Professional Documents

Culture Documents

Mechanism of Mutual Funds

Uploaded by

Utsav Ethan PatelOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mechanism of Mutual Funds

Uploaded by

Utsav Ethan PatelCopyright:

Available Formats

Mechanism of Mutual Funds

EMERGENCE OF MUTUAL FUNDS:

Mutual Funds now represent perhaps the most appropriate investment opportunity for most small investors. As financial markets become more sophisticated and complex, investor need a financial intermediary who provides the required knowledge and professional expertise on successful investing. It is no wonder then that in the birthplace of mutual funds-the U.S.A.-the fund industry has already overtaken the banking industry, with more money under Mutual Fund management than deposited with banks. The Indian Mutual Fund industry has already opened up many exciting investment opportunities to Indian investors. Despite the expected continuing growth in the industry, Mutual Fund is a still new financial intermediary in India.1

WHAT IS MUTUAL FUND?

A mutual fund is just the connecting bridge or a financial intermediary that allows a group of investors to pool their money together with a predetermined investment objective. The mutual fund will have a fund manager who is responsible for investing the gathered money into specific securities (stocks or bonds). When you invest in a mutual fund, you are buying units or portions of the mutual fund and thus on investing becomes a shareholder or unit holder of the fund. The income earned through these investments and the capital appreciations realized are shared by its unit holders in proportion to the number of units owned by them. Thus a Mutual Fund is the most suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost.

http://www.mutualfundsindia.com/mfbasic.asp

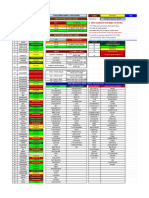

Working of Mutual Funds

REGULATORY AUTHORITIES:

To protect the interest of the investors, SEBI formulates policies and regulates the mutual funds. It notified regulations in 1993 (fully revised in 1996) and issues guidelines from time to time. MF either promoted by public or by private sector entities including one promoted by foreign entities is governed by these Regulations.

SEBI approved Asset Management Company (AMC) manages the funds by making investments in various types of securities. Custodian, registered with SEBI, holds the securities of various schemes of the fund in its custody.

The Association of Mutual Funds in India (AMFI) reassures the investors in units of mutual funds that the mutual funds function within the strict regulatory framework. Its objective is to increase public awareness of the mutual fund industry.2

http://www.mutualfundsindia.com/mfbasic.asp

WHO ALL ARE INVOLVED IN MUTUAL FUND?

1. Investors: Investors are the people who put their money or invest in the Mutual Fund. Every investor, given his/her financial position and personal disposition, has a certain inclination to take risk. The more risk one is capable of taking, the more return one can expect to get, and vice versa. However, most people have neither the time nor the knowledge to directly invest in the market. Mutual Fund is a solution for investors who lack either the time or the inclination or the necessary skills to actively manage their investments in individual securities. In the scheme of a Mutual Fund, the investor may have invested in a bank or any other safe option, thus depriving them of the possibility of getting a better return.

2. Trustees: Trustees are the people who are responsible for ensuring the proper care of the investors interest in a scheme. In return, they are paid the trustees fees.

3. Asset Management Company (AMC): Asset Management Companies are those companies who manage the investment portfolios of the schemes. Its income comes from the management fee that it charges for its services. The management fee is calculated as a percentage of the net asset that is managed. In some countries, the management fee is based on performance.

An AMC has to employ people in order to bear all the establishment costs related to its activities such as premises, furniture, etc. These costs are paid from the management fee earned by it. Expenses such as trustee fees, marketing costs, etc are borne by the Mutual Fund scheme. Sometimes, due to competition, the AMC is forced to bear these costs. As long as the income is more than the expenditure, the AMC is viable. All AMCs have certain Asset Under Management (AUM), below which it is not viable. In Indian context, it is difficult for an AMC to achieve Break-Even if its AUM is below Rs. 2,000 crores. Within an AMC, the fund manager ensures that the schemes funds are invested in such a way that the objectives of the scheme in the interest of its investors are achieved. The CEO, in turn, sees that the fund manager performs his duty in a correct way.

