bringing about improvements in the Agency's intemal

control environment through rigorous testing of financial controls. Corrective actions are

required and monitored for all control deficiencies. OPM will extend that program of

evaluation and testing to key controls over the quality ofOPM's spending data.

OPM has defined Federal spending data under the scope of th is plan to include:

Contract spending data reported monthly to USASpending.gov through the Federal

Procurement Data System- Next Generation (FPDS-NG) and Federal Funding

Accountability and Transparency Act (FFATA);

Cost, schedule and peliormance data reported to the IT Dashboard part of

ITSpending.gov;

Financial reporting under the American Reinvestment and RecovelY Act (Recovery

Act}-OPM received no direct RecovelY Act appropriations but has been reporting to

the web site forfinancial activity where it provides requested assistance to other

agencies who use their identified RecovelY Act fimds;

Annual OPM Consolidated Financial Statements-controls over those statements are

covered by the existing OPM A-123 Appendix A program as well as the annual financial

statement audit.

19. If your agency interacts directly with USASpending.gov, in addition to submitting

information to the systems that feed USASpending.gov, describe the nature, frequency, and

purposes ofthat interaction.

OPM Response: While our agency does not interact directly with USASpendinggov, OPM

information and data is submitted to USASpending.gov through other reporting

mechanisms.

15 I P age

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

Datafrom OPM's Oracle Purchasing module is not directly published (regularly or

periodically) onlinefor public viewing. Dataji'om this system is used indirectly to

confirm obligation of jimds through Oracle Purchasing prior to contract award within

the PRISM application. Upon contract award, data is entered manually into the

government-wide FPDS system. Informationji'om this system is then made available to

the public through USASpending.gov. The frequency of the confirmation of obligated

jimds occurs daily into PRISM

Datafrom CompuSearch PRISM is not directly published (regularly orperiodically)

online for public viewing. Contract award data from PRISM is periodically entered into

the FPDS government-wide contract management and reporting system. The process

lIsed to get data into FPDS is manual. The data/information into FPDS is then made

available to the public through USASpending.gov. The frequency of data ently into

FPDS-NG periodic and the purpose is to meet requirements of the Federal Financial

Accountability and Transparency Act (FFATA) guidance.

20. Describe the data quality controls and procedures that your agency has implemented for

information that is submitted to USASpending.gov, including information submitted directly

and information submitted to one of the systems that feed USASpending.gov.

OPM Response: The governing authority for OPM's Internal Control program is its Senior

Assessment Board for Internal Control over Financial Reporting. The Board was originally

instituted in 2005 in preparation for the A-123 Appendix A requirements that went illto

effect beginning in FY 2006. The Board oversees the evaluation and testing of financial

controls which is primarily pelformed by staff in OPM's Policy and Internal Control

organization. The Board meets three or four times each year to, among other things, ensure

the annual assessment is carried out in a thorough, effective, and Iimely manner; approve

the scope of the assessment and the annual evaluation and testing schedule; analyze the

results of testing including internal control deficiencies and recommendations to address

those deficiencies; and approve the overall results of the annual assessment. The Board is

currently co-chaired by the Chief Financial Officer (CFO) and the Internal

Oversight and Compliance. It includes senior executive representatives from all major

OPM organizations, including positions identified in the OMB guidance: the CFO, Senior

Procurement Executive, Chief Human Capital Officer, Chief Information Officer (CIO),

Performance Improvement Officer, Senior Accountable Official over Recovery Act, and the

Senior Accountable Official for the Federal Spending Data Quality Plan.

Chief Financial Officer (CFO), Co-Chair - Stephen Agostini

Director, Office of Internal Oversight and Compliance, Co-Chair - Mark Lambert

Deputy CFO - Dan Marella

Associate CFO for Budget and Pelformance and Pelformance Improvement Officer-

Ed Callicott (Acting)

Associate CFO for Financial Services - vacant

161P age

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

Associate CFO for Financial Systems Management and Senior Accountable Official for

the Federal Spending Data Quality Plan - Rochelle Bayard

Chief Information Officer - Matthew Peny

Senior Executive Representative ji-om the General Counsel- Alan Miller

Senior Executive Representative ji-Olll Employee Services, Chief Human Capital Officer,

and Senior Accountable Official for RecovelY Act Implementation- Nancy Kichak

Senior Executive Representative ji-om Retirement and Benejits - Bill Zielinski

Senior Executive Representative ji-OIn Merit System Audit and Compliance - Jeff

Sumberg

Senior Executive Representative ji-om Federal Investigative Services - Merton Miller

