Professional Documents

Culture Documents

Jaykumar Thar - Report On Pharma Industry

Uploaded by

jaytharOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jaykumar Thar - Report On Pharma Industry

Uploaded by

jaytharCopyright:

Available Formats

Report on Pharma Industry

Definition:

The pharmaceutical industry produces, and markets drug licensed for use as medications. Pharmaceutical companies are allowed to deal in generic and brand medications and medical devices. The two types of drugs are broadly defined as:A generic drug is a drug defined as "a drug product that is comparable to brand/reference listed drug product in dosage form, strength, route of administration, quality and performance characteristics, and intended use." It has also been defined as a term referring to any drug marketed under its chemical name without advertising. Although they may not be associated with a particular company, generic drugs are subject to the regulations of the governments of countries where they are dispensed. Generic drugs are labeled with the name of the manufacturer and the adopted (non-proprietary) name of the drug. The difference between generic drug and the branded drug is the pricing. Generic drugs are sold at significantly lower prices compared to the branded equivalent. Companies incur fewer costs in creating generic drugs and hence are able to maintain profitability at much lower prices.

Context:

In the 1970s, India had hardly any noticeable activity that could have accounted for being part of a domestic pharmaceutical industry. Multinationals were dominating 85% of the trade, and the country's industrialization wasn't considering fine chemicals as a priority. With the advent of the import-substitution policy and the implementation of the 1970 Patents Act, the country started building chemical know-how and industrial tools that would be instrumental to the real birth of the Indian Pharma sector. Today, the contrast is sharp, to say the least. India is home to more than 20,000 production units, out of which just short of 300 form the real backbone of the industry, accounting for more than 80% of production. The country also has watched a number of local stars go global to become some of the world's best pharmaceutical performers in terms of delivering growth, market penetration, or cost-efficiency. The likes of Cipla (Mumbai), Dr. Reddy's Laboratories (Hyderabad), and Lupin Limited (Mumbai) are indeed carrying the industry forward and aggressively penetrating the world market, displaying a mix of unabated confidence, know-how, and bold moves. Yet, the success of these players should not hide the many challenges faced by the industry, as their number has never been as high as today. The most recent and decisive factor of change was the enactment in 2005 of an amendment to the 1970 Patents Act that, in effect, has made copying drugs patented after 1995 illegal. An industry that had been developing and flourishing based on the production of pharmaceutical copies suddenly found itself in need of redefinition and redirection. After years of being shielded from the global market's realities, the industry has had to adapt fast. At the same time, a number of Indian patents were put at risk, and the cost of post- 1995 patented drugs grew out of reach for many Indians, in a country where there is no real state health insurance, and where most of the population is unable to afford health coverage.

Critical Market Drivers affecting the sector:

The major implication of the amendment of the 1995 Patent Act was that the products of the foreign companies were safeguarded and the Indian companies had to look at other avenues for generating revenue. From an inward-looking industry enjoying the benefits of a cozy intellectual property regime, India has found itself exposed to the rigors of global competition and has succeeded rather convincingly in the exercise. With a total sales value of $5.3 billion, $3.7 billion (70%) is now drawn from exports. Compare this with the less than $600 million the country was bringing in from exports when India joined the World Trade Organization in 1995. In just over a decade, Indian manufacturers have mastered the secrets of global trade so well that the country today accounts for more than 20% of the world's generics production. From the above data obtained, we can conclude that following are the major market drivers of the Indian Pharma industry. Export-driven leaders A group of export driven companies developed an aggressive strategy of generating revenues from US and European markets. They penetrated the global market when the health budgets plummeted in the major economies and have now developed a presence in these markets. API producers turned formulators The major strength of Indian companies was API (Active pharmaceutical ingredient). Some of the group of companies comprising relatively large organization by Indian standards has been trying to emulate the model of the export-driven leaders. With the onset of globalization, most of their local clients in the formulation field targeted the same unpatented molecules and drove down production material prices. In turn, API producers ended up churning out the same active ingredients, and many ultimately decided to pursue export sales and develop their own finished dosage forms. The transition has not been easy. API producers have had to expand services, focus more on customer relationships, and increase their scope of production to strengthen their profiles and come out of this transitional period on top. Contract organizations The advent and fast development of contract research and contract manufacturing organizations (CROs, CMOs) are direct results of India's changing pharmaceutical environment. Drawing on the industry's know-how in fine chemistry, low production costs (as much as 70% cheaper than in some other countries), and scientific talent, these organizations have developed rather quickly during the past decade. Today, they represent potential growth for India's industry and provide much-needed services to the global pharmaceutical sector.