4. Distributors: Distributors are the people who attract or bring in the investors into the schemes of a mutual fund. They earn a commission for this. The commission is an expense for the AMC and it may choose to bear the cost wholly or partially. Depending upon the financial and physical resources at their disposal, the distributors can be classified into 3 tiers: Tier-1 Distributor: These distributors have their own or franchise network reaching out to investors all across the country. Tier-2 Distributor: These distributors are mostly regional players. Tier-3 Distributor: These are the small distributors marginal players and have limited reach.

Distributors bring in investors for the AMC, for which they earn commission from them. But they also safeguard the financial health of the investors who dont pay them in return. Karvy the finapolis belongs to the tier-1 distributors with the wide-spread channels all across the India for distribution of mutual funds.

5. Registrars: Registrars and Transfer Agents (R&T) keeps track of the Mutual Fund scheme on account of the investors investments and disinvestments from the scheme. The R&T of the Mutual Fund maintains the database of investors. As a result, interest based transactions of the existing investors in the schemes of an AMC are affected through its database server.

6. Custodial Depository: The Custodial Depository maintains custody of the securities in which the scheme invests. This ensures an ongoing independent record of the investment of the scheme. It also follows various corporate actions such as bonus and dividends declared by the invested companies. Its importance is growing as securities are increasingly being dematerialized.

Types of Mutual Funds:3

Types of Mutual Fund

By Strucuture

By Nature

By Investment

Other Schemes

OpenEnded Schemes CloseEnded Schemes

Equity fund

Growth Schemes

Tax Saving Schemes

Debt fund

Income Schemes

Index Schemes

Interval Schemes

Balanced funds

Balanced schemes

Sector specific schemes

Money Market schemes

http://www.mutualfundsindia.com/mfbasic.asp

A. By Structure:

1. Open - Ended Schemes: An open-end fund is one that is available for subscription all through the year. These do not have a fixed maturity. Investors can conveniently buy and sell units at Net Asset Value ("NAV") related prices. The key feature of open-end schemes is liquidity.

2. Close - Ended Schemes: These schemes have a pre-specified maturity period. One can invest directly in the scheme at the time of the initial issue. Depending on the structure of the scheme there are two exit options available to an investor after the initial offer period closes. Investors can transact (buy or sell) the units of the scheme on the stock exchanges where they are listed. The market price at the stock exchanges could vary from the net asset value (NAV) of the scheme on account of demand and supply situation, expectations of unit holder and other market factors. Alternatively some closeended schemes provide an additional option of selling the units directly to the Mutual Fund through periodic repurchase at the schemes NAV; however one cannot buy units and can only sell units during the liquidity window. SEBI Regulations ensure that at least one of the two exit routes is provided to the investor.

3. Interval Schemes: Interval Schemes are that scheme, which combines the features of open-ended and close-ended schemes. The units may be traded on the stock exchange or may be open for sale or redemption during pre-determined intervals at NAV related prices.

B. By Nature:

You might also like

- Project On MFDocument43 pagesProject On MFAbhi Rajendraprasad100% (1)

- 432B Case 2 Questions Mogen Inc Mar221Document1 page432B Case 2 Questions Mogen Inc Mar221wole1974No ratings yet

- Comparative Analysis of HDFC and Icici Mutual FundsDocument8 pagesComparative Analysis of HDFC and Icici Mutual FundsVeeravalli AparnaNo ratings yet

- Negotiation Is Not A Competitive SportDocument12 pagesNegotiation Is Not A Competitive Sportshreyas1111100% (2)

- Principles of ManagementDocument8 pagesPrinciples of Managementecemurali210% (1)

- Topic 5 FORMS OF ORGANIZATIONAL STRUCTURE PDFDocument15 pagesTopic 5 FORMS OF ORGANIZATIONAL STRUCTURE PDFlolipopzeeNo ratings yet

- Commercial Bill MarketDocument25 pagesCommercial Bill Marketapeksha_606532056No ratings yet