Senior Executive Representative ji-Olll HR Solutions - Kay Ely

Director, Facilities, Security, and Contracting and Senior Procurement Executive- Tina

McGuire

Director, Planning and Policy Analysis - John 0 'Brien

Senior Executive Representative ji-om the OIG - Mike Esser (advisOly and consultative

capacity)

Chief, CFO Policy and Internal Control, Executive Secretmy - Robert Wurster

OPM uses the Board as the primmy mechanism to ensure that data quality over Federal

spending information is properly addressed in accordance with the OMB Framework and

existing data quality standards. The USASpending.gov data and reporting processes will be

added to OPM's list of "assessable units" to test under A-123 Appendix A in FY 2010 under

the Board's guidance.

21. State whether all of your agency's current grants, contracts, and loans accurately reflected on

USASpending.gov, and, if not, estimate the percentage of current grants, contracts, and

loans that are not accurately reflected, using both the number oftransactions and dollar

figures.

22. OPM Respollse: While OPM does not administer or manage grants, direct loans, andlor

loan guarantees, it does manage and administer contracts. However, the data on USA

Spending does not accurately reflect OPM contract information. Please see our estimates of

the percentages of current COli tracts reflected by transaction count and dollarjigures

below.

PRISM USA

Est. % of Dala 011

(OPM Sl!.elldinf:. Difference

Sl!,stellll III (p /'111 ati 011

USASpendillg.gov

Trallsacti01l

4221 1350 2871 32%

COl/lit

171Page

OPM RESPONSE TO MARCH 8, 2011, INQUIRY FROM

COMMITTEE ON OVERSIGHT AND GOVERNMENT REFORM ON

FINANCIAL SYSTEMS MANAGEMENT

MARCH 22, 2011

Transaction Vallie

$ 651 $ 350 $ 301 54%

*

* Vallie are displayed is Millions.

23. State whether your agency incurs any reporting burdens or costs because of its obligations

under the Federal Financial Assistance Transparency Act ("FFATA") that does not incur

because of other reporting obligations, and estimate those burdens and costs in worker-hours

and dollars.

OPM Response: OPM does incur cost burdens because of its obligations under FFATA. As

FFATA changes its requirements or guidance, OPM incurs the additional cost for which it

sometimes canllot adequately plan. These cost burdens are estimated below.

Annual Estimate

Count Avg Labor Rate Est. Total

perhr Hours

Government FTE 0.30 $57.00 40 $2.280.00

Contractor Maintenance Snpport 0.30 $90.00 40 $3,600.00

TOTAL $5,880.00

24. Identify the individual( s) who serve( s) as Senior Accountable Official( s) ("SAO") over

federal spending data quality for your agency, as defined by OMB.

OPM Response: OPM has designated the Associate CFO for Financial Systems

Management as the Senior Accountable Official for Federal Spending Data Quality. The

Senior Accountable Official is afitllmember of the Board and works with the other Board

members to ensure that the Framework requirements are met and that OPM has a strong

process ill place to evaluate, test, and report on the quality of Federal spending data. The

Senior Accountable Official, as well as the CFO and CIO, have fidly reviewed this Plall.

181Page

You might also like

- IQMS Accounting SetupDocument109 pagesIQMS Accounting SetupSmith And YNo ratings yet

- Fica Dispute Case Creation ProcessDocument19 pagesFica Dispute Case Creation ProcessrinkushahNo ratings yet

- Sap Fi Bootcamp Training Case Study For Day5Document30 pagesSap Fi Bootcamp Training Case Study For Day5abdul haseebNo ratings yet

- FundraiserDocument1 pageFundraiserSunlight FoundationNo ratings yet

- Sox Internal Controls ChecklistDocument22 pagesSox Internal Controls Checklisttkannab100% (4)

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Intro To Dynamics AX Modules PDFDocument44 pagesIntro To Dynamics AX Modules PDFAditi Sharma100% (4)

- Data Migration Strategy DocumentDocument18 pagesData Migration Strategy DocumentGurram SrihariNo ratings yet