Machinery Makers Although the pharmaceutical machinery makers are relatively small, they are part of an emerging group of the industry. From serving local customers with machines copied through reverse engineering, to locally producing equipment for global clients, the learning curve has been steep. Today, Indian pharmaceutical machinery makers are positioning themselves for even faster growth ahead.

Market Constraints affecting the sector:

Although India has a growing middle class, major population of the country is still poor. The purchasing power of the population is still low. Hence the major expensive drugs find very few takers. Also, lack of government spending in public healthcare results in lack of affordability of even generic drugs. Thus, the market for drugs is still very small. y y y y y India has one of the least developed Pharma markets in Asia. The government policies and drug-pricing control is opaque. Vast disparities in healthcare infrastructure. Movement away from original drug research will lower future margins. Lack of innovation resulting in lack of new drugs in the market.

Industry trends shaping the sector As mentioned earlier, post- 1995 Patent Act, the major players started looking at the European and US markets. They established offices and acquired local players to benefit from approved abbreviated new drug applications (ANDAs), drug master files, sales networks, local brand names and experience. Some of the key points mentioned are: Increasing R&D activities Pharmaceutical industry is knowledge intensive and R&D investment plays a crucial role in the growth of the industry. R&D in pharmaceutical industry include directional search for solutions to existing medical problems and unmet medical requirements. In addition, pharmaceutical R&D may also be aimed at improving the existing solutions to improve the efficiency or safety of medicines. Thus, the pharmaceutical R&D may be concentrated in New Chemical Entities (NCEs), Novel Drug Delivery Systems (NDDS) or in generic products. Historically, research in Indian pharmaceutical firms was concentrated mainly on process engineering of bulk drugs and development of NDDS for formulations. Though research in the area of discovery of NCE has taken place, due to heavy investment required in the clinical trial phase, many companies have either licensed the molecules to players abroad or collaborated with the overseas players to conduct clinical research. However, the post WTO patent regime introduced new challenges for

the Indian pharmaceutical industry. Now the pharmaceutical companies are increasingly becoming innovative rather than imitative. The industry is changing their R&D strategy from reverse engineering to patent driven research. Though the product patent was introduced from 2005, many pharmaceutical companies realized the need of increasing their R&D efforts much earlier. R&D expenditure of the Indian pharmaceutical sector, which was Rs. 50 Crores during 1986-87, has more than doubled (to Rs. 125 crores) by 1993-94. This constituted around 1.8% of sales. In the later years, R&D expenditure of the industry increased further to reach a level of Rs. 1220 crores by the end of 2004-05.This accounts for 5% of total sales of the industry, though few research-based companies are in fact spending more than 10% of their sales on R&D.

Public-Private partnership in R&D Another important feature in the current trend of R&D activities in India is public private partnership. Many Indian companies, besides setting up their own R&D base, are collaborating with the research laboratories such as Central Drug Research Institute (CDRI), Lucknow; Indian Institute of Chemical Technology (IICT), Hyderabad; and Centre for Cellular and Molecular Biology (CCMB), Hyderabad. Leveraging Bio Technology Biotechnology is one of the areas that are showing promising future in the Indian healthcare sector. Biotechnology drugs represent a significant part of the new innovative medicines launched worldwide. Bio-pharmaceuticals account for more than 10% of global pharmaceutical industry and India has emerged as one of the leading biotech players. Bio-pharmaceuticals in