- Mba ProjectDocument71 pagesMba ProjectSahana SindyaNo ratings yet

- CP Damini Jyoti PDFDocument90 pagesCP Damini Jyoti PDFjyoti dabhi100% (1)

- Project Report - Merger, Amalgamation, TakeoverDocument18 pagesProject Report - Merger, Amalgamation, TakeoverRohan kedia0% (1)

- RNSTE Management NotesDocument71 pagesRNSTE Management Notesantoshdyade100% (1)

- Ch-09 Findings, Suggestions & Conclusion GayathriDocument4 pagesCh-09 Findings, Suggestions & Conclusion Gayathrirgkusumba0% (1)

- India's Balance of Payments Crisis and It's ImpactsDocument62 pagesIndia's Balance of Payments Crisis and It's ImpactsAkhil RupaniNo ratings yet

- Becg Corporate Governance:: Notes Complied by Dr. Dhimen Jani Mba, CBS, Pgdibo, PHD MBA Sem. 1Document32 pagesBecg Corporate Governance:: Notes Complied by Dr. Dhimen Jani Mba, CBS, Pgdibo, PHD MBA Sem. 112Twinkal ModiNo ratings yet

- Book BuildingDocument10 pagesBook BuildingSaad Mahmood100% (1)

- Depository Participants PPT by Raj Sekhar and Abhishek KumarDocument43 pagesDepository Participants PPT by Raj Sekhar and Abhishek KumarRaj Sekhar100% (1)

- MRPDocument52 pagesMRPJAI SINGHNo ratings yet

- Savings and Investment in IndiaDocument20 pagesSavings and Investment in Indianenu_10071% (7)

- An Empirical Study On Indian Mutual Funds Equity Diversified Growth Schemes" and Their Performance EvaluationDocument18 pagesAn Empirical Study On Indian Mutual Funds Equity Diversified Growth Schemes" and Their Performance Evaluationkanwal12345hudaatNo ratings yet

- Bhavesh Sawant Bhuvan DalviDocument8 pagesBhavesh Sawant Bhuvan DalviBhuvan DalviNo ratings yet

- SRM Car IndustryDocument10 pagesSRM Car Industrysir_koustNo ratings yet

- Create PPT from Excel Charts MacroDocument7 pagesCreate PPT from Excel Charts MacroSunil DadhichNo ratings yet

- New Issue MarketDocument15 pagesNew Issue MarketRavi Kumar100% (1)

- Investment Process and CharacteristicsDocument305 pagesInvestment Process and Characteristicsrajvinder deolNo ratings yet

- Kotak SecuritiesDocument99 pagesKotak Securitiesfun_magNo ratings yet

- Workplace Violence PreventionDocument16 pagesWorkplace Violence PreventionNeha ShelkeNo ratings yet

- Online Offline Trading in Stock MarketDocument7 pagesOnline Offline Trading in Stock Marketkumar4243No ratings yet

- Investors' Perceptions Towards Mutual FundsDocument3 pagesInvestors' Perceptions Towards Mutual Fundssaurabh dixitNo ratings yet

- Legal and Procedural Aspects of MergerDocument8 pagesLegal and Procedural Aspects of MergerAnkit Kumar (B.A. LLB 16)No ratings yet

- Mutual FundsDocument16 pagesMutual Fundsvirenshah_9846No ratings yet

- Mutual Funds in India A Comparative Study of Select Public Sector and Private Sector CompaniesDocument13 pagesMutual Funds in India A Comparative Study of Select Public Sector and Private Sector Companiesarcherselevators0% (1)

- Awareness and Preferences of Small Savings Plans in ChennaiDocument93 pagesAwareness and Preferences of Small Savings Plans in ChennaiSourav RoyNo ratings yet

- Unit 1Document65 pagesUnit 1Ramu PandeyNo ratings yet

- Innovative Financial ServicesDocument9 pagesInnovative Financial ServicesShubham GuptaNo ratings yet

- Nepalese Stock Market Growth Problem and ProspectsDocument94 pagesNepalese Stock Market Growth Problem and ProspectsArun Kaycee80% (5)

