Professional Documents

Culture Documents

Power Sector - India March 2009 Power Sector - India March 2009

Uploaded by

Ankit PratapOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Power Sector - India March 2009 Power Sector - India March 2009

Uploaded by

Ankit PratapCopyright:

Available Formats

Power Sector India March 2009 Power Sector India March 2009

Key Trends: Increase in per capita consumption of electricity, Increase in corporate investments, Increase in FDI, increasing interest shown by PE/ VC firms in power sector and surge in captive Power trading is still at nascent stage with merely y% of the power generated traded in 200708 Distribution is primarily controlled by state electricity boards

(SEBs) Government policies are aimed at encouraging investment in the sector and increasing the competition Government allows 100% FDI under the automatic approval route in all segments of the industry (except atomic energy) 5year tax holiday is given for power generating projects Import duty at the confessional rate of x% has been set for import

of equipment Power trading is still at nascent stage with merely y% of the power generated traded in 200708 Distribution is primarily controlled by state electricity boards (SEBs) Government policies are aimed at encouraging investment in the sector and increasing the competition Government allows 100% FDI under the automatic approval route in all segments of

the industry (except atomic energy) 5year tax holiday is given for power generating projects Import duty at the confessional rate of x% has been set for import of equipment Executive Summary Market Overview & Value Chain Government Policies & Incentives Key Trends & Challenges . Public sector undertakings like AA Ltd , BB Ltd hold

the majority of the total installed capacity . Private players including ABC, XYZ have presence across value chain and making significant Competition investments in power sector . Foreign players like XY, ZY, AY have entered/planning to enter Indian power market . India has 5th largest electricity generation capacity in the world . The installed capacity of India as

of July 2008 was X MW . India is facing acute power deficit with peak power deficit of about x% production . Challenges: Shortage of coal, power loss in transmission and distribution, ageing and improperly maintained infrastructure POWER SECTOR INDIA.PPT

Introduction Power Sector Overview Value Chain Analysis Government Policies and Initiatives Key Trends & Challenges Competitive Landscape Key Developments Appendix POWER SECTOR INDIA.PPT

Installed capacity has been increasing continuously to meet the need of growing economy. . Supply Side Plan-wise Installed Capacity India has 5th largest electricity generation capacity in MW the world 140,000 Z Installed capacity of X MW as of July 2008 Y Nuclear Renewable Gasbased X 120,000 60,000

100,000 80,000 W Demand for power is growing at x% per annum Y ZPlanned Demand X w% Thermal y% z% v% Plan Hydel power x% VII VIII IX X Demand Side Current and projected demand MW bn units Energy Required Demand has five key components: 250,000 1,500 . Industry, commercial, residential, agriculture,

and others 200,000 Key drivers of increasing demand are growth in: 1,000 150,000 . Household consumption . Electrification of rural areas 100,000 500 . Manufacturing growing faster 50,000 . Realization of suppressed demand due to loadshedding 0 Required investment of ~USD X bn by 2017 0 X XI XII

Source: POWER SECTOR INDIA.PPT

Generators Traders Transmission Distribution End user Raw materials ------------------------Generators Traders Transmission Distribution End user Raw materials -------------

------------Public sector companies or State Electricity Boards ( SEB) have presence across the value chain Source: POWER SECTOR INDIA.PPT

Road v% w% Ports x% z% Urban Development Energy y% u% partnerships in infrastructure The power sector in India has not witness much PPP activity as compared to other sectors Power sector witnessed investments worth USD XX bn Government is encouraging PPP model to meet the capacity addition target of XY MW in XIth Plan

Government plans to promote PPP model in ash utilization, augmentation of transmission lines and distribution Distribution Franchisee Ultra Mega Power Projects (UMPP) Types of public private partnerships in India Road v% w% Ports x% z% Urban Development Energy y% u% partnerships in infrastructure The power sector in India has not witness much PPP activity as compared to other sectors

Power sector witnessed investments worth USD XX bn Government is encouraging PPP model to meet the capacity addition target of XY MW in XIth Plan Government plans to promote PPP model in ash utilization, augmentation of transmission lines and distribution Distribution Franchisee Ultra Mega Power Projects (UMPP) Types of public private partnerships in India Public Private Partnership

(PPP) model is not witnessing much activity compared to other sector in infrastructure PPP Model Overview

India has around x projects under the public private Airports Railways Source: POWER SECTOR INDIA.PPT

Key Trends Trends PE firms showing interest in power sector Increase in captive power production Increase in FDI Increase in domestic investments Increase in per capita consumption POWER SECTOR INDIA.PPT

Challenges Huge power loss in transmission and distribution Ageing and improperlymaintained infrastructure Shortage of coal Inability to meet the capacity addition targets Challenges POWER SECTOR INDIA.PPT

Majority of the installed power capacity in India with public sector undertakings Public Sector Players EBITDA (FY2007 8) Revenues (FY2007 8) Generation Transmission Distribution Total Capacity Company Name AA Ltd USD bn USD bn -MW BB Ltd USD mn USD mn -MW