India, comprising vaccines, therapeutics and diagnostics, have recorded over US$ 1.05 billion revenues in 2005-06. Biopharmaceuticals thus account for over 70% of Indian biotech industry. Share of India in global biopharmaceuticals market thus works out to nearly 2%. Many Indian pharmaceutical firms have been leveraging their expertise in biotechnology including manufacture of bio-generics. Inorganic Growth Strategy The global pharmaceutical industry has been undergoing the consolidation mode driven by increasing competition, and pressure on pricing and margins, on the one hand, and desire for geographical diversification and growth in market share, on the other. Indian companies have also adopted the inorganic growth strategy since recent times and have undertaken several mergers and acquisitions (M&A) activities. There are various reasons, which motivate companies to go for M&As or setting up of joint ventures abroad. These include: 1. A company may have strong product portfolio but it may lack access to overseas distribution network. In such cases a firm may acquire a foreign company to have a sound distribution network. Thus, the acquisition helps the acquirer to explore new markets; 2. The reason for acquisition may be firm specific also. Acquisition may take place to gain control over new product, brands, technology and skills. Companies can acquire strong research expertise and boost their capabilities through consolidation; 3. The recent trend in acquisitions also shows an attempt for vertical integration by many firms, which are specializing in generics production to get into API production. This has been driven by sharp erosion of margin in finished dosage products and intense pressure on pricing experienced by generics manufacturing. The below table shows the trend in overseas acquisitions by Indian pharmaceutical firms since 1995. (Annexure - 4 gives a detailed list of acquisitions by Indian Pharmaceutical firms) Though the acquisition trend has started from 1995, Indian firms have started aggressively acquiring foreign firms since the beginning of the decade. The year 2005 witnessed the highest number of overseas acquisitions by Indian pharmaceutical firms. Ranbaxy, one of the largest Indian pharmaceutical firms made 12 acquisitions during this period, in different countries like USA, Germany, UK, Japan, and France. Other firms that have made considerable number of overseas acquisitions include Glenmark and Nicholas Piramal (5 each); Dr. Reddys Laboratories; Sun Pharmaceuticals and Jubilant Organosys (4 each); Strides Arcolab and Matrix Laboratories (3 each); and Wockhardt, Alembic and Aurobindo Pharma (2 each). . The USA and Europe together constitute the biggest pharmaceutical market in the world. In order to remain globally competitive it becomes extremely necessary to have foothold in these markets. Acquisition of Europe and the US based firms has been adopted as a strategy by many Indian firms to enter these markets. Wockhardt was one of the first India based firms to make major pharmaceutical acquisition in UK; It acquired Wallis Laboratory in 1998. Since then Indian pharmaceutical companies have succeeded in acquiring many companies in Europe. For example, out of 12 acquisitions of Ranbaxy during the analysed period, 7 of them are in Europe. In terms of individual countries, USA tops the list with 15 acquisitions followed by UK (8), Belgium (5),Germany (4), China, Japan, South Africa and Spain (3 each).

Ranbaxy which has a strong presence in generics manufacturing acquired unbranded generic business of Allen S.p.A, a division of GlaxoSmithkline (GSK) in Italy, in 2006. As the acquired generic business of GSK complements Ranbaxys product portfolio, it would help the company to penetrate in the European market further. Ranbaxys other recent acquisitions such as Terapia in Romania, Ethimed NV in Belgium are also guided by similar objectives. Such acquisitions give Ranbaxys already existing sound network to explore these markets. Acquisition of Terapia would also give Ranbaxy access to two manufacturing plants and over 150 drugs. Another major Indian pharmaceutical company, Dr. Reddys Laboratories, has also made a number of overseas acquisitions. Its acquisition of German generic drug maker Betapharm Arzeneimittel GmbH in 2006 is considered to be one of the biggest overseas acquisitions by an Indian pharmaceutical company. Betapharm Arzeneimittel GmbH is one of Germanys top generic manufacturers and this acquisition is expected to give Dr. Reddys Laboratories a significant platform for global product development, as also the marketing infrastructure for strengthening its generics business in Europe. Earlier, Dr. Reddys Laboratories had acquired UK -based BMS Laboratories and its wholly owned subsidiary Meridian Healthcare. In 2004, it acquired Roches API Business at the state-of-the- art manufacturing facility in Mexico. This would boost its activitiesin the API segment. Aurobindo pharmaceuticals acquisition of UK based generic company Milpharm helped it to integrate into the formulation business in Europe.