- Mutual Funds IndustryDocument36 pagesMutual Funds IndustryMaster HusainNo ratings yet

- DineshDocument62 pagesDineshDinesh KumarNo ratings yet

- A Project On Capital Market: Submitted To: Punjab Technical University, JalandharDocument95 pagesA Project On Capital Market: Submitted To: Punjab Technical University, JalandharSourav ChoudharyNo ratings yet

- Sip Final GarimaDocument81 pagesSip Final GarimagudoNo ratings yet

- Element of CostDocument16 pagesElement of CostcwarekhaNo ratings yet

- Project ReportDocument53 pagesProject ReportAbhishek MishraNo ratings yet

- Project ReportDocument57 pagesProject ReportPAWAR0015No ratings yet

- An Introduction To Mutual FundsDocument15 pagesAn Introduction To Mutual FundsAman KothariNo ratings yet

- A Study On Mergers and Acquisitions of Indian Banking SectorDocument9 pagesA Study On Mergers and Acquisitions of Indian Banking SectorEditor IJTSRDNo ratings yet

- Mutual Fund ProjectDocument35 pagesMutual Fund ProjectKripal SinghNo ratings yet

- "A Study On Fundamental Analysis of Indian Infrastructure IndustryDocument18 pages"A Study On Fundamental Analysis of Indian Infrastructure IndustrySaadgi AgarwalNo ratings yet

- Ifbm 04020060202 PDFDocument9 pagesIfbm 04020060202 PDFDhani SahuNo ratings yet

- Investors Financial Investments Towards Local Chit FundsDocument10 pagesInvestors Financial Investments Towards Local Chit FundsDurai Mani100% (1)

- Primary MarketDocument26 pagesPrimary MarketumarsmakNo ratings yet

- Parative Analysis On The Performance of Mutual Funds Between Private & PublicDocument3 pagesParative Analysis On The Performance of Mutual Funds Between Private & PublicN.MUTHUKUMARANNo ratings yet

- Comparative Analysis of SHAREKHAN and Other Stock Broker HouseDocument78 pagesComparative Analysis of SHAREKHAN and Other Stock Broker Housedishank jain0% (1)

- Itc SrinivasaraoDocument76 pagesItc SrinivasaraoVenkatesh Periketi100% (2)

- Capital Market Clearing and Settlement ProcessDocument9 pagesCapital Market Clearing and Settlement ProcessTushali TrivediNo ratings yet

- Synergy and Dysergy: Understanding Positive and Negative EffectsDocument2 pagesSynergy and Dysergy: Understanding Positive and Negative EffectsTitus ClementNo ratings yet

- SIP Report On Varmora Plastech Pvt. Ltd.Document59 pagesSIP Report On Varmora Plastech Pvt. Ltd.PallavsinhZala67% (3)

- Portfolio Diversification &MPTDocument23 pagesPortfolio Diversification &MPTRuchika JainNo ratings yet

- Fund FlowDocument8 pagesFund Flowbhargavik2002100% (1)

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- It’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceFrom EverandIt’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceNo ratings yet

- Gatt Declaration FormDocument1 pageGatt Declaration FormUtsav Ethan PatelNo ratings yet

- FinalDocument11 pagesFinalUtsav Ethan PatelNo ratings yet

- Strategic Options for Industries Facing DeclineDocument6 pagesStrategic Options for Industries Facing DeclineUtsav Ethan PatelNo ratings yet

- Evils of Super Specialization-FinalDocument30 pagesEvils of Super Specialization-FinalUtsav Ethan PatelNo ratings yet

- BRM Report FinalDocument16 pagesBRM Report FinalsultrydaysNo ratings yet

- Date Doctors FinalDocument41 pagesDate Doctors FinalUtsav Ethan PatelNo ratings yet

- Bond and Stock Valuation: Lembar Jawaban Lab 4 IpmDocument4 pagesBond and Stock Valuation: Lembar Jawaban Lab 4 IpmIcal PahleviNo ratings yet