- Information Systems Auditing: The IS Audit Follow-up ProcessFrom EverandInformation Systems Auditing: The IS Audit Follow-up ProcessRating: 2 out of 5 stars2/5 (1)

- Vat Audit Check ListDocument1 pageVat Audit Check Listmehtayash90No ratings yet

- Accounts Payable (J60) - Process DiagramsDocument16 pagesAccounts Payable (J60) - Process Diagramsgobasha100% (1)

- Sample Audit PlanDocument6 pagesSample Audit PlanHecel Olita100% (2)

- Oracle Project Cost and BLLDocument3 pagesOracle Project Cost and BLLindira selvarajNo ratings yet

- CH 11Document9 pagesCH 11Mendoza Klarise50% (2)

- AP - FI-MM Intigration - Complete DocumentDocument151 pagesAP - FI-MM Intigration - Complete Documentzabiullah1243No ratings yet

- FICA - Contract Accounts Receivable and PayableDocument21 pagesFICA - Contract Accounts Receivable and Payablekush2477No ratings yet

- Project Contracts Overview and DemopptxDocument11 pagesProject Contracts Overview and Demopptxppleasant1No ratings yet

- Oracle Hyperion Financial ManagementDocument45 pagesOracle Hyperion Financial Managementkonda83No ratings yet

- Automating The Financial Process - How You Can BenefitDocument8 pagesAutomating The Financial Process - How You Can BenefitNam Duy VuNo ratings yet

- Manufacturing From Financial PerspectiveDocument17 pagesManufacturing From Financial Perspectivesaqi22No ratings yet

- Supplemental Guide: Module 4: Reporting & TroubleshootingDocument75 pagesSupplemental Guide: Module 4: Reporting & TroubleshootingEdward DubeNo ratings yet

- Shailendra Resume 10Document4 pagesShailendra Resume 10Trainer SAP100% (1)

- R12 - New Features in Financial ModulesDocument8 pagesR12 - New Features in Financial Modulessurinder_singh_69No ratings yet

- ICT and The Hospitality IndustryDocument45 pagesICT and The Hospitality IndustryGeorges OtienoNo ratings yet

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Sarbanes-Oxley Compliance: Using BMC CONTROL-M Solutions For Operations ManagementDocument9 pagesSarbanes-Oxley Compliance: Using BMC CONTROL-M Solutions For Operations ManagementguddupraveenNo ratings yet

- Ifw Process GimDocument24 pagesIfw Process Gimmyownhminbox485No ratings yet

- BTEC HND Unit 5 Management Accounting Assignment 2Document26 pagesBTEC HND Unit 5 Management Accounting Assignment 2Suranga SamaranayakeNo ratings yet

- Module 4 ERP SystemDocument98 pagesModule 4 ERP Systemadnan pashaNo ratings yet

- Cost Accounting Information SystemDocument9 pagesCost Accounting Information SystemFaiz KhanNo ratings yet

- Overview of Oracle Receivables ProcessDocument27 pagesOverview of Oracle Receivables Processkashinath09No ratings yet

- Chapter 8Document6 pagesChapter 8John PaulNo ratings yet

- Oracle Financial Analytics: Key Features and BenefitsDocument5 pagesOracle Financial Analytics: Key Features and Benefitsjbeatofl0% (1)

- AIS Project Plan Document - v1.0Document14 pagesAIS Project Plan Document - v1.0mcheyouwNo ratings yet

- Chapter 1 - Discussion QuestionsDocument7 pagesChapter 1 - Discussion QuestionsKougane SanNo ratings yet

- The Basic Activities in Glars:: U Ëc Invlvc Pingc C C Jrnalc Nric RMC A C IcDocument6 pagesThe Basic Activities in Glars:: U Ëc Invlvc Pingc C C Jrnalc Nric RMC A C IcgatchanessNo ratings yet

- R2R Unit 1Document16 pagesR2R Unit 1Bhavika ChughNo ratings yet

- Introduction To HFMDocument27 pagesIntroduction To HFMSuneetha MarthaNo ratings yet

- Coco Cola 2Document14 pagesCoco Cola 2Bharath ManimaranNo ratings yet

- Set Up and Operate A Computerized Accounting SystemDocument10 pagesSet Up and Operate A Computerized Accounting Systemabebe kumelaNo ratings yet