CC Ltd USD bn USD mn -MW DD Ltd USD bn USD mn EE Ltd USD mn USD mn AA Ltd is the sixth largest thermal power producer in the world and India s largest power producer. It accounts for x% of

the country s installed capacity. It plans to invest up to USD XX bn by 2012 to transform itself into an integrated regional energy player and have an installed capacity of over X MW BB Ltd plans to increase the power generation capacity to over X MW by 2011 12 CC Ltd has 5 plants under construction adding X MW

by 2012 DD Ltd is responsible for interstate transmission of electricity. The company reported revenue of USD X bn in FY2007 EE Ltd is the Government of India initiated public private partnership, formed for the purpose of trading of power Source: POWER SECTOR INDIA.PPT

Thank you for the attention The Power Market report is a part of Netscribes Power Industry Series. For more detailed information or customized research requirements please contact: Natasha Mehta, CFA Subhash Chennuri Phone: +65 9651 6382 Phone: +91 98190 59664 EMail: natasham@netscribes. com EMail: subhashr@netscribes. com About Netscribes Netscribes is a

knowledgeconsulting and solutions firm with clientele across the globe. The company s expertise spans areas of investment & business research, business & corporate intelligence, contentmanagement services, and knowledgesoftware services. At its core lies a true value proposition that draws upon a vast knowledge base. Netscribes is a onestop shop designed to fulfil clients profitability and growth objectives.

This report is published for general information only. Although high standards have been used in preparing this report, Netscribes (India) Pvt. Ltd. or Netscribes is not responsible for any loss or damage arising from use of this document. This document is the sole property of Netscribes (India) Pvt. Ltd. and no part may be reproduced without prior written permission.

www. netscribes.com

POWER SECTOR INDIA.PPT

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- JIT Mod 5Document11 pagesJIT Mod 5hetsagarNo ratings yet

- Resume of JohnquerqueDocument2 pagesResume of Johnquerqueapi-28247722No ratings yet

- TNPSC Maths Only QuestionsDocument22 pagesTNPSC Maths Only QuestionsSri RamNo ratings yet

- CVE156 SampleDocument14 pagesCVE156 SampleLightning SparkNo ratings yet

- Raf 03 2013 0029Document23 pagesRaf 03 2013 0029vallenciaNo ratings yet

- Basic Questions IIDocument8 pagesBasic Questions IImohan yadavNo ratings yet

- 2011 Q4 - McKinsey Quarterly - Big Data, You Have It, Now Use It PDFDocument124 pages2011 Q4 - McKinsey Quarterly - Big Data, You Have It, Now Use It PDFBayside BlueNo ratings yet

- Hershey v. LBB ImportsDocument50 pagesHershey v. LBB ImportsMark JaffeNo ratings yet

- en GoDocument190 pagesen GoJoseph SepulvedaNo ratings yet

- Russian Military IndustryDocument3 pagesRussian Military IndustryEXTREME1987No ratings yet

- D. Abstract & Executive Summary - Docx FormattedDocument12 pagesD. Abstract & Executive Summary - Docx FormattedJeston TamayoNo ratings yet

- Risk Assesment FormatDocument2 pagesRisk Assesment FormatThumbanNo ratings yet

- Balmaceda Vs CorominasDocument9 pagesBalmaceda Vs Corominaskoey100% (1)

- Capital Budgeting Decision Criteria: 2002, Prentice Hall, IncDocument59 pagesCapital Budgeting Decision Criteria: 2002, Prentice Hall, IncMarselinus Aditya Hartanto TjungadiNo ratings yet

- Reliability Block DiagramsDocument21 pagesReliability Block Diagramslingesh1892No ratings yet

- Distribution RecordsDocument10 pagesDistribution RecordsRenaldy NongbetNo ratings yet

- Walt DisneyDocument16 pagesWalt Disneychuckd_87No ratings yet

- LLB Banking NotesDocument14 pagesLLB Banking Notesjagankilari80% (5)

- Portfolio October To December 2011Document89 pagesPortfolio October To December 2011rishad30No ratings yet

- Appendix 4A: Net Present Value: First Principles of FinanceDocument14 pagesAppendix 4A: Net Present Value: First Principles of FinanceQuynh NguyenNo ratings yet

- DaburDocument6 pagesDabursneh pimpalkarNo ratings yet

- Maroof Profile PDFDocument6 pagesMaroof Profile PDFMuhammad AzeemNo ratings yet

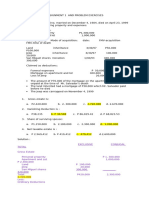

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Swot Analysis R&D: NPD Stages and ExplanationDocument3 pagesSwot Analysis R&D: NPD Stages and ExplanationHarshdeep BhatiaNo ratings yet

- ESM 17 18 EngDocument309 pagesESM 17 18 EnglovelynatureNo ratings yet

- EC1301 Semester 1 Tutorial 2 Short Answer QuestionsDocument2 pagesEC1301 Semester 1 Tutorial 2 Short Answer QuestionsShuMuKongNo ratings yet

- Case Study - PescanovaDocument17 pagesCase Study - PescanovaAngus SadpetNo ratings yet

- Unit 07 Investigating Travel Agency OperationsDocument6 pagesUnit 07 Investigating Travel Agency OperationsVictor Oscar Nanquen OrtizNo ratings yet

- Case AnalysisDocument17 pagesCase Analysischaithanya71% (7)

- SukritiDocument11 pagesSukritiFoodie InsaaanNo ratings yet