- Security Analysis and Portfolio Management: Question BankDocument12 pagesSecurity Analysis and Portfolio Management: Question BankgiteshNo ratings yet

- Lai Inc Had The Following Investment Transactions 1 Purchased Chang CorporationDocument1 pageLai Inc Had The Following Investment Transactions 1 Purchased Chang CorporationMiroslav GegoskiNo ratings yet

- Carbon TradingDocument32 pagesCarbon TradingCarlos ChangNo ratings yet

- Advantages and Disadvantages of HedgingDocument3 pagesAdvantages and Disadvantages of HedgingShaibya100% (1)

- Topic 7 - Financial Leverage - Part 2Document35 pagesTopic 7 - Financial Leverage - Part 2Baby Khor100% (2)

- HW 2Document2 pagesHW 2chrislmcNo ratings yet

- Asset Allocation Calculator - SmartAssetDocument1 pageAsset Allocation Calculator - SmartAssetSulemanNo ratings yet

- Derivatives Financial Market in India: Perspective and FutureDocument26 pagesDerivatives Financial Market in India: Perspective and Futuregaganhungama007No ratings yet

- UBFF 2013 BUSINESS FINANCE VALUING COMMON AND PREFERRED STOCKDocument2 pagesUBFF 2013 BUSINESS FINANCE VALUING COMMON AND PREFERRED STOCKJason LimNo ratings yet

- Manajemen InvestasiDocument33 pagesManajemen InvestasiSiti FauziahNo ratings yet

- (Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsDocument14 pages(Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsJonathan Ching100% (1)

- CFAS - Chapter 26Document49 pagesCFAS - Chapter 26Syrell NaborNo ratings yet

- Online Trading AssignmentDocument72 pagesOnline Trading AssignmentKr Ish NaNo ratings yet

- Insider Trading PPT - CIADocument20 pagesInsider Trading PPT - CIACmaSumanKumarVermaNo ratings yet

- Chapter 11 Bonds PayableDocument27 pagesChapter 11 Bonds PayableNicho Deven HamawiNo ratings yet

- FRM Risk Measurement and Management TechniquesDocument8 pagesFRM Risk Measurement and Management TechniquesMark WarneNo ratings yet

- Options Mentorship - Day 1Document49 pagesOptions Mentorship - Day 1Unesh JughsNo ratings yet

- Chapter 7Document23 pagesChapter 7Lusiana Margaretha ManurungNo ratings yet

- Glisson Case SEC BriefDocument44 pagesGlisson Case SEC BriefglimmertwinsNo ratings yet

- Problem Set 1 The Framework For Valuation: FNCE30011 Essentials of Corporate ValuationDocument2 pagesProblem Set 1 The Framework For Valuation: FNCE30011 Essentials of Corporate ValuationYuki TanNo ratings yet

- Plain Vanilla Interest Rate SwapDocument9 pagesPlain Vanilla Interest Rate Swapmishradhiraj533_gmaiNo ratings yet

- Chapter 10 Subsidiary Preferred StockDocument28 pagesChapter 10 Subsidiary Preferred StockNicolas ErnestoNo ratings yet

- Activity Sheets: Quarter 2 - MELC 12Document9 pagesActivity Sheets: Quarter 2 - MELC 12John Zyrone CayondongNo ratings yet

- DFNN Top 100 Stockholders and PCD Beneficial Owners As of 12.31.2017Document7 pagesDFNN Top 100 Stockholders and PCD Beneficial Owners As of 12.31.2017bayot limNo ratings yet

- Bittman TradingIndexOptionsDocument77 pagesBittman TradingIndexOptionsKeerthy Veeran100% (1)

- IRM CHAPTER 1 Concept ReviewsDocument6 pagesIRM CHAPTER 1 Concept ReviewsJustine Belle FryorNo ratings yet

- EquityDocument2 pagesEquityjethro carlobos0% (1)

- Daily & Weekly Trend Finder PDFDocument17 pagesDaily & Weekly Trend Finder PDFAnil KumarNo ratings yet