Diversification of Markets India is exporting pharmaceutical products to an increasingly large number of countries. Over the years Indian pharmaceutical companies have been successful in increasing its exports to the traditional export destinations as well as entering into newer destinations. In the beginning of 1990s, Russia was the largest market for Indian pharmaceutical products accounting for 25% of Indias total pharmaceutical exports. However over the years, there has been a decline in Indias pharmaceutical exports to Russia to reach a level of 5% share in Indias total pharmaceutical exports in 2006-07. Nevertheless, Russia is still the third largest destination for pharmaceutical exports from India. Share of exports to the USA has shown gradual increase from 10.8% in 1991-92 to more than 16% by 2006- 07. USA has emerged as the largest export destination for Indian pharmaceutical products. USA, being the largest pharmaceutical market in the world, is obviously a target market for most of the Indian pharmaceutical companies also. Germany is another major export destination for India, accounting for over 5% of Indias total pharmaceutical exports. However it also has experienced decline in its share from 13% in 1991-92. China is a country, which has of late become an important export destination for Indian pharmaceutical products. From a level of 0.1% share in 1991-92 (ranked at 18), Indias export of pharmaceuticals to China has increased to around 2.6% by 2006-07. It is the 6th largest export destination for Indian pharmaceutical products. Another significant trend in Indias pharmaceutical export scenario is diversification in export destinations. In recent years, many new countries have emerged as important export destinations for Indian pharmaceutical companies. These countries include Brazil, South Africa, Turkey and Ukraine. Till 1990s, most of these countries were not target markets for Indian pharmaceutical products. But in the recent years many such countries are being targeted by Indian pharmaceutical industry as potential target markets. Annexure-5 discusses in detail the changing destination of Indias pharmaceutical exports. For many countries in Africa and South Asia, India is one of the principal source countries for pharmaceutical imports. Nepal, Maldives, Bhutan and Sri Lanka in South Asia; Lesotho, Namibia, Guinea, Angola, Burundi, Eritrea, Malawi, Zambia, Swaziland in Africa, source large share of their pharmaceutical import requirements from India. However, in large developed country markets such as USA, UK, Canada and Germany, Indias share is insignificant (less than 1 percent). Thus there is still immense potential for growth as Indias share in the total pharmaceutical import of many of these countries is still very low. These markets provide Indian pharmaceutical companies growth opportunities to expand business. Many Indian companies are experiencing significant growth in their overseas sales and are constantly exploring new markets. Table 25 shows the share of overseas sales in the total earnings of select companies. It may be noted that for most of these companies more than half of their earnings come from overseas operations. USA is the major market for most of the global pharmaceutical companies due to the market size and growth opportunities.

Ranbaxy sells 96 products in the USA approved by the US-FDA. For Divis Laboratories the share of exports in total earnings is as high as 90%. Out of which almost 40% comes from the USA and another 34% from European market. Research based pharmaceutical companies like Glenmark Pharmaceuticals are also experiencing high revenue growth from overseas operations. Africa also shows great potential for Indian pharmaceutical companies. Ranbaxy, the first Indian company to venture into African continent is generating about US$ 100 million every year, which is 7% of the companys global revenue. Different companies focus in different therapeutic segments to enter the global market. Many have strategic motives behind such moves. Wockhardt for example obtained regulatory approvals in the US to sell its diuretic Furosemide injection, which is a widely used drug to remove excess water from body.Focusing on injectables is a strategy on the part of the company as regulatory process for approvals of sterile injectables are complex, which limits the number of competitors.

Sector diversity and key players: India is home to more than 20,000 production units, out of which 300 form the major backbone of the industry, accounting for 80% of the production. Top ten players are:

Top 10 Pharmaceuticals in India, as of 2010 Rank Company 1 2 3 4 5 6 7 8 9 10 Cipla Ranbaxy Revenue 2010 Revenue 2010 (Rs crore) (Rs billion) 4,198.96 4,162.25 41.989 41.622 37.637 24.635 22.155 20.801 17.734 16.13 9.838 9.8044

Dr. Reddy's Laboratories 3,763.72 Sun Pharmaceutical Lupin Ltd Aurobindo Pharma GlaxoSmithKline Cadila Healthcare Aventis Pharma Ipca Laboratories 2,463.59 2,215.52 2,081.19 1,773.41 1,613 983.80 980.44

CIPLA: Cipla Limited is a prominent Indian Pharmaceutical industry, best-known outside its home country for manufacturing low-cost anti-AIDS drugs for HIV-positive patients in developing countries. Founded by Khwaja Abdul Hamied as The Chemical, Industrial & Pharmaceutical Laboratories in 1935, Cipla makes drugs to treat cardiovascular disease, arthritis, diabetes, weight control, depression and many other health conditions, and its products are distributed in more than 180 countries worldwide.

RANBAXY: Ranbaxy Laboratories Limited is an Indian pharmaceutical company. Incorporated in 1961, Ranbaxy exports its products to 125 countries with ground operations in 46 and manufacturing facilities in seven countries. The company went public in 1973 and Japanese pharmaceutical company Daiichi Sankyo gained majority control in 2008. Dr. Reddys Laboratories: Dr. Reddy's Laboratories Ltd. founded in 1984 by Dr. K. Anil Reddy, has become India's second biggest pharmaceutical company. Dr. Anji Reddy had worked in the publicly-owned Indian Drugs and Pharmaceuticals Limited, Hyderabad. Reddy's manufactures and markets a wide range of pharmaceuticals in India and overseas. The company has over 190 medications, 60 active pharmaceutical ingredients for drug manufacture, diagnostic kits, critical care, and biotechnology products.