- Business Process Reengineering: 8.1 OverviewDocument4 pagesBusiness Process Reengineering: 8.1 OverviewBalduino MoreiraNo ratings yet

- Oracle Hyperion Financial ManagementDocument45 pagesOracle Hyperion Financial Managementmalleswar7No ratings yet

- AIS Project Plan Document - v1.0Document15 pagesAIS Project Plan Document - v1.0Candy SpiceNo ratings yet

- Group 3Document22 pagesGroup 3HahahahahahahahahaNo ratings yet

- Oracle Applications R12 - New FeaturesDocument73 pagesOracle Applications R12 - New FeaturesJaswanth KumarNo ratings yet

- Chapter 1Document14 pagesChapter 1syed ehsan aliNo ratings yet

- Oracle DBI For Financials: Daily Business Intelligence - Automating Operational ReportingDocument16 pagesOracle DBI For Financials: Daily Business Intelligence - Automating Operational Reportingmaanee.8No ratings yet

- Acctg20 CH14-16 FinalsDocument4 pagesAcctg20 CH14-16 FinalsAguilan, Alondra JaneNo ratings yet

- Module 5Document26 pagesModule 5Eric CauilanNo ratings yet

- Financial Accounting Hub PDFDocument6 pagesFinancial Accounting Hub PDFvenuoracle9No ratings yet

- Chapter 2 - Business ProcessesDocument4 pagesChapter 2 - Business ProcessesKim VisperasNo ratings yet

- Module 1 Review of The Accounting ProcessDocument14 pagesModule 1 Review of The Accounting ProcessmcanutoNo ratings yet

- Expanding Horizon of Entrepreneurship Through Computerized Accounting FullDocument10 pagesExpanding Horizon of Entrepreneurship Through Computerized Accounting FullVasim AhmadNo ratings yet

- Oracle Fusion Financials Cloud Service: Complete Financial Management SolutionDocument7 pagesOracle Fusion Financials Cloud Service: Complete Financial Management Solutionhergamia9872No ratings yet

- Encumbrance Accounting, Budgetary Accounting and Budgetary ControlDocument33 pagesEncumbrance Accounting, Budgetary Accounting and Budgetary ControlasdfNo ratings yet

- AIS Group 8 Report Chapter 17 Hand-OutDocument8 pagesAIS Group 8 Report Chapter 17 Hand-OutPoy GuintoNo ratings yet

- Accounting Information System For Mia: Employee Multipurpose Cooperative (Mempc)Document24 pagesAccounting Information System For Mia: Employee Multipurpose Cooperative (Mempc)Julius Michael BalingitNo ratings yet

- Record To Report (R2R) Best Practices: Report (R2R) Process Is Used To Collect, Organize, and Analyze Your Company'sDocument11 pagesRecord To Report (R2R) Best Practices: Report (R2R) Process Is Used To Collect, Organize, and Analyze Your Company'sManna MahadiNo ratings yet

- BSBFIM801 Task 2 TemplateDocument29 pagesBSBFIM801 Task 2 TemplateMahwish AmmadNo ratings yet

- The General Ledger SystemDocument3 pagesThe General Ledger Systemfathma azzahroNo ratings yet

- HFM PPT TrainingDocument13 pagesHFM PPT TrainingsourabhNo ratings yet

- Activity05 - Lfca133e022 - Lique GinoDocument4 pagesActivity05 - Lfca133e022 - Lique GinoGino LiqueNo ratings yet

- Accounting Information System ReviewerDocument7 pagesAccounting Information System ReviewerMary Grace CiervoNo ratings yet

- Afa - Unit IV - V - Nov 2021Document54 pagesAfa - Unit IV - V - Nov 2021Gopi KrisnanNo ratings yet

- Oracle Application Solution Document 27.06.22Document12 pagesOracle Application Solution Document 27.06.22Shivagami GuganNo ratings yet

- ch09 Accounting Systems Solution ManualDocument10 pagesch09 Accounting Systems Solution ManualLindsey Clair RoyalNo ratings yet

- Credit and CollectionDocument2 pagesCredit and CollectionDorhea Kristha Guian SantosNo ratings yet