Evolving strategies and Future Trends:

Strategies such as greater level of R&D activities, patent filings, contract manufacturing, contract research, inorganic growth strategy through acquisitions, co-marketing and co- licensing arrangements have helped the Indian pharmaceutical industry to surge as a global player. However, challenges are also ahead for the Indian pharmaceutical industry with changes in global trends and TRIPS compliant patent regime in India. Strengthening R&D: R&D is crucial for the growth of pharmaceutical industry; thus success of pharmaceutical industry depends more on successful R&D activities. This factor has more relevance for India since new product patent regime has been introduced to comply with TRIPS Agreement. Many Indian pharmaceutical companies have realized the need to enhance their R&D activities well in time and accordingly raised the R&D spending considerably. I though the industry level R&D intensity is well above the average R&D intensity in manufacturing sector (estimated to be 1%), compared to developed countries, such as USA, Germany, it is very low. In USA, pharmaceutical companies spend more than 17% of their sales in R&D activities. In Europe, pharmaceutical R&D accounts for 18% of their total industrial R&D expenditure.

Market penetration: Acquisitions in ldcs: During the last decade, the activities of the Indian pharmaceutical companies have expanded globally. Enhancements of activities have not only been limited to exports but also by way of the industrys presence in manufacturing / marketing activities in various countries. Many Indian pharmaceutical firms have made a number of acquisitions in various countries. More than twothird of these acquisitions have been in the developed country markets of Europe and USA. However, there lies the scope for further penetration in other countries, especially least developed countries. Biopharma convergence: Biopharmaceuticals have witnessed significant growth in recent times. The size of world biopharmaceuticals industry has been estimated at over US$ 60 billion in 2005 with more than 200 drugs being marketed. India is being recognized as one of the important players in the biopharmaceuticals market. Many Indian pharmaceutical firms are going for convergence with biotech industry for development of new drugs. However, it is indeed very important to accelerate the level of convergence and the pace. It may be mentioned that by 2010, more than US$ 10 billion worth of biopharmaceutical products are expected to lose patent protection in developed country markets. More thrust on patent filing: Indian pharmaceutical industry has comparative advantage in R&D due to its high intellectual base and low cost of R&D. However, number of patents filed by and approved for India is lower as compared to many developed as well as developing countries. World Intellectual Property Organisation (WIPO), in its Report on Worldwide Patent Activities (2006) has analysed the patent filings / holdings of various countries with other indicators such as population of the country, GDP, and R&D spending. Such analysis allows for more meaningful cross-country comparisons by weighting the number of patents by different measures of country size and economic activity. Safety and product quality: Menace of spurious drugs. Ensuring safety and quality of the products produced and marketed by the pharmaceutical industry is another major concern. In addition to safety and quality, in the Indian context, the problem of spurious drugs has become a cause of concern. It is alleged that a large percentage of the worlds spurious drugs are produced in India. It is estimated that in the domestic market about 20% of drugs sold are alleged to be spurious. The problem is more acute in remote areas like villages. Traditionally, antibiotics, anti-protozoals, anti-malarial, anti-hormone and steroids were the candidates for faking. Of late, even lifestyle drugs (such as nutritional, anti-diabetes, anti-hypertensives and cancer drugs) are also allegedly produced. Though, spurious drugs may not endanger the life, they can be ineffective in curing the patients.

Pricing strategies: Pricing strategies for launching of pharmaceutical products have never been more of a key issue as it is right now. Globally there is a trend of falling bulk drug prices. According to industry sources, bulk drug prices have been falling over the years due to highly competitive environment. Indian pharmaceutical industry is in the process of developing many potential new pharmaceutical products for world markets. While some of them are in early stages of development, others are well on their way to commercialization. Business wisdom dictates that early assessment of a products concept and its potential to generate acceptable investment returns is crucial when deciding allocation of funds for undertaking R&D activities. Skill development: Pharmaceutical industry is highly R&D intensive. In order to remain globally competitive the industry requires pool of highly skilled man-power. India has already made its mark in scientific research in the world, with large pool of scientific man-power. The education system in India with wide network of universities providing quality science education has helped immensely in this regard.