- Project Initiation and Scope: Listing The Bank'S Pain PointsDocument14 pagesProject Initiation and Scope: Listing The Bank'S Pain PointsEhsan AliNo ratings yet

- Oracle Financial Analytics PDFDocument5 pagesOracle Financial Analytics PDFGangadri524No ratings yet

- AR Global Design - AIA - V1Document67 pagesAR Global Design - AIA - V1Extreme TourismNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- LuncheonDocument4 pagesLuncheonSunlight FoundationNo ratings yet

- Luncheon For Republican Governors AssociationDocument2 pagesLuncheon For Republican Governors AssociationSunlight FoundationNo ratings yet

- Information SessionDocument2 pagesInformation SessionSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Private Screening of Jason Bourne For Pete SessionsDocument2 pagesPrivate Screening of Jason Bourne For Pete SessionsSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- Birthday CelebrationDocument3 pagesBirthday CelebrationSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- FundraiserDocument2 pagesFundraiserSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- Reception For John RatcliffeDocument1 pageReception For John RatcliffeSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- ReceptionDocument2 pagesReceptionSunlight FoundationNo ratings yet

- LuncheonDocument2 pagesLuncheonSunlight FoundationNo ratings yet

- How To Resolve Holds Information Sheet: Issued by Central Accounts Payable Helpdesk 11/07/2016Document2 pagesHow To Resolve Holds Information Sheet: Issued by Central Accounts Payable Helpdesk 11/07/2016Keerthivasan BNo ratings yet

- 2TW S4hana2021 BPD en UsDocument33 pages2TW S4hana2021 BPD en Usmazdak mousaviNo ratings yet

- CBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesCBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingMayank Singh Rajawat100% (1)

- Chapter 5 - Accounting For Inventory PPEDocument12 pagesChapter 5 - Accounting For Inventory PPESuzanne SenadreNo ratings yet

- The Delineate On "Mohammad Wahid Abdullah Khan's" Surprising Biographical Report & His Personal Information's Experience (Part - 03)Document12 pagesThe Delineate On "Mohammad Wahid Abdullah Khan's" Surprising Biographical Report & His Personal Information's Experience (Part - 03)Dr.Mohammad Wahid Abdullah KhanNo ratings yet

- Auditing Inventory, Goods and Services, and Accounts Payable - The Acquisition and Payment CycleDocument64 pagesAuditing Inventory, Goods and Services, and Accounts Payable - The Acquisition and Payment CycleAuliya HafizNo ratings yet

- Answer 2Document4 pagesAnswer 2NabeelAhmedNo ratings yet

- Ale Aubrey - Bsma 3 1.exercise123Document28 pagesAle Aubrey - Bsma 3 1.exercise123Astrid XiNo ratings yet

- Audit Testing (Audttheo)Document5 pagesAudit Testing (Audttheo)marieieiem100% (1)

- Session 3Document19 pagesSession 3BikramdevPadhiNo ratings yet

- Using Project CostingDocument134 pagesUsing Project CostingmanitenkasiNo ratings yet

- Case Study On Accounts PayableDocument7 pagesCase Study On Accounts PayableMukeshkumar RajuNo ratings yet

- ACCTG 16 FAR W2 Problems Part 2 PDFDocument6 pagesACCTG 16 FAR W2 Problems Part 2 PDFLabLab ChattoNo ratings yet

- Ebook PDF Using Sage 50 Accounting 2019 by Mary Purbhoo PDFDocument41 pagesEbook PDF Using Sage 50 Accounting 2019 by Mary Purbhoo PDFmarie.simons156100% (36)

- Odoo Erp SolutionDocument53 pagesOdoo Erp SolutionDiana Rosa GonzálezNo ratings yet

- Naufal Faruq - 2106753675 - PBPI - KUIS 01Document1 pageNaufal Faruq - 2106753675 - PBPI - KUIS 01Naufal FaruqNo ratings yet

- Week 13 Exercise With AnswersDocument10 pagesWeek 13 Exercise With Answersmaria fernNo ratings yet

- Basic Business Needs: Multi Org (Multiple Organizations)Document25 pagesBasic Business Needs: Multi Org (Multiple Organizations)Rahul GNo ratings yet

- Chapter 6 EX2Document3 pagesChapter 6 EX2Erika Mie UlatNo ratings yet