References: http://search.proquest.com/pqcentral/docview/198239618/13161A7460526266B4F/10?accountid =32277 www.wikipedia.org

www.eximbankindia.com A brief report on Indian Pharmaceutical Industry, 2011 Report.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- AP Physics B 2012 SolutionsDocument10 pagesAP Physics B 2012 SolutionsBilawal Nasir Raja50% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Understanding The Self: Module 1 Contents/ LessonsDocument6 pagesUnderstanding The Self: Module 1 Contents/ LessonsGuki Suzuki100% (6)

- Nutrition Education For The Health Care ProfessionsDocument121 pagesNutrition Education For The Health Care ProfessionsvishwassinghagraNo ratings yet

- Social Interactionist TheoryDocument13 pagesSocial Interactionist TheorySeraphMalikNo ratings yet

- Strategic Human Resource Management PDFDocument251 pagesStrategic Human Resource Management PDFkoshyligo100% (2)

- SOP For Discharge Planning (Nursing)Document2 pagesSOP For Discharge Planning (Nursing)enumula kumar100% (2)

- BSBADM506 Manage Business Document Workbook IBM PDFDocument136 pagesBSBADM506 Manage Business Document Workbook IBM PDFnadeeja meeriyamNo ratings yet

- General Shaping PaperDocument39 pagesGeneral Shaping PaperRuth WellNo ratings yet

- Raj Raturi 2011Document2 pagesRaj Raturi 2011Raj RaturiNo ratings yet

- Writing - Sample EssayDocument4 pagesWriting - Sample EssayHazim HasbullahNo ratings yet

- BSBXTW401 Assessment Task 2 PDFDocument38 pagesBSBXTW401 Assessment Task 2 PDFBig OngNo ratings yet

- A Comparative Study of Attitude of Prospective Teachers Towards Privatization of EducationDocument8 pagesA Comparative Study of Attitude of Prospective Teachers Towards Privatization of EducationAnonymous CwJeBCAXpNo ratings yet

- KS2 English 2022 Reading BookletDocument12 pagesKS2 English 2022 Reading BookletZayn Merchant DarNo ratings yet

- Virtual Reality and EnvironmentsDocument216 pagesVirtual Reality and EnvironmentsJosé RamírezNo ratings yet

- Mechanical Engineering ResumeDocument2 pagesMechanical Engineering ResumeShivaraj K YadavNo ratings yet

- History Scope and SequenceDocument18 pagesHistory Scope and Sequenceapi-286540486No ratings yet

- Democracy Socialism and SecularismDocument9 pagesDemocracy Socialism and SecularismVikas KumarNo ratings yet

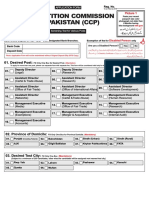

- Competition Commission of Pakistan (CCP) : S T NS T NDocument4 pagesCompetition Commission of Pakistan (CCP) : S T NS T NMuhammad TuriNo ratings yet

- Final ReflectionDocument2 pagesFinal Reflectionapi-563509052No ratings yet

- Uploadingcirculating Medal ListDocument7 pagesUploadingcirculating Medal ListGal LucyNo ratings yet

- Untitled DocumentDocument8 pagesUntitled DocumentAkshat PagareNo ratings yet

- Effective Teaching Methods in Higher Education: Requirements and BarriersDocument10 pagesEffective Teaching Methods in Higher Education: Requirements and BarriersJoan NPNo ratings yet

- Sisal Nano Fluid First PagesDocument4 pagesSisal Nano Fluid First Pagesashok_abclNo ratings yet

- Nep in Open Secondary SchoolDocument7 pagesNep in Open Secondary Schoolfpsjnd7t4pNo ratings yet

- Module No II Legal Bases of Non-Formal EducationDocument22 pagesModule No II Legal Bases of Non-Formal EducationEye LashNo ratings yet

- Week 1 MTLBDocument7 pagesWeek 1 MTLBHanni Jane CalibosoNo ratings yet

- North South University: ID# 213 1035 642 DegreeDocument1 pageNorth South University: ID# 213 1035 642 DegreeTihum KabirNo ratings yet

- DLL, December 03 - 06, 2018Document3 pagesDLL, December 03 - 06, 2018Malmon TabetsNo ratings yet

- Groups Satisfying The Converse To Lagranges TheoremDocument41 pagesGroups Satisfying The Converse To Lagranges TheoremTestNo ratings yet

- ProfEd Rationalization FinalDocument143 pagesProfEd Rationalization FinalrowenaNo ratings yet